Dive into the world of financial documentation with our all-encompassing guide on the General Journal Form. Whether you’re navigating the complexities of a Journal Review Form or streamlining your finances with a Daily Cash Log, our guide ensures clarity and ease in every step. Explore practical examples and gain insights to efficiently manage your accounting needs. Make your financial recording error-free and straightforward with our expertly crafted guide, tailored for both beginners and seasoned professionals.

Download General Journal Form Bundle

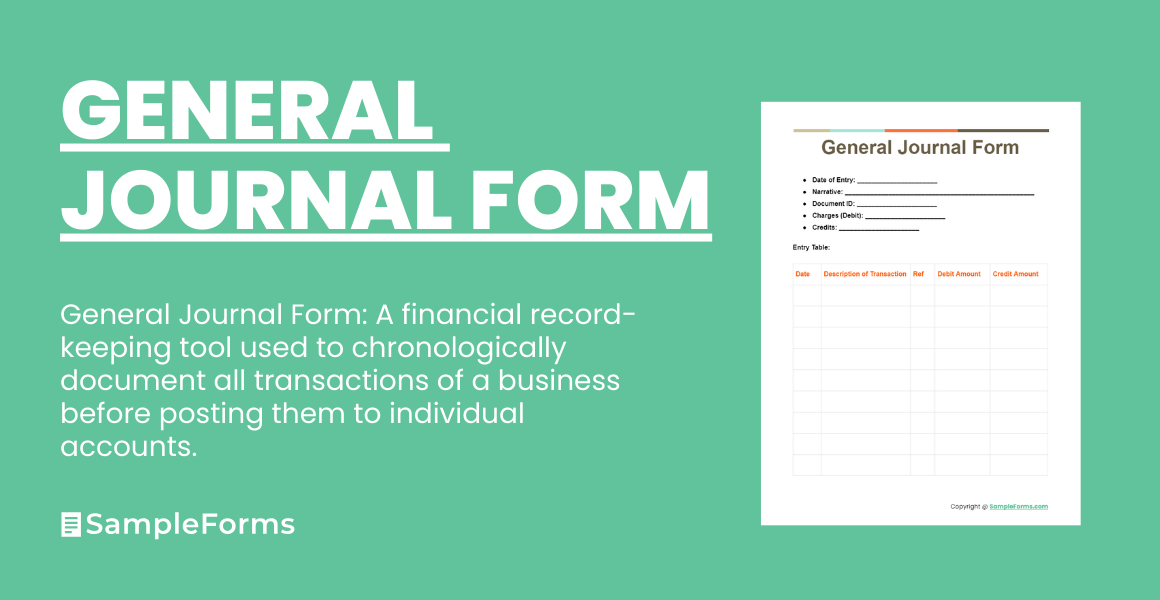

What is General Journal Form? – Meaning

A General Journal Form is a fundamental accounting tool used to record all financial transactions of a business in chronological order. This form includes details such as the date of the transaction, the accounts affected, the amounts debited and credited, and a brief description of the transaction. It serves as the primary entry point for all financial data before it’s categorized into specific accounts in the ledger. Simplifying complex financial data, the General Journal Form is essential for maintaining accurate and transparent financial records.

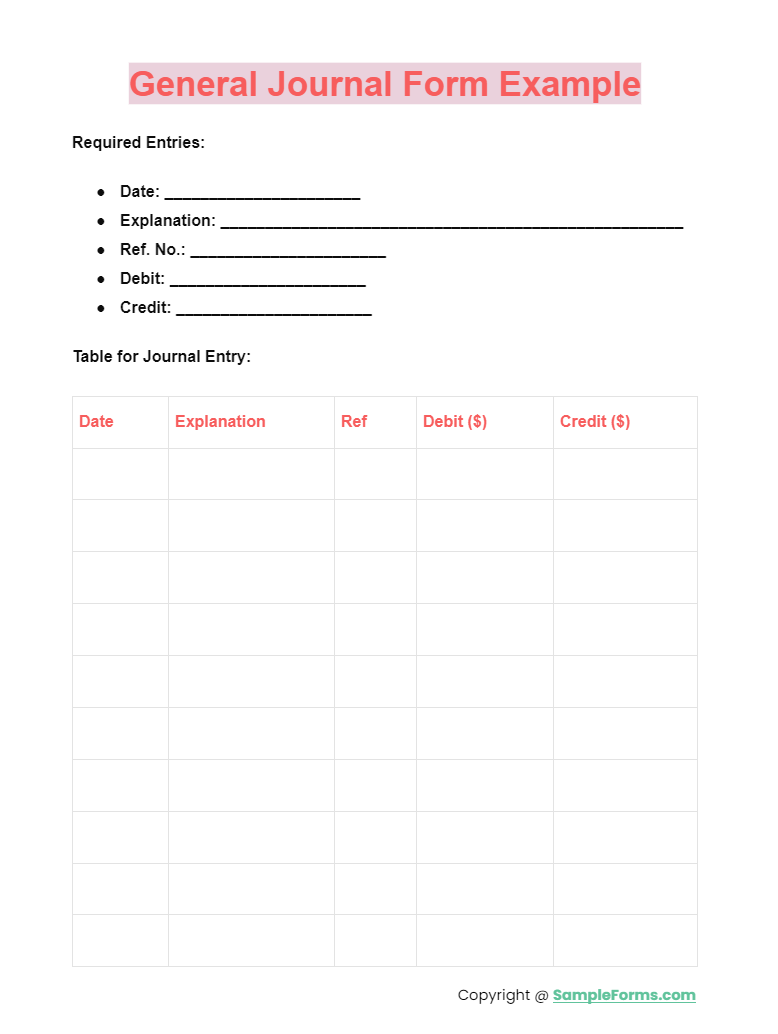

General Journal Format

Heading: General Journal

Sub-Headings:

- Date

- Record the date of the transaction.

- Account Information

- Account Title: Specify the name of the account affected.

- Account Number: Assign a unique identifier for the account.

- Transaction Details

- Debit/Credit Amounts: Indicate the amounts for the debit and credit sides.

- Narrative: Provide a brief description of the transaction purpose.

- Reference

- Note any associated document numbers or identifiers that relate to the transaction.

Conclusion

This format is designed to ensure that all necessary information is captured for each transaction, facilitating efficient and accurate financial reporting and analysis.

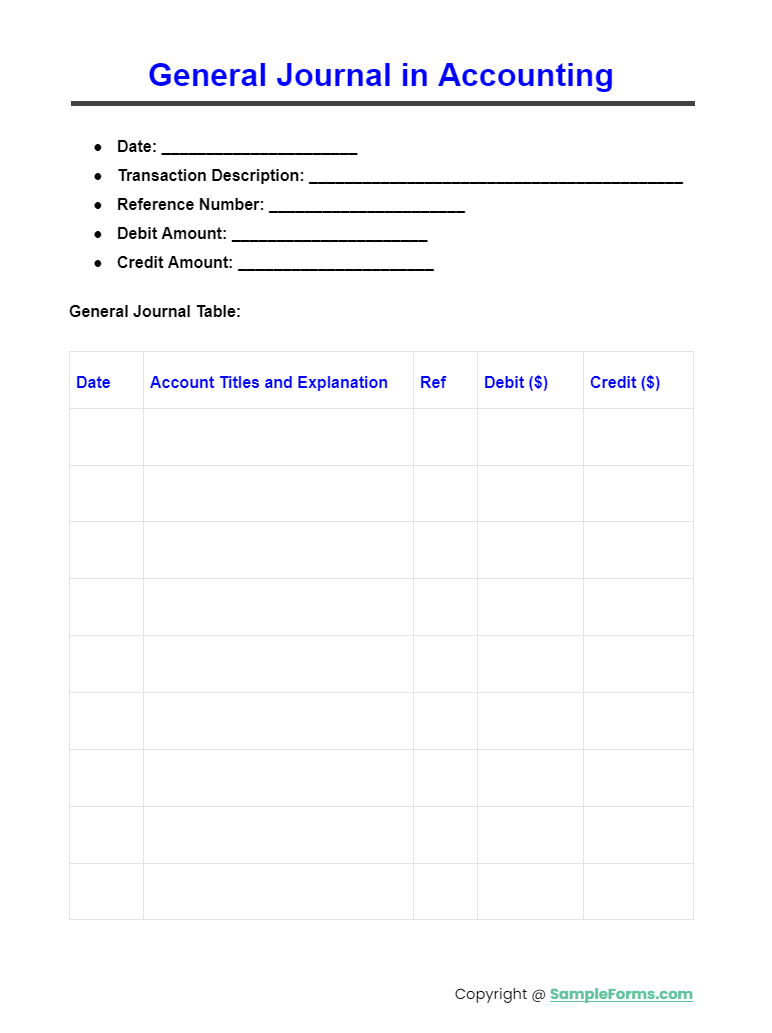

General Journal in Accounting

Discover how a General Journal in Accounting serves as the cornerstone for recording transactions, integrating seamlessly with Ledger Account Form to ensure comprehensive financial tracking and analysis.

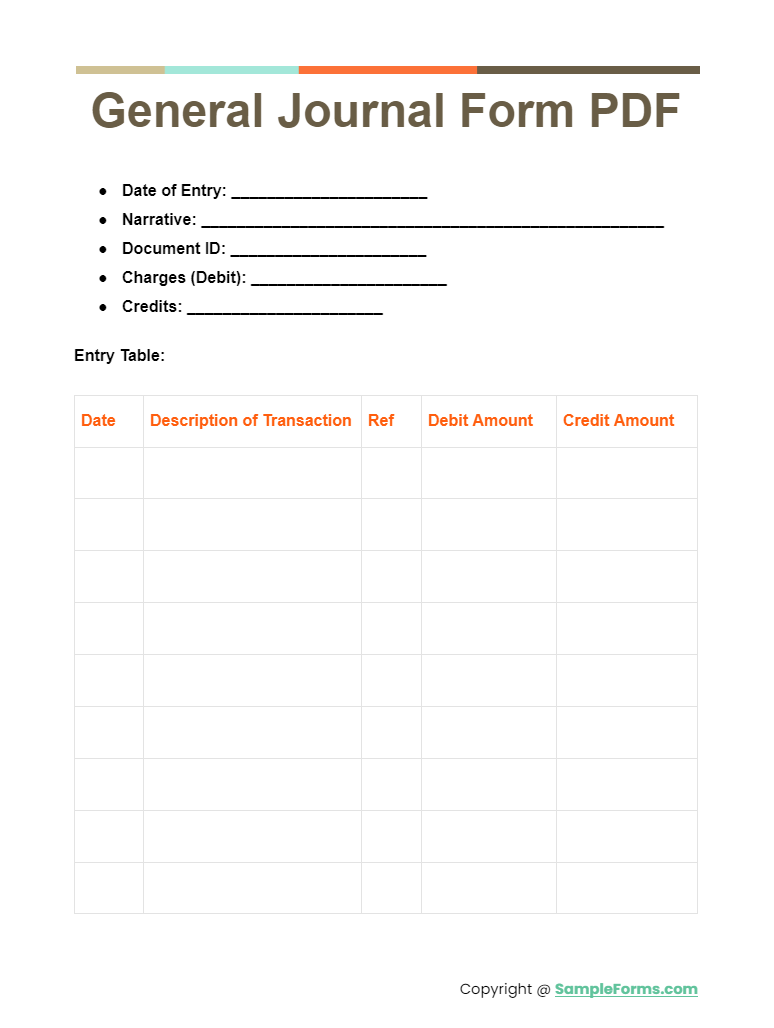

General Journal Form PDF

Leverage a General Journal Form PDF for a streamlined approach to managing your accounts, perfectly complementing your Petty Cash Log to maintain accurate and up-to-date financial records.

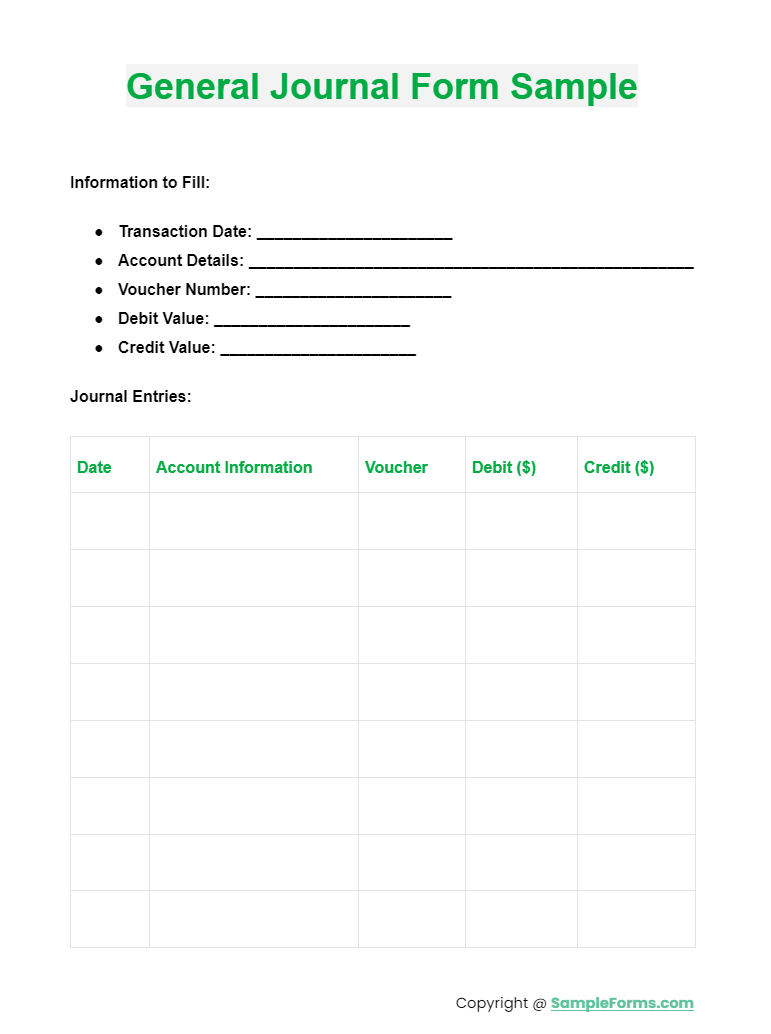

General Journal Form Sample

Explore our General Journal Form Sample to see how effectively it works alongside an Investment Trading Journal Form, providing a clear framework for documenting investments and their impact on your financial landscape.

General Journal Form Example

More General Journal Form Sample

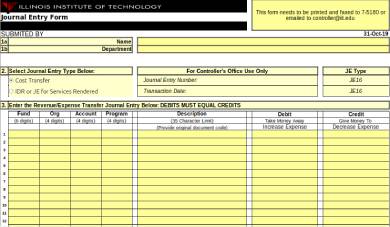

Sample General Journal Entry Template

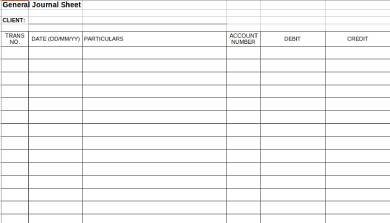

General Journal Entry Sheet Template

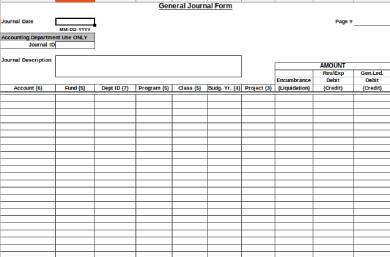

Sample General Journal Form

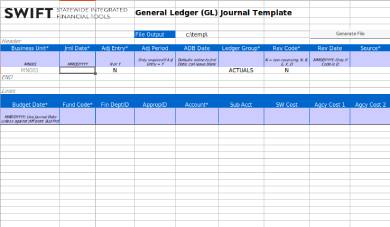

General Ledger Journal Form Template

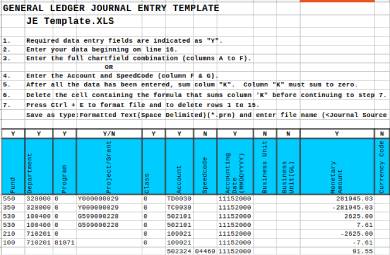

General Ledger Journal Entry Template

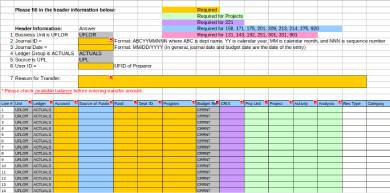

Actuals General Journal Entry Template

How do you Write a General Journal Entry?

Writing a General Journal Entry involves a systematic process to accurately document business transactions. Here are the steps:

- Date the Entry: Begin with the date of the transaction.

- Account Titles: Write the debited and credited accounts. For example, if you purchase inventory on credit, you would debit the Inventory account and credit the Accounts Payable Form.

- Amounts: Enter the amounts for the debited and credited accounts.

- Description: Provide a brief description of the transaction.

- Reference: Include an Account Code Request Form number for tracking and future reference.

What is the Purpose of a General Journal?

The Purpose of a General Journal is multifaceted:

- Record Transactions: It systematically records every financial transaction in chronological order.

- Detail Accounts: Offers detailed information about transactions that can’t be captured in specific ledgers like the Vendor Ledger.

- Trial Balance Preparation: Facilitates the preparation of a trial balance to ensure debits equal credits.

- Financial Statements: Assists in the compilation of financial statements by providing necessary transaction details.

How to do a General Journal Step by Step?

Creating a General Journal Entry Step by Step ensures accurate financial reporting:

- Identify Transactions: Determine the transaction to be recorded.

- Analyze Transactions: Understand which accounts are affected and how (debit or credit).

- Record Date and Details: Enter the transaction date, affected accounts (e.g., Sales Receipt Form), and details.

- Enter Amounts: Specify the debit and credit amounts.

- Narration: Add a brief narration for the transaction.

- Review: Double-check the entry for accuracy. You should also take a look at our Account Report Form

What are the 4 Types of General Journals?

Types of General Journals cater to different accounting needs:

- Sales Journal: Records all credit sales, linked to the Sales Agreement Form.

- Purchase Journal: Documents all credit purchases, useful for managing the Accounts Receivable Ledger Form.

- Cash Receipts Journal: Tracks all cash inflows, relevant for sales through the Sales Order Form.

- Cash Disbursements Journal: For all cash payments, integrating with an Advertising Form for expense tracking.

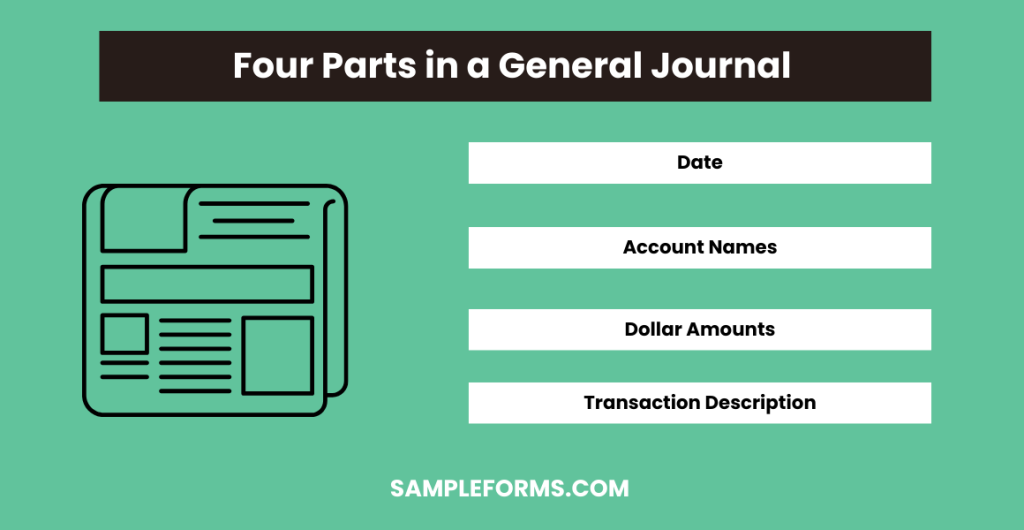

What are the Four Parts Every Entry in a General Journal?

Every Entry in a General Journal comprises:

- Date: The transaction date.

- Account Names: The names of the debited and credited accounts, such as using the Accounting Request Form.

- Dollar Amounts: The amounts for each debited and credited account.

- Transaction Description: A brief explanation, possibly referencing the Accounting Registration Form.

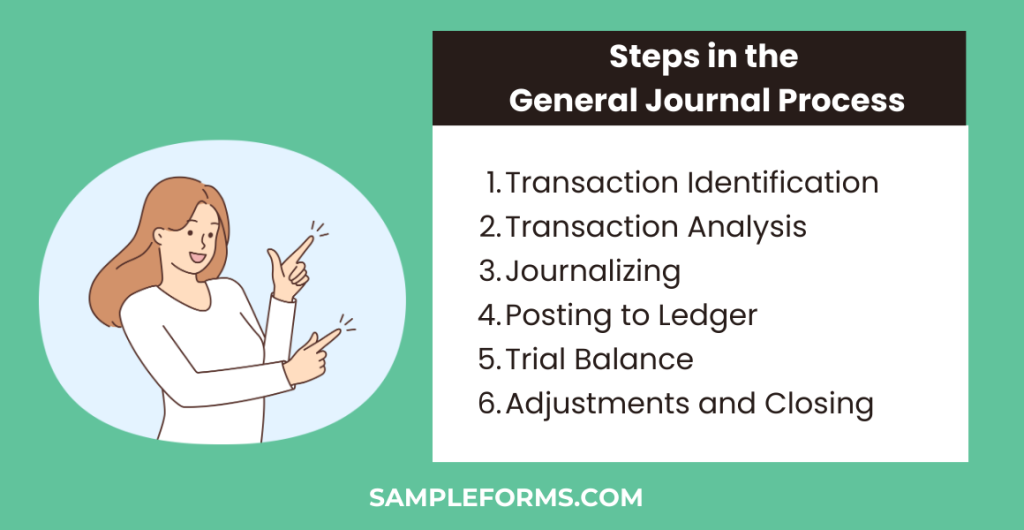

What are the 6 Steps in the General Journal?

The 6 Steps in the General Journal Process enhance accuracy:

- Transaction Identification: Recognize and clarify the transaction.

- Transaction Analysis: Determine its impact on account balances.

- Journalizing: Document the transaction in the journal.

- Posting to Ledger: Transfer journal entries to respective ledgers, like the Account Payable Form.

- Trial Balance: Summarize ending balances of all accounts to check for discrepancies.

- Adjustments and Closing: Make necessary adjustments, referencing the Request Accounting Form for adjustments and finalizing accounts.

What are the Basic Rules of Journal?

The basic rules of journalizing include recording transactions in chronological order, using double-entry accounting for each transaction, and detailing with a Credit Debit Form for accuracy and compliance.

Which is Always Recorded in the General Journal?

Transactions that don’t fit into specialized journals, such as adjustments, uncommon financial activities, and entries related to the Credit Dispute Form, are always recorded in the General Journal.

Is General Journal the Same as Journal Entry?

Yes, a General Journal encompasses journal entries, which are records of financial transactions. Each entry in the General Journal reflects the business transactions using formats like the Business Credit Check Form.

What is General Journal PDF?

A General Journal PDF is a digital format of the journal, facilitating easy recording and sharing of financial transactions, including those involving the Daily Report Form, in a secure and accessible manner.

How Long Should Journal Entries Be?

Journal entries should be concise yet comprehensive, typically not exceeding a few sentences, including relevant details such as those found in the Income and Expense Form, ensuring clarity and completeness.

What is Another Name for a General Journal?

Another name for a General Journal is the “book of original entry,” reflecting its role in initially capturing financial transactions involving various forms, like the Income Assessment Form or the Income Tax Extension Form.

Related Posts

-

Balance Sheet Form

-

Accounts Receivable Ledger Form

-

FREE 5+ Petty Cash Register Samples in Excel | PDF

-

FREE 6+ Vendor Ledger Samples in PDF

-

Credit Debit Form

-

FREE 4+ Financial Audit Forms in PDF

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

Daily Cash Log

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF