An Investment Proposal Form is a crucial document used to present business opportunities to potential investors. This Proposal Form outlines key details such as business objectives, financial projections, expected returns, and risk factors. It helps entrepreneurs clearly communicate their vision, while investors assess the feasibility and profitability of the opportunity. A well-structured Investment Proposal Form increases the chances of securing funding by demonstrating a solid business plan.

Download Investment Proposal Form Bundle

What is Investment Proposal Form?

An Investment Proposal Form is a formal document that presents a business idea to investors, detailing financial needs, expected profits, and risk assessments. It acts as a structured pitch, helping businesses attract funding by providing a clear financial and operational roadmap. The form typically includes business objectives, investment requirements, return projections, and legal terms. A well-crafted Investment Proposal Form ensures transparency, builds investor confidence, and increases funding potential for new and expanding ventures.

Investment Proposal Format

Business Overview

This proposal outlines an investment opportunity in [Business Name], focusing on [Industry/Market], with a projected growth rate of [Percentage].

Investment Objectives

The purpose of this investment is to [Expand Operations, Develop New Product, Increase Market Share], providing investors with significant financial returns.

Financial Projections

Projected revenue for the next [Timeframe] is estimated at [Amount], with an expected return on investment (ROI) of [Percentage].

Investment Requirements

Seeking funding of [Amount] to cover [Infrastructure, Staffing, Marketing], with equity participation of [Percentage] or profit-sharing at [Terms].

Risk Analysis

Potential risks include [Market Fluctuations, Competitive Pressure, Regulatory Changes], with mitigation strategies in place to minimize financial exposure.

Exit Strategy

Investors may exit through [Buyout, IPO, Stake Sale], ensuring profitability and liquidity within [Timeframe].

Startup Investment Proposal Form

A Startup Investment Proposal Form is essential for attracting investors to new ventures. Similar to a Business Proposal Form, it outlines the business model, financial projections, and growth potential, ensuring a compelling pitch that increases funding opportunities.

Investment Proposal Template Word

An Investment Proposal Template Word provides a structured format for presenting financial opportunities. Like a Grant Proposal Form, it includes sections on business objectives, funding needs, and expected returns, making it easier to secure investment from stakeholders.

Small Business Investment Proposal Form

A Small Business Investment Proposal Form helps entrepreneurs communicate funding requirements effectively. Similar to a Catering Proposal Form, it highlights key business details, market potential, and financial plans, ensuring clarity and investor confidence in small business ventures.

Partnership Investment Proposal Form

A Partnership Investment Proposal Form defines investment terms between partners. Like a Project Proposal Form, it details contribution structures, profit-sharing terms, and risk management strategies, ensuring transparency and mutual agreement in business collaborations.

