We work hard to make ends meet. But sometimes it is not enough to cover the rent, bills, debts, and other dues. The possible solution to this problem is an extension form. With this document, you can request to extend the deadline and pay on the agreed date. However, if you are to file an extension, make sure to keep your promises, or else it will be forfeited. Let us take you into an in-depth discussion about extension forms with this article. Read more below.

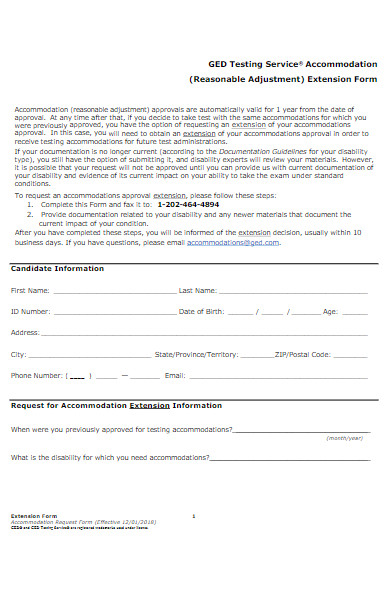

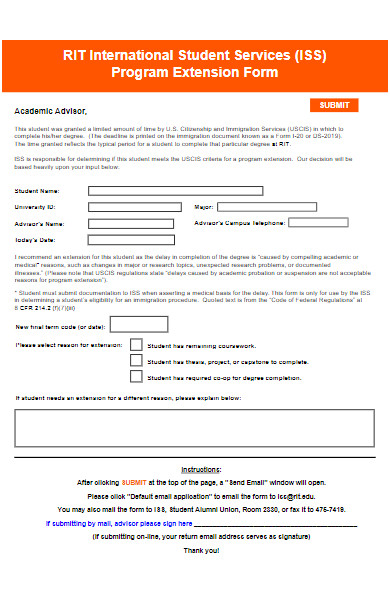

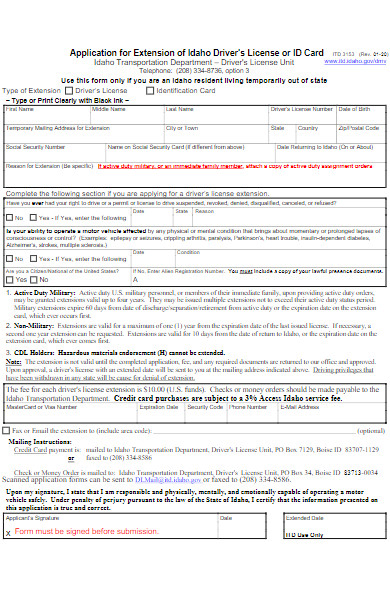

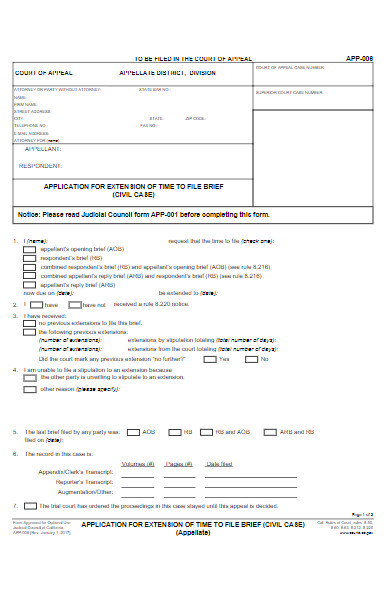

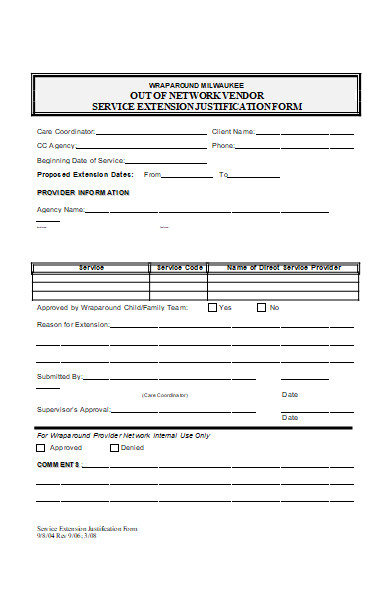

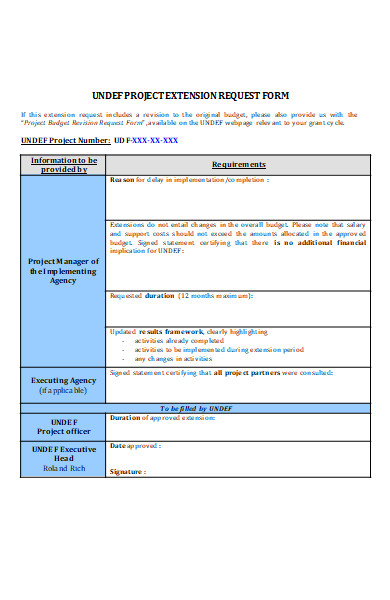

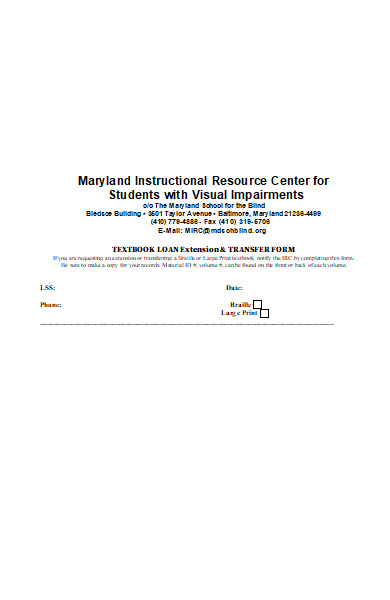

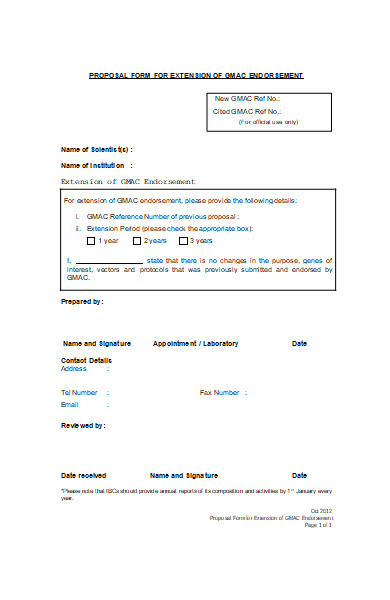

FREE 50+ Extension Forms in PDF | MS Word

What Is an Extension Form?

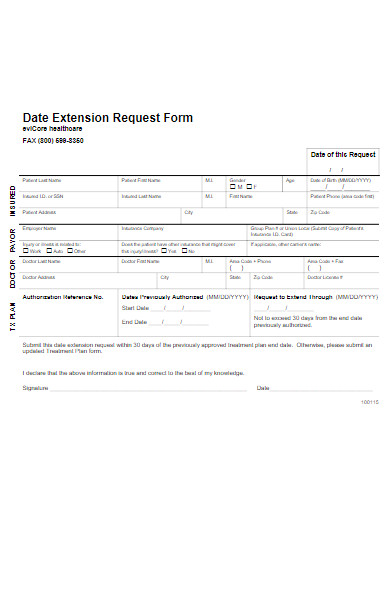

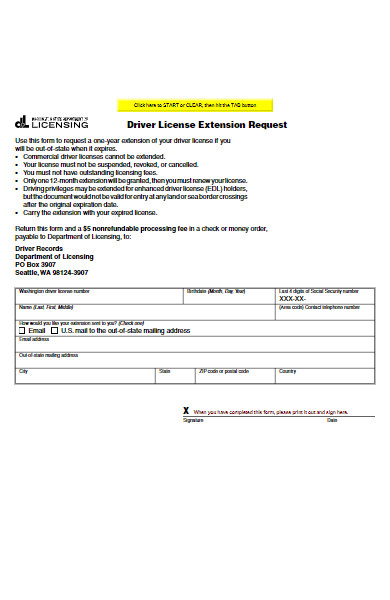

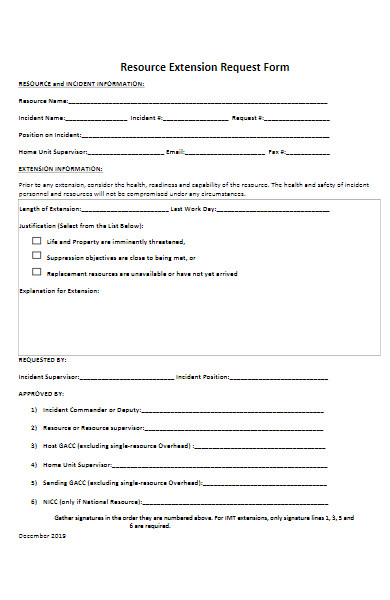

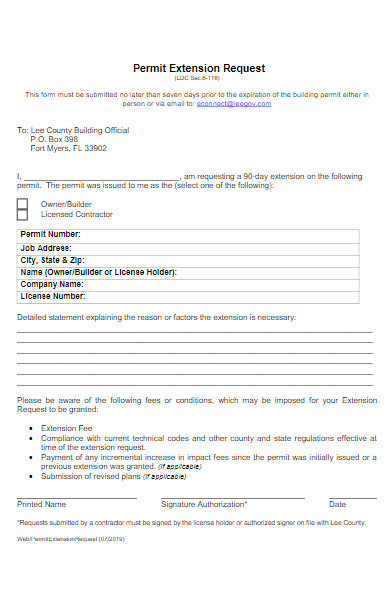

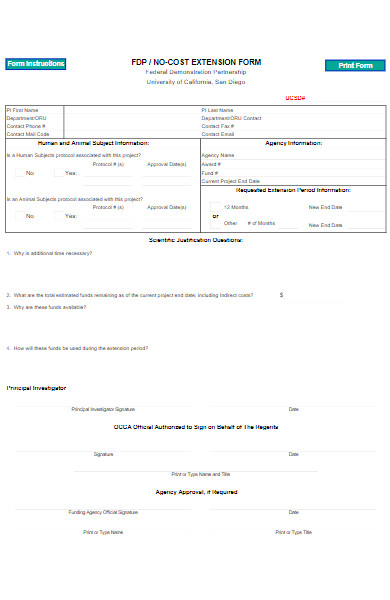

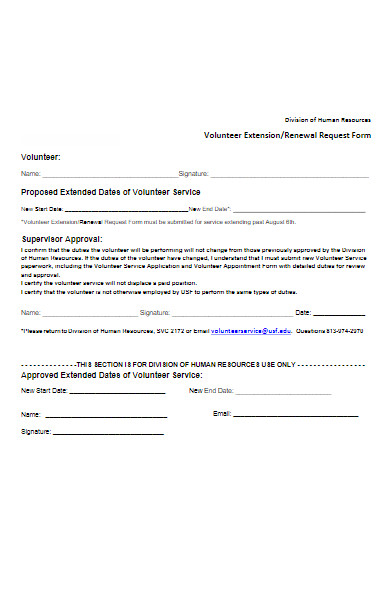

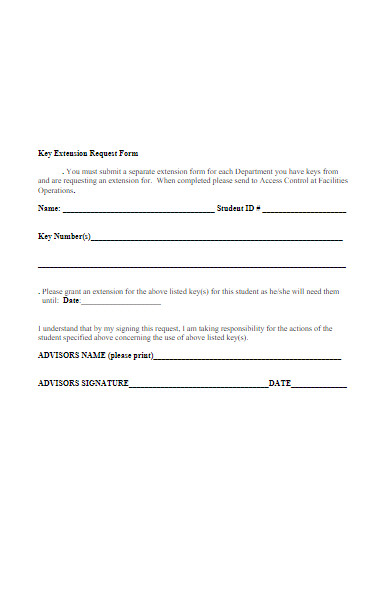

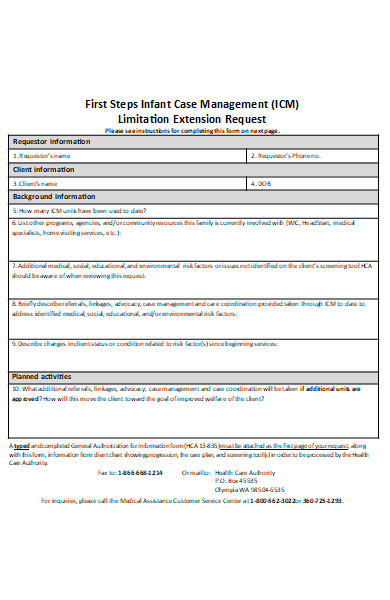

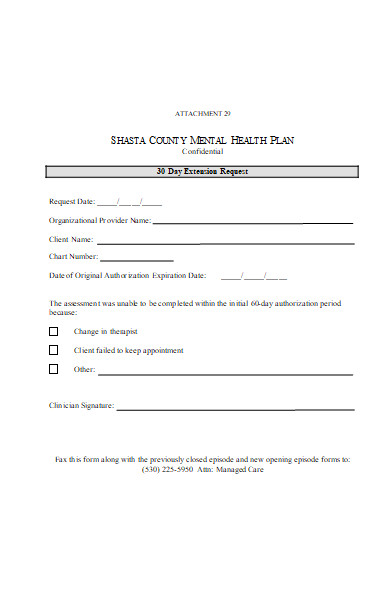

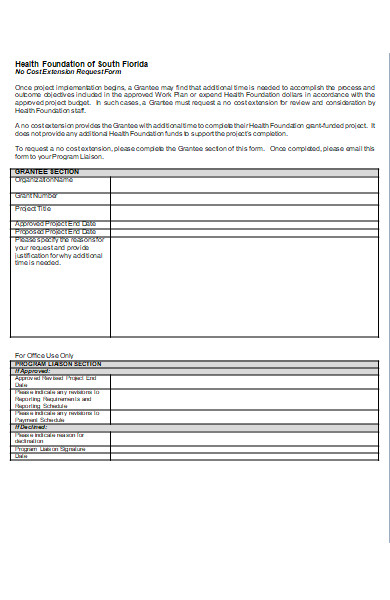

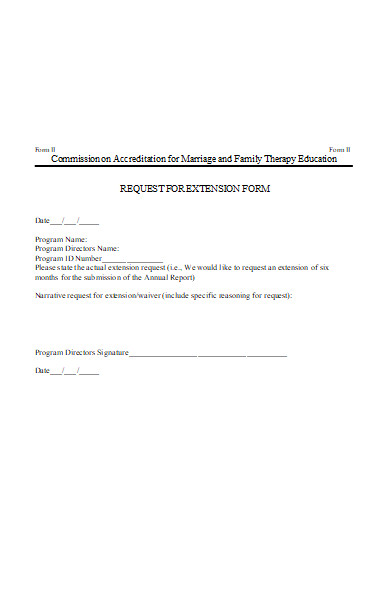

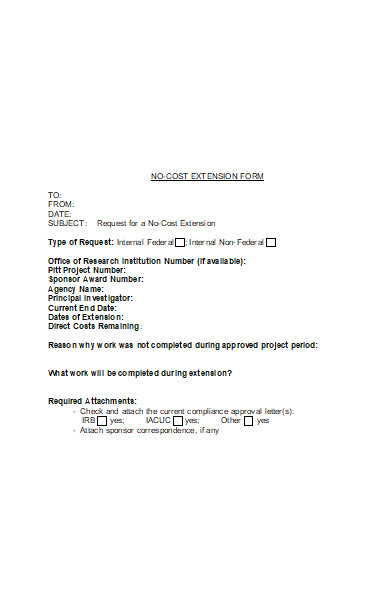

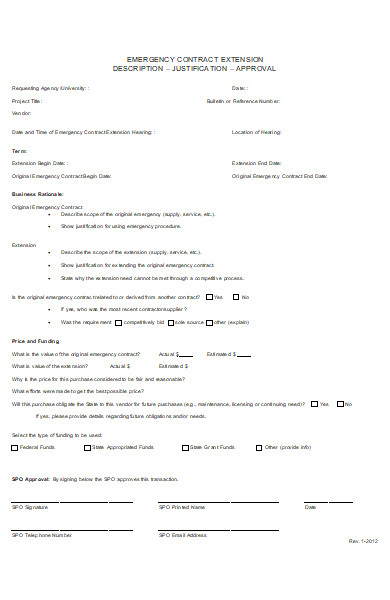

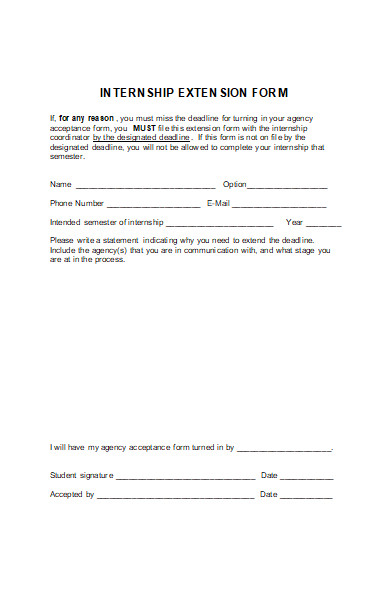

Often, a transaction can be extended if the parties involved agreed in doing so. But, in some cases, a submitter would have to file an extension request to approve it. Hence, the need for an extension form. This could be one of the reasons why many people extend payment dates rather than getting away from their responsibilities.

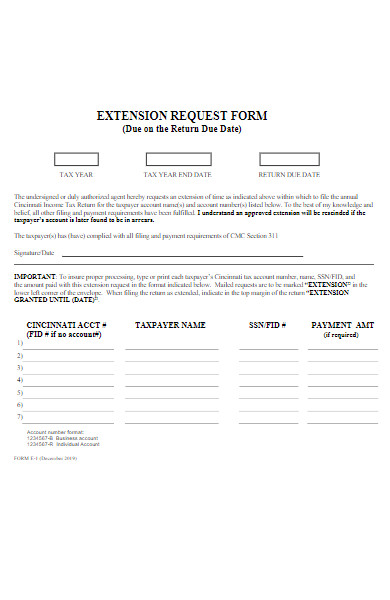

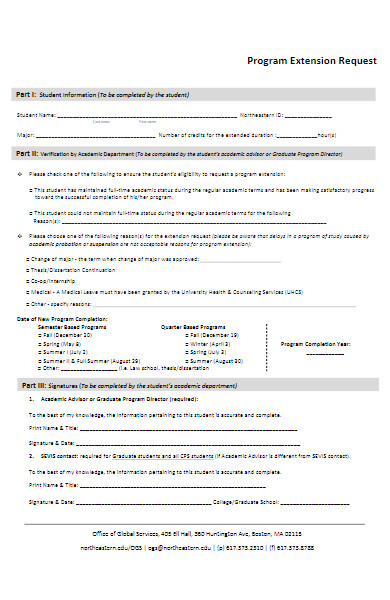

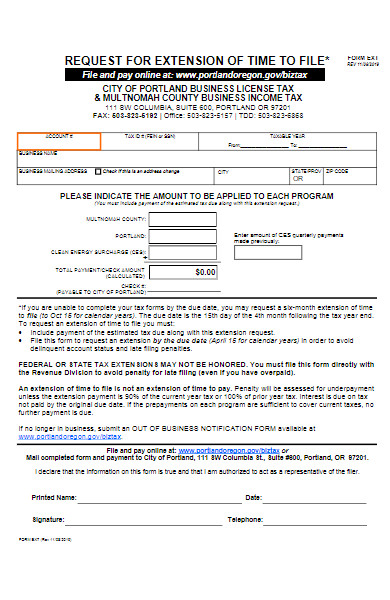

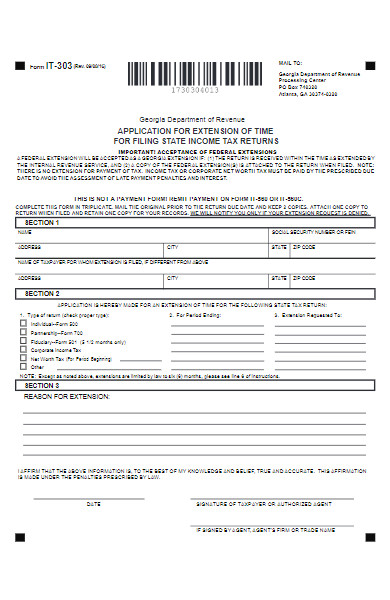

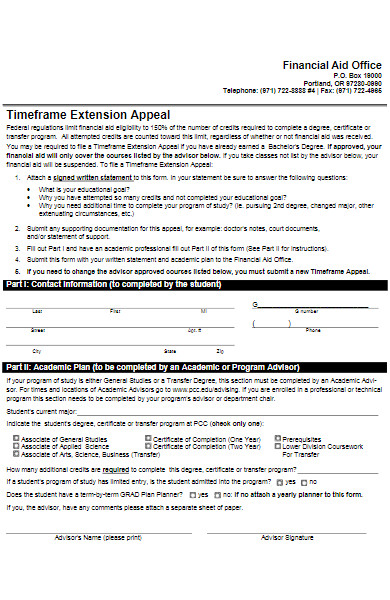

Furthermore, the extension form has multiple functions, which makes it an essential part of many industries. This form is commonly used by businesses and taxpayers who cannot file a tax return by the deadline. Depending on the state, a submitter can extend the due date for up to six months. With that, the extender will have a greater penalty than those who paid on time. Although the extension form has been proven useful for extending tax returns, it plays a significant role in other sectors as well.

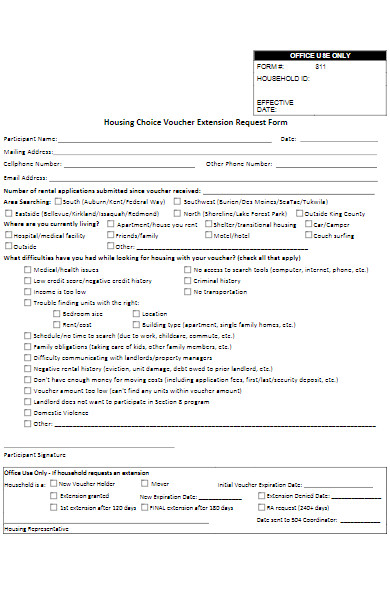

Say, for example, a property owner is expecting rent from his tenant. Unfortunately, the tenant cannot pay for his dues, assuming that he had an urgent debt to pay. So, both of them agreed to extend the deadline of the lease to a particular time. For the tenant, he has to file an extension form, and the landlord will sign the document to approve the rental agreement. Thus, it is important not to breach the terms and conditions written on the form. Even other public and private sectors, including universities and hospitals, use extension form to extend some transactions.

Why Is an Extension Form Important?

A deadline is the latest date to pay for dues. Unless the other party does not allow it, you can request to extend the due date. Some sectors automatically put up payment extension dates to allow their clients to find alternatives in meeting their dues—that is why an extension form is important because it gives the involved parties the time to navigate other options. Filing an extension could include penalties as well, but it depends on what the parties agreed with. In comparison to a contract form, approving an extension form means abiding with the rules it sets out. And violating these rules is forfeiting its purpose.

Cashing Out: The Things You Need To Know About Tax Extensions

Oliver Wendell Holmes Jr., former US Supreme Court Justice, once said: “I like to pay taxes, with them, I buy civilization.” Indeed, governments need a source of funding if they want to provide quality services to society. Today, the most common form of taxation is income tax—people contribute part of what they earn to the society.

The United States collects tax revenue through federal, state, and local taxes. And the taxes on income fall under federal and state levels. Based on a report by Statista, the two highest earners for the government are income taxes and payroll taxes in 2018. With this, many citizens consider society’s necessity of taxes. Here are things that will enlighten you about tax extensions.

1. Reduce the Risk of an Audit

An extension from the tax day—six months from the filing of extension—does increase the audit risk from the Internal Revenue Services (IRS). But do not file right away and amend later because an amendment will increase your audit risk.

2. Pay Taxes Through the Year

Taxpayers are required to pay the tax due through the entire year. And it should be 100% of the previous year’s tax due, 90% of the current tax due. Otherwise, penalties can apply. Do this and withhold it with your annual wages so that it will apply evenly throughout the entire tax year.

3. Decrease Taxes After the Tax Year

According to Forbes, reducing taxes after the tax year is possible in many ways. That said, you should not rely on retroactively inputting data on tax forms. Ask questions if you find it challenging to understand complicated tax situation, or meet with a tax coach, to improve tax planning.

What Are the Benefits of Extension Forms?

When due dates are approaching, you may feel the need to cram yourself to comply with the requirements. But you do not have to stress out on the first half of the process because you can request for an extension. This will allow you additional time to prepare for your dues. Asking for an extension is a great option for people who are feeling stressed about the deadline or who have some other things on their plate. Remember, requesting an extension is easy, and it gives you benefits. More on this below:

1. Explore More Options

With additional time, you can explore more options or other alternatives, which you can use to your advantage. But, this period is limited, and you have to be critical in making choices. The need for extension may cause by the lack of preparation, reminder, reluctance, or all of the above. So, learn from these and sort out your future deadlines. The chance to extend is not always available, as much as possible, be obligated to look after your dues because no one would do it for you.

2. Gives More Time To Decide

How long the extension period will depend on the people involved. Six months is the least extension time in the taxation industry. But you can come up with reasonable longevity, which is suitable for the transactions involved. Allowing too long extensions may not be the best idea. If the decision requires approval from several people, make time to discuss why you come up with your ideas. Let them understand the reason behind the extension. The right extension period will give you enough time to decide without compromising the things ahead of you.

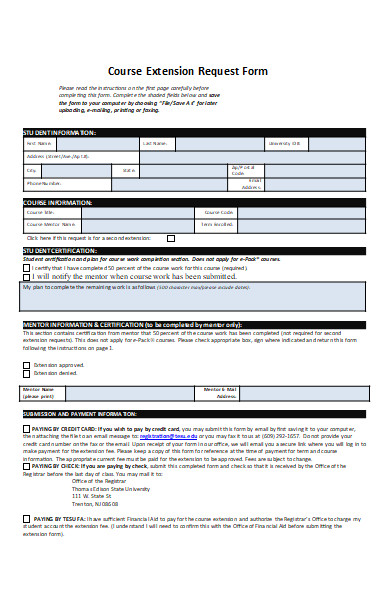

3. Easy Extension Request

Filing for an extension is easy. Instead of scrambling yourself to comply with the deadline—which is more likely unsuccessful—you can process an extension form. Usually, the extender needs to fill out an extension form to kick-off the process. After that, it will undergo a series of approval before it is considered complete. Its approval means extra time to take care of the postponed deadline. If the process seems challenging, there are instructions in the form which will guide you through the entire process.

4. Take Stress Off Your Shoulder

Like other forms: job application form, marketing form, and simple loan form, an extension form is effective in gathering relevant data in an organized manner. On top of that, it also initiates an action, records a transaction, and reports various results, which are essential in the work communication process. It is undeniable that a form document makes your life convenient and saves time. This way, you can channel some of your attention to other important things, especially those that do not allow extensions.

How Do You Craft an Extension Form in Four Steps?

Crafting an extension form is easy. Similar to other forms, such as content form, volunteer form, and tracking form, making this form will require thorough preparation and some of your time. With the following steps, we encourage you to gather everything you need before going directly into the task. Also, we made this list so that you can utilize your resources and end up with great results. Our list will elaborate on how to craft an extension form in four easy steps. Continue reading below.

Step 1: Download a Template

Using a template is optional. However, its functions are undeniably beneficial to your task. With a template, you can customize the document on various editing software and application. And, you can easily produce copies of the form. Also, downloading a stencil will guarantee professional-looking, useful, and easy-to-use extension form. Although starting from scratch lets you pay more attention to the details, using a template only requires a few tweaking, and your task is done! You do not have to go any further because you can get one from our list.

Step 2: Make a Plan and Draft

Planning is fundamental in every task. With a plan, you can establish your goals and set out a series of actions to achieve those goals. Also, it is the building block of the task and the cornerstone of the form. Creating a plan is simple. Answer this question: Why is there a need to make an extension form? The answer will lead you to your objectives—the first step of the plan. Meanwhile, start drafting the extension form to create a blueprint. This will be your reference as you complete the extension form.

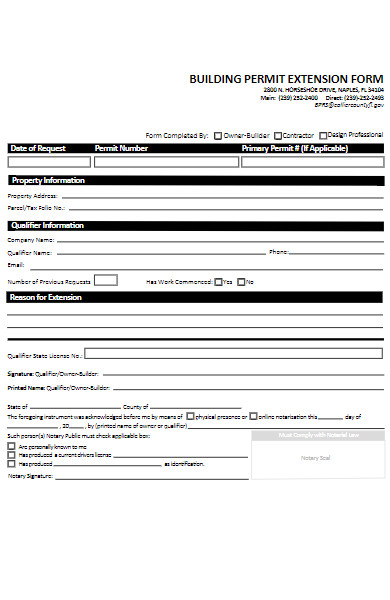

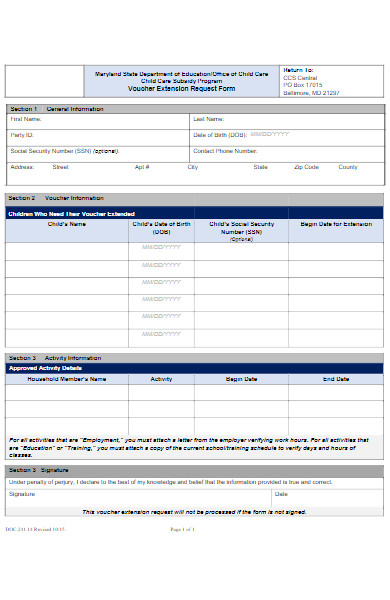

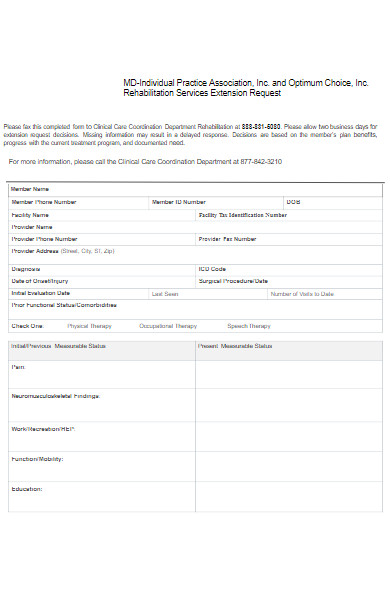

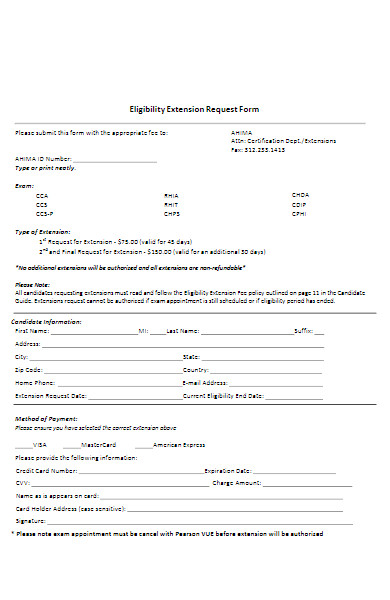

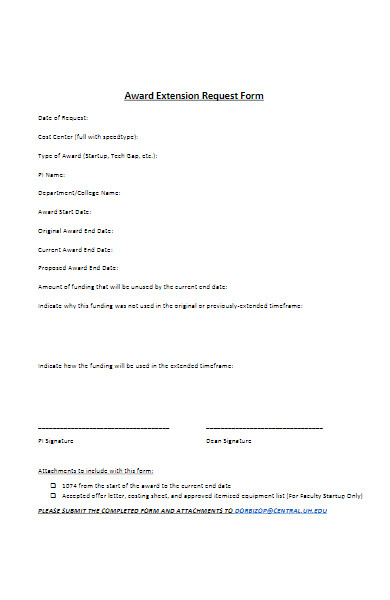

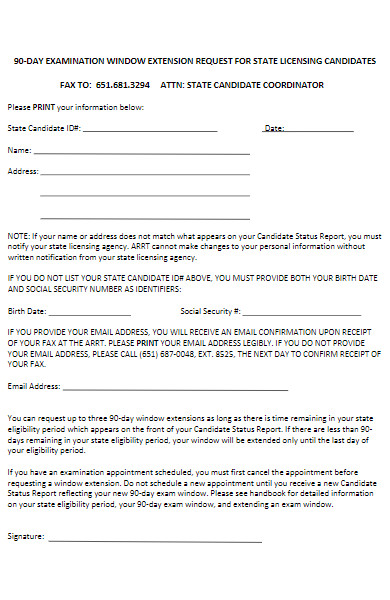

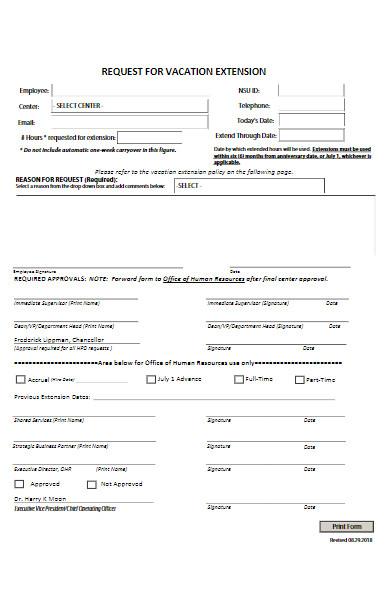

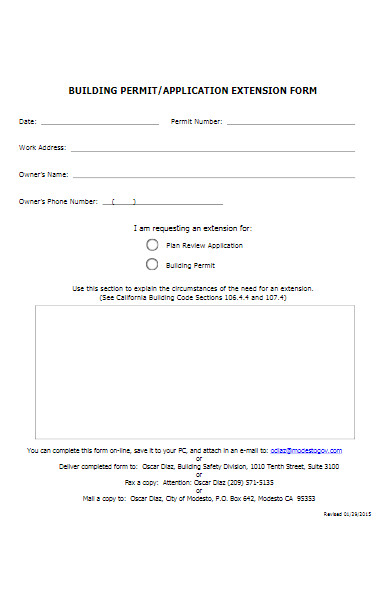

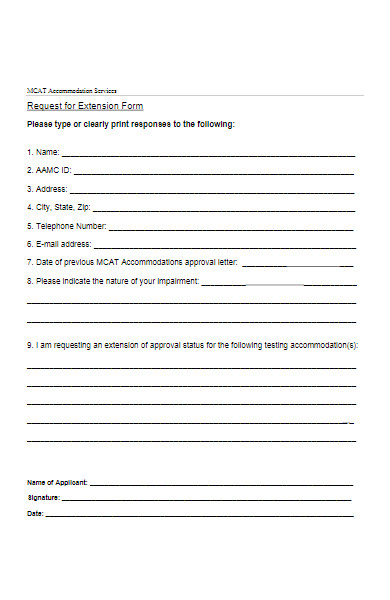

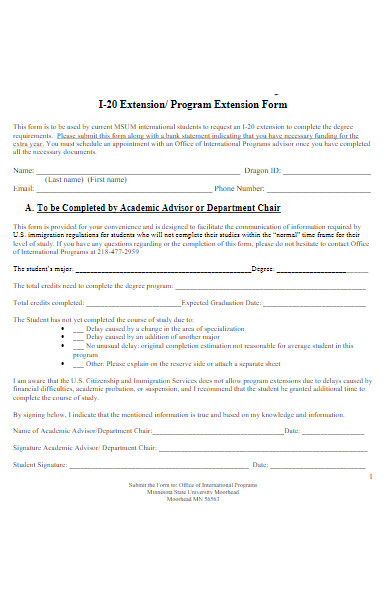

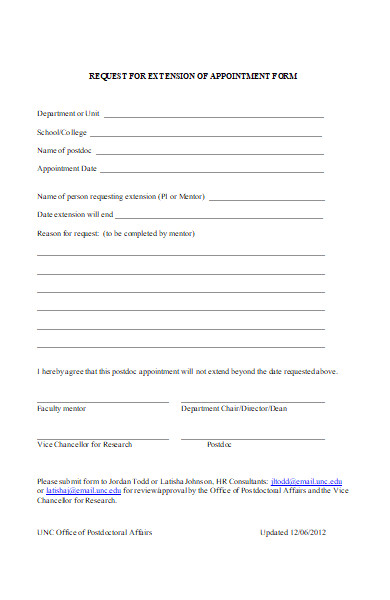

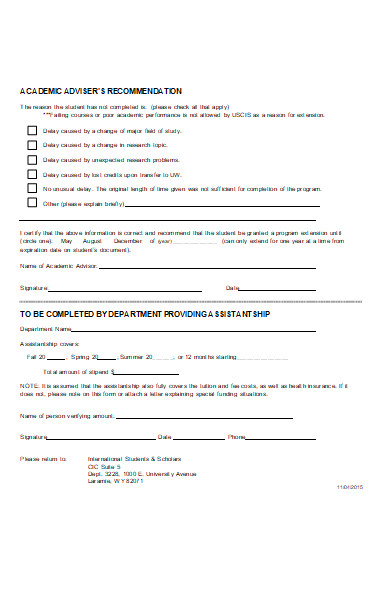

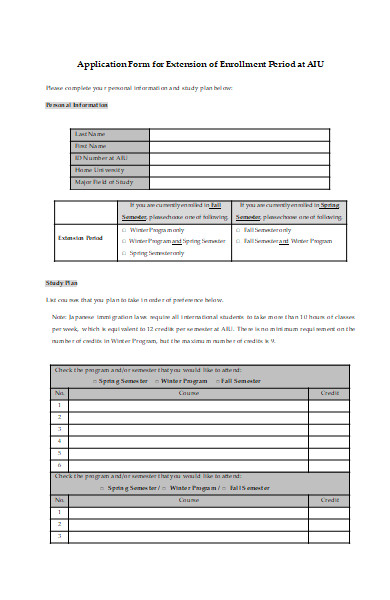

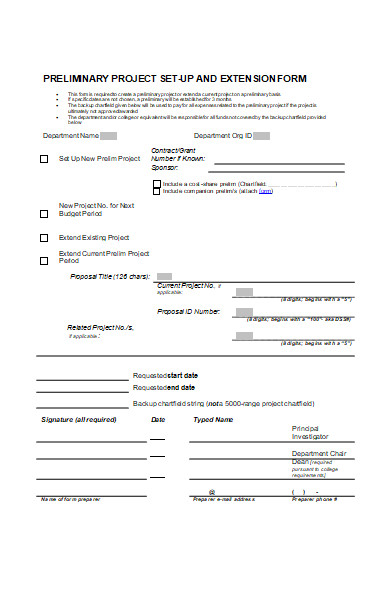

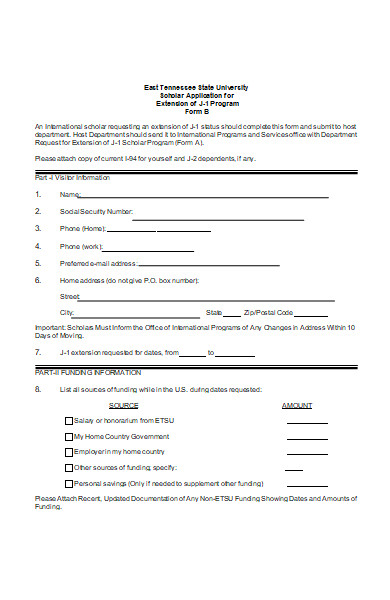

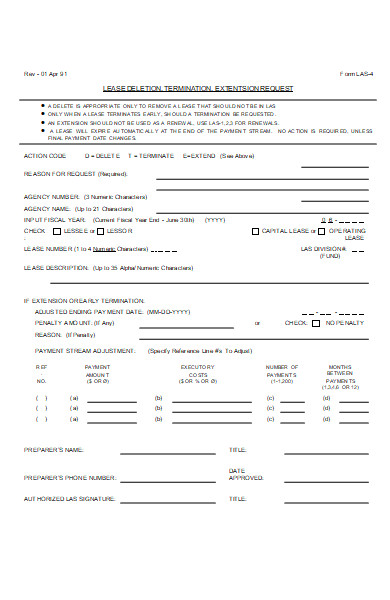

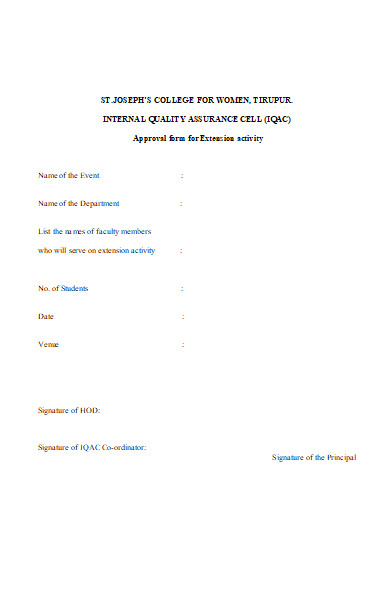

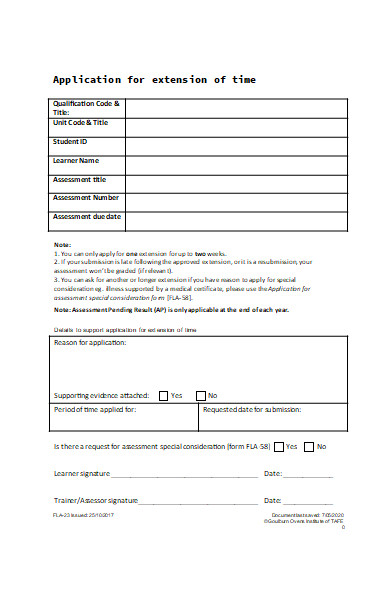

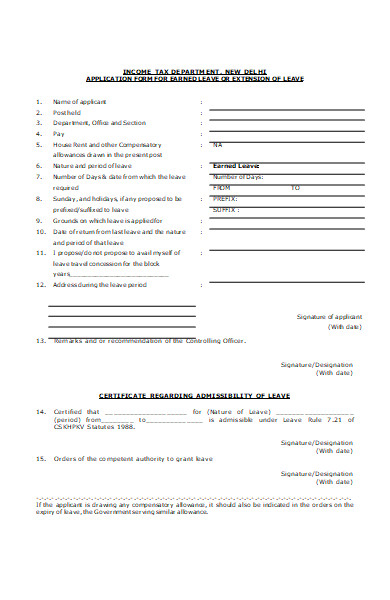

Step 3: Provide the Required Fields

The purpose of extension forms varies on each transaction. So, it is important to familiarize the blank process before providing the required fields; these are the spaces set aside to carry out the needed details. It will serve as guideposts for the user in filling out the extension form. Label these fields and other portions of the printable form. You can add title header, logo, date, contact information, business location, and other details. Moreover, use different fonts for the label and the content, so it easier to identify which item to fill.

Step 4: Update the Form

For days, weeks, and months of using the fillable form, changes in the process might happen. In that case, update the extension form so that it will remain relevant and useful. In doing so, track the irrelevant fields and change them. However, if changing the forms takes more time than making a new one, opt to start another form instead. Start from the top and redo the process. This time, it will be less challenging.

FAQs

How do I request an extension?

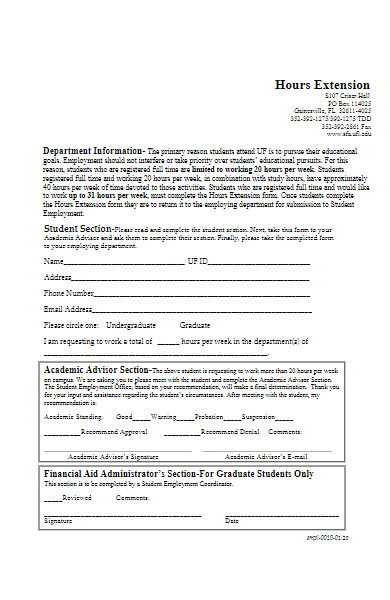

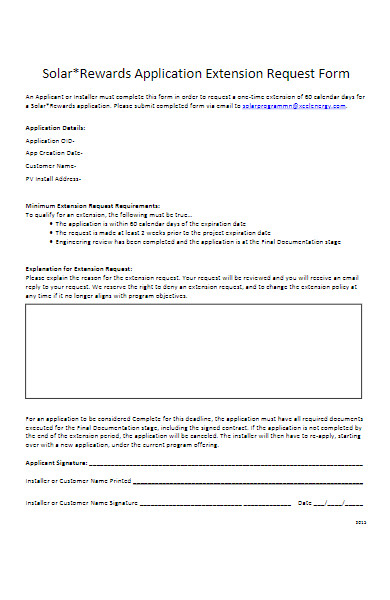

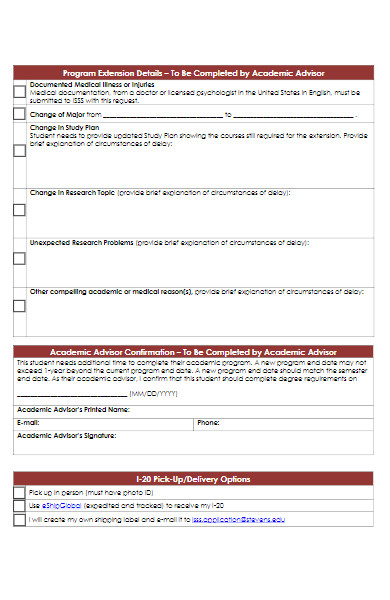

To get an extension, you have to fill out an extension form first. After that, process the form and submit it to an approver. Once approved, the supposed deadline will be extended and moved to another date.

Is filing an extension bad?

There are pros and cons in filing an extension. On the bright side, it will give you extra time to file your interest. And, it will reduce the penalties down to 0.5 percent per month and interest. However, any tax you owe will remain payable on the same date.

Do I need to file an extension if I am getting a refund?

No. You do not need to file an extension if you are getting a refund. It is similar to getting a tax refund as well. If you take the refund out of the equation, it is suggested to file an extension.

Extending dues might seem the easiest way to forget about our responsibilities temporarily. But, just because we can do so, it does not mean we will remain to slack on the deadlines. Businesses are often wary about unpaid dues, and it is perfectly understandable why. Bad clients are not healthy for the business, as it may ruin their financial accounts, too. If you are about to extend due dates, think about what you can do first to avoid extensions.

Related Posts Here

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract