You are a certified public accountant tapped by a businessman, worried by the decomposing state of his business’s finances. After discussing and reaching an agreement to save his business from bankruptcy, you don your superman cape and set out to save that businessman from financial ruin. After receiving the financial documents that you requested from the businessman, you examined them and found out how bad the situation is. You then prepared summaries and compiled them in a Financial Audit Form and find out that there is still hope for the fellow’s business. The next day, armed to the teeth with a pen and finished Financial Audit Form inside your briefcase, you hopped in your car, ready to fix that poor fellow’s business from the eventual misfortune of insolvency.

What is a Financial Audit Form

Financial Audit Forms are used by organizations and businesses to conduct a review of their financial assets and management. This form is a kind of audit form specifically employed to ascertain a business’s financial status and its financial management’s efficiency and effectiveness. It also summarizes the organization’s assets, liabilities, equity, and cash flow. Lastly, it also helps an organization to solve financial problems and improve existing policies and practices. Certified public accountants use financial Audit Forms in performing audits.

FREE 4+ Financial Audit Forms in PDF

Financial Audit Forms are auditing forms utilized by certified public accountants whenever they set out to conduct a financial audit. Listed below are Financial Audit Form Samples that you can use as a reference when making a Financial Audit Form or use it as it is to save time. These ready-made Financial Audit Form samples are highly editable and ready to print.

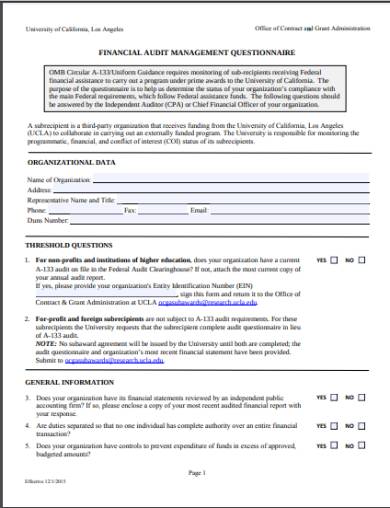

1. Financial Management Audit Questionnaire Form

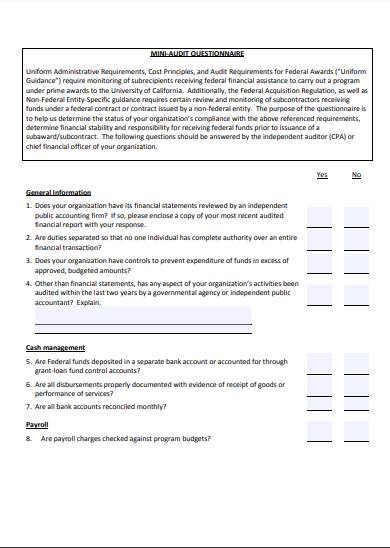

2. Mini Financial Audit Questionnaire Form

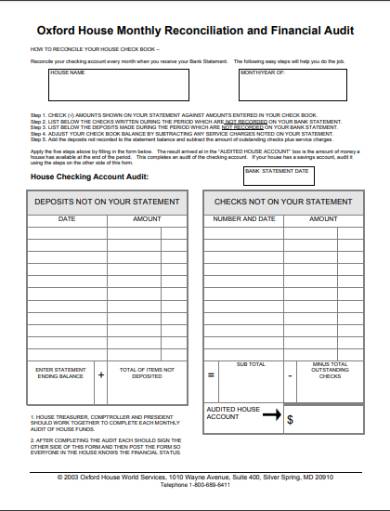

3. Monthly Reconciliation and Financial Audit Form

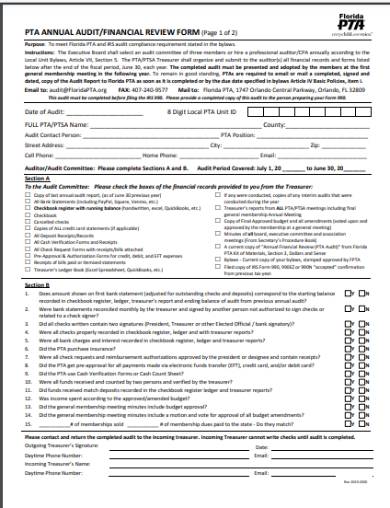

4. Financial Audit & Review Form

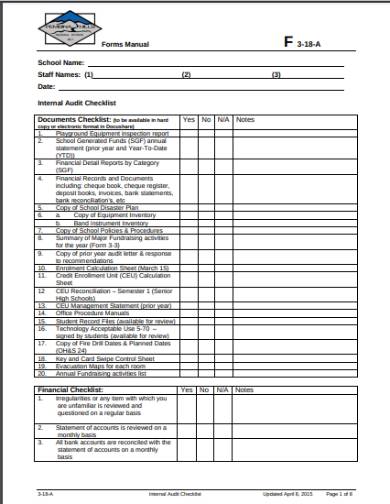

5. Internal Financial Audit Checklist Form

What are Financial Audits

Organizations conduct financial audits to determine the fairness and accuracy of their financial statements. Auditing became a staple towards the late 19th century in response to the extensively inaccurate and embellished financial reports that resulted in the stock market crash of 1929 and eventually caused the great depression. Consequently, this led Congress to pass the Securities Acts of 1933 and 1934, which led to standard accounting and auditing practices.

Financial audits are conducted through the use of various documents such as sales receipts, invoices, and bills. Auditors probe into these documents to enable them to gather correct and timely data to give an insight into an organization’s financial situation. Financial audits provide an unbiased, transparent, and accurate report on the status of an organization’s financial holdings and assets.

How to Make a Financial Audit Form

Being a certified public accountant hired to perform a financial audit on someone’s business, you are more likely to spend more time shuffling and examining financial documents and at the same time, busy yourself in making journal entries using the figures reflected on those documents. That means that there’s lesser time for you to prepare a Financial Audit Form from scratch. To help you with that, using a ready-made sample of a Financial Audit Form enables you to make a proper audit form quickly and easily. Written below are the steps on how to conveniently make a Financial Audit Form in accordance with the principles of accounting.

Step 1. Gather Financial Documents and Prepare Journal Entries

To begin the process of financial auditing, the first thing you should do is gather the business’s financial documents. These documents contain the business’s transactions such as sales, loans, and purchases, which provide you an insight into the business’s cash flow. It also gives you the facts and figures which you will need to help you prepare a journal entry. Journal entries are summaries of the business’s assets, liabilities, income, and expenses. Prepare journal entries based on the facts and figures reflected on the documents gathered.

Step 2. Make a Ledger Account

Make a ledger account using the summaries or journal entries that you made previously. While journal entries are summaries of the business’s income and expenses, ledger accounts are the further summaries of the contents of journal entries. Ledger accounts are arranged by the following, first is the balance sheet followed by the income statement. The balance sheets are summaries of a business’s assets, liabilities, and owner’s equity. On the other hand, income statements show the business’s profit, income, and losses. Preparing ledger accounts enables you to reduce all the facts and figures into a brief and concise package.

Step 3. Get a Financial Audit Form Template

After making preparing your summaries of the business’s business’s assets, liabilities, income, and expenses, it’s time for you to make your Financial Audit Form. To get you started, download one of the Financial Audit Form samples included in this article. Making use of a ready-made template allows you to speed up the process of accomplishing your financial audit. It also allows you to regain the time lost from gathering financial documents and preparing summaries of the facts and figures from those. These ready-made templates are ready to use and download for free.

Step 4. Input your Findings in the Financial Audit Form

Input your findings from the ledger accounts you prepared previously, once you downloaded a ready-made template of the Financial Audit Form. To begin, answer the questions contained in the form by typing in your findings on the corresponding fields. Financial Audit Forms may sometimes come in the form of an audit checklist. Mark the box next to the question in the form based on your findings.

Step 5. Submit and Discuss your Findings

After completing the Financial Audit Form, you can either print or email it for submission. But, it is preferable to submit your Financial Audit Form personally so that you can discuss your findings with your client. Discussing your findings with your clients enables them to know the status of their business’s financial standing. It also helps them improve their current financial status, internal financial controls, policies, and practices.

Related Posts

-

What are Financial Accounting Forms? [ Objective, How to, Benefits, Guidelines ]

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF