Step into the realm of safeguarding your assets with an Insurance Power of Attorney Form—a vital document that grants trusted individuals the authority to handle your insurance matters. Delve into its significance, explore the different types tailored for diverse needs, and see examples that illuminate its practical use. Our guide will walk you through creating this pivotal form, accompanied by insider tips to ensure your financial security is managed with precision and foresight. Prepare to empower your insurance decisions with confidence.

What is the Insurance Power of Attorney Form ?

An Insurance Power of Attorney Form is a legal document that designates an individual, known as the agent or attorney-in-fact, to handle insurance-related matters on behalf of the principal. This form allows the agent to manage tasks such as purchasing insurance, filing claims, accessing insurance policy details, and making decisions regarding coverage on the principal’s behalf. It ensures that insurance affairs are maintained, even if the principal is unavailable or incapacitated, thus providing continuity and protection of the principal’s assets and interests.

What is the Meaning of the Insurance Power of Attorney Form?

The Insurance Power of Attorney Form is a document that assigns an agent the authority to make decisions and take actions related to an individual’s insurance policies. This can include managing, changing, or canceling insurance coverage and filing claims. It’s a specialized form of Power of Attorney focused on ensuring that the principal’s insurance affairs are handled appropriately when they cannot do so themselves, thereby safeguarding their investments and assets.

What is the best Sample Insurance Power of Attorney Form?

INSURANCE POWER OF ATTORNEY

PRINCIPAL INFORMATION:

Full Legal Name: ___________________________

Address: ___________________________

City/State/Zip: ___________________________

Phone Number: ___________________________

Email Address: ___________________________

AGENT INFORMATION:

Full Legal Name: ___________________________

Address: ___________________________

City/State/Zip: ___________________________

Phone Number: ___________________________

Email Address: ___________________________

SPECIAL INSTRUCTIONS:

(Here, include any specific limitations or special instructions not covered below.)

POWERS GRANTED:

The principal does hereby grant the agent full power and authority to act on the principal’s behalf in relation to all insurance matters, including but not limited to:

- Purchase, modify, or terminate any insurance policies.

- File claims and receive claim proceeds.

- Negotiate and resolve disputes with the insurance provider.

- Access and disclose necessary information related to insurance policies.

DURATION OF POWER:

This Power of Attorney shall become effective on [Effective Date] and shall continue until [Expiration Date] unless otherwise revoked by the principal.

THIRD PARTY RELIANCE:

Any third party who relies on the representations of the agent under this Power of Attorney may do so without any liability or obligation to verify the authority or representations of the agent.

SIGNATURES:

This document was executed on [Date].

Principal’s Signature: _________________________________

Principal’s Name (Print): _________________________________

Agent’s Signature: ___________________________________

Agent’s Name (Print): ___________________________________

NOTARIZATION:

State of _______________

County of _______________

On [Date], before me, [Notary Name], personally appeared [Principal’s Name] and [Agent’s Name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

Notary Public’s Signature: _________________________________

Notary Public’s Name (Printed): ______________________________

My Commission Expires: _________________

SEAL:

This form is a sample and should be reviewed by a legal professional to ensure it meets your needs and complies with your jurisdiction’s laws. It should be signed, witnessed, and notarized as required.

10+ Insurance Power of Attorney Form

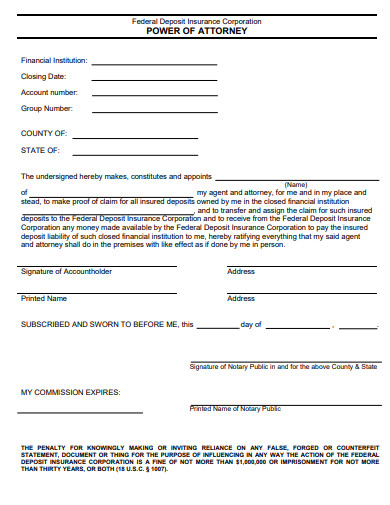

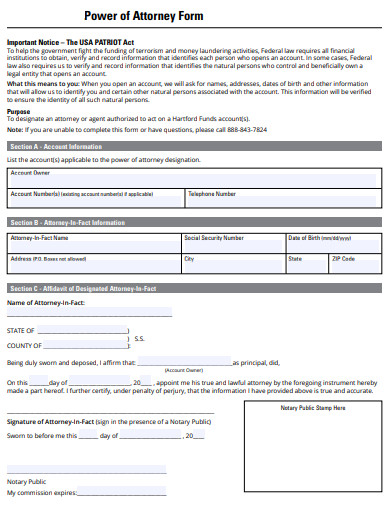

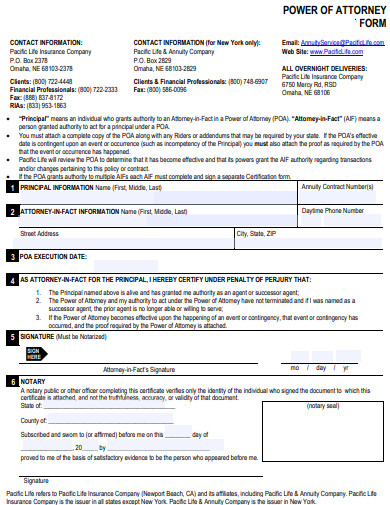

1. Prudential Life Insurance Power of Attorney Form

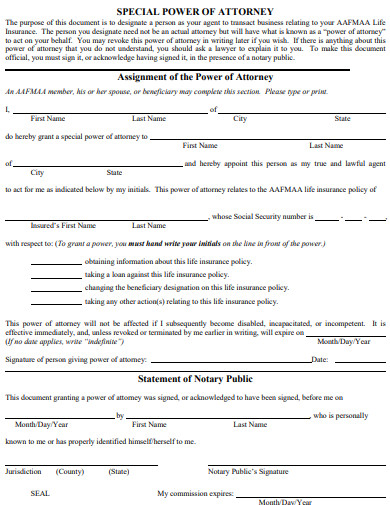

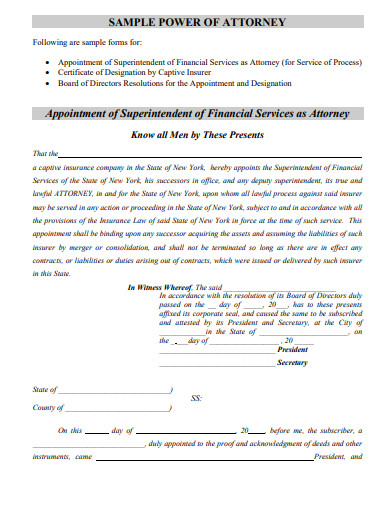

2. Special Power of Attorney Form

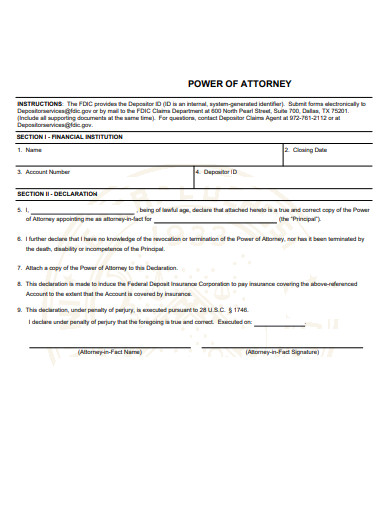

3. Florida Insurance Power of Attorney Form

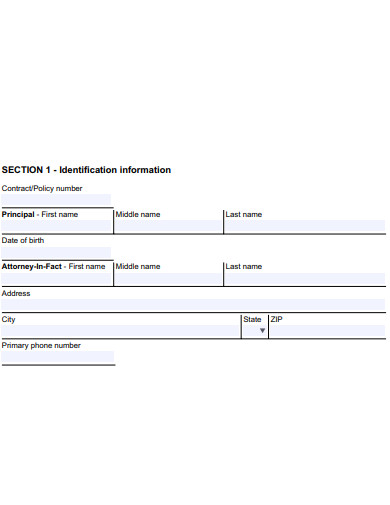

4. Simple Insurance Power of Attorney Form

5. Blank Insurance Power of Attorney Form

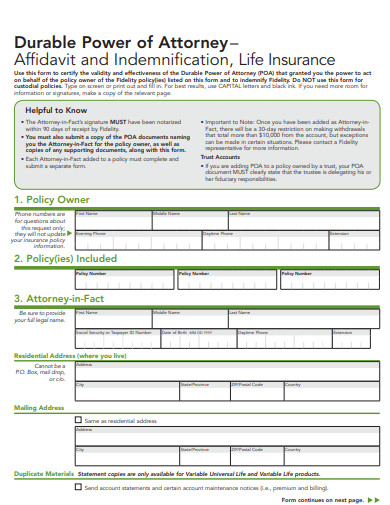

6. Durable Life Insurance Power of Attorney Form

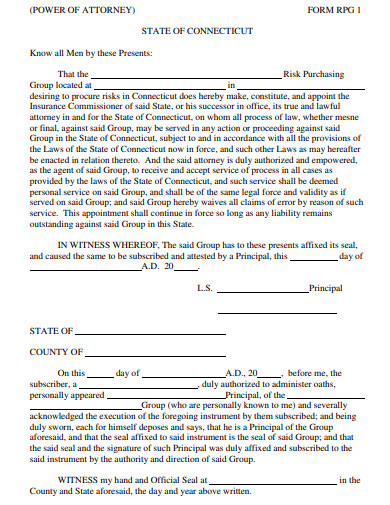

7. Illinois Insurance Power of Attorney Form

8. Printable Insurance Power of Attorney Form

9. Ohio Insurance Power of Attorney Form

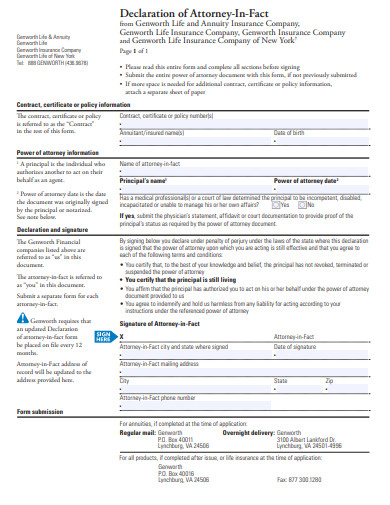

10. Farmers Insurance Power of Attorney Form

11. Standard Insurance Power of Attorney Form

What is Purposes of Insurance in Power of Attorney?

Here is the Power of attorney for insurance Purpose :

Power of Attorney for insurance purposes

A Power of Attorney for insurance purposes is a legal document that grants an individual the authority to manage insurance transactions on behalf of another person. This authority can include buying new insurance policies, managing current ones, filing claims, and handling the payout of claims. It ensures that if the principal cannot oversee these tasks due to absence, incapacity, or other reasons, their insurance matters are still taken care of. This type of Power of Attorney can be tailored to specific insurance-related needs, ensuring that the agent acts within the boundaries set by the principal for managing their insurance affairs.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips