Navigating the Kentucky Power of Attorney Form is crucial for effective legal delegation. This guide provides essential tips and a user-friendly approach to creating a legally compliant document in Kentucky. Tailored to address financial, healthcare, or general affairs, it ensures your Power of Attorney form aligns with state laws and your personal needs. Our expert advice simplifies the process, offering peace of mind and clarity in empowering your chosen agent.

What is the Kentucky Power of Attorney Form?

The Kentucky Power of Attorney Form is a legal document that allows you to appoint someone else to make decisions on your behalf. This person, known as your agent, can handle tasks like managing your finances, property, or making healthcare decisions, especially if you’re unable to do so yourself. It’s a way to ensure that your affairs are taken care of according to your wishes in Kentucky.

What is the Best Sample Kentucky Power of Attorney Form?

Creating a comprehensive sample Kentucky Power of Attorney (POA) form requires including several key elements to ensure it is effective and legally sound. Below is a basic template. Remember, this is a general example and should be tailored to specific needs and legal requirements. Consulting with a legal professional is always recommended for a binding and customized document.

KENTUCKY POWER OF ATTORNEY FORM

Principal’s Information:

- Name: ___________________________________

- Address: ___________________________________

- Phone Number: ___________________________________

Agent’s Information:

- Name: ___________________________________

- Address: ___________________________________

- Phone Number: ___________________________________

Powers Granted (check applicable powers):

- Financial Decisions

- Real Estate Transactions

- Personal and Family Maintenance

- Health Care Decisions

- Other Specific Powers: ___________________________________

Special Instructions:

Effective Date:

- This Power of Attorney shall become effective on (date) _________________.

Duration:

- Durable (remains in effect if I become incapacitated)

- Non-Durable (ends if I become incapacitated)

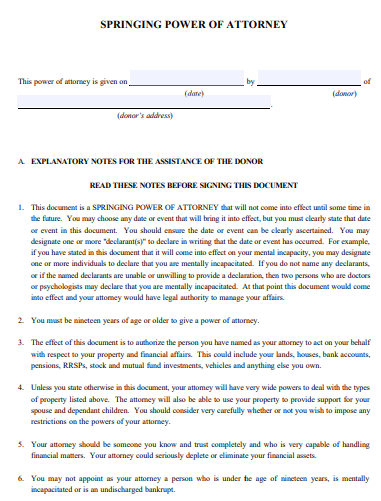

- Springing (becomes effective upon a specified event or condition)

Governing Law:

- This document will be governed by the laws of the State of Kentucky.

Principal’s Signature:

- Signature: _________________

- Date: _________________

Agent’s Acknowledgment:

- I, _________________, accept the appointment as an agent and agree to act in the principal’s best interest to the best of my ability.

- Signature: _________________

- Date: _________________

Notarization (if required):

- State of Kentucky, County of _________________

- On _________________, before me, _________________ (Notary Public), personally appeared _________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

- In witness whereof, I hereunto set my hand and official seal.

- Notary Public: _________________

- My Commission Expires: _________________

This sample form is provided for general informational purposes only and may not be appropriate in all situations. It is important to consult with a legal professional to ensure that any Power of Attorney form meets all legal requirements and accurately reflects your intentions.

