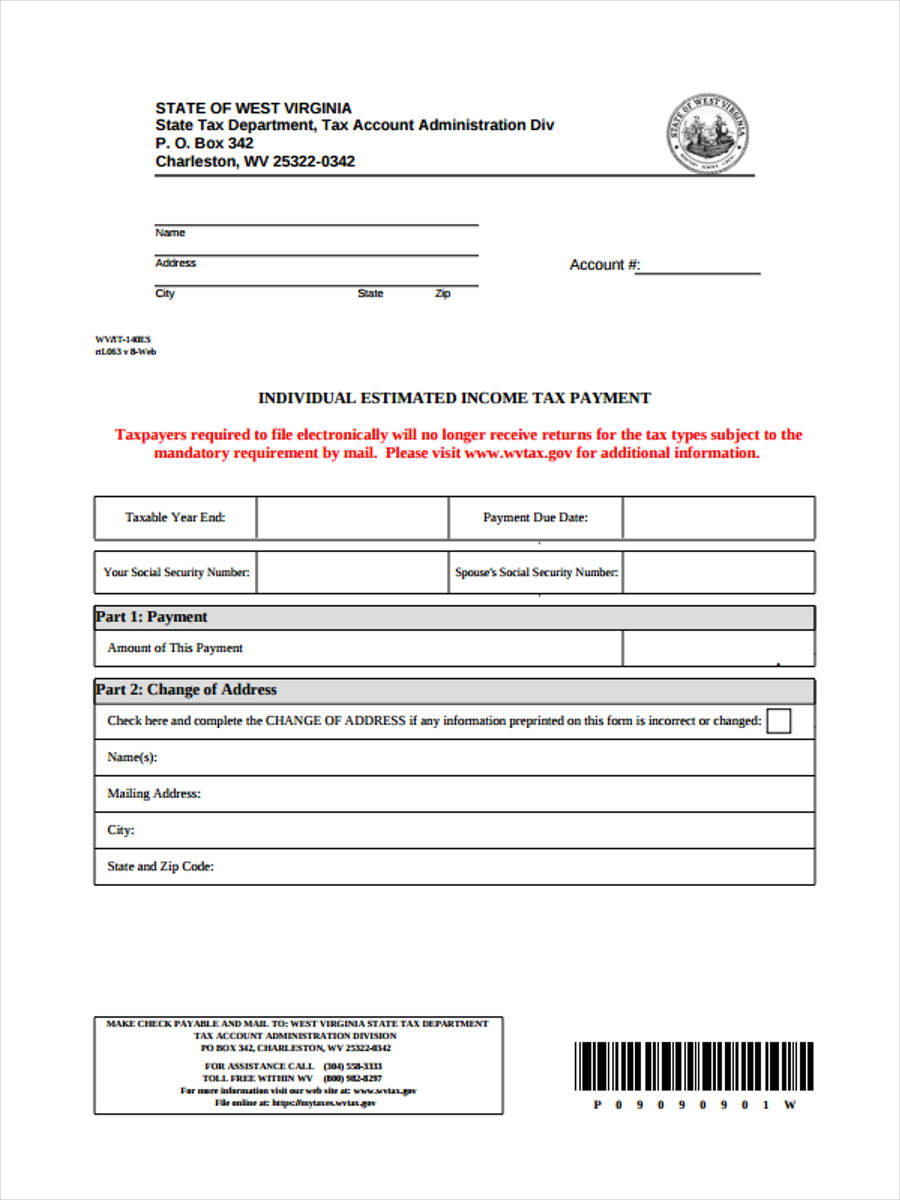

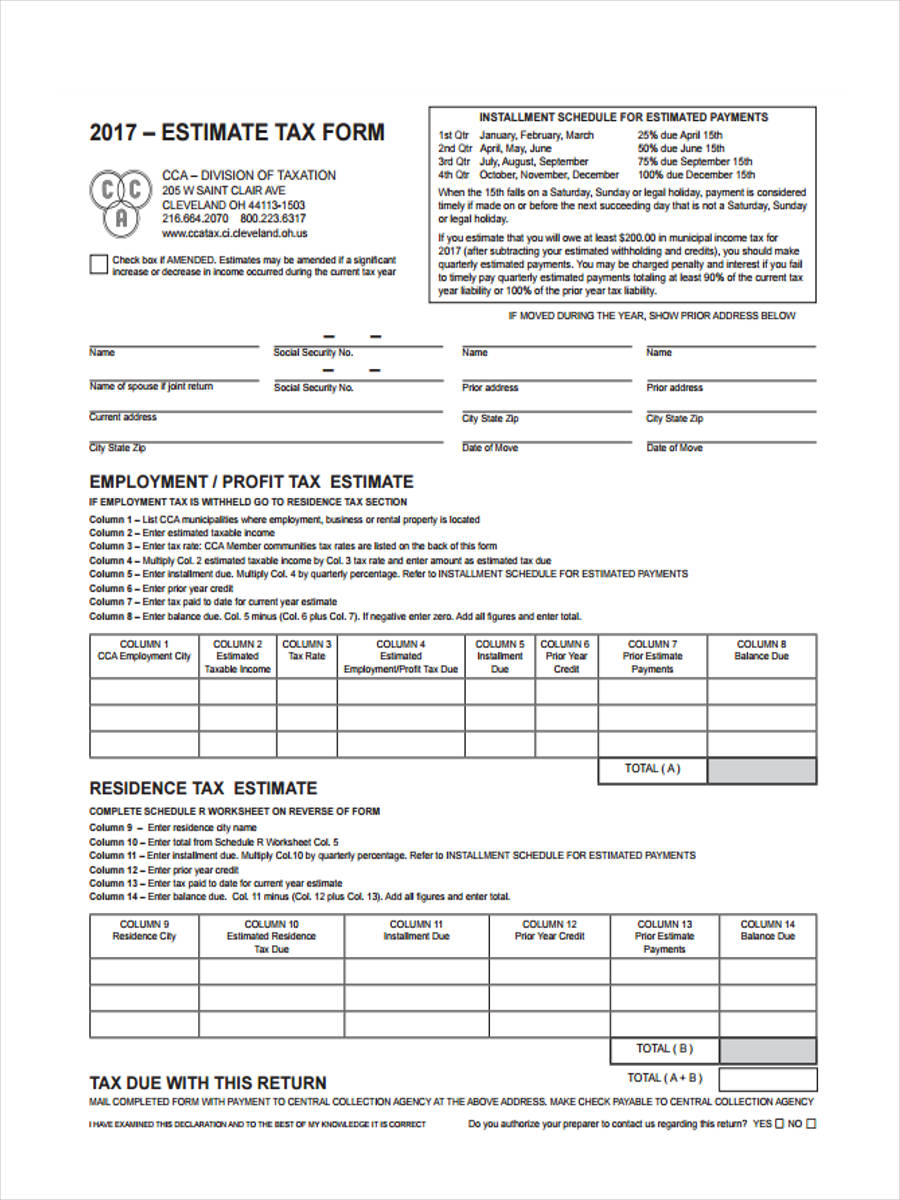

Doing an estimate is making a projection and a judgment for a subject’s possible value. This is evidently seen in the field of statistics, especially for dealing with businesses. One type of document which includes estimation is an Estimated Tax Form which will state the estimated tax payments for those who do not have a voluntary withholding.

