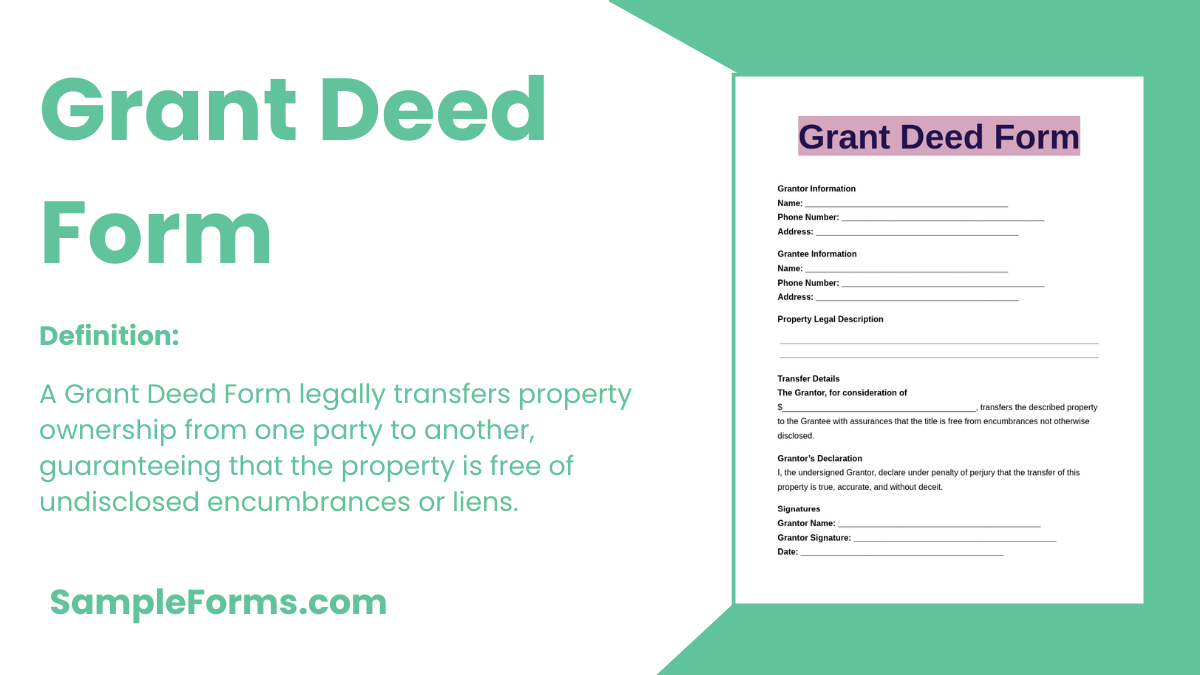

A Grant Deed Form is a vital legal document for transferring property ownership between parties. This form guarantees the transferor holds the title and ensures the property is free from undisclosed encumbrances. Whether for a real estate sale or a gift transfer, the Deed Form establishes legal clarity, protecting both parties. This comprehensive guide explores its significance, components, and examples, helping you draft an error-free grant deed. From detailing grantor and grantee information to notarization requirements, learn how to use this document effectively for property transactions.

Download Grant Deed Form Bundle

What is Grant Deed Form?

A Grant Deed Form is a legal document used in property transactions to transfer ownership from one party (grantor) to another (grantee). This form guarantees that the grantor holds a valid title and that there are no undisclosed liens or claims against the property. It is commonly used in real estate to ensure clear title transfer while maintaining a transparent transaction process. The grant deed provides legal protection for both buyer and seller in the transfer process.

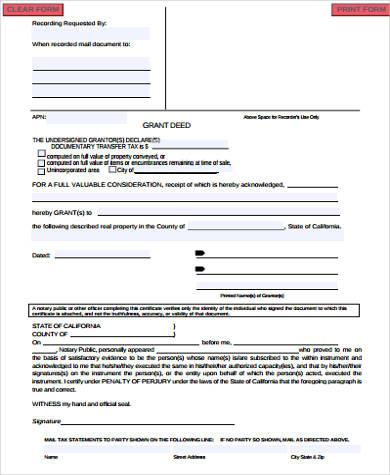

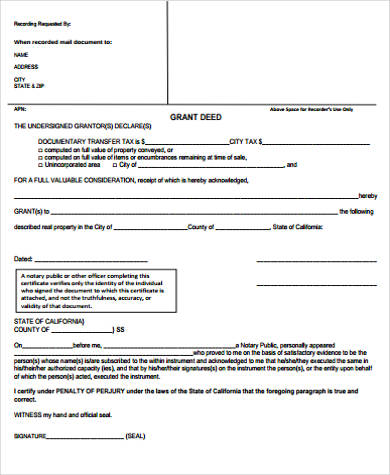

Grant Deed Format

Grantor Name: ____________________________________________

Address: ____________________________________________

Contact Number: ____________________________________________

Grantee Name: ____________________________________________

Address: ____________________________________________

Contact Number: ____________________________________________

Property Legal Description:

Transfer Purpose: [ ] Sale [ ] Gift [ ] Other: ____________________________________________

Grantor Signature: ____________________________________________

Date: ____________________________________________

Grantee Signature: ____________________________________________

Date: ____________________________________________

Notary Public Name: ____________________________________________

Notary Signature: ____________________________________________

Date: ____________________________________________

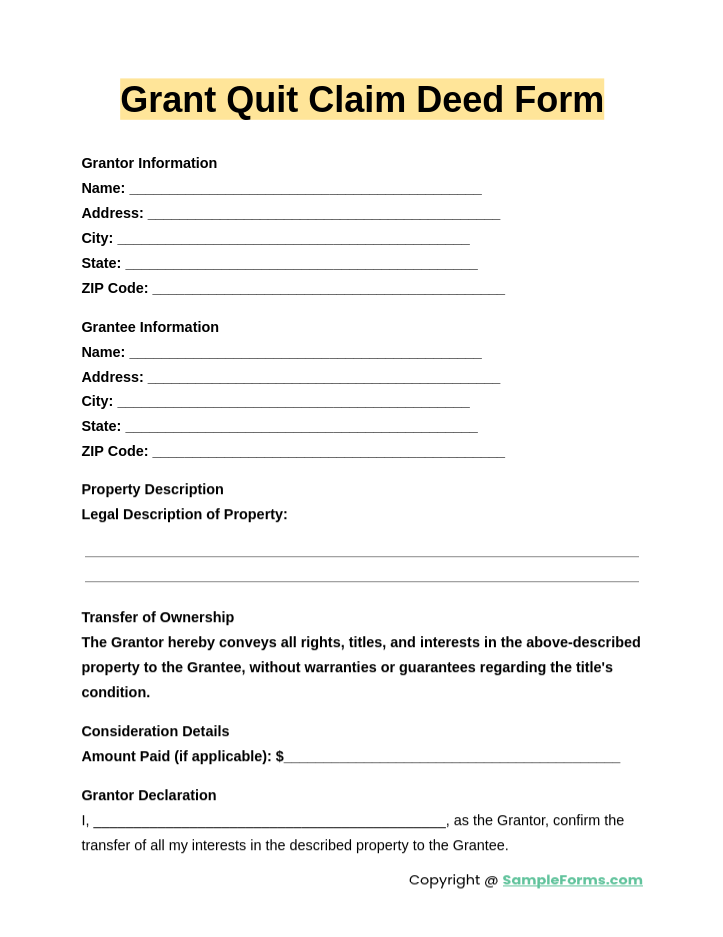

Grant Quit Claim Deed Form

A Grant Quit Claim Deed Form allows for property transfer without title warranties. Similar to a Quit Claim Deed Form, it conveys the grantor’s interest without guaranteeing title integrity, often used for family or non-financial transfers.

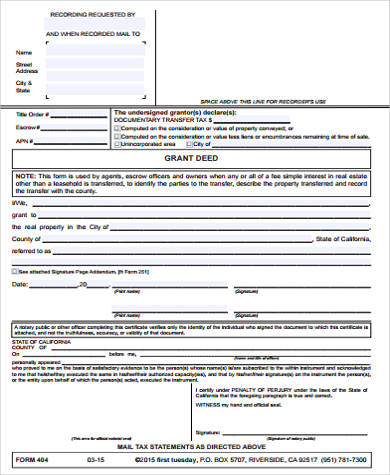

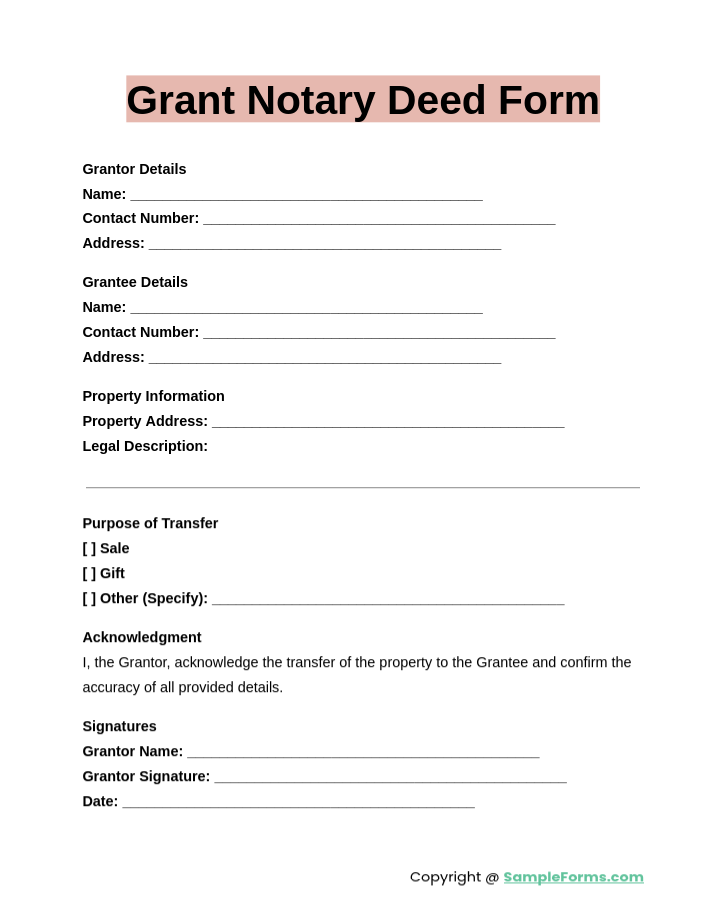

Grant Notary Deed Form

A Grant Notary Deed Form ensures legal authenticity through notarization of property transfer agreements. Similar to a Contract for Deed Form, it secures credibility and legality by recording the grantor and grantee’s transaction details.

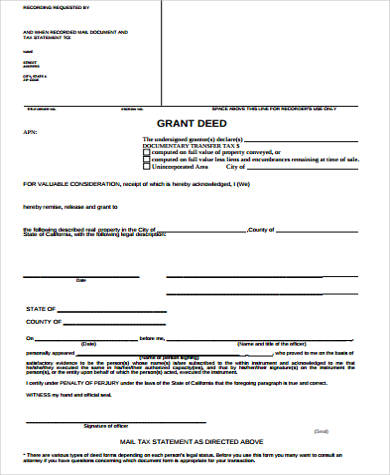

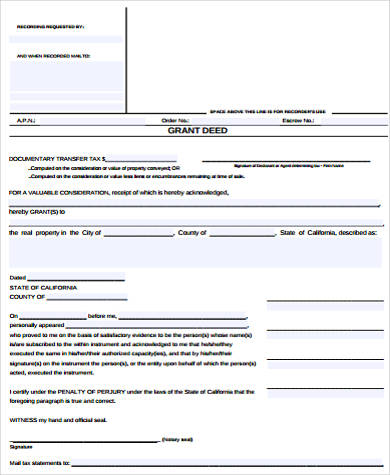

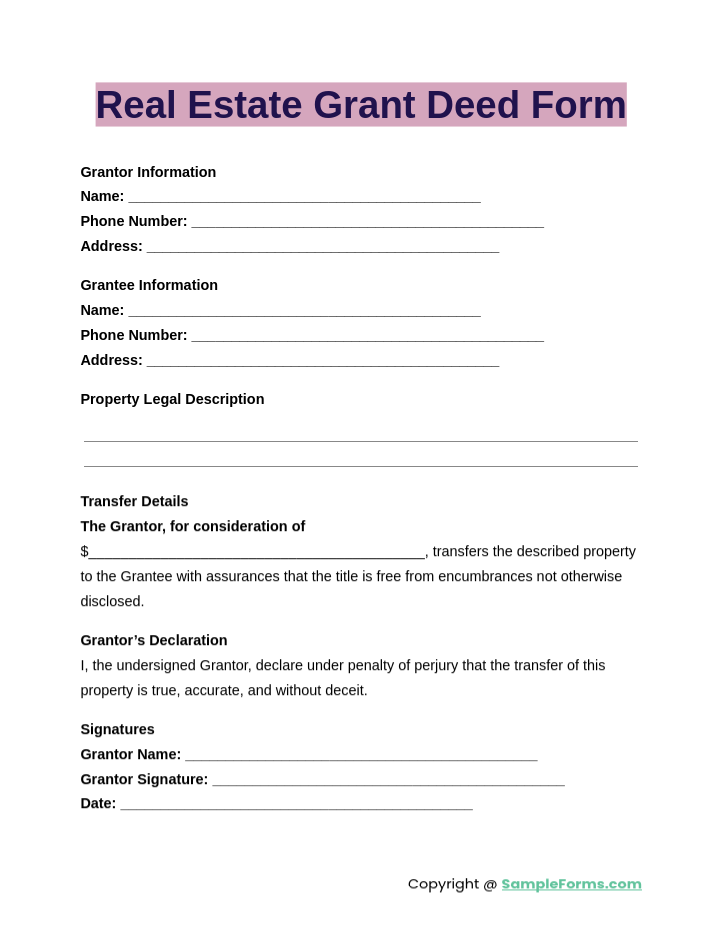

Real Estate Grant Deed Form

A Real Estate Grant Deed Form facilitates the transfer of property rights with limited warranties. Comparable to a Deed Transfer Form, it provides assurance against undisclosed liens, making it a reliable tool for property transactions.

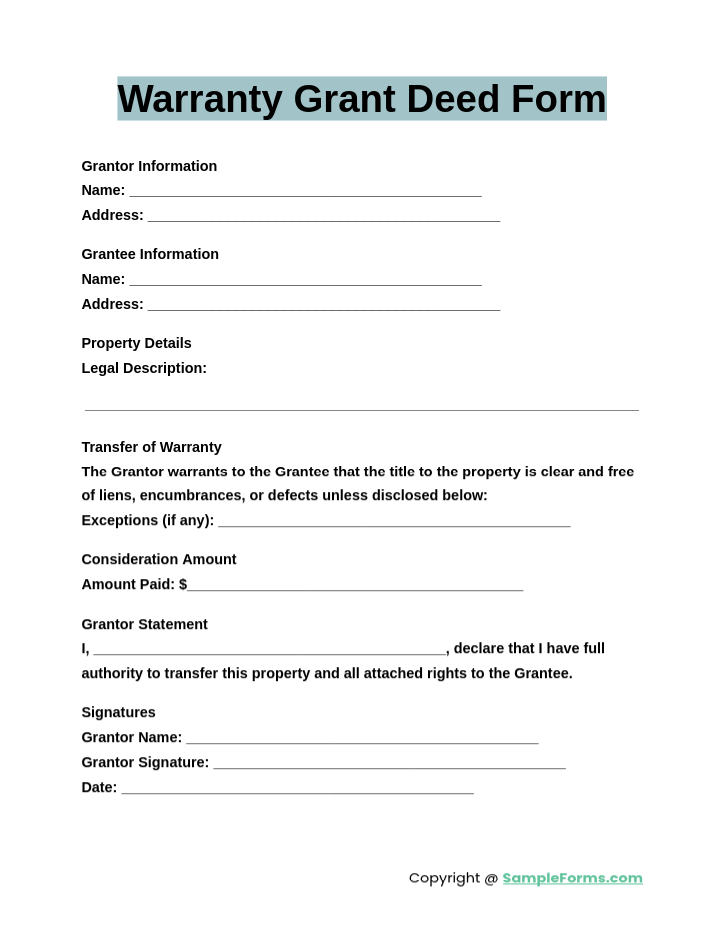

Warranty Grant Deed Form

A Warranty Grant Deed Form guarantees the title’s validity and freedom from encumbrances. Like a Warranty Deed Form, it offers the highest level of protection to buyers in property transactions.

Browse More Grant Deed Forms

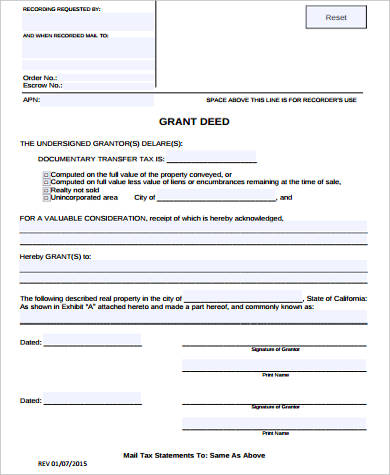

Free Grant Deed Form

Fillable Grant Deed Form

Blank Grant Deed Form

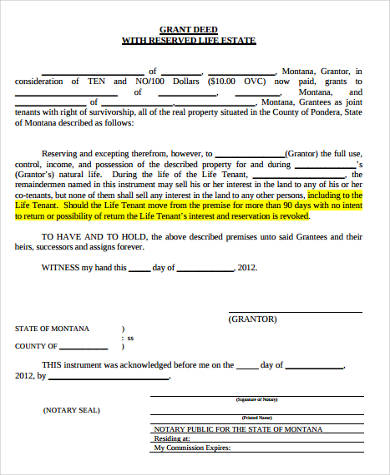

Life Estate Grant Deed Form

Property Grant Deed Form

Transfer Grant Deed Form

Grant Deed Form Example

Grant Deed Form in PDF

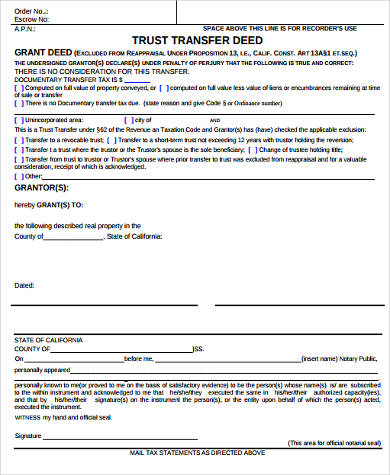

Trust Transfer Deed Form

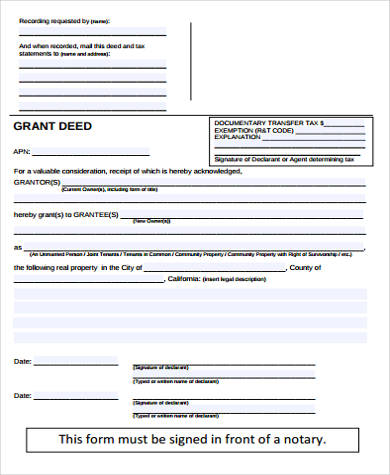

How to get a grant deed in California?

Obtaining a grant deed in California involves formal documentation and legal steps to ensure compliance, similar to creating a Deed of Trust Form for property transactions.

- Research Legal Requirements: Understand California’s grant deed regulations.

- Draft the Deed: Include property details, grantor, and grantee information.

- Notarize the Document: Ensure the grant deed is legally valid.

- Submit for Recording: File the deed at the county recorder’s office.

- Retain a Copy: Keep a certified copy for your records.

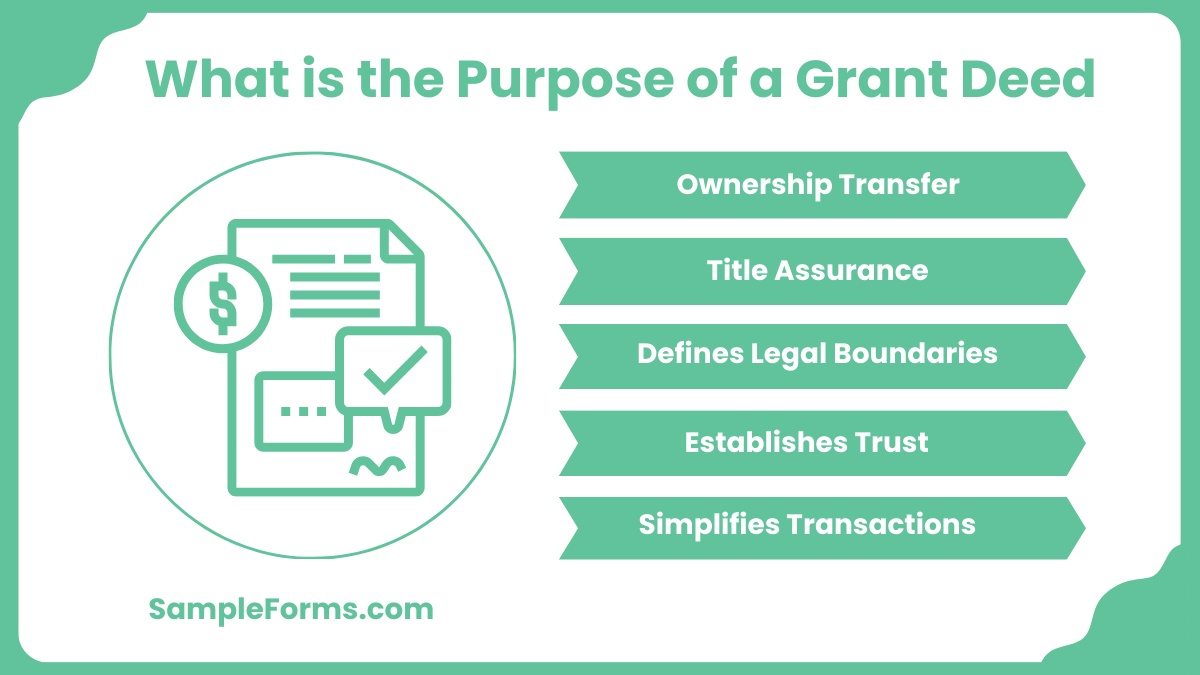

What is the purpose of a grant deed?

A grant deed transfers property ownership while guaranteeing the title is clear of encumbrances. It differs from a Real Estate Deed Form in providing limited warranties.

- Ownership Transfer: Legally conveys property to the grantee.

- Title Assurance: Ensures the title has no hidden liens.

- Defines Legal Boundaries: Clarifies property specifics.

- Establishes Trust: Builds buyer confidence in the transaction.

- Simplifies Transactions: Ensures clear documentation for ownership.

What is the agreement for grant of right of way?

This agreement allows legal use of land for specific purposes like transportation or utilities, akin to a Quitclaim Deed Form for restricted property rights.

- Define Scope: Specify the rights granted (e.g., access or construction).

- Identify Parties: Include grantor and grantee details.

- Legal Description: Clarify the land or property boundaries.

- Record the Agreement: File it with the local land registry.

- Establish Terms: Include duration, restrictions, and conditions.

Which deed grants the most protection?

A warranty deed offers the highest buyer protection, ensuring clear title transfer, unlike a Quit Deed Form, which provides minimal assurances.

- Comprehensive Title Warranties: Protects against any title defects.

- Legal Assurance: Guarantees clear ownership rights.

- Broad Coverage: Includes historical ownership issues.

- Buyer Confidence: Preferred in most real estate transactions.

- Minimizes Disputes: Reduces legal conflicts over title claims.

What are the benefits of a grant?

A grant deed offers secure property transfers with clear legal documentation, similar to a Insurance Claim Form ensuring hassle-free ownership.

- Clear Ownership Transfer: Legally conveys property.

- Ensures Trust: Provides confidence in the title’s validity.

- Supports Legal Claims: Strengthens property ownership rights.

- Reduces Disputes: Minimizes misunderstandings or legal issues.

- Simplifies Transactions: Streamlines the real estate process.

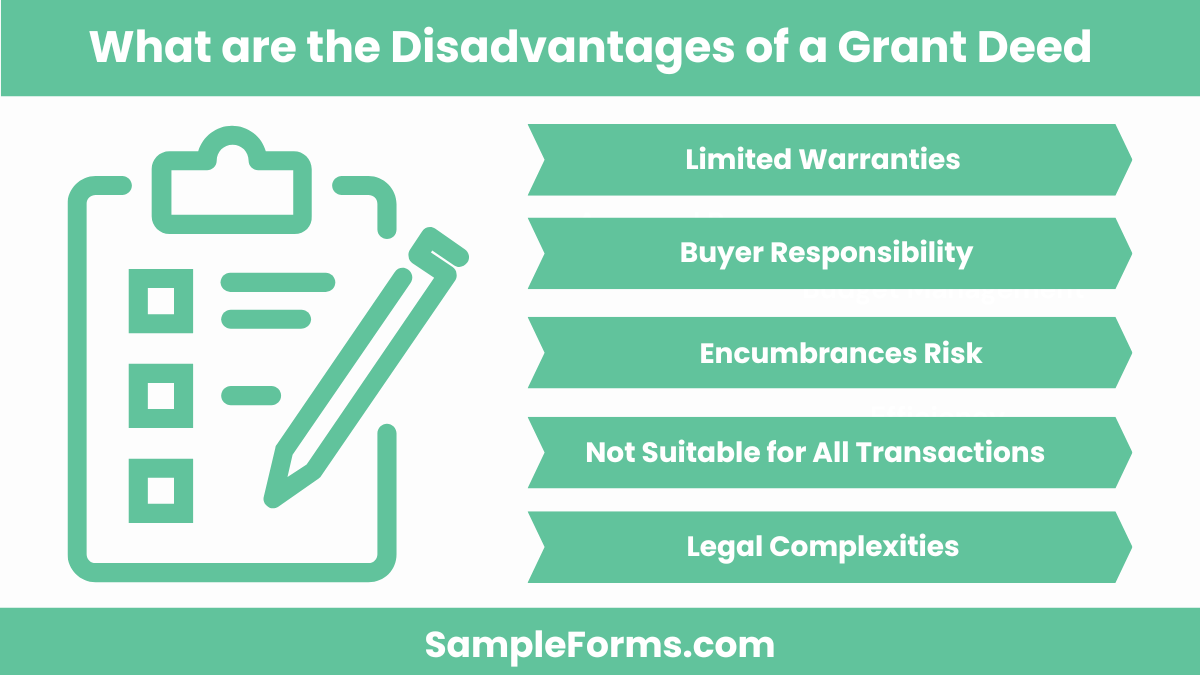

What are the disadvantages of a grant deed?

A grant deed’s limited warranties may expose buyers to risks, unlike the protections offered in a Deed Release Form for more secure transfers.

- Limited Warranties: Covers fewer title issues than other deeds.

- Buyer Responsibility: Buyers may need additional title insurance.

- Encumbrances Risk: Undisclosed liens might affect the property.

- Not Suitable for All Transactions: Inadequate for high-value sales.

- Legal Complexities: Requires professional guidance for drafting.

What type of deed is best for a house?

A Medical Claim Form is the best option for a house as it provides maximum protection, guaranteeing the title is clear and valid.

Which is better sale deed or settlement deed?

A sale deed is better for monetary transactions, while a Grant Proposal Form is ideal for documenting mutual agreements without monetary exchange.

Where should I keep my house deeds?

Store house deeds in a secure location like a bank locker or a fireproof safe, ensuring access when needed, similar to a Warranty Form.

Which deed is most commonly used to clear a title?

A Small Claim Form is most commonly used to clear a title as it quickly transfers interest without warranty.

What is the weakest type of deed?

A Statement of Claim Form is the weakest type, as it provides no guarantees or warranties about the title’s condition.

What is gift deed of property?

A gift deed transfers property ownership without monetary consideration, similar to a Grant Application Form, ensuring legal documentation of the transfer.

What is the safest kind of deed?

The Warranty Deed Form is the safest, offering comprehensive assurances against any title defects or claims.

How to get a deed to a house in California?

Obtain a deed in California through county recorder offices, ensuring it’s filed correctly, much like submitting a Contractor Warranty Form.

What makes a grant deed invalid?

A grant deed becomes invalid if it lacks essential details, signatures, or proper notarization, akin to an incomplete Warranty Claim Form Form.

What makes a grant deed valid in California?

A valid grant deed in California requires complete property details, both parties’ signatures, and proper notarization, similar to a compliant Grant Review Form.

The Grant Deed Form is indispensable for smooth property ownership transfers. It ensures a legally binding and transparent process, protecting both parties’ interests. With a structured approach, this document guarantees clear title transfer and mitigates disputes. Similar to a Claim Form, the grant deed formalizes legal rights, providing security in property dealings. Utilize this guide to understand, draft, and execute grant deeds efficiently, enhancing trust and compliance in real estate transactions.

Related Posts

Employment Application

Commission Agreement Contract Form

Employee Disciplinary Action Form

Recruitment Requisition Form

Employee Promotion Form

Exit Clearance Form

Construction Report Form

Consent Affidavit Form

360 Degree Feedback Form

Childcare Registration Form

Employee Termination Form

Employee Engagement Survey Form

DJ Contract Form

Employee Verification Form

Church Budget Form