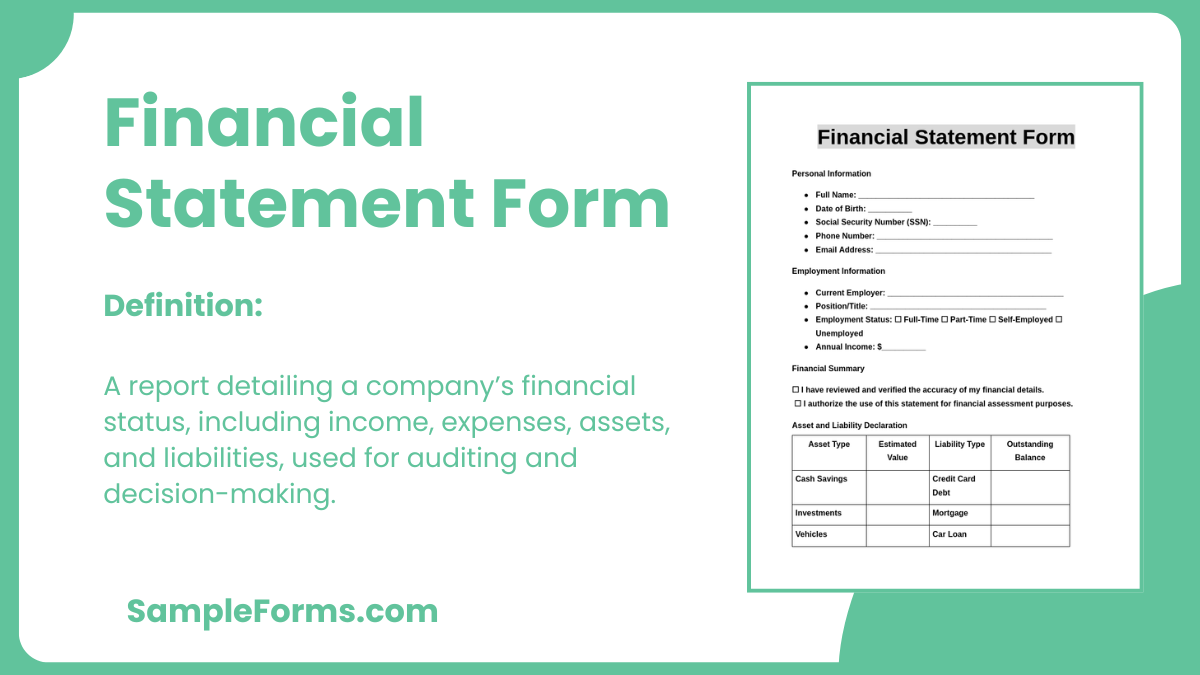

A Financial Statement Form is a structured document used to summarize financial transactions, assets, liabilities, and overall financial status. It is essential for businesses, organizations, and individuals to assess financial health, make informed decisions, and maintain compliance with financial regulations. A well-prepared Financial Form includes sections for income, expenses, debt, and net worth, ensuring a clear financial overview. Whether for tax filings, loan applications, or business reports, a properly formatted Statement Form provides transparency and credibility.

Download Financial Statement Form Bundle

What is Financial Statement Form?

A Financial Statement Form is a document that records financial data, including income, expenses, assets, and liabilities, to provide a complete financial snapshot. Businesses and individuals use it for tax reporting, financial planning, loan applications, and investment analysis. It ensures transparency in financial transactions and compliance with regulatory standards. Typically, a Statement Form includes a balance sheet, income statement, and cash flow report, offering a structured financial overview. This document helps organizations track financial performance, manage budgets, and make strategic financial decisions.

Financial Statement Format

Company Information

- Company Name – Registered name of the business.

- Business Address – Headquarters or branch location.

- Report Date – Date of the financial statement.

Income Statement

- Revenue – Total earnings from business activities.

- Expenses – Breakdown of operational costs.

- Net Profit/Loss – Final profit after deducting expenses.

Balance Sheet

- Assets – Cash, inventory, and property owned.

- Liabilities – Outstanding debts or financial obligations.

- Equity – Shareholder investments and retained earnings.

Cash Flow Statement

- Operating Activities – Cash generated from business operations.

- Investing Activities – Funds spent on assets or investments.

- Financing Activities – Loans or equity-related transactions.

Certification & Approval

- Finance Officer Name – Authorized personnel verifying the report.

- Signature & Date – Confirmation of accuracy.

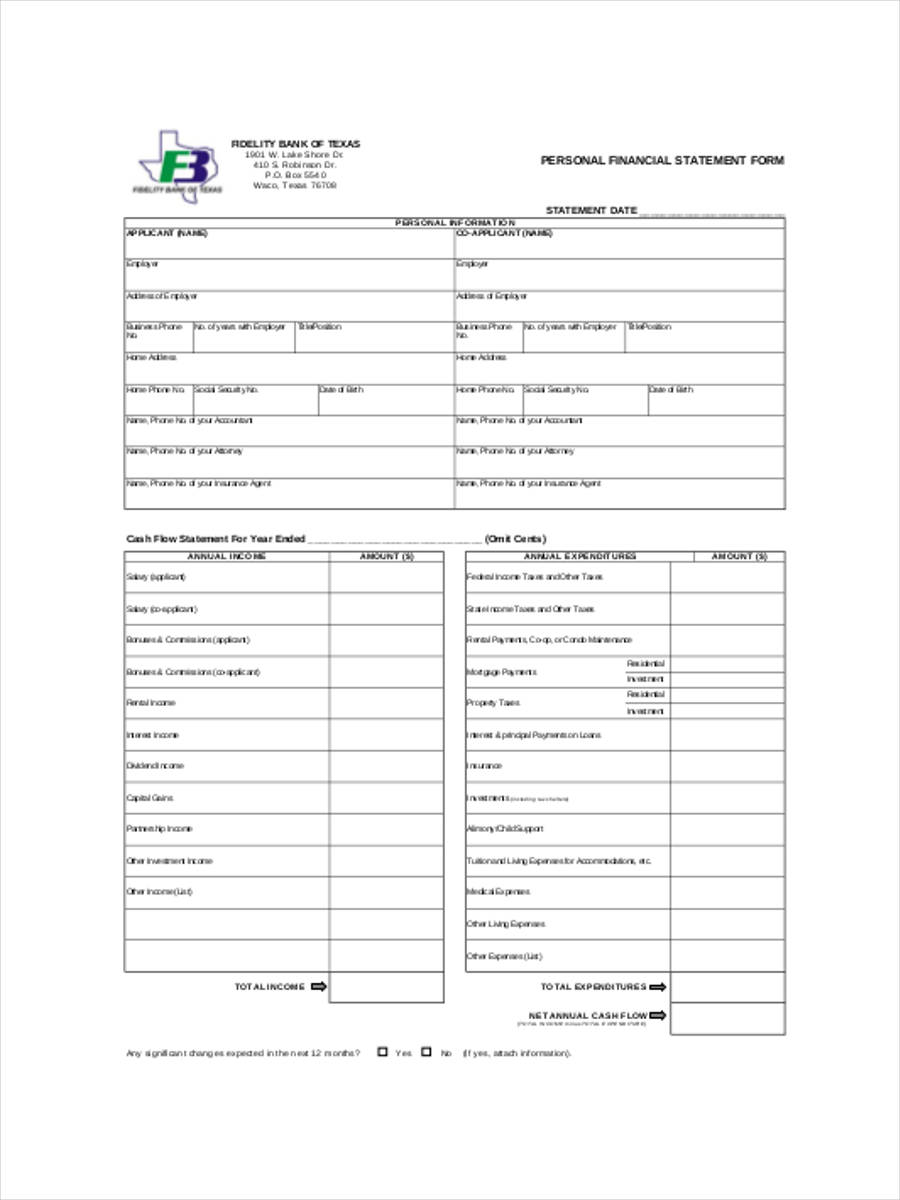

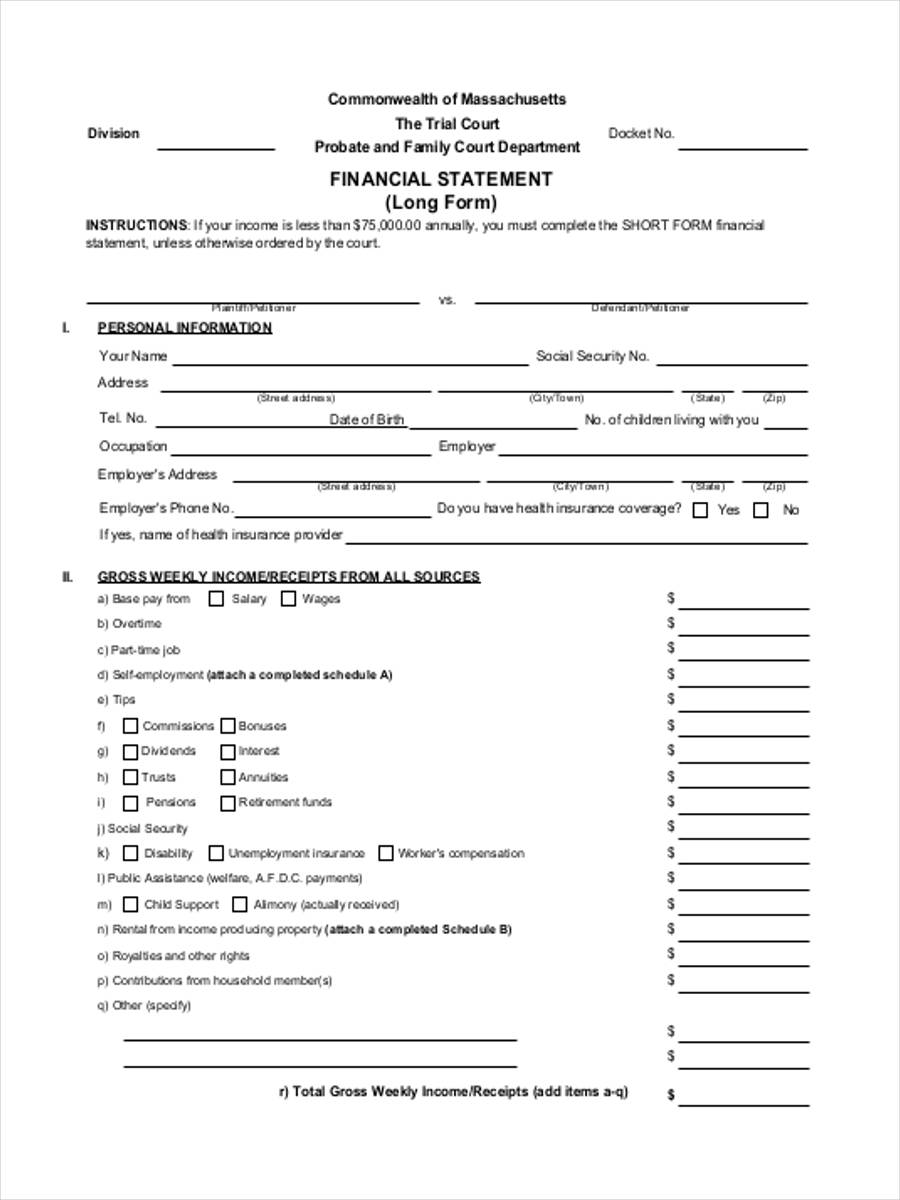

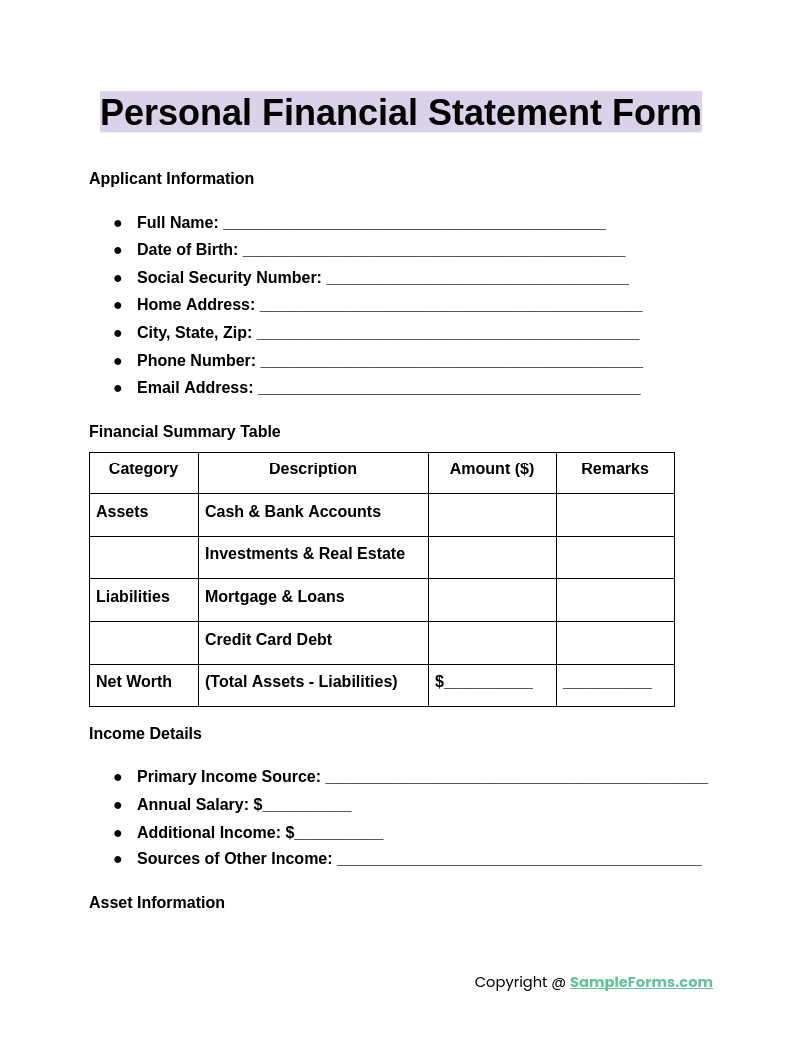

Personal Financial Statement Form

A Personal Financial Statement Form helps individuals track income, expenses, assets, and liabilities for financial planning. Similar to an Employee Witness Statement Form, it provides structured documentation to assess personal financial health, loan eligibility, and investment decisions accurately.