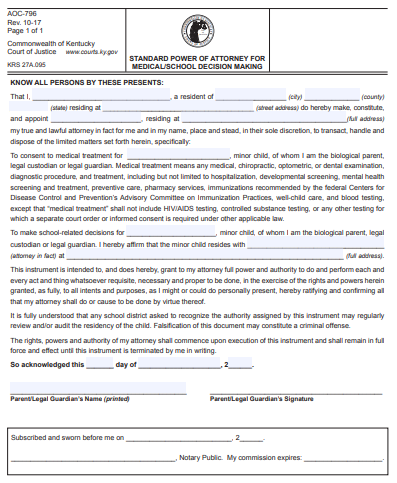

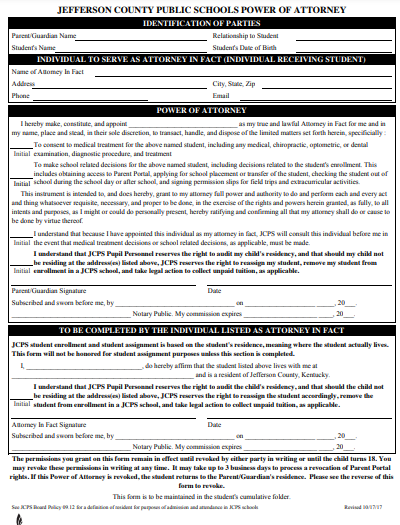

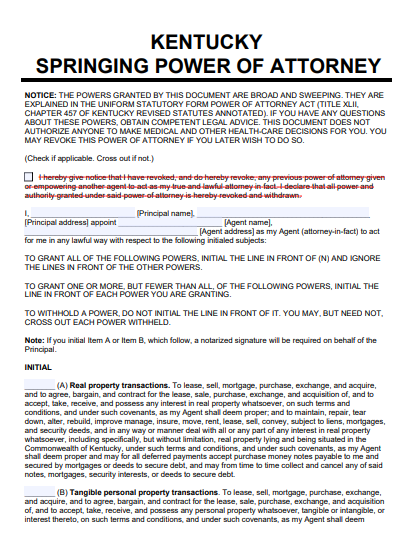

1. Kentucky Standard Power of Attorney Form

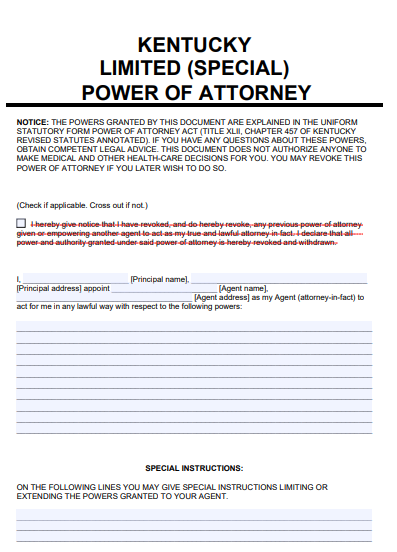

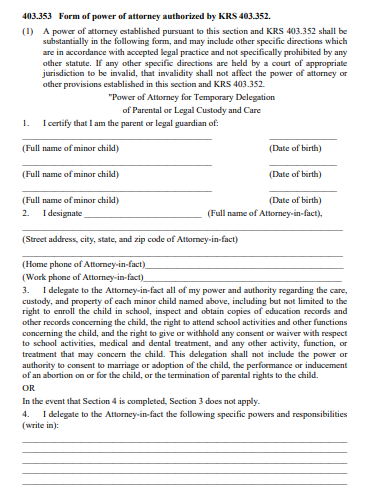

2. Kentucky Special Power of Attorney Form

3. Kentucky Simple Power of Attorney Form

4. Kentucky Sample Power of Attorney Form

5. Kentucky Printable Power of Attorney Form

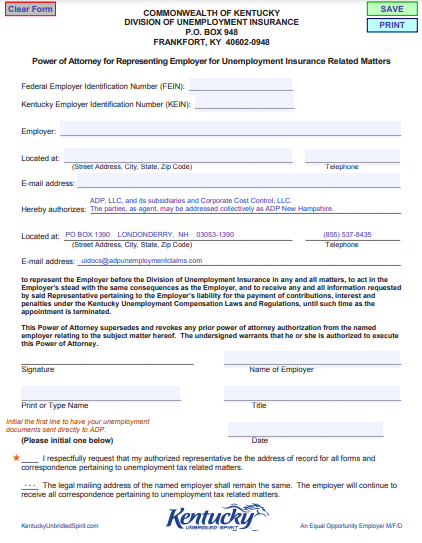

6. Kentucky Power of Attorney Form

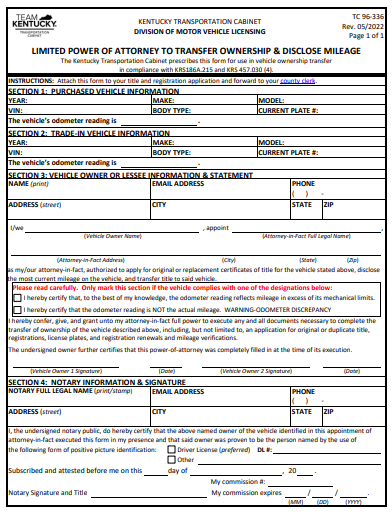

7. Kentucky Motor Vehicle Power of Attorney Form

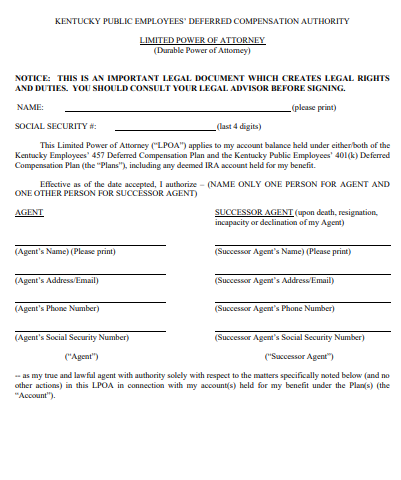

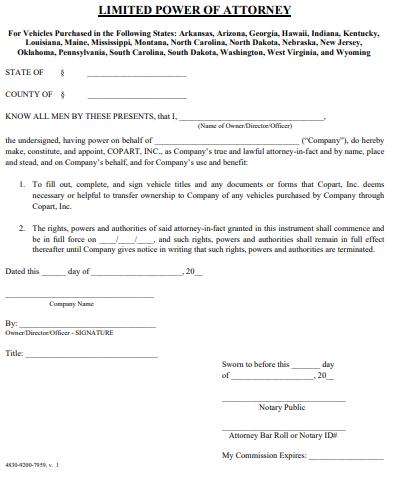

8. Kentucky Limited Power of Attorney Form

9. Kentucky General Power of Attorney Form

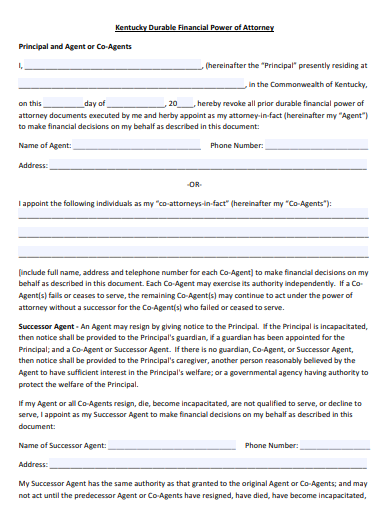

10. Kentucky Durable Financial Power of Attorney Form

11. Kentucky Blank Power of Attorney Form

How Do I Get a Power of Attorney in KY?

Obtaining a Power of Attorney in Kentucky involves selecting a trusted individual as your agent, completing a Kentucky-specific POA form, and ensuring it meets all legal requirements, including signatures and notarization if necessary. It’s crucial to clearly define the powers granted and understand the responsibilities involved.

Examples:

- Selecting an Agent: Choose a trustworthy person who understands your preferences and needs.

- Completing the Form: Use a Kentucky-specific POA form for legal compliance.

- Defining Powers: Clearly outline the extent of authority granted to your agent.

- Legal Requirements: Ensure all legalities, like signatures and notarization, are met.

- Understanding Responsibilities: Both principal and agent should understand their roles and responsibilities.

What is a Limited Power of Attorney Form in Kentucky?

A Limited Power of Attorney in Kentucky is a legal document granting an agent specific, restricted powers, usually for a particular task or for a limited time, unlike a general POA which offers broader authority.

Examples:

- Real Estate Transactions: Authorizing an agent to handle a specific property sale.

- Financial Transactions: Limited to certain financial activities like managing a bank account.

- Business Decisions: For making specific business-related decisions.

- Medical Decisions: Limited to certain healthcare decisions.

- Duration Specific: Often set for a specific time frame or event.

Does a Power of Attorney Have to be Filed with the Court in Kentucky?

In Kentucky, a Power of Attorney does not generally need to be filed with the court unless it is used for specific purposes, such as handling real estate transactions, where recording might be necessary.

Examples:

- Real Estate Transactions: Filing with the court for property dealings.

- No General Filing Requirement: For most other matters, court filing isn’t necessary.

- Legal Proceedings: Involvement in certain legal actions may require court filing.

- Guardianship Matters: If related to guardianship or conservatorship.

- Estate Planning: As part of broader estate planning strategies.

What are the Duties of Power of Attorney in Kentucky?

The duties of a Power of Attorney in Kentucky include acting in the principal’s best interest, managing finances or healthcare decisions, and adhering to the terms specified in the POA document.

Examples:

- Fiduciary Responsibility: Acting with honesty and integrity.

- Financial Management: Handling the principal’s financial affairs.

- Healthcare Decisions: Making medical decisions if authorized.

- Record Keeping: Maintaining records of all transactions.

- Legal Compliance: Adhering to Kentucky laws and POA terms.

Does Power of Attorney End at Death in Kentucky?

Yes, in Kentucky, a Power of Attorney automatically terminates upon the death of the principal. The agent’s authority ends, and the estate’s matters transfer to the executor or court.

Examples:

- Termination Upon Death: POA ceases when the principal passes away.

- Estate Management: Shifts to an executor or administrator.

- No Further Authority: Agent cannot make decisions post-death.

- Probate Process: Estate enters probate if applicable.

- Immediate Cessation: All POA powers end immediately upon death.

Does a POA Have to be Notarized in Kentucky?

In Kentucky, notarizing a Power of Attorney is highly recommended for legal validity, especially for financial or healthcare decisions, ensuring the document is accepted by institutions and courts.

Examples:

- Financial Institutions: Banks often require notarization.

- Healthcare Decisions: Adds credibility to healthcare POAs.

- Legal Strength: A notarized POA is less likely to be contested.

- Statewide Recognition: Ensures acceptance across various entities.

- Real Estate Transactions: Essential for property-related POAs.

How to Prepare a Kentucky Power of Attorney Form

Preparing a Kentucky Power of Attorney (POA) form is a critical process that requires attention to detail and an understanding of legal requirements. This guide provides a step-by-step approach to ensure your POA is effective and legally binding.

Step 1: Understanding the Types of POA

Begin by familiarizing yourself with different types of POA forms available in Kentucky, such as Durable, Medical, or Limited POA. Each type serves a unique purpose, catering to specific needs like healthcare decisions or financial management.

Step 2: Selecting the Right Form

Choose the appropriate POA form that aligns with your requirements. Kentucky law has specific forms for different POA types. Ensure you select the one that best suits your needs.

Step 3: Identifying the Principal and Agent

Clearly identify the principal (the person granting the power) and the agent (the person receiving the power). Full legal names and addresses should be included to avoid any confusion.

Step 4: Defining the Powers Granted

Specify the powers you are granting. Be as detailed as possible to avoid ambiguity. For instance, if it’s a Financial POA, outline the specific financial rights and responsibilities granted to the agent.

Step 5: Addressing Durability

Decide whether the POA should be durable. A Durable POA remains in effect even if the principal becomes incapacitated, which is crucial for long-term planning.

Tips for Using Effective Kentucky Power of Attorney Form

Using a Kentucky Power of Attorney form effectively involves more than just filling out and signing a document. Here are some tips to ensure its effectiveness:

Tip 1: Be Specific with Powers Granted

Clearly outline the powers granted in the POA. Vague descriptions can lead to confusion and legal challenges. Specify the extent and limitations of the agent’s authority.

Tip 2: Choose the Right Agent

Select an agent who is trustworthy and capable of handling the responsibilities. The agent should have the principal’s best interests at heart and be able to make decisions in various situations.

Tip 3: Communicate with Your Agent

Discuss the POA with your chosen agent. Ensure they understand their duties and are willing to take on the responsibility. Effective communication is key to a successful POA arrangement.

Tip 4: Review and Update Regularly

Circumstances change, and so should your POA. Regularly review and update your POA to reflect current wishes and situations. This is crucial for maintaining its relevance and effectiveness.

Tip 5: Legal Consultation

Consider consulting with a legal professional. They can provide valuable advice on Kentucky’s specific requirements and help tailor the POA to your unique situation.

Tip 6: Avoid Co-Agents When Possible

Appointing co-agents can lead to conflicts and complications. If possible, appoint a single agent or designate a successor agent to avoid potential disputes.

Tip 7: Understand the Revocation Process

Be aware of how to revoke a POA. If circumstances change, you should know the process for legally revoking the document to ensure your affairs are managed as per your current wishes.

By following these steps and tips, you can prepare and use a Kentucky Power of Attorney form effectively, ensuring your affairs are handled according to your preferences and legal standards.

What are the Rights of a Power of Attorney in Kentucky?

In Kentucky, a Power of Attorney grants rights like managing financial affairs, making healthcare decisions, and handling legal matters on behalf of another.

What are the Limitations of a Power of Attorney?

A Power of Attorney cannot make decisions after the principal’s death, change their will, or act against their best interests.

What is the New Rules of Power of Attorney?

New Power of Attorney rules often include stricter signing requirements, clear definitions of authority, and enhanced protections against abuse.

What are the Duties of Power of Attorney in Kentucky?

In Kentucky, a Power of Attorney’s duties include acting in the principal’s best interest, managing affairs prudently, and keeping accurate records.

Does a Power of Attorney Have to be Recorded in Kentucky?

In Kentucky, recording a Power of Attorney is not mandatory unless it deals with real estate transactions.

Understanding and effectively preparing a Kentucky Power of Attorney form is crucial for managing affairs with legal precision. This guide and tips provide a comprehensive approach, ensuring clarity in granting and executing powers responsibly. Remember, regular updates and legal consultations are key to maintaining the form’s relevance and effectiveness in safeguarding your interests.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Illinois (IL) Power of Attorney Form Download – How to Create Guide, Tips