Browse More Investment Proposal Forms

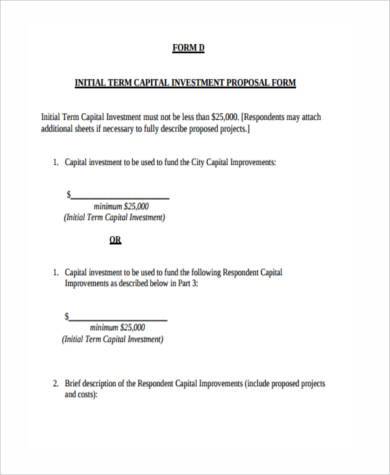

Capital Investment Proposal Form

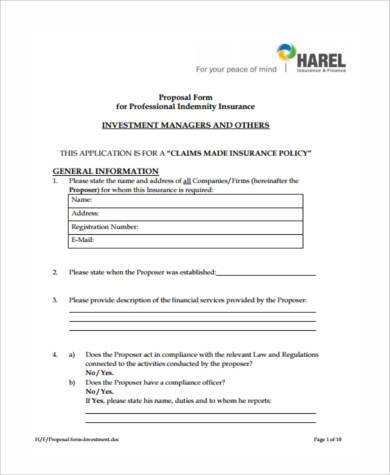

Investment Managers Insurance Proposal Form

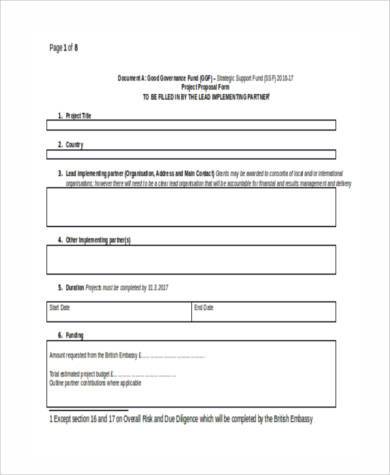

Investment Fund Project Proposal Form in Word Format

Free Investment Proposal Form

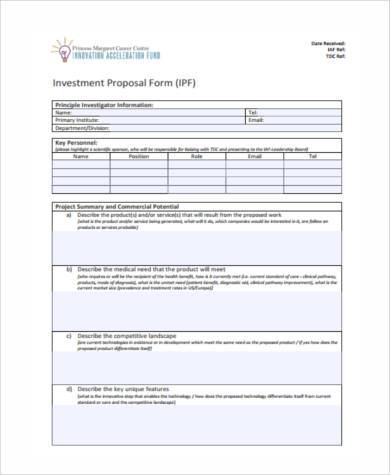

Investment Proposal Form Example

Generic Investment Proposal Form

Investment Manager Proposal Form

Investment Proposal Form in PDF

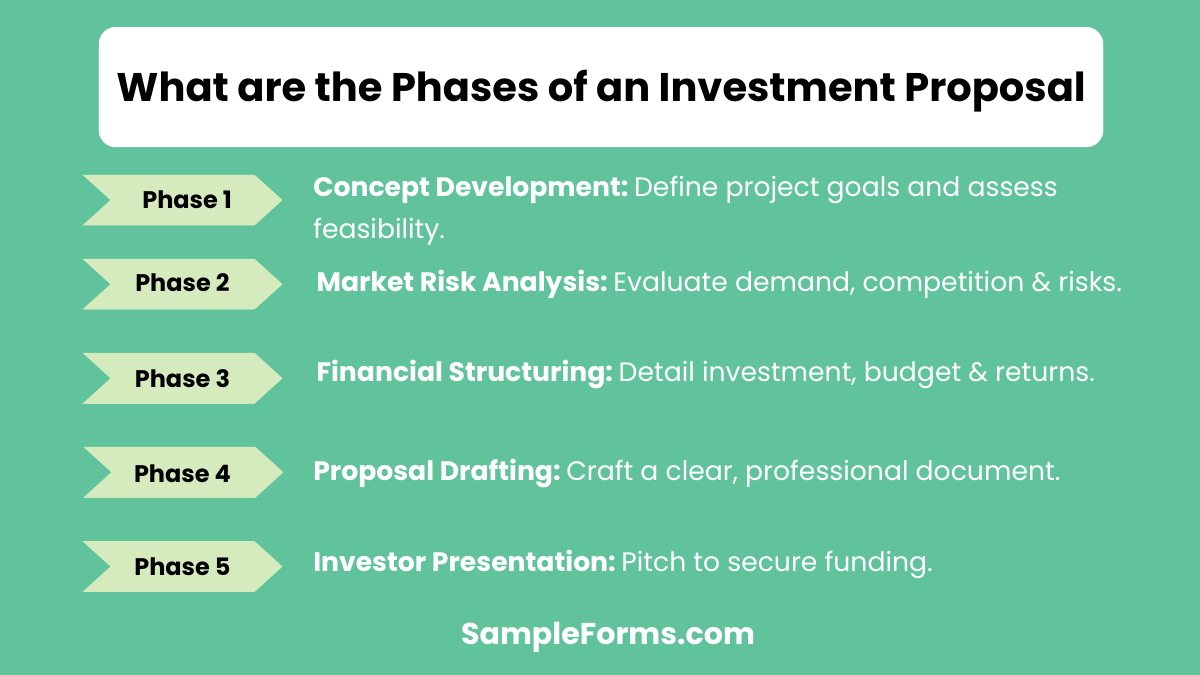

What are the phases of an investment proposal?

An Investment Proposal Form follows distinct phases to develop a well-structured funding request.

- Concept Development: Define the project’s objectives and feasibility, much like a Funding Proposal Form.

- Market & Risk Analysis: Assess market demand, competition, and potential risks.

- Financial Structuring: Outline investment needs, budget allocation, and projected returns.

- Proposal Drafting: Create a professional document with clear and concise details.

- Investor Presentation: Pitch the proposal to potential investors for funding approval.

How do I write an investment proposal?

An Investment Proposal Form must clearly present the business opportunity, financial projections, and potential returns to attract investors effectively.

- Define the Business Idea: Clearly outline the business concept, goals, and unique selling points, similar to a Contractor Proposal Form in structured planning.

- Detail Financial Projections: Include projected revenue, expenses, and expected return on investment.

- Highlight Market Analysis: Demonstrate demand, competition, and target audience insights.

- Explain Funding Requirements: Specify the total investment needed and allocation of funds.

- Provide an Exit Strategy: Offer potential ways for investors to withdraw profits or exit the investment.

How to make a real estate investment proposal?

A real estate Investment Proposal Form should include property details, financial projections, and risk assessments to secure investor confidence.

- Describe the Property: Provide location, size, and condition details, similar to a Seminar Proposal Form in structured presentations.

- Present Investment Costs: List purchase price, renovation costs, and operational expenses.

- Include Market Trends: Provide real estate market insights and expected property appreciation.

- Specify Revenue Potential: Detail rental income, resale value, and projected ROI.

- Highlight Legal Considerations: Mention zoning laws, permits, and property rights.

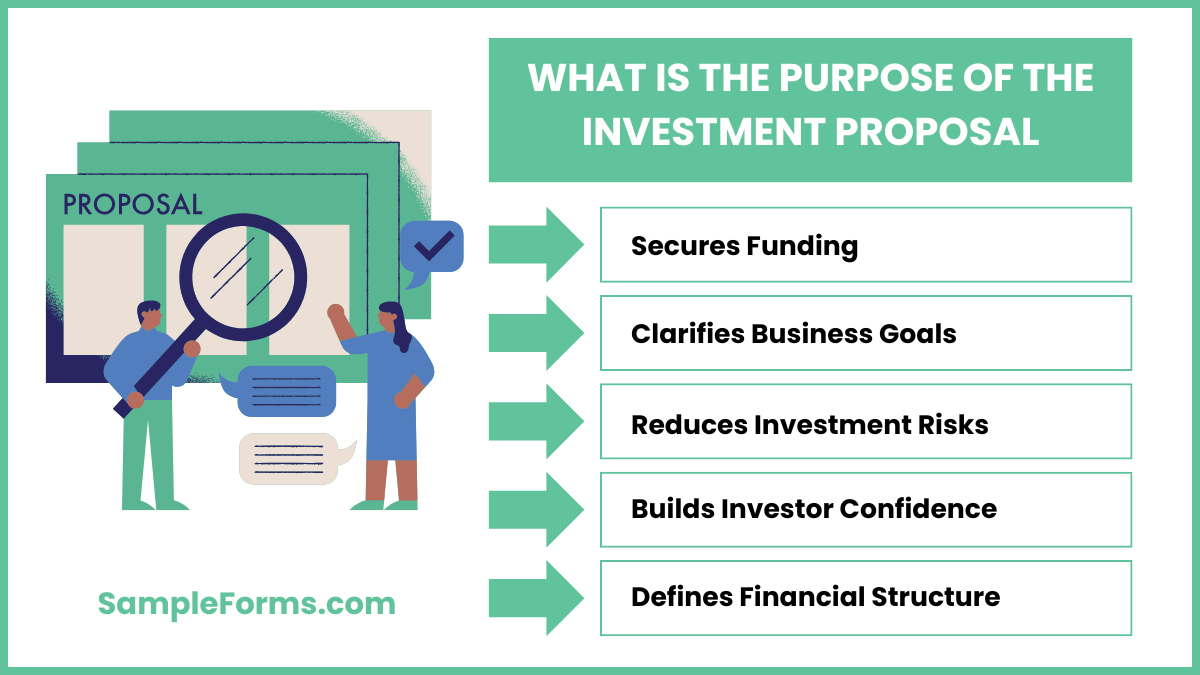

What is the purpose of the investment proposal?

An Investment Proposal Form serves as a structured document that convinces investors to fund a business venture or project.

- Secures Funding: Helps businesses obtain capital, similar to a Video Proposal Form used for creative project pitches.

- Clarifies Business Goals: Provides a detailed plan of action for stakeholders.

- Reduces Investment Risks: Offers data-driven projections to assure investors.

- Builds Investor Confidence: Enhances credibility by demonstrating a solid strategy.

- Defines Financial Structure: Outlines revenue streams, costs, and expected returns.

What are the steps in writing your proposal?

A successful Investment Proposal Form requires a structured approach to ensure clarity and investor appeal.

- Introduction & Objectives: Clearly state the investment purpose, just like a Conference Proposal Form sets event goals.

- Market Research & Analysis: Provide industry insights, competition analysis, and potential risks.

- Financial Projections & Budgeting: Detail revenue models, costs, and expected returns.

- Investment Requirements: Define the required funding, equity distribution, and repayment terms.

- Conclusion & Call to Action: Summarize key points and encourage investor engagement.

What is meant by investment proposal?

An Investment Proposal Form is a structured document that outlines a business opportunity, financial projections, and expected returns, similar to a Finance Proposal Form, ensuring investors understand potential benefits and risks before committing funds.

How many pages should an investment proposal be?

An investment proposal should be 5-15 pages, depending on complexity. Like a Loan Proposal Form, it must be concise yet detailed enough to provide financial, operational, and risk insights for investor confidence.

What is an investment grade proposal?

An investment-grade proposal is a well-researched, financially sound document that meets industry standards. Similar to a Thesis Proposal Form, it includes risk assessment, financial stability, and growth potential to attract investors.

What comes first, a business plan or a proposal?

A business plan comes first as it provides the foundation for an Investment Proposal Form, just like a Bid Proposal Form refines details for funding approval after initial business structuring.

How to assess an investment proposal?

Assess it by analyzing risks, financial forecasts, market potential, and viability. Like a Job Proposal Form, it should outline clear goals, projected returns, and competitive advantages for credibility.

How does an investment proposal look like?

It includes business objectives, funding requirements, revenue projections, and exit strategies. Similar to a Book Proposal Form, it must be structured, engaging, and data-driven for investor approval.

What should a funding proposal look like?

A funding proposal should highlight the business model, expected ROI, and risk mitigation. Like a Science Fair Proposal Form, it must present a well-researched, factual, and persuasive case for funding.

What is an investment proposal called?

An investment proposal is often referred to as a business pitch, investor memorandum, or funding request, similar to how a Taxi Proposal Form outlines vehicle financing and service expansion plans.

What is an example of an investment project?

Examples include real estate, startups, and tech developments. Like a Restaurant Proposal Form, investment projects should have a clear financial model, expected profitability, and growth potential.

What is an RFP in investment?

A Request for Proposal (RFP) in investment invites firms to submit proposals for funding opportunities, similar to an Insurance Proposal, ensuring compliance, financial transparency, and structured evaluation.

A well-prepared Investment Proposal Form is vital for securing financial backing. It clearly presents the business vision, funding requirements, and growth strategy, ensuring investor confidence. Like an LIC Proposal Form, it serves as a structured tool to communicate potential returns and risks effectively.

Related Posts

-

FREE 14+ Travel Proposal Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Service Proposal Forms in PDF | MS Word

-

Seminar Proposal Form

-

FREE 9+ Conference Proposal Forms in PDF | MS Word

-

FREE 9+ Catering Proposal Forms in PDF | MS Word | Excel

-

FREE 9+ Health Proposal Forms in PDF | MS Word

-

FREE 8+ Science Fair Proposal Forms in PDF | MS Word

-

FREE 10+ Taxi Proposal Forms in PDF | MS Word

-

Field Trip Proposal Form

-

FREE 9+ Course Proposal Forms in PDF

-

FREE 8+ Video Proposal Forms in PDF | MS Word

-

FREE 9+ Book Proposals Forms in PDF | MS Word

-

FREE 9+ Bid Proposal Forms in PDF | MS Word

-

Proposal Evaluation Form

-

FREE 8+ Proposal Summary Forms in PDF | MS Word