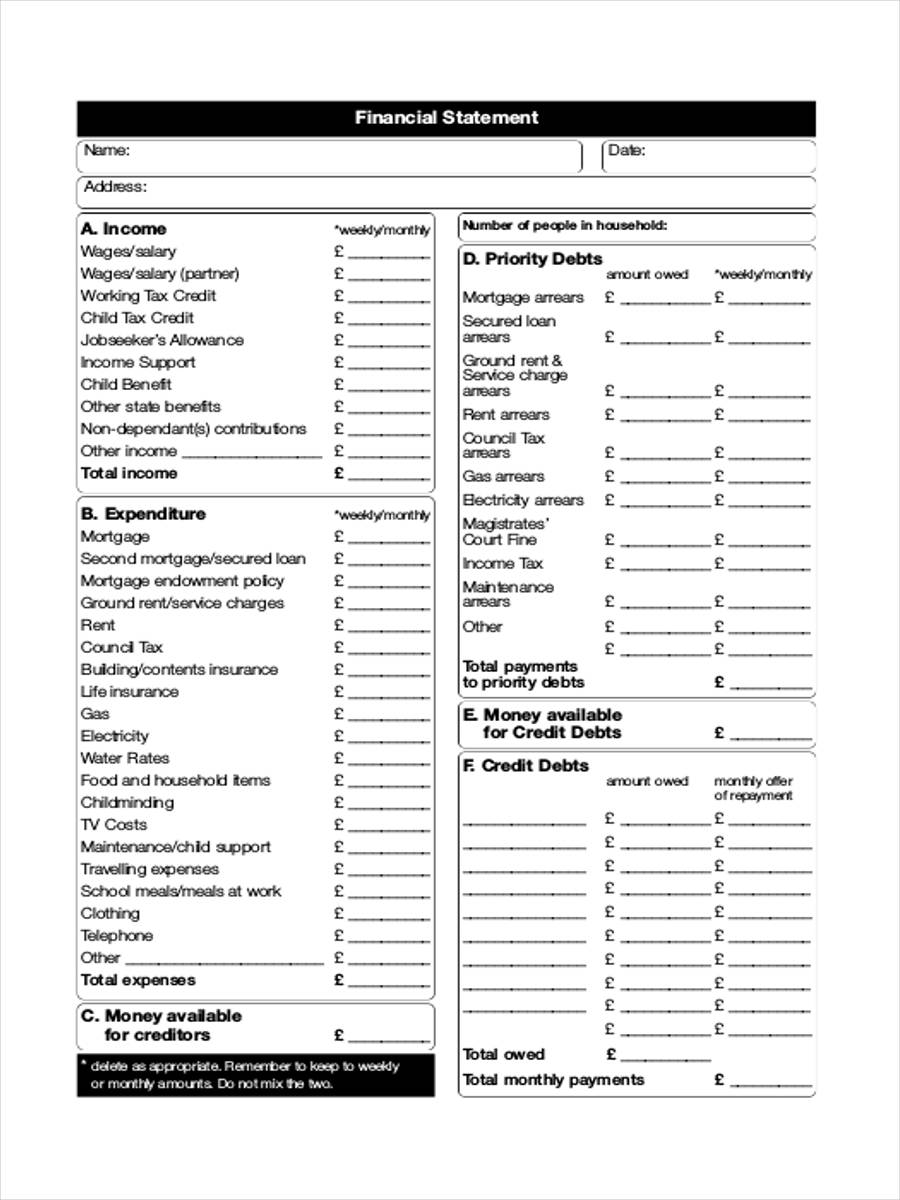

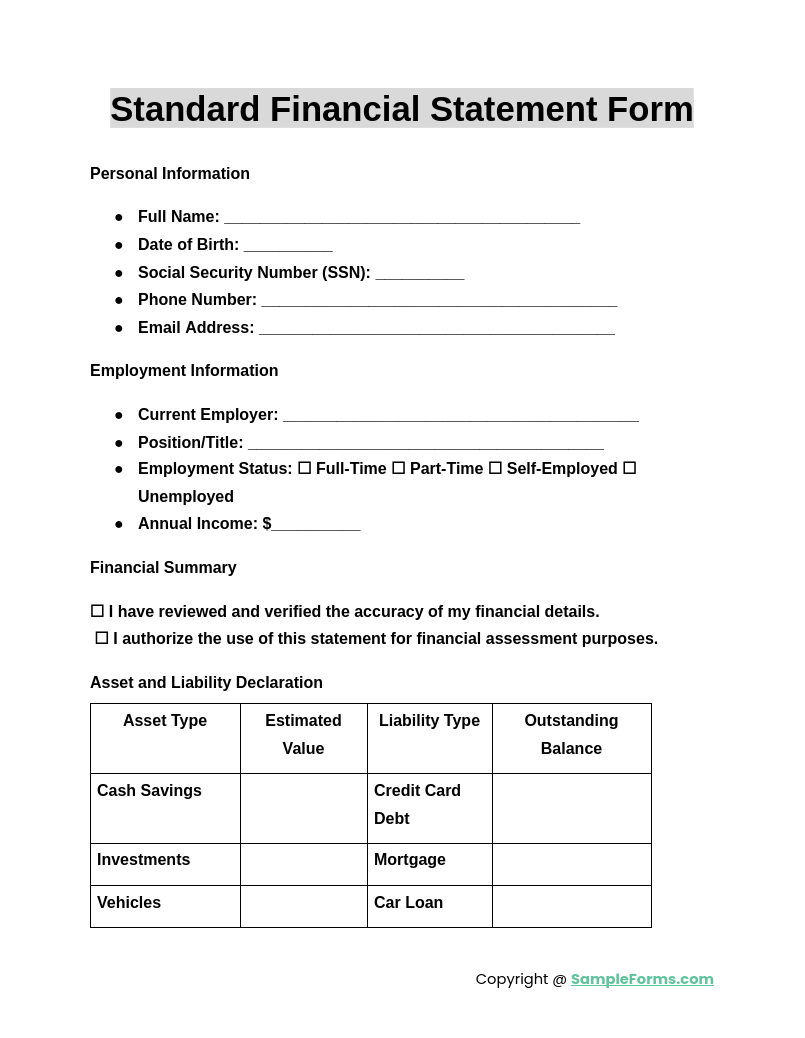

Standard Financial Statement Form

A Standard Financial Statement Form is used for general financial reporting, ensuring consistency in documenting income and expenses. Like a Closing Statement Form, it provides a comprehensive financial overview essential for audits, tax filings, and financial decision-making.

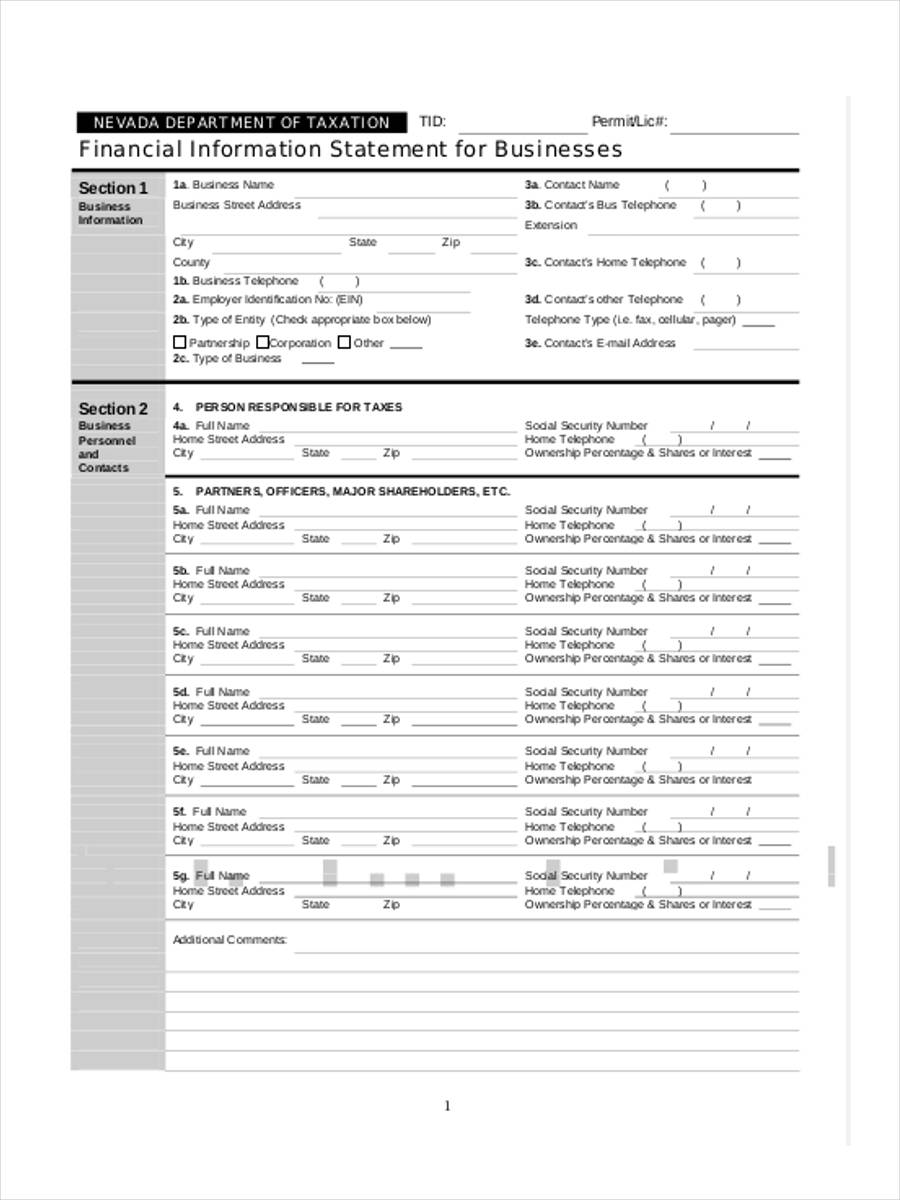

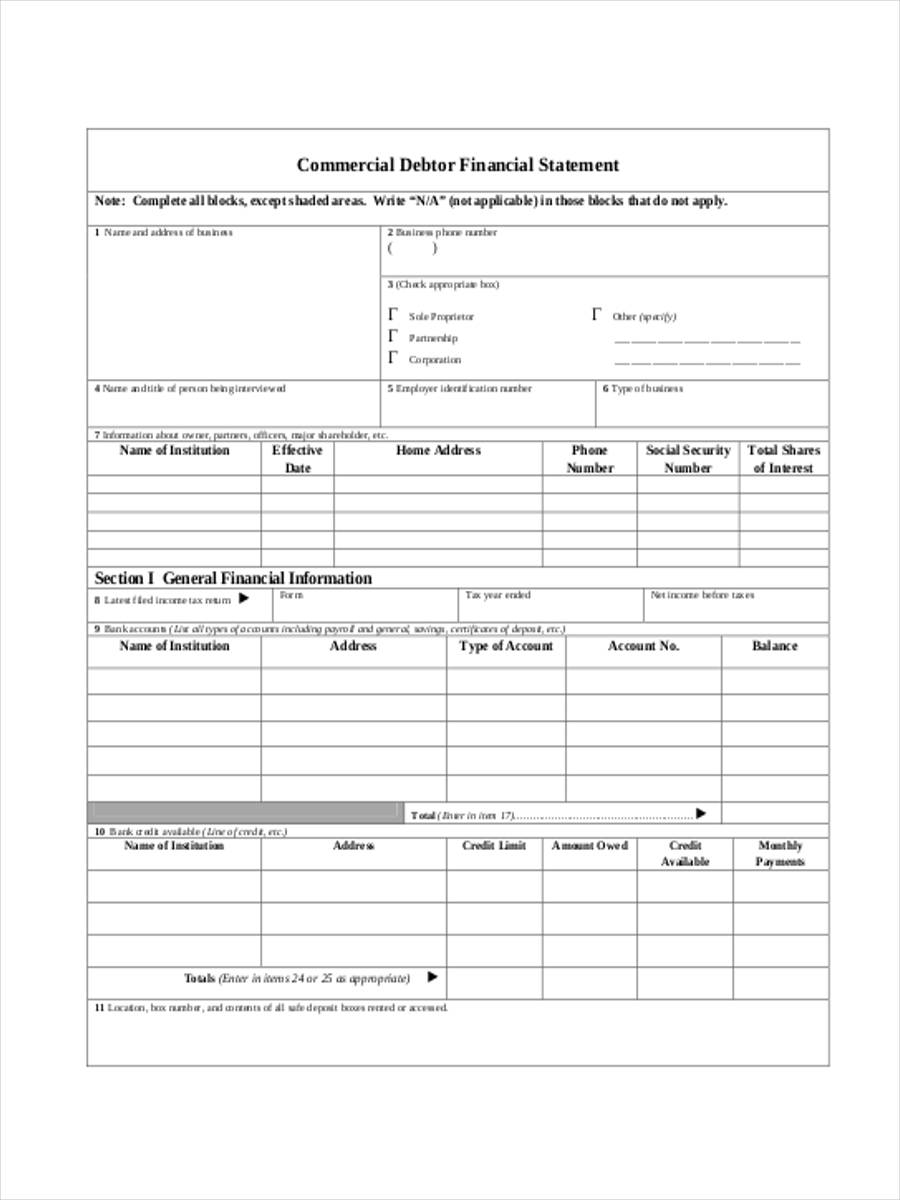

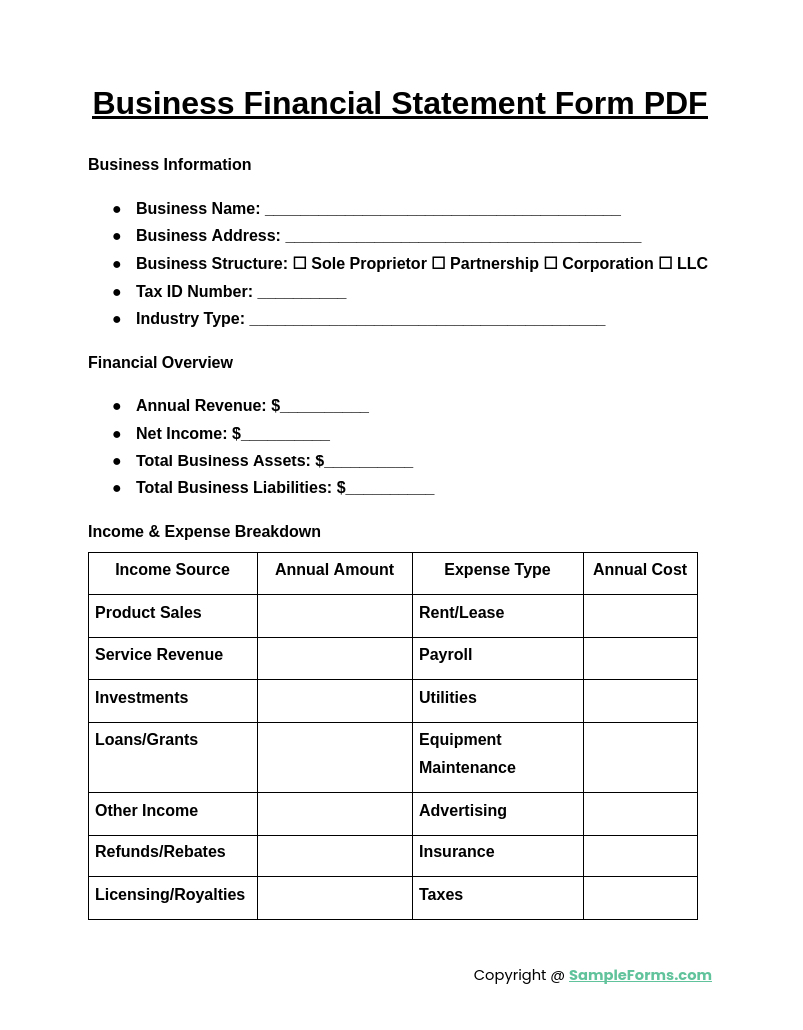

Business Financial Statement Form PDF

A Business Financial Statement Form PDF outlines company assets, liabilities, and revenue for financial analysis. Similar to a Billing Statement Form, it ensures transparency, enabling businesses to manage cash flow, secure funding, and meet compliance requirements efficiently.

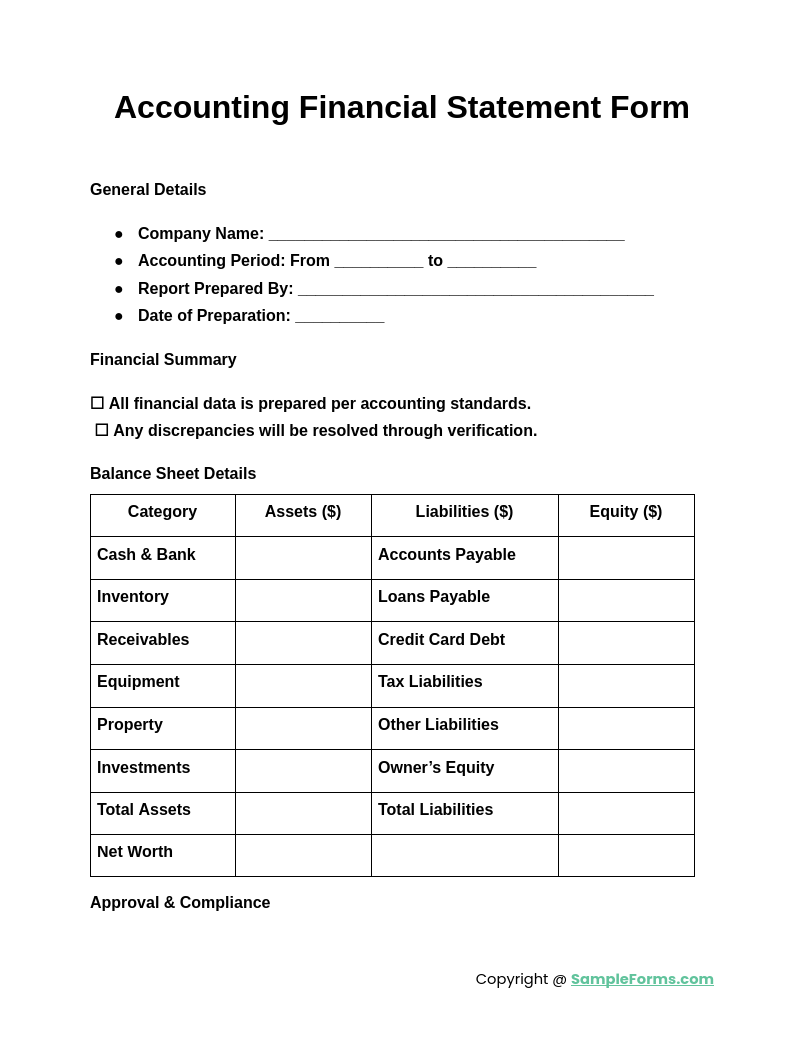

Accounting Financial Statement Form

An Accounting Financial Statement Form records financial transactions, aiding businesses in accurate bookkeeping. Like a Salary Statement Form, it helps maintain transparency in financial records, ensuring compliance with accounting standards and regulatory requirements

Browse More Financial Statement Forms

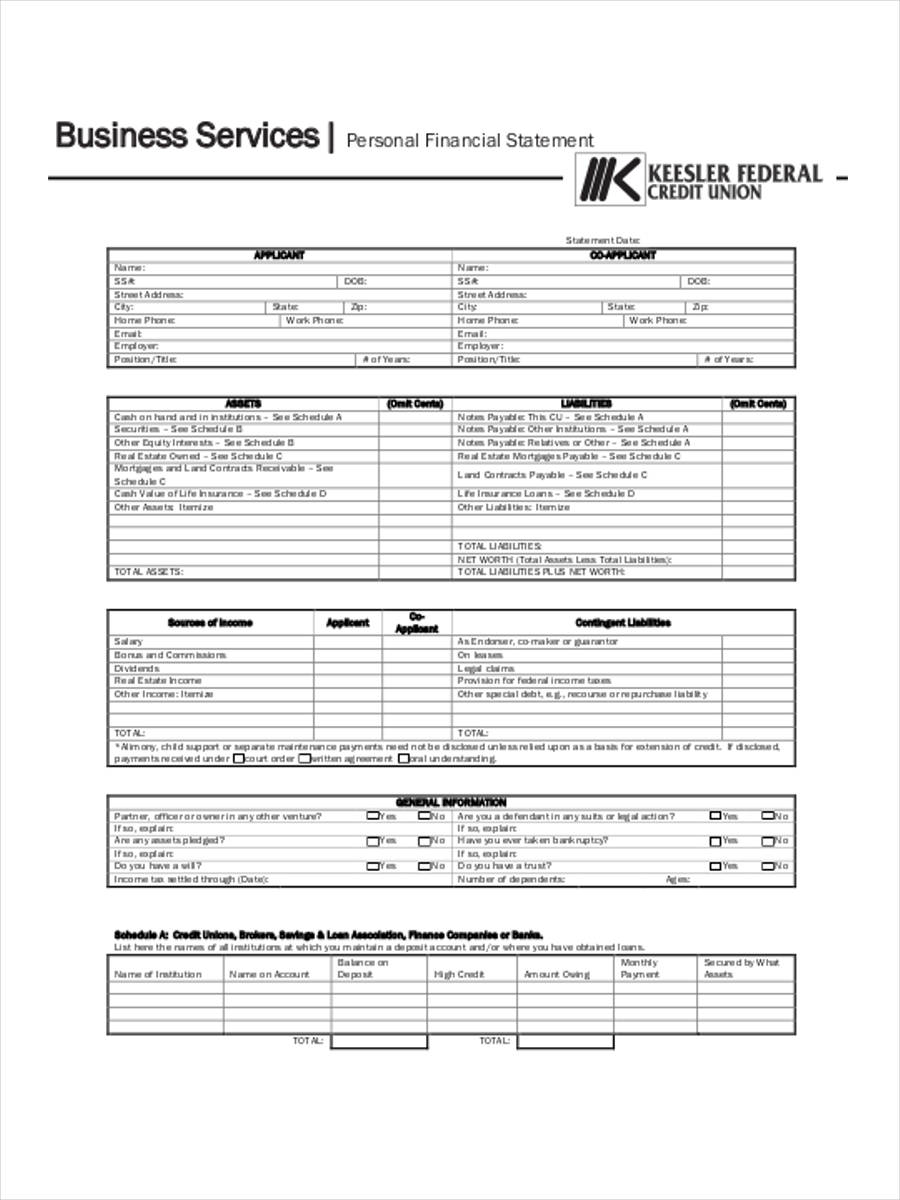

Business Services Financial Statement

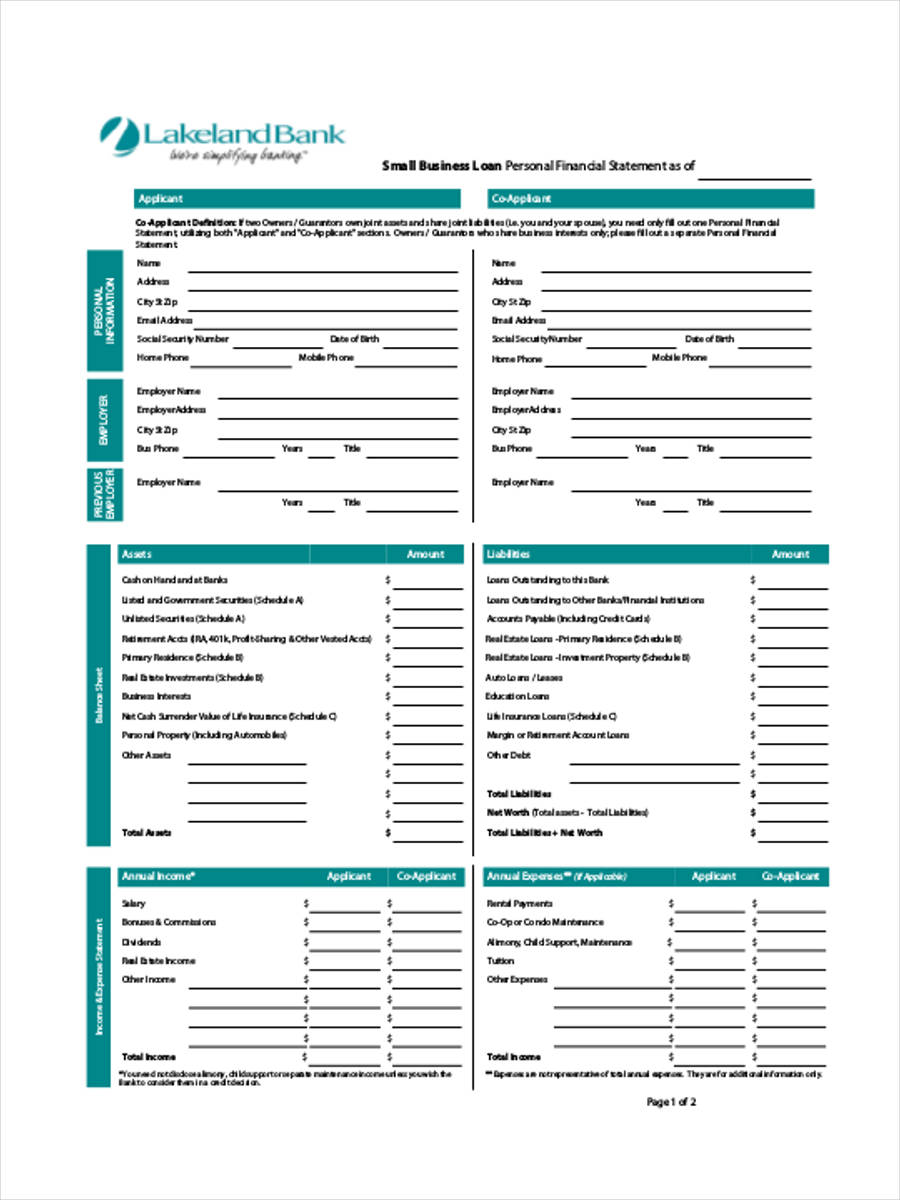

Small Business Financial Statement

Financial Information Statement for Business

Personal Financial Statement

Annual Financial Statement

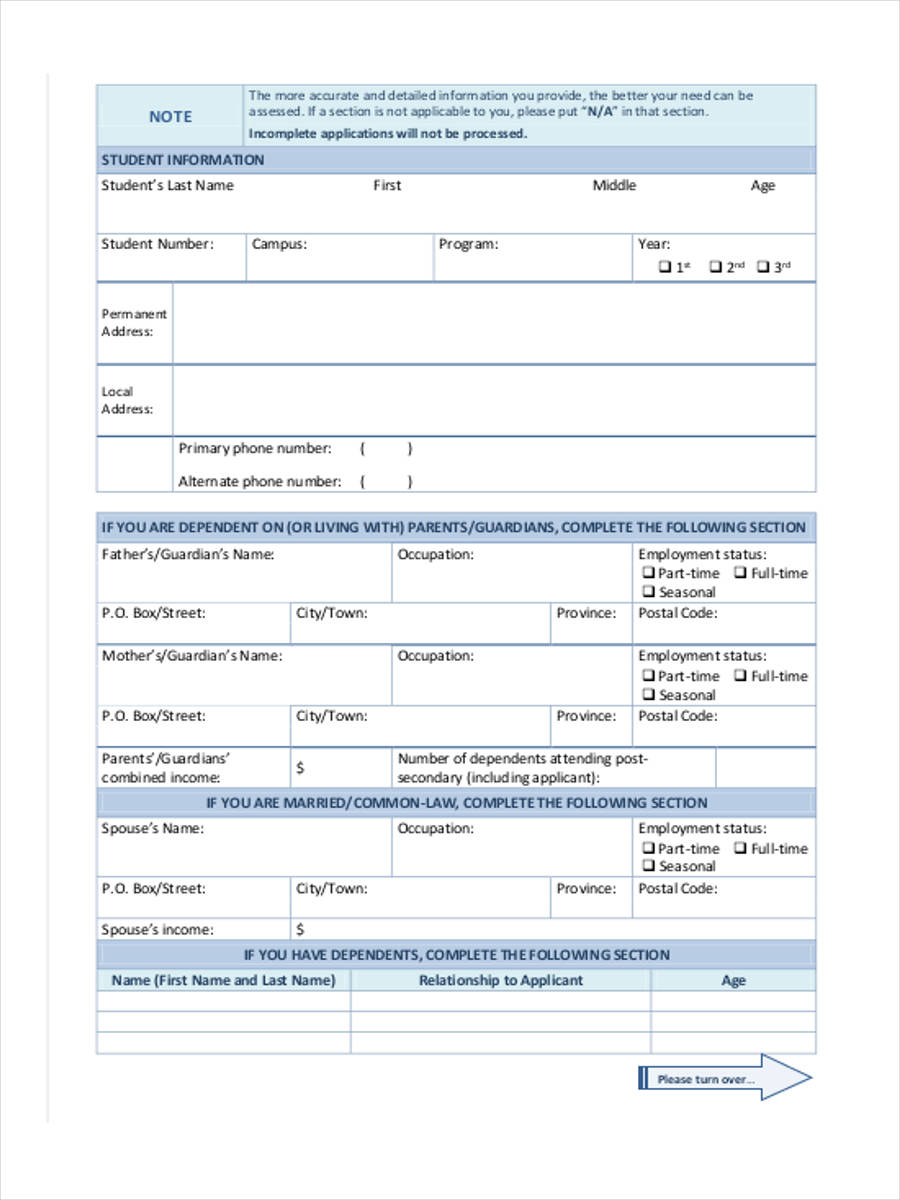

College Financial Statement

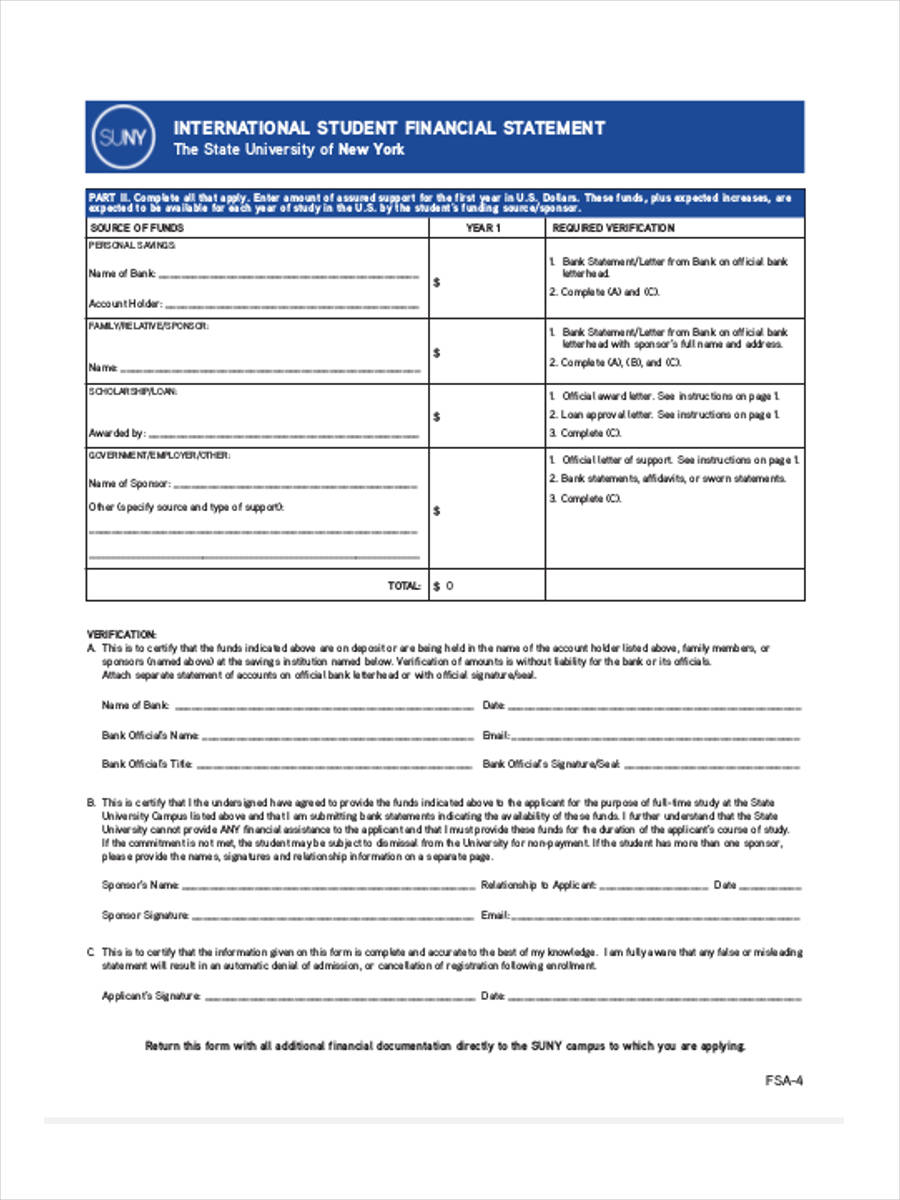

International Student Financial

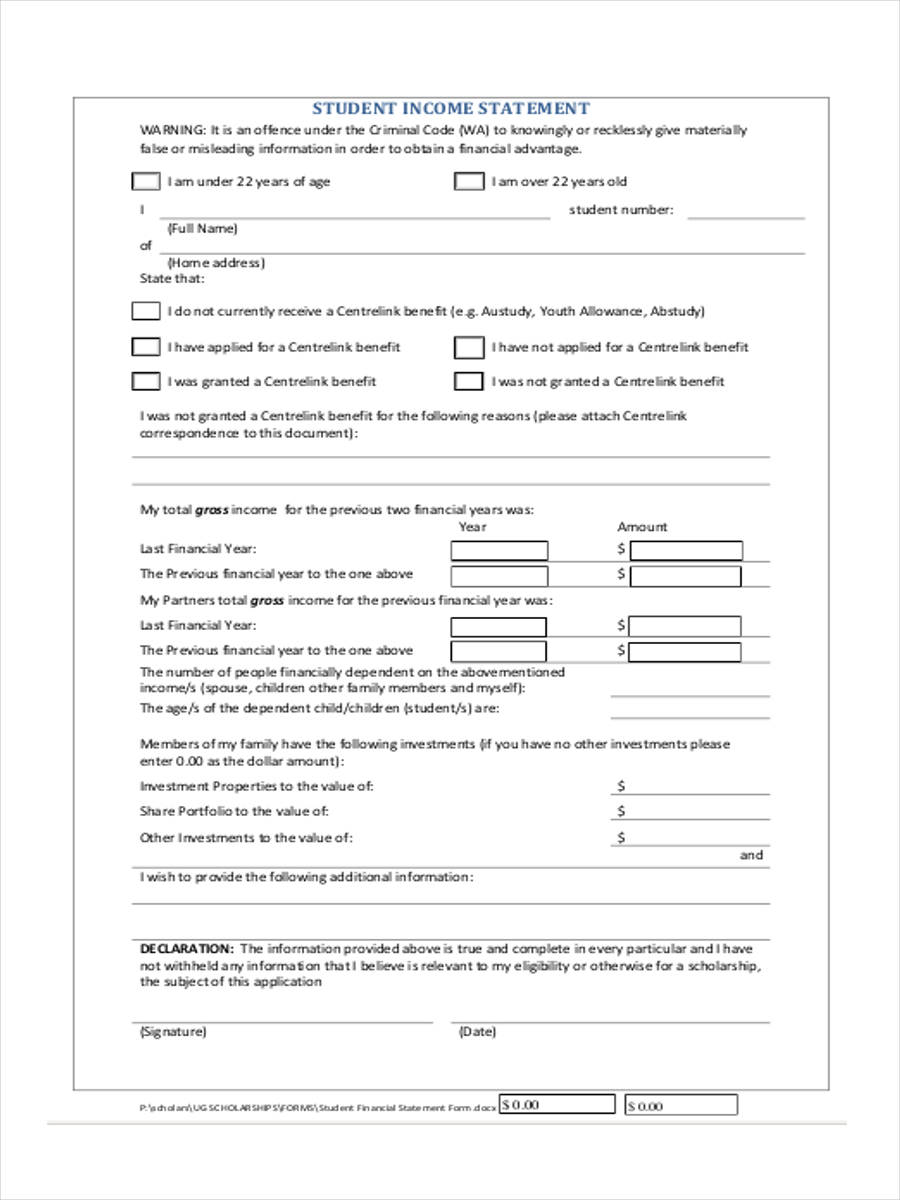

Student Income Statement

Blank Financial Statement

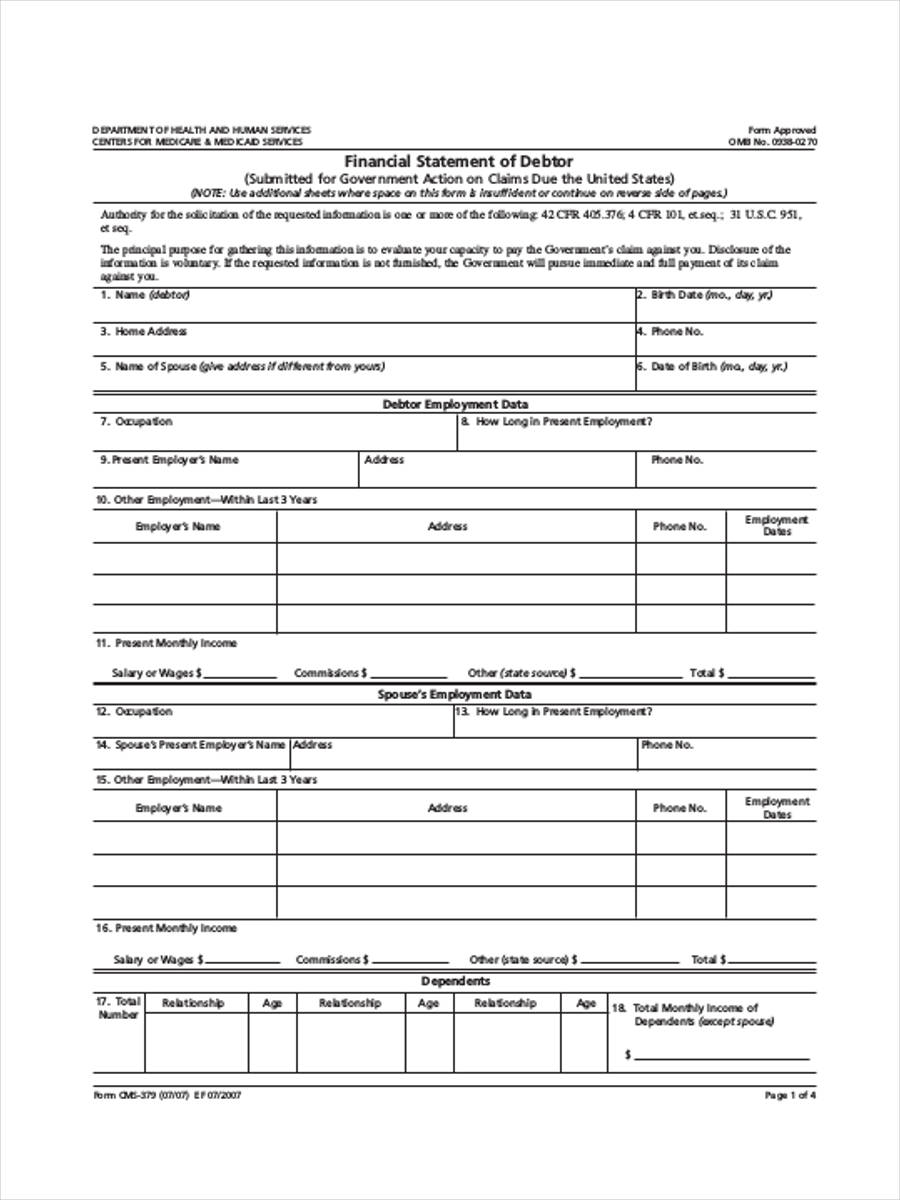

Financial Statement of Debtor

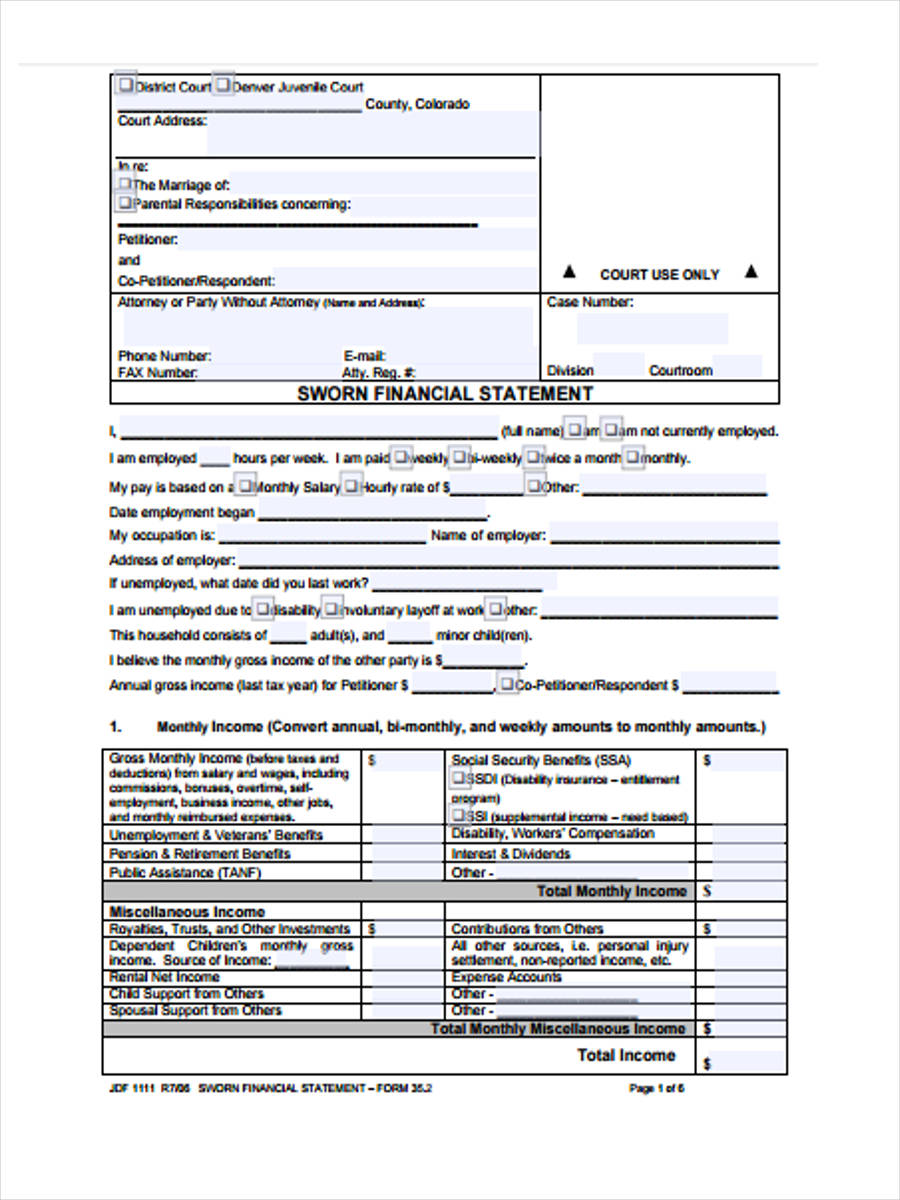

Sworn Financial Statement

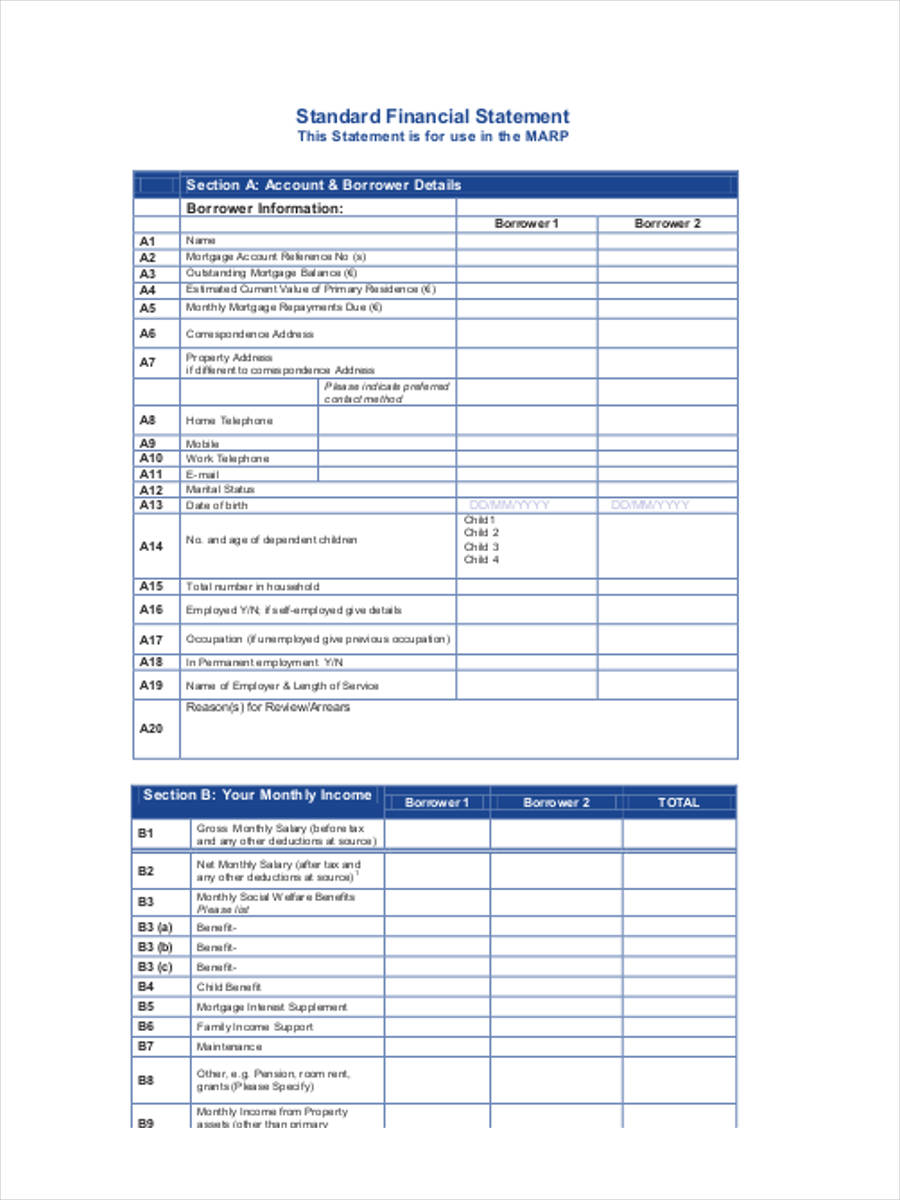

Standard Financial Statement

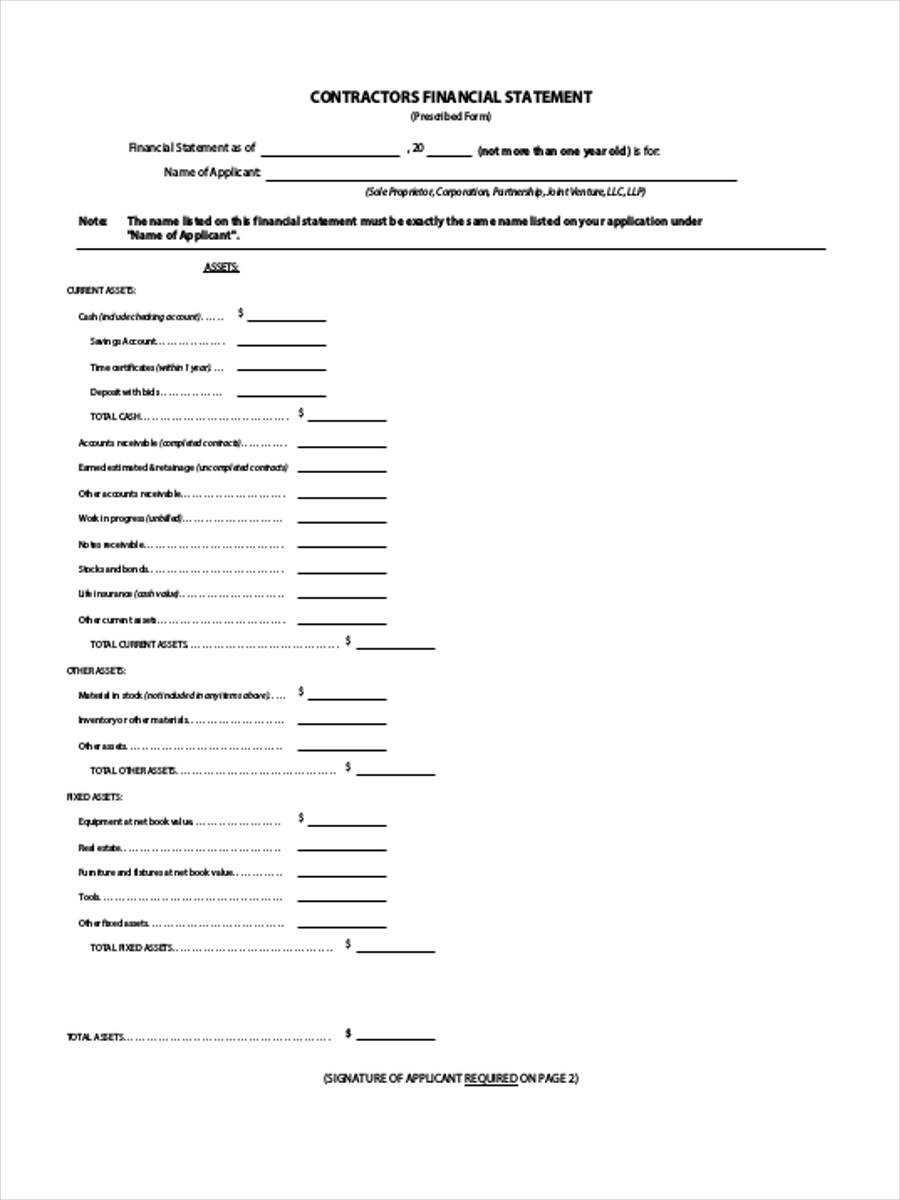

Contractor’s Financial Statement

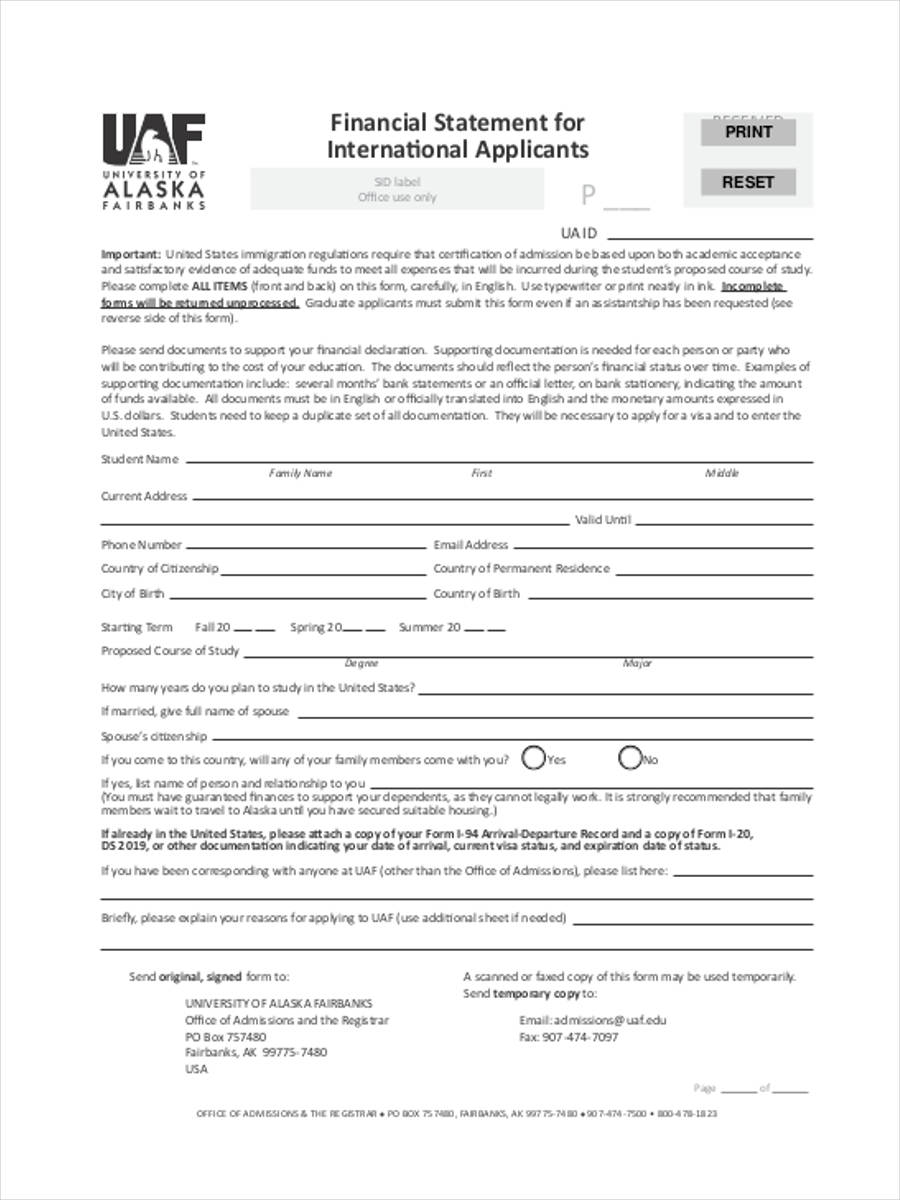

Financial Statement Application

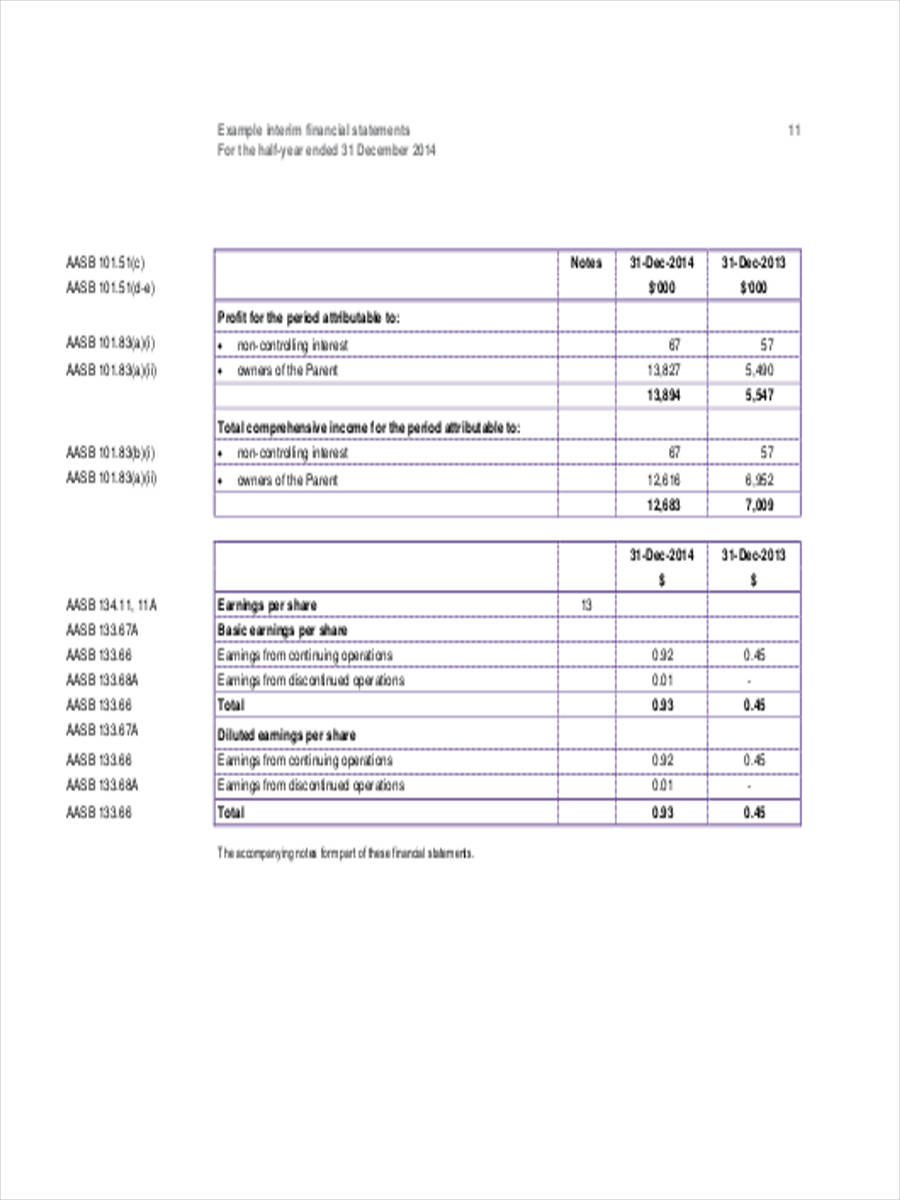

Interim Financial statement

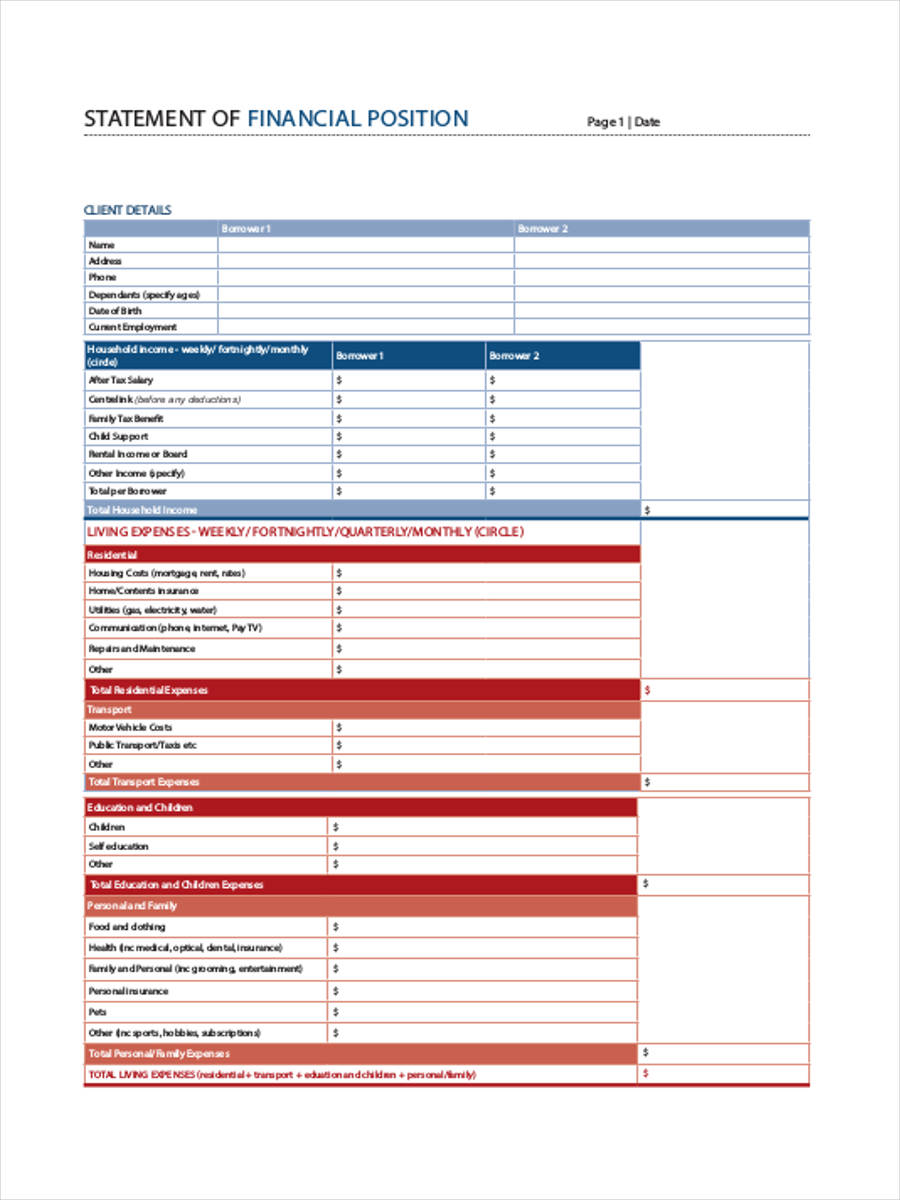

Statement of Financial Position

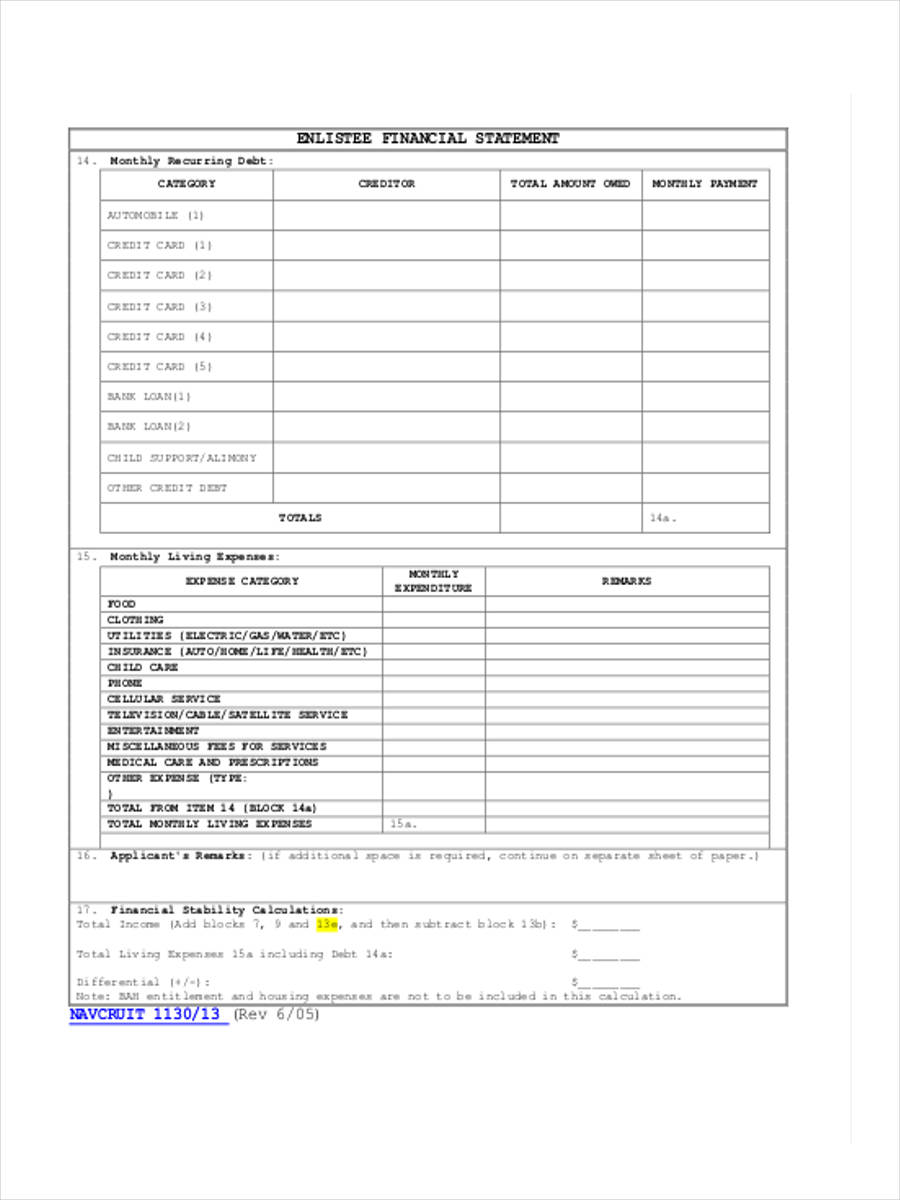

Enlistee Financial Statement

Financial Statements in XLS

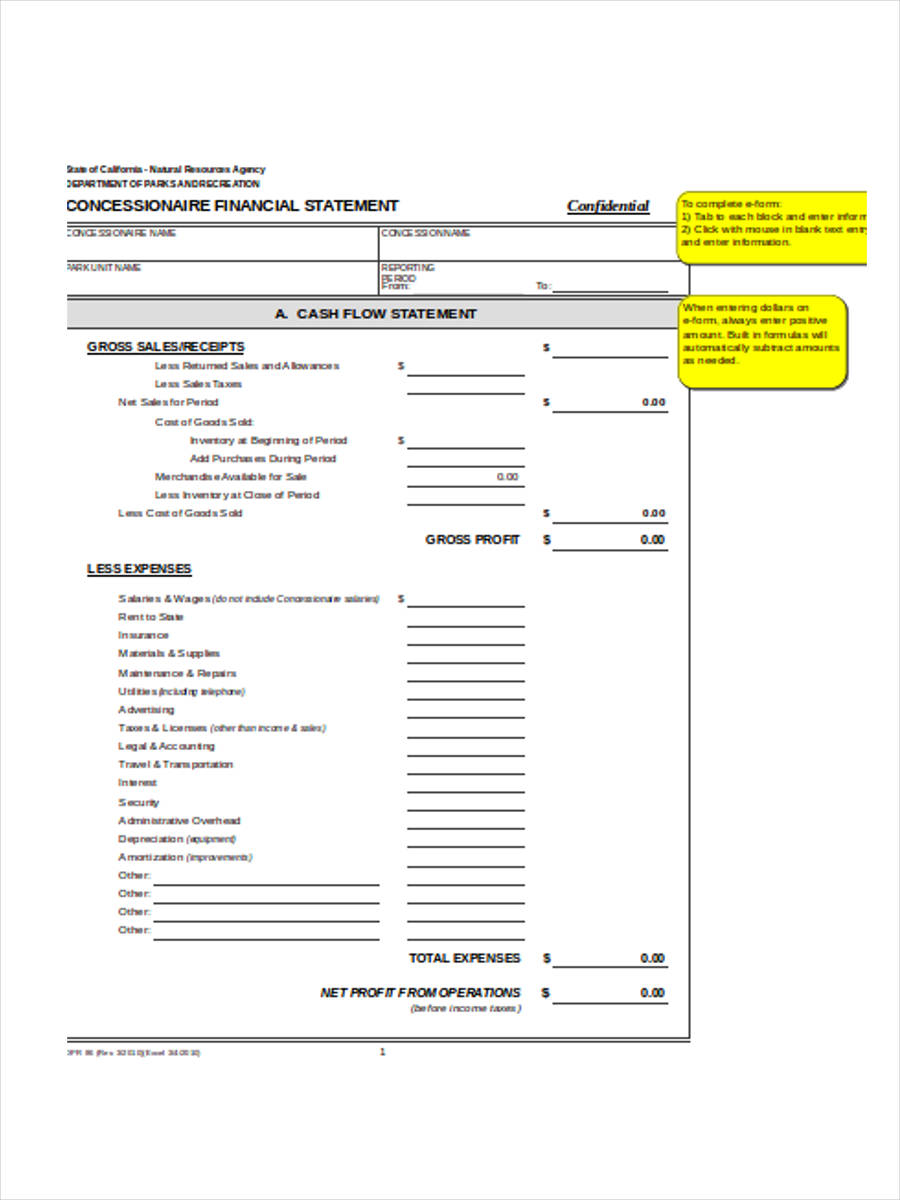

Concessionaire Financial Statement

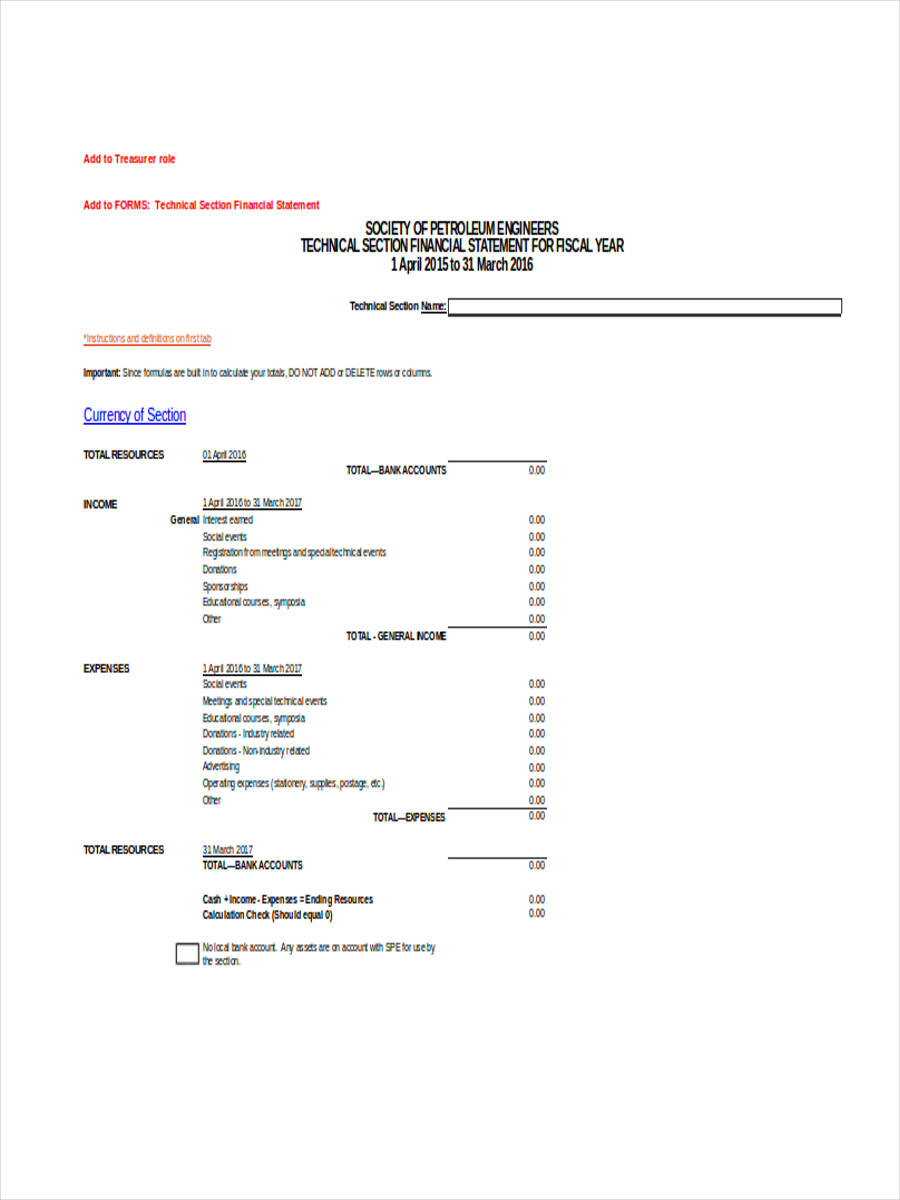

Technical Section Financial Statement

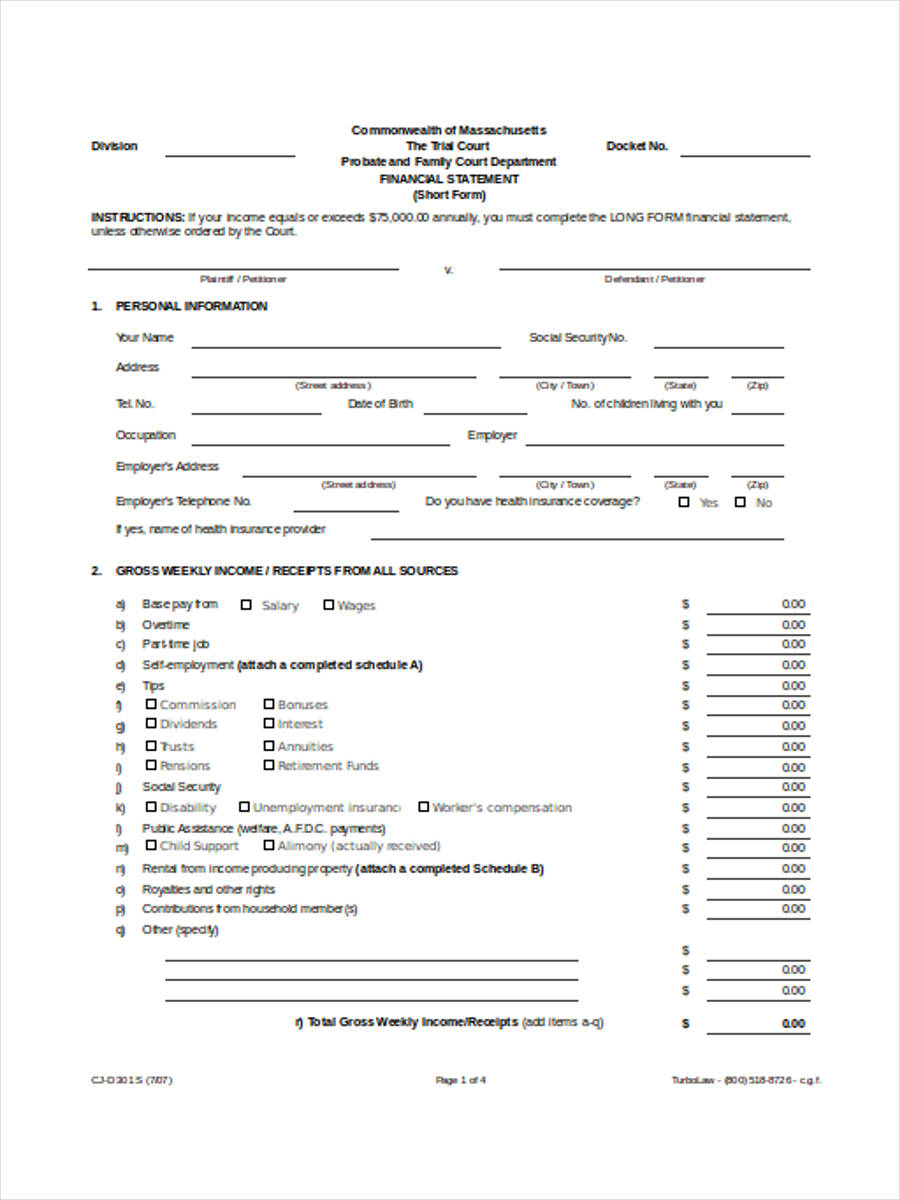

Short-Form Financial Statement

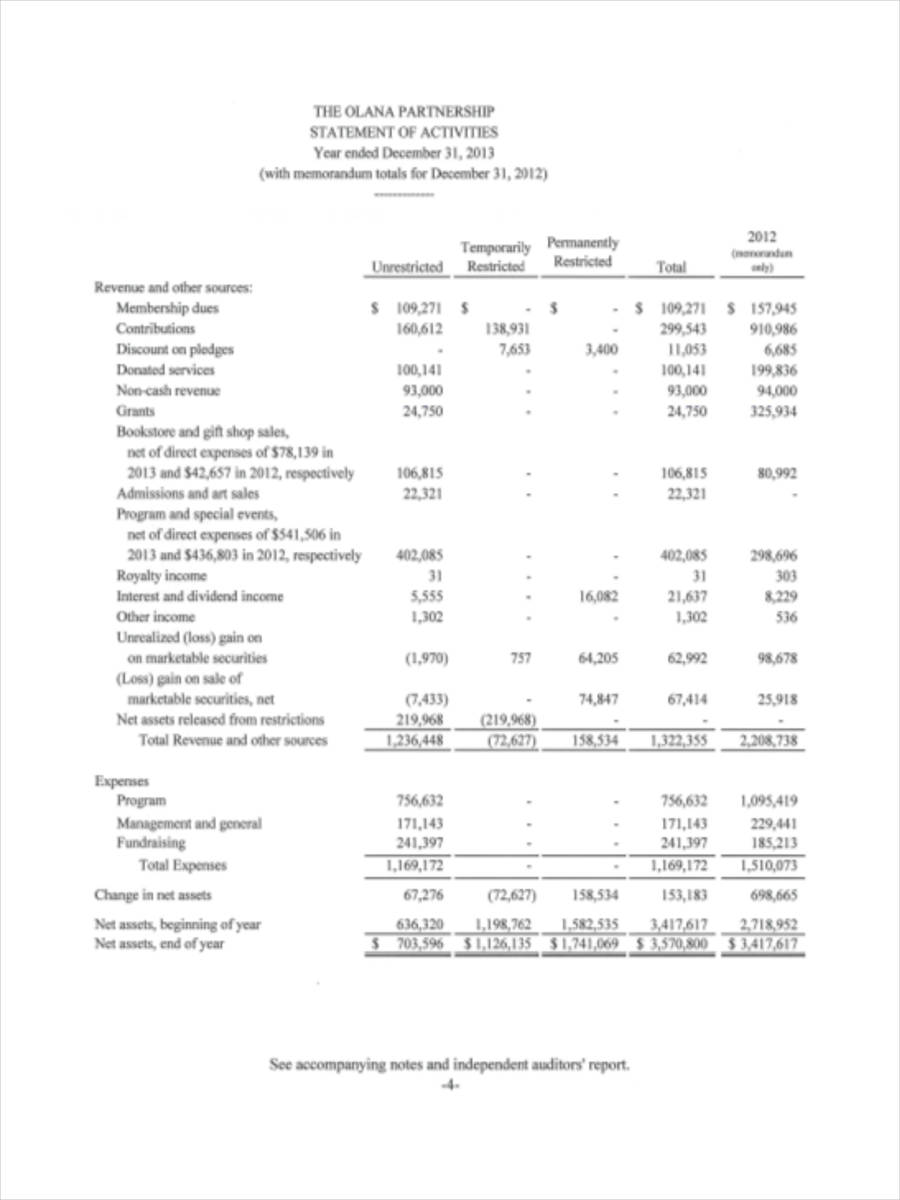

Partnership Financial Statement

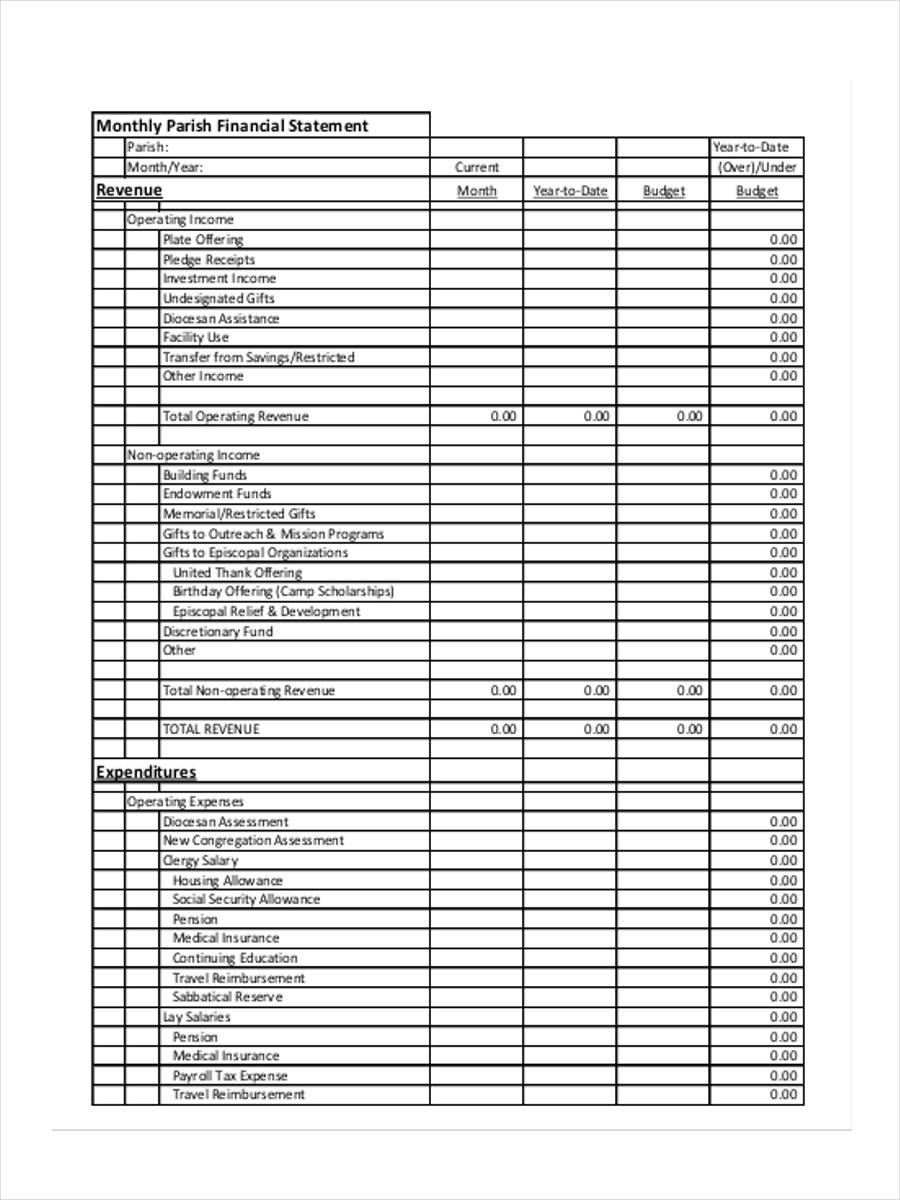

Monthly Financial Statement

Free Financial Statement

Commercial Debtor Financial Statement

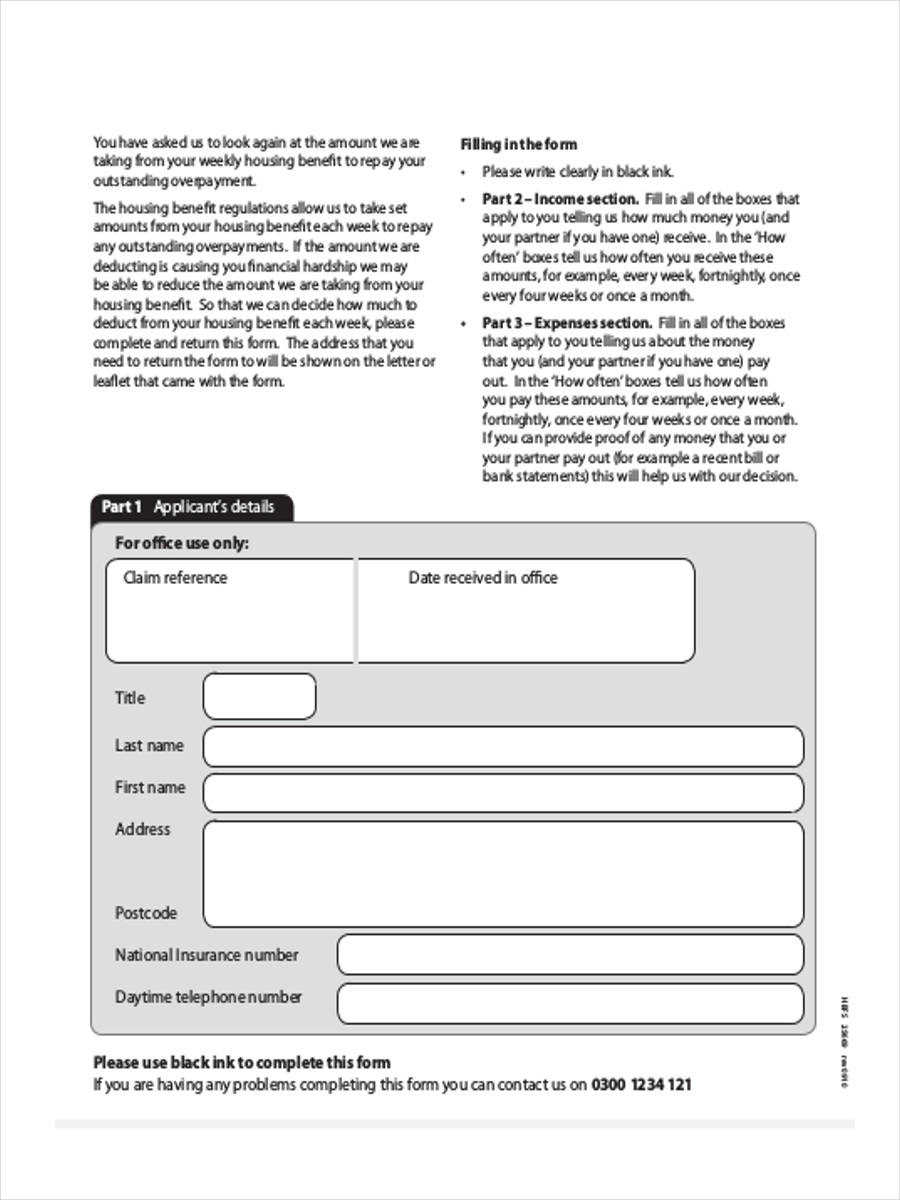

Housing Benefit Financial Statement

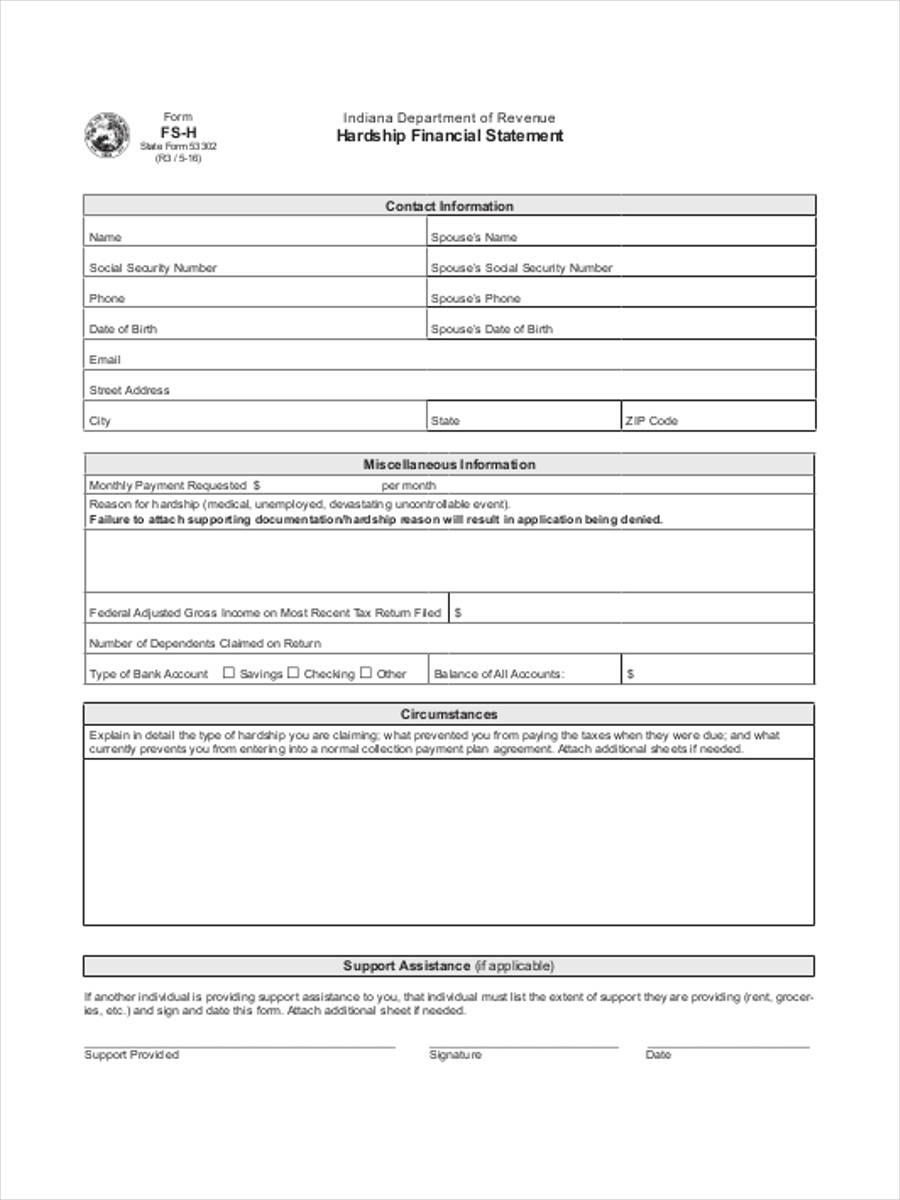

Hardship Financial Statement

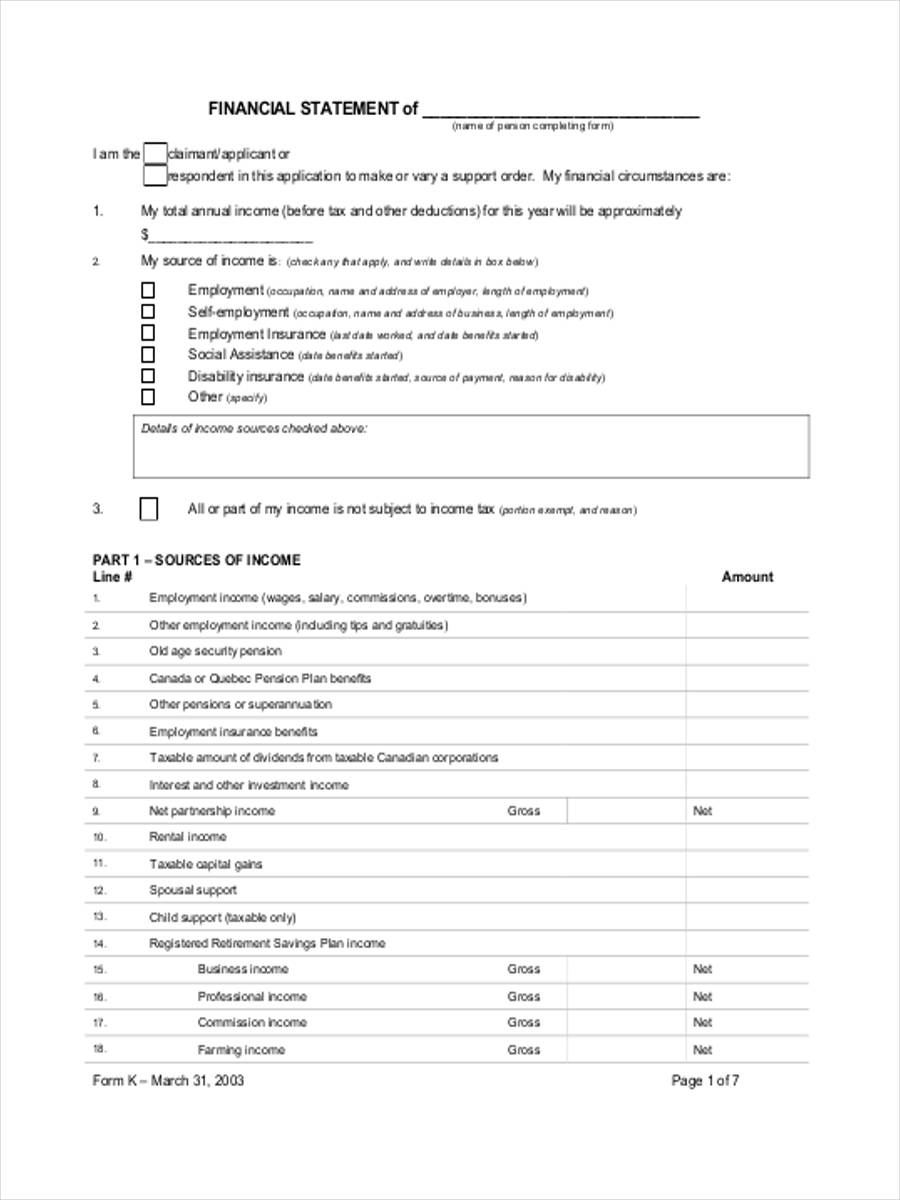

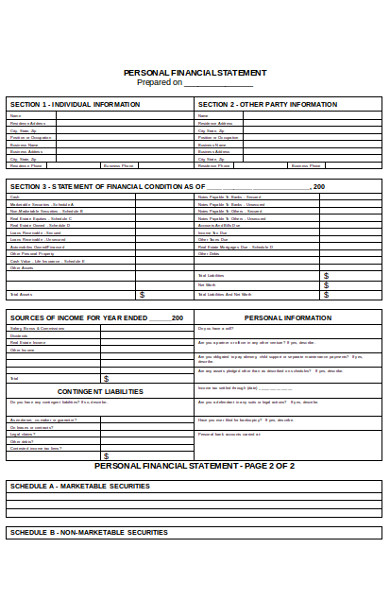

Personal Financial Statement Form

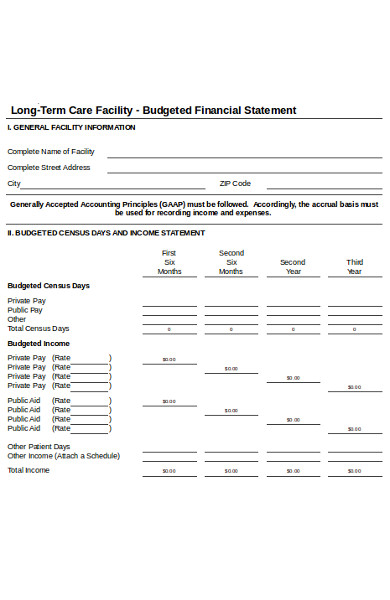

Budgeted Financial Statement Form

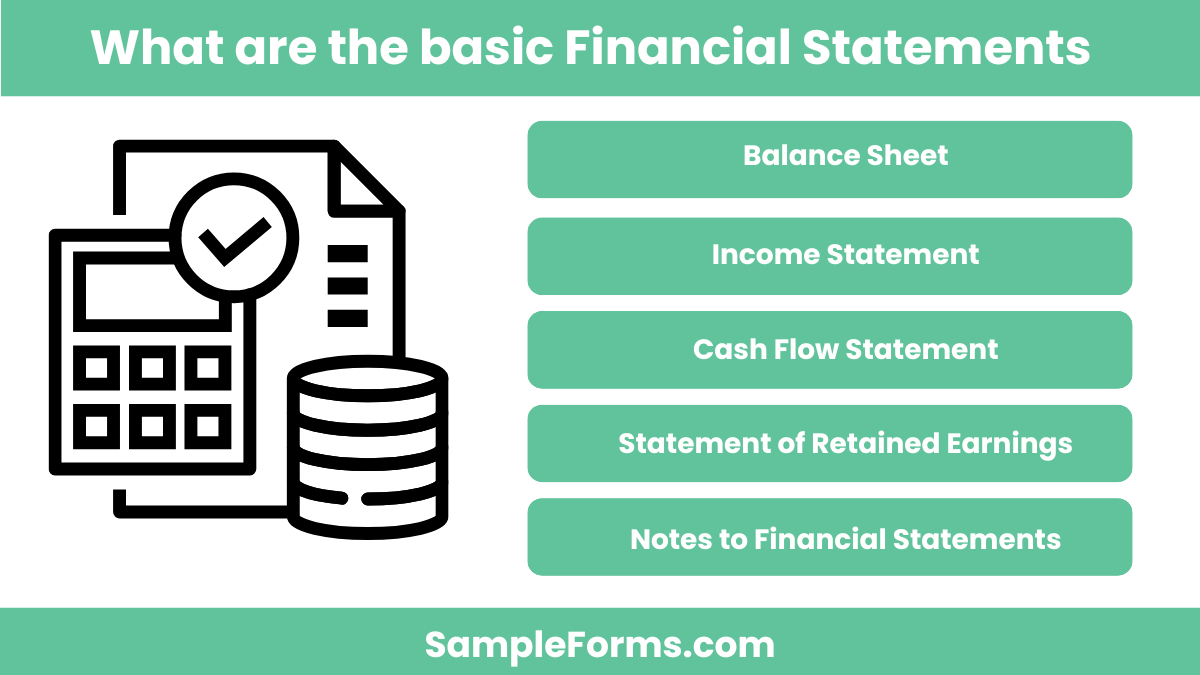

What are the 5 basic financial statements?

Financial statements provide an overview of an organization’s financial health. These statements ensure transparency and help in making informed financial decisions.

- Balance Sheet: Like an Employee Statement Form, it lists assets, liabilities, and equity to show the company’s net worth.

- Income Statement: Details revenue, expenses, and profit to analyze financial performance.

- Cash Flow Statement: Tracks cash inflows and outflows from operations, investments, and financing.

- Statement of Retained Earnings: Shows changes in equity, including profits reinvested in the business.

- Notes to Financial Statements: Provides additional details on accounting policies and financial assumptions.

How to write a personal financial statement?

A Personal Financial Statement Form summarizes an individual’s financial position, helping in financial planning, loan applications, and investment decisions.

- List Assets and Liabilities: Similar to a Business Financial Statement Form, include cash, real estate, loans, and credit balances.

- Document Income Sources: Record salary, business earnings, rental income, or other revenue streams.

- Calculate Net Worth: Subtract liabilities from assets to determine financial stability.

- Include Monthly Expenses: Track recurring costs such as rent, utilities, insurance, and savings.

- Review and Update Regularly: Keep the statement accurate by revising it as financial situations change.

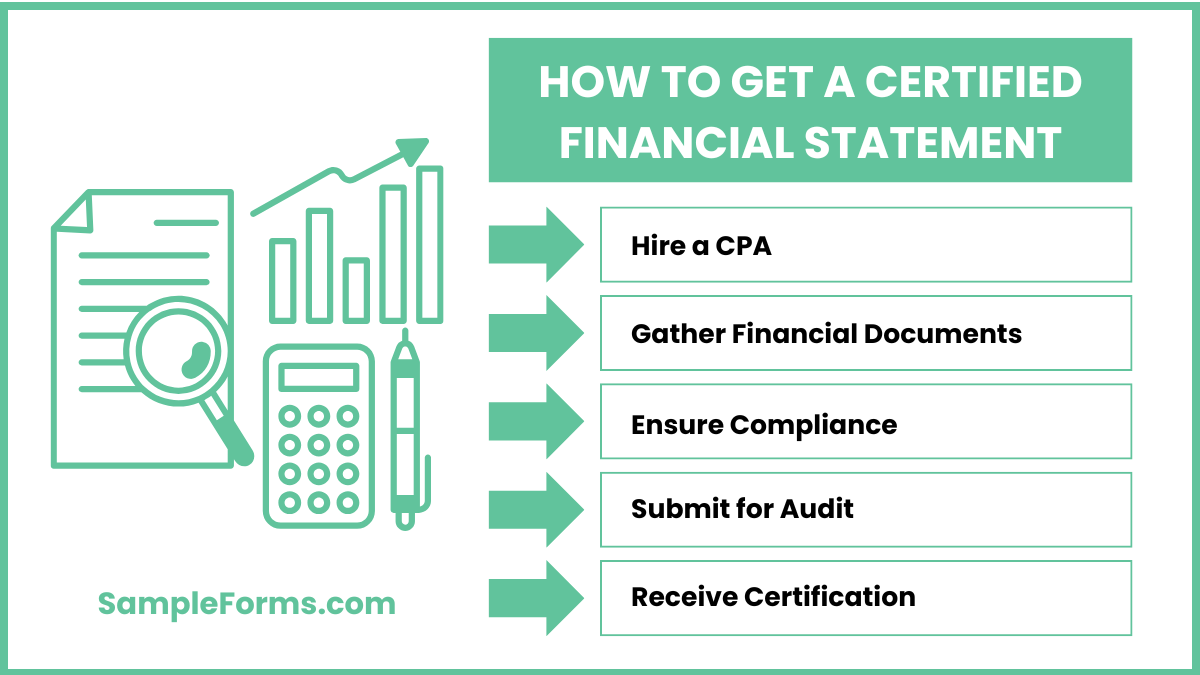

How do I get a certified financial statement?

A certified financial statement is an audited financial report prepared by a licensed accountant, ensuring accuracy and compliance with accounting standards.

- Hire a CPA: A certified public accountant verifies and signs the statement, like verifying an Operating Statement Form in legal cases.

- Gather Financial Documents: Provide balance sheets, income statements, tax returns, and bank statements.

- Ensure Compliance: Follow accounting regulations and standards required for certification.

- Submit for Audit: Allow the CPA to review and validate financial records.

- Receive Certification: Once approved, the statement is certified for official use in loan applications, tax filings, or investor reports.

What are the 4 most common financial statements?

Financial statements are essential for understanding an organization’s financial position, guiding decision-making, and ensuring regulatory compliance.

- Income Statement: Like an Witness Statement Form, it shows revenue, expenses, and profit over a specific period.

- Balance Sheet: Reports assets, liabilities, and equity, providing a financial snapshot.

- Cash Flow Statement: Tracks cash movements in operations, investments, and financing.

- Statement of Changes in Equity: Displays retained earnings, dividends, and shareholder contributions.

How to do your own financial statement?

Creating a Financial Statement Form helps individuals and businesses track financial health and make informed decisions.

- Collect Financial Data: Similar to a Counseling Statement Form, gather income records, asset details, and liabilities.

- Create a Balance Sheet: List assets (cash, property) and liabilities (loans, debts) to determine net worth.

- Prepare an Income Statement: Record income sources and expenses for accurate financial tracking.

- Develop a Cash Flow Report: Track cash inflows and outflows to monitor liquidity and financial stability.

- Review and Update Regularly: Adjust the statement periodically to reflect financial changes and ensure accurate reporting.

Do financial statements need to be notarized?

Financial statements do not usually require notarization unless used for legal purposes. Similar to an Accident Statement Form, notarization may be necessary when submitting documents for official verification or court proceedings.

How much does it cost to prepare financial statements?

The cost varies based on complexity. Like an Income Statement Form, fees range from $100 to $1,000+ depending on whether an accountant, CPA, or firm is hired for preparation.

Who can prepare financial statements?

Financial statements can be prepared by accountants, CPAs, or business owners. Similar to a Personal Statement Form, they must be accurate, structured, and compliant with financial regulations for credibility.

What are the golden rules of accounting?

The three golden rules: Debit what comes in, credit what goes out; Debit expenses and losses, credit income and gains; Debit the receiver, credit the giver—ensuring financial accuracy like a Landlord Statement Form.

Does a financing statement need to be signed?

Yes, a financing statement requires authorized signatures, similar to a Medical Statement Form, to validate transactions, ownership claims, and financial obligations in legal or business dealings.

Can you prepare your own financial statements?

Yes, individuals and businesses can create statements. Like a Personal Financial Statement Form, tracking income, expenses, assets, and liabilities ensures proper financial planning, budgeting, and tax compliance.

Are financial statements the same as tax returns?

No, tax returns report taxable income, while financial statements summarize financial health. Like a Legal Statement Form, both serve different purposes but are essential for financial transparency.

What is a financial statement form 413?

A Financial Statement Form 413 is used by the SBA to assess net worth and creditworthiness, similar to a Profit and Loss Statement Form, helping determine financial stability for loans.

Can a bookkeeper prepare financial statements?

Yes, bookkeepers can prepare basic statements, but audited reports require a CPA. Like a Health Statement Form, financial reports must be precise for credibility and compliance.

What qualifies as an audited financial statement?

A CPA-reviewed financial statement ensuring accuracy, compliance, and reliability. Similar to a Wealth Statement Form, it provides verified financial data for investors, lenders, and regulatory bodies.

A Financial Statement Form is crucial for financial documentation, ensuring proper tracking of income, expenses, and liabilities. Whether for personal finance management or business reporting, an accurately structured financial statement enhances decision-making and regulatory compliance. Various templates help individuals and businesses create standardized financial reports tailored to their needs. Using a Financial Review Form, organizations can efficiently document financial activities, reducing errors and ensuring transparency in financial dealings. A well-prepared financial statement supports tax preparation, audits, and financial forecasting, making it an essential financial management tool.

Related Posts

-

FREE 14+ Tax Statement Forms in PDF | MS Word

-

FREE 6+ Contribution Margin Forms in Excel

-

FREE 5+ Gross Profit Margin Forms in Excel

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

FREE 5+ Sample Accident Statement Forms in PDF

-

Statement Form

-

Salary Statement Form

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]