A Fund Transfer Form is essential for authorizing secure and documented money transfers. Whether you’re sending funds between accounts or to a third party, using the correct format ensures accuracy and compliance. This guide provides a detailed breakdown of different types of Transfer Form, complete with samples, tips, and best practices. From personal transactions to business-related transfers, we cover everything you need to know.

Download Fund Transfer Form Bundle

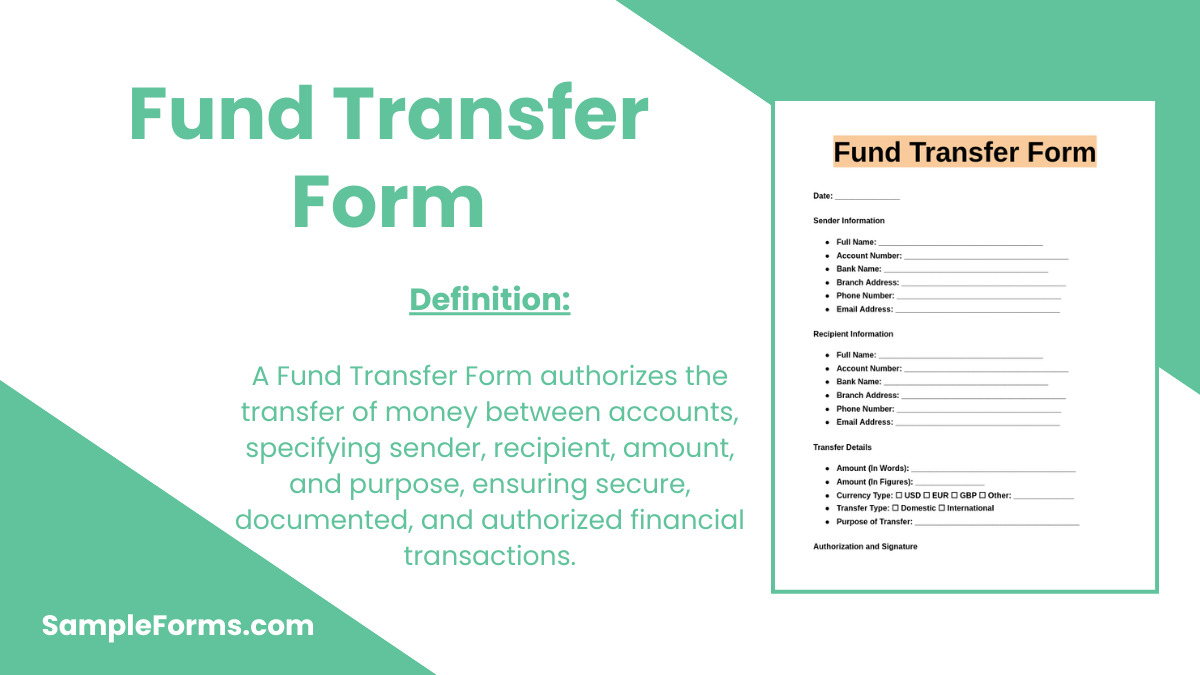

What is Fund Transfer Form?

A Transfer Form is an official document used to move money from one account to another securely. It includes details like sender and recipient information, amount, and purpose of the transfer. This form ensures accuracy in transactions and prevents errors. Whether for business payments, payroll, or personal transfers, a Transfer Form provides proof and authorization for financial institutions. By filling out the required fields correctly, users can avoid delays and complications. These forms may vary based on the institution but generally follow a standard structure to streamline the transfer process.

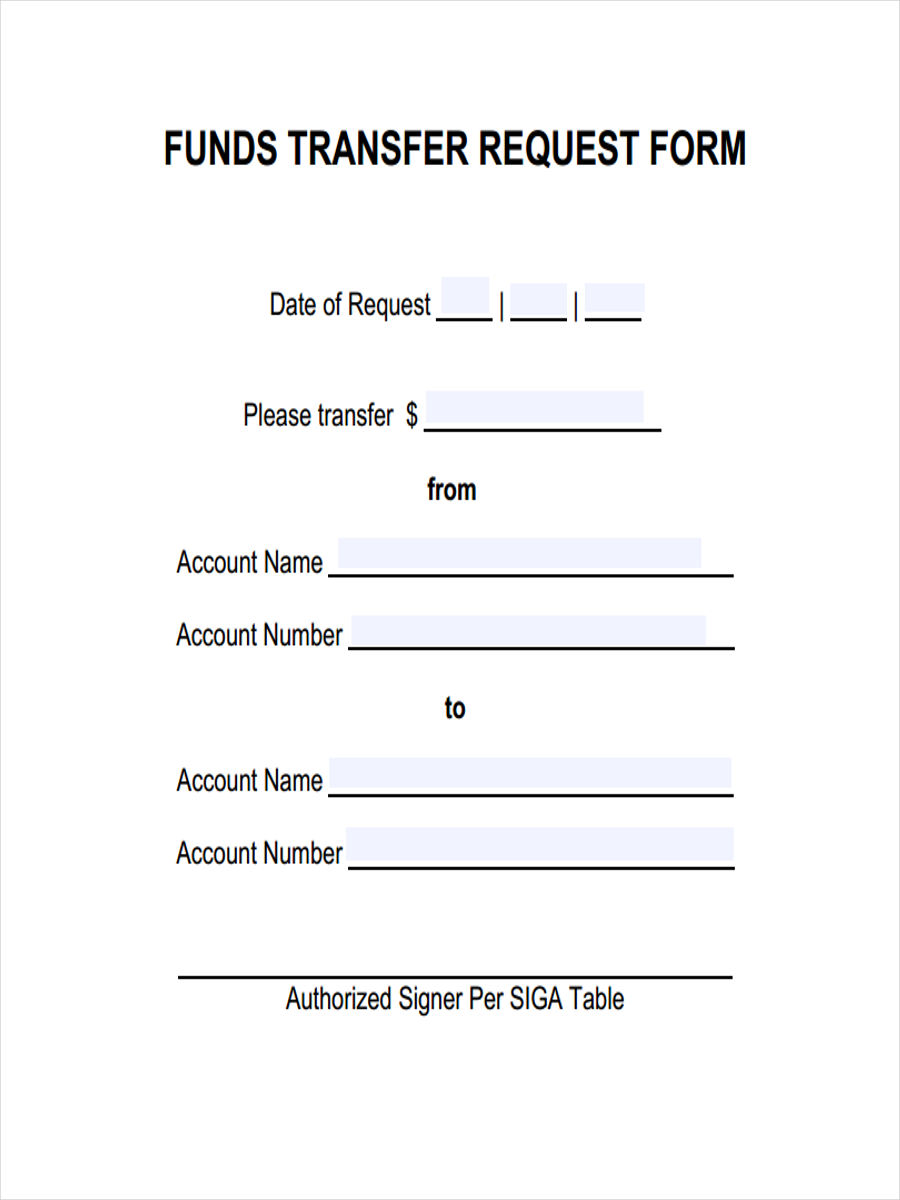

Fund Transfer Format

Transfer Details

- Date: [Insert Date]

