An Indemnity Agreement Form is essential for protecting parties from potential losses or liabilities arising from specific activities or agreements. This legal document ensures one party, the indemnifier, agrees to compensate the indemnitee for damages or losses incurred. Whether used in business transactions, employment, or personal matters, it helps clarify responsibilities and avoid disputes. By understanding its structure and purpose, you can craft an Agreement Form tailored to your needs, ensuring robust legal protection. This guide provides detailed examples and practical advice to simplify creating these essential agreements.

Download Indemnity Agreement Contract Form Bundle

What is Indemnity Agreement Form?

An Indemnity Agreement Form is a legal document in which one party agrees to compensate another for potential losses or liabilities. It defines the scope of protection, responsibilities, and conditions under which indemnification applies. This form is commonly used in business, employment, or contractual scenarios to safeguard against unforeseen damages or claims. By clearly outlining terms, it ensures accountability and reduces the risk of legal conflicts.

Indemnity Agreement Format

Parties Involved:

- Indemnifier: _____________________

- Indemnitee: _____________________

Agreement Terms:

- Activity Covered: ________________

- Indemnity Clause: ________________

- Effective Date: _________________

Responsibilities:

- Obligations of Indemnifier: _______

- Limitations: _____________________

Termination Clause:

- Conditions for Termination: _______

Signatures:

- Indemnifier: _____________________

- Indemnitee: _____________________

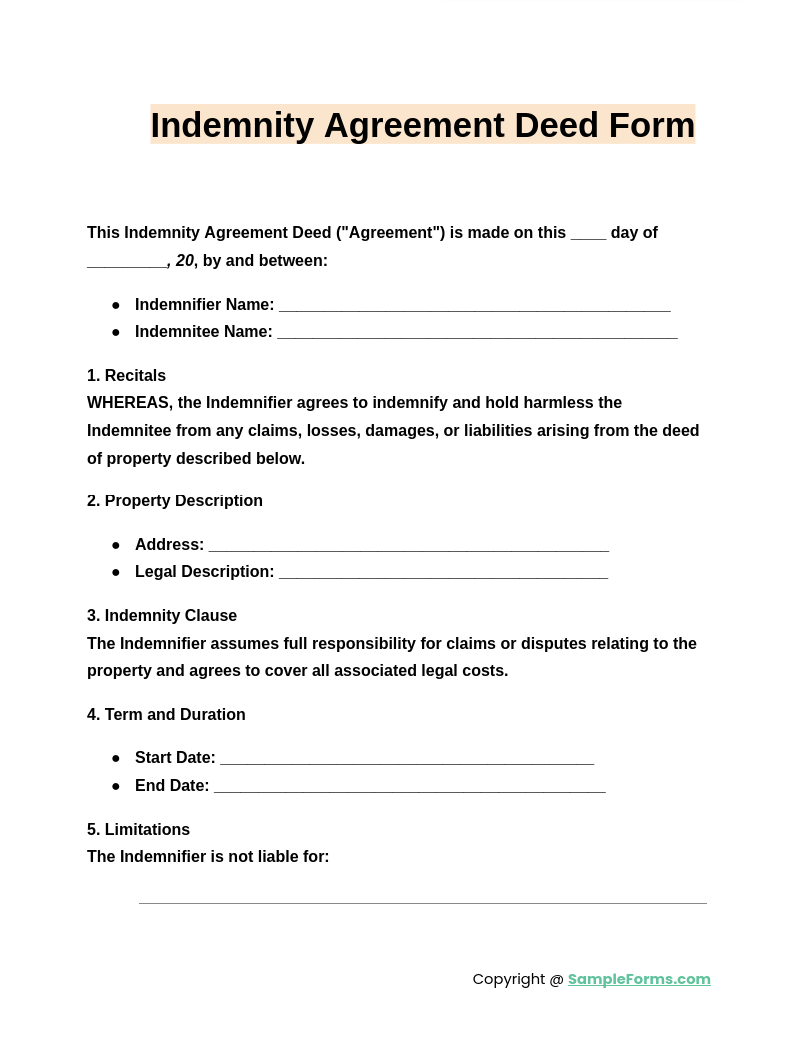

Indemnity Agreement Deed Form

An Indemnity Agreement Deed Form provides legal protection in property-related transactions. Similar to a Horse Lease Agreement Form, it includes indemnifier and indemnitee details, liability clauses, and compensation terms to secure rights and accountability.

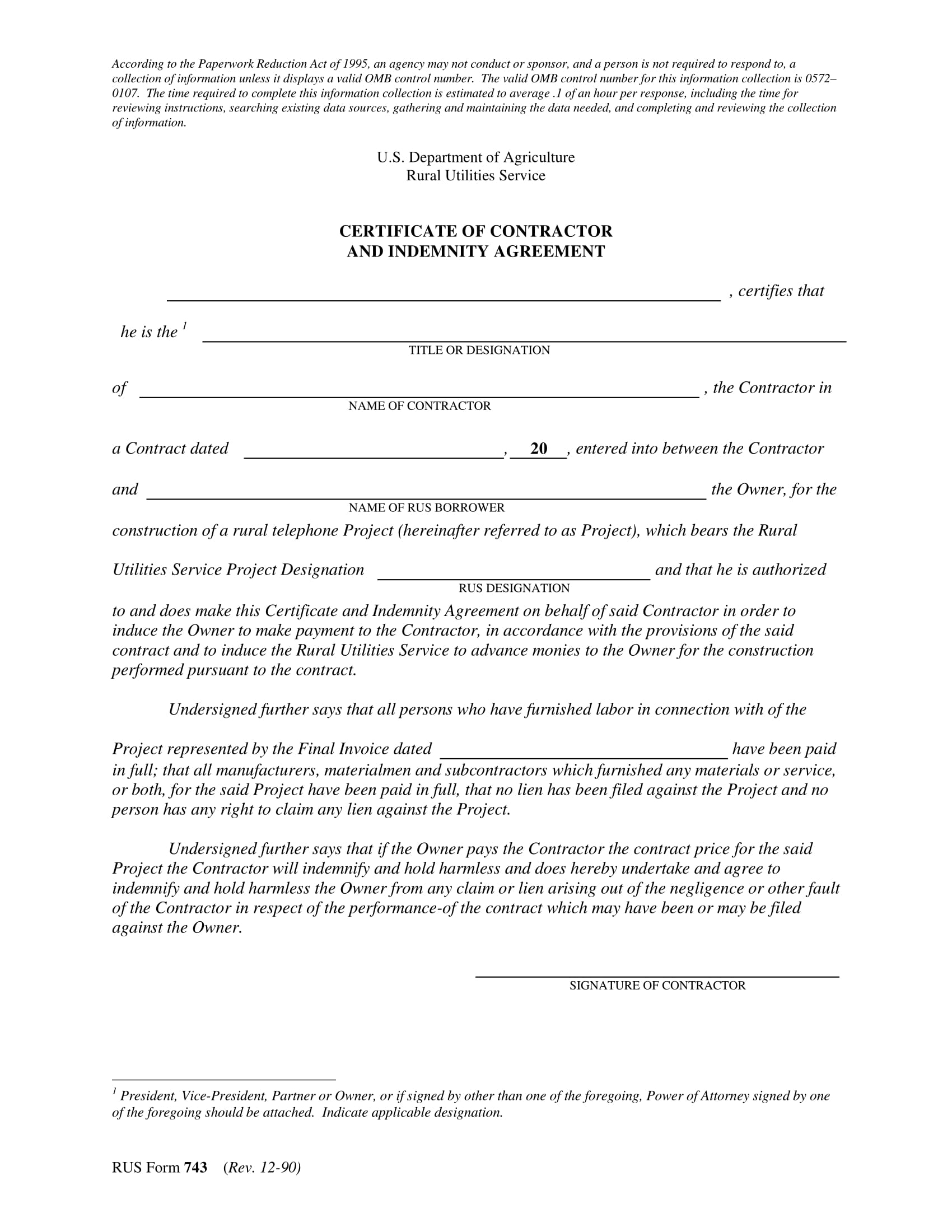

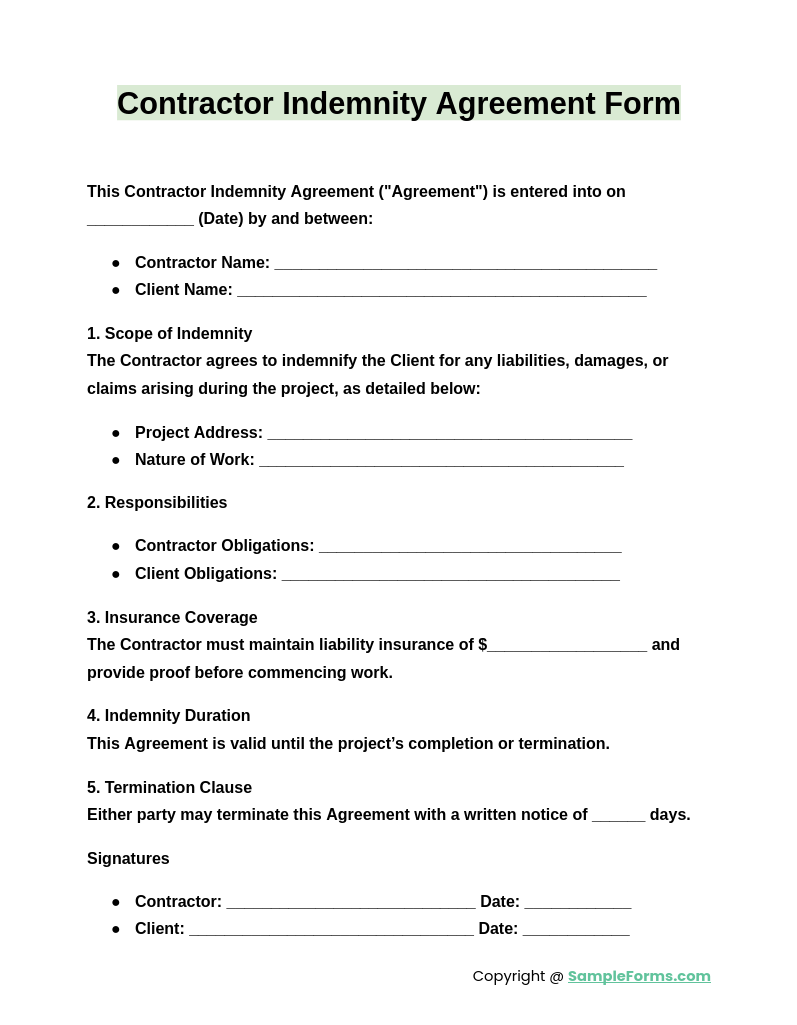

Contractor Indemnity Agreement Form

A Contractor Indemnity Agreement Form ensures businesses are protected from contractor-related liabilities. Similar to an Event Agreement Form, it outlines responsibilities, coverage, and risk management for safe project execution and financial security.

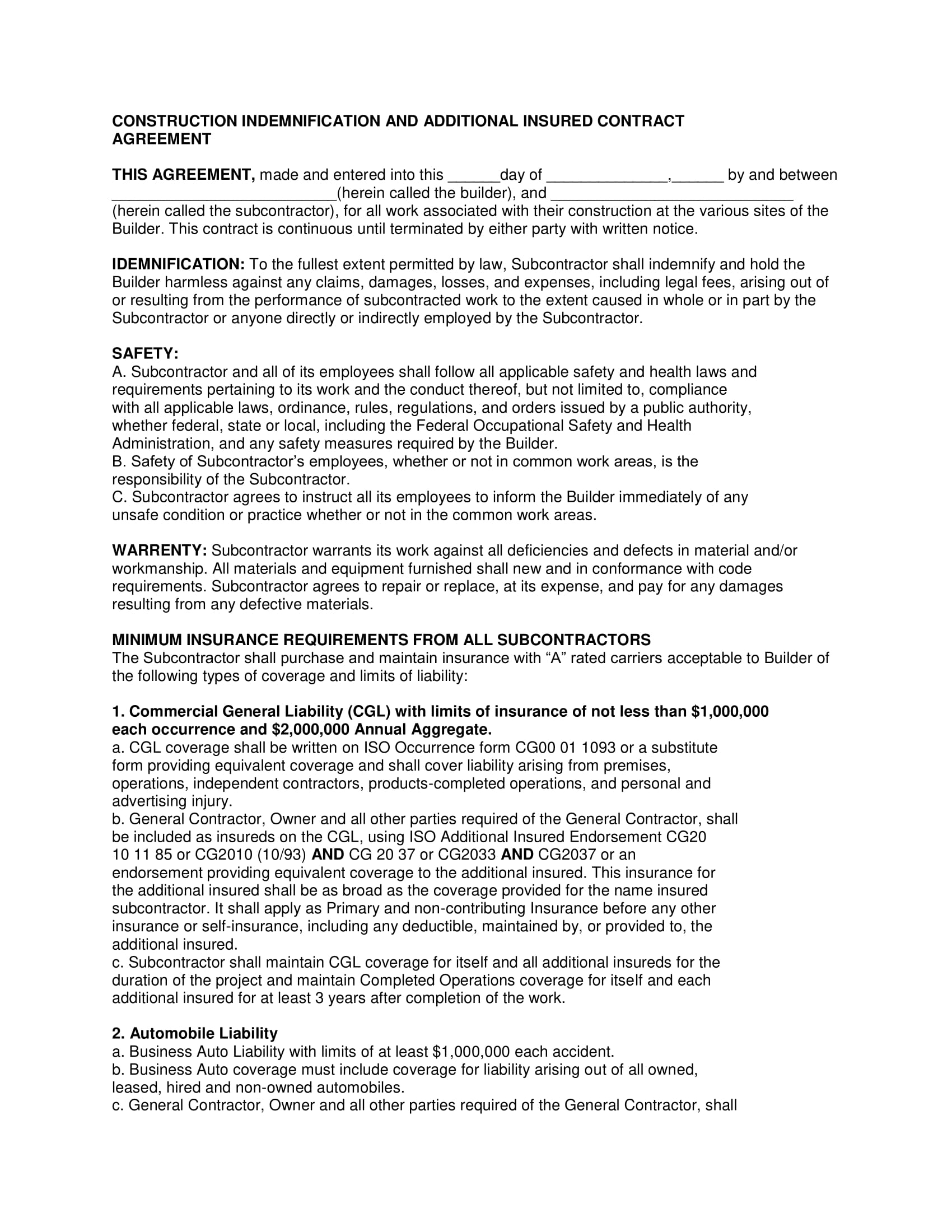

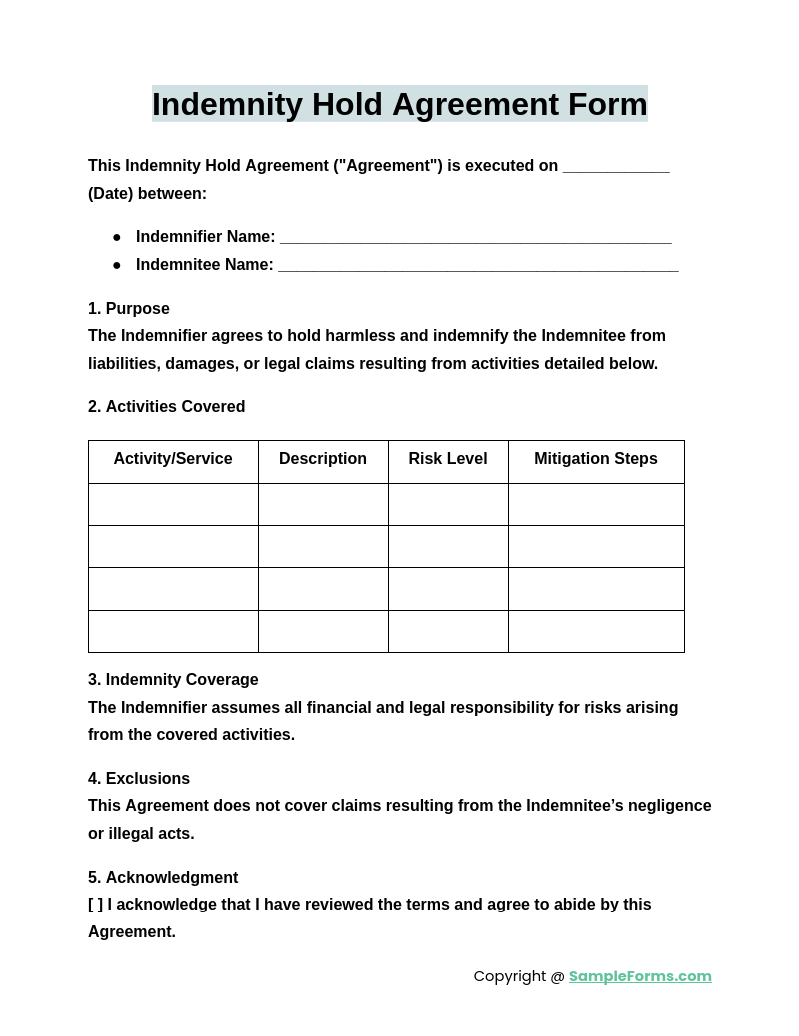

Indemnity Hold Agreement Form

An Indemnity Hold Agreement Form transfers liability protection between parties. Similar to a Parking Space Rental Agreement Form, it specifies conditions, liability coverage, and protections to mitigate risks effectively in shared responsibilities.

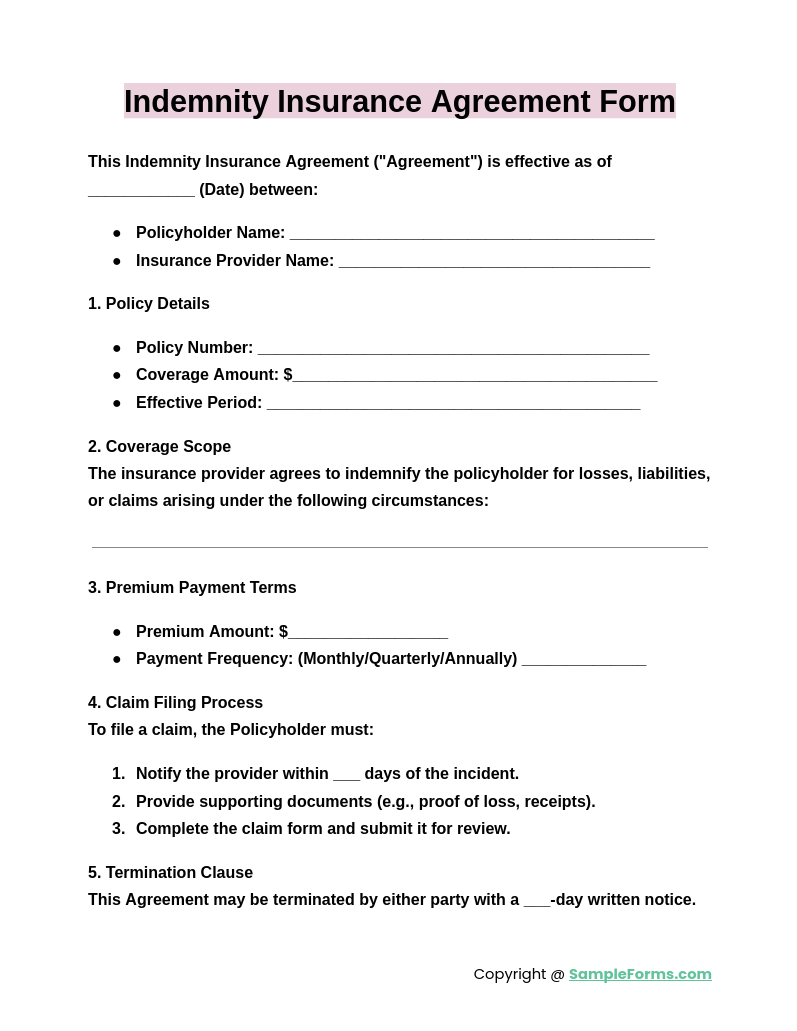

Indemnity Insurance Agreement Form

An Indemnity Insurance Agreement Form provides financial coverage for liabilities. Similar to a Contingency Fee Agreement Form, it includes coverage details, compensation terms, and specific indemnity clauses to protect against unforeseen risks and losses.

Browse More Indemnity Agreement Contract Forms

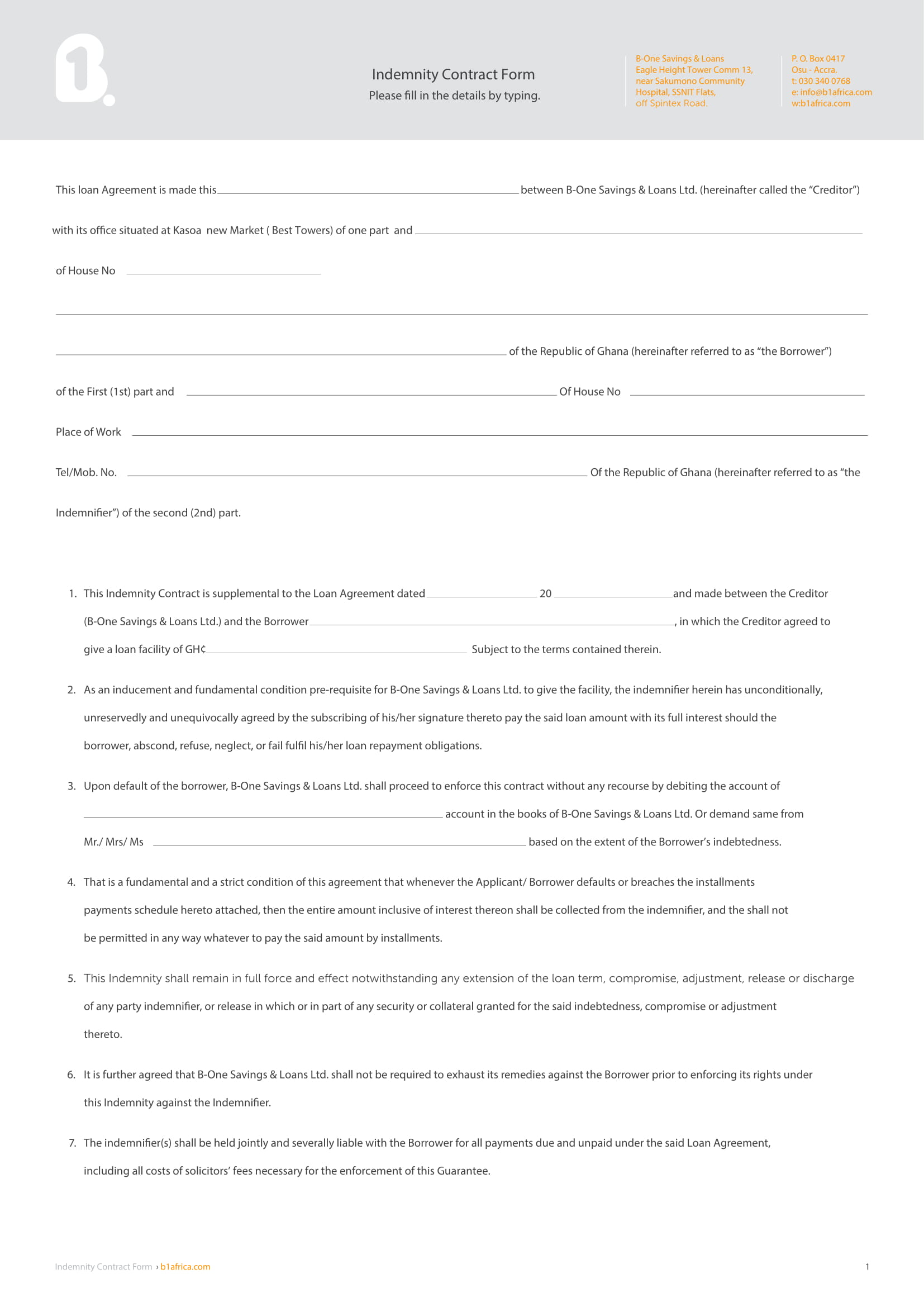

Indemnity Contract Form Sample

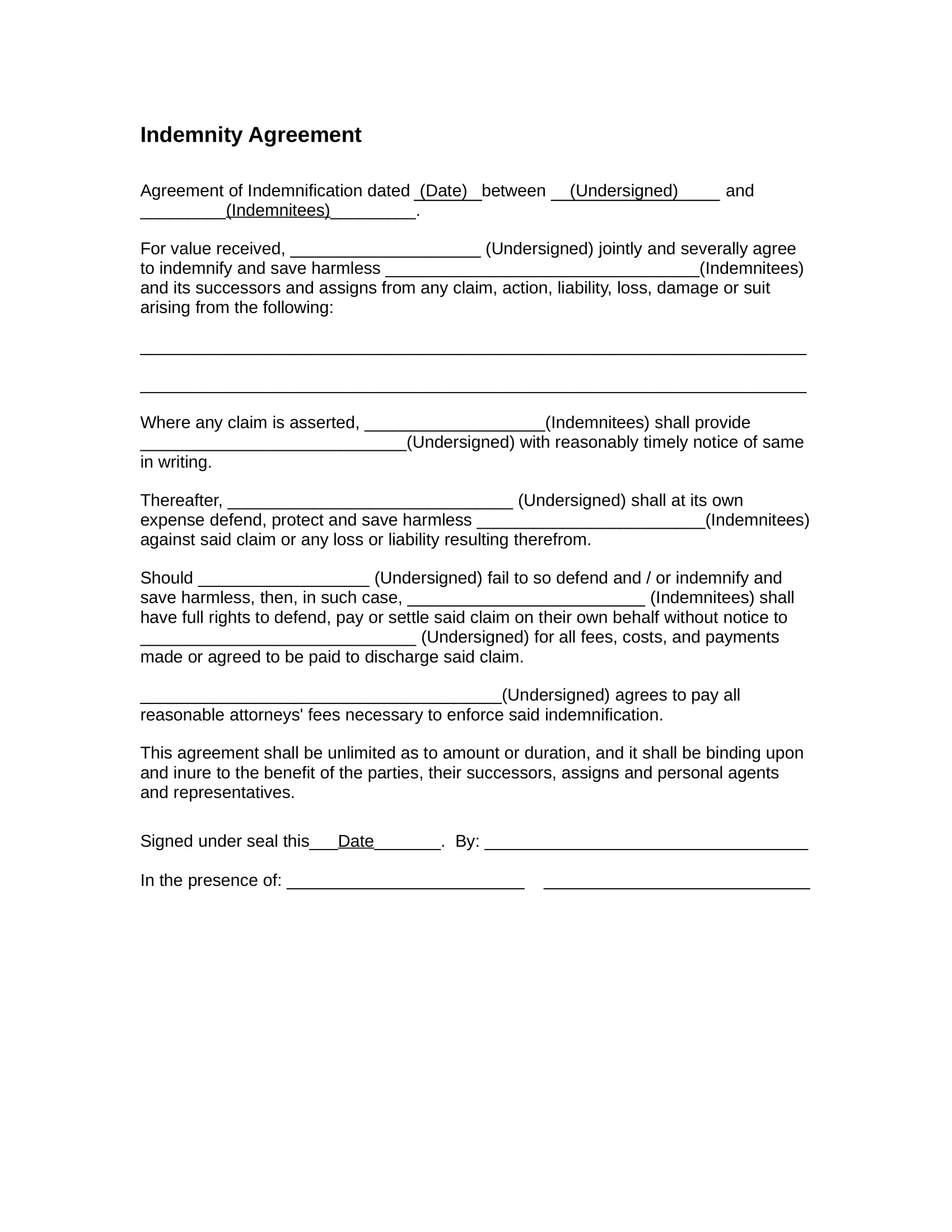

Indemnity Agreement Form in DOC

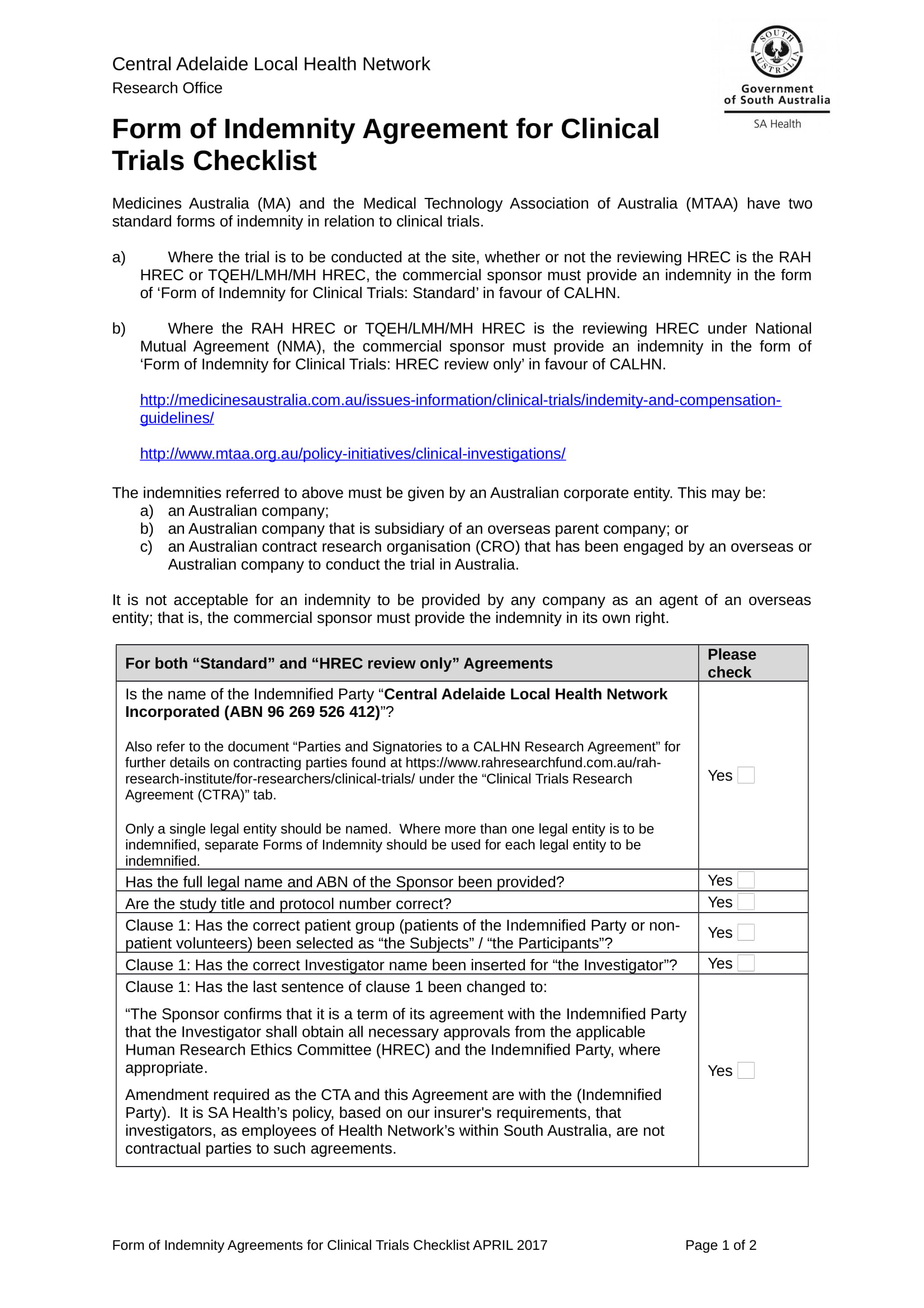

Clinical Trial Indemnity Agreement Form

Contractor Certificate Indemnity Agreement Form

General Contractor Indemnity Agreement Contract Form

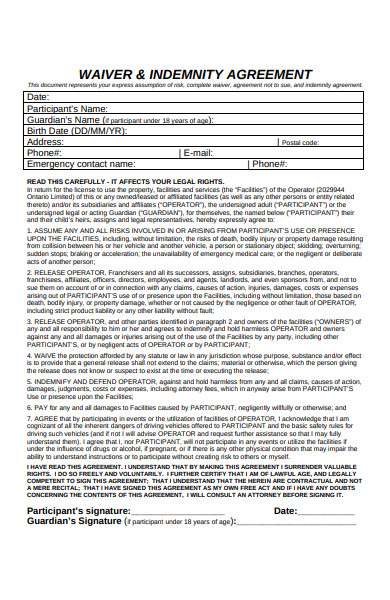

Wavier Indemnity Agreement Form

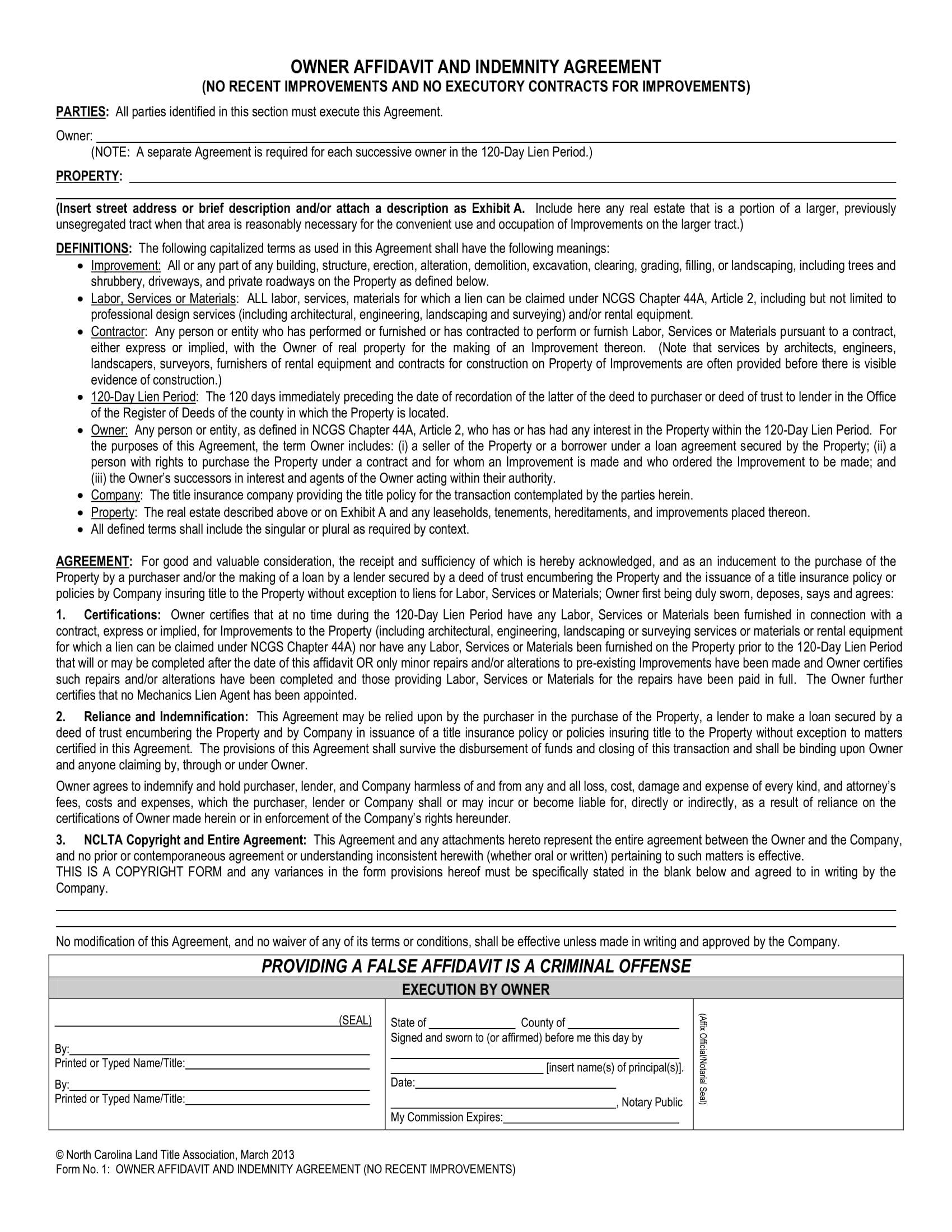

Owner Affidavit Indemnity Agreement Contract Form

What is the purpose of an indemnity agreement?

The primary purpose of an indemnity agreement is to protect one party from financial or legal liabilities arising from specific activities or risks.

- Risk Mitigation: Helps safeguard parties from unforeseen financial losses, similar to a Commercial Rental Agreement Form for shared risks.

- Legal Protection: Establishes a clear understanding of obligations and protections.

- Clarity in Responsibilities: Outlines indemnifier and indemnitee roles to prevent conflicts.

- Compensation for Damages: Provides a framework for reimbursement in case of loss.

- Applicable Across Scenarios: Useful in contracts, property dealings, and other agreements.

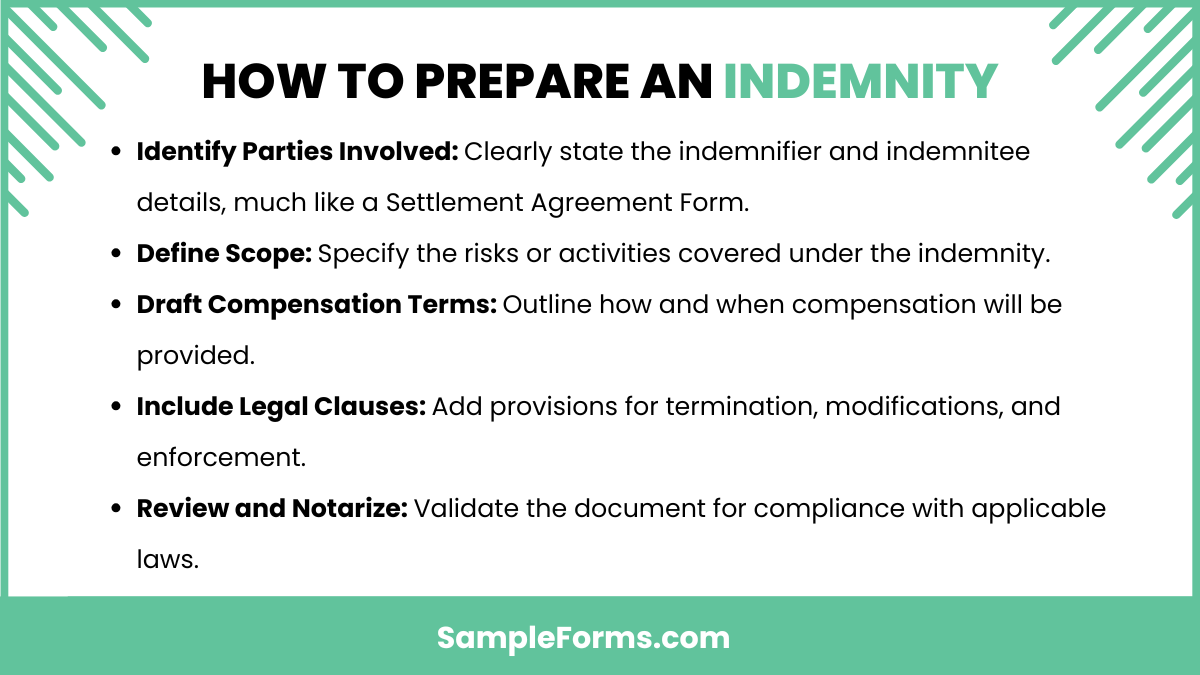

How to prepare an indemnity?

Preparing an indemnity requires detailed documentation of terms, conditions, and responsibilities to ensure mutual understanding and legal compliance.

- Identify Parties Involved: Clearly state the indemnifier and indemnitee details, much like a Settlement Agreement Form.

- Define Scope: Specify the risks or activities covered under the indemnity.

- Draft Compensation Terms: Outline how and when compensation will be provided.

- Include Legal Clauses: Add provisions for termination, modifications, and enforcement.

- Review and Notarize: Validate the document for compliance with applicable laws.

How do I draft an indemnity agreement?

Drafting an indemnity agreement involves a clear layout of terms, responsibilities, and legal clauses to create a robust document.

- Understand the Purpose: Identify the reason for the indemnity, akin to a Trailer Rental Agreement Form for asset protection.

- Outline Obligations: Clearly state what each party is responsible for under the agreement.

- Add Indemnity Clauses: Include clauses covering the extent of liability and exclusions.

- Include Dispute Resolution: Specify how disputes will be handled if they arise.

- Review and Approve: Seek legal advice to finalize and validate the document.

What are the rules of indemnity?

The rules of indemnity govern the rights and responsibilities of the indemnifier and indemnitee, ensuring fair and lawful protection.

- Good Faith Execution: Both parties must act in good faith, much like a Business Purchase Agreement Form ensures transparency.

- Defined Scope: The agreement should clearly state the coverage limits.

- Reimbursement Clause: Specify how damages or losses will be compensated.

- Exclusion of Negligence: Liability exclusions should not include willful negligence.

- Legal Enforceability: The agreement must comply with applicable laws and regulations.

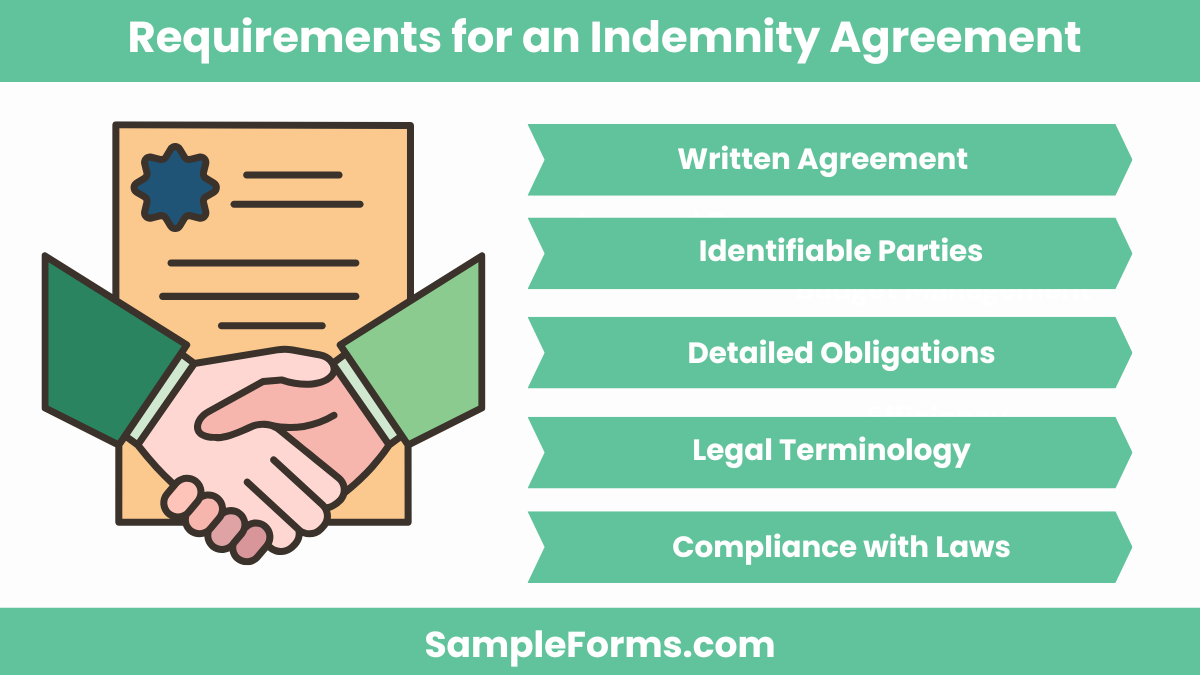

What are the requirements for an indemnity agreement?

An indemnity agreement must meet specific legal and structural criteria to ensure validity and enforceability.

- Written Agreement: The document must be clearly drafted and signed, similar to a Rental Lease Agreement Form.

- Identifiable Parties: Include complete details of the indemnifier and indemnitee.

- Detailed Obligations: Specify responsibilities and compensation terms for both parties.

- Legal Terminology: Use precise legal language to avoid ambiguities.

- Compliance with Laws: Ensure alignment with local and federal legal requirements.

Who fills an indemnity form?

An indemnity form is typically filled by the indemnifier, agreeing to compensate for potential losses. It may resemble a Non Compete Agreement Form in terms of liability clarity.

Is an indemnity legally binding?

Yes, an indemnity is legally binding if signed by both parties and meets legal criteria, similar to a Room Agreement Form.

Are indemnity agreements enforceable?

Indemnity agreements are enforceable when they adhere to legal requirements and clearly outline liabilities, like a Parking Agreement Form for specific situations.

What documents are required for an indemnity bond?

Documents such as proof of identity, financial statements, and agreement terms are needed, similar to what a House Agreement Form might require.

Why would you indemnify someone?

Indemnification provides financial protection, ensuring accountability in contracts, akin to the responsibilities outlined in a Commercial Agreement Form.

Can you sue for indemnity?

Yes, indemnity can be pursued legally if obligations are unmet, as outlined in agreements like an Assignment Agreement Form.

What is the cost of an indemnity bond?

Costs vary based on bond type and coverage, typically a percentage of the bond amount, much like a Holding Deposit Agreement Form structure.

How do you prove indemnity?

Proof of indemnity requires a valid agreement, proof of damage, and evidence of compliance, comparable to terms in a Roommate Agreement Form.

Who pays the indemnity?

The indemnifier is responsible for paying the indemnity, similar to financial responsibilities in an Installment Agreement Form.

Is indemnity good or bad?

Indemnity is good as it provides financial protection; however, it can pose risks if terms are unfavorable, much like a Postnuptial Agreement Form.

The Non Disclosure Agreement Form and the Indemnity Agreement Form share the goal of legal clarity and protection. While the former ensures confidentiality, the latter mitigates risks from financial or legal liabilities. By understanding its components and using the examples provided, businesses and individuals can create effective indemnity agreements that secure their interests. This guide simplifies the process, offering insights into drafting legally compliant, straightforward, and practical agreements to address a wide range of scenarios confidently.

Related Posts

-

FREE 5+ Bartender Contract Forms in PDF | MS Word

-

FREE 3+ Limited Partnership Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Medical Release Agreement Contract Forms in PDF

-

FREE 5+ Office Lease Agreement Contract Forms in PDF

-

FREE 6+ Pledge Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Medicaid Agreement Contract Forms in PDF

-

FREE 8+ Non-Competition Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Limited Liability Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Joint Venture Contract Forms in PDF | MS Word

-

FREE 3+ Sale of Goods Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Home Sales Agreement Contract Forms in PDF | MS Word

-

FREE 10+ Easement Agreement Contract Forms in PDF

-

Contract Termination Letter

-

FREE 8+ Consulting Contract Forms in PDF | MS Word

-

FREE 10+ Hire Agreement Contract Forms in PDF | MS Word