A Guarantor Agreement Form is a vital document ensuring a guarantor legally commits to fulfilling a borrower’s obligations if they default. This comprehensive guide covers everything you need to know about drafting and using this form effectively. Learn about the key components of a Guarantor Form, how to structure it properly, and the legal implications involved. With clear examples and step-by-step instructions, this guide makes it easy to understand and create a solid Agreement Form. Whether you are a lender seeking security or a guarantor understanding your responsibilities, this guide provides essential insights to protect your interests.

Download Guarantor Agreement Form Bundle

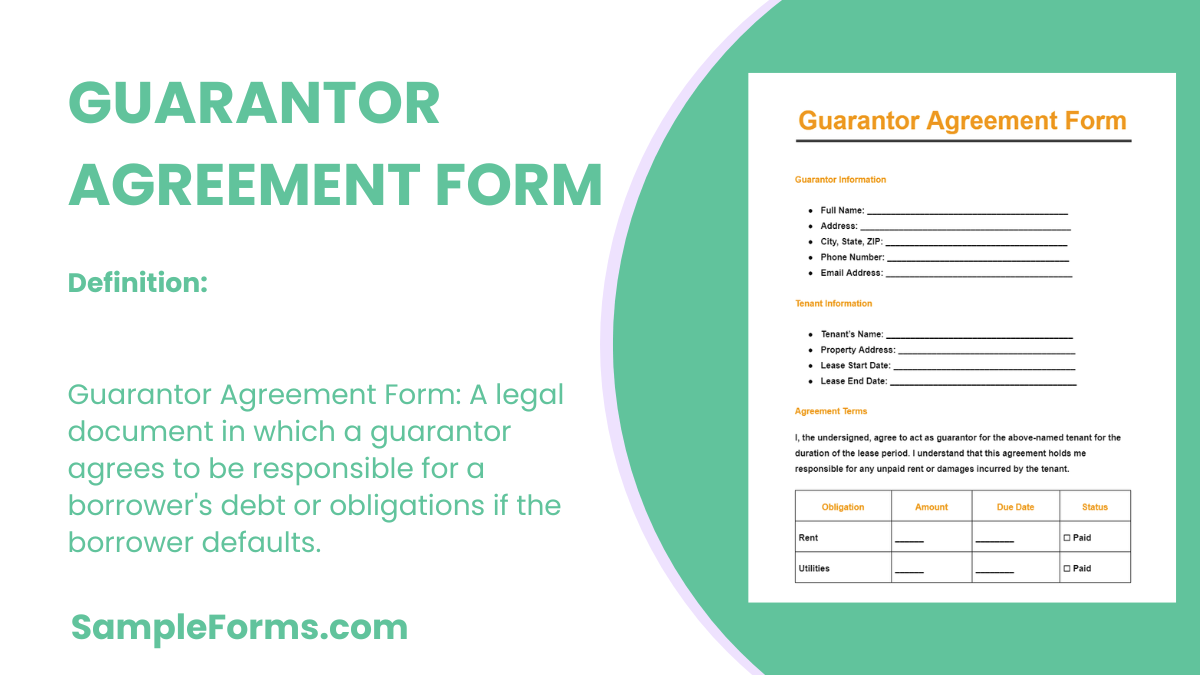

What is Guarantor Agreement Form?

A Guarantor Agreement Form is a legal document where a guarantor agrees to take responsibility for a borrower’s debt or obligation if the borrower defaults. This Agreement Form provides lenders with additional security, ensuring that obligations are met even if the primary party fails to do so. It includes the terms and conditions under which the guarantor will fulfill the obligations, ensuring clear understanding and legal compliance for all involved parties.

Guarantor Agreement Format

Guarantor Agreement

Agreement Date:

- Date:

Parties Involved:

- Guarantor Name:

- Borrower Name:

- Lender Name:

Loan Details:

- Loan Amount:

- Loan Term:

- Interest Rate:

Guarantor’s Obligations:

- Payment Responsibilities:

- Conditions for Guarantee:

Terms and Conditions:

- Duration of Guarantee:

- Circumstances Leading to Guarantor’s Liability:

- Repayment Plan in Case of Default:

Signatures:

- Guarantor’s Signature:

- Borrower’s Signature:

- Lender’s Signature:

- Date:

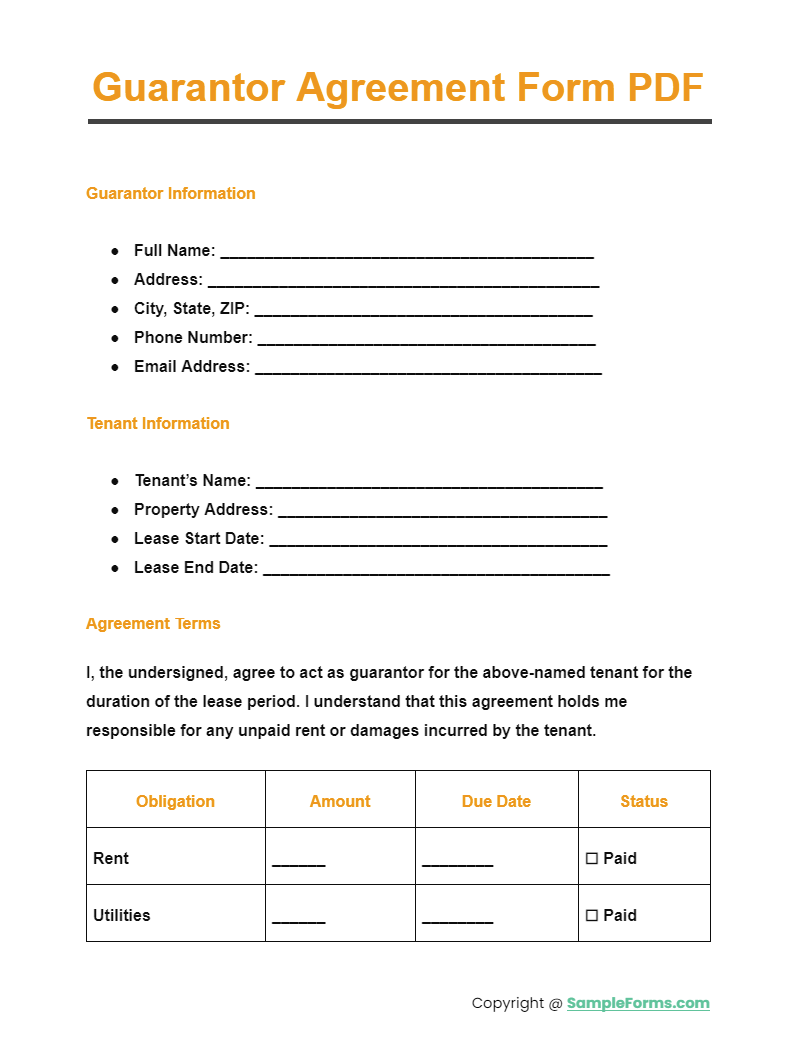

Guarantor Agreement Form PDF

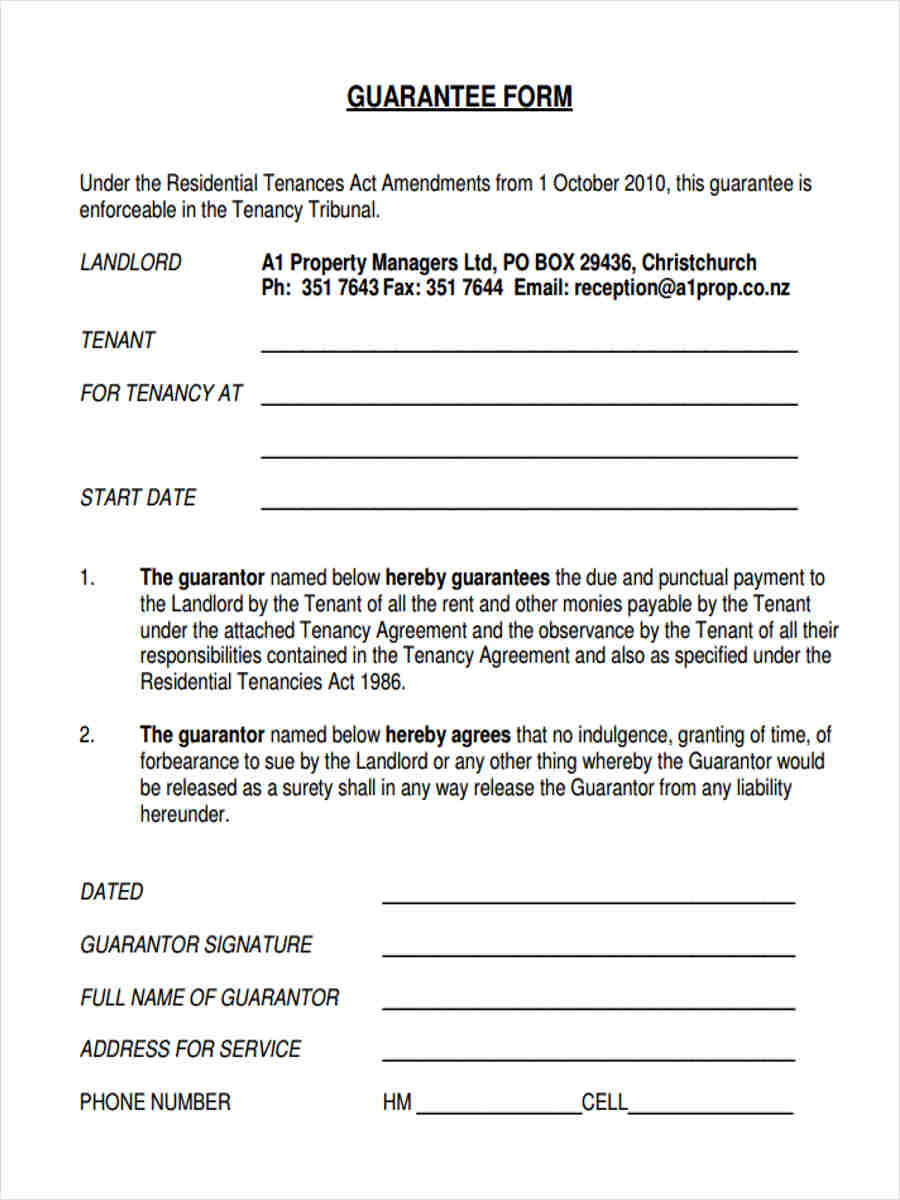

A Guarantor Agreement Form PDF provides a downloadable, fillable format ensuring clear, legally binding terms. Easily accessible, it simplifies the process of securing commitments, like a Tenancy Agreement Form, ensuring compliance and clarity. You may also see Holding Deposit Agreement Form

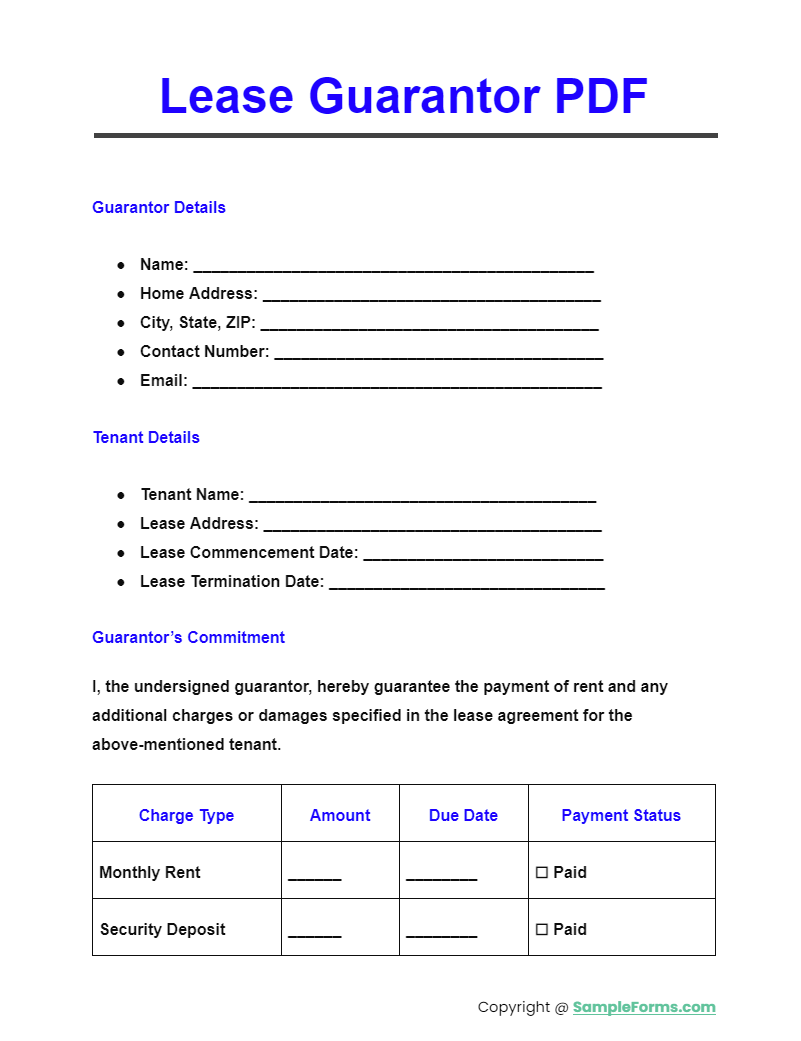

Lease Guarantor PDF

A Lease Guarantor PDF is a crucial document ensuring a guarantor’s responsibility for lease obligations. It offers a clear, structured format similar to a Business Agreement Form, protecting both landlords and tenants by outlining specific terms. You may also see Land Agreement Form

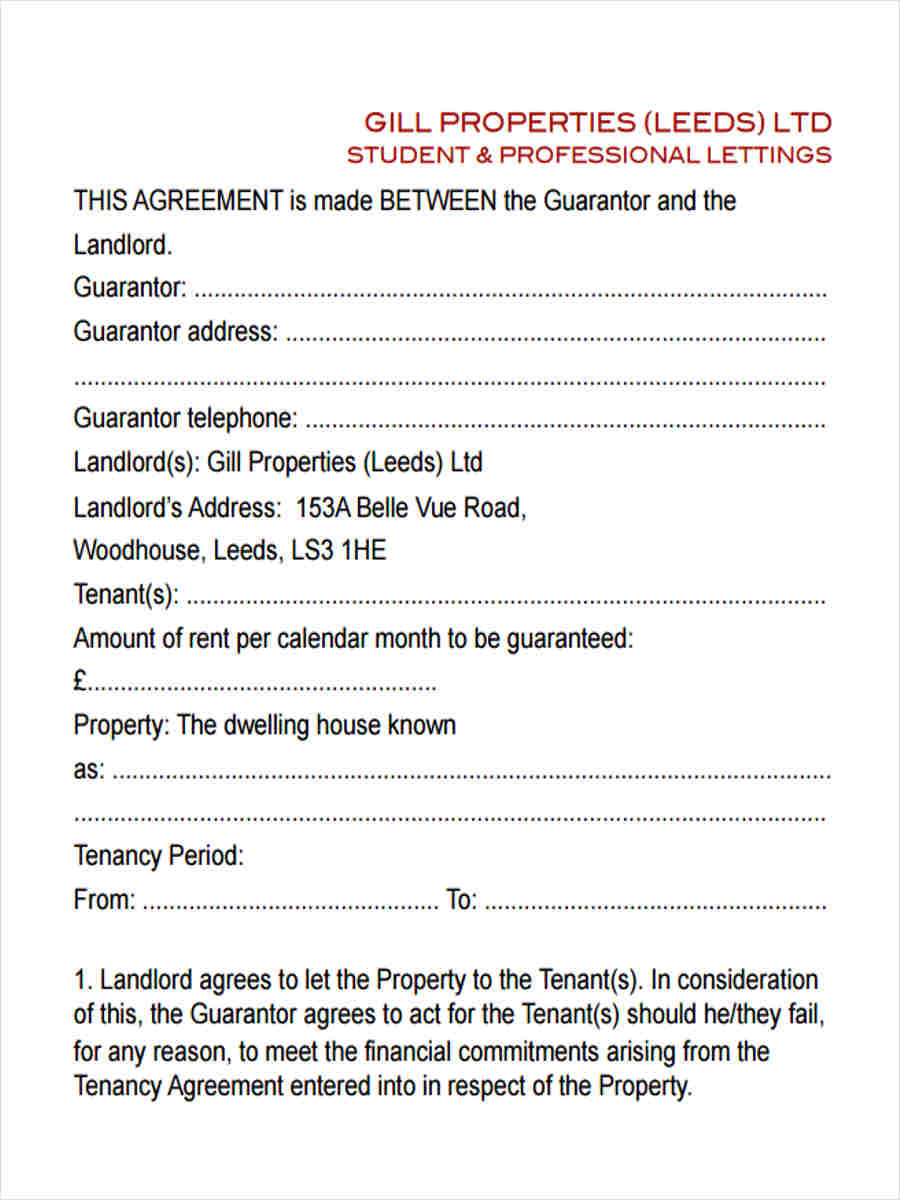

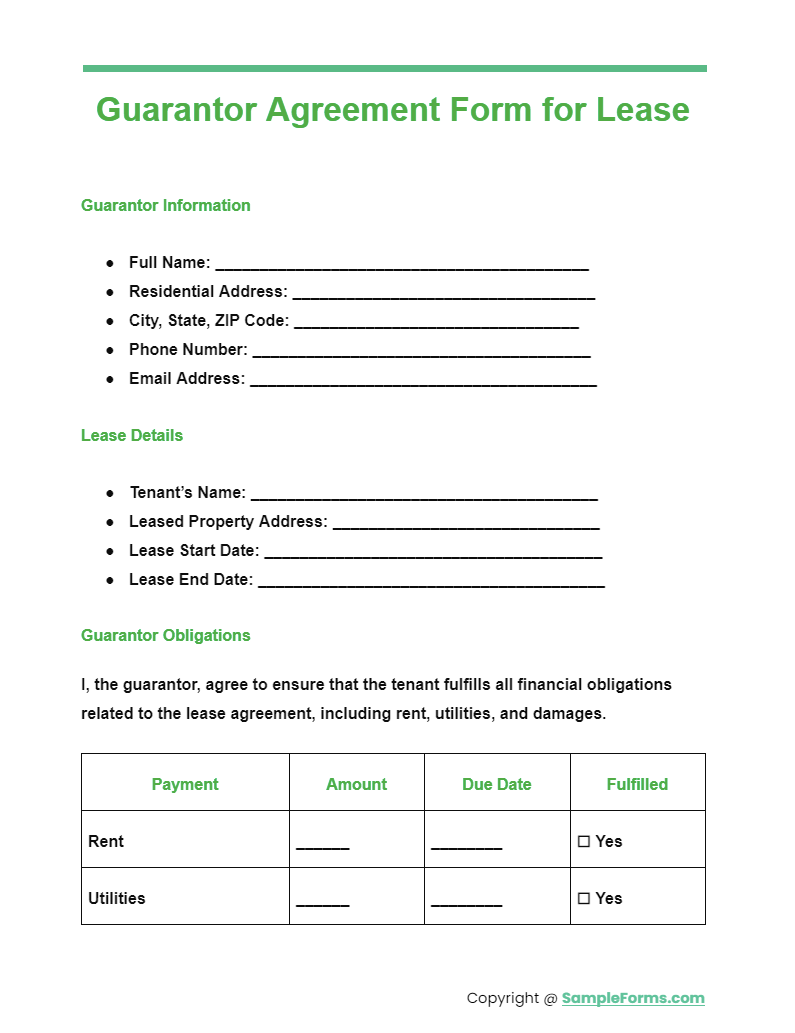

Guarantor Agreement Form for Lease

A Guarantor Agreement Form for Lease outlines the guarantor’s obligations for a tenant’s lease. This form, akin to a Promissory Note Agreement Form, ensures landlords have security in case of tenant default, clearly defining all responsibilities. You may also see Training Agreement Form

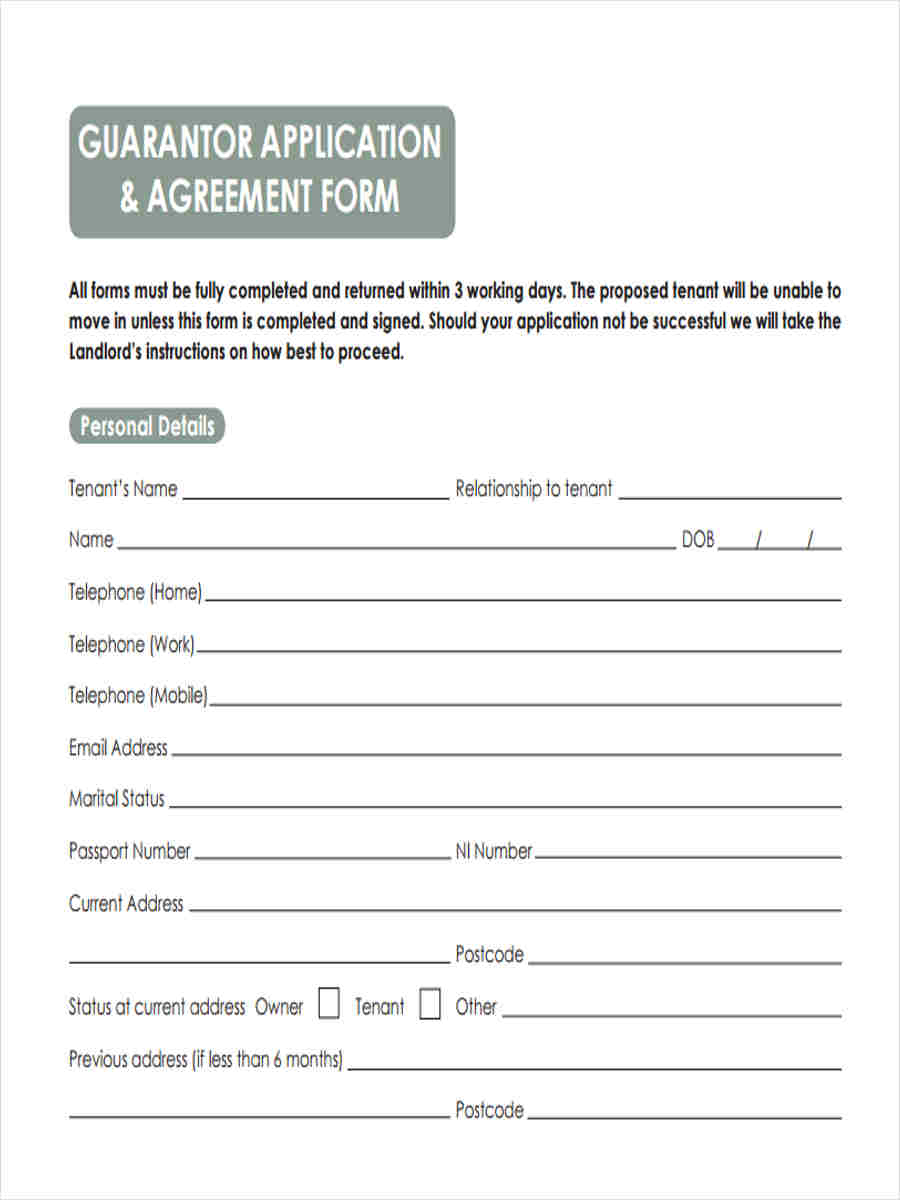

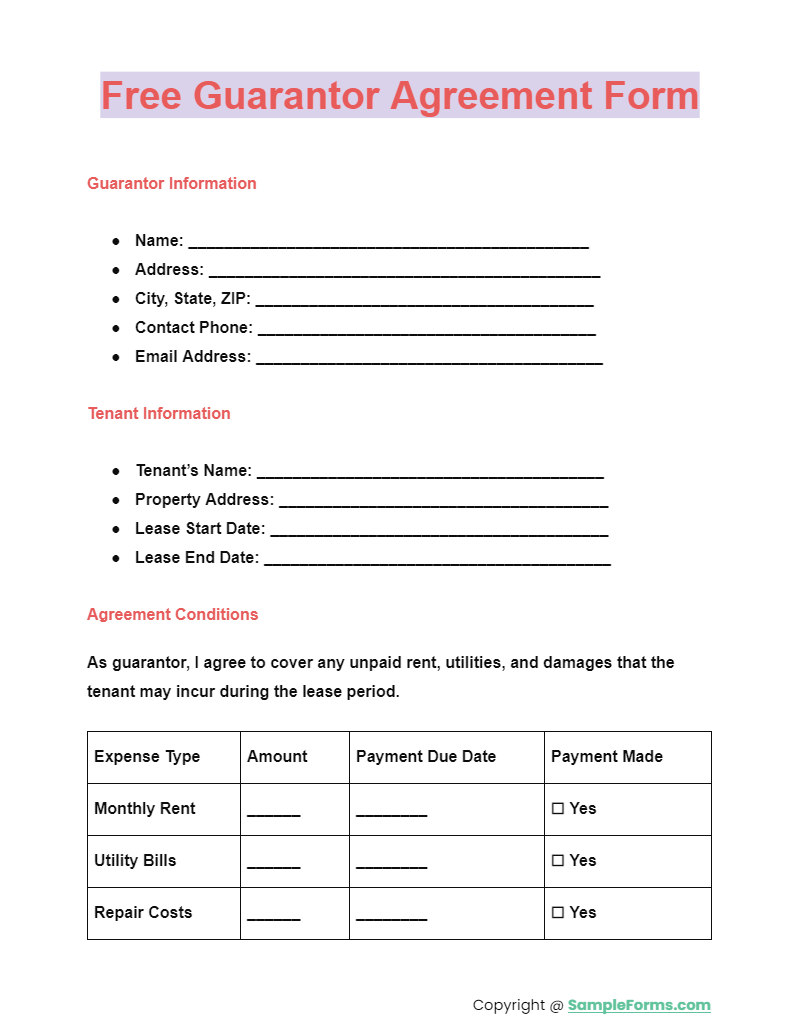

Free Guarantor Agreement Form

A Free Guarantor Agreement Form provides an accessible way to secure financial agreements without cost. Similar to a Personal Loan Agreement Form, it offers a straightforward method to ensure obligations are met, protecting all parties involved. You may also see Operating Agreement Form

Sample Guarantor Agreement Form Samples

Tenant Guarantee Form

Guarantor Agreement for Residential

Guarantor Application Agreement From

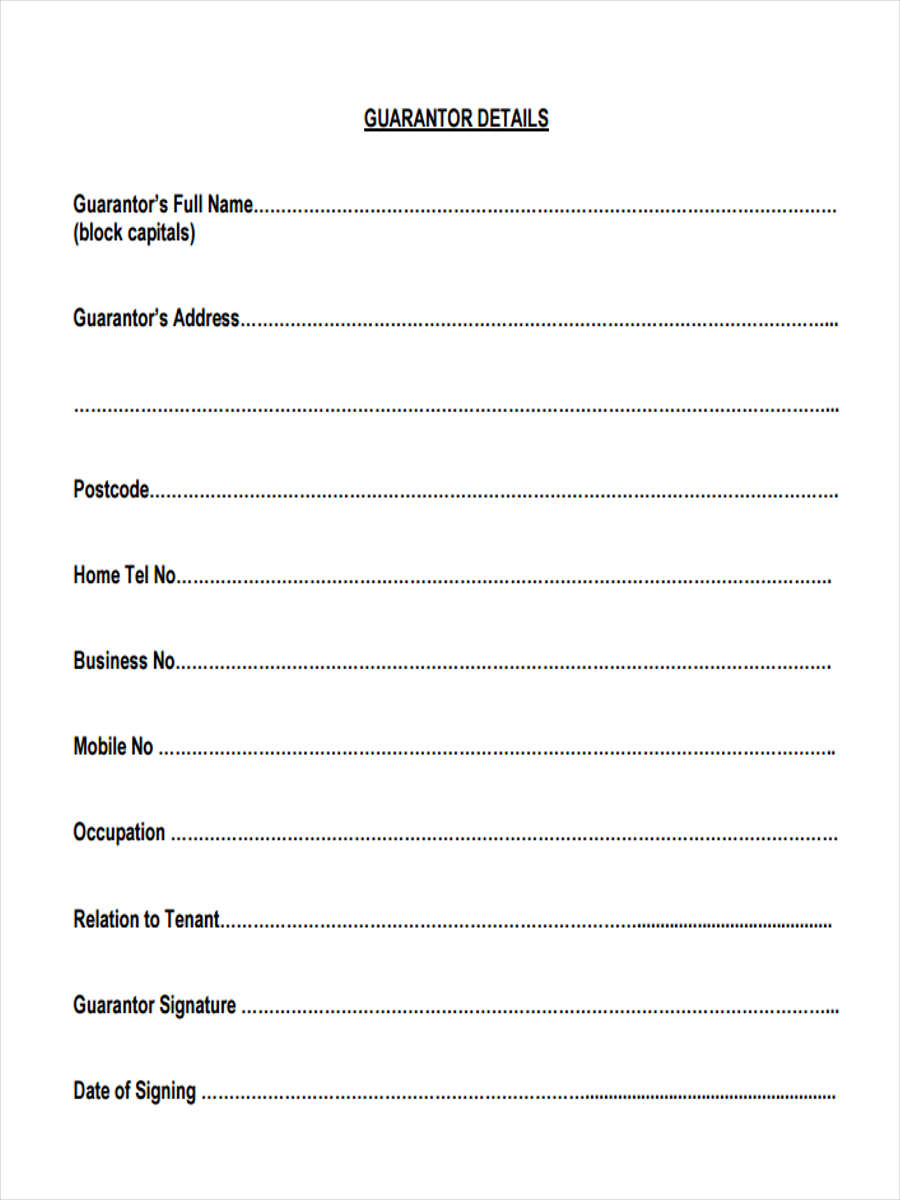

Tenant Guarantor Form

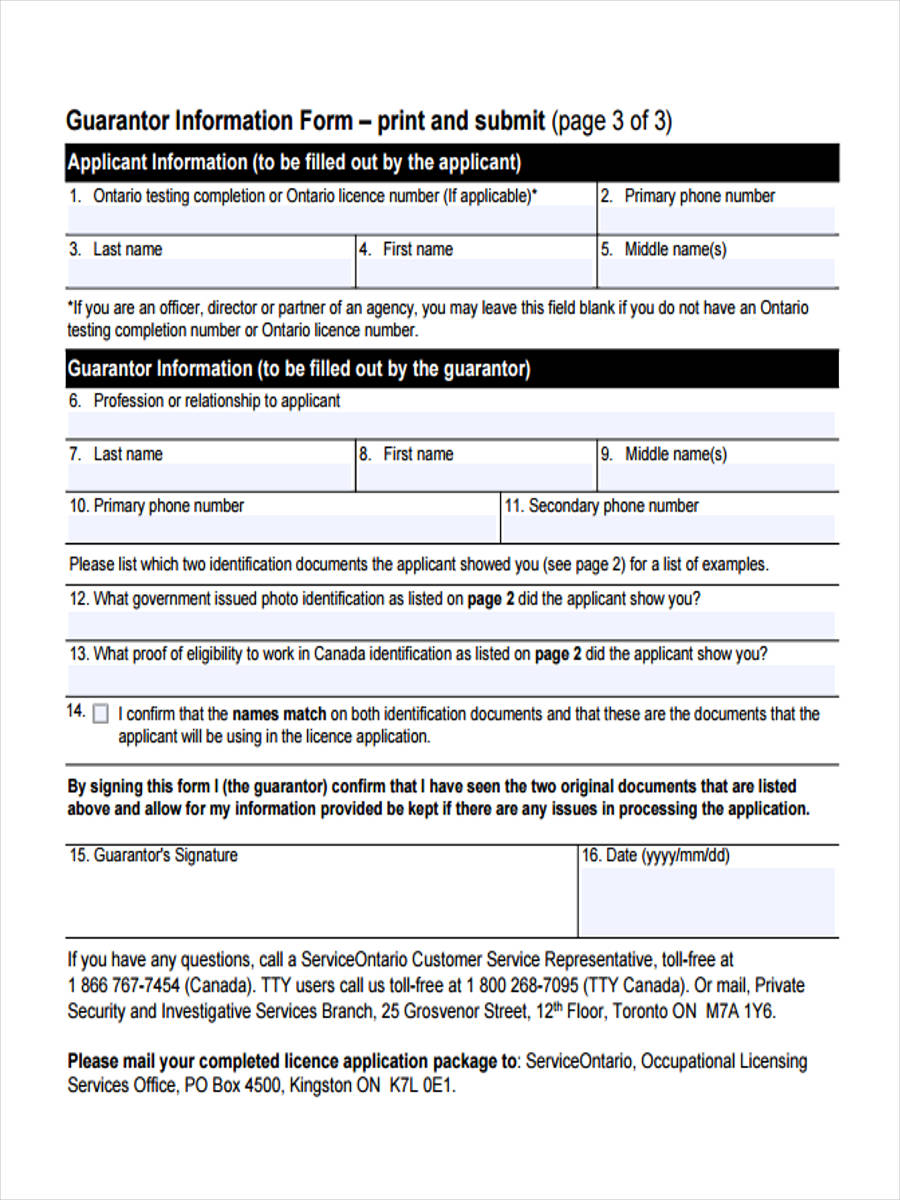

Guarantor Information Form

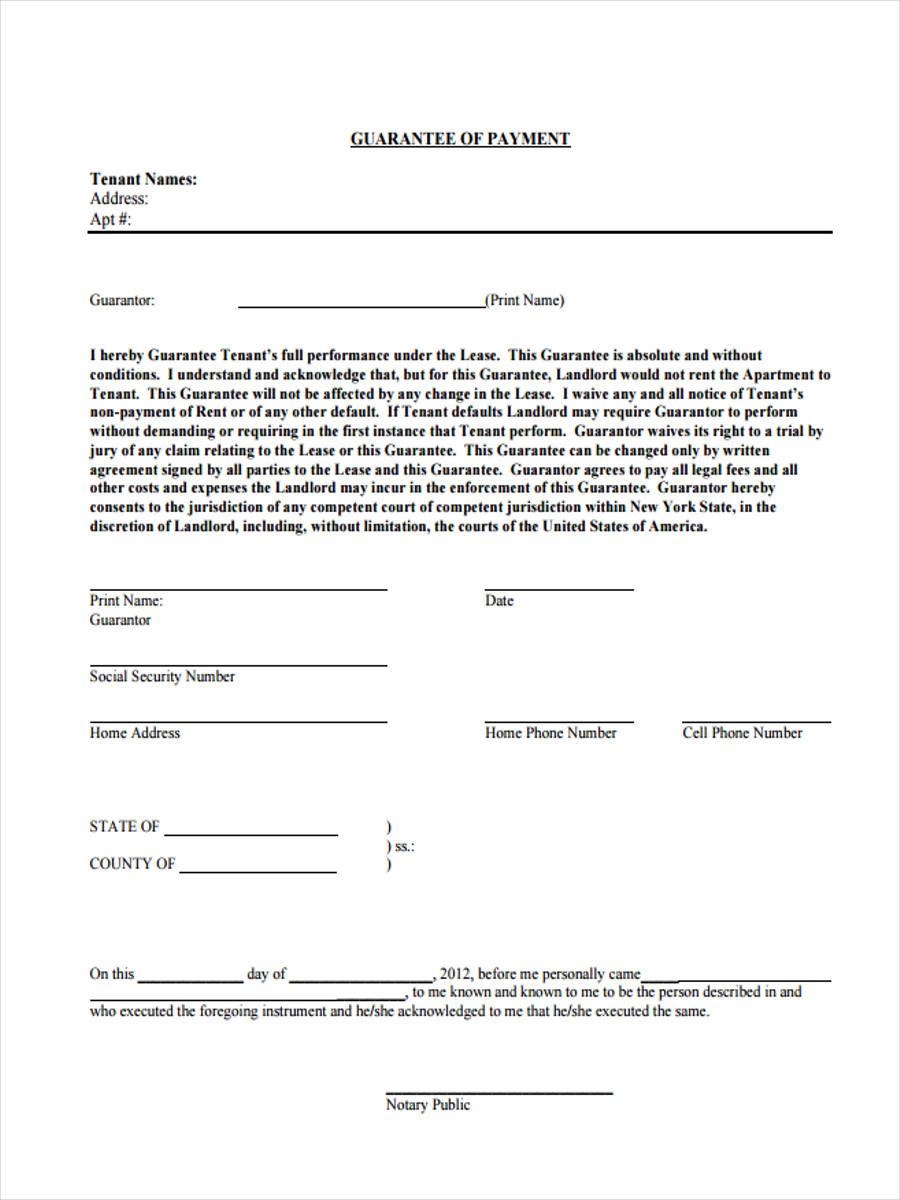

Guarantee of Payment Form

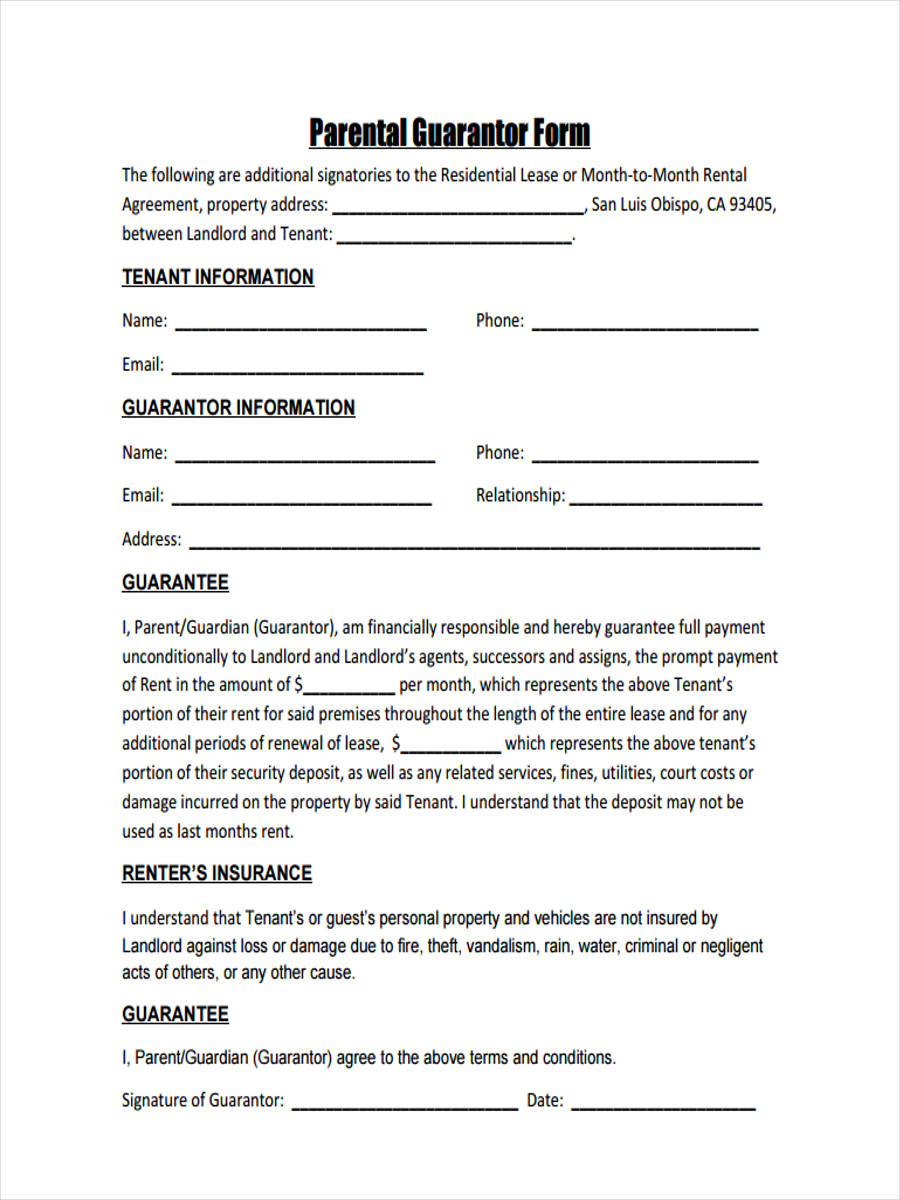

Parental Guarantor

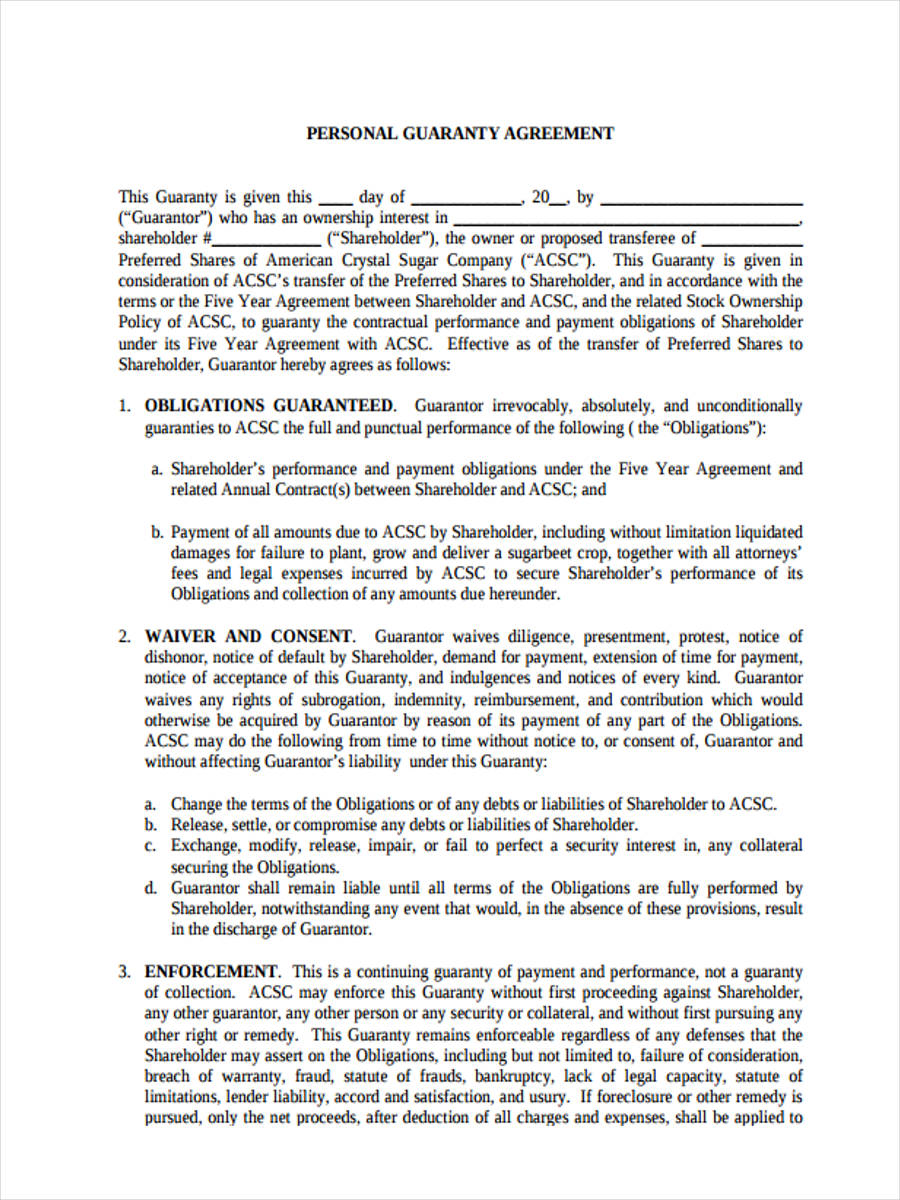

Personal Guaranty Agreement

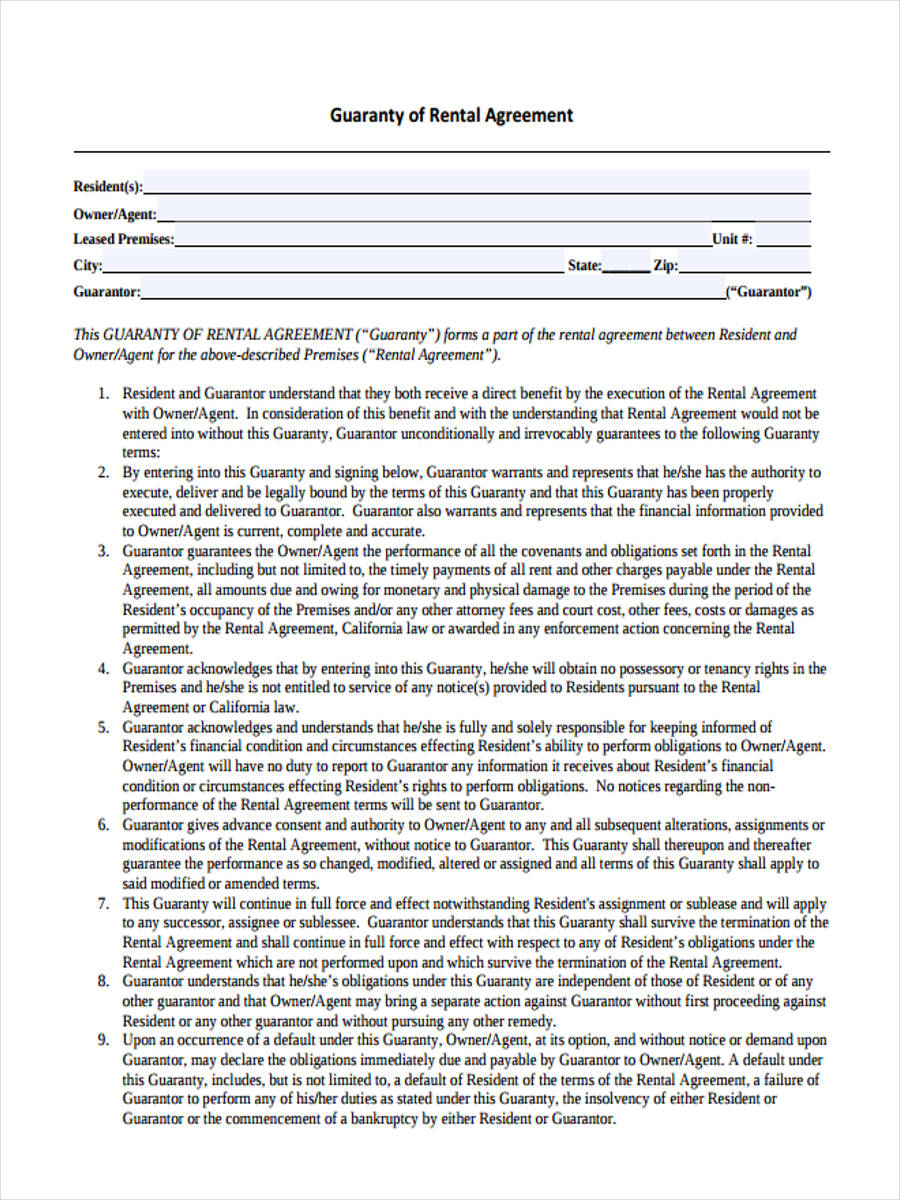

Guaranty of Rental Agreement

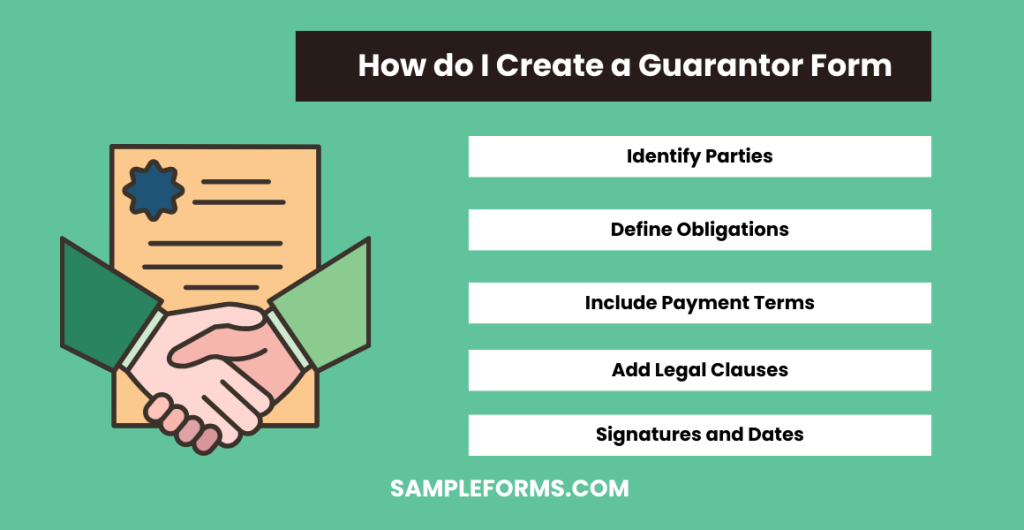

How do I create a guarantor form?

Creating a guarantor form involves outlining the guarantor’s obligations clearly. Follow these steps for a comprehensive and legally sound document.

- Identify Parties: Clearly state the names of the involved parties, similar to a Joint Venture Agreement Form.

- Define Obligations: Specify the guarantor’s responsibilities and conditions under which they are liable.

- Include Payment Terms: Outline the payment terms and conditions, similar to a Payment Agreement Form.

- Add Legal Clauses: Incorporate necessary legal clauses to ensure enforceability.

- Signatures and Dates: Ensure all parties sign and date the document to make it legally binding.

What does a guarantor need to write?

A guarantor must provide specific information and declarations in the agreement. Follow these steps for clarity and completeness.

- Personal Details: Include the guarantor’s full name, address, and contact information.

- Obligations Acknowledgment: Clearly state acknowledgment of their obligations, akin to a Contingency Fee Agreement Form.

- Financial Status: Provide information on their financial status to prove capability.

- Terms Agreement: Confirm understanding and agreement to the terms outlined.

- Signature: Sign the document to confirm their commitment and responsibility. You may also see Assignment Agreement Form

What should a guarantor letter include?

A guarantor letter must include detailed information to be legally valid. Follow these steps to ensure completeness.

- Introduction: State the purpose of the letter and the relationship to the primary party.

- Details of Obligation: Clearly outline the specific obligations the guarantor is agreeing to cover.

- Financial Capability: Mention the guarantor’s financial capability, similar to terms in an Installment Agreement Form.

- Duration of Guarantee: Specify the duration for which the guarantee is valid.

- Signature and Date: Include the guarantor’s signature and date to make it official. You may also see Commercial Agreement Form

What are the types of guarantors?

Different situations require different types of guarantors. Here are the main types.

- Individual Guarantor: A person who guarantees the obligations of another, similar to a Security Agreement Form.

- Corporate Guarantor: A company that guarantees another company’s debts or obligations.

- Limited Guarantor: A guarantor who limits their responsibility to specific obligations or amounts.

- Unlimited Guarantor: A guarantor responsible for all obligations without any limit.

- Specific Purpose Guarantor: A guarantor for a specific transaction or contract, such as a Sublease Agreement Form.

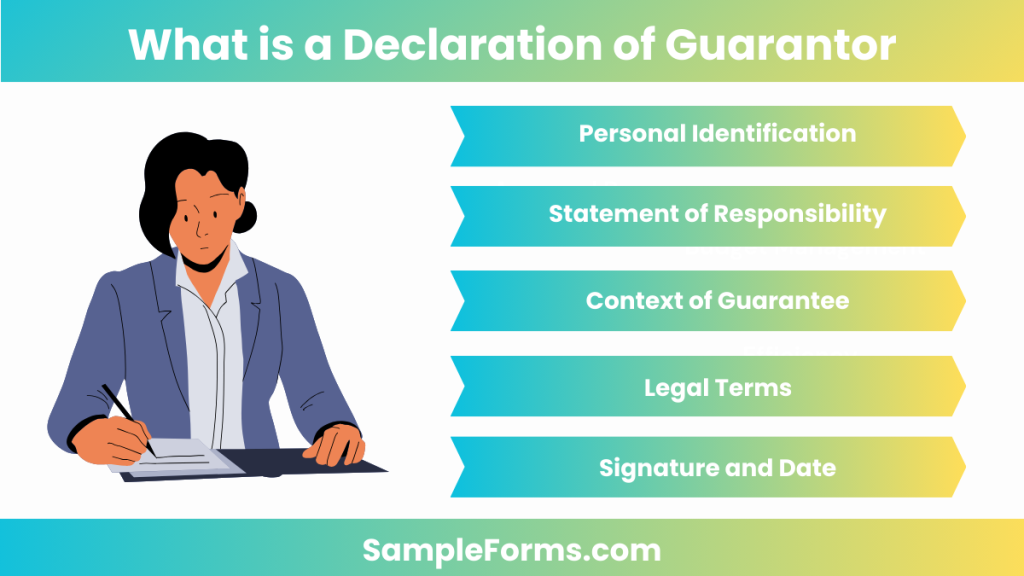

What is a declaration of guarantor?

A declaration of guarantor is a formal statement where a guarantor acknowledges and commits to their responsibilities. Follow these steps to create one.

- Personal Identification: Provide the guarantor’s personal details.

- Statement of Responsibility: Clearly state the responsibilities the guarantor is taking on.

- Context of Guarantee: Mention the context, such as a Student Loan Agreement Form.

- Legal Terms: Include relevant legal terms and conditions.

- Signature and Date: Ensure the declaration is signed and dated to confirm its validity. You may also see House Agreement Form

Tips for Guarantors in Tenancy Agreements

- Read and comprehend. Before signing as the guarantor for a tenancy agreement, read thoroughly what are the terms and your possible liabilities and obligations.

- Look out for traps. Take note of the time-range which you are obligated to pay the debt amount of the tenant since some lenders are quite wise enough to obligate you for a number of years.

- Assure responsiveness. This refers to the immediate calls that you may receive in the exact month that the tenant missed a rental payment. You should inform the landlord and the tenant that you will require a call for a particular number of hours after the missed payment day.

- Trust is the key. Signing to be a guarantor is giving your full trust to the tenant that he will not mess up your credit records. As much as you can, talk and negotiate matters of financial capability to the tenant before agreeing to his terms and give out possible suggestions on how you, as a guarantor, will not be given too much liability due to his actions. You may also see Room Agreement Form

Where can I get a guarantor form?

You can obtain a Guarantor Form online, through legal services, or at financial institutions. Ensure it meets specific legal requirements. You may also see Parking Agreement Form

What do you need to prove to be a guarantor?

To be a guarantor, you must prove financial stability, income, and creditworthiness, similar to requirements for an Investment Agreement Form.

What needs to be signed by guarantor?

A guarantor needs to sign the Guarantor Agreement Form, acknowledging their responsibilities and obligations, ensuring legal binding.

How long does a guarantor last?

A guarantor’s obligation lasts until the guaranteed debt or obligation is fulfilled, as specified in the Purchase Agreement Form.

What are the risks of being a guarantor?

Being a guarantor involves financial risks, such as covering unpaid debts, similar to obligations in a Consignment Agreement Form.

How much does a guarantor need to guarantee?

A guarantor needs to guarantee the amount specified in the Guarantor Agreement Form, ensuring full coverage of the borrower’s obligations.

Who is a valid guarantor?

A valid guarantor is a financially stable individual or entity, similar to those signing an Apprenticeship Agreement Form, who meets specific legal and credit requirements.

In conclusion, a Guarantor Agreement Form is essential for securing financial transactions, providing a safety net for lenders. This guide offers detailed samples, forms, and letters to assist in drafting effective agreements. Using a comprehensive Shareholder Agreement Form ensures clarity and legal protection. Understanding the importance and structure of these forms can safeguard your financial interests and provide peace of mind. Whether you are drafting a new agreement or reviewing an existing one, these insights will help you create legally sound and enforceable documents.

Related Posts

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Lottery Agreement Forms in PDF | MS Word