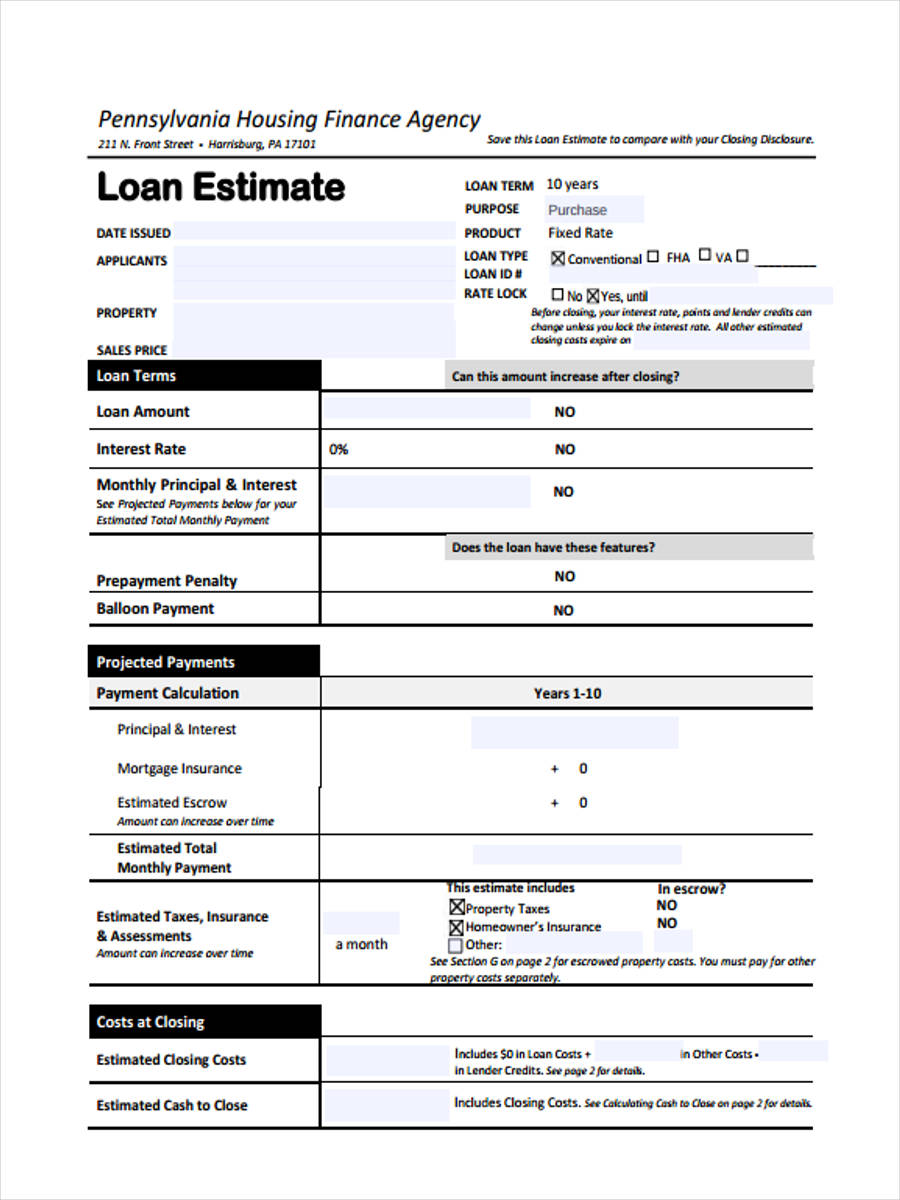

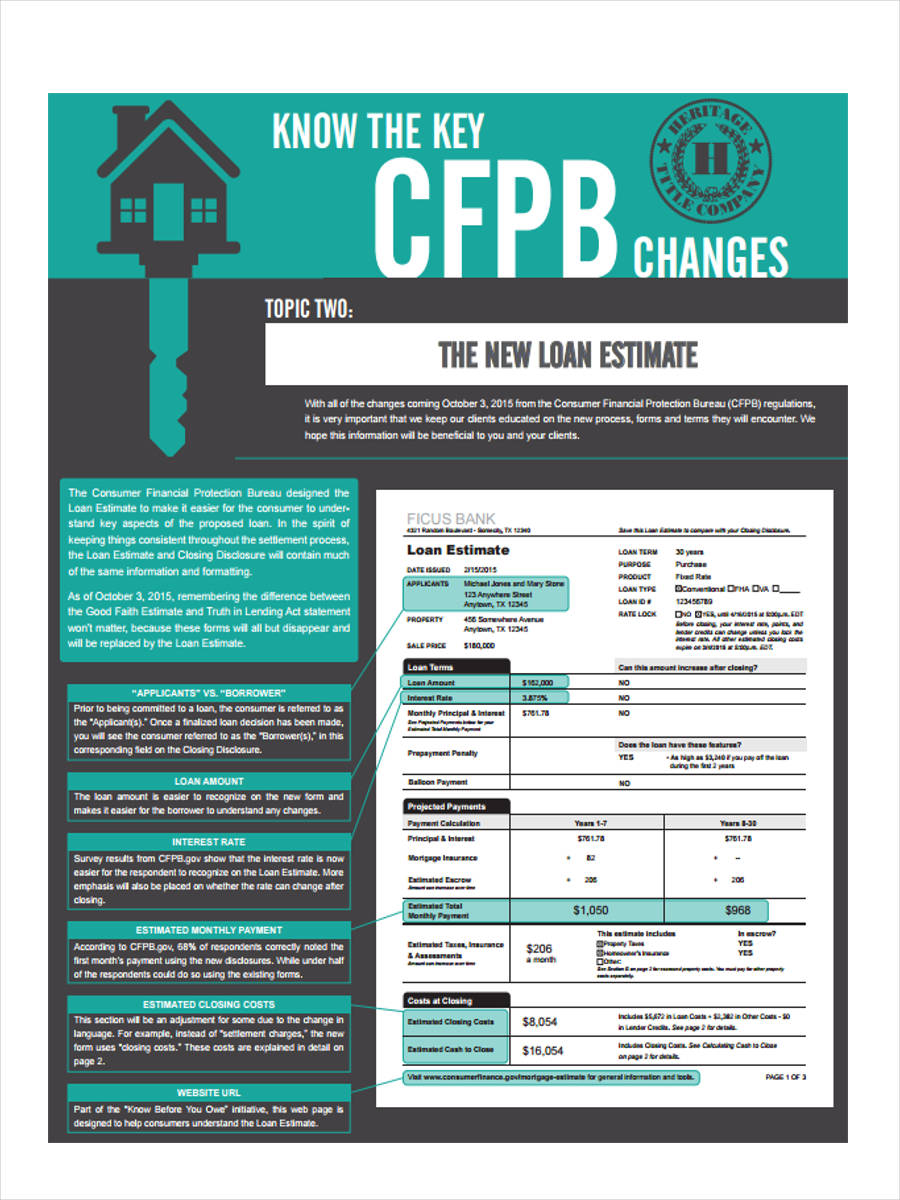

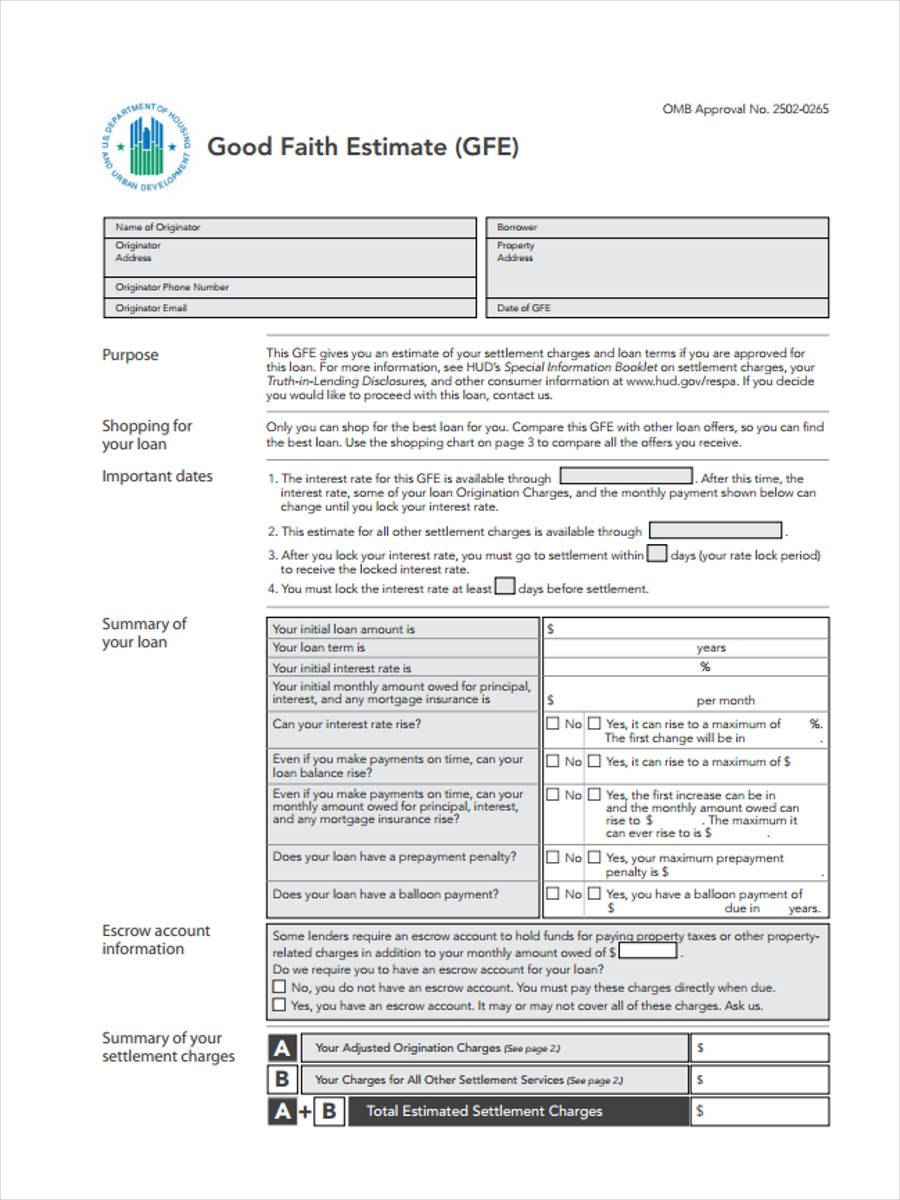

An estimate form is also of great use when it comes to mortgage and loans. Using a Loan Estimate Form, the parties will know the estimated monthly payments and interest rates. This is usually a three-paged document which is presented to the borrower after three working days from his application.