- Transaction Reference Number: [Unique ID]

Sender Information

- Full Name: [Sender’s Full Name]

- Address: [Sender’s Address]

- Contact Number: [Phone Number]

- Email: [Email Address]

- Bank Name: [Sender’s Bank Name]

- Account Number: [Sender’s Account Number]

Recipient Information

- Full Name: [Recipient’s Full Name]

- Address: [Recipient’s Address]

- Contact Number: [Phone Number]

- Email: [Email Address]

- Bank Name: [Recipient’s Bank Name]

- Account Number: [Recipient’s Account Number]

Transfer Amount

- Currency: [Currency Type]

- Amount: [Amount to be Transferred]

- Purpose of Transfer: [Reason for Transfer]

Authorization and Declaration

- Authorized By: [Sender’s Name]

- Signature: [Sender’s Signature]

- Date: [Date of Authorization]

- Bank Representative Name: [Representative’s Name]

- Signature: [Representative’s Signature]

- Approval Date: [Date of Approval]

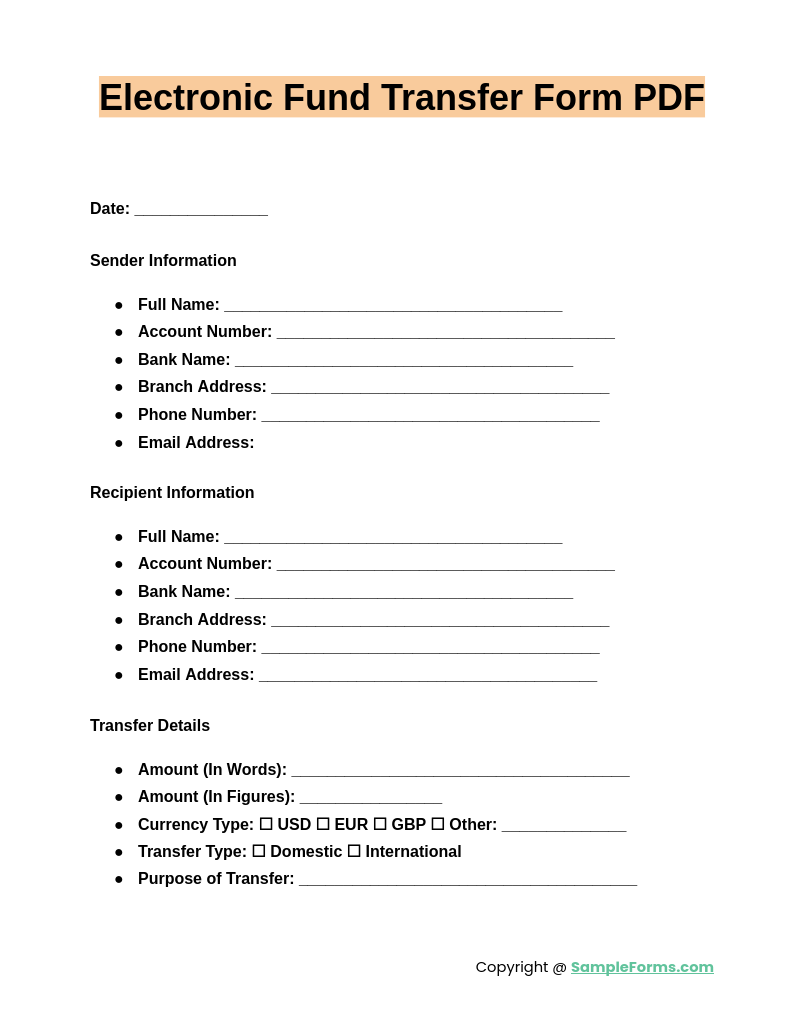

Electronic Fund Transfer Form PDF

An Electronic Fund Transfer Form PDF is essential for processing digital transactions securely. Similar to a Wire Transfer Form, it includes sender and recipient details, amount, and authorization, ensuring accurate and legally compliant money transfers through online banking systems.

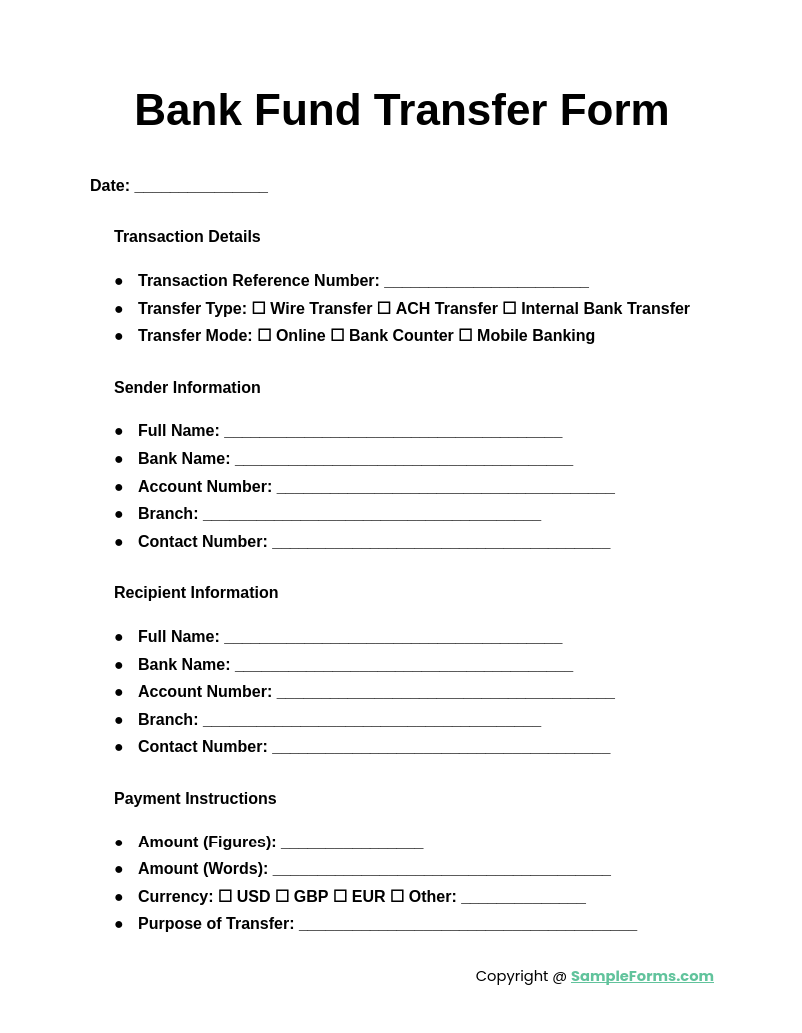

Bank Fund Transfer Form

A Bank Fund Transfer Form facilitates seamless money transfers between bank accounts. Like a School Transfer Form, it requires accurate information, including account details and purpose, to ensure smooth financial transactions while maintaining security and compliance with banking regulations.

