An individual’s health is very important in pursuing his dreams and goals. Health care providers are granting insurance and discounts to help every person keep track of their well-being. Health Forms are legal documents that are used for health-related inquiries.

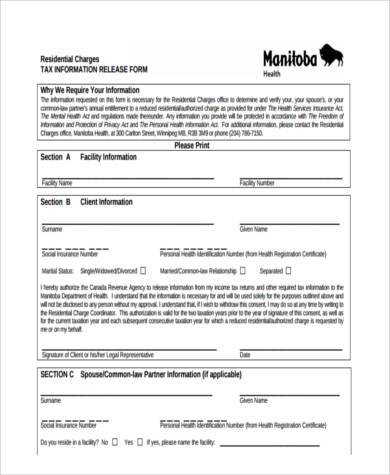

One type of health form is a Health Care Tax Form which is to be completed by everyone, whether he is a beneficiary of a health care provider or not. In this form, the coverage of the health insurance taxes shouldered by the provider for a specific tax year is indicated. If an employed person is not under a health care provider, he is then obligated to pay a number of shared taxes to meet the company’s requirements.

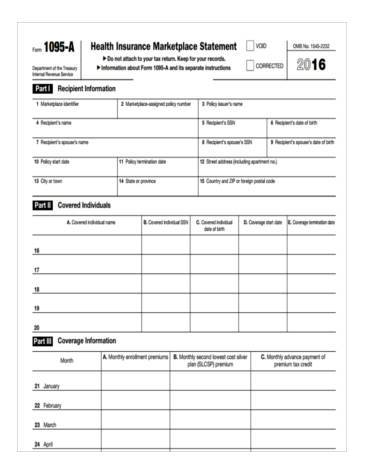

Affordable Health Care Tax Form

New Health Care Tax Form

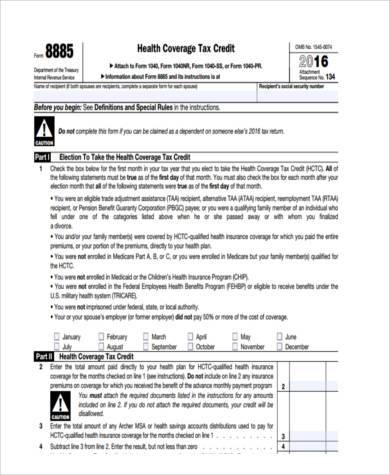

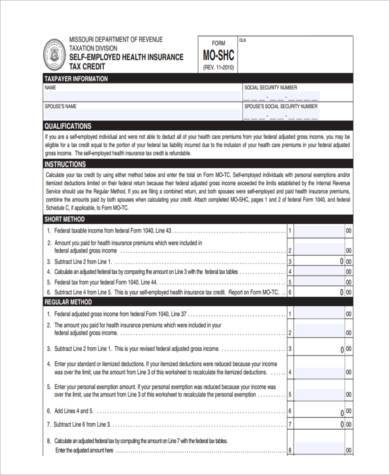

Health Care Credit Tax Form for Self-Employed

Health Care Coverage Tax Form

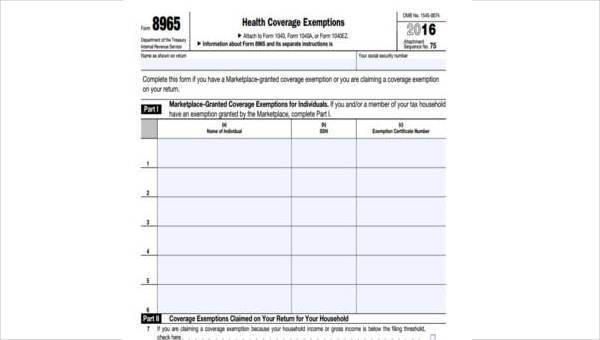

Health Care Exemption Tax Form

What’s inside a Health Care Tax Form?

A Health Care Tax Form, often called as Form 1095, contains information for specific fees that an individual is required to pay if they did not avail of any health care insurance. For those who are members of a health insurance company, the premium offers of the provider are stated in the form. Listed below are the information that you can see in three different Health Care Tax Forms:

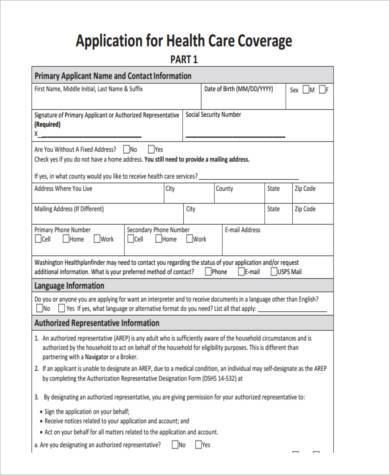

Form 1095-A: The information in this form may be used when you are going to file for an income tax.

- Your full legal name

- The coverage of the insurance

- Your entitled tax credits

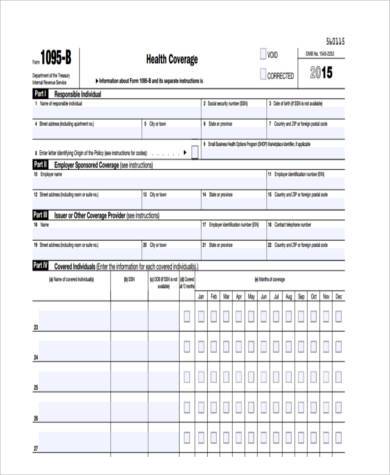

Form 1095-B: The information in this form will be used for verifying your own tax returns.

- Your basic identification

- The amount of your coverage

- The dependents or your beneficiaries

- The time-frame of your insurance coverage

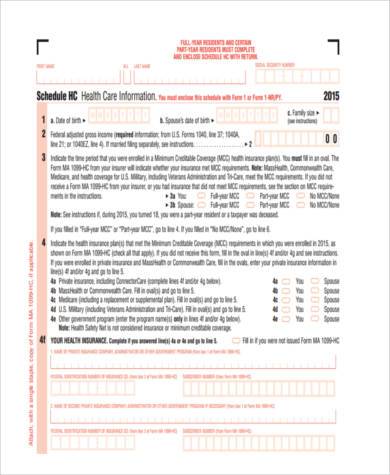

Form 1095-C: The information in this form includes all the benefits and coverage of the two other forms, 1095-A and 1095-B. This form is often used by companies that have more than a hundred employees. The form may also be used to complete filling out an individual’s tax returns.

Often misunderstood, a Health Certificate is different from a Healthcare Tax Form. The certificate contains the findings and diagnostics of a physician, while the latter states the taxes involved in a health care insurance company.

Health Care Act Tax Form

Health Care Penalty Tax Form

Health Care Tax Application Form

Health Care Tax Form in PDF

Who are entitled to receive the Health Care Tax Form?

Anyone can avail a health insurance, but few are availing due to their employment requirements. When a person had already signed for a membership in an insurance company through the Marketplace, he is expected to receive the Form 1095-A. If an individual is enrolled in an insurance which is sponsored by the government, he should be able to receive a Form 1095-B from the insurance provider. Lastly, if an individual is employed in a large company, he is entitled to receive a Form 1095-C from his employer.

The Heath Care Tax Act is a mandate by the government which requires the citizens of a country to be part of a health care insurance plan. If an individual does not have an insurance and he had valid reasons for not having the penalty, he needs to file a Health Care Exemption Tax Form. The form will contain the possible exemptions for reasons why an individual may not become a subject for a penalty.

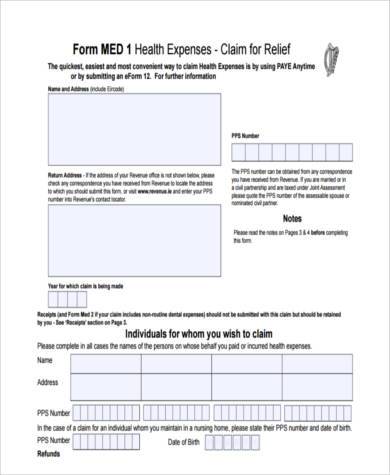

A person may use the insurance and benefits of the health care provider when he is asserting a claim. A Health Care Claim Form will be filled out by the member and should be submitted with accompanying legal documents.

Related Posts

-

FREE 8+ Sample BSA Health Forms in PDF | Word

-

FREE 9+ Sample Scout Health Forms in PDF | Word

-

FREE 12+ Sample Health History Forms in PDF | Excel | Word

-

FREE 18+ Sample Health Forms in PDF | MS Word | Excel

-

Health Questionnaire Form

-

Health Check Form

-

Health Record Form

-

Mental Health Assessment Form

-

Health Declaration Form

-

Health Insurance Form

-

Health Certificate Form

-

Difference Between an Advance Directive and a Living Will