A Horse Bill of Sale Form is essential for documenting the sale of a horse, ensuring legal compliance and transparency for both buyer and seller. This comprehensive guide explores examples, steps to create, and best practices for drafting a reliable Bill of Sale Form. Whether you’re a first-time buyer or experienced seller, these forms protect your rights and formalize the transaction. Key components include details of the horse, payment terms, and both parties’ signatures. Use this guide to create a professional form that simplifies ownership transfer and provides clarity. Learn more about drafting a Horse Bill of Sale Form today!

Download Horse Bill of Sale Form Bundle

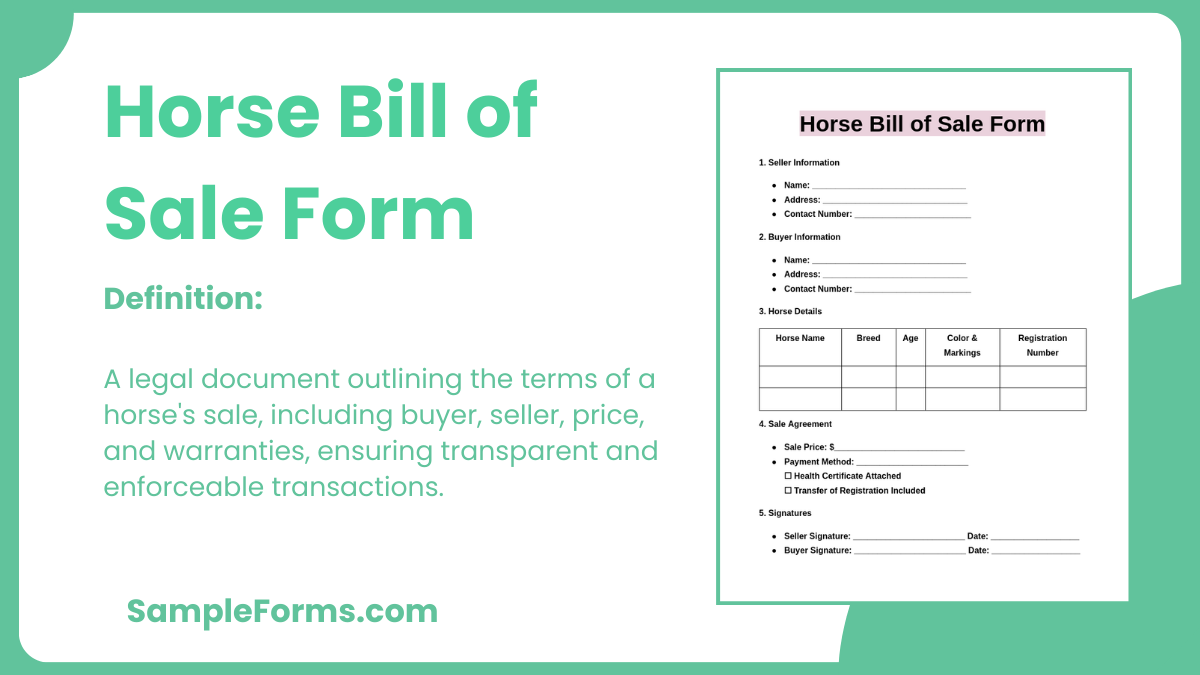

What is Horse Bill of Sale Form?

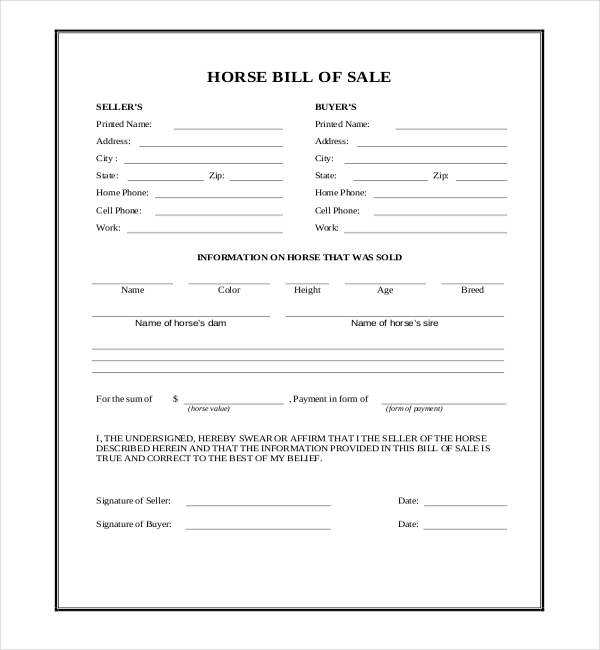

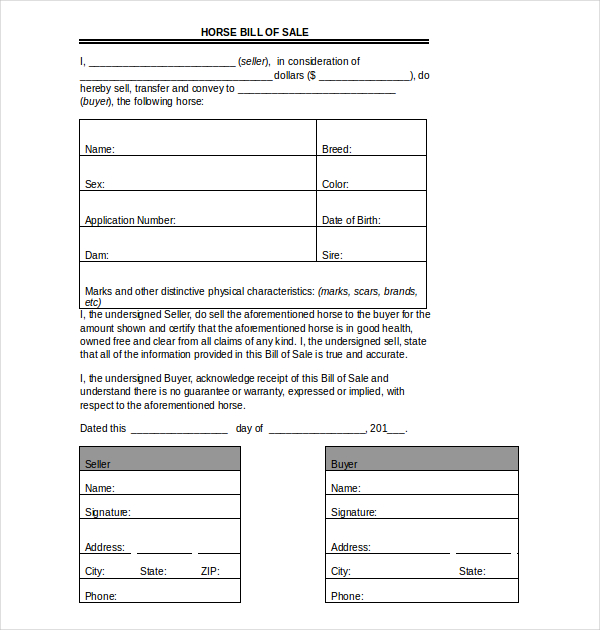

A Horse Bill of Sale Form is a legal document that records the sale of a horse, ensuring ownership transfer and transaction terms are clearly defined. It includes information such as the buyer’s and seller’s details, horse description, price, and warranties (if any). This document protects both parties by serving as proof of the agreement. Whether for personal or professional purposes, using this form simplifies the sale process and minimizes disputes.

Horse Bill of Sale Format

1. Seller Information

- Name: ___________________________

- Address: _________________________

- Contact Details: _________________

2. Buyer Information

- Name: ___________________________

- Address: _________________________

- Contact Details: _________________

3. Horse Details

- Name of Horse: ___________________

- Breed: ___________________________

- Age: _____________________________

- Color and Markings: _______________

- Registration Number (if applicable): _____________

4. Sale Details

- Sale Price: $_____________________

- Payment Method: _________________

- Sale Date: ______________________

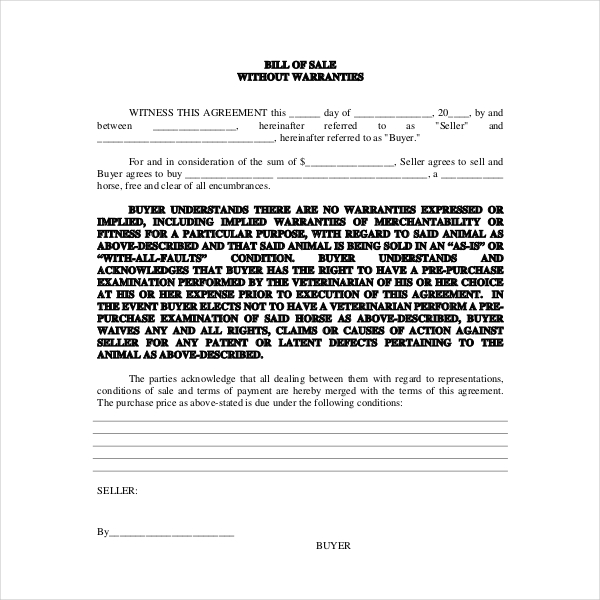

5. Warranty/Disclaimer

☐ Sold “As-Is”

☐ Health Guarantee (Specify): _____________________

6. Signatures

- Seller Signature: __________________ Date: ________

- Buyer Signature: __________________ Date: ________

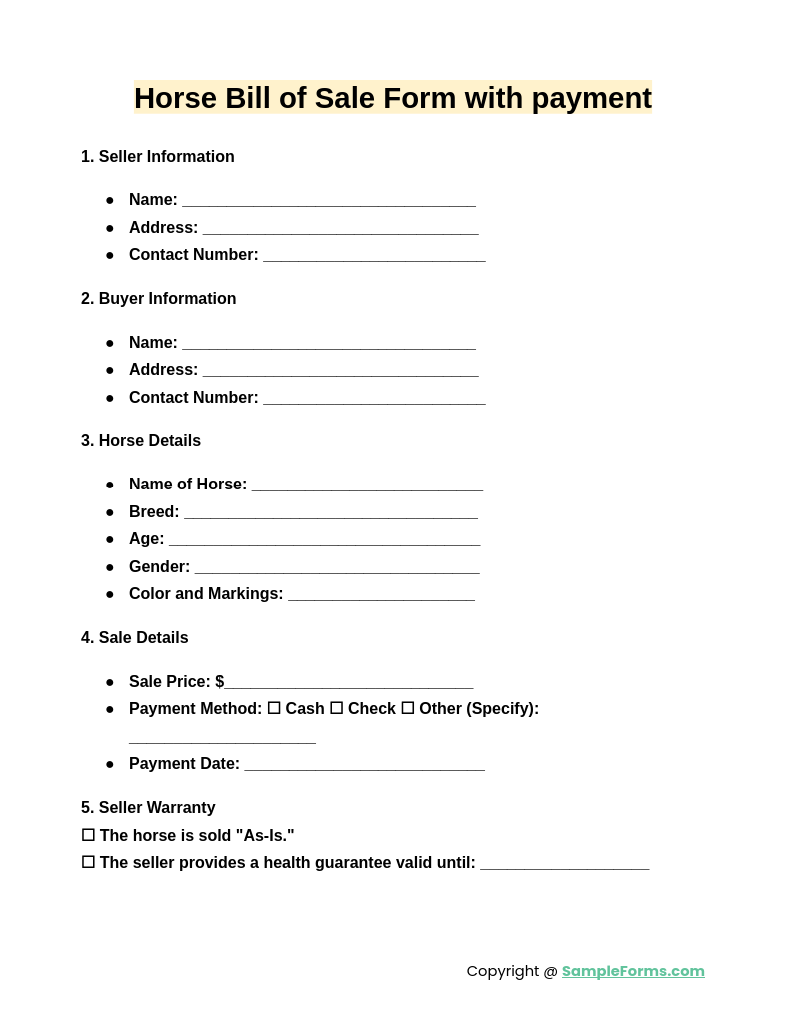

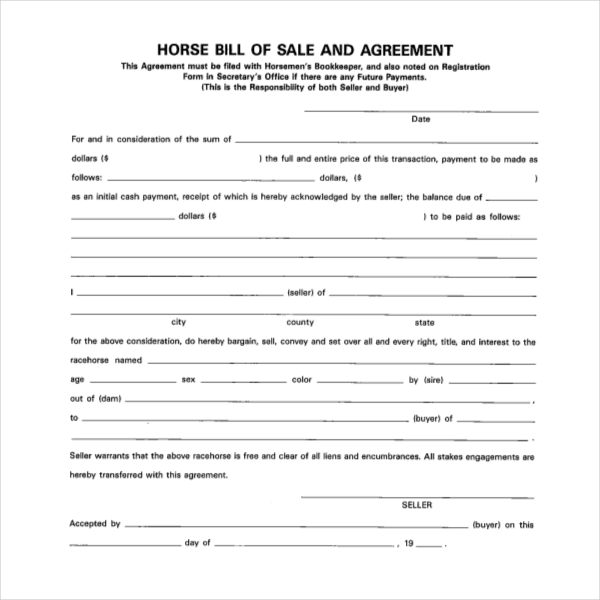

Horse Bill of Sale Form with Payment

A Horse Bill of Sale Form with payment includes detailed payment terms, ensuring financial clarity. Buyers and sellers outline payment methods, amounts, and timelines. This form minimizes disputes and aligns with the transparency of a Boat Bill of Sale Form.

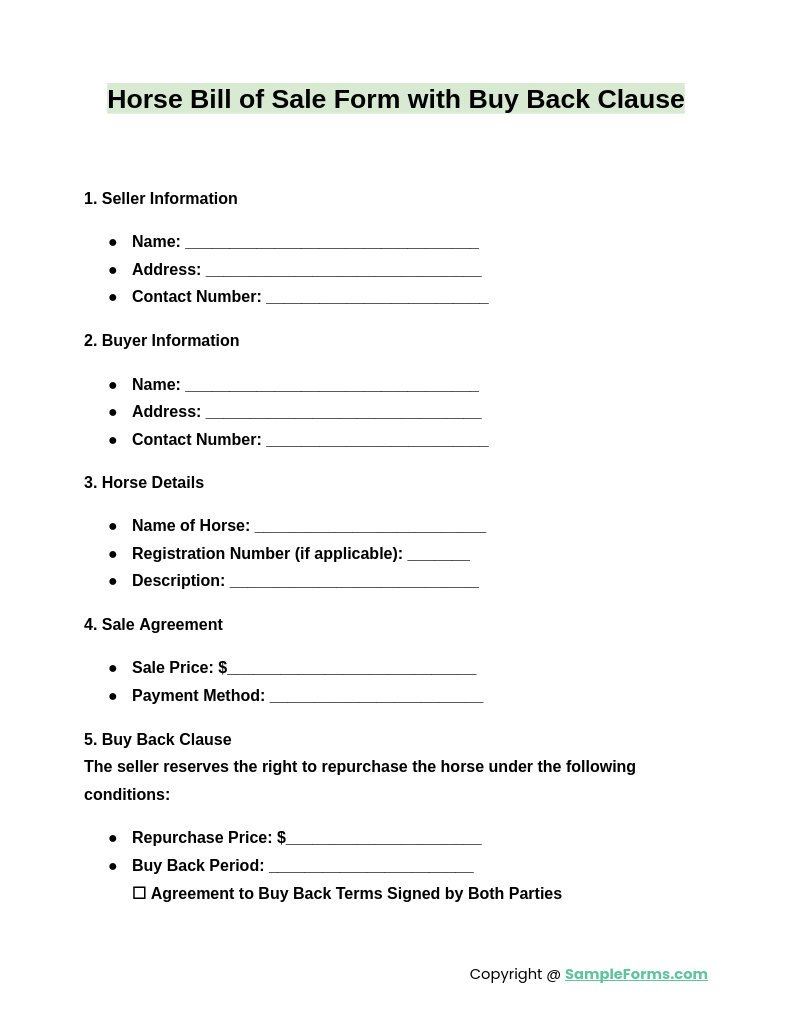

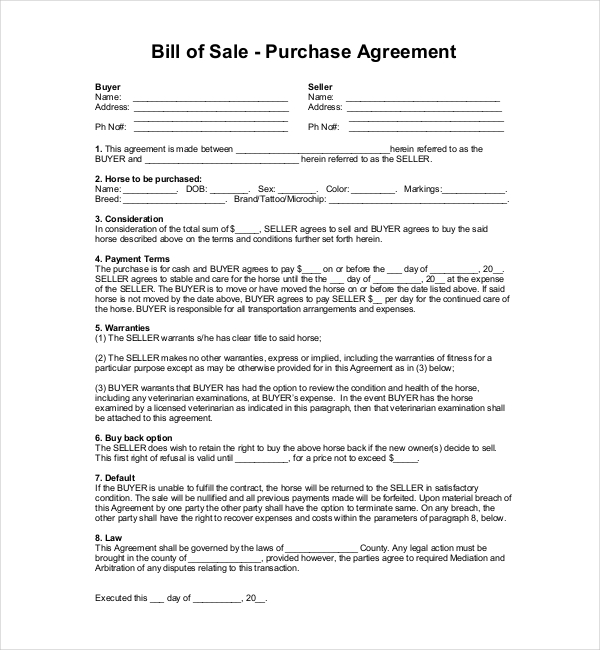

Horse Bill of Sale Form with Buy Back Clause

The Horse Bill of Sale Form with Buy Back Clause safeguards seller rights to repurchase the horse under agreed conditions. This format is ideal for temporary transfers, mirroring the security provided by an Equipment Bill of Sale Form.

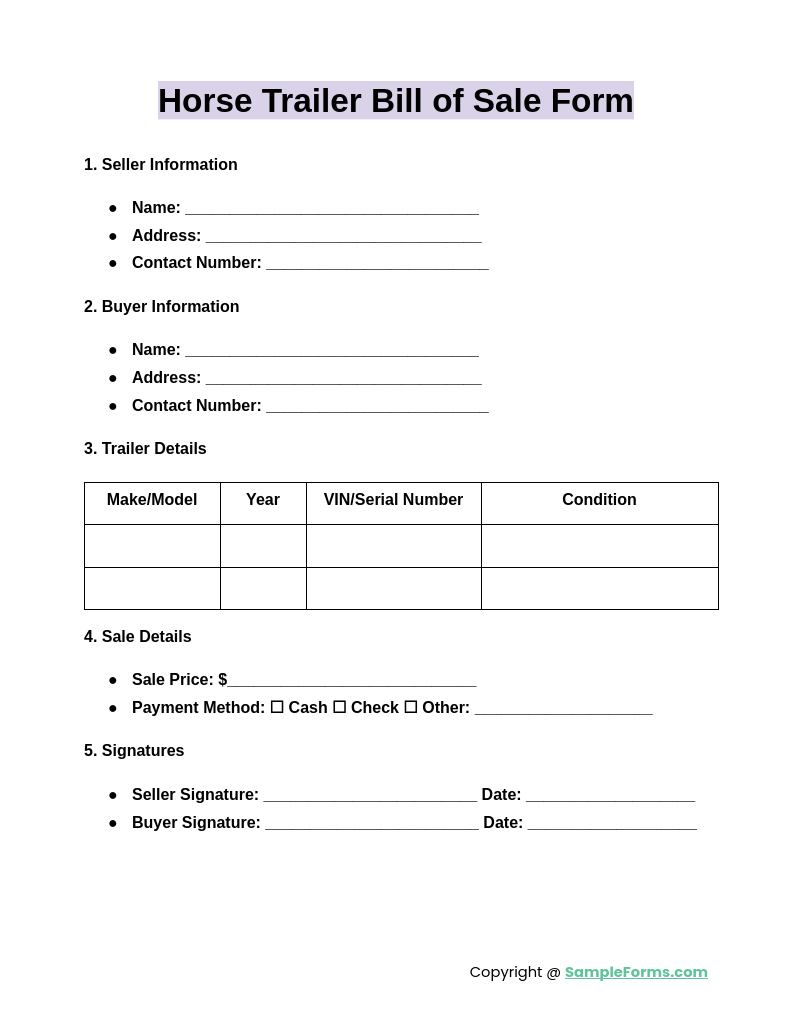

Horse Trailer Bill of Sale Form

A Horse Trailer Bill of Sale Form documents the transfer of ownership for trailers. It details trailer specifications, sale terms, and warranty (if any). Similar to a DMV Bill of Sale Form, this form ensures legal compliance for vehicle-related sales.

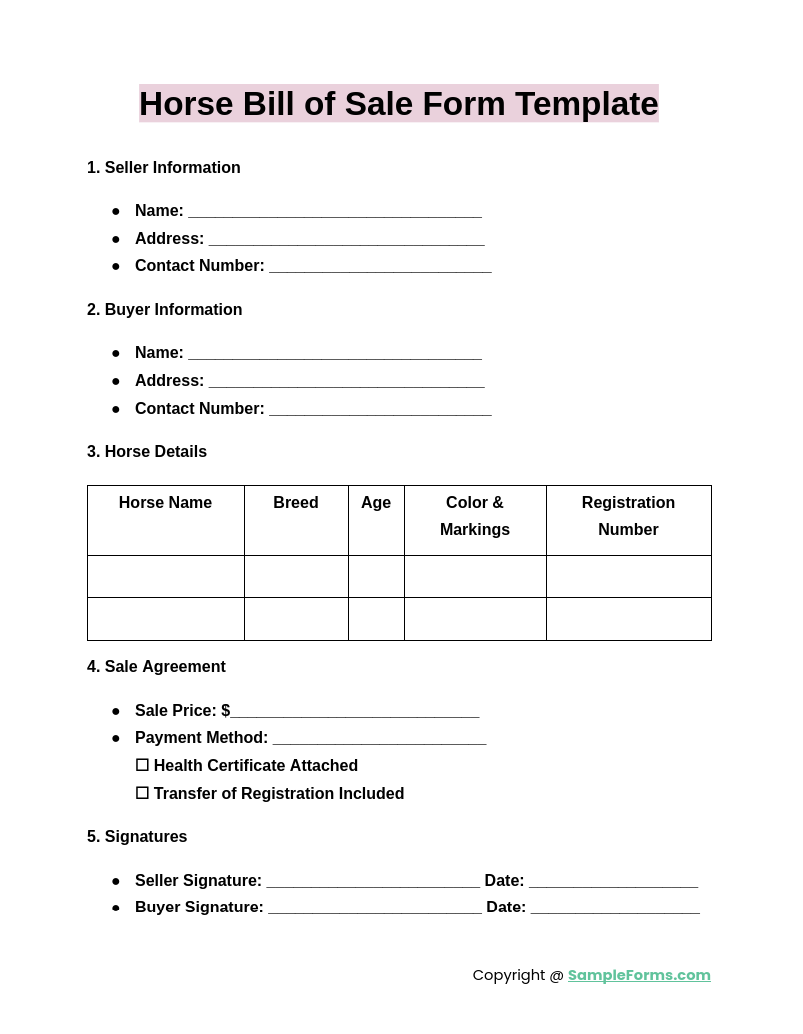

Horse Bill of Sale Form Template

The Horse Bill of Sale Form Template simplifies transaction documentation, offering a customizable structure. This ensures accuracy and efficiency, much like the comprehensive layout of a Vehicle Bill of Sale Form.

Browse More Horse Bill of Sale Forms

Horse Bill of Sale with First Right of Refusal

hardluckhorses.com

Equine Bill of Sale Template

8ws.org

Alabama Bill of Sale for Conveyance of Horse

s3.amazonaws.com

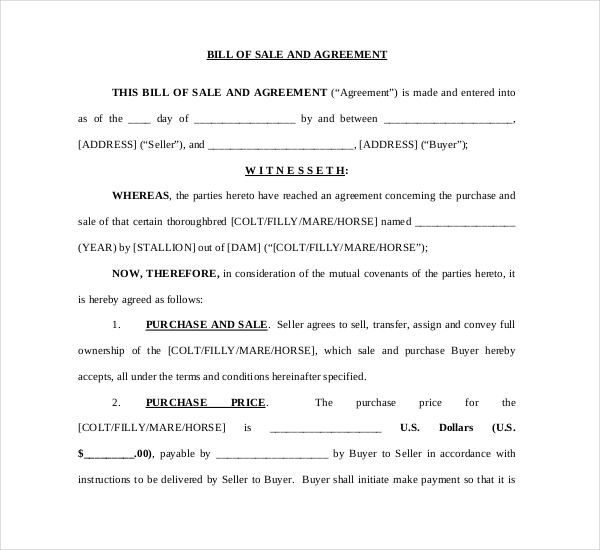

Horse Bill of Sale and Agreement

khrc.ky.gov

Horse Bill of Sale Form Free Download

billofsale-form.com

Sample Horse Bill of Sale Form

wordtemplate.net

Horse Bill of Sale and Agreement Free Download

toba.org

How to write a bill of sale for a horse?

Creating a clear and professional horse bill of sale ensures legal protection for both buyer and seller. Key steps include:

- Include Identifying Details: Provide full names and addresses of the buyer and seller.

- Horse Description: Mention breed, age, color, markings, and registration number.

- Payment Information: Specify the price, payment method, and payment date.

- Agreement Terms: Include warranties or an “as-is” clause, as seen in a Notarized Bill of Sale Form.

- Signatures: Both parties must sign and date the document.

What is proof of purchase of horse?

Proof of purchase for a horse is a document confirming the sale, detailing buyer, seller, and transaction terms. Essential elements include:

- Seller Details: Include full name, address, and contact information.

- Buyer Details: Mention the buyer’s name and contact information.

- Horse Details: Provide a clear description of the horse.

- Transaction Record: Record payment details, similar to a Motorcycle Bill of Sale Form.

- Signatures: Ensure the document is signed by both parties.

How to claim ownership of a horse?

Claiming ownership of a horse requires documentation proving the transaction and compliance with local regulations. Follow these steps:

- Obtain a Bill of Sale: A completed Horse Bill of Sale Form serves as proof of ownership.

- Registration: Register the horse with relevant breed or livestock organizations, as applicable in a Livestock Bill of Sale Form.

- Microchipping or Branding: Add an identifying mark if required.

- Proof of Payment: Keep receipts and financial records.

- Transfer Records: Ensure proper transfer of any prior registrations.

How do I transfer a horse into my name?

Transferring a horse into your name ensures legal ownership and updates official records. Key steps include:

- Obtain the Bill of Sale: Ensure the seller provides a signed Horse Bill of Sale Form.

- Update Registration: Notify breed associations or registries.

- Comply with Local Laws: Adhere to state-specific regulations, like an ATV Bill of Sale Form for vehicle transfers.

- Keep Proof of Purchase: Retain all transaction documents.

- Verify Ownership Details: Ensure all horse details match the documentation.

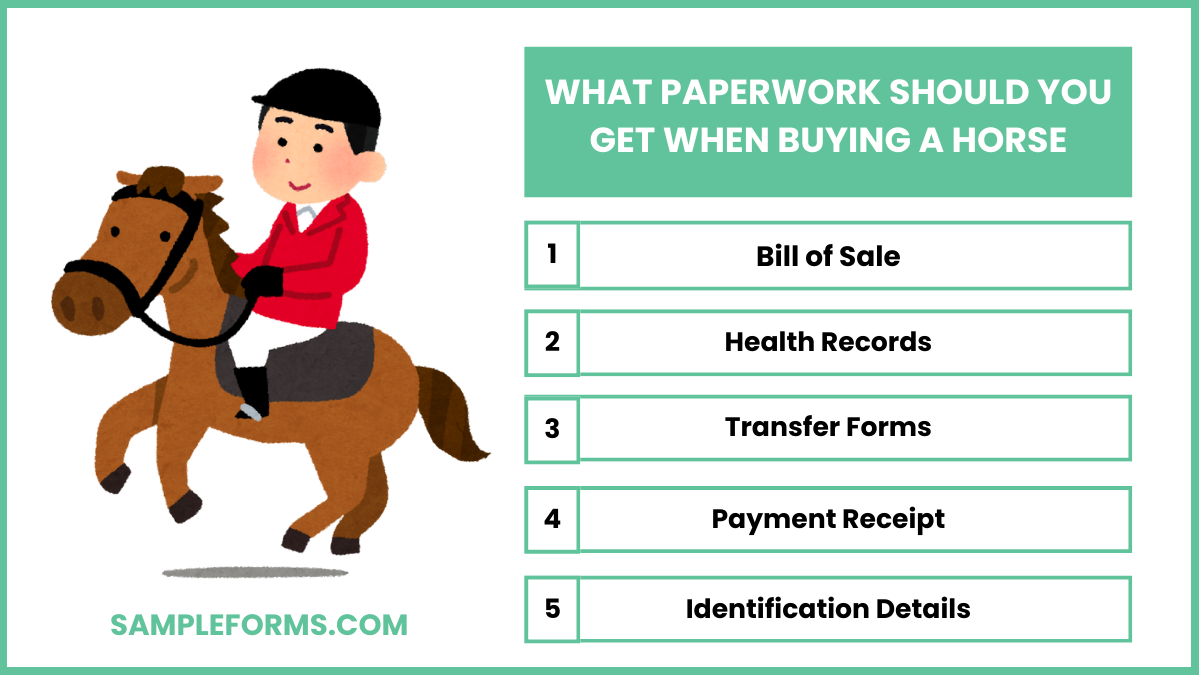

What paperwork should you get when buying a horse?

Proper paperwork ensures a smooth transaction and establishes legal ownership. Gather the following documents during the purchase:

- Bill of Sale: Use a detailed document like an Auto Bill of Sale Form for accuracy.

- Health Records: Collect vaccination and veterinary records.

- Transfer Forms: Obtain registration or ownership transfer forms.

- Payment Receipt: Keep proof of payment.

- Identification Details: Verify the horse’s description, microchip, or brand.

What paperwork do you need to sell a horse?

You need a detailed Horse Bill of Sale, health records, registration documents, and transfer forms. These mirror requirements in a Dog Bill of Sale Form for accuracy and legal compliance.

How do you write a sale contract for a horse?

Include seller and buyer details, horse description, payment terms, warranties, and both parties’ signatures. Similar to a Business Bill of Sale Form, this contract formalizes the transaction.

How should a bill of sale be worded?

A bill of sale should clearly outline the buyer and seller, horse details, sale price, and signatures. Similar to a Real Estate Bill of Sale Form, clarity is key.

Who pays commission on horse sale?

Typically, the seller pays the agent’s commission. Terms are negotiable and must be agreed upon beforehand, akin to agreements in an Aircraft Bill of Sale Form.

What proves ownership of a horse?

A completed Horse Bill of Sale, registration papers, and microchip or brand details serve as proof. Like a Gun Bill of Sale Form, it ensures legal documentation of ownership.

Is selling a horse considered income?

Yes, proceeds from horse sales are considered income and may be taxable, depending on jurisdiction and circumstances, similar to Mobile Manufactured Homes Bill of Sale Form transactions.

Is buying a horse a tax write off?

Buying a horse may be a tax write-off if used for business purposes or breeding, much like expenses outlined in a Firearm Bill of Sale Form.

How do horse sales work?

Horse sales involve agreeing on terms, signing a Horse Bill of Sale, and completing ownership transfer, much like processes for a Personal Property Bill of Sale Form.

What to say when selling a horse?

Highlight the horse’s strengths, unique traits, and suitability for the buyer’s needs. Ensure transparency, as with transactions involving a Horse Lease Agreement Form.

Can I claim my horses on my taxes?

Horses may qualify as a tax deduction if used for breeding, farming, or business purposes, similar to deductions in a Car Sale Form transaction.

In conclusion, the Horse Bill of Sale Form ensures that horse transactions are legally sound and clearly documented. Including all necessary details, such as horse description, sale price, and warranties, these forms protect buyers and sellers. A properly drafted form minimizes confusion and ensures smooth ownership transfer. Whether you’re selling, buying, or gifting a horse, this guide helps create a form tailored to your needs. Use a well-crafted Sales Invoice Form to formalize every step of your equine transaction.

Related Posts

-

Florida Bill of Sale Form

-

District of Columbia Bill of Sale Form

-

Delaware Bill of Sale Form

-

Connecticut Bill of Sale Form

-

Colorado Bill of Sale Form

-

California Bill of Sale Form

-

Arizona Bill of Sale Form

-

Arkansas Bill of Sale Form

-

Alaska Bill of Sale Form

-

Alabama Bill of Sale Form

-

FREE 6+ Recreational Vehicle Bill of Sale Forms in PDF | MS Word

-

FREE 5+ Kitten / Cat Bill of Sale Forms in PDF

-

FREE 6+ Notarized bill of sale Forms in PDF

-

FREE 6+ Boat (Vessel) Bill of Sale Forms in PDF | MS Word

-

FREE 6+ Motorcycle Bill of Sale Forms in PDF | MS Word