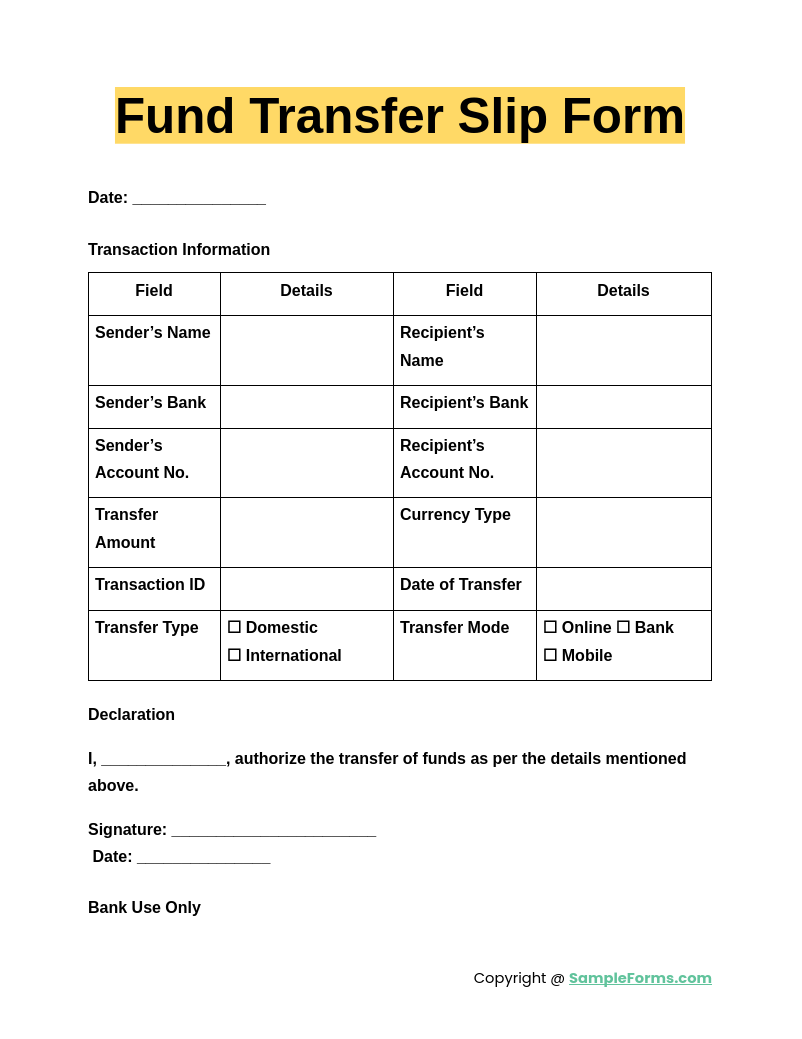

Fund Transfer Slip Form

A Fund Transfer Slip Form is a physical document used for manual money transfers. Similar to a Vehicle Transfer Form, it records transaction details, ensuring accurate fund movement and verification within banking institutions for safe and traceable transfers.

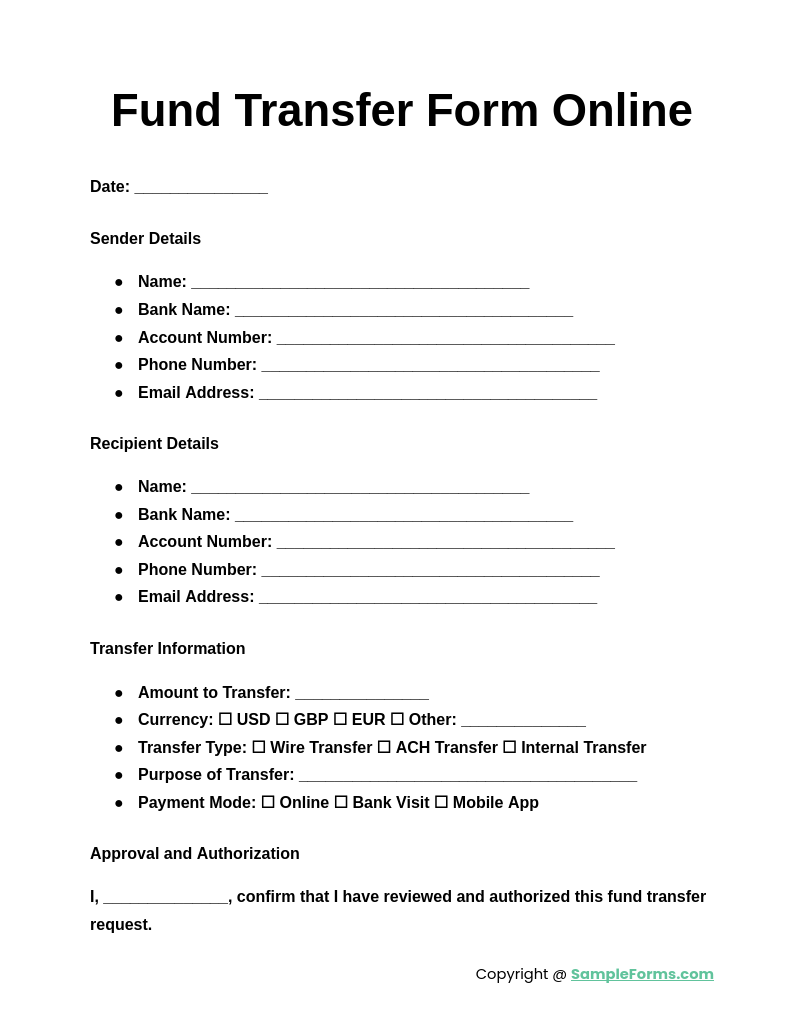

Fund Transfer Form Online

A Fund Transfer Form Online allows quick, paperless transactions via digital platforms. Like a Deed Transfer Form, it requires proper authorization and verification, ensuring funds are securely transferred while complying with online banking protocols and financial regulations.

Browse More Fund Transfer Forms

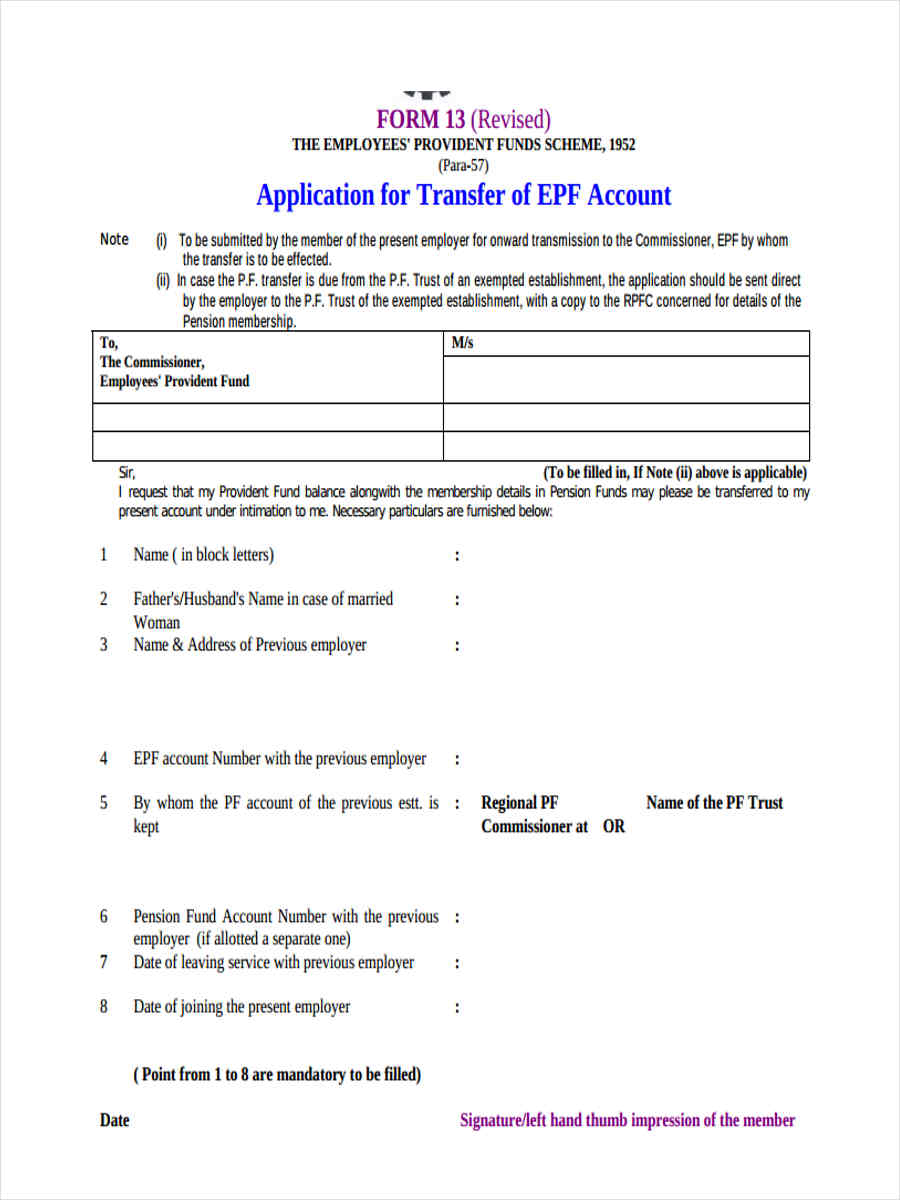

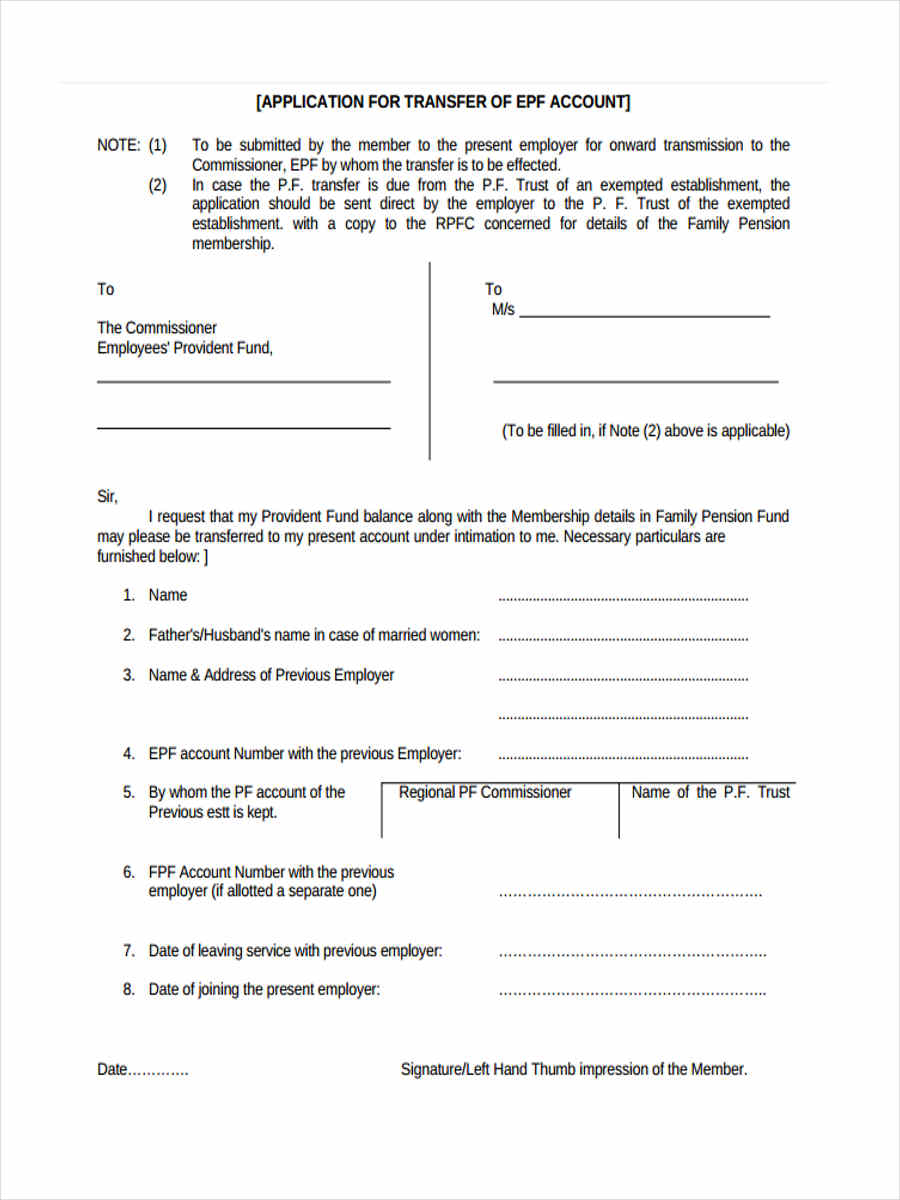

Provident Fund Transfer

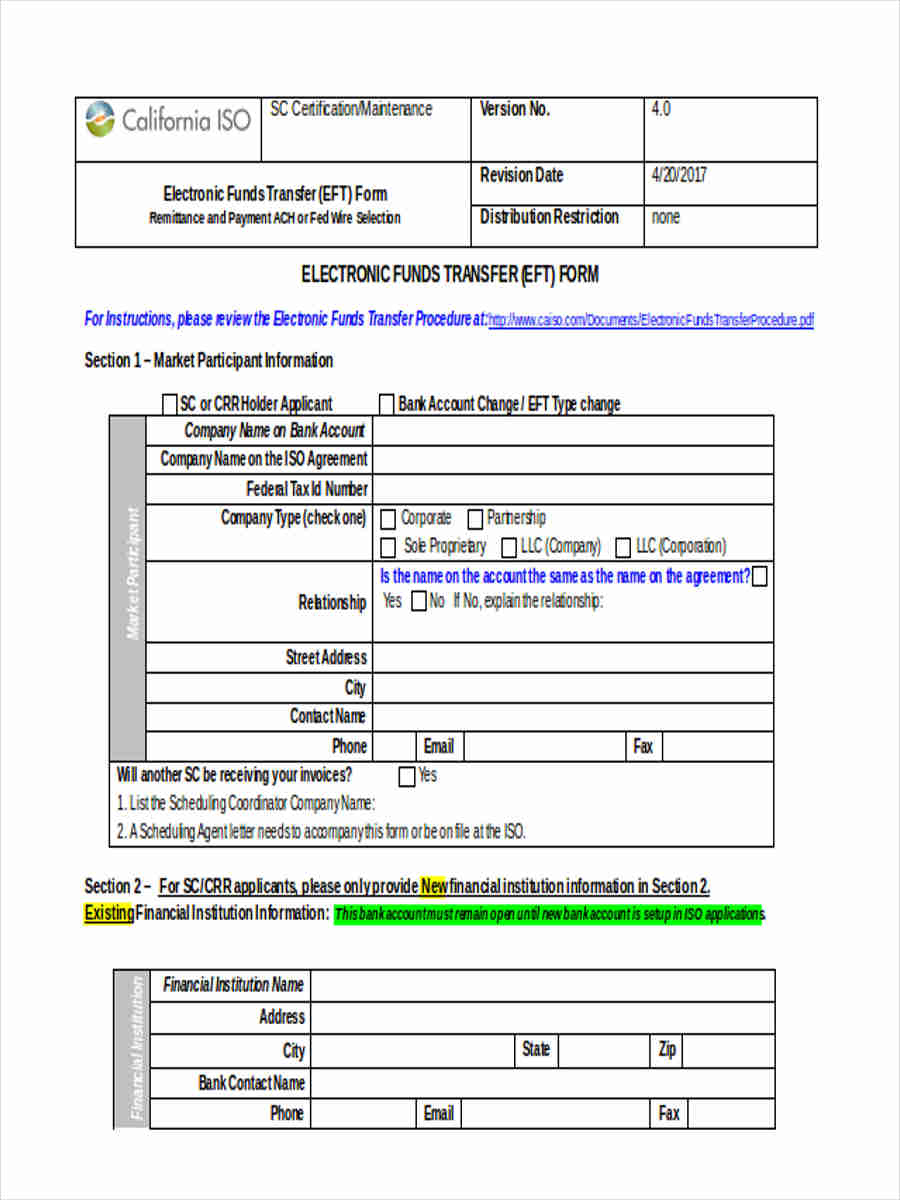

Electronic Fund

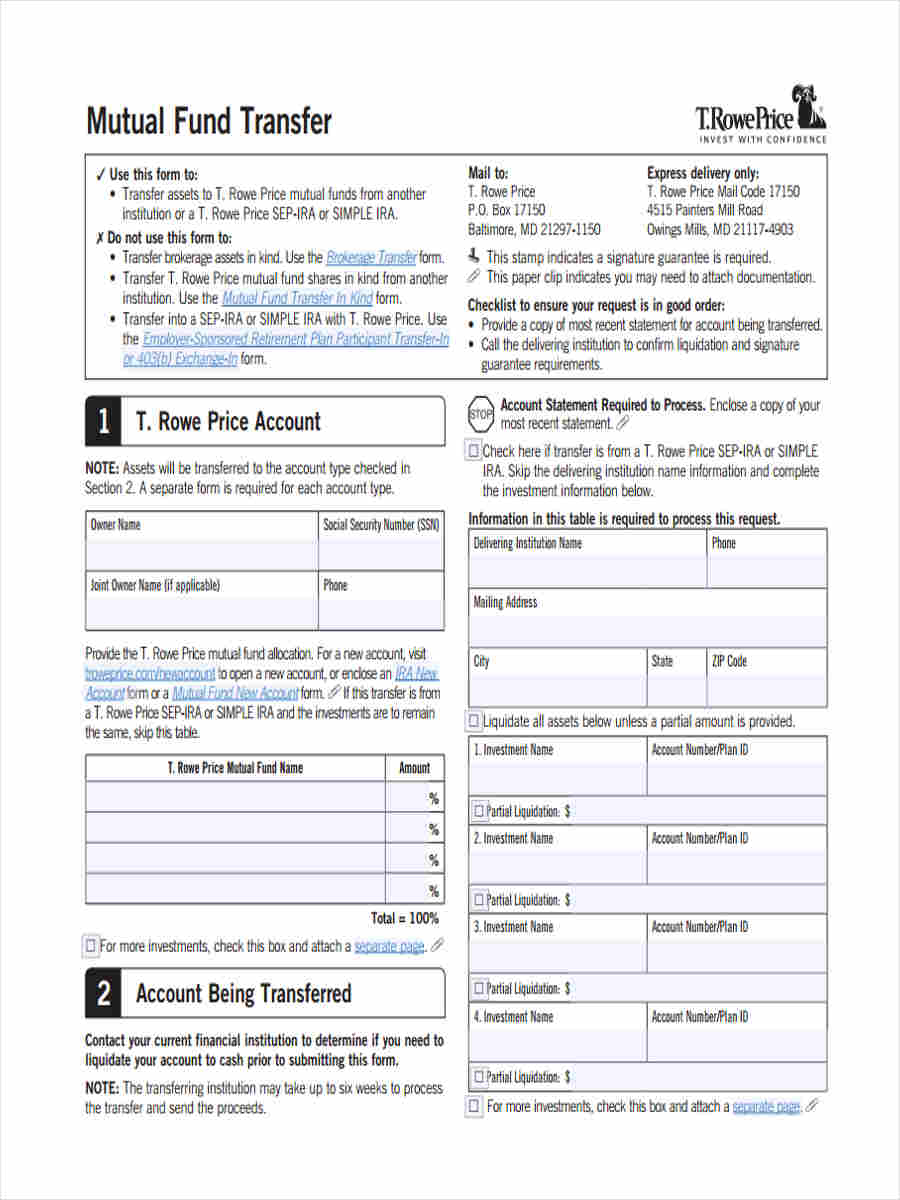

Mutual Fund Transfer

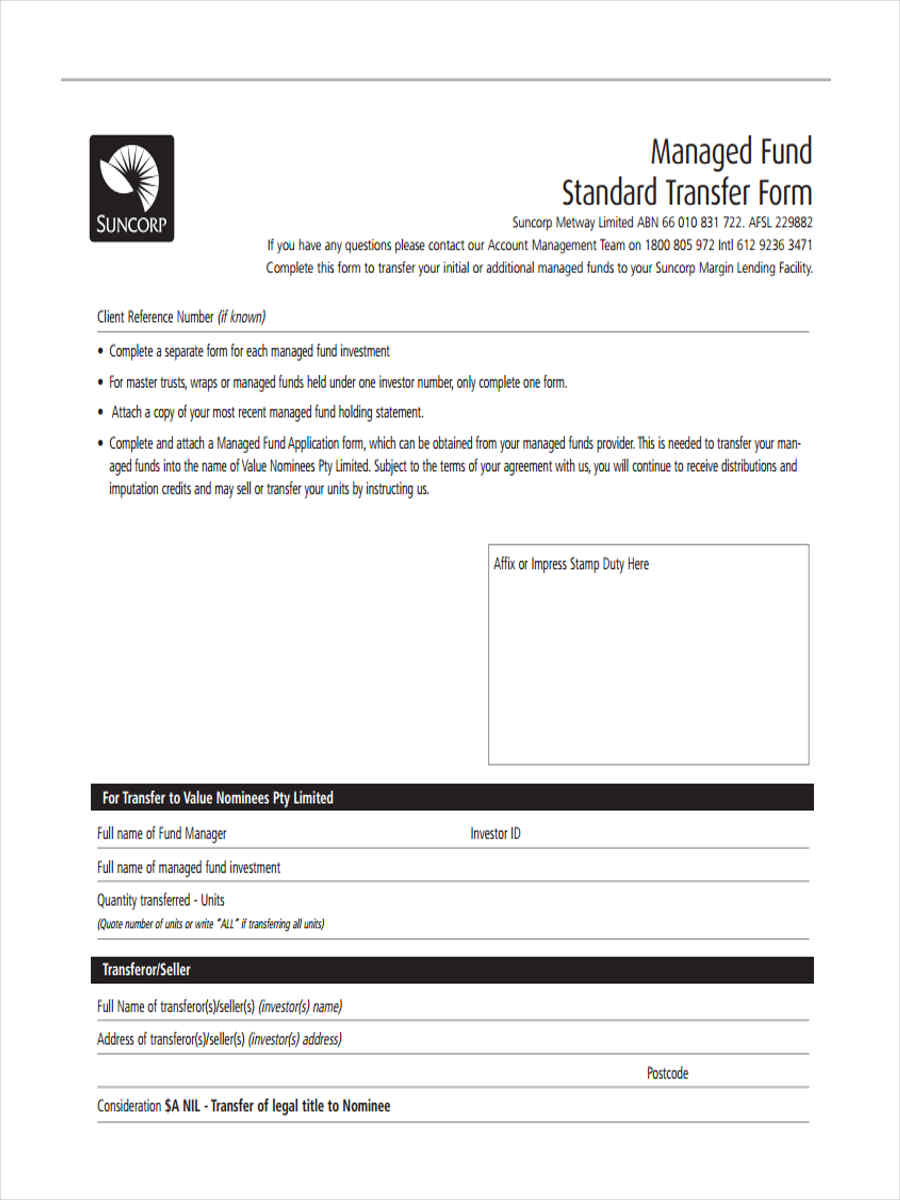

Managed Fund Form

Pension Fund

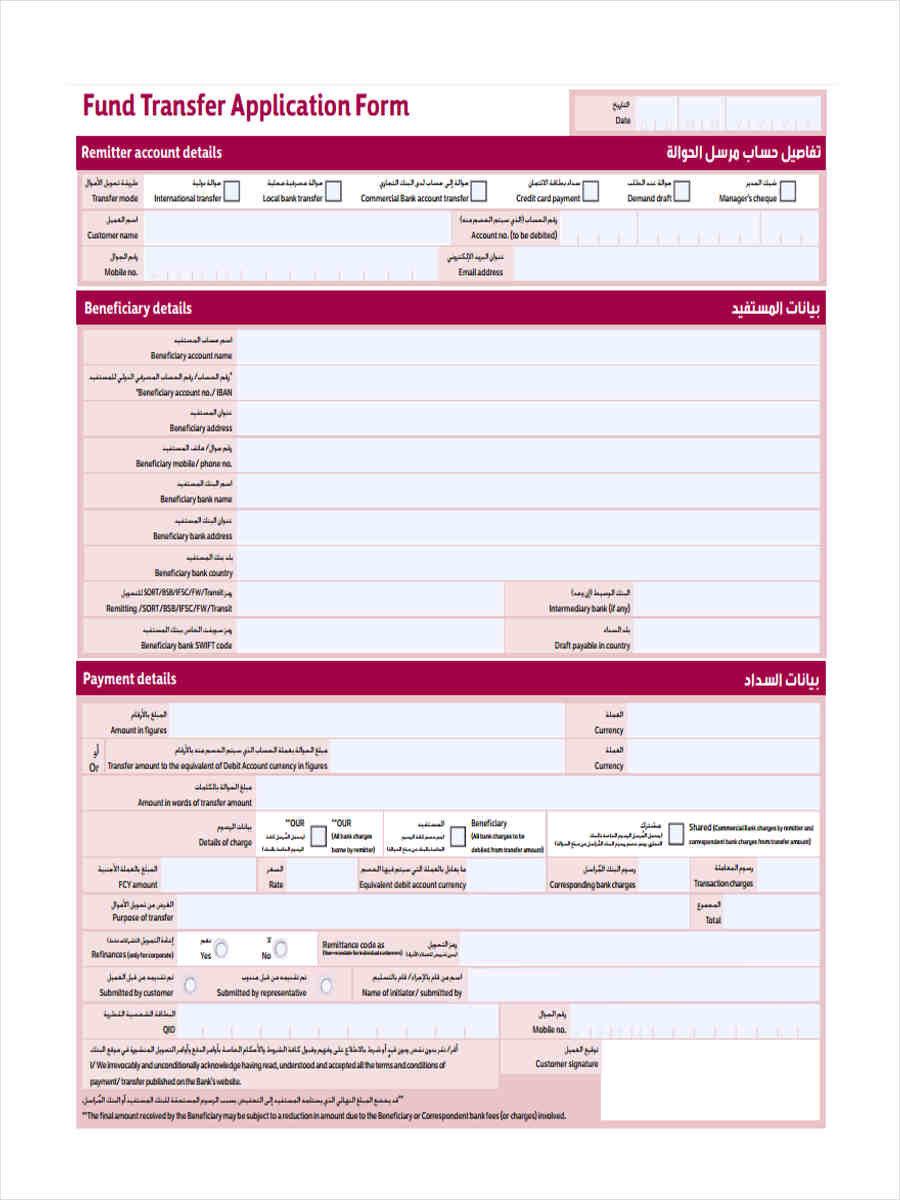

Fund Transfer Application

Fund Transfer Request

Electronic Fund Transfer Form

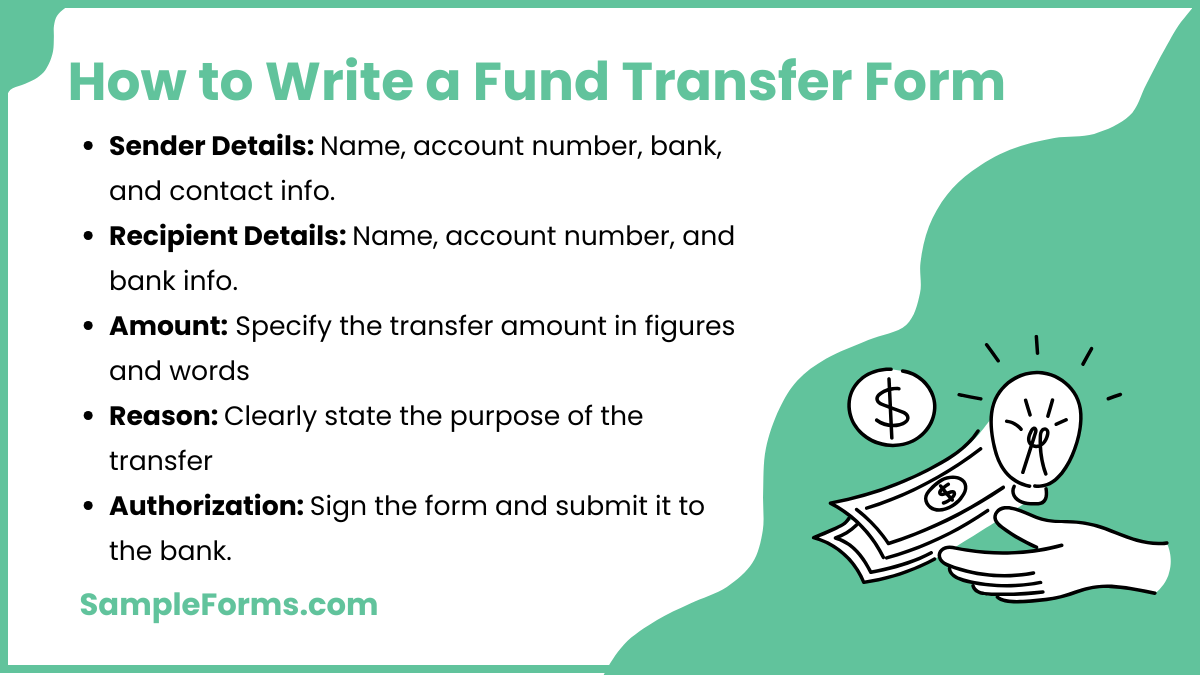

How to write a fund transfer form?

A Fund Transfer Form must be accurately drafted to ensure a smooth transaction. It should include essential details and authorization steps.

- Personal and Bank Details: Provide the sender’s full name, account number, bank name, and contact details to authenticate the transfer.

- Recipient’s Information: Include the recipient’s full name, account number, and bank details, similar to a Registration Transfer Form, ensuring accuracy.

- Amount and Currency: Specify the transfer amount in figures and words, along with the correct currency to avoid processing errors.

- Reason for Transfer: Clearly state the purpose of the transfer, whether for business payments, personal transactions, or bill settlements.

- Authorization and Signatures: Sign the form and submit it to the bank, ensuring compliance with financial regulations and bank policies.

How do I transfer money to someone else’s bank account?

Transferring money to another person’s bank account requires following standard banking procedures to ensure security and efficiency.

- Choose a Transfer Method: Select between online banking, mobile apps, or filling out a Land Transfer Form for bank-based transfers.

- Gather Recipient’s Details: Ensure you have the recipient’s bank name, account number, and routing number for a successful transaction.

- Initiate the Transfer: Log in to your bank account, select “Fund Transfer,” and enter the recipient’s details along with the transfer amount.

- Confirm Transaction: Double-check all information before confirming to avoid errors that could delay the transfer.

- Receive Confirmation: Banks provide a confirmation receipt or email, ensuring proof of transaction completion for future reference.

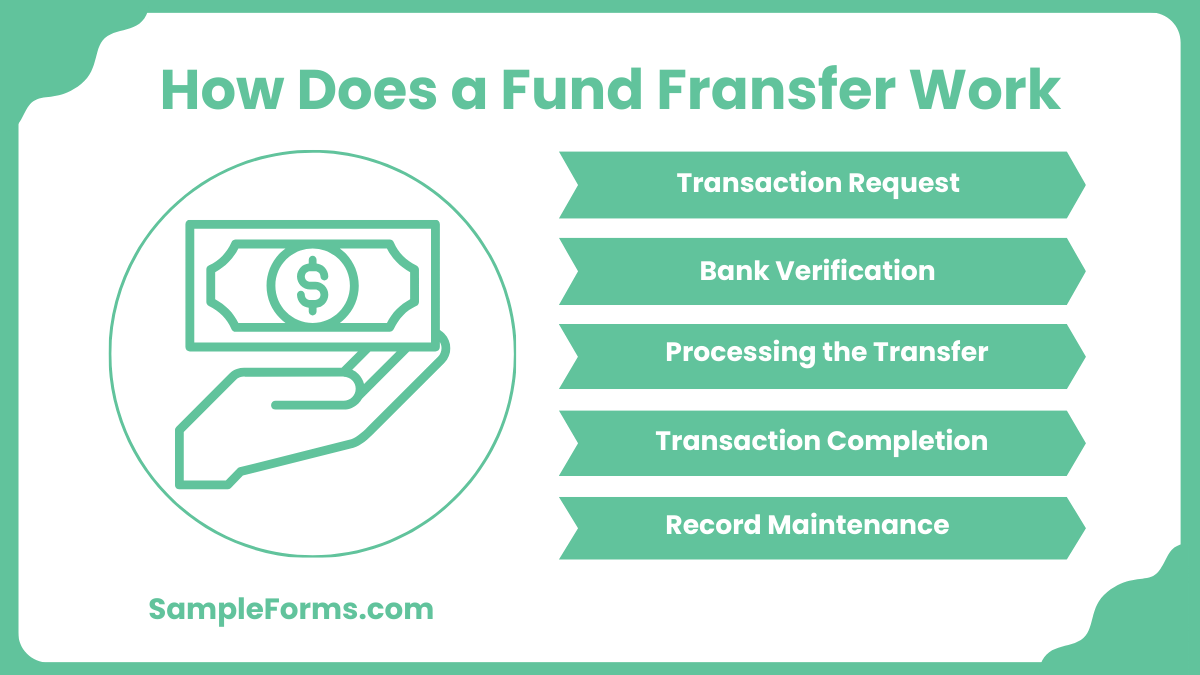

How does a fund transfer work?

A Fund Transfer Form facilitates secure money movement between accounts through banking systems, ensuring accuracy and compliance.

- Transaction Request: A sender initiates the transfer by filling out a form, similar to a Student Transfer Form, providing all necessary details.

- Bank Verification: The bank verifies the sender’s account, recipient’s details, and transaction amount to prevent fraud.

- Processing the Transfer: Depending on the method used, the bank either processes it instantly or schedules it for clearance.

- Transaction Completion: The recipient’s account is credited, and the sender receives a confirmation of a successful transfer.

- Record Maintenance: Banks and users keep transaction records to track payments and resolve disputes if needed.

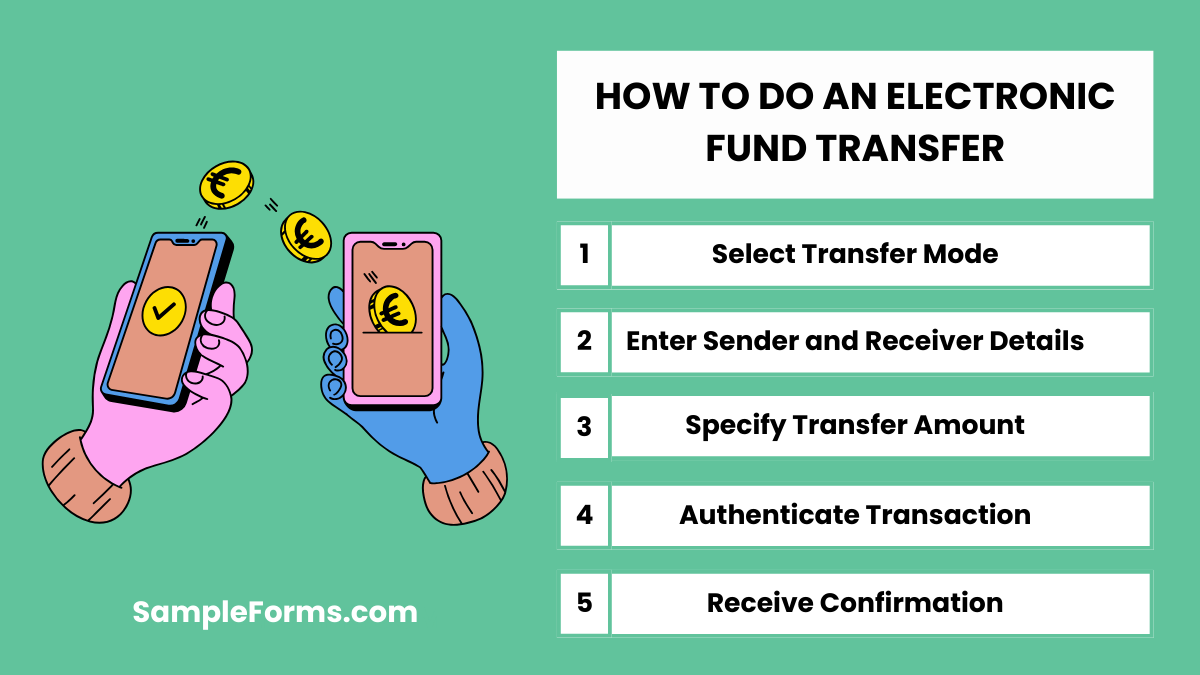

How to do an electronic fund transfer?

Electronic fund transfers (EFTs) provide a fast and secure way to move money between accounts without physical paperwork.

- Select Transfer Mode: Use online banking, mobile apps, or a Material Transfer Form to initiate the electronic fund transfer process.

- Enter Sender and Receiver Details: Provide names, account numbers, and bank details to ensure a secure and correct transaction.

- Specify Transfer Amount: Clearly input the amount and currency, ensuring accuracy before proceeding to the next step.

- Authenticate Transaction: Use passwords, OTPs, or biometric authentication to verify and authorize the transfer.

- Receive Confirmation: A receipt or SMS confirms the transfer, helping both sender and receiver track the transaction.

How to fill out a fund transfer form?

Completing a Fund Transfer Form correctly ensures the bank processes the transaction without delays or errors.

- Fill in Sender Information: Include your full name, account number, and bank details, similar to an Employee Transfer Form, to identify the sender.

- Enter Recipient’s Details: Provide accurate information about the recipient, including bank name and account number, to avoid transaction failure.

- Specify Transfer Amount: Write the amount both in numbers and words to prevent discrepancies in processing.

- Mention Purpose of Transfer: Clearly state the reason for transferring funds to ensure transparency and compliance.

- Sign and Submit the Form: Attach necessary documents if required, sign the form, and submit it to the bank for processing.

Who fills out a stock transfer form?

A Stock Transfer Form is typically completed by the seller or transferor of shares. Similar to an Inventory Transfer Form, it includes details of the buyer, seller, and stock being transferred to ensure legal ownership change.

Is electronic funds transfer safe?

Yes, electronic funds transfers are safe when using secure banking channels. Like an Asset Transfer Form, they require proper verification, encryption, and authentication to prevent fraud, ensuring secure transactions between financial institutions.

What is the safest way to transfer money?

Bank-to-bank transfers with strong encryption offer the safest method. Similar to a Gun Transfer Form, ensuring verified identities, using trusted institutions, and enabling transaction tracking enhances security in financial transfers.

Can a bank account be transferred to another person?

A bank account itself cannot be transferred, but funds can be moved. Like a Title Transfer Form, changing ownership requires closing an account and opening a new one under the recipient’s name.

What is the document for transferring money?

A Fund Transfer Form is the primary document for sending money. Similar to a Motor Vehicle Transfer Form, it records sender and recipient details, ensuring legal compliance and proper tracking of financial transactions.

What is the funds transfer rule?

Fund transfer rules mandate proper authorization, fraud prevention, and legal compliance. Like a Gun Owners Transfer Form, these regulations ensure money transfers are processed securely while meeting banking and legal requirements.

Can someone take your money through e transfer?

Unauthorized transfers are rare but possible with compromised credentials. Like an Ownership Transfer Form, strong security, two-factor authentication, and fraud monitoring help prevent unauthorized access to your funds.

How do I send proof of funds?

Proof of funds can be sent through a bank statement or letter. Similar to a Medical Records Transfer Form, it must include official documentation verifying account balance, ownership, and availability of funds.

What is proof of bank transfer called?

A proof of bank transfer is known as a transaction receipt. Like a Property Transfer Form, it serves as documented evidence of a completed transaction, including reference numbers, dates, and recipient details.

What is the most secure payment transfer?

Wire transfers and bank drafts are the most secure. Similar to an Insurance Transfer Form, they involve strict verification, encrypted processing, and official banking channels to minimize fraud risks in financial transactions.

a Fund Transfer Form helps prevent delays and issues. Our guide covers various templates, letters, and samples to make the process seamless. Whether you’re handling a Budget Transfer Form or processing a routine payment, using the right document is key to smooth financial operations.

Related Posts

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 6+ Sample Residence Questionnaire Forms in PDF

-

FREE 7+ Inventory Transfer Forms in MS Word | PDF | Excel

-

FREE 7+ Ownership Transfer Forms in PDF

-

FREE 9+ Asset Transfer Forms in PDF | Ms Word | Excel

-

FREE 10+ Transfer Form Samples in PDF | MS Word | Excel

-

FREE 8+ Sample Transfer Verification Forms in PDF | MS Word

-

FREE 7+ Sample Assets Transfer Forms in MS Excel | PDF

-

FREE 8+ Deed Transfer Form Samples in PDF | MS Word

-

Transfer of Ownership Form

-

FREE 9+ Sample Firearm Transfer Forms in PDF | MS Word

-

Gun Ownership Transfer Form

-

FREE 9+ Sample Title Transfer Forms in PDF | Word

-

School Transfer Form

-

Deed Transfer Form