A Health Insurance Form is a critical document that facilitates communication between patients, healthcare providers, and insurance companies. This complete guide explains the structure, examples, and how to accurately complete the form to avoid delays or rejections. Whether you’re filling out a Healthcare Form or a Health Insurance Claim Form, understanding the essential fields and required information is key for a smooth process. These forms help in claiming insurance benefits for medical expenses, ensuring that patients receive necessary financial support. By following the steps outlined, individuals can efficiently manage their health-related financial paperwork and enhance their access to healthcare.

Download Health Insurance Form Bundle

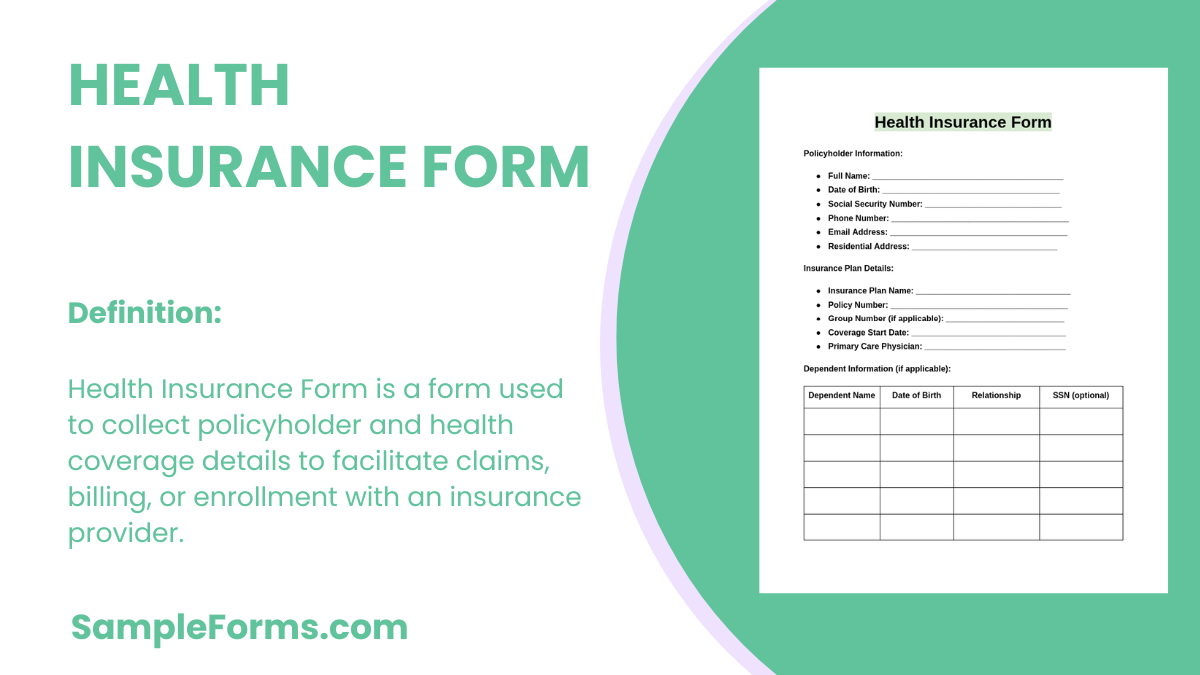

What is Health Insurance Form?

A Health Insurance Form is a document used to claim benefits or coverage from an insurance provider for healthcare expenses. This form collects details about the patient, the treatment received, and related costs. It ensures that the insurance company has all the necessary information to process a claim and disburse payment for medical services. These forms are vital for documenting the patient’s care and facilitating timely reimbursements. A complete and accurate submission helps minimize delays, ensuring that policyholders can leverage their health coverage effectively when they need it most.

Health Insurance Format

Title: Health Insurance Enrollment/Claim Form

Policyholder Details:

- Full Name: ______________________________________________

- Policy Number: ___________________________________________

- Date of Birth: ___________________

- Contact Number: __________________________________________

- Address: _________________________________________________

Coverage Information:

- Insurance Plan Name: _____________________________________

- Group Number (if applicable): _______________________________

- Start Date of Coverage: ___________________

Dependent Information (if applicable):

- Full Name of Dependent(s): ________________________________

- Relationship: _____________________________________________

- Date(s) of Birth: __________________________________________

Claim Details (if applicable):

- Date of Service: ___________________

- Service Provider Name: ____________________________________

- Type of Service: __________________________________________

- Amount Billed: $__________

Signature of Policyholder: __________________________________

Date: ___________________

Insurance Representative Signature: __________________________

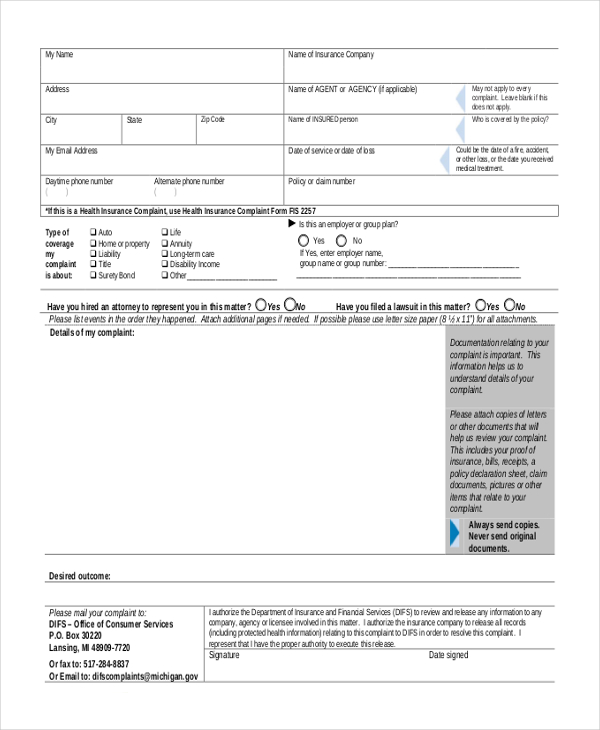

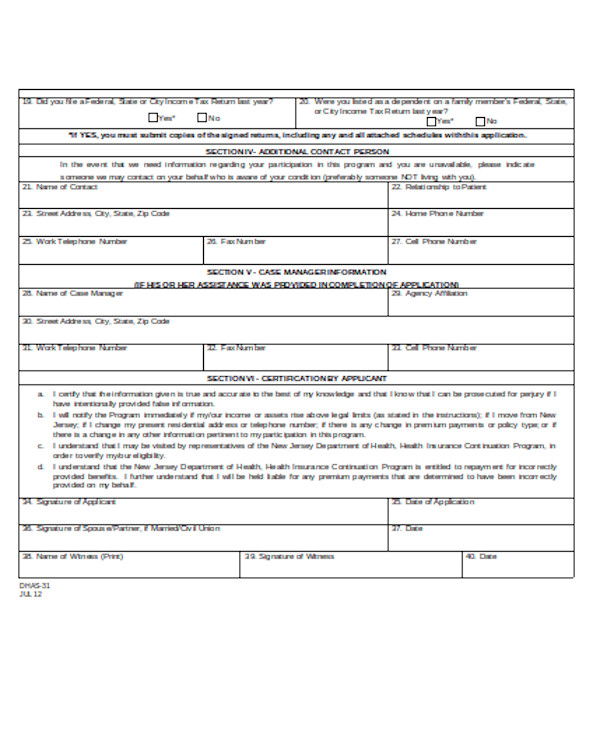

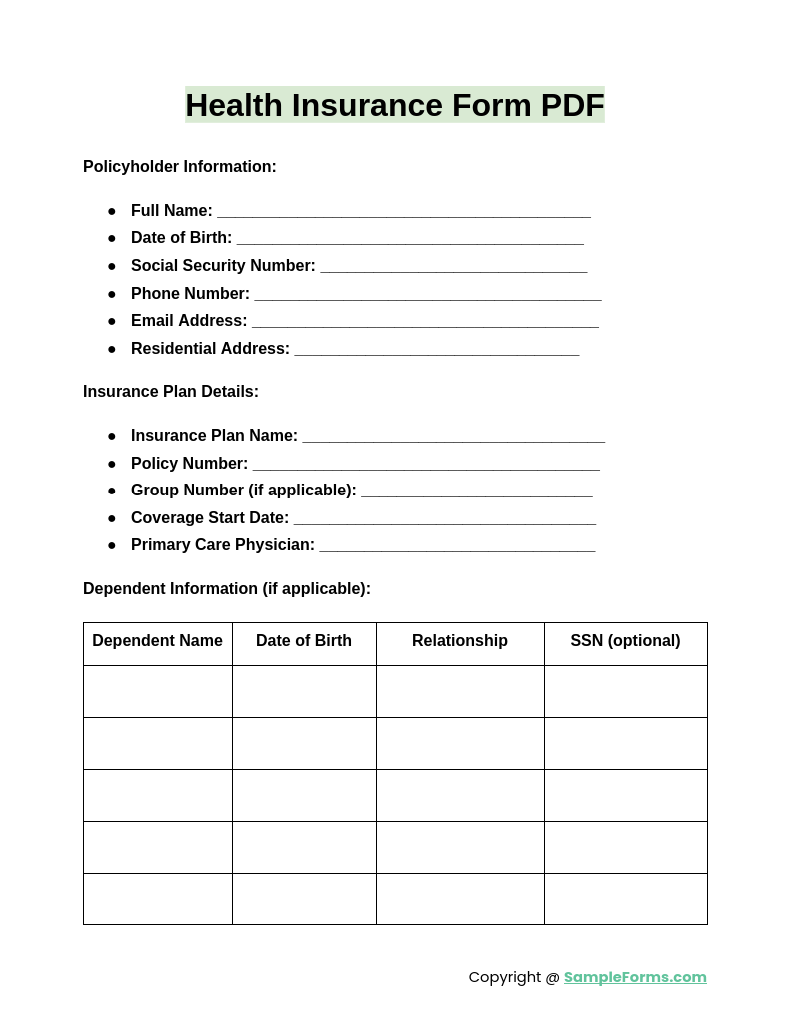

Health Insurance Form PDF

A Health Insurance Form PDF offers a downloadable, fillable format for easy sharing and submission. This format ensures secure and organized documentation, similar to a Health Certificate Form, promoting smooth claim processes and accurate record-keeping.

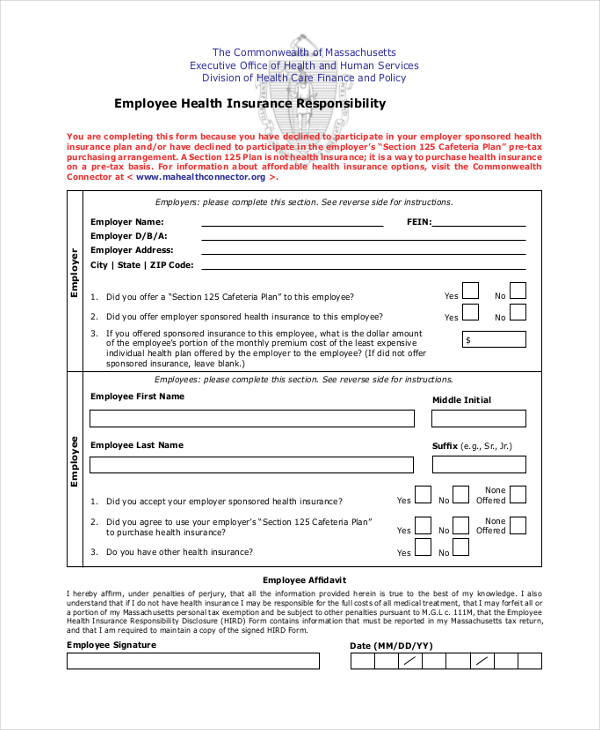

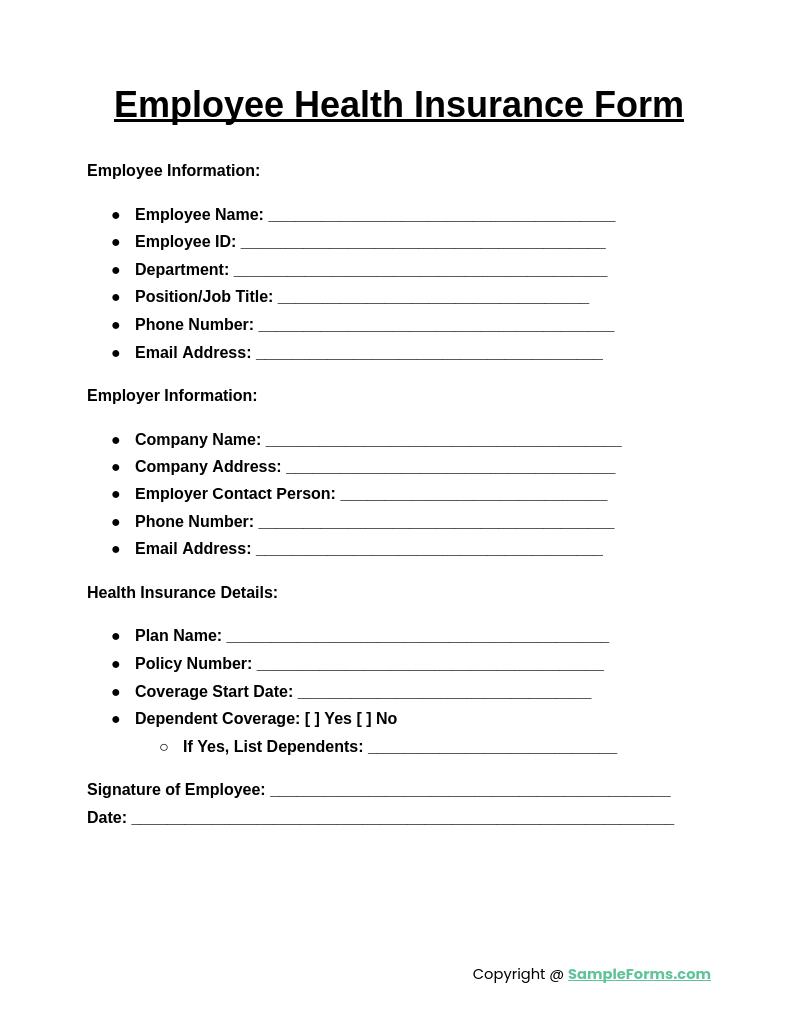

Employee Health Insurance Form

An Employee Health Insurance Form collects essential health and coverage information from employees for workplace insurance plans. It includes personal and employment details, akin to a Health Declaration Form, ensuring comprehensive documentation for company-sponsored insurance.

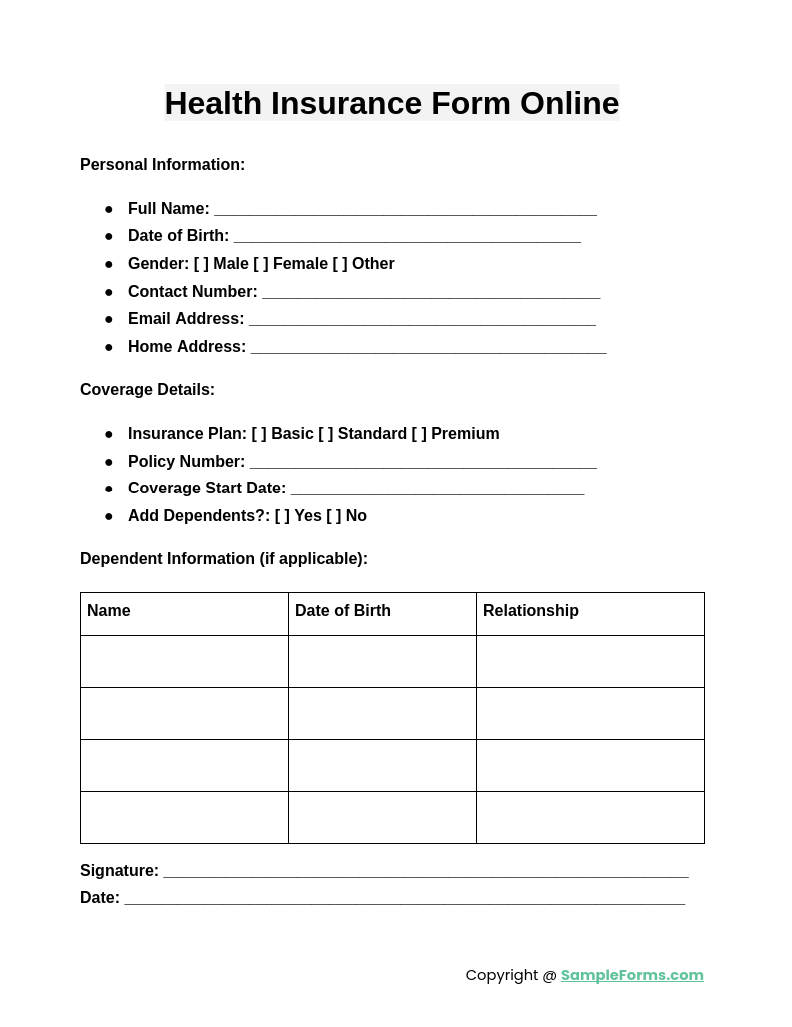

Health Insurance Form Online

A Health Insurance Form Online streamlines the process by enabling digital completion and submission. Accessible from any device, it simplifies the claims process, just as a Mental Health Assessment Form does for remote health evaluations.

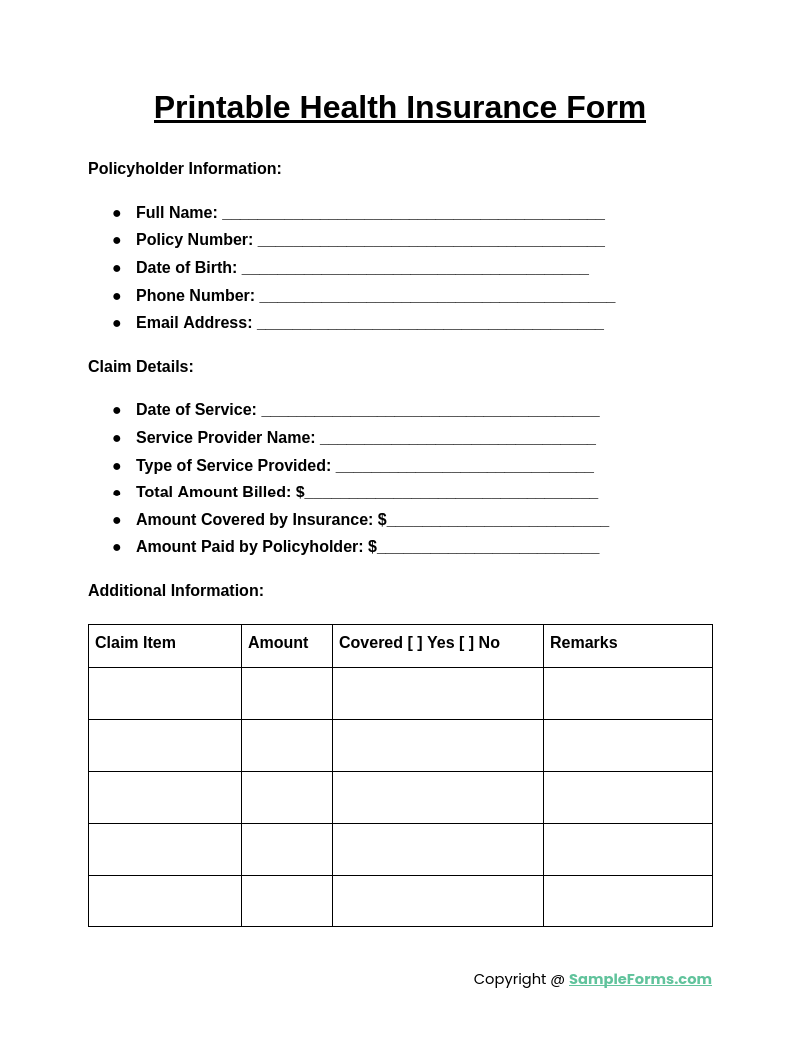

Printable Health Insurance Form

A Printable Health Insurance Form is perfect for individuals needing a hard copy to submit or file. This form ensures consistency in documentation, similar to a Health Assessment Form, for straightforward, reliable claim processing and record management.

Browse More Health Insurance Forms

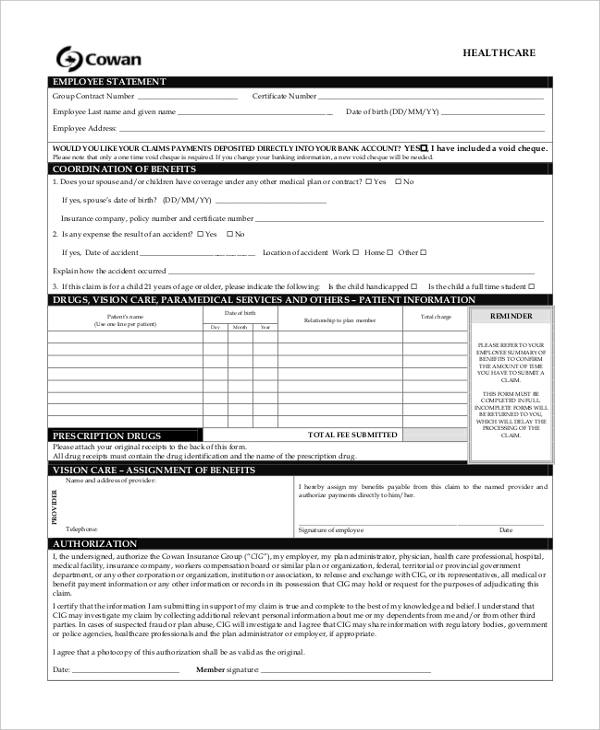

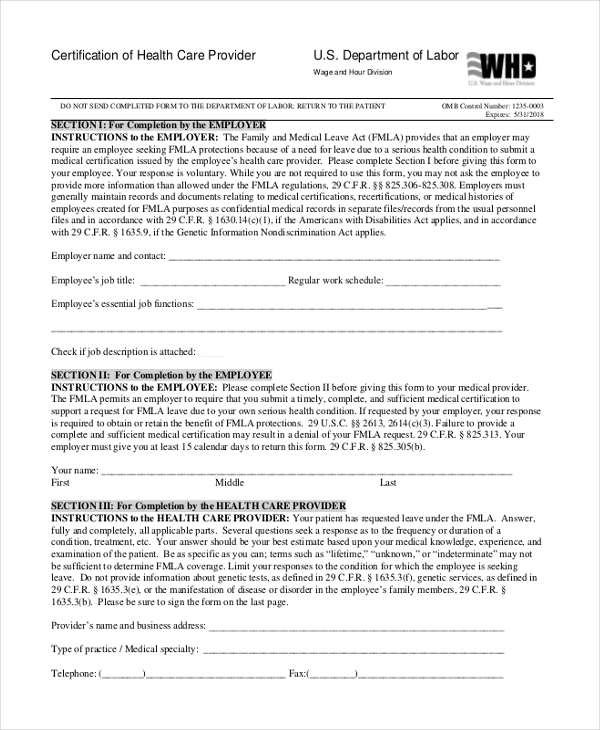

Sample Health Care Insurance Form

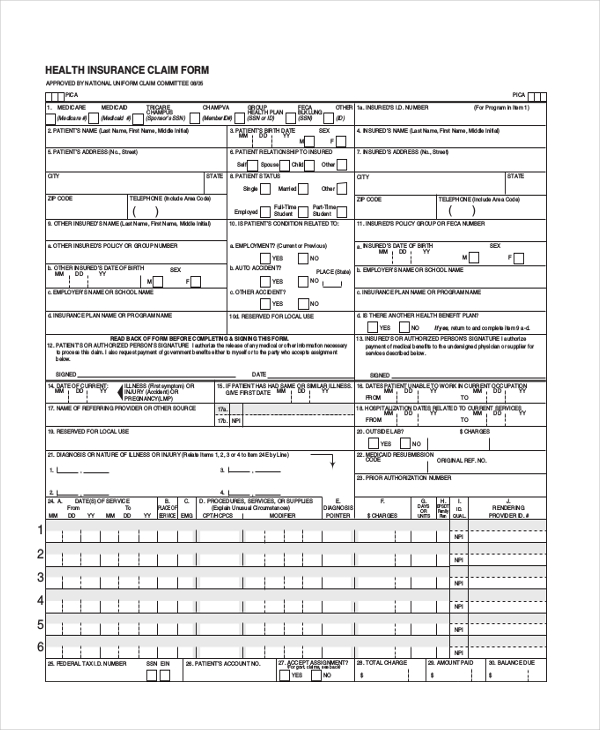

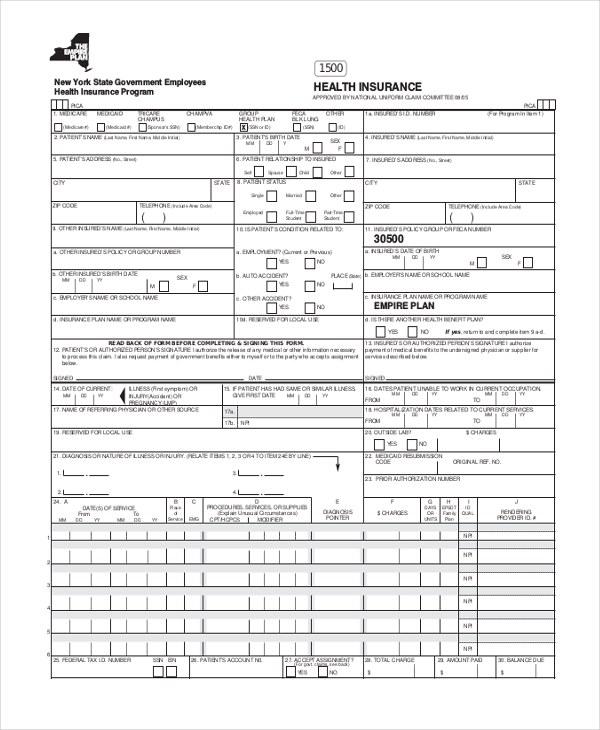

Health Insurance Claim Form

Health Insurance Commission Form

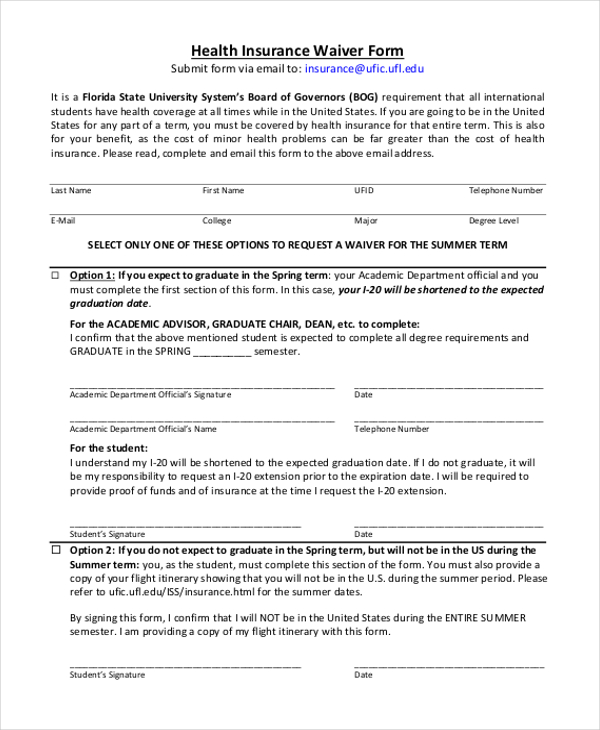

Sample Health Insurance Waiver Form

Health Insurance Billing Form

Sample Certificate of Health Insurance Form

Employee Health Insurance Form

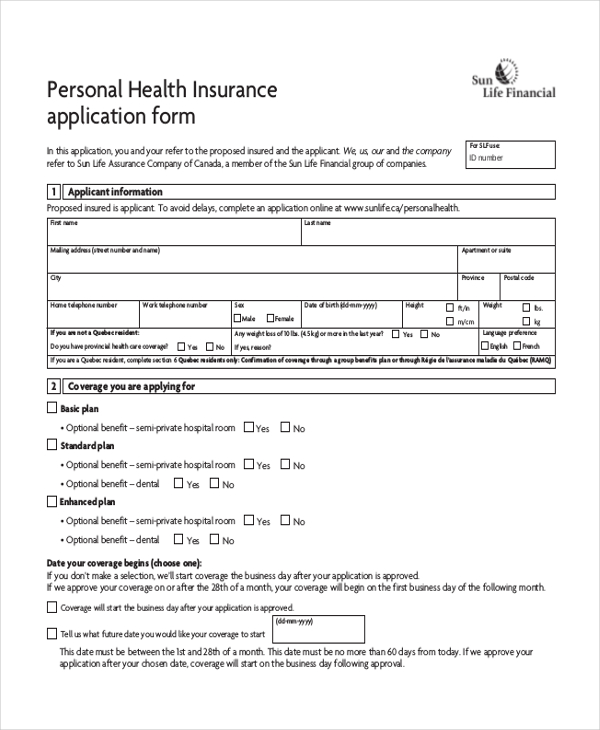

Personal Health Insurance Application Form

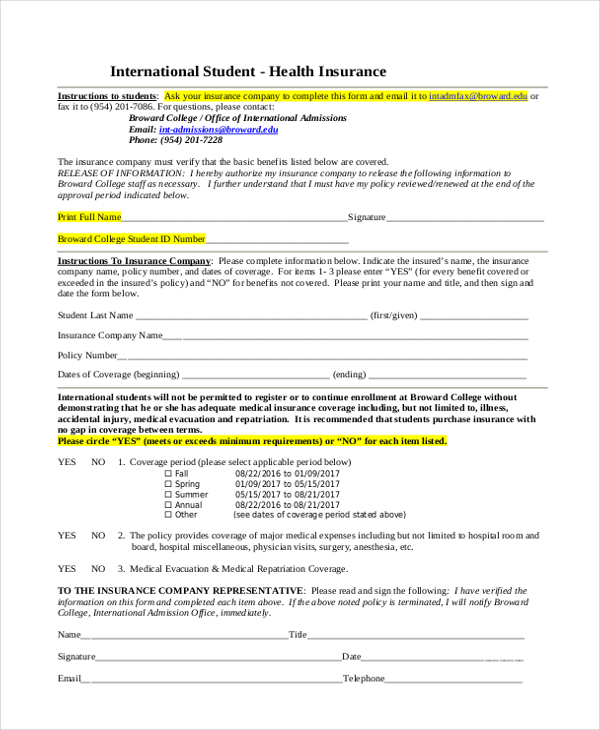

Sample Student Health Insurance Coverage Form

Health Insurance Application Form

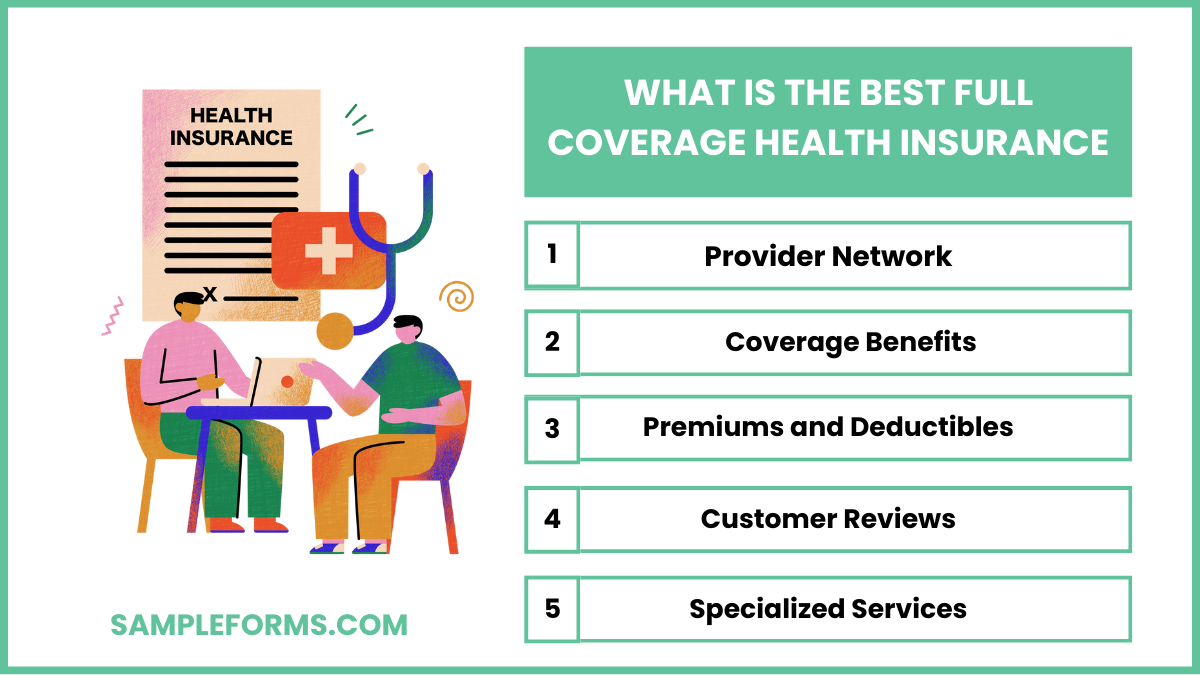

What is the best full coverage health insurance?

Choosing the best full coverage health insurance depends on individual needs and budget. Comprehensive plans should include essential services. Key considerations include:

- Provider Network: Ensure a broad network for accessible care, similar to completing a Health Check Form.

- Coverage Benefits: Look for extensive coverage for hospital, doctor visits, and prescriptions.

- Premiums and Deductibles: Compare monthly premiums and out-of-pocket costs.

- Customer Reviews: Assess user feedback for reliability.

- Specialized Services: Include mental health and preventive services for complete coverage.

How much do most people pay for health insurance?

Most people pay for health insurance based on plan type, coverage, and subsidies. Monthly costs vary significantly. Key factors include:

- Type of Plan: Premiums differ between HMO, PPO, and EPO plans.

- Age and Location: Rates can increase with age and vary by region, similar to filling a Health Questionnaire Form.

- Income Level: Eligibility for subsidies impacts monthly premiums.

- Coverage Level: Comprehensive plans often have higher costs.

- Employer Contributions: Employer-sponsored plans can lower employee premiums.

How much do most people pay for insurance per month?

Most people pay for insurance per month based on plan type, age, and subsidies. The average cost varies widely. Main factors include:

- Plan Tier: Bronze, Silver, and Gold plans have different pricing.

- Age Group: Older individuals typically face higher premiums.

- Subsidies Applied: Eligibility for financial aid can reduce costs.

- Employer Benefits: Employer contributions help lower monthly expenses.

- Individual vs. Family Plans: Costs differ for personal versus family coverage, similar to filing a Health Screening Form.

How can I avoid paying back my premium tax credit?

Avoid paying back your premium tax credit by maintaining accurate income reporting and adjusting your tax situation. Steps include:

- Update Income Regularly: Report any changes promptly, as you would update a Mental Health Form.

- Choose Conservative Estimates: Use modest income estimates to prevent overpayment.

- Review Marketplace Info: Verify details to avoid discrepancies.

- Plan Ahead: Set aside savings for potential tax liabilities.

- Seek Professional Advice: Consult tax professionals for guidance on staying compliant.

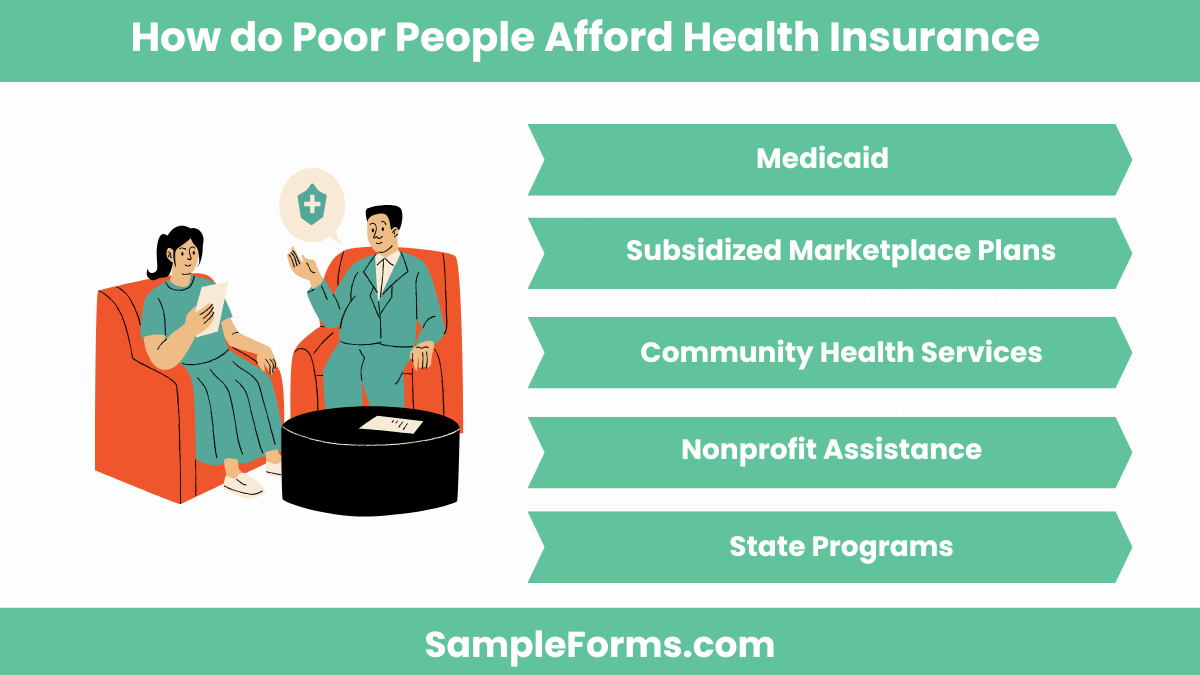

How do poor people afford health insurance?

Poor people afford health insurance through government programs and subsidies aimed at low-income individuals. Main strategies include:

- Medicaid: Government-sponsored program offering free or low-cost coverage.

- Subsidized Marketplace Plans: Affordable plans with reduced premiums based on income.

- Community Health Services: Clinics providing basic services and filling out a Health Record Form for minimal fees.

- Nonprofit Assistance: Organizations helping with premium payments.

- State Programs: State-specific health initiatives for low-income families.

Which one health insurance is best?

The best health insurance depends on individual needs, but plans with comprehensive coverage and low deductibles are ideal, similar to evaluating a Health History Form for a complete overview of benefits.

What is the most expensive health insurance?

The most expensive health insurance includes high-end private plans offering extensive coverage, like VIP packages or international policies, comparable to the detailed information provided in a Health Risk Assessment Form.

What insurance company has the best coverage?

Companies like Blue Cross Blue Shield and UnitedHealthcare are known for their best coverage, offering a wide network and benefits, as a Personal Health Form provides comprehensive details on individual needs.

What is the most popular form of health insurance?

Employer-sponsored health insurance is the most popular, covering many Americans. It’s often paired with resources similar to a Health Appraisal Form for understanding employee health benefits.

How much income should go to health insurance?

Ideally, income spent on health insurance should not exceed 10% of total income, ensuring financial balance, as calculated with a Health Survey Form for assessing affordability.

How much is health insurance a month for a single person in the US?

Health insurance for a single person averages $450 per month, varying based on plan type and coverage, similar to evaluating a Health Waiver Form for specifics.

Why is healthcare so expensive?

Healthcare is expensive due to advanced technology, administrative costs, and complex insurance structures, requiring documentation akin to a Health Statement Form for detailed cost transparency.

What percent of paycheck goes to health insurance?

Typically, 5-10% of a paycheck goes to health insurance, varying by employer contributions and plan choice, much like using a Health Care Directive Form for cost planning.

What is the average out-of-pocket healthcare cost?

The average out-of-pocket healthcare cost in the US is around $1,200 annually, depending on coverage, similar to data found in a Health Insurance Quote Form for expense tracking.

How much does the average American pay for healthcare?

The average American spends about $12,500 annually on healthcare, including premiums, deductibles, and copays, akin to figures calculated in a Health and Safety Risk Assessment Form.

In conclusion, a Health Insurance Form: Sample, Forms, Letters, Use is essential for accessing medical benefits efficiently. Understanding how to complete these forms accurately can save time and ensure that claims are processed smoothly. Just like a Health Complaint Form, a correctly filled health insurance form aids in clear communication between patients, providers, and insurers. By following the examples and guidelines provided, individuals can manage their healthcare claims confidently and efficiently. Mastering these forms enhances overall healthcare experiences, ensuring that patients receive the financial support they need for medical treatments.

Related Posts

-

FREE 8+ Sample Health Consent Forms in PDF | MS Word

-

Health Declaration Form

-

FREE 9+ Sample Health Inventory Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Health Care Exemption Forms in PDF | MS Word

-

FREE 13+ Sample Health Care Claim Forms in PDF | Excel | MS Word

-

FREE 11+ Sample Health Screening Forms in PDF | MS Word | Excel

-

FREE 8+ Sample BSA Health Forms in PDF | Word

-

FREE 9+ Sample Scout Health Forms in PDF | Word

-

FREE 12+ Sample Health History Forms in PDF | Excel | Word

-

Health Certificate Form

-

FREE 18+ Sample Health Forms in PDF | MS Word | Excel

-

Difference Between an Advance Directive and a Living Will