Expense Management is the process or the system that is utilized by a business in order to process, pay, and to conduct procedural accounting inspections on costs or expenses that were initiated by employees such as the costs incurred for travel, work, and entertainment.

Policies and procedures need to be established by a company to ensure that a company’s cash flow is well-accounted for. Expense Management typically goes through two vital aspects: The procedures that are conducted by an employee to file an expense claim and the processes conducted by accounting staff in order to process the claims made.

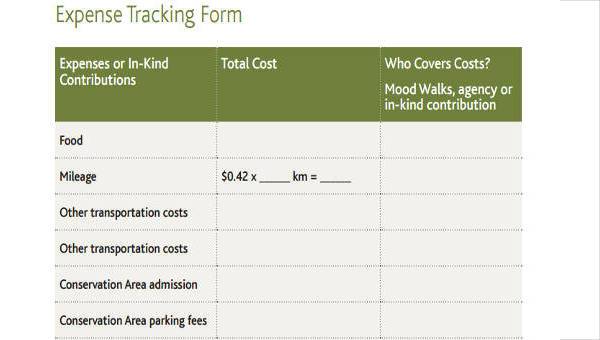

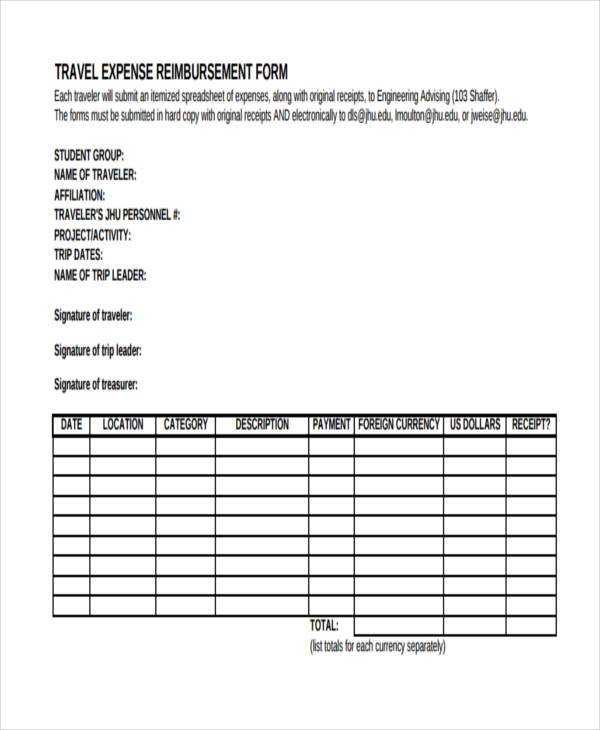

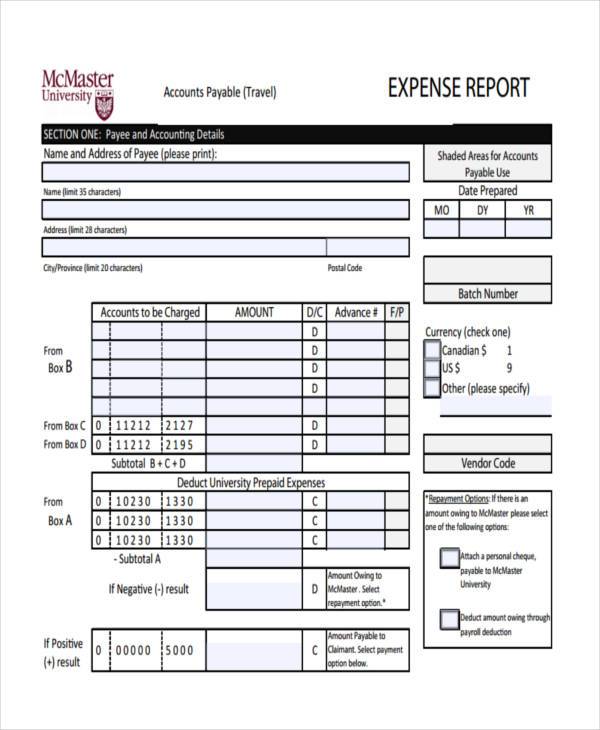

Free Travel Expense Forms

Free Travel Expense Reimbursement Form

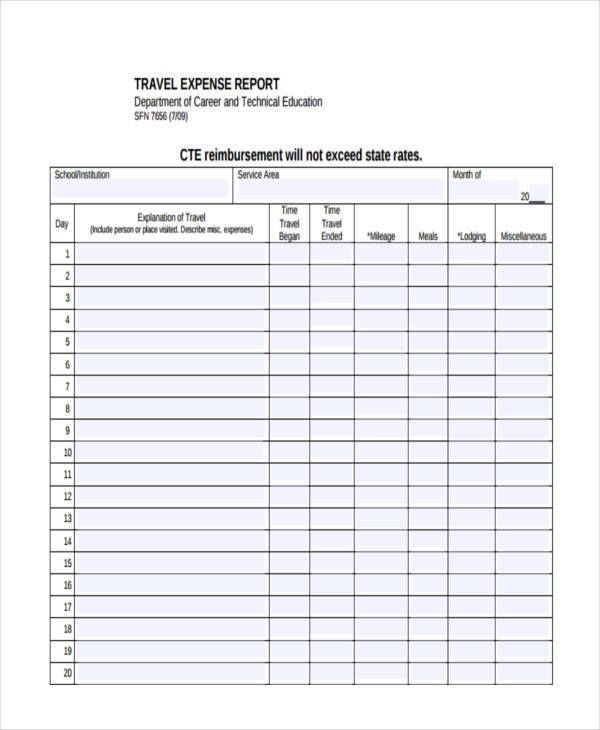

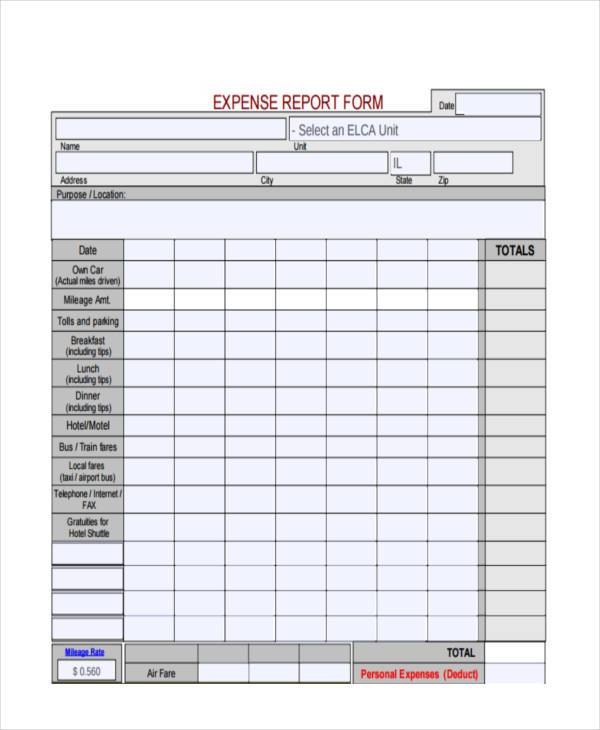

Free Travel Expense Report Form

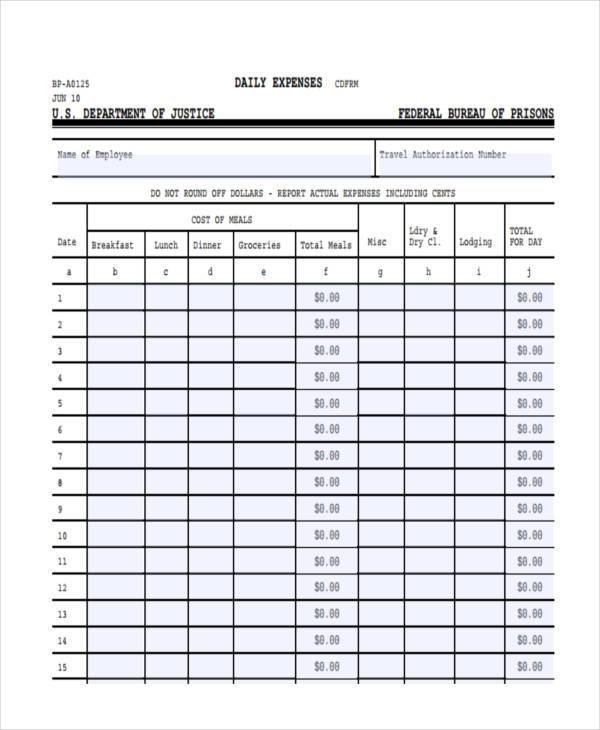

Free Printable Expense Forms

Free Printable Daily Expenses Form

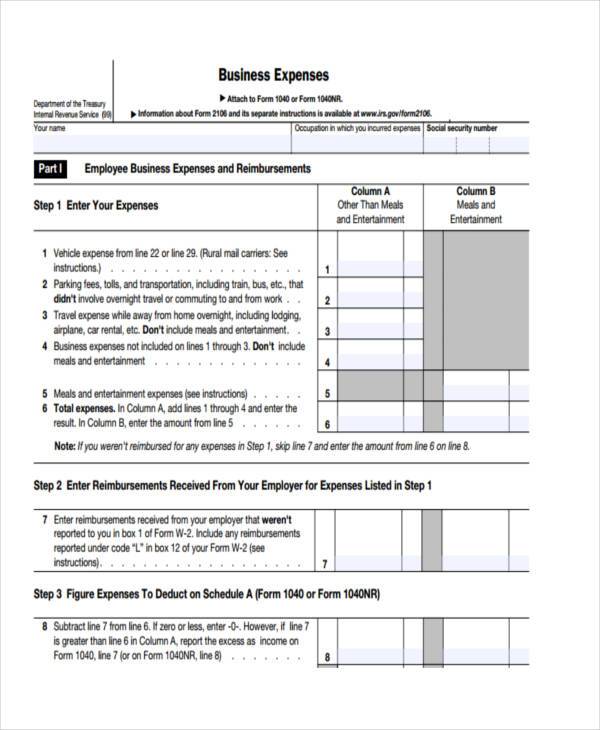

Free Printable Business Expense Form

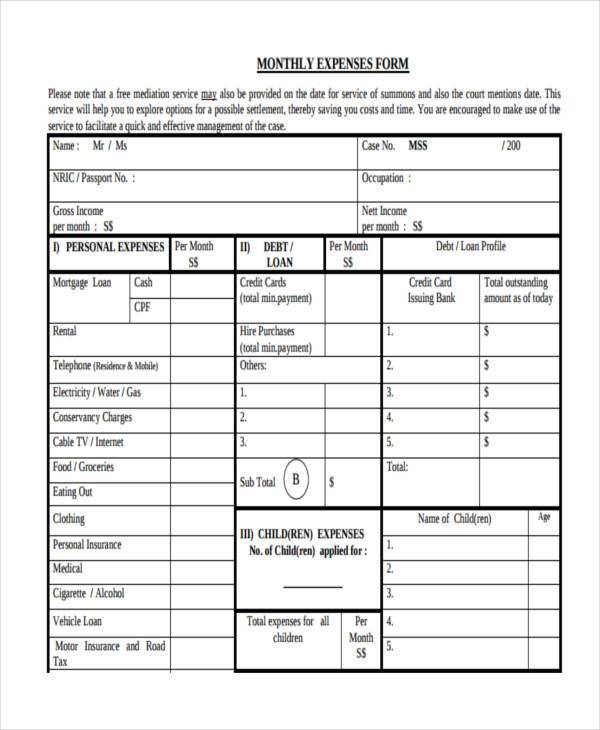

Free Printable Monthly Expenses Form

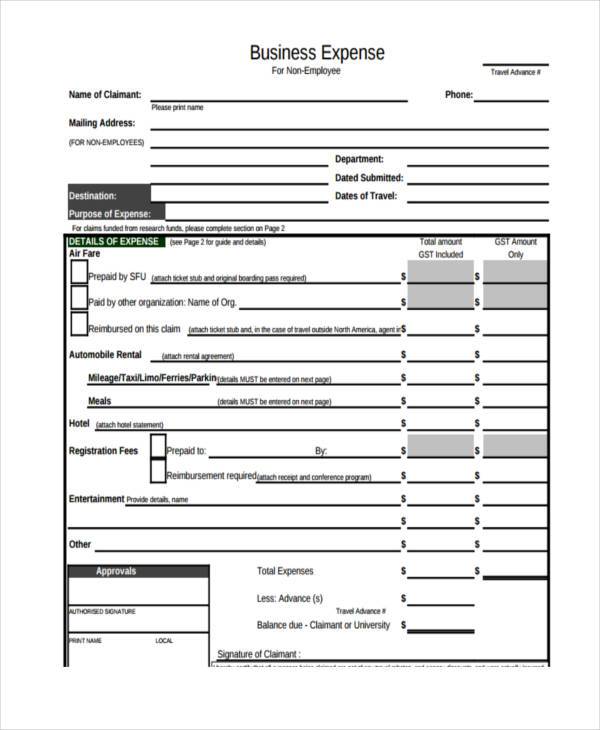

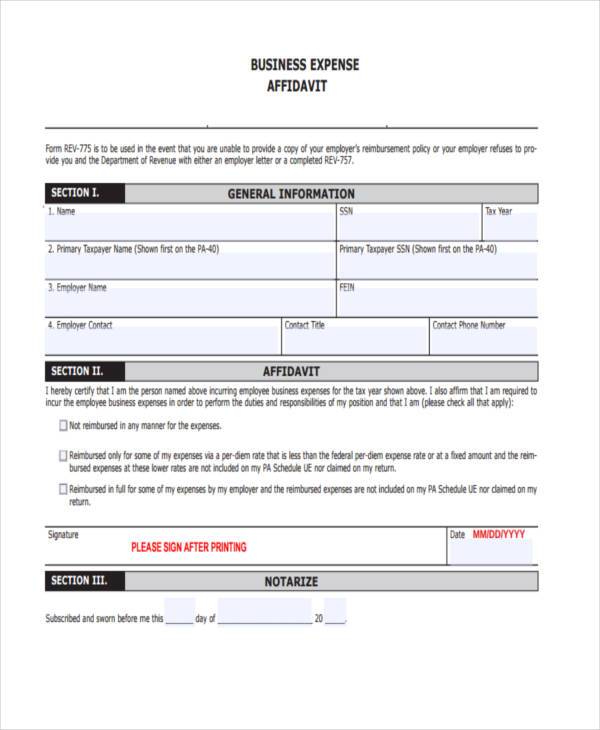

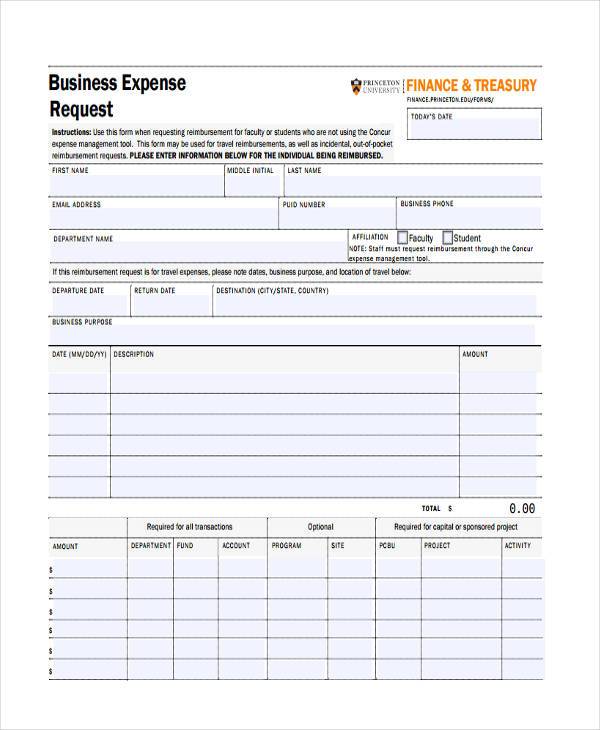

Free Business Expense Forms

Free Business Expense Form

Business Expense Affidavit Form Free

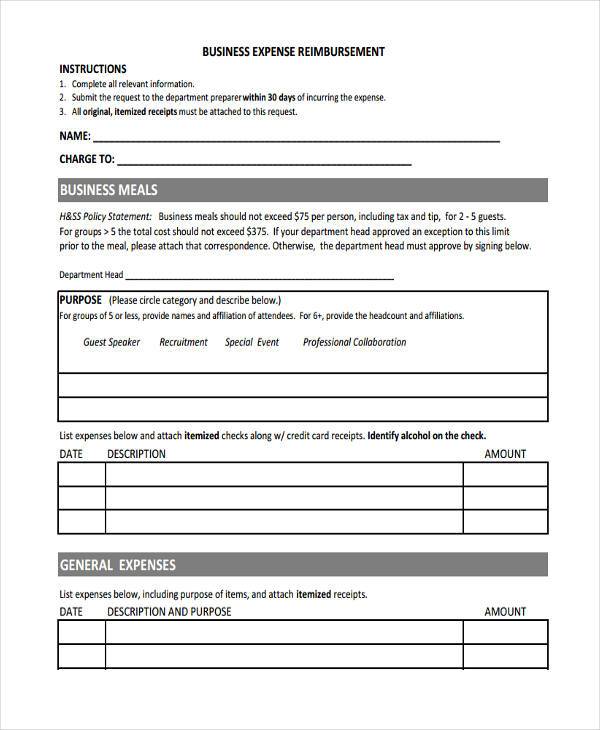

Free Business Expense Reimbursement Form

Free Monthly Expense Forms

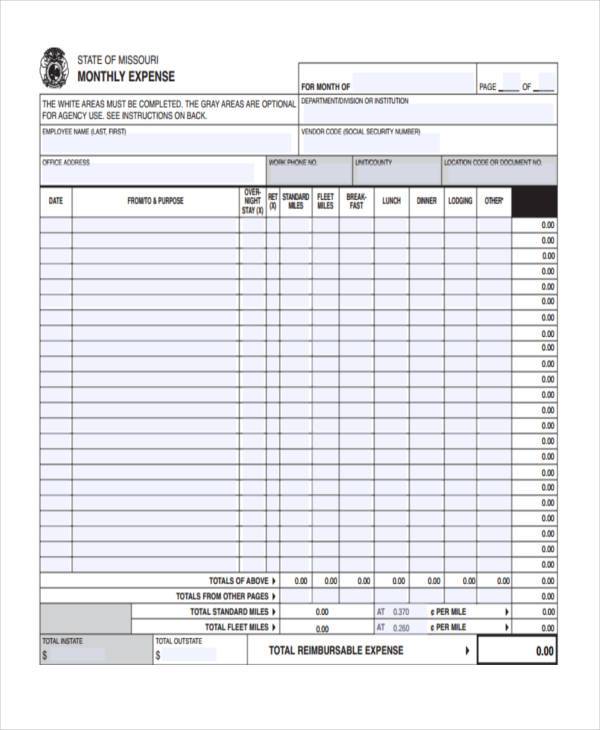

Free Monthly Expense Report Form

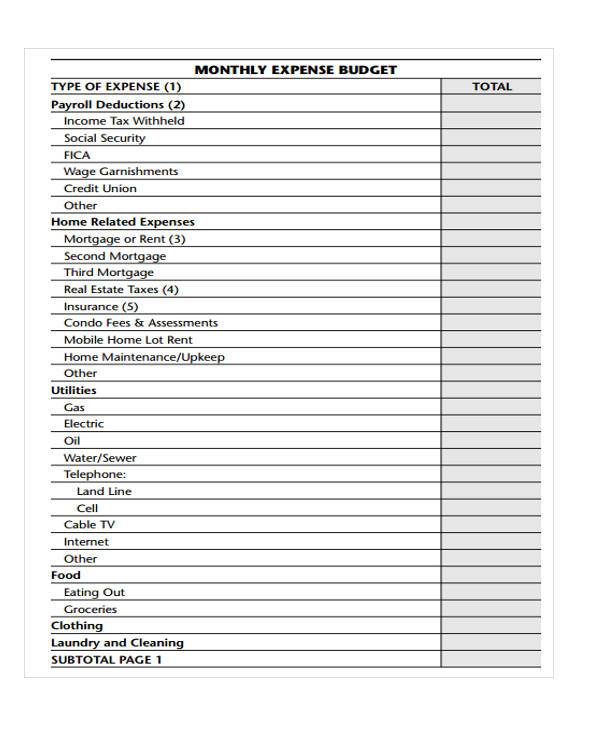

Monthly Expense Budget Form

Monthly Expenses Tracking Form

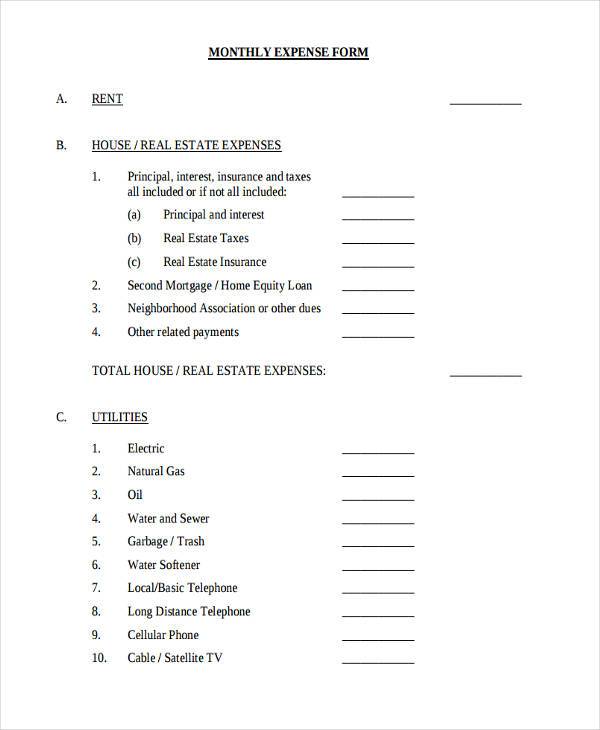

Monthly Expense Form Sample

Free Expense Report Forms

Free Blank Expense Report Form

Free Basic Expense Report Form

Free Printable Expense Report Form

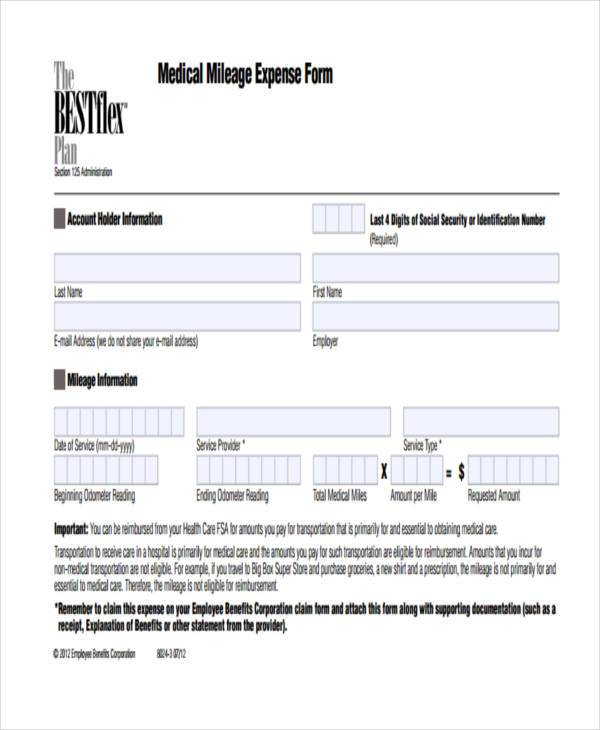

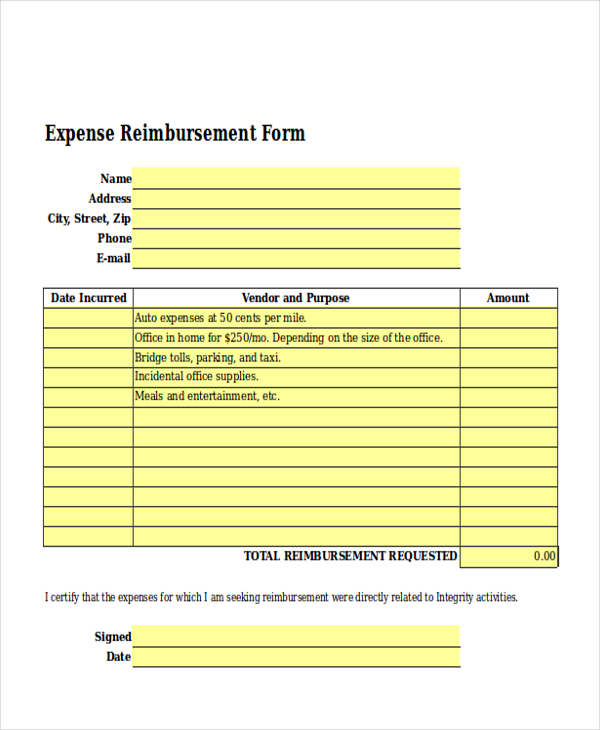

An Expense Claim Form or a Reimbursement Form is a form that allows employees or staff to identify and record expenses made for business or for work for approval. Most companies and organizations use Expense Forms and Reimbursement Forms in order for companies to control expenses that are not within budget.

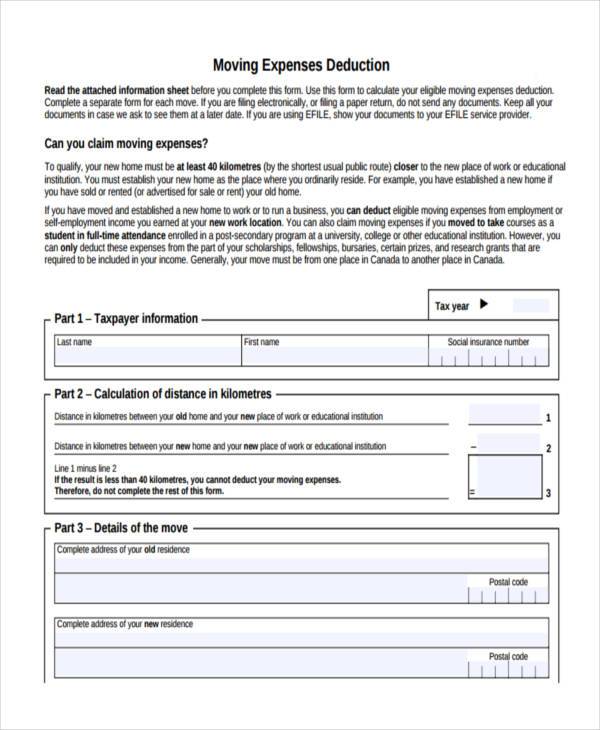

Typically, a company or an organization will compensate an employee for any expense made that is deemed necessary and reasonable. Reimbursement also applies to expenses outside of the office setting such as in government agencies or insurance companies when a provider pays for expenses right after they have been directly paid by the policyholder. Another example of a reimbursement situation is when a tax refund is given to taxpayers.

In an office setting, an Expense Form needs to be filled out by an employee before actually incurring the expense. Expenses such as client meeting lunches, travel, and entertainment must be included. An Expense Form template or form needs to be readily available to help manage and control resources and finances.

Here is a breakdown of why an Expense Form should be provided in your company:

- Expense Forms aid in monitoring and controlling business expenditures.

- Expense Forms allow management to approve or reject expenses.

- Expense Forms ensure that your manager or supervisor is aware of any expenses incurred or expense issues.

- Expense Forms ensure that you remain within the allotted budget.

One other key reason for providing an Expense Management Process in a company or in an organization is to make sure that all reimbursement claims are legitimate and that these claims are not fraudulent or frivolous. In today’s society where lying and scamming people is a mainstream occurrence, a lot of agencies have doubled their security measures against false claims and fraudulent activities. Some of the following requirements are typically asked by companies and agencies to ensure the authenticity of a reimbursement claim:

- An Expense Claim Form or a Reimbursement Form containing an explanation of the expense.

- An Expense or Reimbursement Form with the original receipt attached to it.

Free Expense Tracking Forms

Medical Expense Tracking Form

Weekly Expenses Tracking Form

Basic Expense Tracking Form

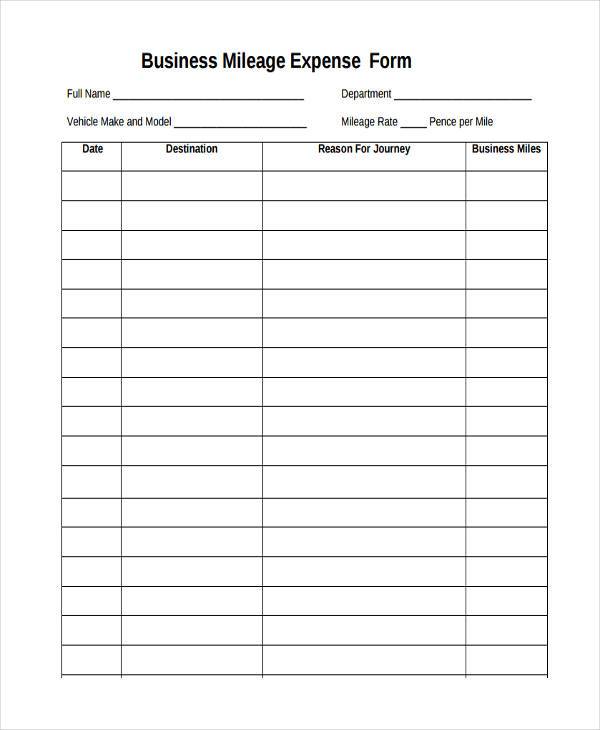

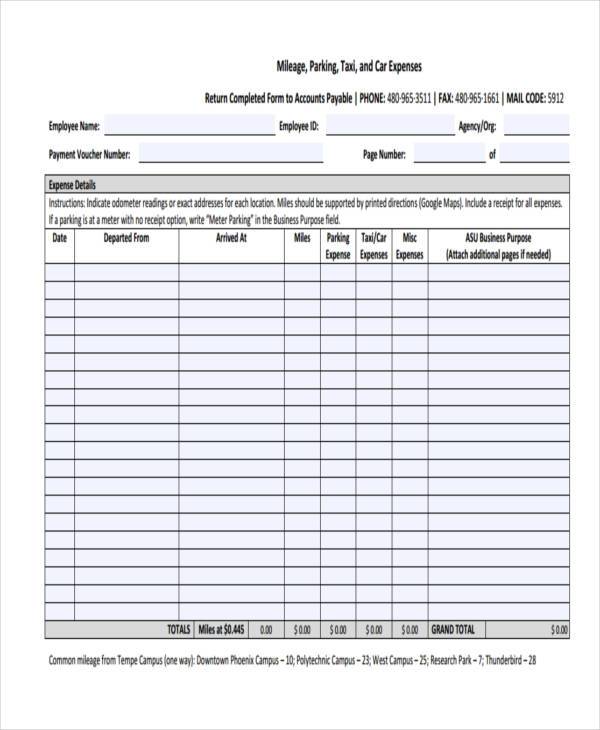

Mileage Expense Forms

Medical Mileage Expense Form

Business Mileage Expense Form

Car Mileage Expense Form

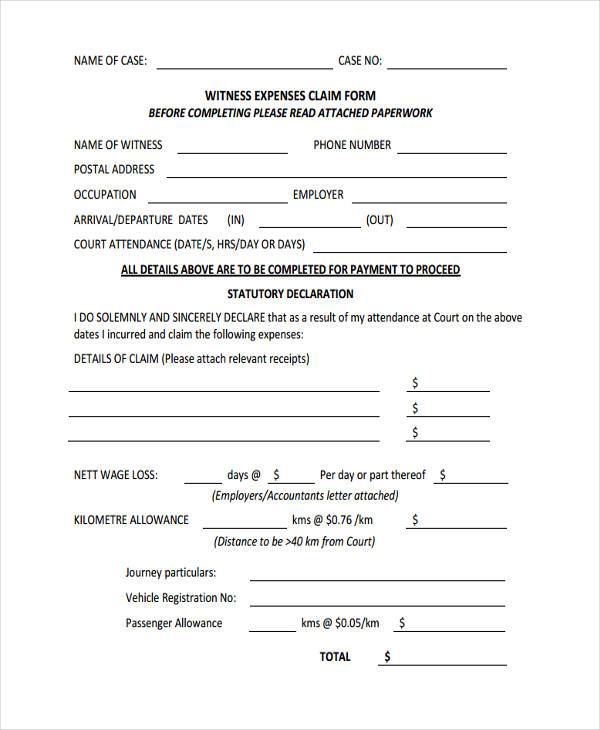

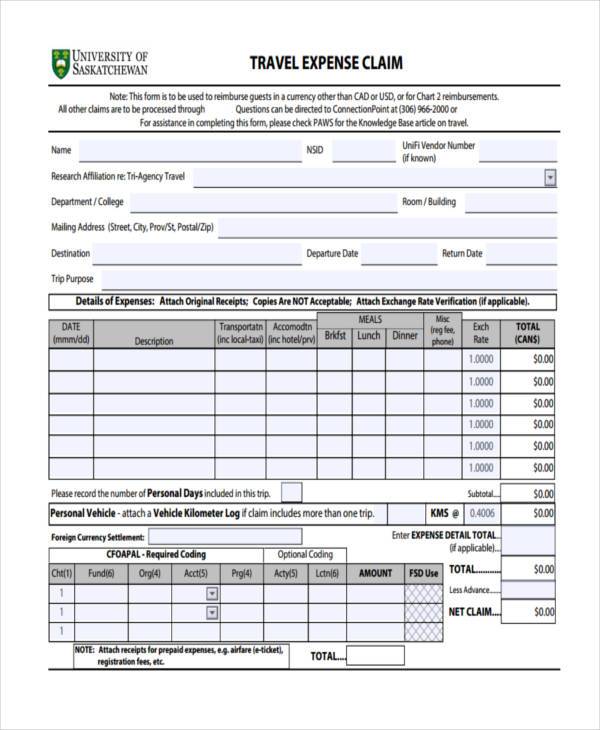

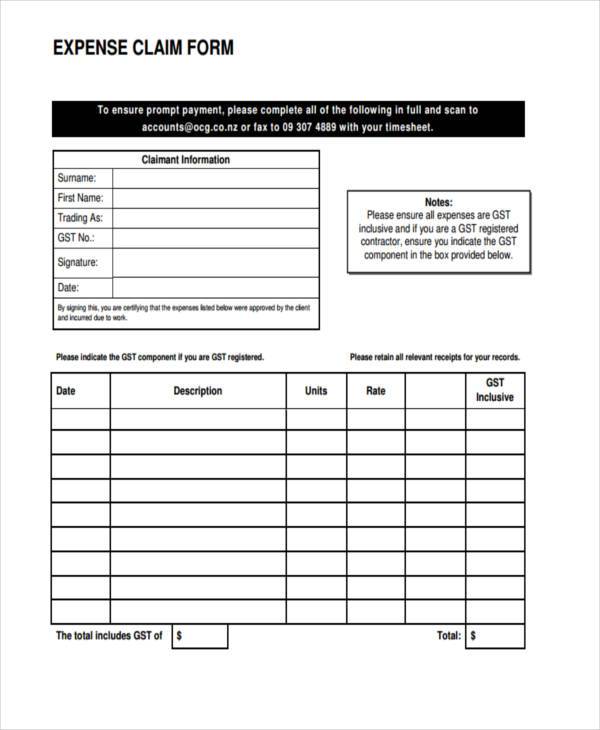

Expense Claim Forms

Employee Expense Claim Form

Witness Expenses Claim Form

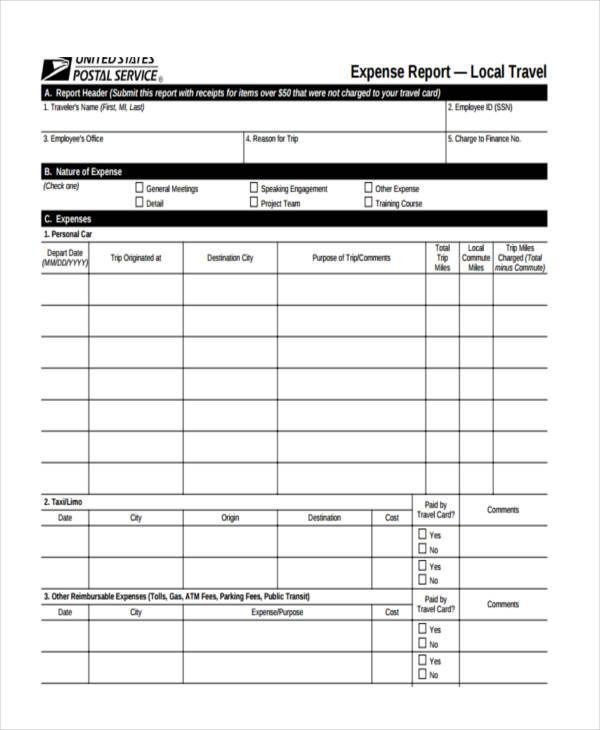

Travel Expense Claim Form

Expense Form Formats

Expense Claim Form Format

Expense Form in Word Format

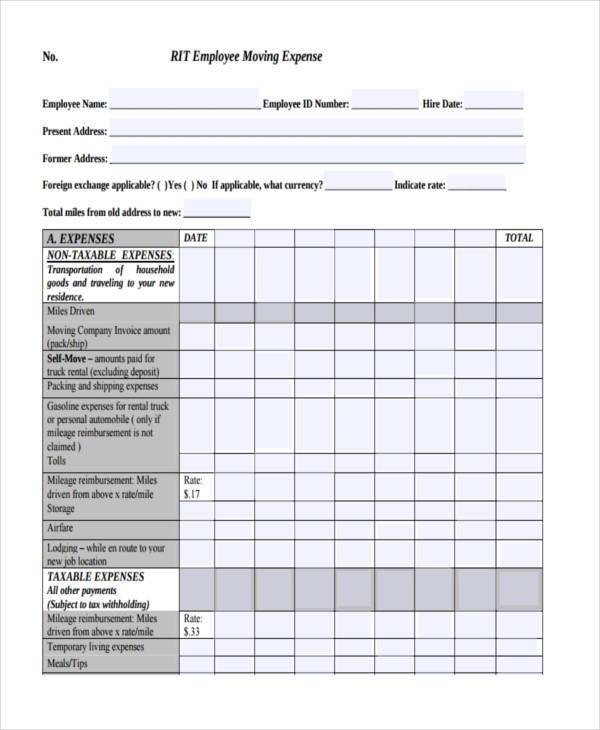

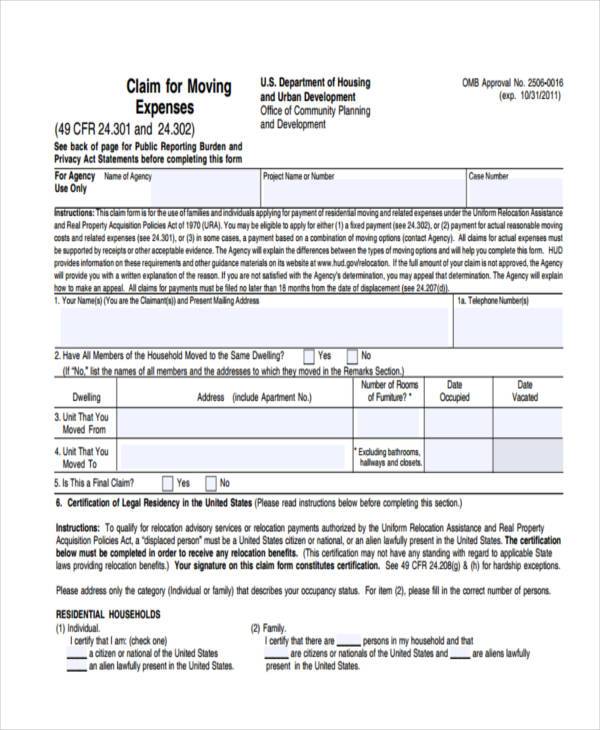

Moving Expense Forms

Employee Moving Expense Form

Moving Expense Deduction Form

Moving Expense Claim Form

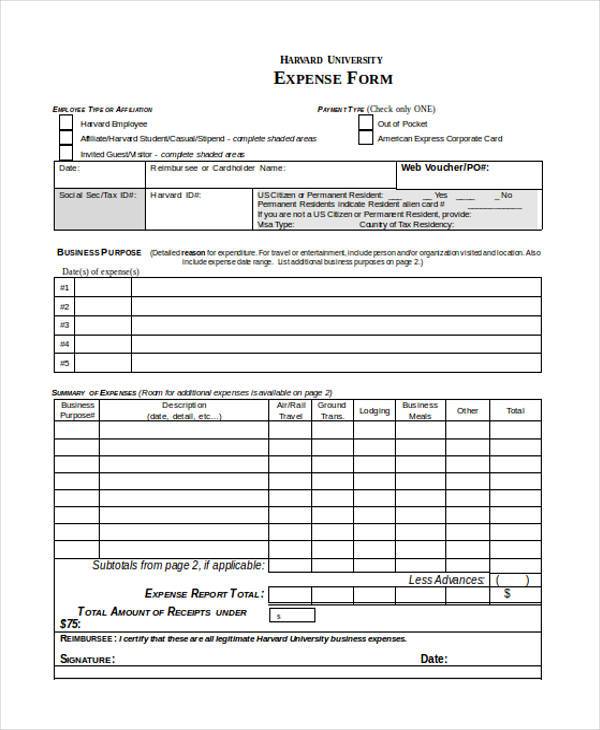

Creating an Expense Report in Business

Because a lot of business people travel and wine and dine with clients, a lot of them – particularly company executives and other higher-level employees – use their credit cards for expenses that are needed or are related to winning a client over. Airline tickets, hotel accommodations, lunch meetings, transportation expenses, and even tips made during a business trip call for reimbursement. One method of proper Expense Management is by filling out an Expense Form or an Expense Report. But how exactly do you make one? You can download our free Expense Forms or you can make your own, whichever helps you save time. Below are tips and tricks to creating a solid Expense Report Form:

1. Be privy to policies about reimbursements. Take the time to review you company’s policy about expense reports, expense-paid meetings, etc. You can check on your employee handbook or discuss it with human resources to help you fully understand the procedures.

2. Have a form handy. Companies usually have an Expense Form or an Expense Report Form template ready. Be sure to fill out the form clearly and legibly and provide accurate details. An inconsistency in the information you have provided might illicit suspicion from your colleagues or the accounting department. Be sure to only put in authentic data.

3. Provide receipts. Providing Expense Reports without receipts is like telling your boss you worked on that business proposal weeks ago but you do not have the actual proposal to show to him. Receipts are the supporting details to your Expense Claim Forms, be sure to carefully organize your receipts according to the date and time that they were incurred as well as the type of expense such as one stack for meal receipts and another one for cab fare.

4. Provide the essential details. Provide your name, the date of the trip, and its purpose on the form. These will come in handy when the company is trying to identify who they need to give a reimbursement to and for what.

5. Deduct personal expenses. Be professional enough not to include any personal expenditures into your Expense Report Form such as a baseball cap that you bought at an International League for your son. Subtract your personal expenses from those that are related to business and indicate the difference on your report.

6. Sign your report. Sign your expense report and then submit it to your supervisor for approval.

Because of the numerous fraudulent actions made by employees in company reimbursement processes, companies have somehow established stricter rules and procedures to follow when reimbursing employees. It is important that an employee is aware of a company’s guidelines pertaining to an Expense Report:

Learn How to Go on a Budget

Employees must learn how to budget the costs that they incur on business trips and to learn how to stay within that budget. You can review your company’s travel expense guidelines and employee handbooks for easy reference on this matter.

Provide Prompt and Accurate Report Details

Your Expense Report Form should go together with the specific date that the expense was incurred and in succession. It is also a big help to organize your receipts according to date. Make sure you double-check your calculations before turning in your expense report.

Do Not Throw Away Proofs of Purchase

When you are on a trip or when you are out to meet a client, it is always good practice to keep all of your receipts such as the lunch bill or cab fare. Most companies provide reimbursement policies by requiring receipts for purchases made over five or ten dollars; however, it is always a good idea to keep your receipts regardless of the expense to help you accurately calculate your expenses.

Expense Forms and Their Other Uses

Despite the fact that Expense Forms are mainly used in the business setting, each one of us could make do with an Expense Form in order for us to track our daily, weekly, or monthly expenses. Expense Forms can also be considered as a budgeting tool to keep us aware of the costs that we incur over a period of time. Below are some tips to help you cut back on costs for work and for everything else!

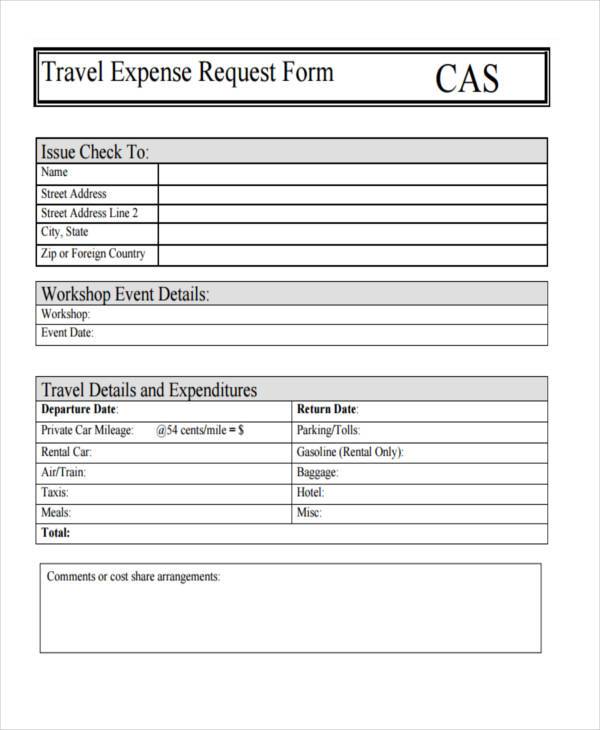

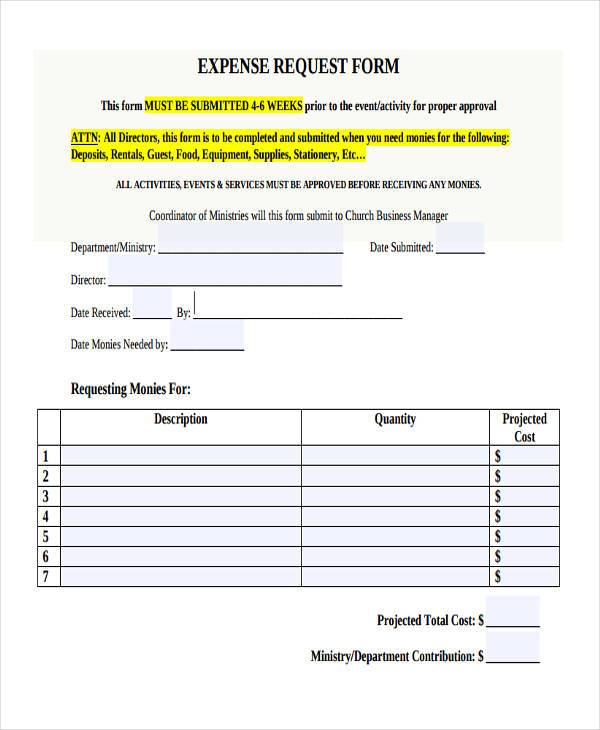

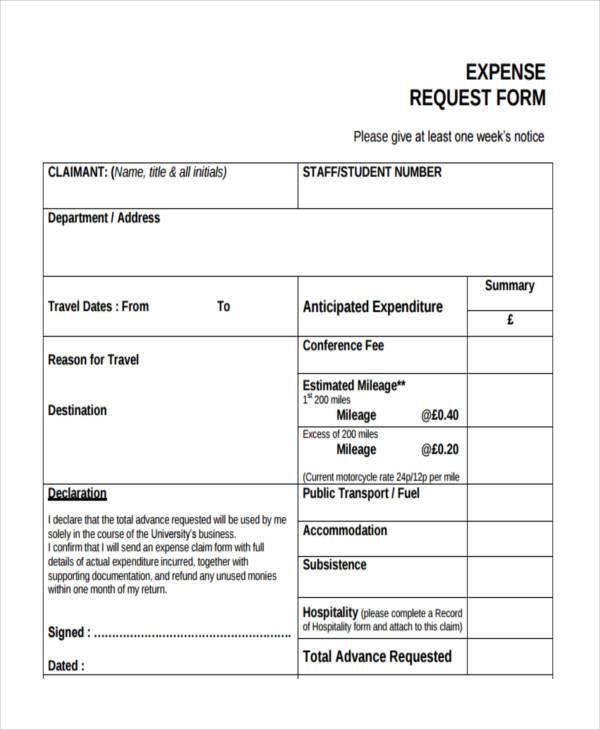

Expense Request Forms

Travel Expense Request Form

Free Expense Request Form

Business Expense Request Form

Sample Expense Request Form

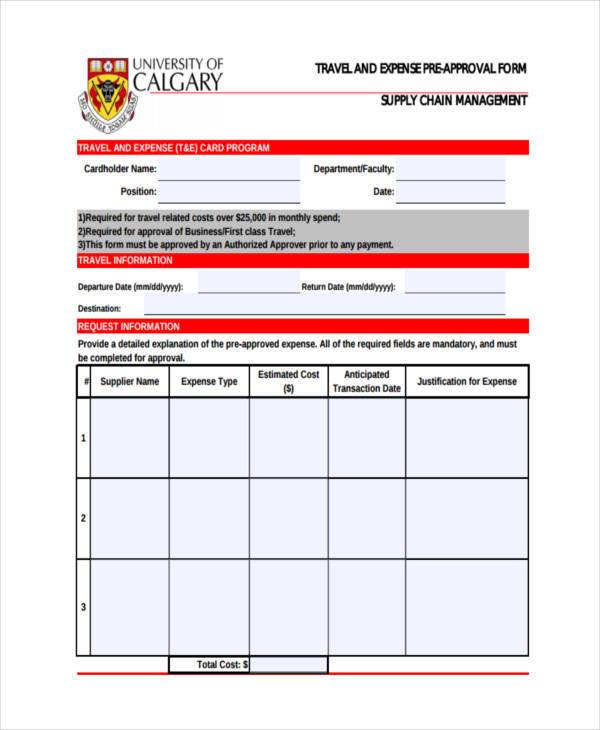

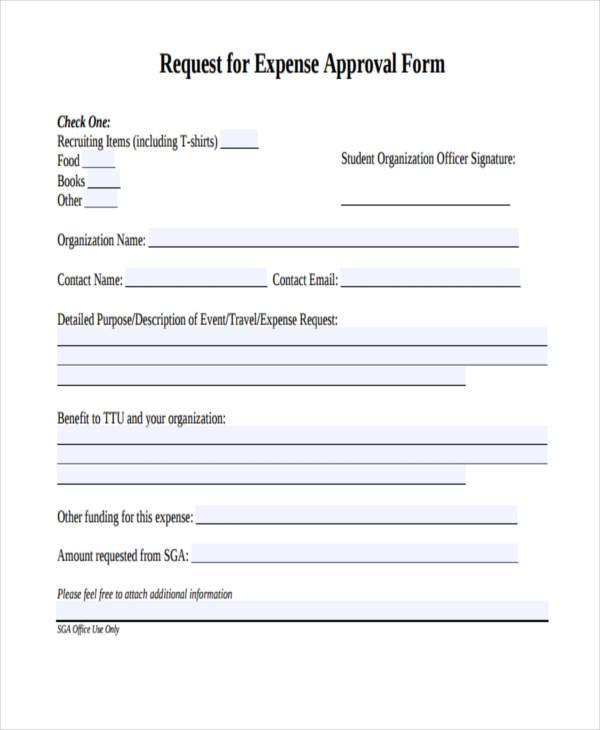

Expense Approval Forms

Travel and Expense Pre-Approval Form

Expense Request Approval Form

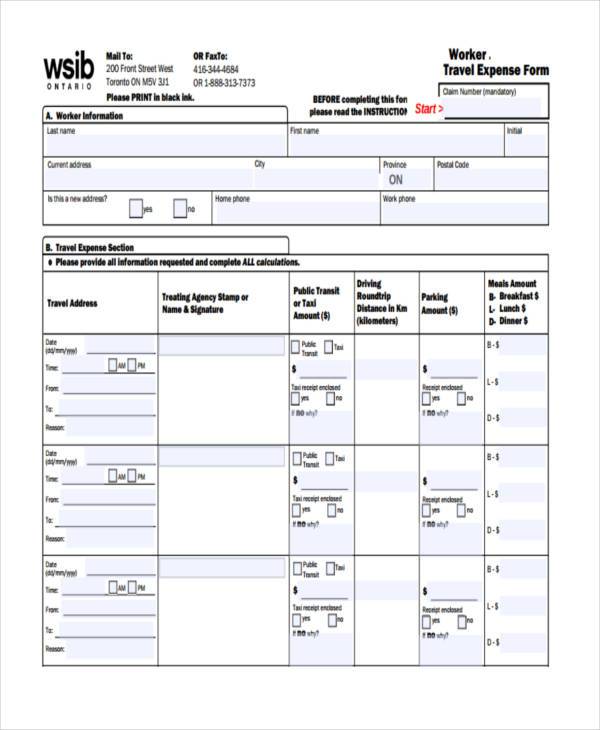

Free Expense Forms in PDF

Worker Travel Expense Form

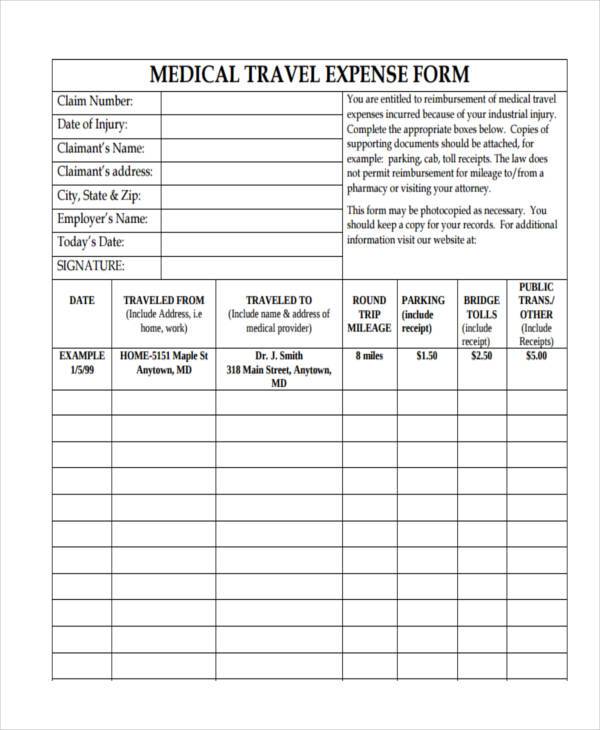

Medical Travel Expense Form

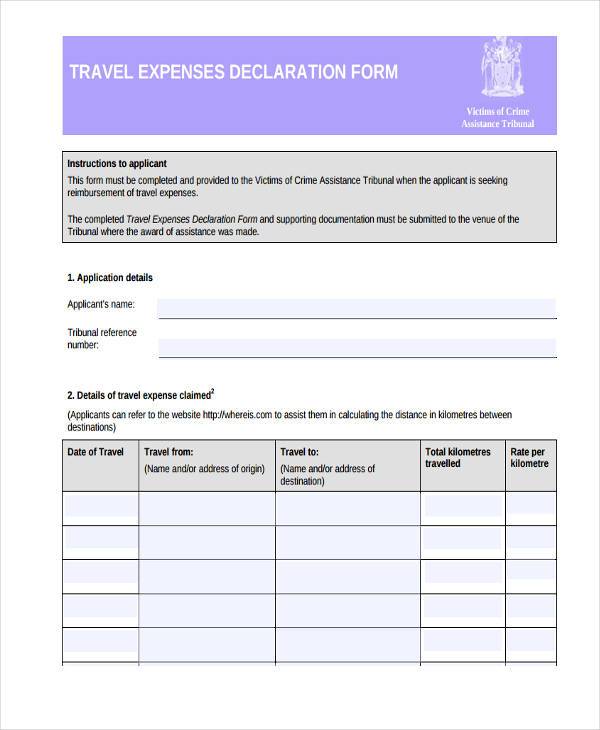

Travel Expenses Declaration Form

Employee Expense Forms

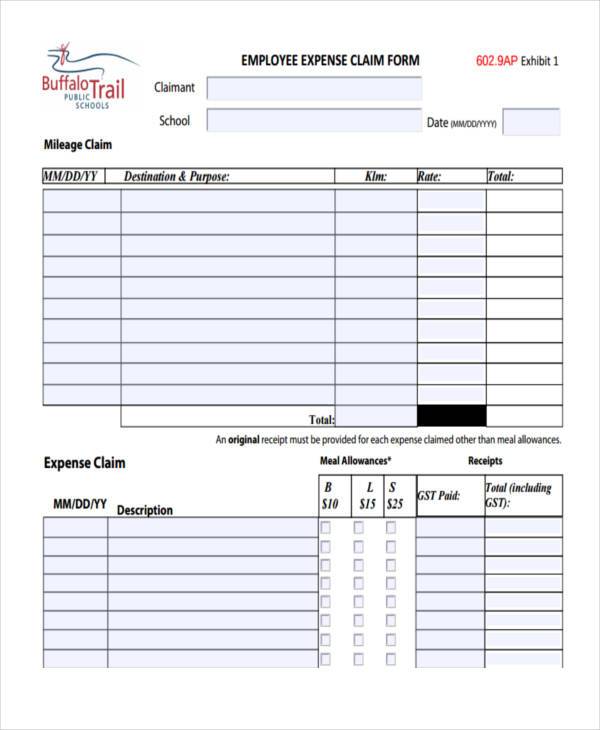

Free Employee Expense Claim Form

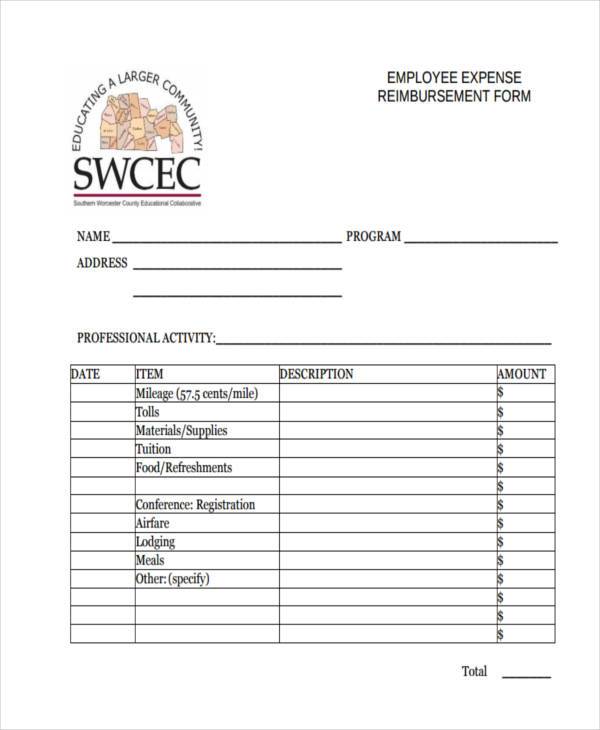

Employee Expense Reimbursement Form

Personal Expense Forms

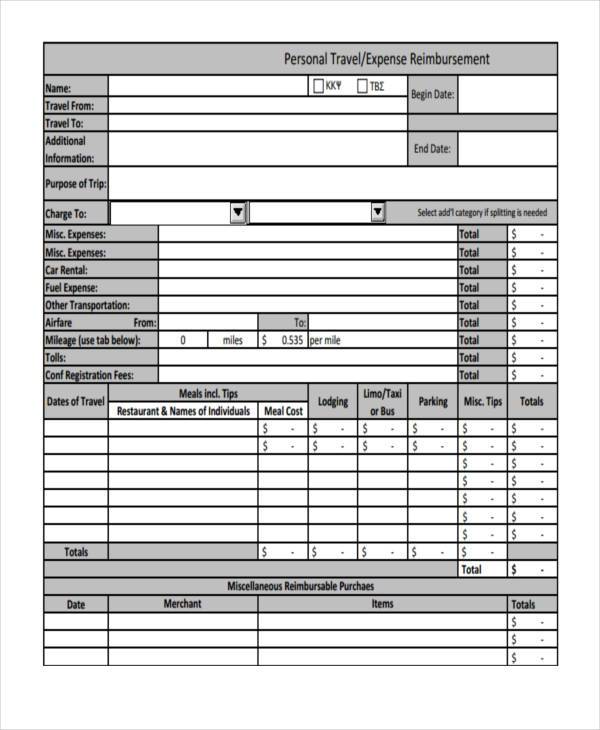

Personal Expense Reimbursement Form

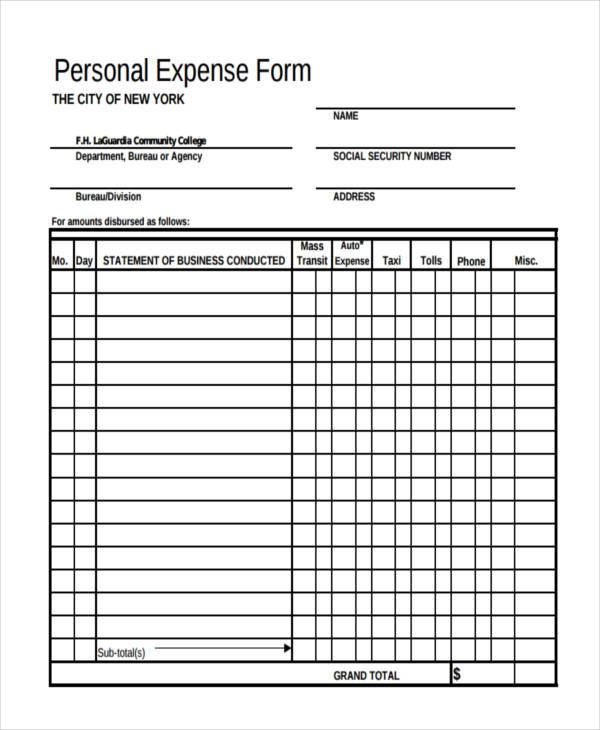

Free Personal Expense Form

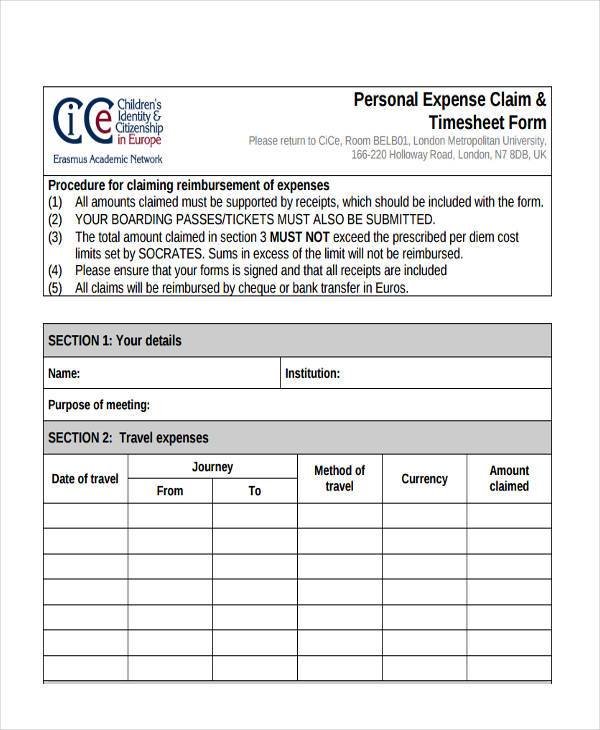

Personal Expense Timesheet Form

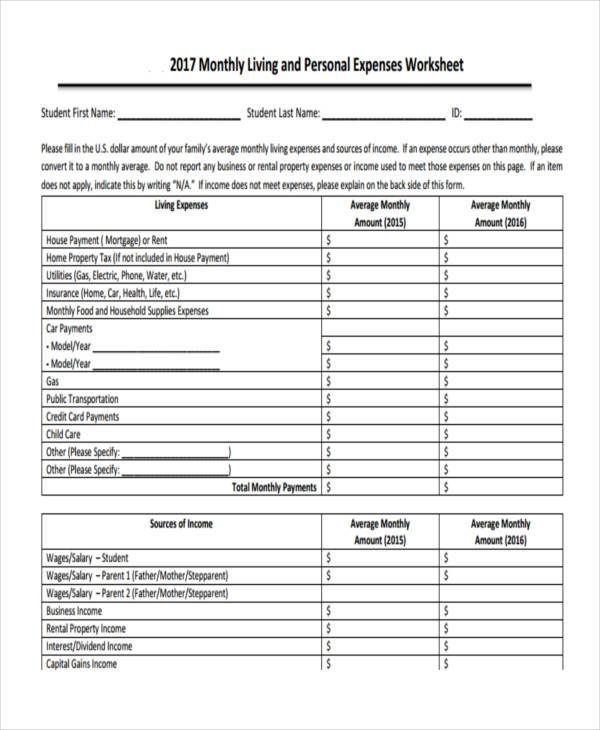

Personal Monthly Expense Form

Free Expense Reimbursement Form in Excel

How to Cut Back on Office Expenses

Go Digital. Piles of paperwork and documents are so last century. It is time that you and your company learn the ropes on how to go digital. This method helps you save on time – because printing and distributing paperwork does eat up a lot of your time. Going digital also allows you to save up on costs by cutting back on the use of paper and ink. Not to mention it helps you save trees, send out information whenever and wherever in just a click of a button, and is a great way to make sure that your files stay safe and intact on the cloud.

Power Down When You Can. One other way to cut back on office costs is to shut down appliances or equipment that are not in use. Office employees will usually have this habit of not unplugging equipment or putting them on stand-by mode. You’d be amazed to see the difference in savings when you impose a “power down” rule among your staff.

Educate Your Employees. Be pro-active in educating your employees about the positive effects of cutting back on expenses and how it will be to their advantage. Point out the fact that what the company saves on utility costs can be spun into more incentive and bonuses for them. On the plus side, your employees can also help you to discover a savings opportunity that you have overlooked.

How to Cut Back on Everything Else

- Categorize your priority expenses from those that are not necessarily needed

- Remove unnecessary routine purchases such as cigarettes or alcohol

- Consider carpooling to work

- Use CFL or Led light bulbs to save on your electrical bill

- Unplug all unused electrical devices

- Cancel club memberships that are not very useful to you, such as your gym membership when you rarely ever go to the gym

- Look for inexpensive options for entertainment, such as attending musical or community event, getting involved in a community sport, or playing board games

- Cook and pack your own meals

- Lessen or eliminate the number of times that you eat out or have take-away

- Use coupons

- Use solar lighting

- Cycle or walk to work

- Purchase generic products when you can

- Sell your unwanted items on eBay or through a garage sale

- Simplify your beauty regime

- Avoid using your credit card and pay cash instead because debts tend to put you into a financial trap

- Make the most of your clothes and accessories rather than buying new ones