Navigating through the complexities of a Guarantor Agreement Form can seem daunting, but with our complete guide, it becomes a breeze. This article delves into the intricacies of guarantor forms, shedding light on every aspect with practical examples. Whether you’re a guarantor or require one, understanding the Agreement Form Word is crucial in securing financial agreements. Our content ensures you grasp the essentials of Guarantor Agreement Forms, making the process straightforward and comprehensible.

Download Guarantor Form Bundle

What is the Guarantor Form?

A Guarantor Form is a legal document that serves as a financial safety net in various agreements. It is used when an individual, the guarantor, agrees to take on the financial obligations of another, the primary party, should they fail to meet their commitments. This form is crucial in situations involving loans, leases, and other financial contracts, providing added security to the lender or landlord. Understanding the terms and conditions outlined in a Guarantor Agreement Form is essential for both the guarantor and the primary party, ensuring clarity and mutual agreement on the responsibilities involved.

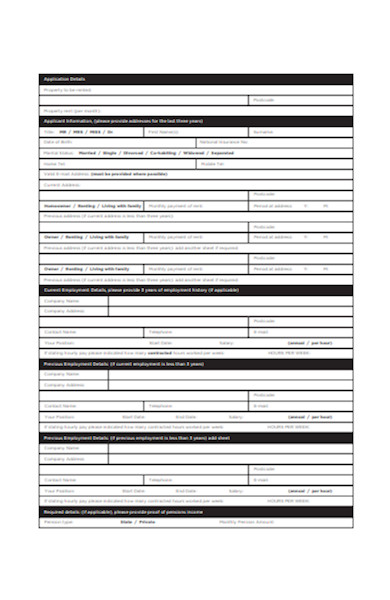

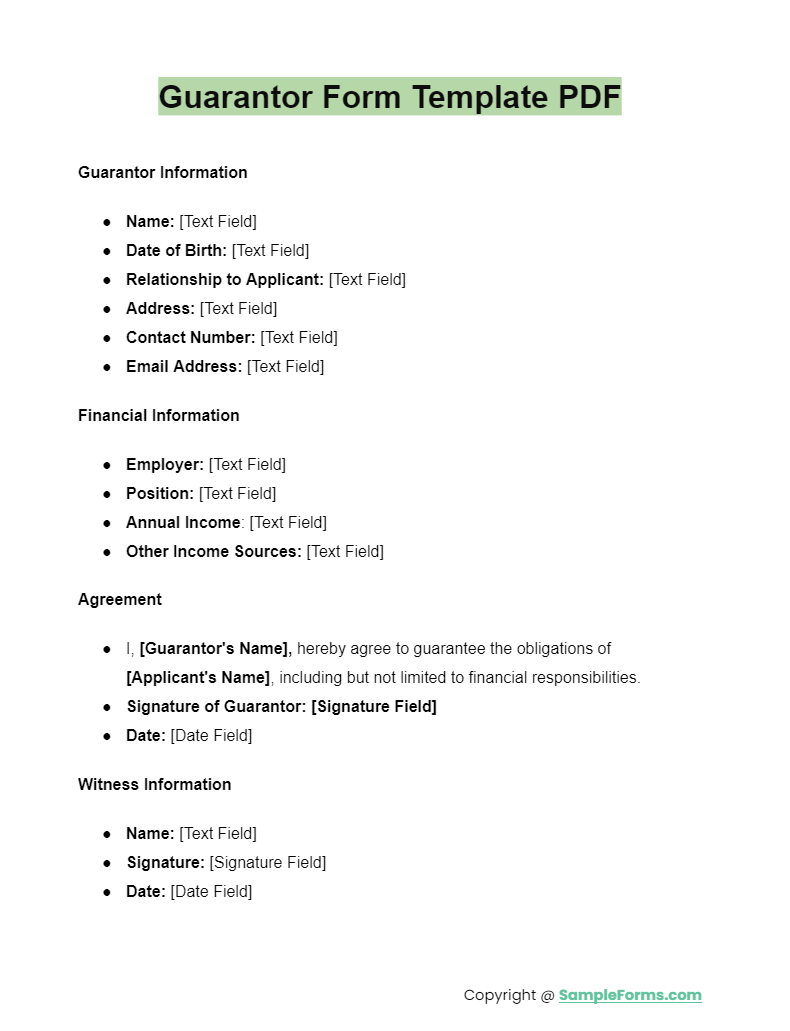

Guarantor Form Format

Introduction

- Start with a title, such as “Guarantor Agreement Form,” centered at the top.

- Include a brief introduction stating the purpose of the form.

Section 1: Particulars of the Principal

- Full Name

- Address

- Contact Details

- Relationship to Guarantor

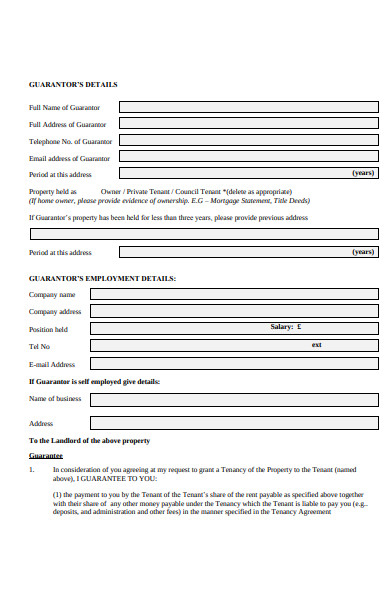

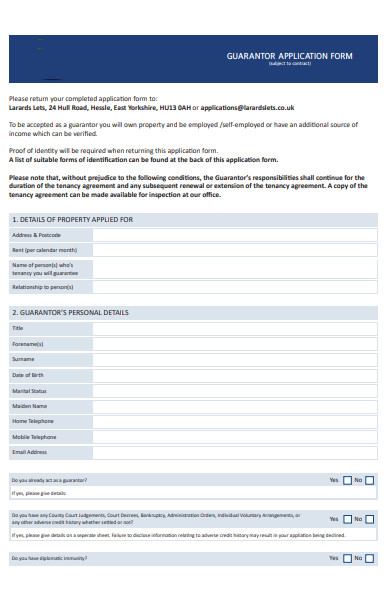

Section 2: Guarantor’s Details

- Full Name

- Address

- Contact Number

- Email Address

- Occupation

- Relationship to the Principal

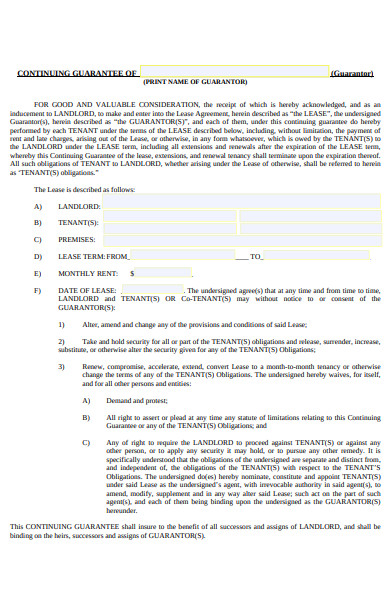

Section 3: Guarantor’s Declaration

- A statement by the guarantor acknowledging their understanding of the responsibilities and liabilities involved in acting as a guarantor. This section should clearly state the extent and limitations of the guarantor’s obligations.

Section 4: Signature of Guarantor

- A line for the guarantor’s signature followed by the date.

Section 5: Witness Information (if required)

- Name

- Signature

- Date

- Relationship to Guarantor

Closing

- A closing statement reiterating the importance of the information provided and the guarantor’s commitment.

Instructions for Use

- Ensure clarity and conciseness in each section.

- Use bold headings to distinguish between sections.

- Provide ample space for signatures and dates.

Guarantor Form Template PDF, Word, Google Docs

A Guarantor Form Template PDF simplifies setting up Temporary Guardianship Form agreements. It’s a versatile tool for creating Guardianship Form, ensuring legal and personal safeguards are firmly in place for temporary guardianships.

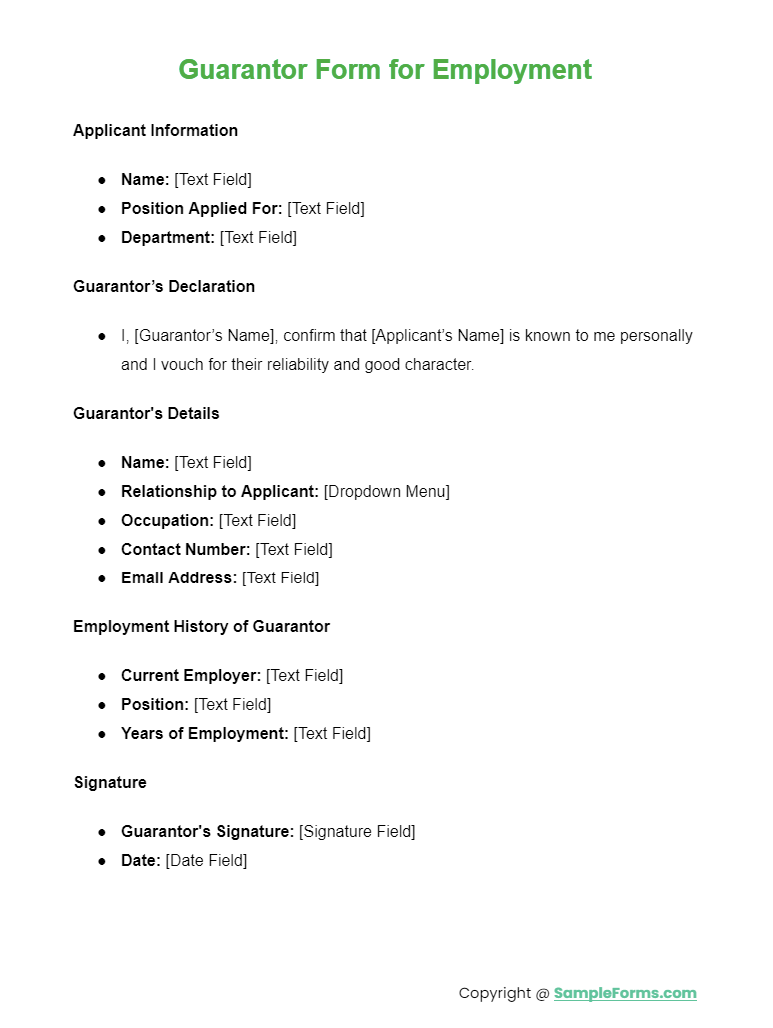

Guarantor Form for Employment

This Guarantor Form for Employment integrates a Personal Financial Statement Form and a Security Guard Application Form, streamlining the vetting process for positions requiring financial integrity and security responsibilities.

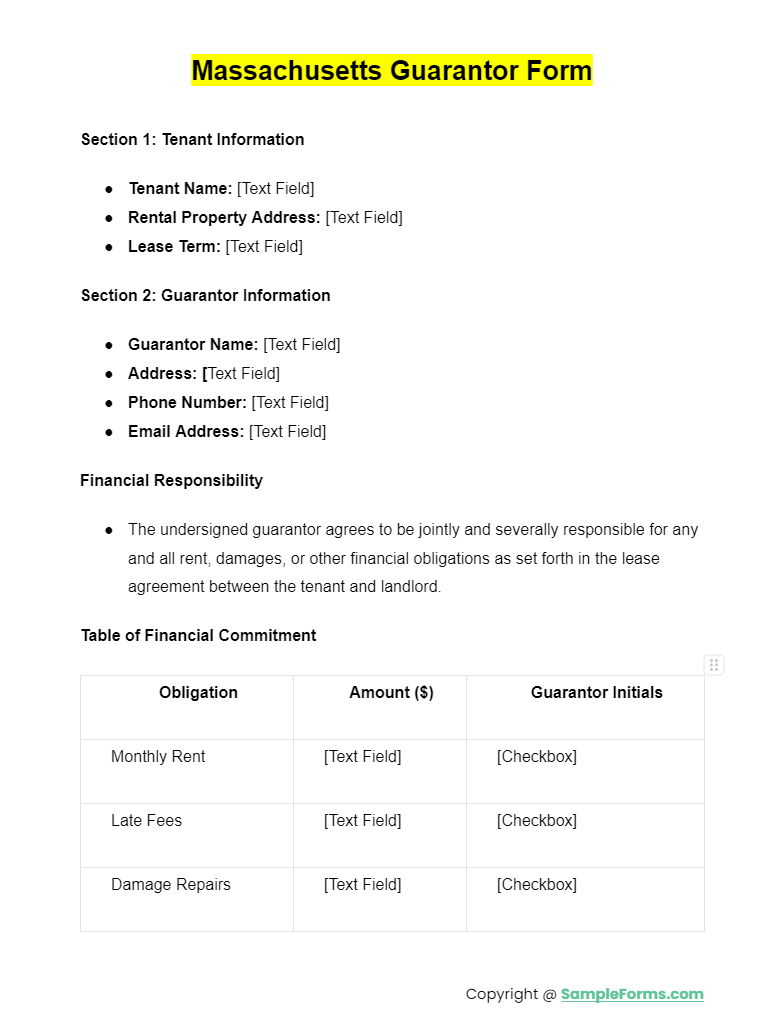

Massachusetts Guarantor Form

The Massachusetts Guarantor Form is essential for establishing Legal Guardianship Form agreements, incorporating a Self-Review Form to ensure compliance with Massachusetts’ specific legal standards and guardianship criteria.

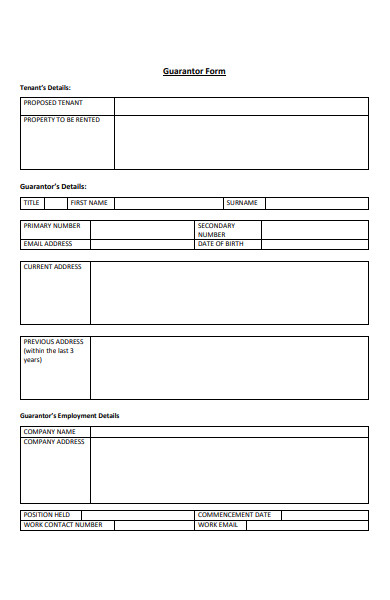

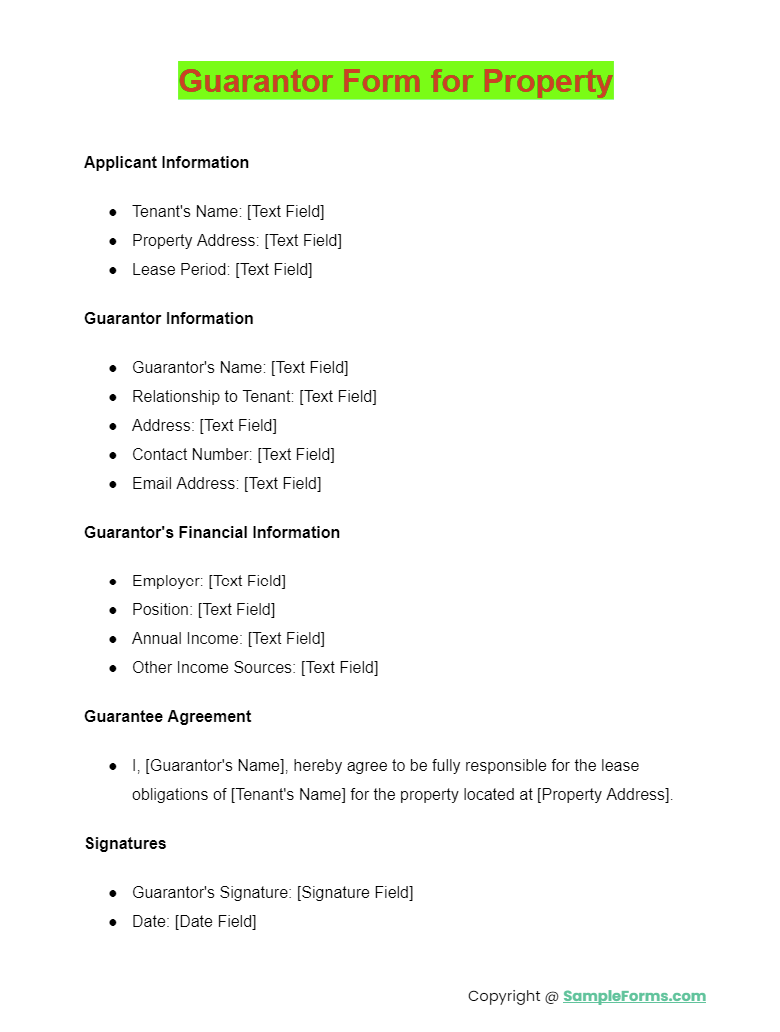

Guarantor Form for Property

Designed for property transactions, this form includes a Release of Personal Guarantee Form and a Legal Guardian Form, providing a comprehensive framework for property guarantees and legal guardianship provisions.

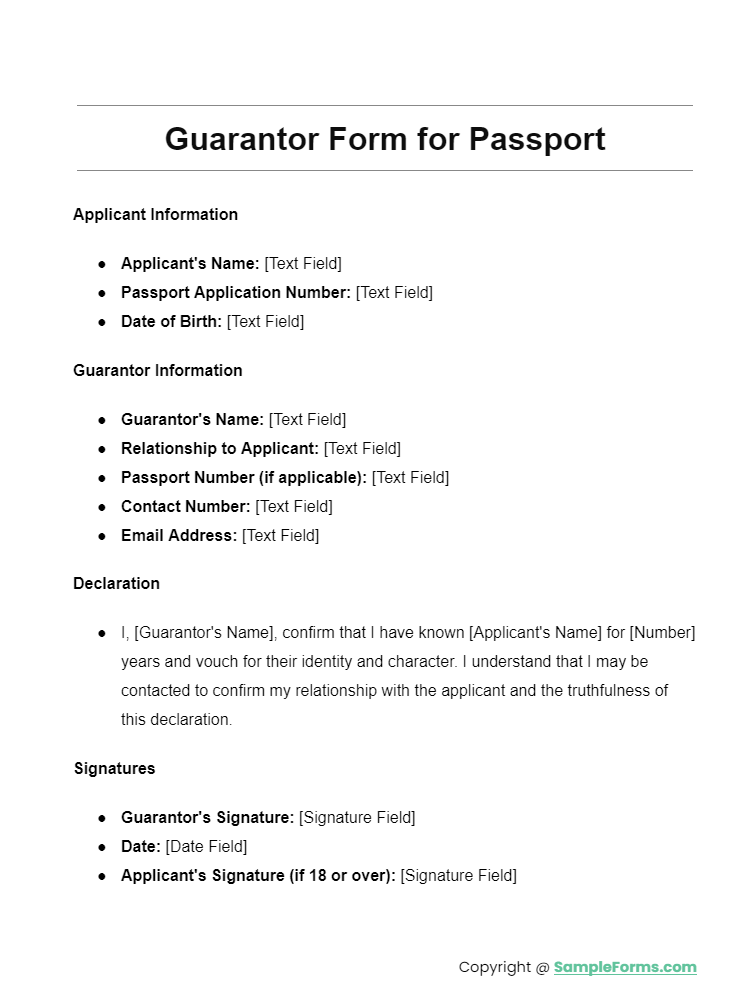

Guarantor Form for Passport

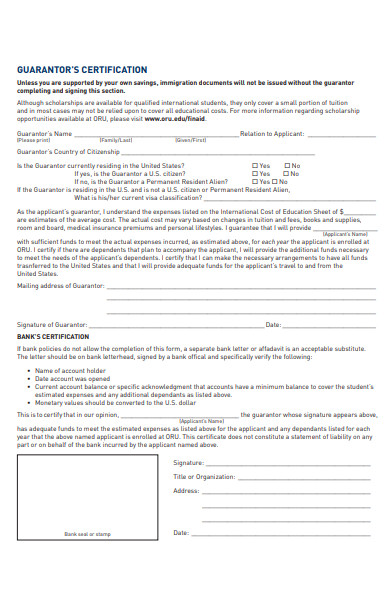

More 40+ Guarantor Form Samples

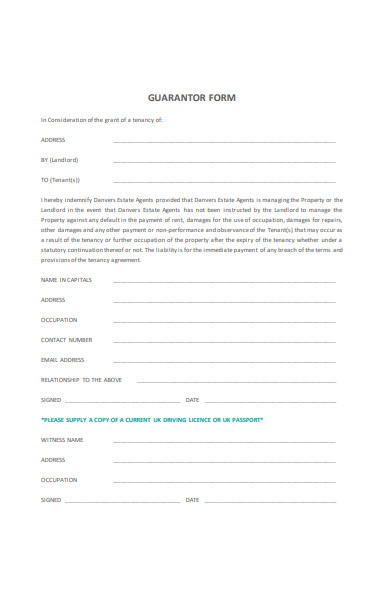

1. Guarantor Form

2. Guarantor Form for Employment

3. Sample Guarantor Form

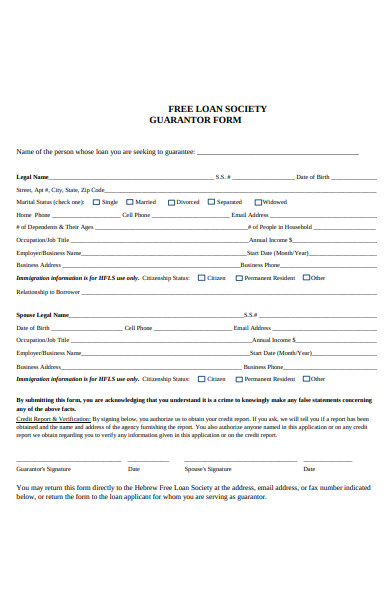

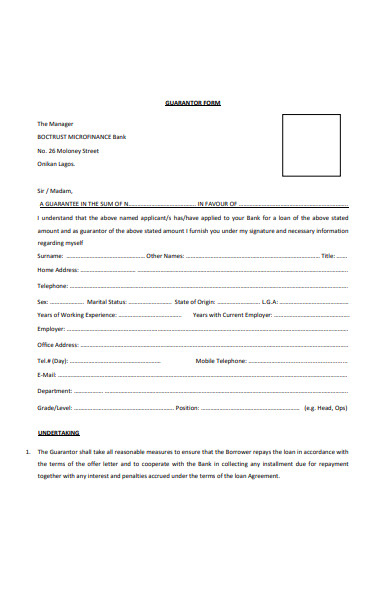

4. Loan Guarantor Form

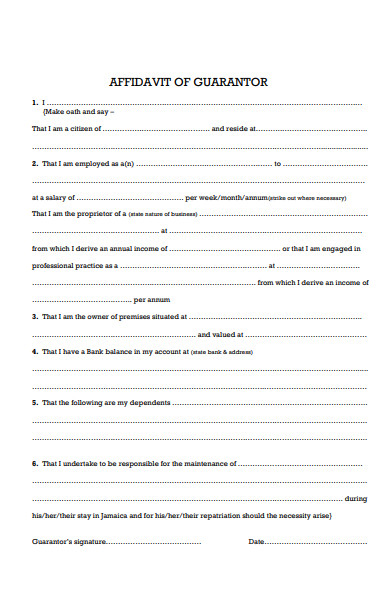

5. Affidavit Guarantor Form

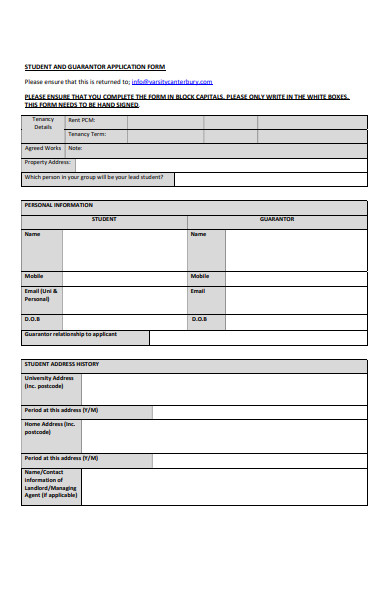

6. Student Guarantor Form

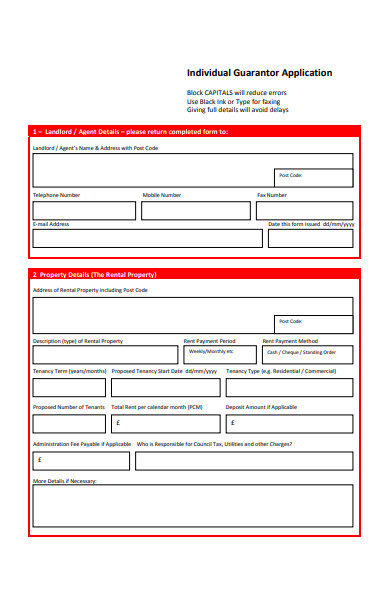

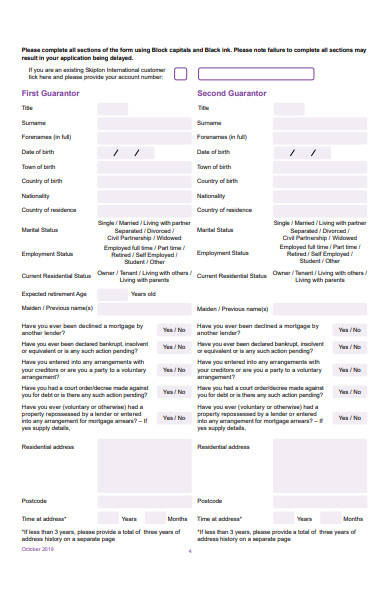

7. Individual Guarantor Application Form

8. Next Generation Guarantor Form

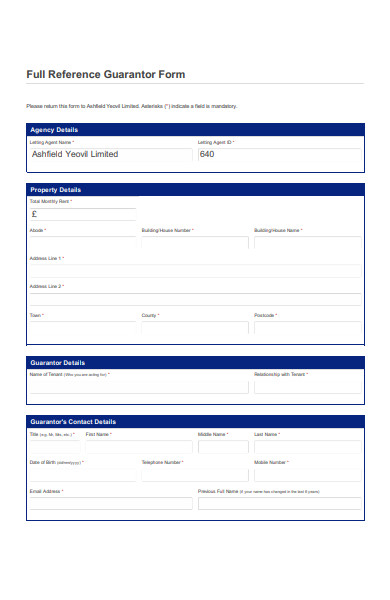

9. Full Reference Guarantor Form

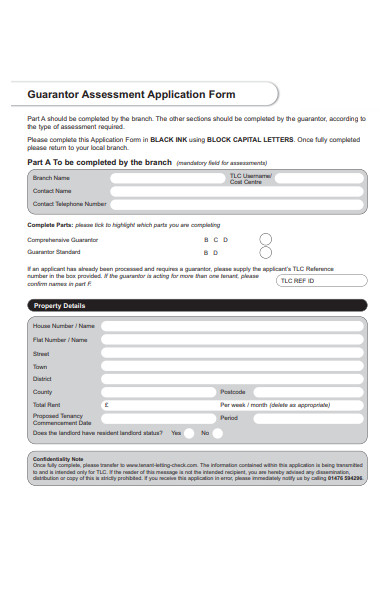

10. Guarantor Assessment Form

11. Guarantor Document Form

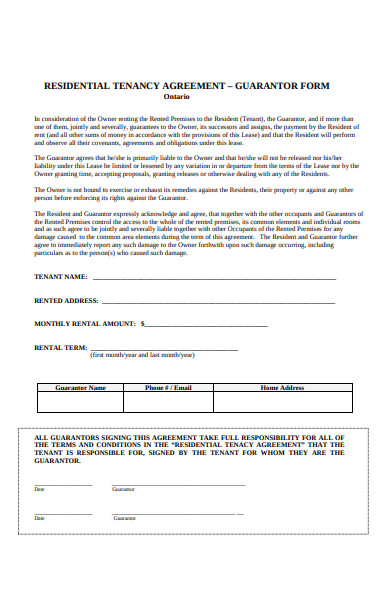

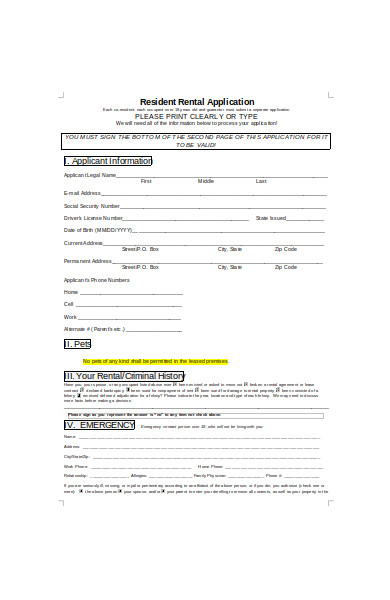

12. Guarantor Residential Agreement Form

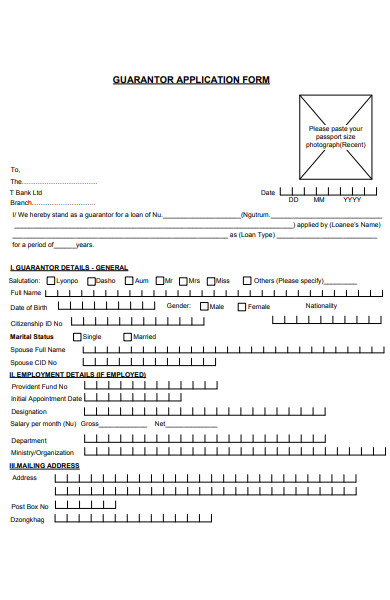

13. Guarantor Application Form

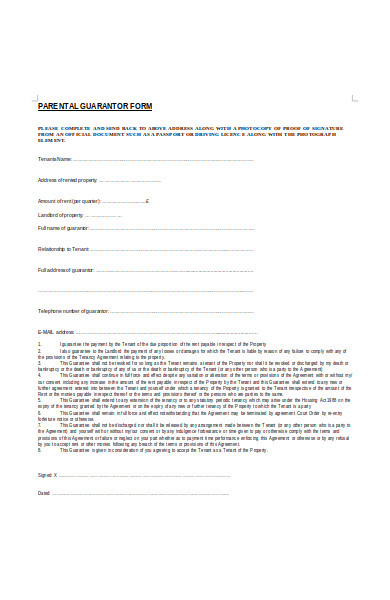

14. Parent Guarantor Form

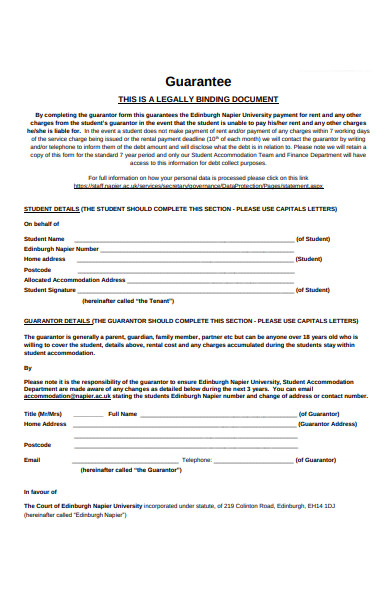

15. Guarantor Legally Binding Form

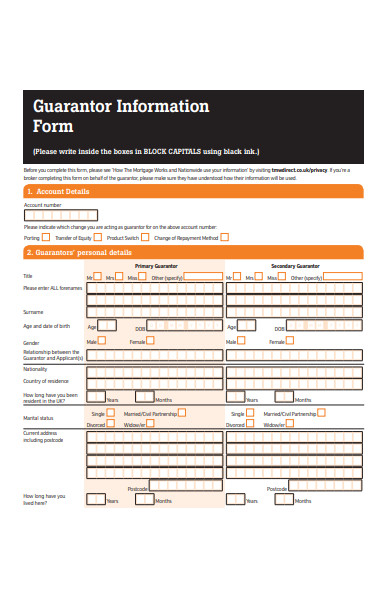

16. Guarantor Information Form

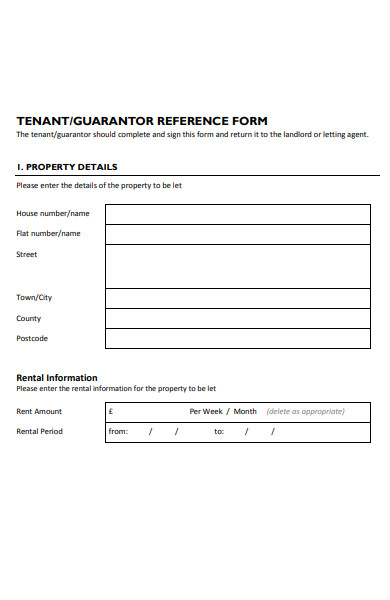

17. Tenant Guarantor Reference Form

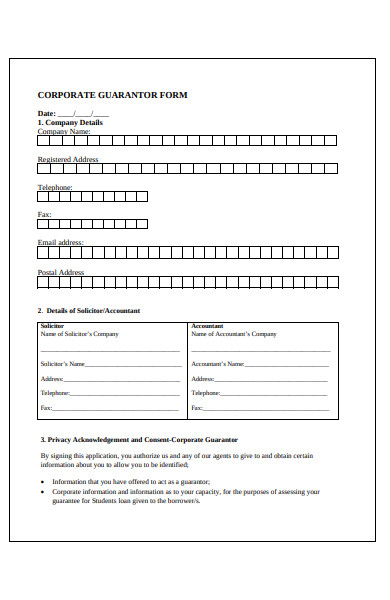

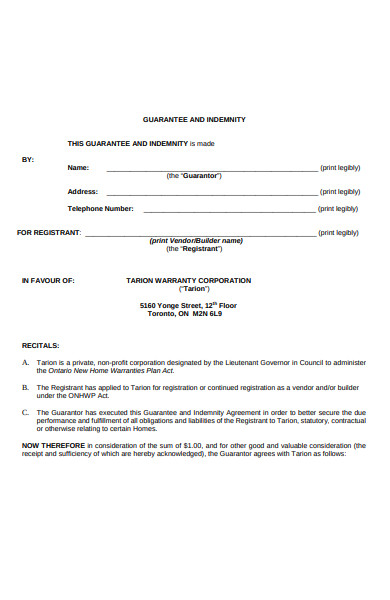

18. Corporate Guarantor Form

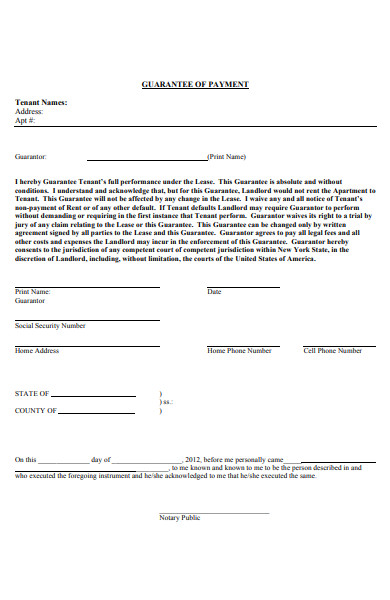

19. Guarantor of Payment Form

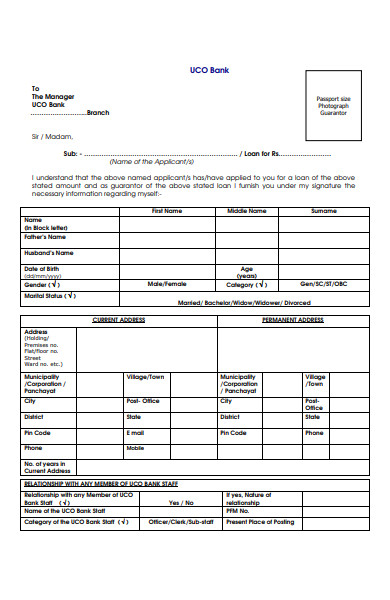

20. Bank Guarantor Form

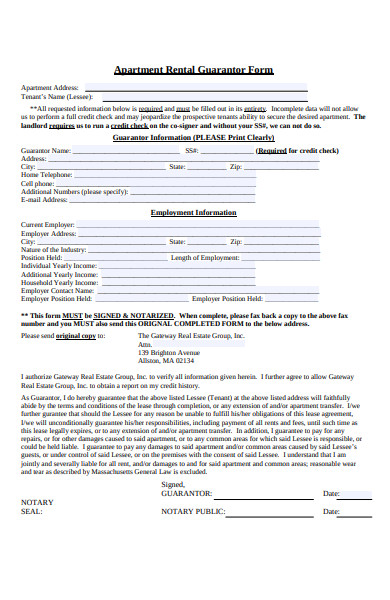

21. Apartment Rental Guarantor Form

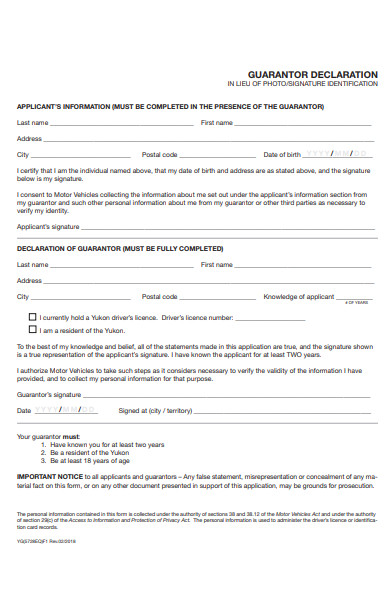

22. Guarantor Declaration Form

23. Guarantor Certificate Form

24. Guarantor Indemnity Form

25. Housing Guarantor Form

26. Manager Guarantor Form

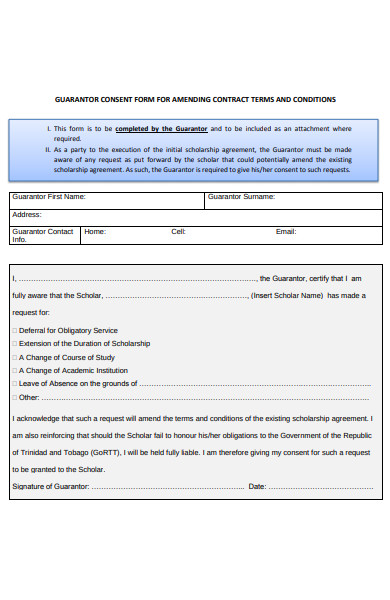

27. Guarantor Consent Form

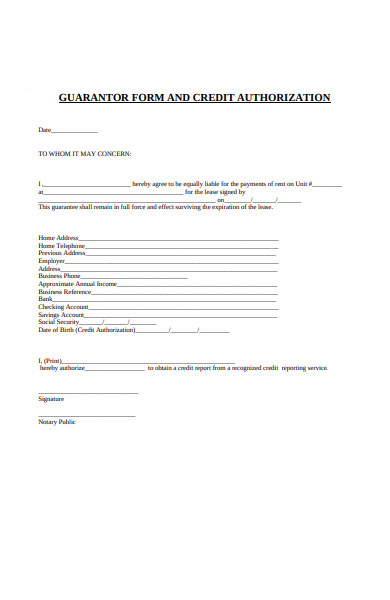

28. Guarantor Form and Credit Aauthorization

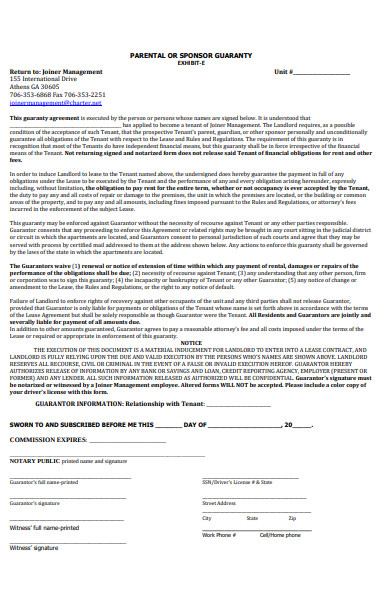

29. Sponsor Guarantor Form

30. Guarantor Terms Form

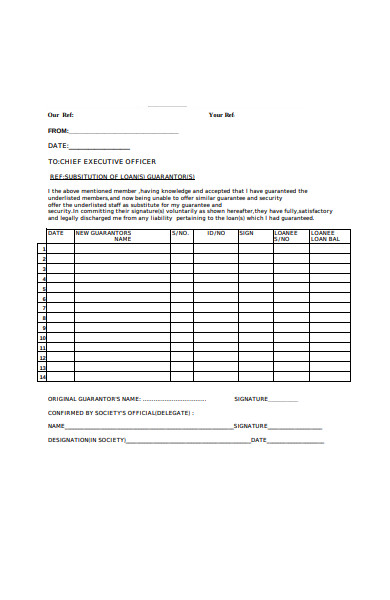

31. Guarantor Substitution Form

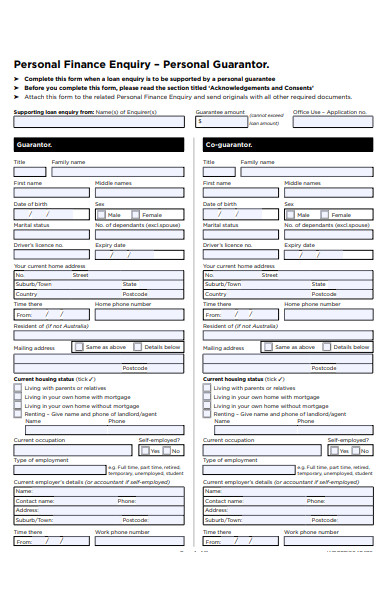

32. Guarantor Finance Enquiry Form

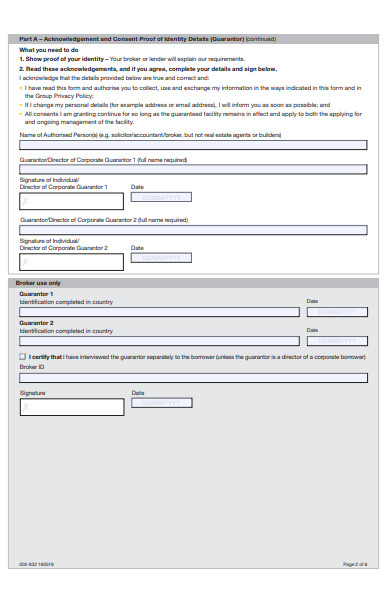

33. Home Loan Details Guarantor Form

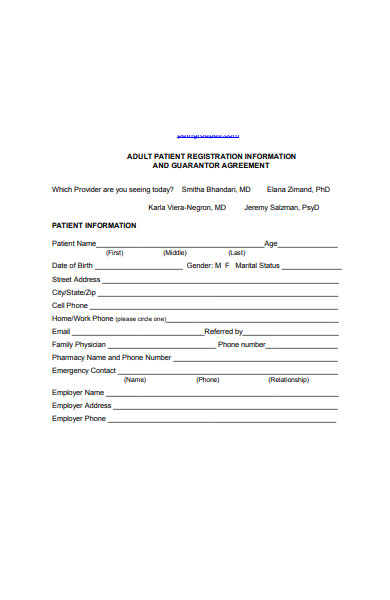

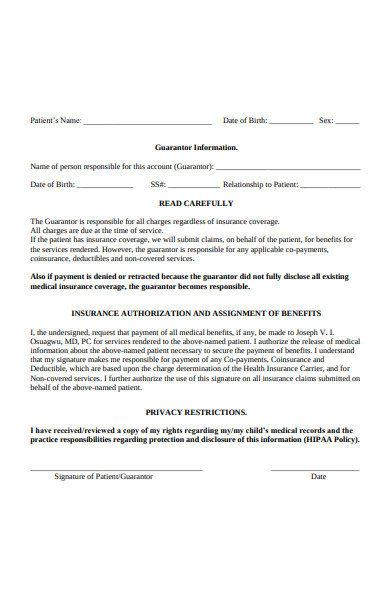

34. Patient Information Guarantor Form

35. Parental Guarantor Form

36. Guarantor Statement Form

37. Pediatrics Guarantor Information Form

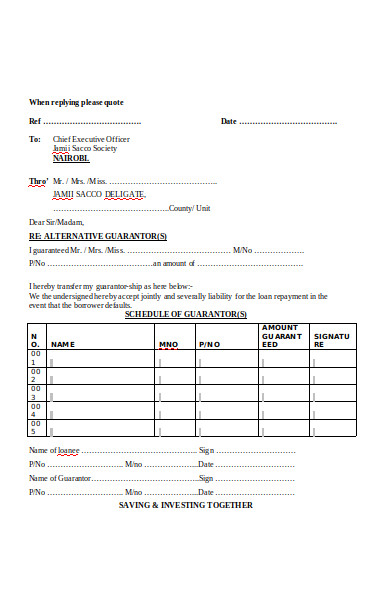

38. Alternative Guarantor Form

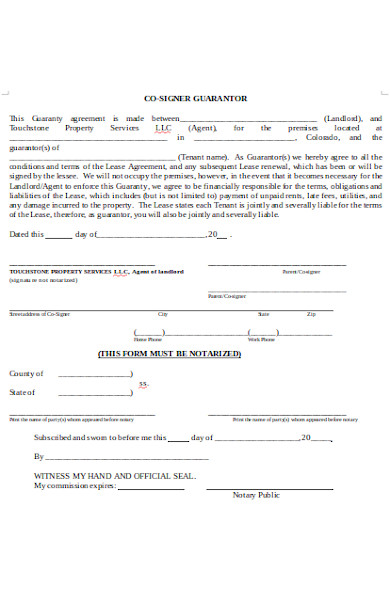

39. Co Signer Guarantor Form

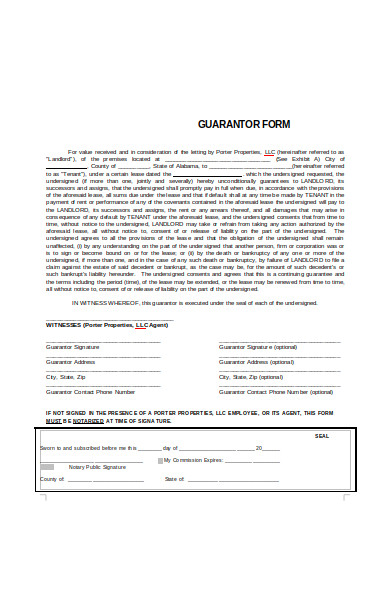

40. Properties Guarantor Form

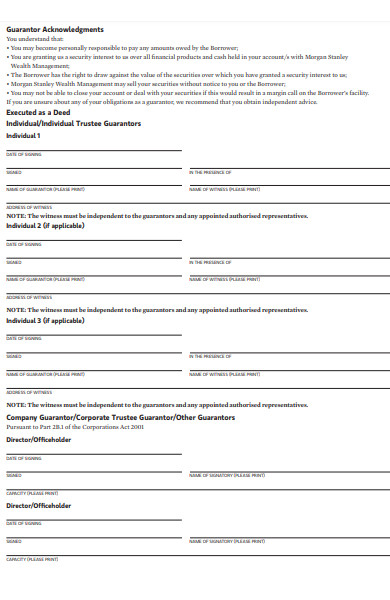

41. General Guarantor Form

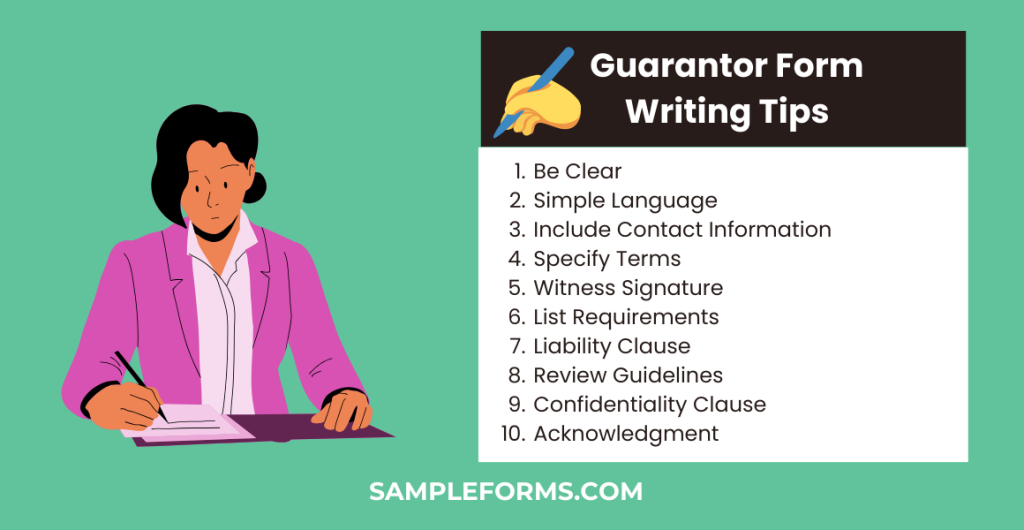

10 Guarantor Form Writing Tips

- Be Clear: Ensure the form clearly outlines the responsibilities and obligations of the guarantor.

- Simple Language: Use plain and easy-to-understand language to avoid confusion.

- Include Contact Information: Provide space for the guarantor’s contact details for easy communication.

- Specify Terms: Clearly state the duration and conditions of the guarantor’s commitment.

- Witness Signature: Include a section for witness signatures to validate the agreement.

- List Requirements: Outline the documents or qualifications needed from the guarantor.

- Liability Clause: Clearly define the extent of the guarantor’s liability in case of default.

- Review Guidelines: Offer guidelines or instructions to help the guarantor fill out the form accurately.

- Confidentiality Clause: Incorporate a clause to ensure the confidentiality of the guarantor’s information.

- Acknowledgment: Include a section where the guarantor acknowledges their understanding and acceptance of the terms.

Guarantor Forms: The Risky Business of Guarantor Agreements

Trust is the initial capital that anyone in the business of lending invests first. It is through this that lenders feel a sense of security and certainty despite the gamble that they wittingly got themselves into. As with any type of business, lending itself also has its very own risks. In this sense, quickly trusting becomes a liability, as well as a headache in a blink of an eye.

Guarantor agreements do not guarantee the absence of uncertainty in the business of extending loans and credit. It is because relying heavily on a person’s credit score doesn’t ensure repayment from both the borrower and the guarantor. Besides, measuring a person’s integrity based on their credit score is nothing but one of the many credit myths in existence. And although lenders themselves pose a primary risk in lending and credit business, the same risk applies to guarantors as well. And, here’s why:

-

Guarantors Themselves Become Insolvent

Guarantor agreements are created primarily as a safeguard measure against nonpayment of debts by the borrower. Insolvency, on their part, is one of the main reasons why. It is the state of financial incapability caused by various reasons, and not only are borrowers prone to this but also guarantors as well.

-

Guarantors Running Away With the Borrower

Running away from their debts are common among borrowers, especially if they can no longer pay it or don’t plan on doing so from the start. Guarantors have the same tendency to run away too, especially if they and the borrower are well acquainted with each other.

-

Guarantor’s Refusal to Pay Unless Guaranteed of Repayment

Refusal to pay on the part of the guarantor is most likely to happen. This scenario is because they see themselves as a witness in a guarantor agreement and may to have not read the provisions as well. The only way to avoid this event is by telling them to sue the borrower as it is within their rights as the guarantor of the loan.

Why Promote Guarantor Agreements?

Extending loans requires one loan applicant to furnish proof of its capacity to pay for the money that they plan to borrow. Credit scores, billing statements, and others are some of the documents that loan applicants need to show as proof. Traditional methods of extending loans have limitations that extend to a would-be borrower’s capacity for repayment, thus making it a bit inaccessible even for a regular joe like struggling college students, for example. Aside from that, using traditional lending methods might not be instantly profitable, especially if you’re still new to the lending business.

Guarantor agreements are very versatile as well as helpful tools whose application extends to almost any type of loan that you’re planning to offer. Student loans, car loans, and housing loans are examples of loan types in which you can apply Service Level Agreement Form. Versatile, because it allows you to offer your customers or clients the possibility to apply for a loan without showing proof of capacity for repayment. Helpful, because it provides those wish to borrow money by just bringing someone who can guarantee for the loan’s repayment. You also browse our Business Agreement Form

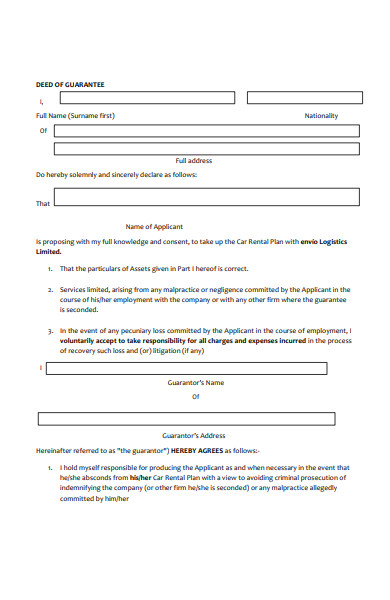

How Do You Implement Guarantor Agreement

Guarantor agreements are suitable options for anyone who has difficulties in securing a loan or buying something on credit. These difficulties may stem from having low credit scores or are just starting to build their credit reputation. Guarantor agreements allow would-be borrowers to secure a loan by having someone to vouch for their integrity and trustworthiness, as well as their capacity to pay for the money that they owe. Now, if you are new to the lending business and are looking to extend loans through this means, then here’s how you can implement a guarantor agreement in your Loan Application Form.

Step 1. Weigh In The Risks

Guarantor lending is prevalent among those who are just starting applying for loans. These people could either be students, the employed, or people whose credit reputation a yet to be built. Or, they could be people whose credit scores are low enough for them to secure a loan all by themselves. All in all, guarantor loans are the usual go-to for people whose capacity to pay for the loan is questionable. And if you decide to extend such an offer out of generosity, it wouldn’t hurt that much. With that, guarantors need to put their guards up and weigh in the risks beforehand.

Step 2. Transfer It On Paper

Once you’ve weighed all the risks and decided to offer guarantor loans, it’s time to put all your ideas into paper. The first thing you should do is grab a blank piece of paper and create a draft of its terms and conditions. Aside from that, it is also during this phase that you elaborate on each party’s rights, duties, and responsibilities as well. Please do take note that this particular step is not about the actual creation of the Loan Agreement Form itself. But, this step is about drafting or creating a rough sketch of it. What this step does is that it allows room for adjustments or revisions and prevents you from repeating the whole process due to mistakes and errors.

Step 3. Legal Advice Is Always Necessary

Consulting a lawyer will assure you that everything written in your draft is legal. For you to do that, have a lawyer review your draft. What will happen during that time is that the lawyer will meticulously check for errors, or even improve the document. What’s more, is that any revision in the document’s provisions can be readily done right away, on-site. Seeking legal advice beforehand not only gives the document a legal effect, but it also makes it more legitimate in the eyes of your clients. You also browse our Overtime Authorization Form

Step 4. Provide Options to Your Borrower

Options offer a sense of security in times of uncertainty, and providing one to your clients will certainly wash their worries away. This scenario is especially important in the event the principal debtor refuses to pay or run away from its obligation. These cases are what dissuades people from becoming guarantors of a loan. However, such fear is understandable. And to avert that situation, telling them about the options to take in case such an event happens will surely enlighten them that there is nothing to fear.

What are other means of Repayment for a Guarantor?

For one, you can use your external sources of income to pay back the bank should the borrower fails to pay on time. Such sources of income include your savings, collateral damages, and income from your family if they are willing to lend you. Another alternative is loaning from a different loan business, though it might be riskier than the previous options. Our Real Estate Lease Guarantee Co-Signer Agreement Forms is also worth a look at

What is a Guarantee Form of Employees?

A Guarantee Form for employees is a document where an individual or entity agrees to take responsibility for certain obligations of an employee. This could include financial responsibilities, such as repaying advances or loans, or performance-related commitments, like completing a project. It ensures accountability and provides a form of security for the employer. The form outlines the specific terms of the guarantee, the extent of the guarantor’s liability, and the conditions under which the guarantee is enforceable. You may also see Trust Agreement Contract Form

How do I get out of being a Guarantor?

There are three ways on how you can go about this. First, when there are additional loans taken without your consent, you can ask any personnel from the bank to relieve you of the burden of taking another payment obligation. Second, if you cannot shoulder the amount your client wants, then you can ask the bank to ask another guarantor who is willing to take your place. The bank only allows the substitution of the guarantor if you can convince them. Third, if you have known the borrower for a long time, you can ask them or their close relatives to help you pay back earlier than expected. However, this scenario is not a legal one, and it only works if you have gotten to know the borrower well already. You may also see Third Party Authorization Form

How can I Write a Guarantor Form?

To write a guarantor form, start with a clear Grant Application Form structure, detailing the obligations and conditions. Ensure clarity and precision in your documentation.

What do you Need to Prove to be a Guarantor?

Being a guarantor requires proving financial stability, often through a Vendor Agreement Form, showcasing your ability to fulfill the guarantor’s responsibilities.

What is a Signed Guarantor Form?

A signed guarantor form, integral to a Partnership Agreement, is a legally binding document where a guarantor agrees to fulfill the obligations if the primary party cannot.

Who can and Cannot be a Guarantor?

Anyone without financial stability or legal capacity, such as those not in a Custody Agreement Form, cannot serve as a guarantor. It requires legal and financial eligibility.

How Much does a Guarantor Need to Have?

A guarantor must demonstrate substantial financial stability, often quantified in a Promissory Note Agreement Form, to cover the obligations outlined in the guaranty agreement.

Related Posts

FREE 7+ Sample Loan Agreement Forms in PDF WORD

FREE 10+ Sample Patient Information Forms in PDF WORD

FREE 10+ Trailer Rental Agreement Forms in PDF DOC

FREE 7+ Sample Apprenticeship Agreement Forms in PDF WORD

FREE 9+ Safety Meeting Forms in PDF DOC

FREE 56+ Loan Agreement Form in Template PDF | DOC

FREE 11+ Lease Addendum Forms in PDF DOC

FREE 3+ Parking Space Rental Agreement Forms PDF

FREE 34+ Loan Agreement Form Samples in PDF DOC

FREE 9+ Copyright Registration Form Samples PDF

FREE 20+ Sample Reservation Forms PDF

FREE 10+ Condominium Lease Agreement Forms in PDF DOC

FREE 31+ Reservation Form Templates PDF

FREE 8+ Guarantor Agreement Forms in Samples, Examples, Formats

FREE 8+ Sample Guarantor Agreement Forms in PDF WORD