Navigate the nuances of drafting an Insurance Termination Letter with our in-depth guide. From understanding the delicate intricacies of policy cancellation to executing it with tact, this guide is your essential companion. Incorporating both Termination Letter and Contract Termination Letter concepts, we provide you with keyword-rich, content. Our expertly curated examples will empower you to articulate your needs clearly, ensuring a smooth transition away from your current policy.

Download Insurance Termination Letter Bundle

What is an Insurance Termination Letter?

An Insurance Termination Letter is a formal document sent by a policyholder to an insurance provider to cancel an insurance policy. It specifies the reason for cancellation, the desired end date, and includes any necessary legal or policy-related information. Crafting this letter with clear intentions ensures a mutual understanding and a smooth termination process, akin to a professional Letter of Resignation.

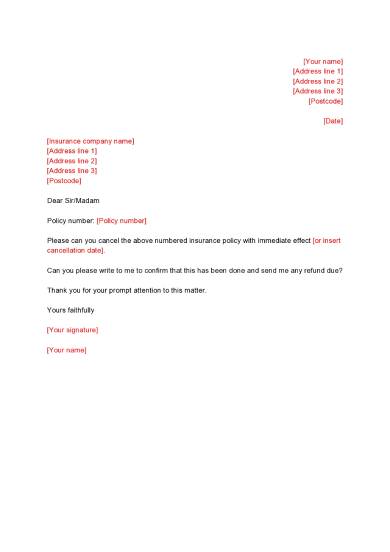

Insurance Termination Letter Format

Heading

Your Name

Your Address

City, State, Zip Code

Email

Phone Number

Date

Addressee

Insurance Company’s Name

Attn: [Specific Department or Individual, if known]

Address

City, State, Zip Code

Salutation

Dear [Recipient’s Name or “Sir/Madam”],

Introduction

State your intention to terminate your insurance policy. Include your policy number and effective date of cancellation.

Body

Reason for Termination

Briefly explain the reason for your decision to terminate the policy.

Request for Confirmation

Request written confirmation of the policy cancellation and any applicable refunds.

Conclusion

Express appreciation for the services provided and any other final thoughts.

Closing

Sincerely,

[Your Name]

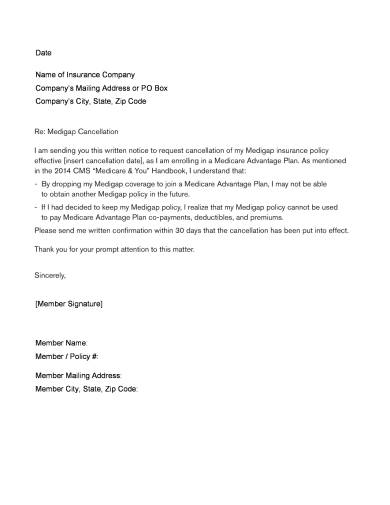

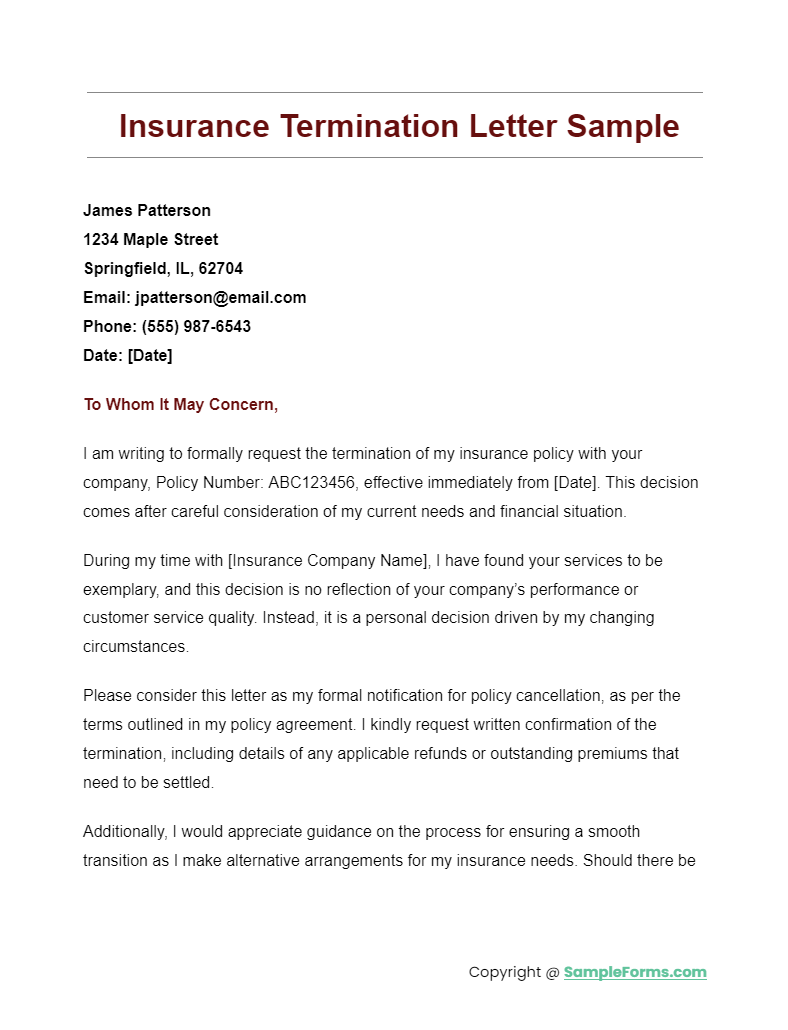

Insurance Termination Letter Sample

A well-crafted Insurance Termination Letter Sample serves as a blueprint for effectively ending your insurance policy. It mirrors the precision needed in an Employment Termination Letter, ensuring clarity and compliance with policy requirements.

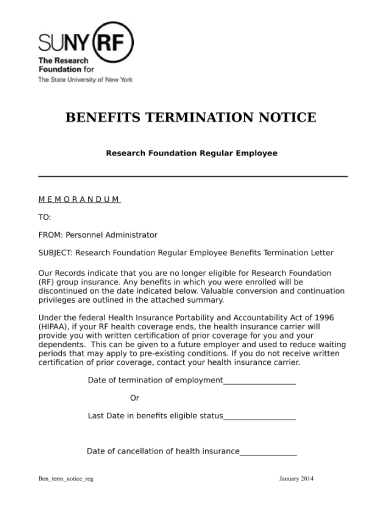

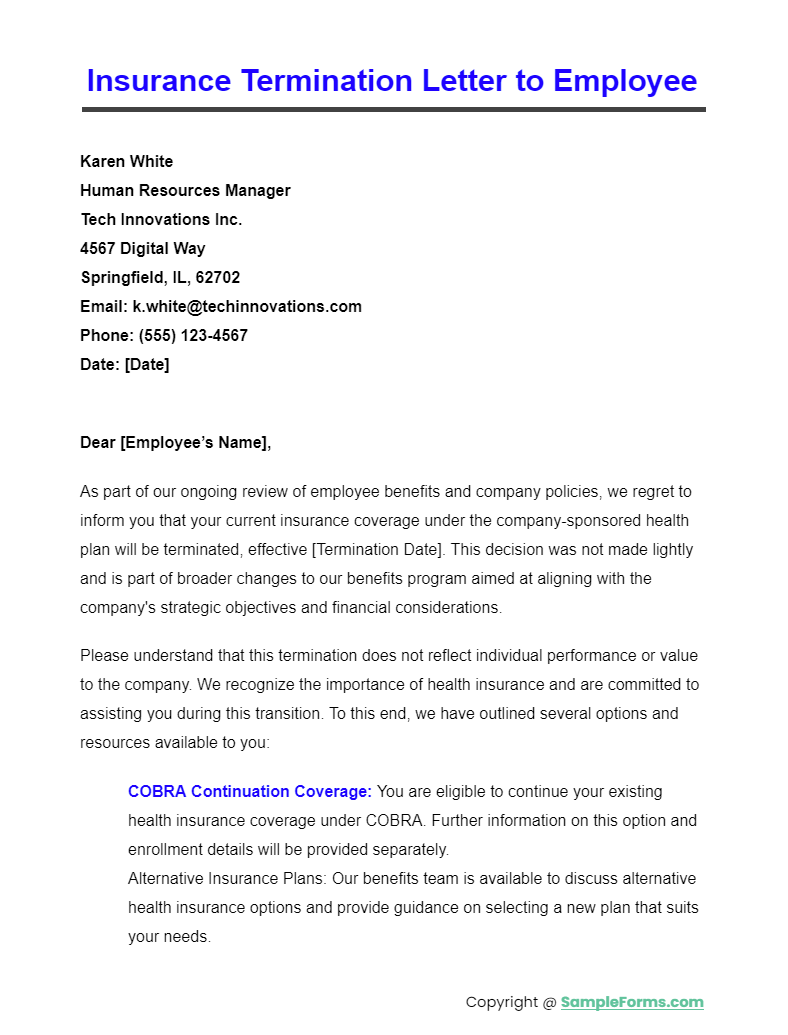

Insurance Termination Letter to Employee

When terminating an employee’s insurance benefits, an Insurance Termination Letter to Employee must be clear and compassionate, akin to the delicacy required in an Employee Termination Letter, outlining the reasons and effective date.

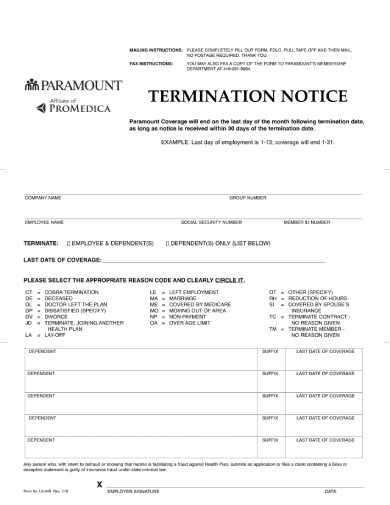

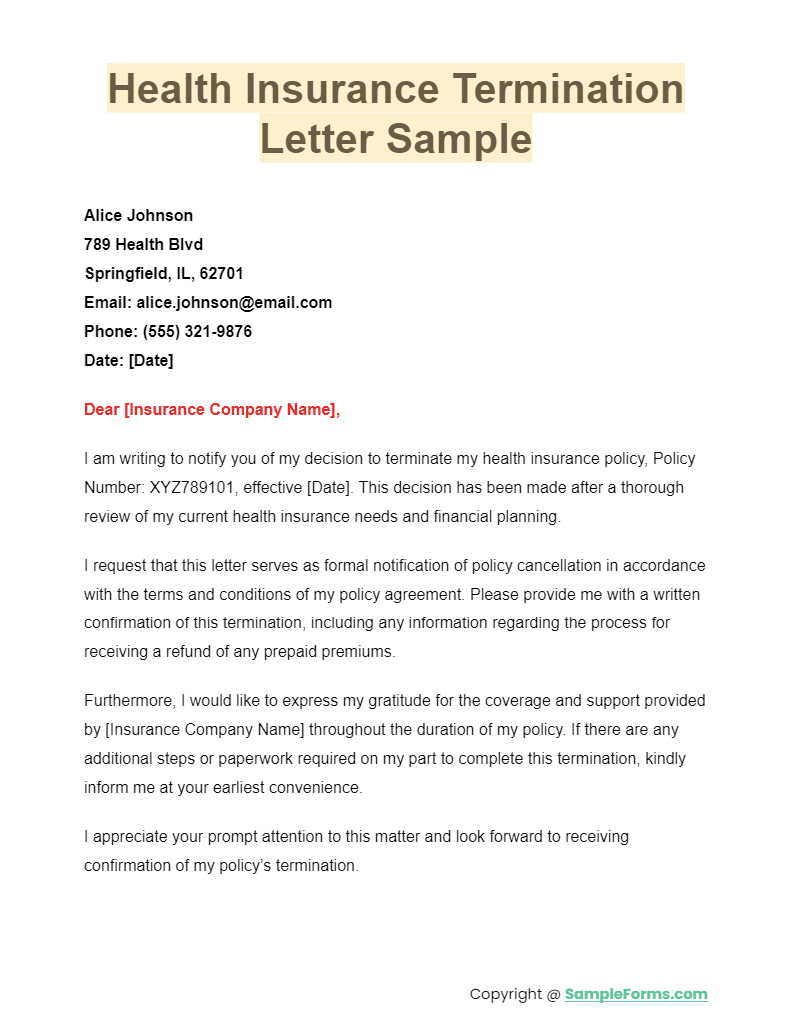

Health Insurance Termination Letter Sample

This Health Insurance Termination Letter Sample provides a template for cancelling health insurance coverage, reflecting the directness of a Contractor Termination Letter, while ensuring all necessary information is communicated effectively.

