A House Rent Allowance Form is essential for employees seeking reimbursement for rental expenses. This guide covers everything you need to know, including the best practices for filling out your Allowance Form and submitting a comprehensive Rent Report Form. Understanding how to complete these forms properly can help maximize your allowance benefits and reduce errors in your submissions. With our guide, you’ll be able to ensure that all necessary documents are attached, making the process smooth and efficient.

Download House Rent Allowance Form Bundle

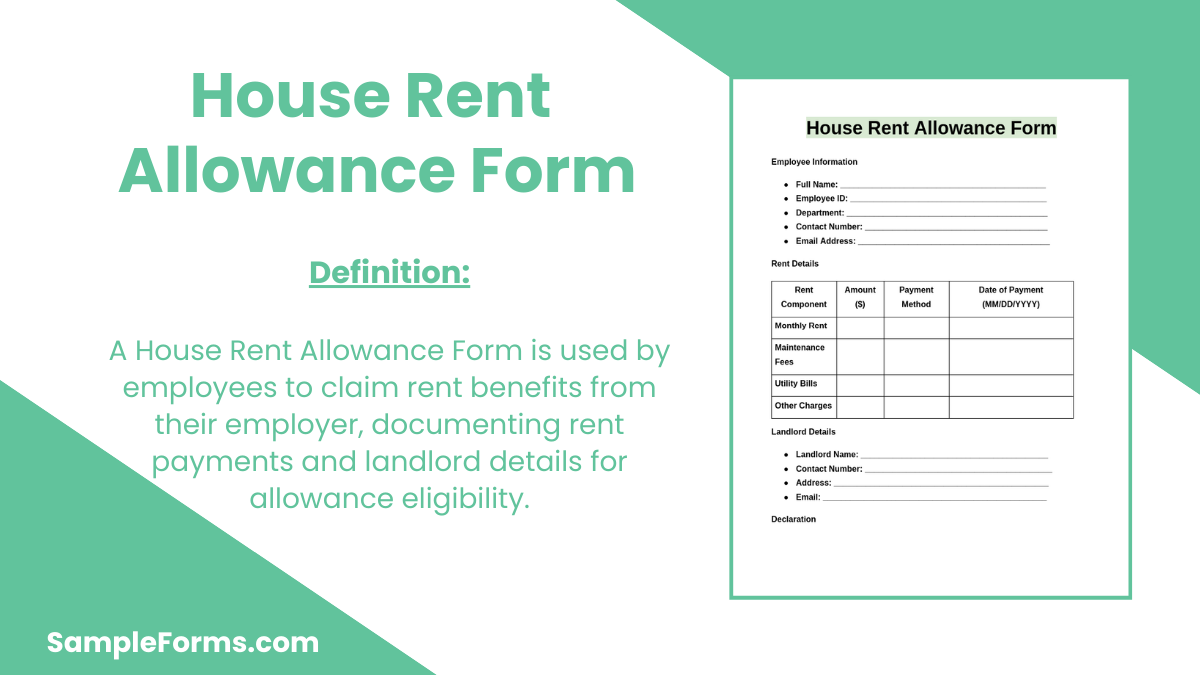

What is House Rent Allowance Form?

A House Rent Allowance Form is a document used by employees to claim rent benefits from their employer. It includes details like the rental amount paid, landlord information, and supporting documents such as rent receipts. This form ensures that employees receive the entitled allowance for their housing expenses, especially when their salary package includes house rent benefits.

House Rent Allowance Format

Employee Details

Employee Name: _________________________________________

Employee ID: ____________________________________________

Designation: _____________________________________________

Department: _____________________________________________

Contact Number: _________________________________________

Email Address: ___________________________________________

Rental Information

Address of Rented Property: ________________________________

Landlord Name: __________________________________________

Landlord Contact Number: _________________________________

Monthly Rent Paid: $______________________________________

Payment Method: ☐ Bank Transfer ☐ Check ☐ Cash

Supporting Documents

- Copy of Rent Agreement

- Rent Receipts for the past 3 months

- Landlord’s Tax Receipt (if applicable)

Declaration by Employee

I, ______________________________________ (Employee Name), hereby declare that I am paying the above rent for my residential accommodation. The details provided are accurate, and I am eligible to claim House Rent Allowance.

☐ I confirm that the submitted information is true and accurate.

☐ I have attached all required documents.

Signature of Employee: _________________________________

Date: _________________________________________________

Approval Section

Approved By: ___________________________________________

Designation: ____________________________________________

Comments (if any): ________________________________________

Signature: ______________________________________________

Date Approved: __________________________________________

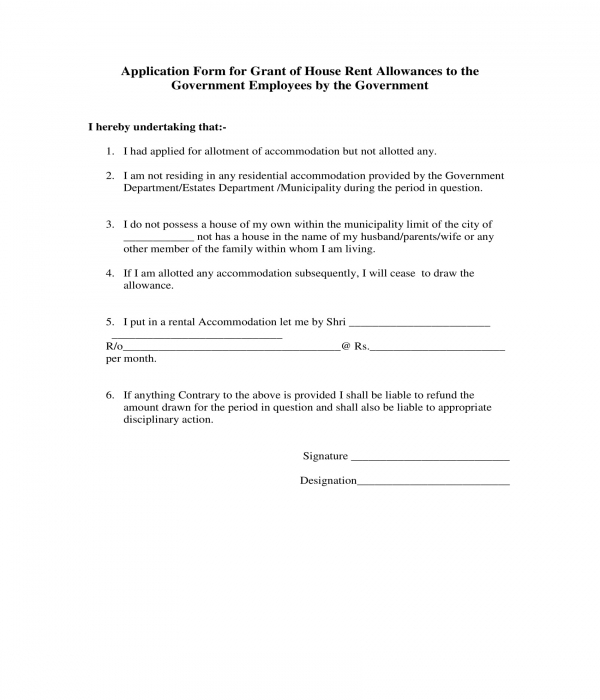

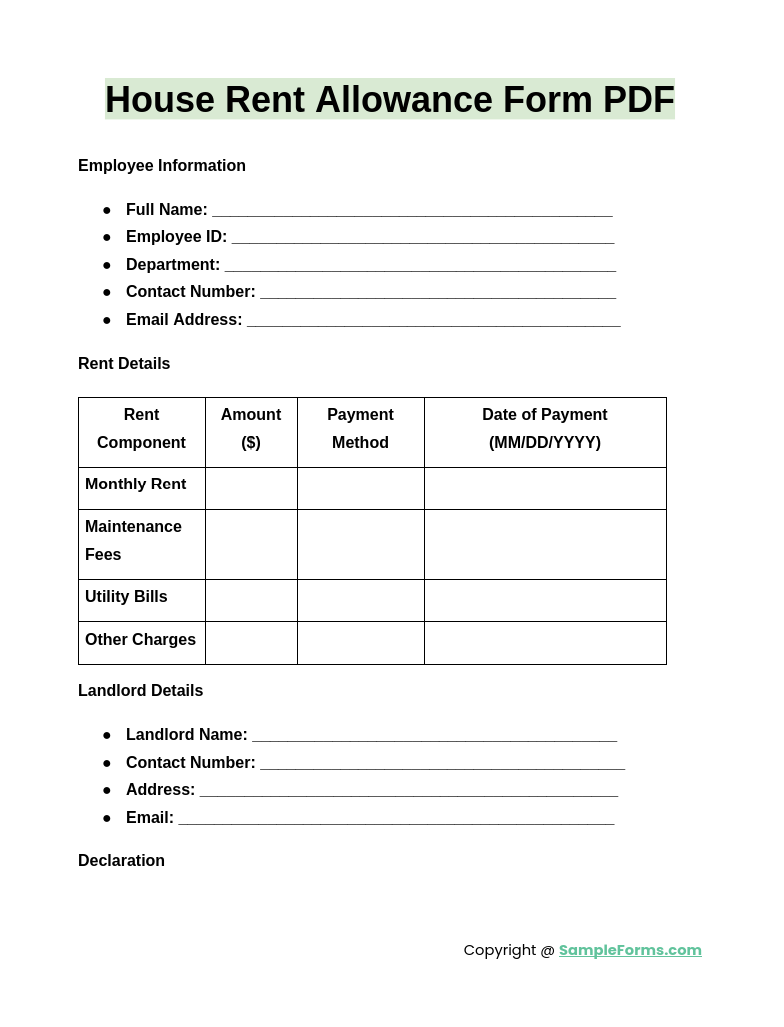

House Rent Allowance Form PDF

A House Rent Allowance Form PDF is a ready-to-use document that allows employees to quickly fill in their rent details and submit claims. It includes sections for rent amount, landlord information, and supporting documents. Downloading a PDF version saves time and ensures compliance. This form complements your House Agreement Form to verify rental arrangements.

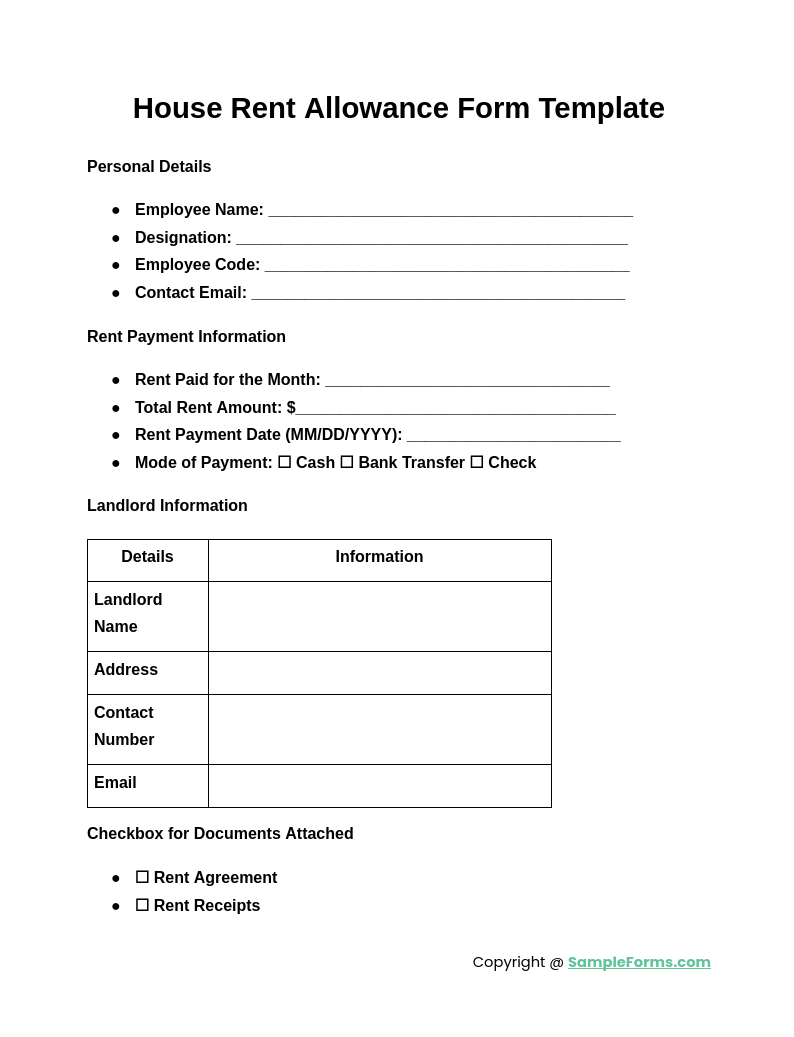

House Rent Allowance Form Template

A House Rent Allowance Form Template serves as a customizable format for employers and employees. It simplifies the process of requesting rent allowances, ensuring all necessary details are captured accurately. This template supports your House Rental Contract, verifying that rent payments align with the agreement terms, thus optimizing reimbursement processes.

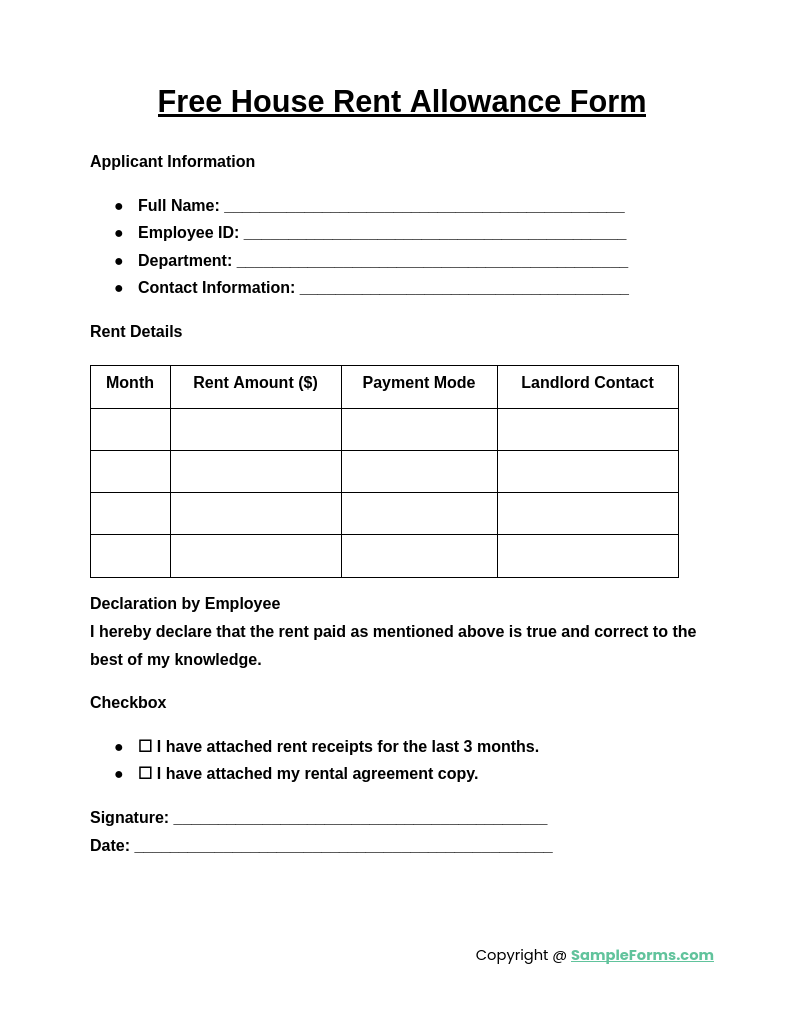

Free House Rent Allowance Form

The Free House Rent Allowance Form is designed for easy access and usage, allowing employees to claim rent benefits without hassle. This form helps track rental payments and attached documentation. It’s an ideal complement to your House Rental Application, ensuring rental details align with employer requirements for housing benefits.

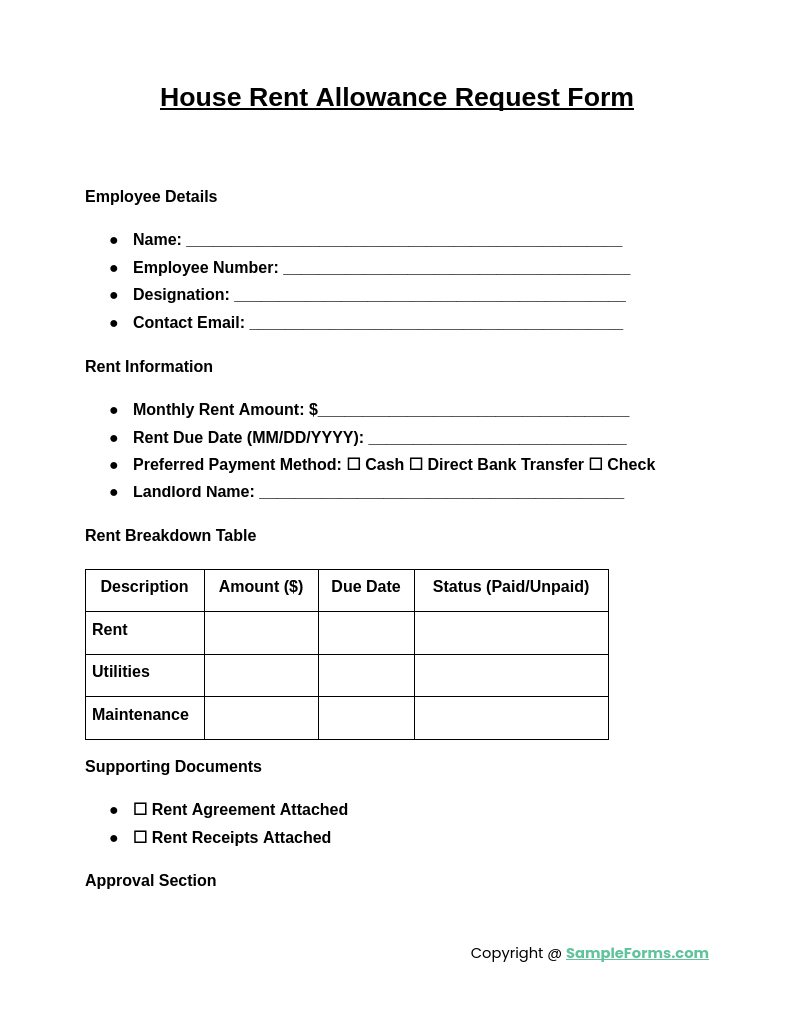

House Rent Allowance Request Form

A House Rent Allowance Request Form is essential for formally requesting rent reimbursements. It includes fields for employee information, rent details, and landlord verification. This form streamlines the approval process and aligns with the Open House Feedback Form, which collects insights on housing experiences to optimize future rental arrangements.

Browse More House Rent Allowance Forms

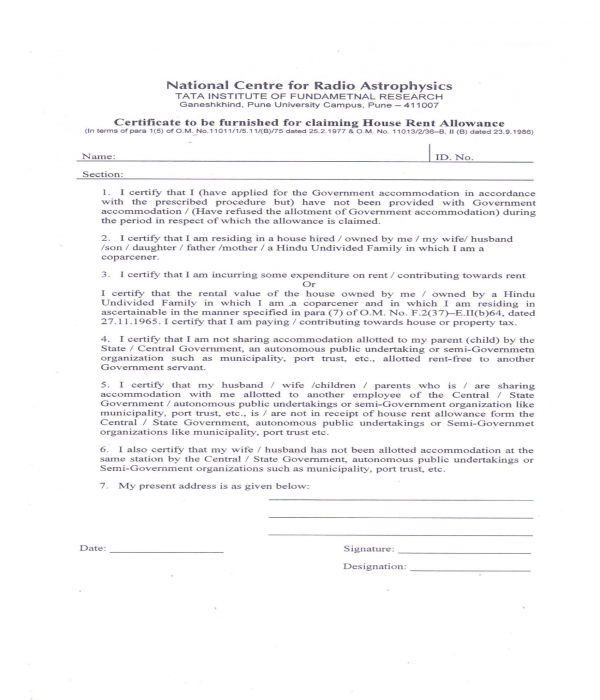

House Rent Allowance Application Form in DOC

House Rent Allowance Application Form

House Rent Allowance Application Statement Form

House Rent Allowance Claim Certificate Form

House Rent Allowance Property Details Form

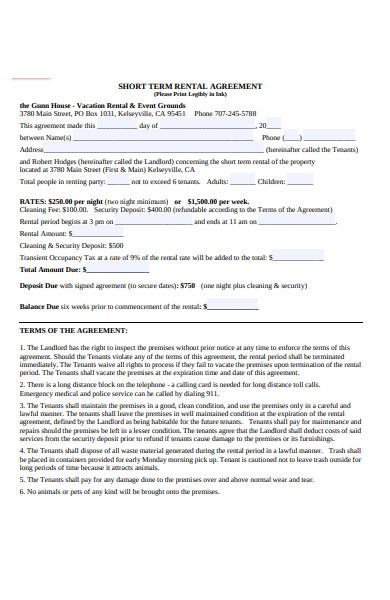

Short Term Rental Agreement Sample

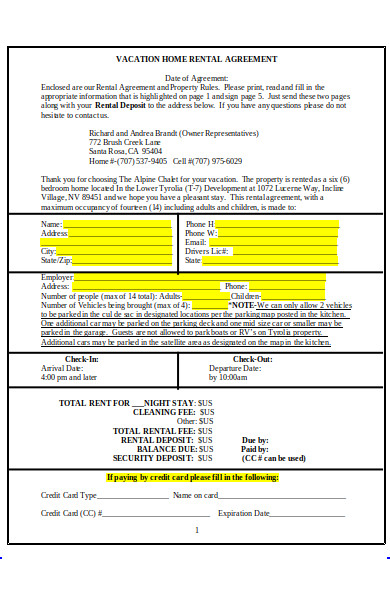

Free Vacation Rental Agreement Form

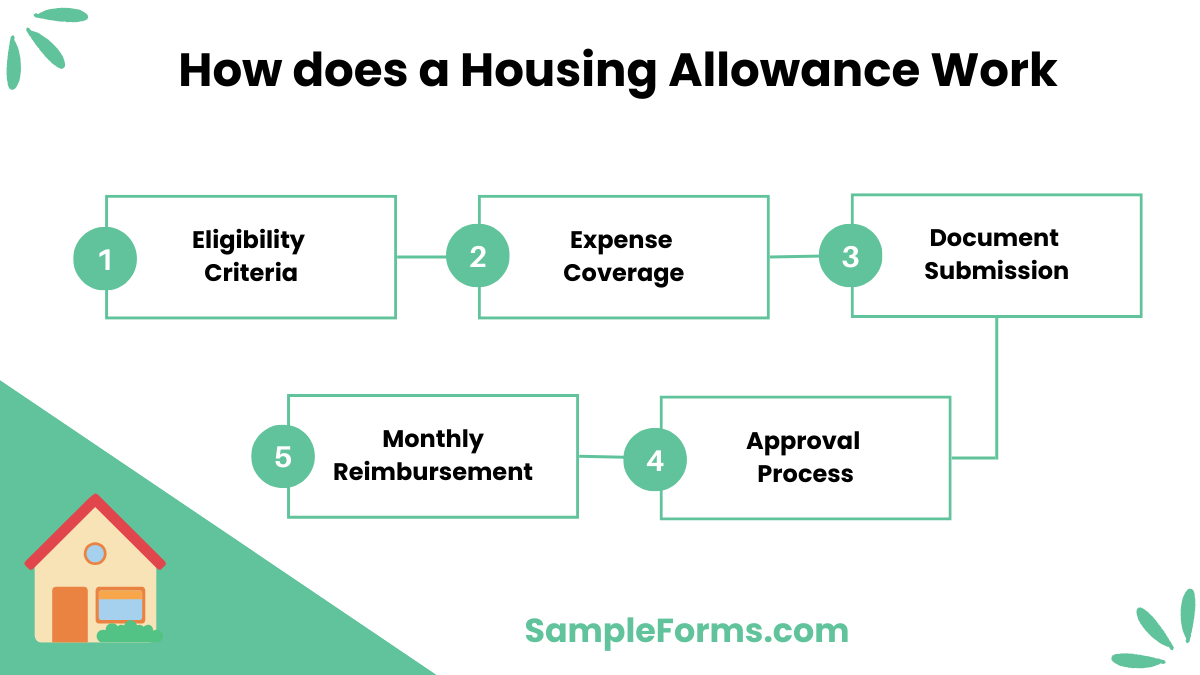

How does a housing allowance work?

A housing allowance helps cover an employee’s housing costs, either partially or fully, based on company policies and employee eligibility.

- Eligibility Criteria: Ensure your employer includes housing benefits in your House Contract Form.

- Expense Coverage: Typically covers rent or mortgage payments.

- Document Submission: Attach relevant rent documents.

- Monthly Reimbursement: Claim allowance on a monthly basis.

- Approval Process: Submit a signed form for verification.

Who gets basic allowance for housing?

This benefit is mainly available to military personnel, expatriates, or employees with specific compensation packages.

- Military Members: Typically receive housing support.

- Expat Employees: Often included in overseas packages.

- Non-Profit Workers: Some NGOs offer allowances.

- Civil Servants: Eligibility varies based on location.

- Documentation: Use a House Lease Agreement to claim benefits.

What expenses count towards housing allowance?

Eligible expenses include rent, utilities, and sometimes home maintenance, helping employees manage living costs more effectively.

- Rental Payments: Claim through a Rent Lease Agreement.

- Utilities: Covers electricity, water, and heating costs.

- Home Repairs: Some allowances cover minor maintenance.

- Insurance: Home insurance may be included.

- Leasing: Document expenses with a valid lease.

What is the most housing benefit you can get?

The maximum housing benefit amount depends on factors like income, location, and household size, ensuring support for employees in high-cost areas.

- Income Levels: Higher salaries may reduce eligibility.

- Family Size: Larger families often receive more benefits.

- Geographic Differences: Urban areas may have higher allowances.

- Documentation: Track expenses using a Household Budget Form.

- Annual Review: Employers reassess benefits periodically.

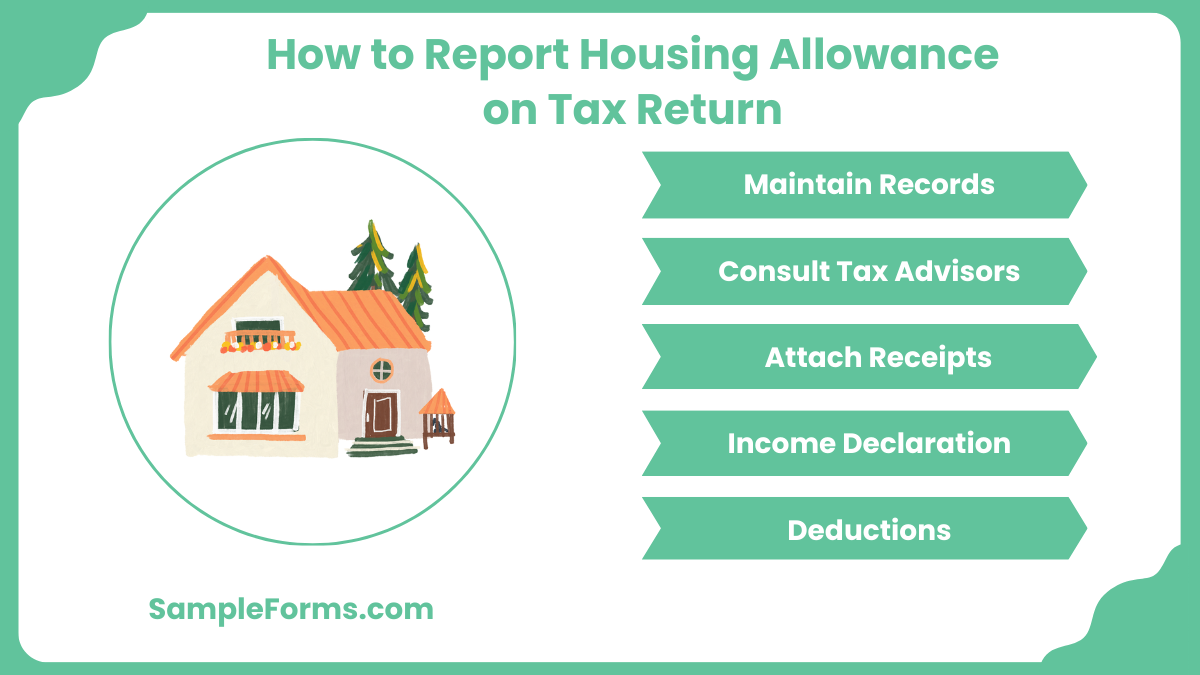

How do I report housing allowance on my tax return?

Proper reporting of housing allowances ensures compliance with tax regulations and prevents legal issues.

- Maintain Records: Use a Room Rental Agreement to document expenses.

- Consult Tax Advisors: Ensure correct filing.

- Attach Receipts: Submit a Rent Receipt Form with your tax return.

- Income Declaration: Include the allowance in your taxable income.

- Deductions: Keep accurate records for possible deductions.

Is housing allowance taxable income?

Yes, housing allowances can be taxable if not explicitly exempt under tax laws. Verify eligibility with your employer and document using a Weekly Rental Agreement.

What is employee housing allowance?

Employee housing allowance covers a portion of rent expenses provided by employers, often detailed in a Commercial Rental Agreement Form to ensure compliance.

Is housing allowance subject to Social Security?

Yes, housing allowances may be subject to Social Security taxes unless explicitly exempt. Documentation is crucial, especially with a Rental Verification Form.

How is local housing allowance calculated?

Local housing allowance is based on factors like rental market rates, location, and family size. Ensure details are included in your Rental Lease Agreement Form.

What is an allowance in real estate?

In real estate, an allowance is a financial benefit provided to cover specific costs like repairs, often specified in a Trailer Rental Agreement Form.

How to record tenant improvement allowance?

Record tenant improvement allowances as assets or lease incentives, ensuring documentation with a Rental Receipt for tax compliance.

Is tenant improvement allowance tax deductible?

Tenant improvement allowances are generally tax deductible if documented correctly using a Rent Roll Form for verification.

What is the highest basic salary?

The highest basic salary varies by industry, but real estate professionals with high-value portfolios and strong Rental History Form records often earn top-tier compensation.

What is housing allowance income?

Housing allowance income refers to funds received for rent, which must be declared using a House Rental Application if it’s taxable.

Do you pay taxes on GI Bill housing allowance?

No, GI Bill housing allowances are typically non-taxable. Ensure you have records like a Rent Invoice Form for any associated rental expenses.

In conclusion, the House Rent Allowance Form plays a critical role in ensuring employees receive the right compensation for their housing expenses. Properly filling out forms, using samples, and attaching all necessary documents like a Rental Agreement Month to Month, can simplify the process significantly. Understanding how to utilize these forms effectively helps employees optimize their rent benefits, reducing the financial burden of housing costs.

Related Posts

-

FREE 8+ Sample Commercial Lease Forms in PDF | MS Word

-

FREE 11+ Sample Residential Lease Forms in PDF | MS Word

-

FREE 7+ Sample Triple Net Lease Forms in PDF | MS Word

-

FREE 23+ Sample Lease Forms in PDF | Excel | Word

-

FREE 10+ Sample Lease Extension Forms in PDF | Word | Excel

-

FREE 9+ Sample Commercial Lease Agreement Forms in PDF | Word

-

FREE 9+ Sample Commercial Lease Forms in PDF | MS Word

-

FREE 7+ Sample Month to Month Lease Forms in PDF | MS Word

-

FREE 7+ Sample Residential Lease Forms in PDF | MS Word

-

FREE 8+ Sample Apartment Lease Forms in PDF | MS Word