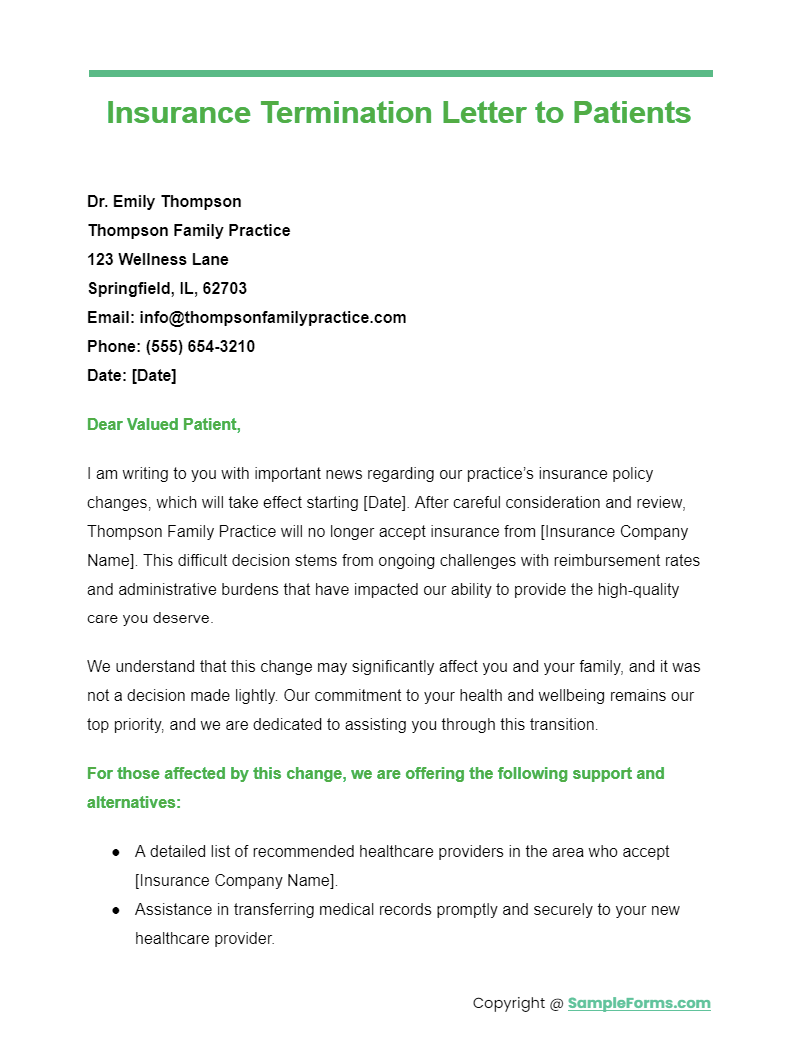

Insurance Termination Letter to Patients

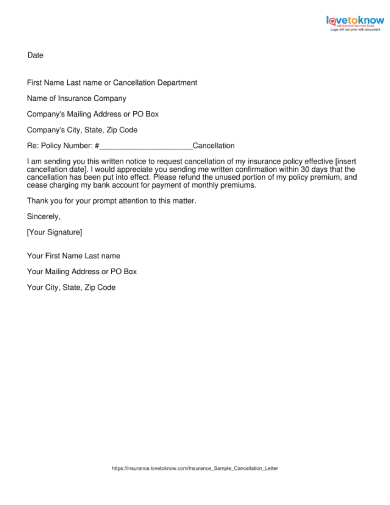

More Insurance Termination Letter Samples

To make things easier for you, we listed a few sample termination letter templates you can use as references when you create your very own insurance termination letters. These documents are available in file formats like PDFs and Docs. You also browse our Farewell Letter.

Sample Insurance Cancelation Letter

Medical Healthcare Insurance Termination Letter

Insurance Sample Termination Letter

Benefits Insurance Termination Notice Letter

Insurance Termination Notice Letter

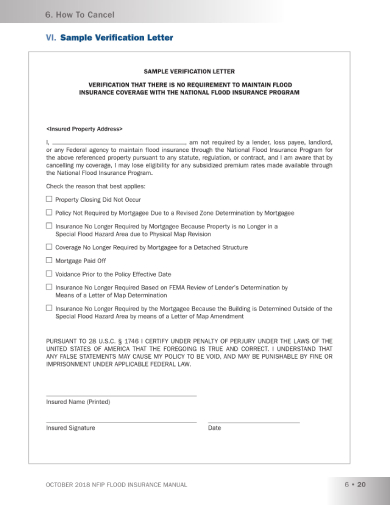

Sample Terminating Insurance Verification Letter

What happens if my health insurance is terminated?

When your health insurance is terminated, follow these steps:

- Notification: You’ll receive a termination notice, similar to a Resignation Letter, outlining the reason and last day of coverage.

- COBRA: Check eligibility for COBRA for continued coverage.

- Marketplace: Explore health insurance marketplace options within 60 days.

- Documentation: Keep all termination documents for records, akin to an Immediate Resignation Letter.

How to get proof of insurance termination?

Obtaining proof of insurance termination involves:

- Contact Insurance Company: Request a termination letter or document, similar to requesting an Email Resignation Letter.

- Written Request: If not automatic, send a written request for documentation.

- Check Online: Some insurers provide digital access to documents, like a Lease Termination Letter.

- Save Documentation: Securely store your termination proof for future reference.

How to Seamlessly Terminate an Insurance Contract?

Terminating an insurance contract seamlessly:

- Review Policy: Understand the terms, as if preparing a Two Weeks Notice Resignation Letter.

- Written Notice: Draft a termination letter, citing reasons similar to a Board Resignation Letter.

- Contact Insurer: Discuss the termination process and any required documentation.

- Confirmation: Ensure you receive a confirmation of termination, akin to an Official Resignation Letter.

How do I write a benefit termination letter?

Writing a benefit termination letter:

- Clear Opening: State the purpose upfront, as in a Nursing RN Resignation Letter.

- Details: Include specific details about the benefits being terminated.

- Reasons: Explain why the benefits are ending, maintaining clarity.

- Effective Date: Specify when the termination takes effect, similar to a 1 Week’s Notice Resignation Letter.

What are the main reasons for the termination of the insurance contract?

Main reasons include:

- Non-Payment: Similar to breach of a Lease Termination Letter, non-payment of premiums can lead to termination.

- Fraud: Misrepresentation or fraud, akin to the severities in a Police Officer Resignation Letter.

- Policyholder Request: Voluntary cancellation by the policyholder, through a Retirement Resignation Letter Doc.

- Insurer Decision: Company decides to no longer offer the policy or coverage.

What is a letter stating loss of insurance coverage?

A letter stating loss of insurance coverage:

- Introduction: Clearly state the purpose, like in a Resignation Letter.

- Details: Provide specifics of the insurance policy and coverage lost.

- Reason for Loss: Explain why coverage was lost, ensuring transparency.

- Next Steps: Guide on how to appeal or seek alternative insurance, reflecting the guidance in an Official Resignation Letter.

How do you terminate an insurance contract?

Terminating an insurance contract:

- Review Contract: Understand termination clauses, as you would with a Certificate of Liability Insurance Form.

- Written Notification: Draft a clear termination letter, akin to an Immediate Resignation Letter.

- Submit Request: Send the letter to your insurer, with any required forms.

- Confirmation: Obtain confirmation of termination, ensuring the process is finalized, similar to receiving a response to a Board Resignation Letter.

Why would insurance be terminated?

Insurance may be terminated due to non-payment of premiums, fraud, policyholder request, or insurer’s decision to discontinue coverage, similar to conditions outlined in a Business Insurance Form.

Should a termination letter be signed?

Yes, a termination letter should be signed by both the issuing party and the recipient to ensure acknowledgment and agreement, akin to the procedure with an Liability Insurance Form.

How do you document a termination?

Document termination by filling out an Employee Termination Form, securing signatures, and keeping copies in company records, ensuring a process similar to handling a Two Week Notice Letter.

Is a termination letter legally binding?

A termination letter is legally binding when it meets contractual obligations and is acknowledged by all parties involved, much like a Lease Termination Form outlines the end of a lease agreement.

Should you ask for a termination letter?

Yes, asking for a termination letter provides a clear record of the terms and conditions of termination, offering protection and clarity similar to a Sample Letter for reference.

Can you cancel insurance policy at any time?

Most insurance policies allow cancellation at any time, provided that you follow the insurer’s required procedure and complete a Health Insurance Form, if applicable.

Can an insurance company just cancel your policy?

An insurance company can cancel your policy for reasons like non-payment, fraud, or violation of terms, but must provide notice, akin to procedures detailed in a Restaurant Termination Form.

Related Posts

-

FREE 5+ Military Recommendation Letter Forms in MS Word | PDF

-

Character Reference for Immigration Recommendation Letter

-

Physician Assistant Recommendation Letter

-

Character Reference for Court Recommendation Letter

-

Legal Confirmation Letter

-

Nursing RN Resignation Letter

-

MBA Recommendation Letter

-

Security Deposit Return Letter

-

FREE 5+ Fraternity Recommendation Letters in PDF

-

Audit Response Letter

-

Medical School Recommendation Letter

-

Law School Recommendation Letter

-

FREE 9+ Paralegal Recommendation Letters in PDF | MS Word

-

FREE 9+ Professional Recommendation Letters in PDF | MS Word

-

FREE 5+ Employment Resignation Letters in PDF