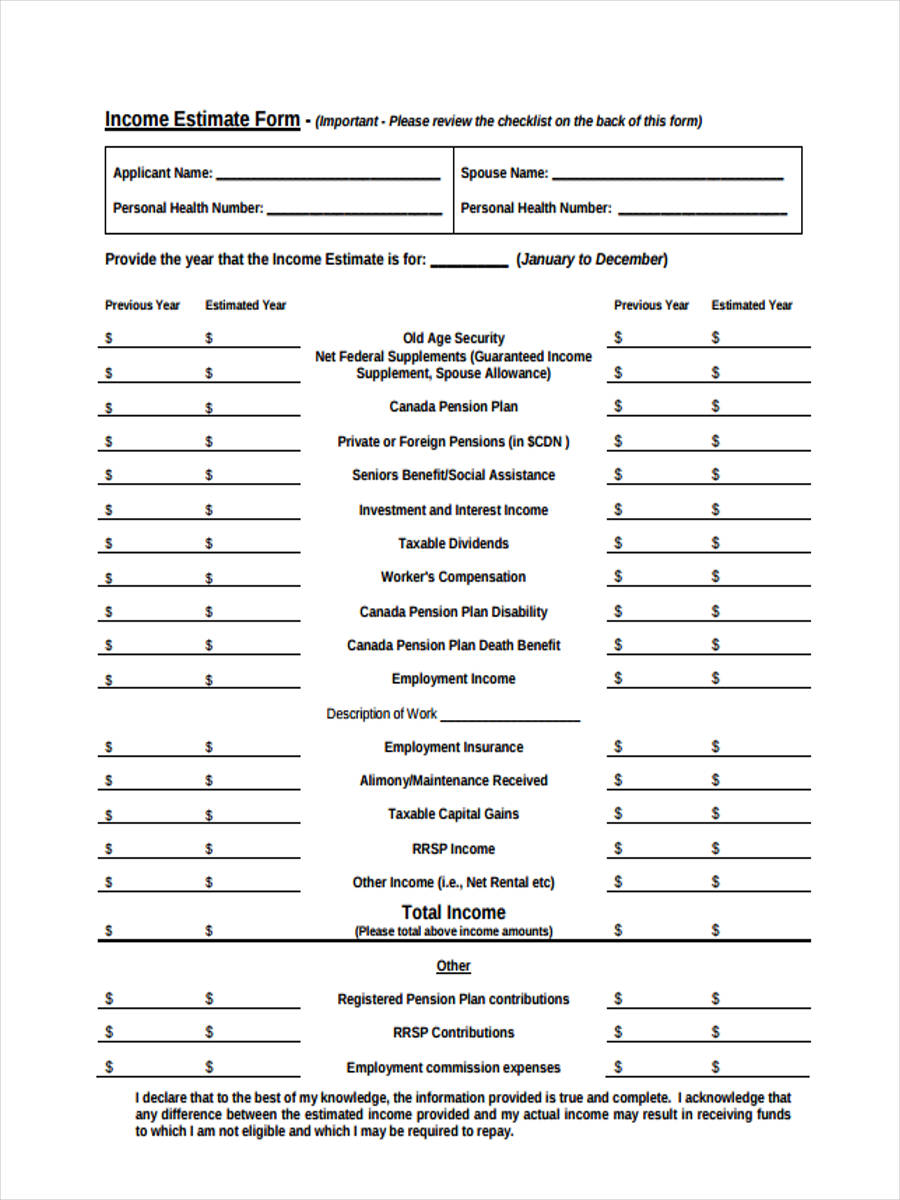

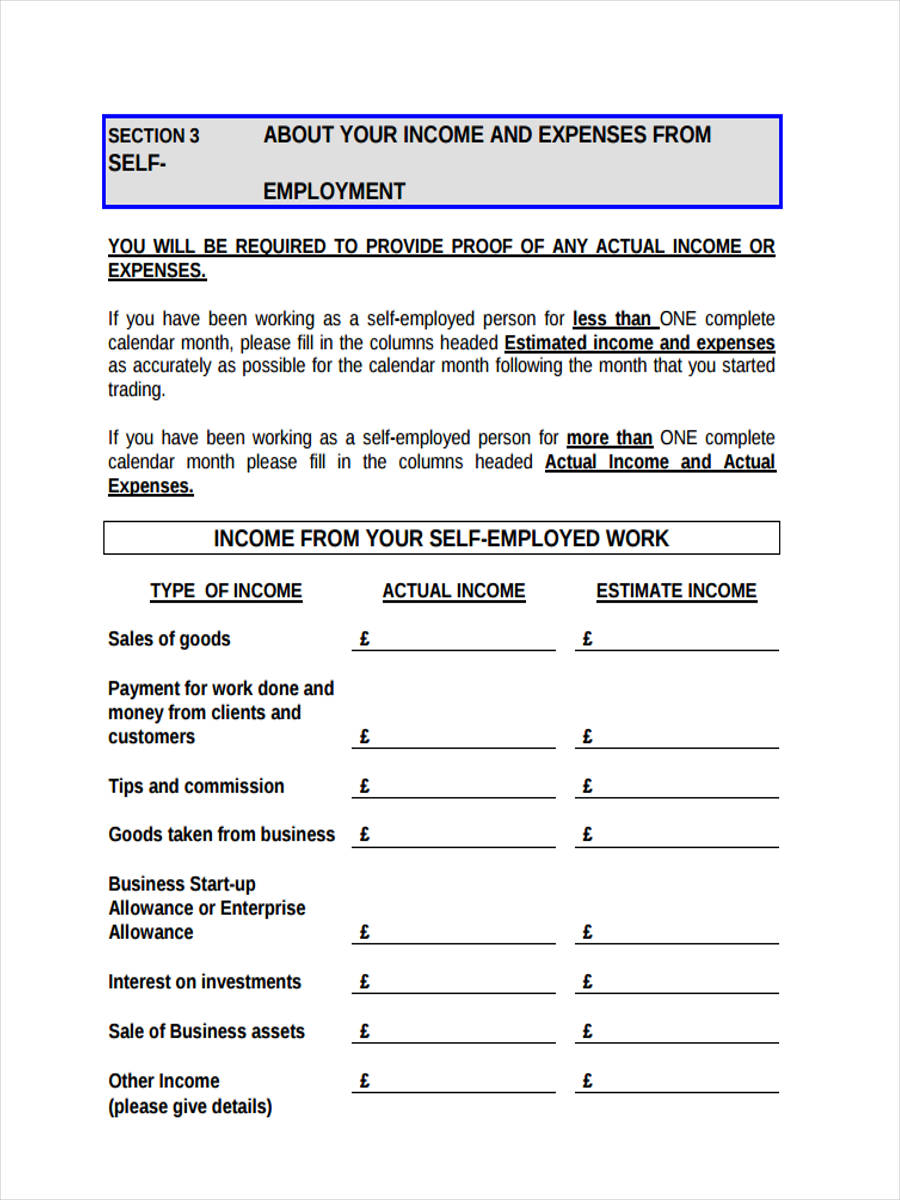

Income Estimate Form Samples

Individual Income Estimate Form

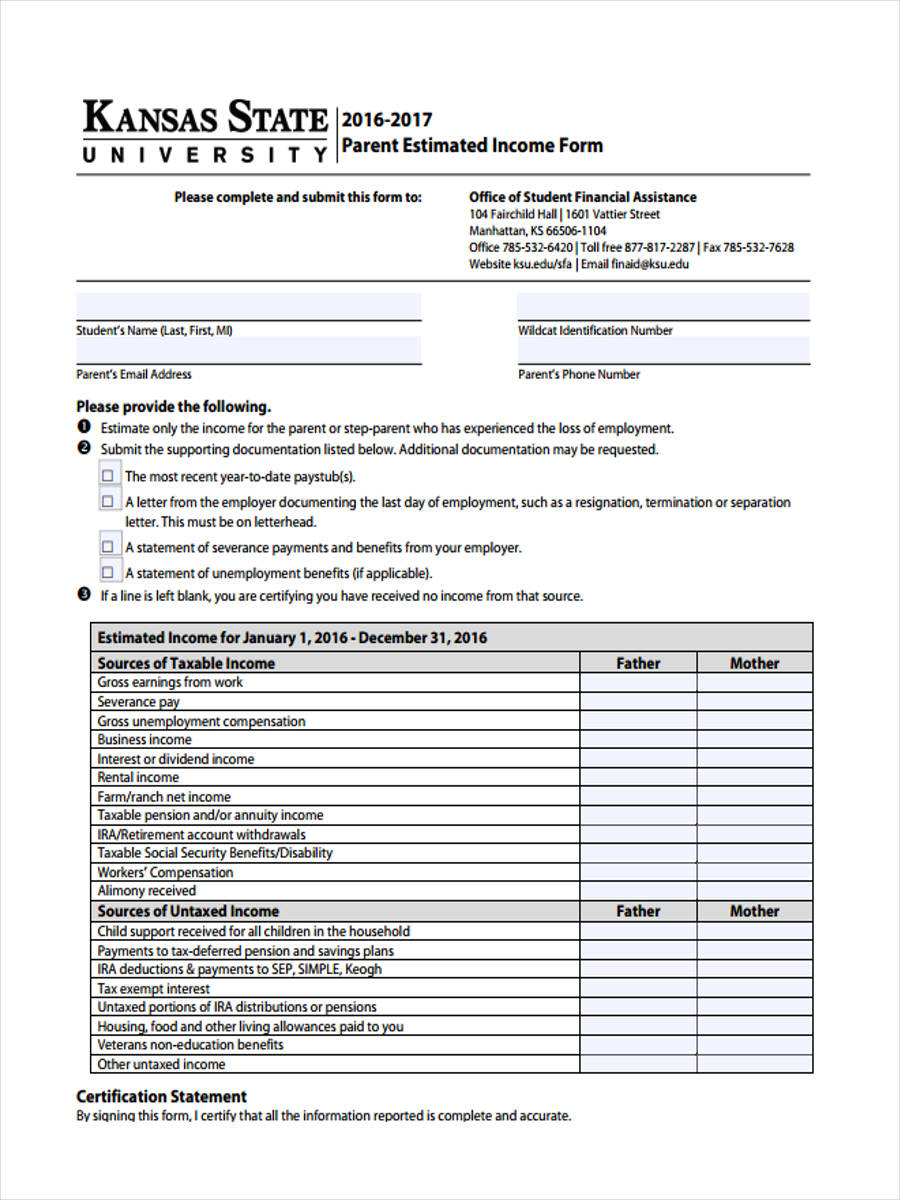

Parent Income Estimate

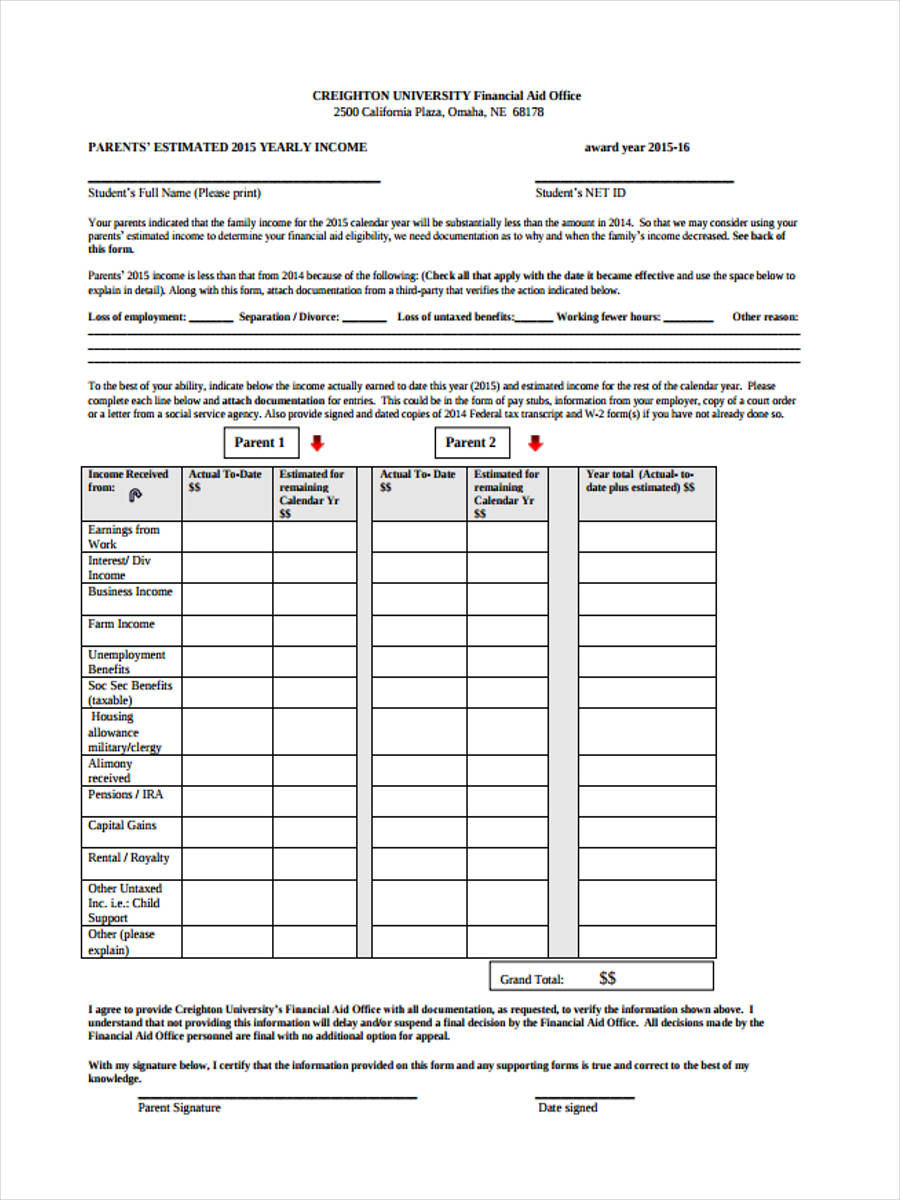

Yearly Income Estimate Form

Loan Estimate Forms

New Loan Estimate Form

Mortgage Loan Estimate

Proposed Loan Estimate

How Do You Design Estimate Forms?

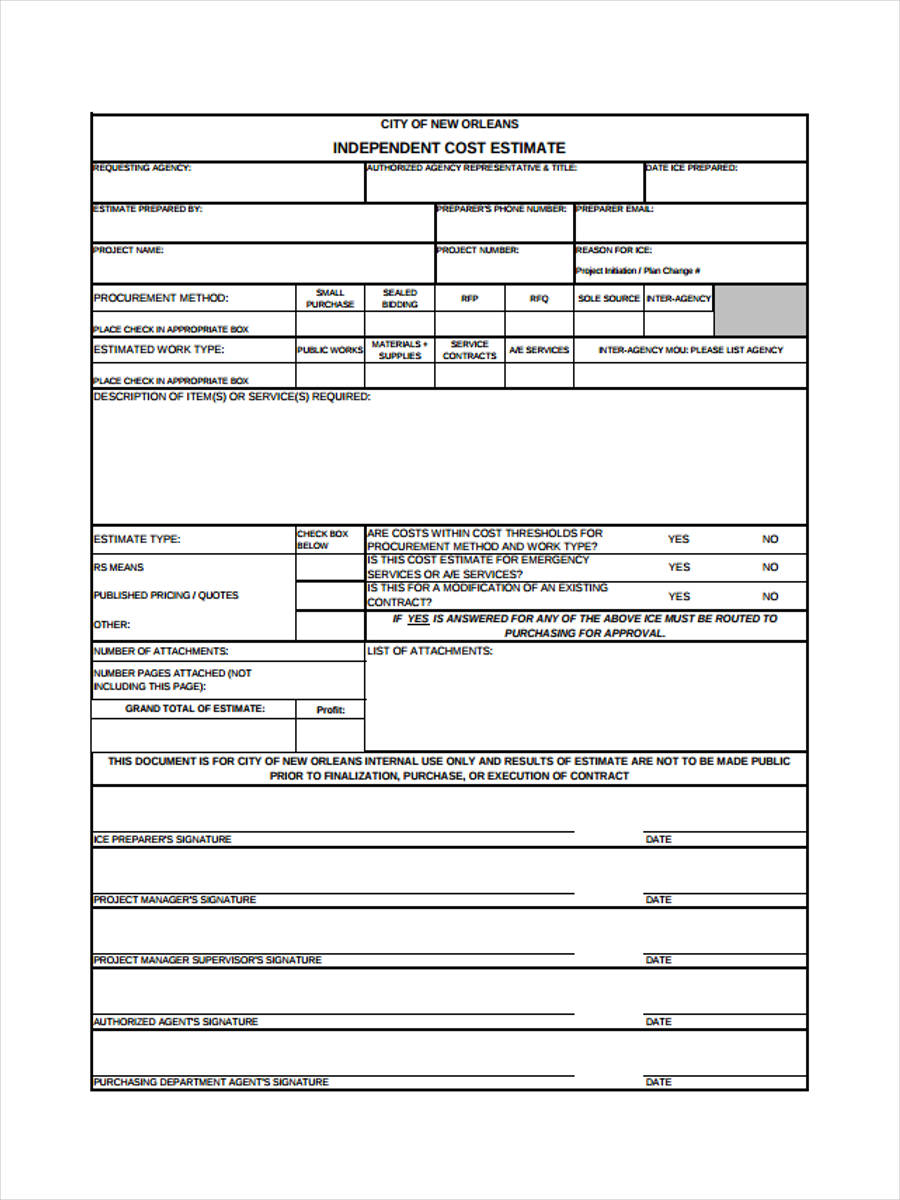

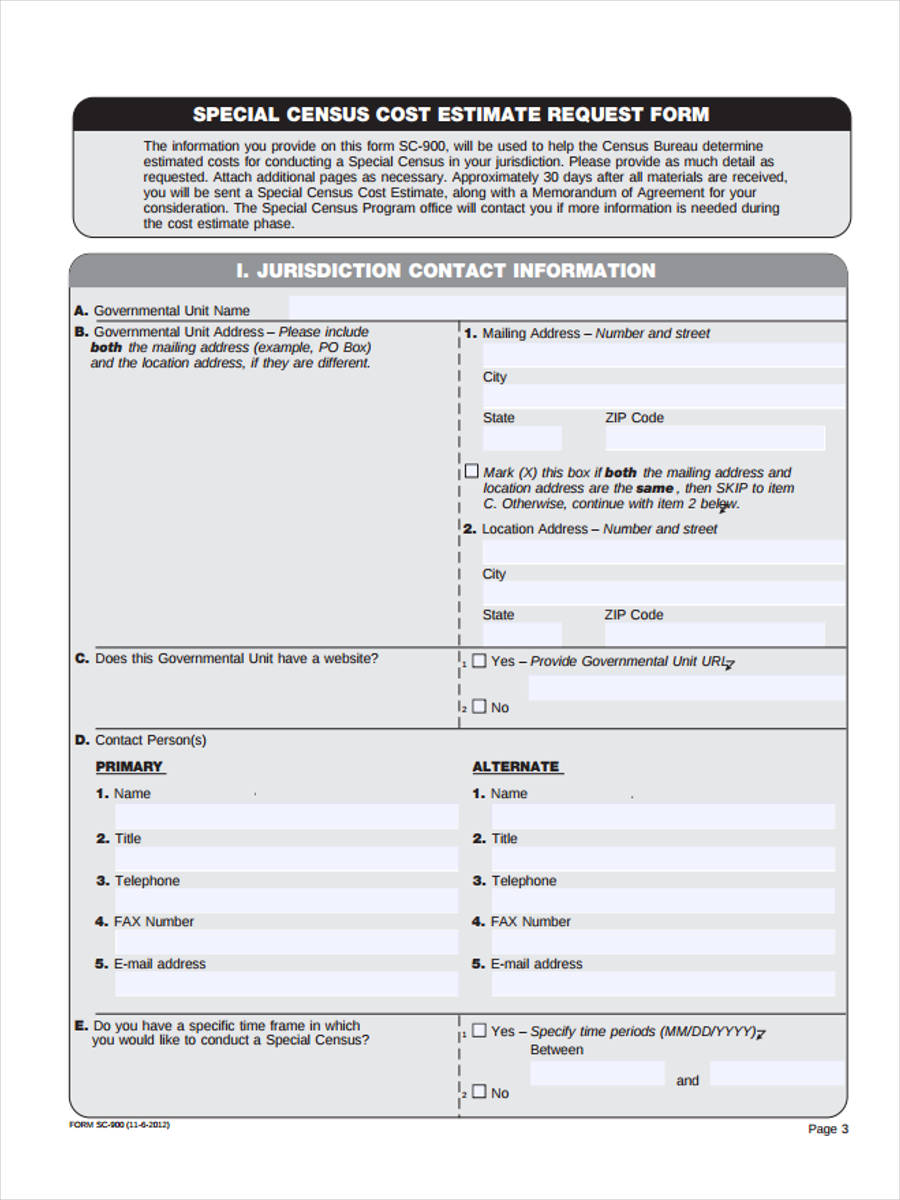

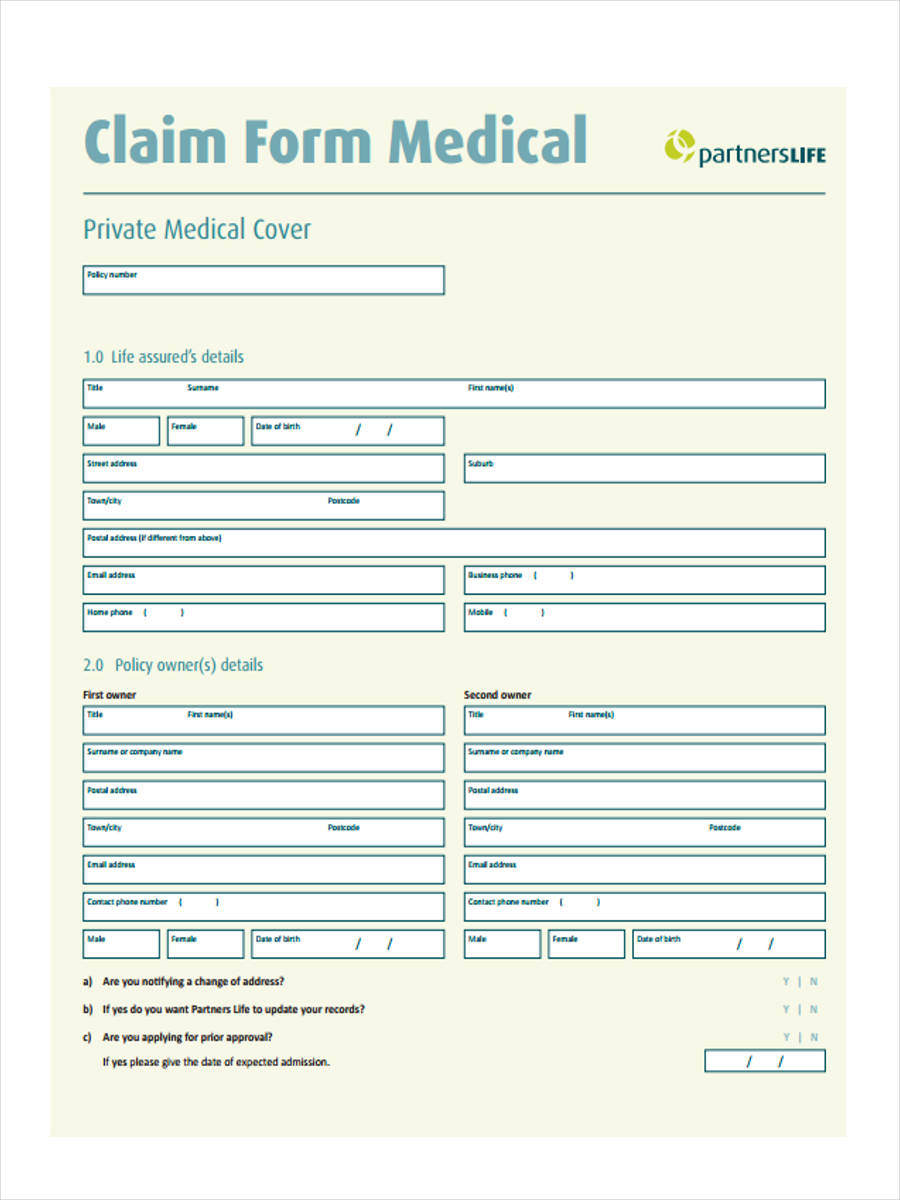

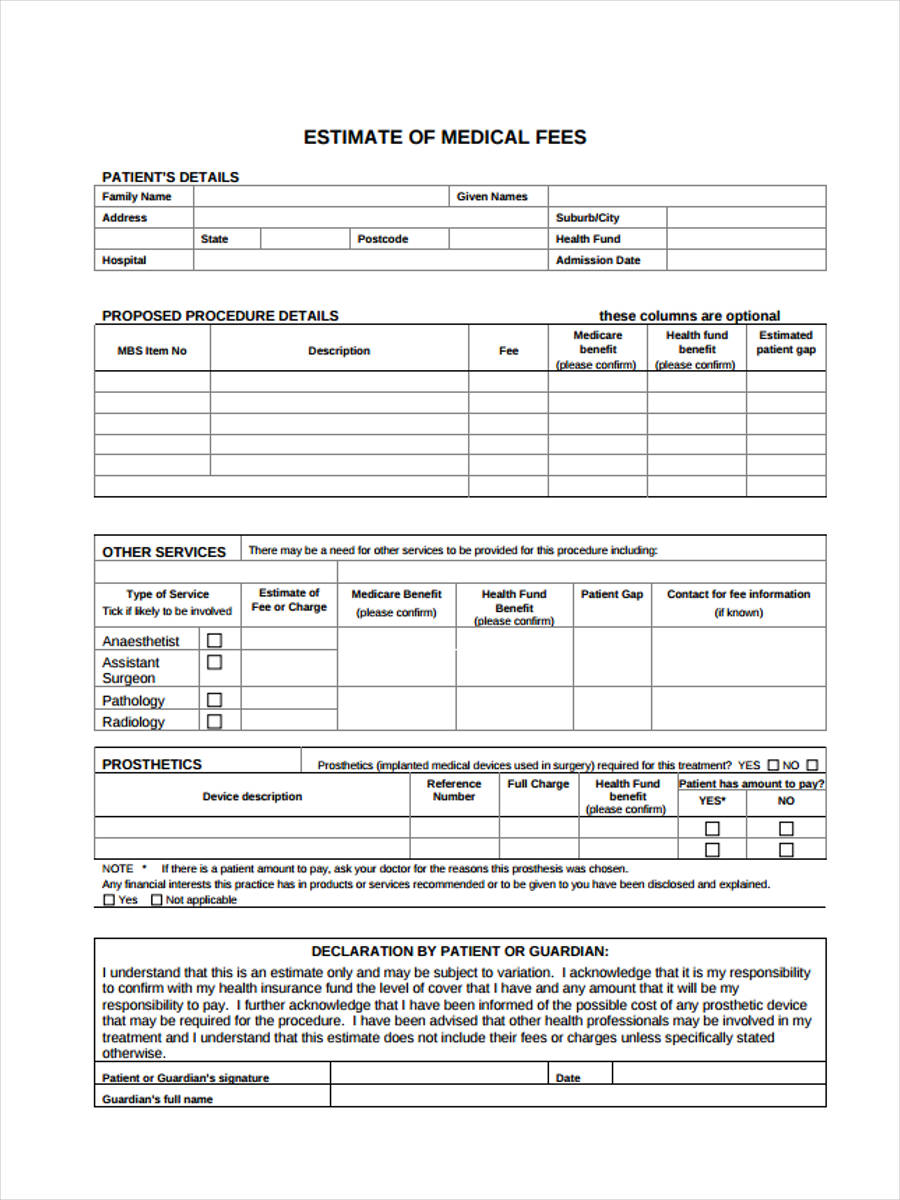

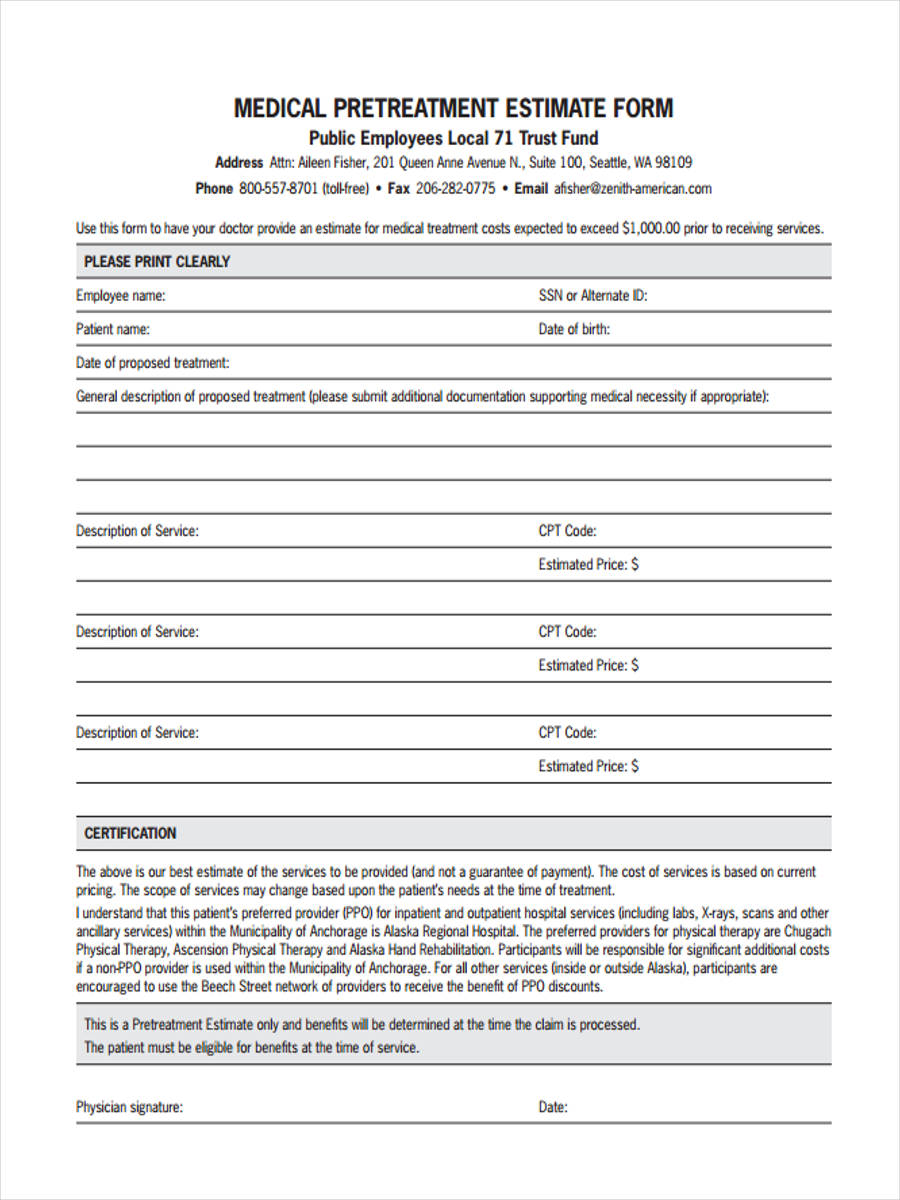

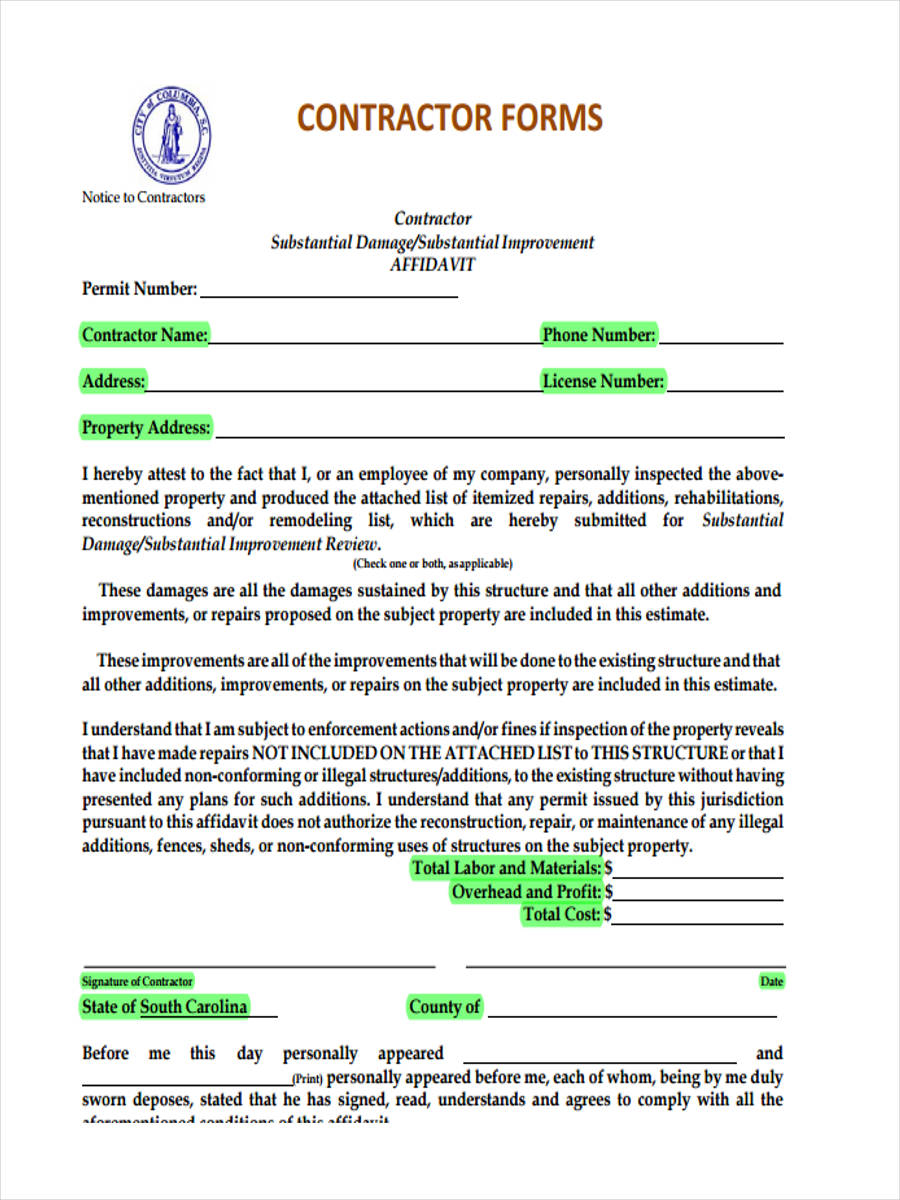

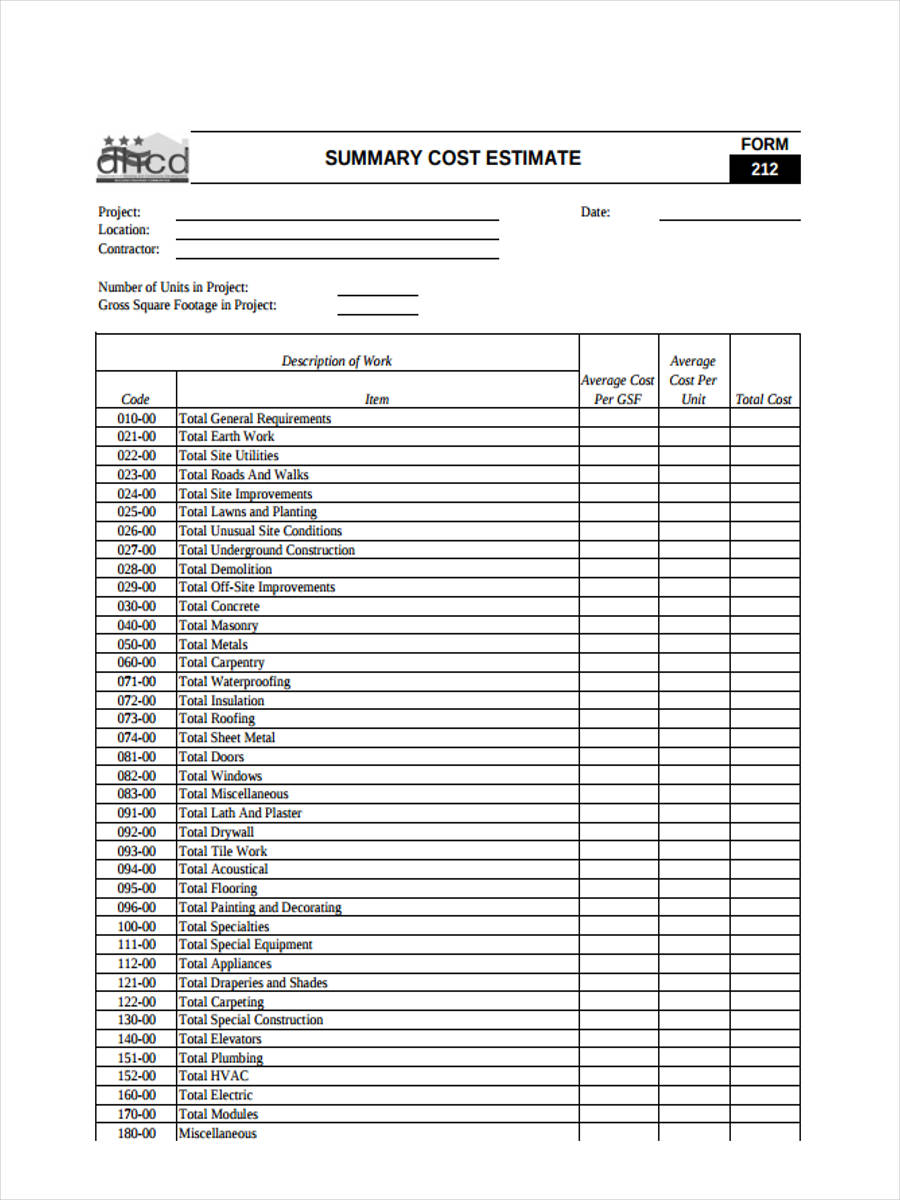

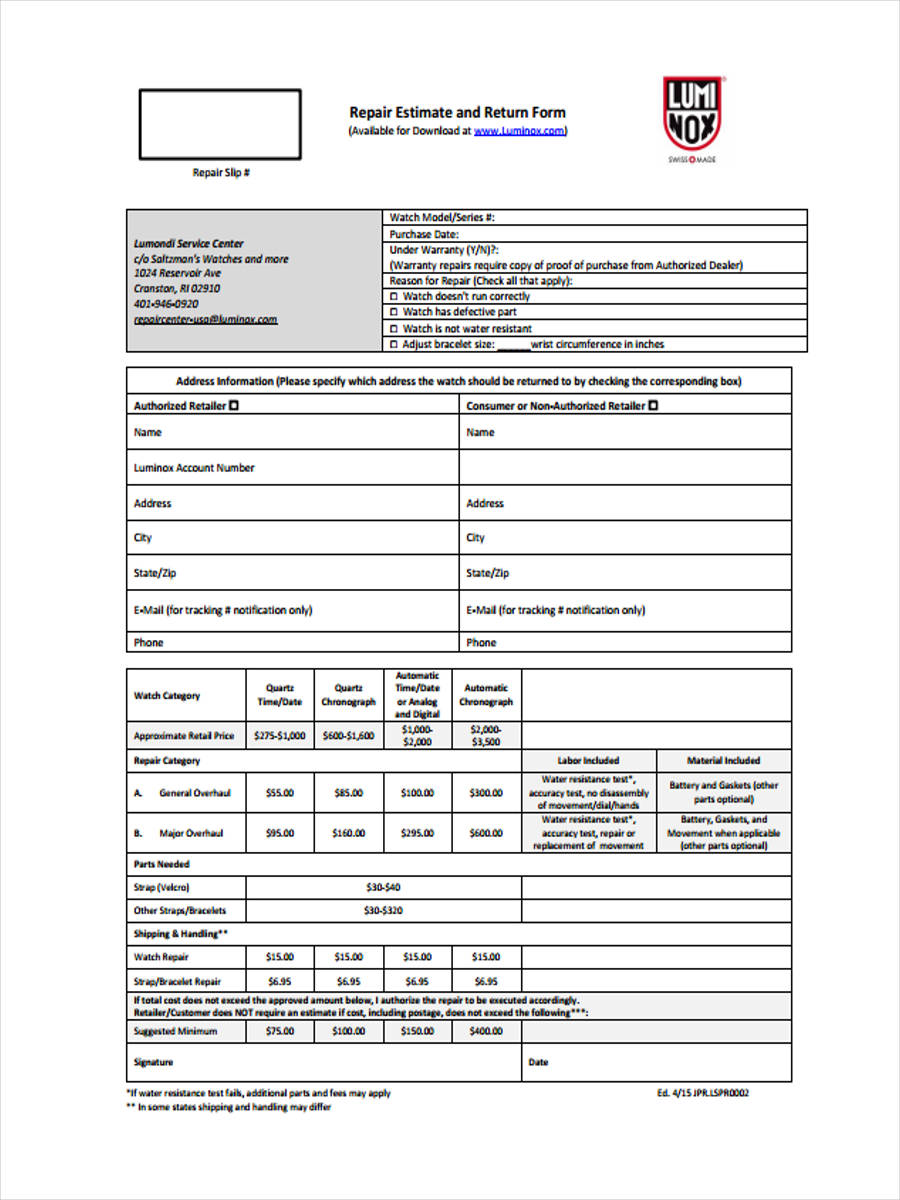

Designing an estimate form will vary greatly on what type of subject will be estimated, such as adding an area for estimating the cost of materials in a Contractor Estimate Form, or estimating the payment for the medical services in a Medical Treatment Estimate Form.

The important factor in designing this document is that it should have the objective of specifying the costs, payments, and other fees for a project. It will also be helpful to have the document in a simple and understandable arrangement wherein the people involved will attain adequate understanding with the statements on each section of the form.

What Is a Loan Estimate Form?

Loan Estimate Forms are documents which merges the information found on the Good Faith Estimate Form and the Truth-In-Lending Disclosure Form. This contains the terms of the mortgage loan, the possible repayment fees of the mortgage, and the down-payment required for the loan.

Depending on the mortgage lender, a Loan Estimate Form may have areas for stating if the amount of the mortgage payment will increase when it nears the closing date, and if there are any possible balloon payments or prepayment penalties associated with the mortgage.

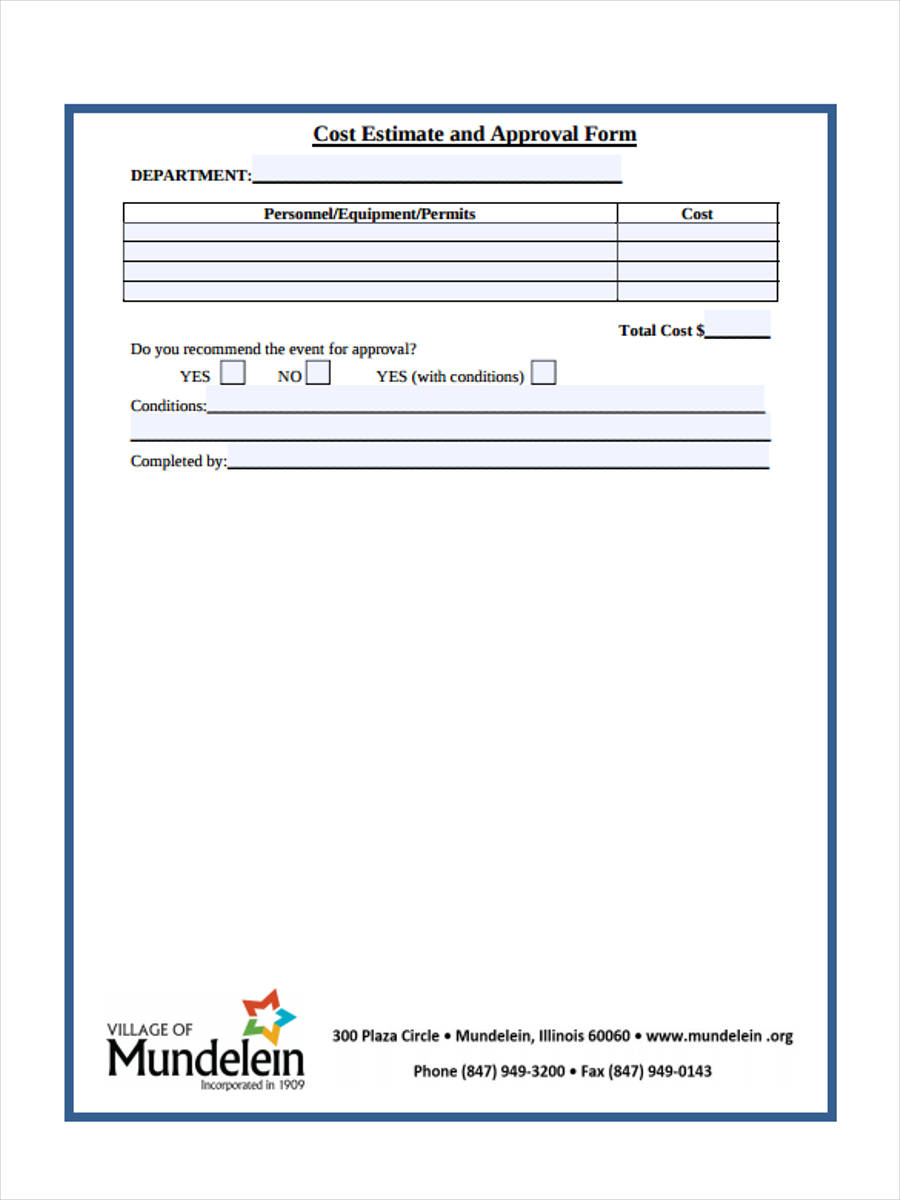

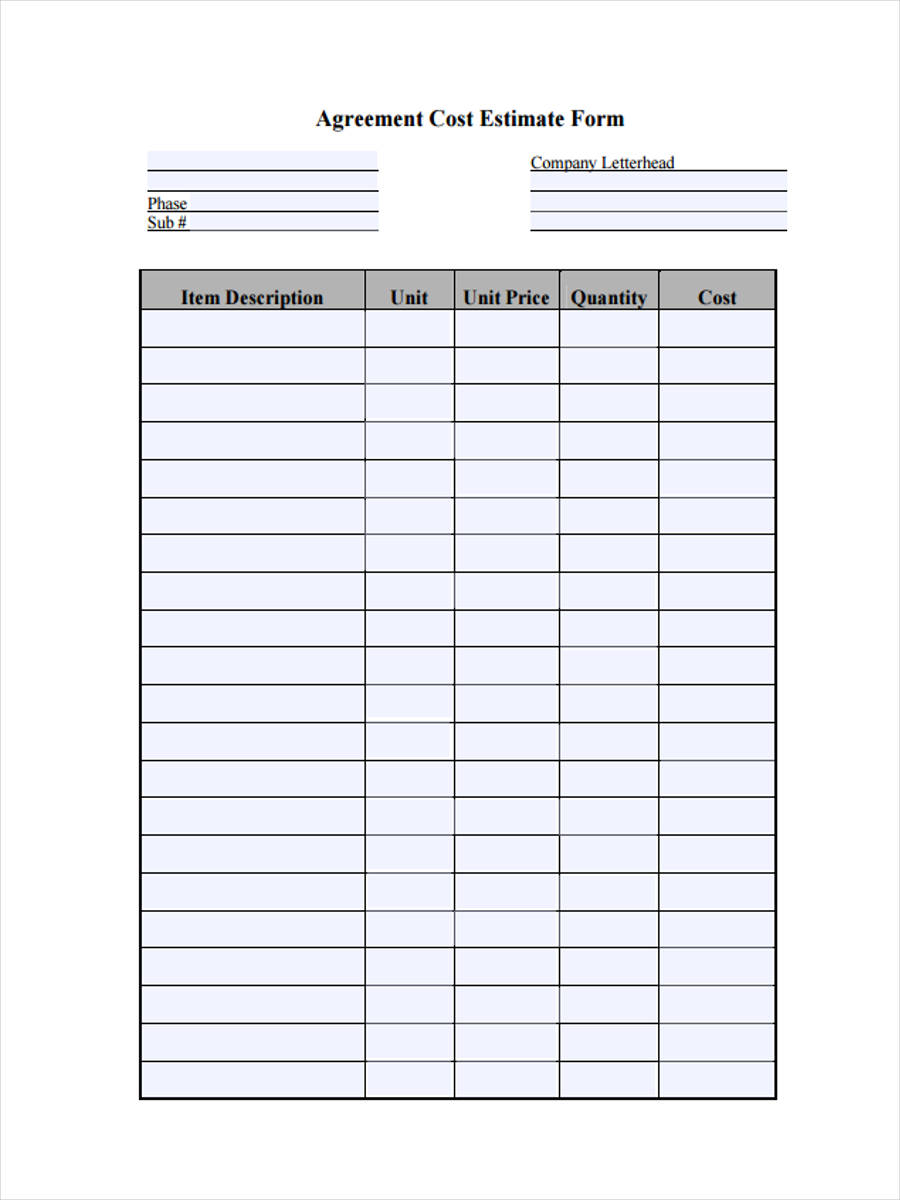

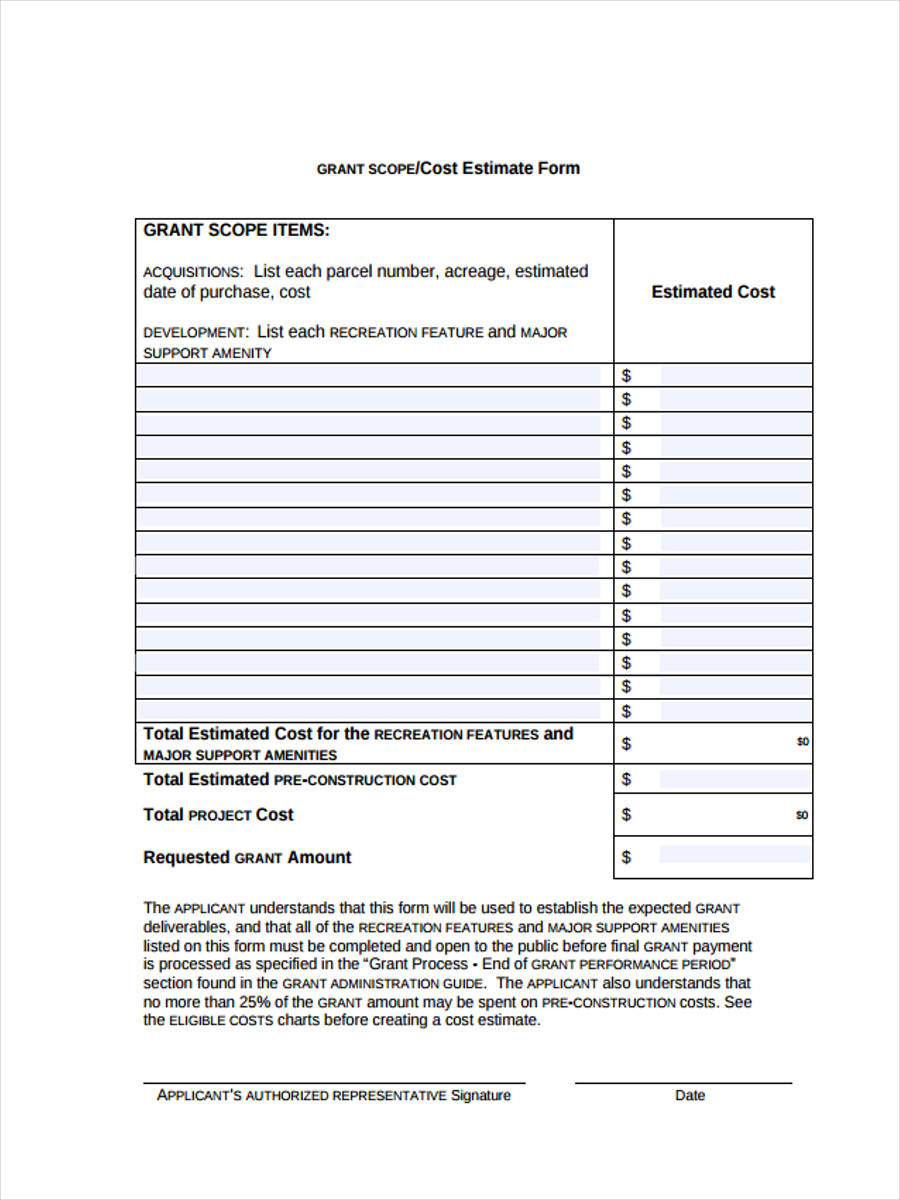

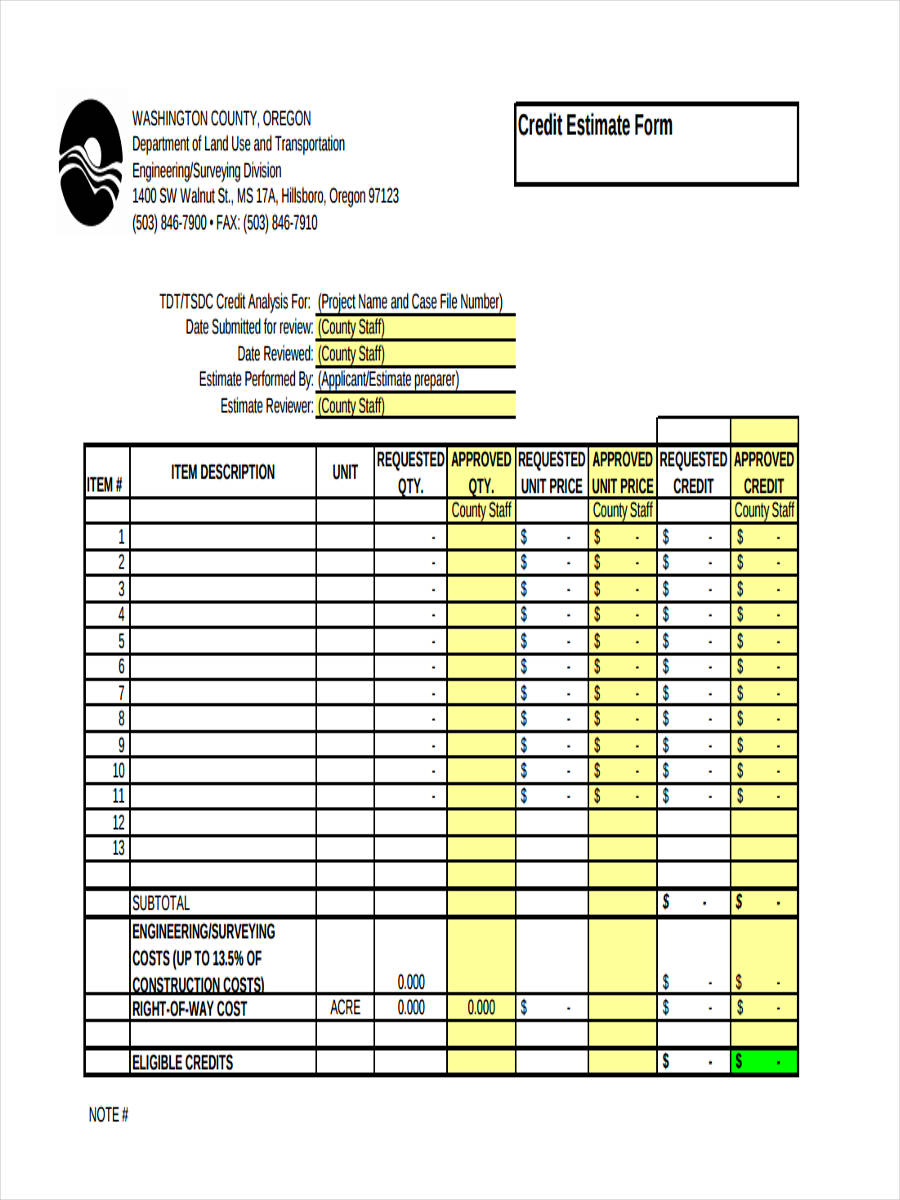

Cost Estimate Forms

Cost Estimate Approval

Cost Estimate Agreement

Purchase Cost Estimate Form

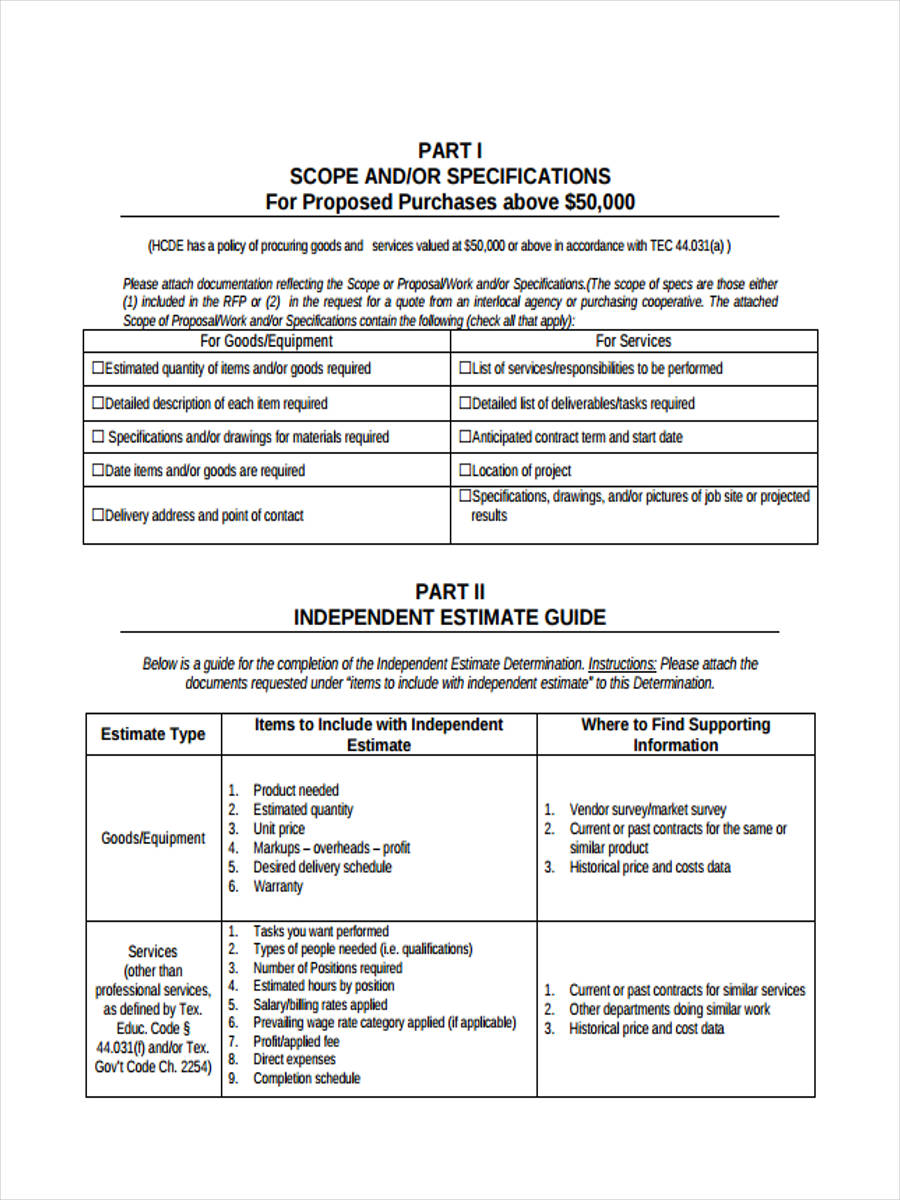

Independent Cost Estimate

Cost Estimate Request

Medical Estimate Forms

Medical Claim Estimate

Estimate Form for Medical Fees

Medical Pretreatment Estimate

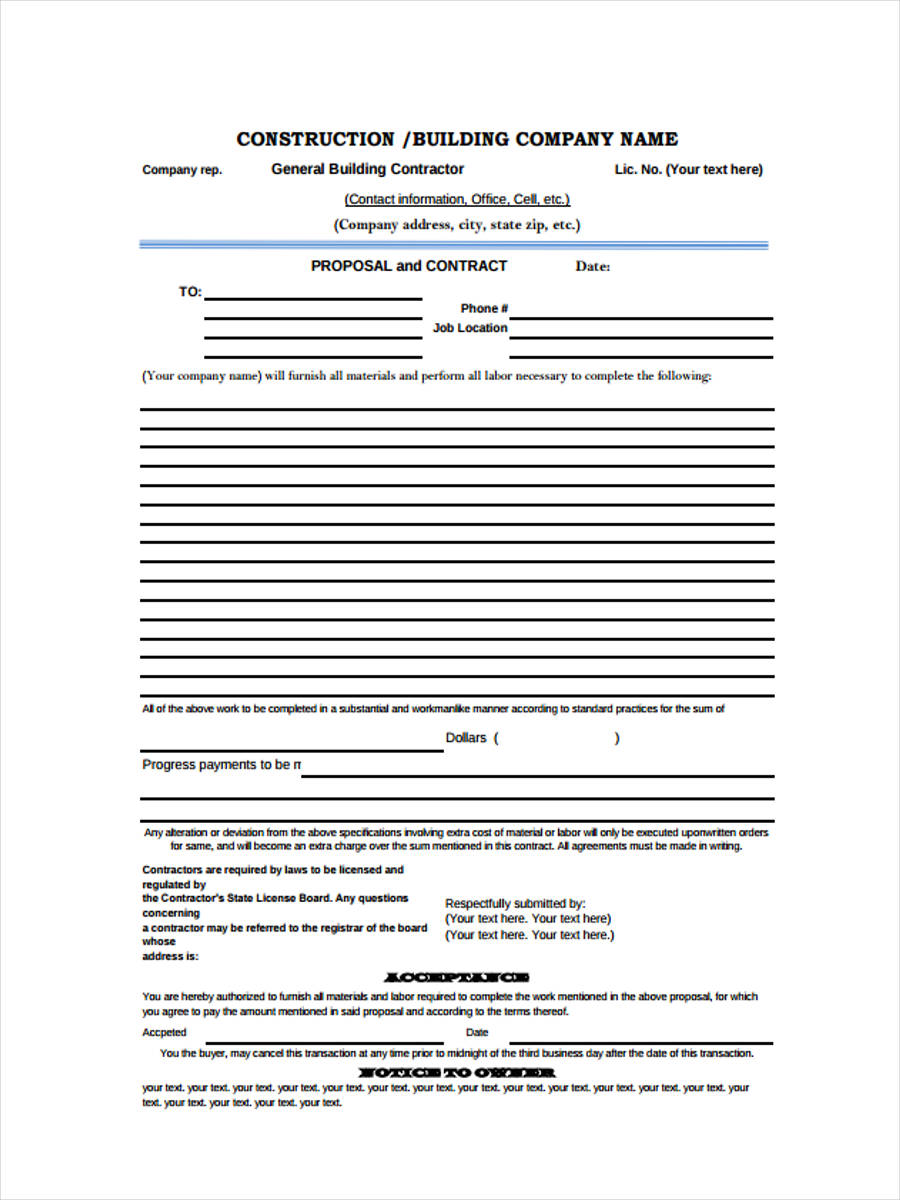

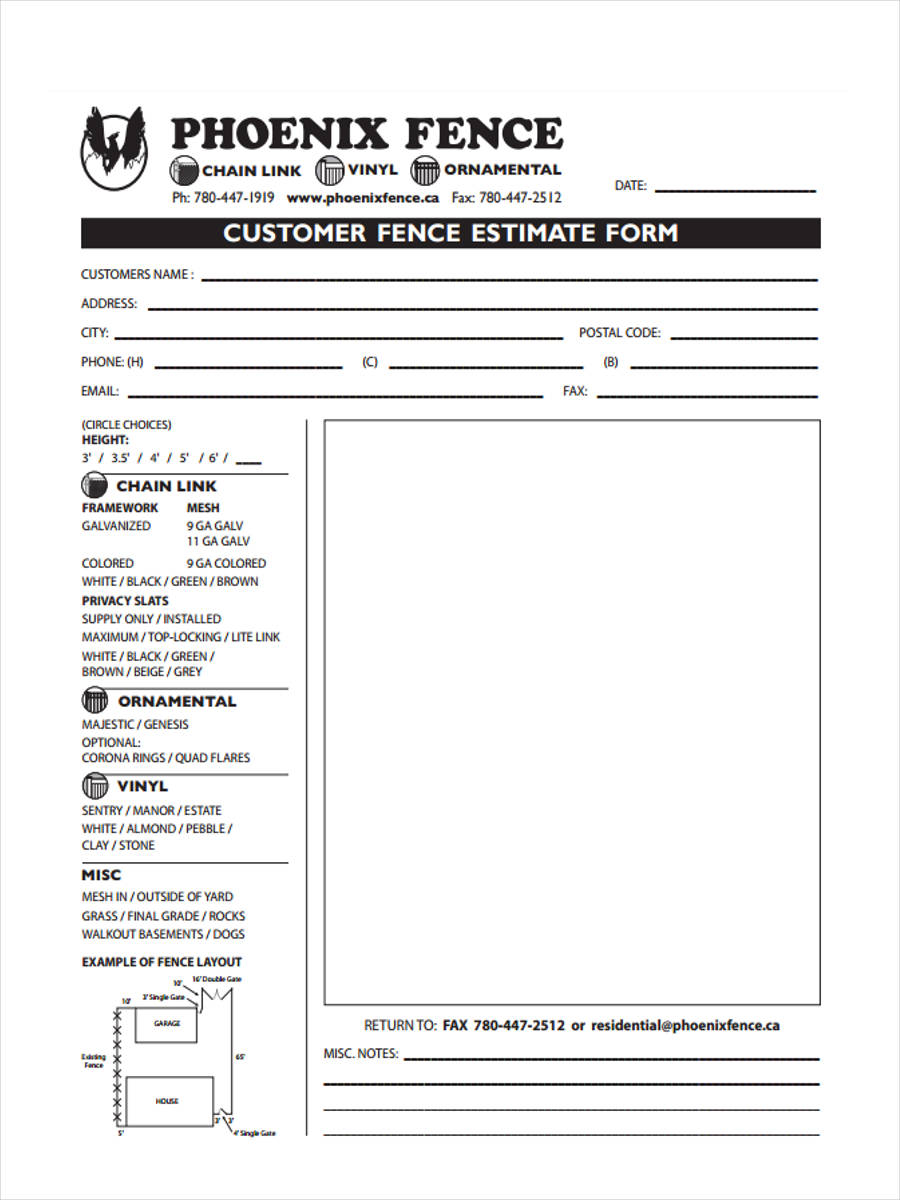

Contractor Estimate Forms

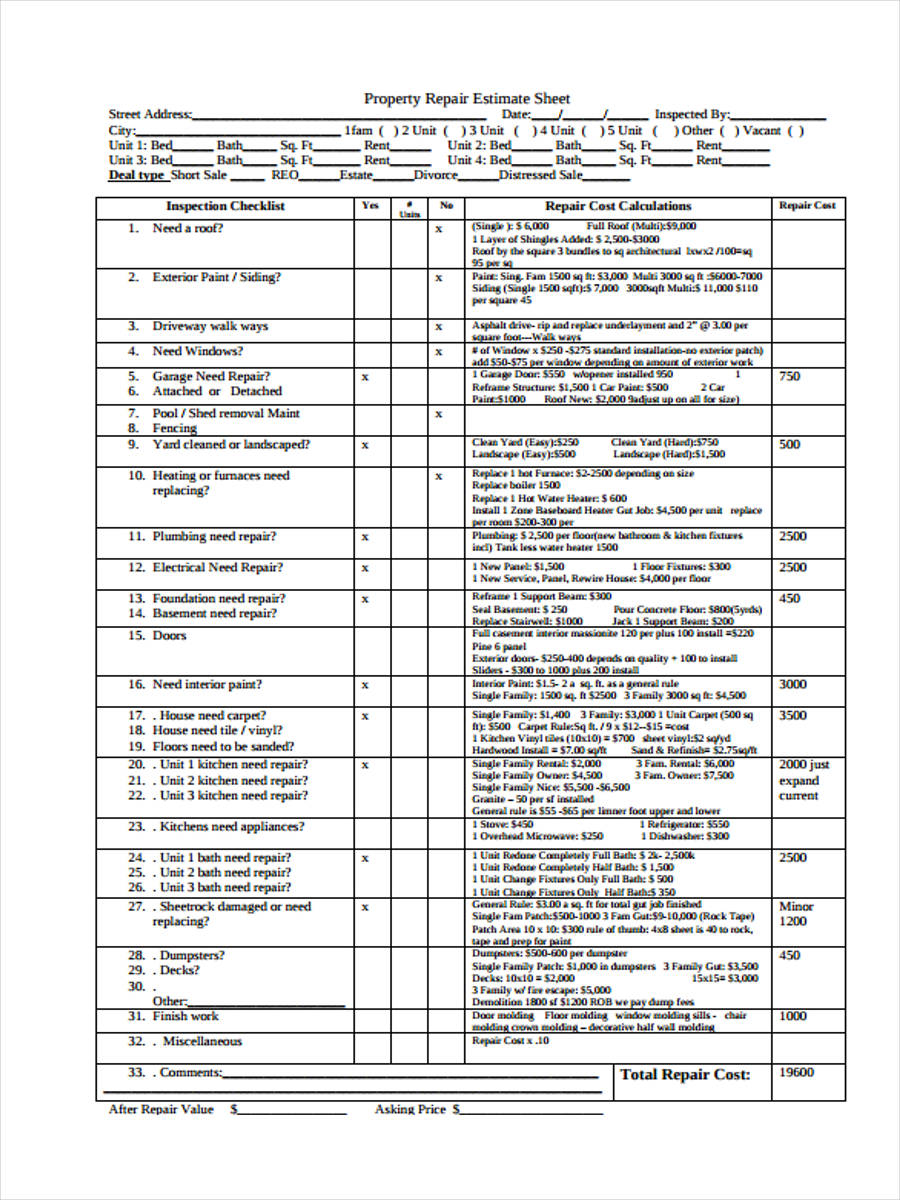

Contractor Repair Estimate

Contractor Cost Estimate

Payment Estimate Form

What Information Should Estimate Forms Include?

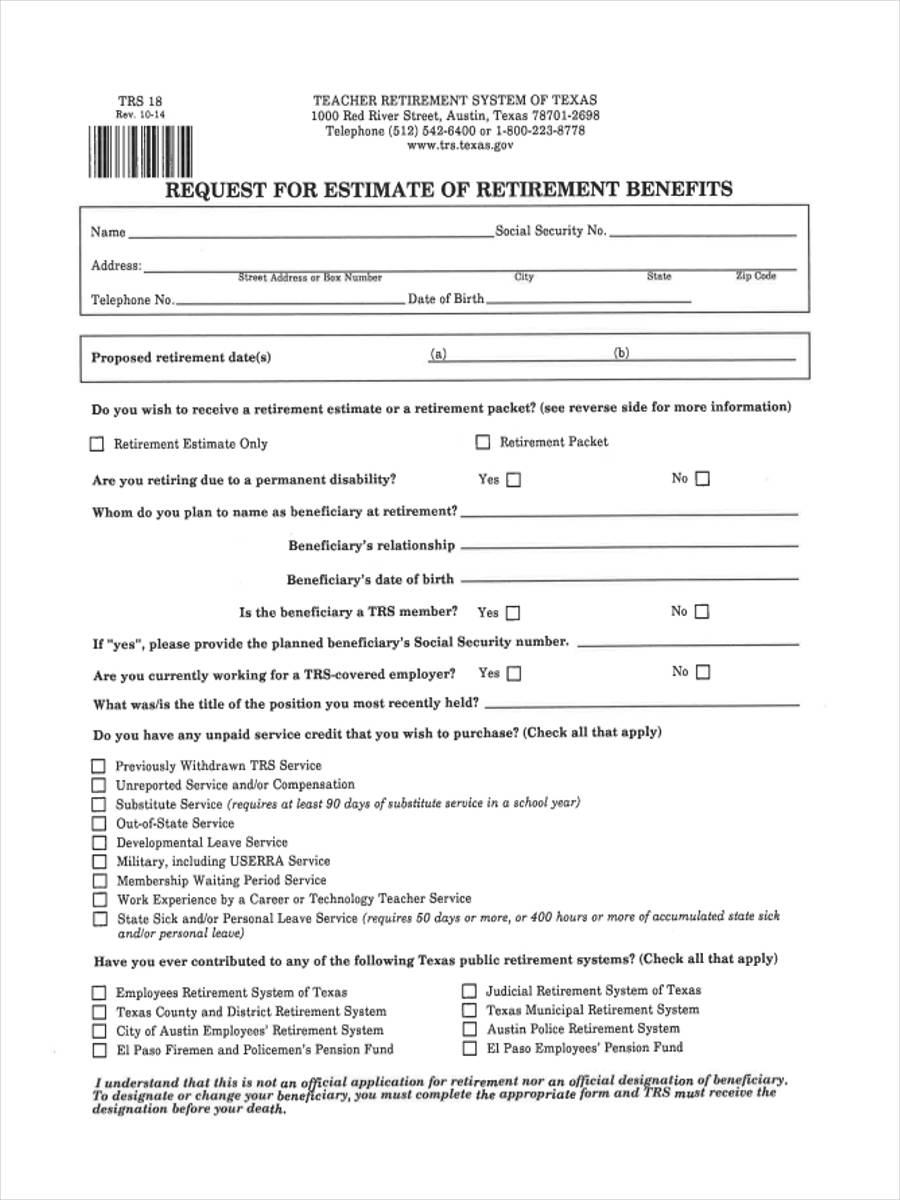

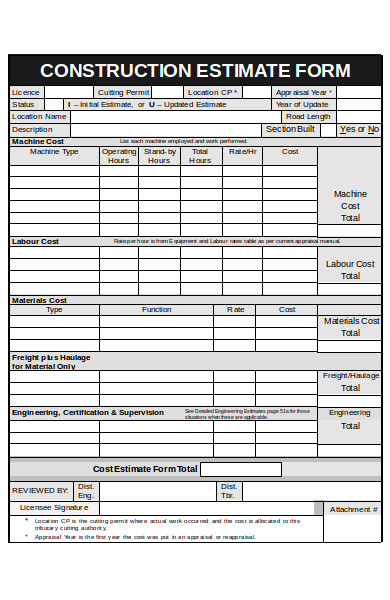

Whether you are making a document for a General Estimate or a Basic Job Estimate, such as a Construction Estimate, you should not forget this significant information on your estimate forms:

- The names and identification of both parties. An example is for a Medical Estimate where it should state the patient and the health care provider.

- The information of the project. This refers to the type of services done for the client or his personal statement that requires an estimation.

- The expected fees and payments. This area will indicate the estimation of the service provider for his client. An example is for an Income Estimate Form where the user will state the estimated years and the associated income statements.

- The declaration of truth and completion. This is in the form of an oath wherein the client assures that he is stating the information with the best of his knowledge and that he incorporated complete data on the document.

- The signatures of the client and the authorized personnel. Similar to any other legal documents used for transactions, this form will require a signature from both parties under the declaration or oath.

- The document checklist. Though not mandated to all Estimate Forms, this is helpful for knowing if the client has successfully given the appropriate and complete information. This is a checklist for the data to be provided by the client and this may include an area for further reasons needed by the provider.

Estimate Proposal Forms

Construction Estimate Proposal

Repair Estimate

Retirement Benefit Estimate

Individual Tax Estimate Form

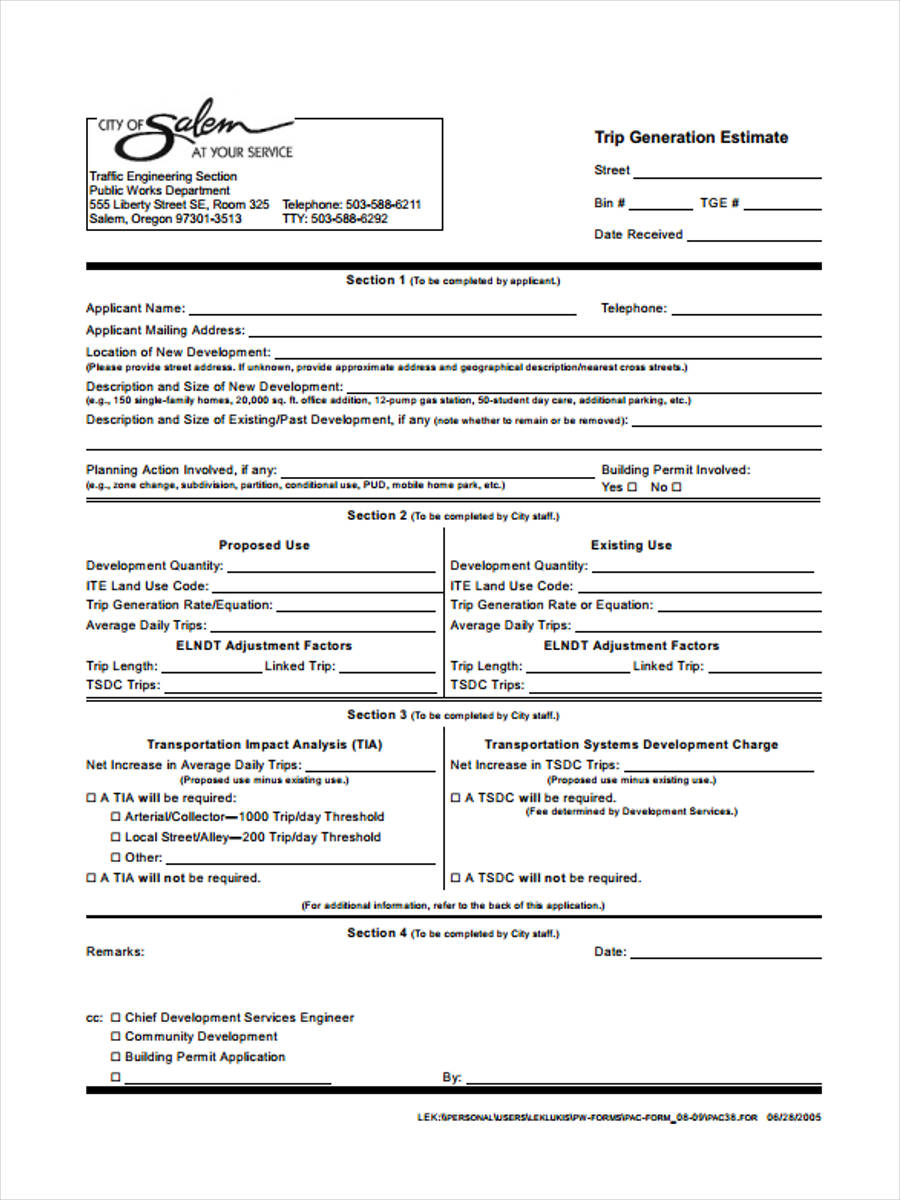

Trip Generation Estimate

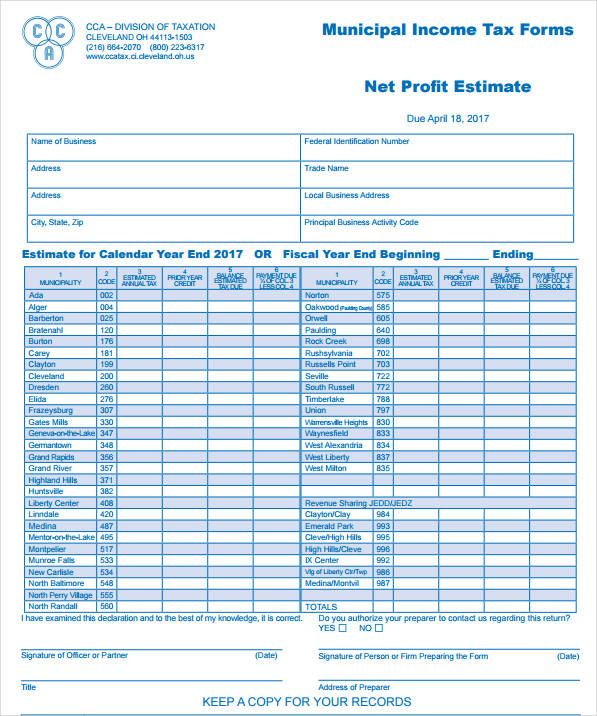

Net Profit Quarterly Estimate

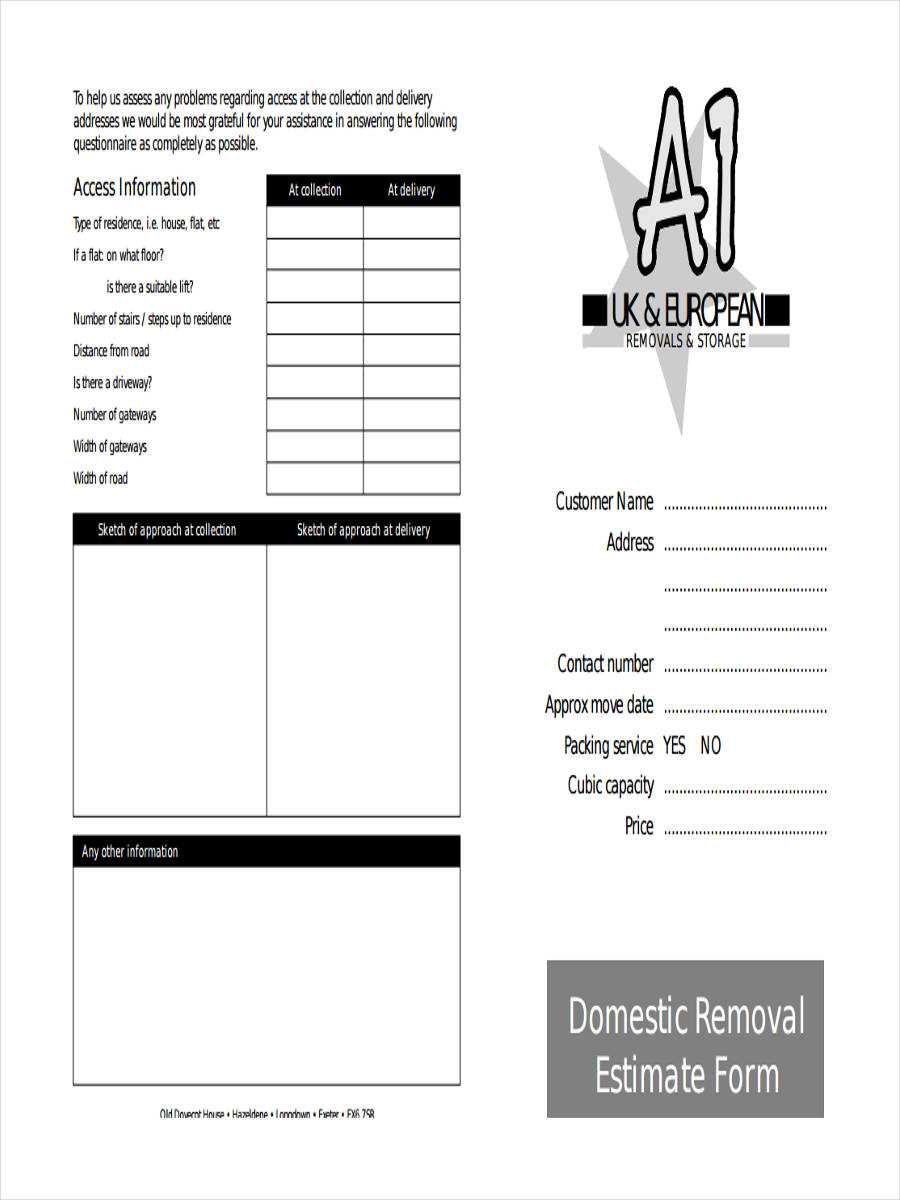

Domestic Removal Estimate

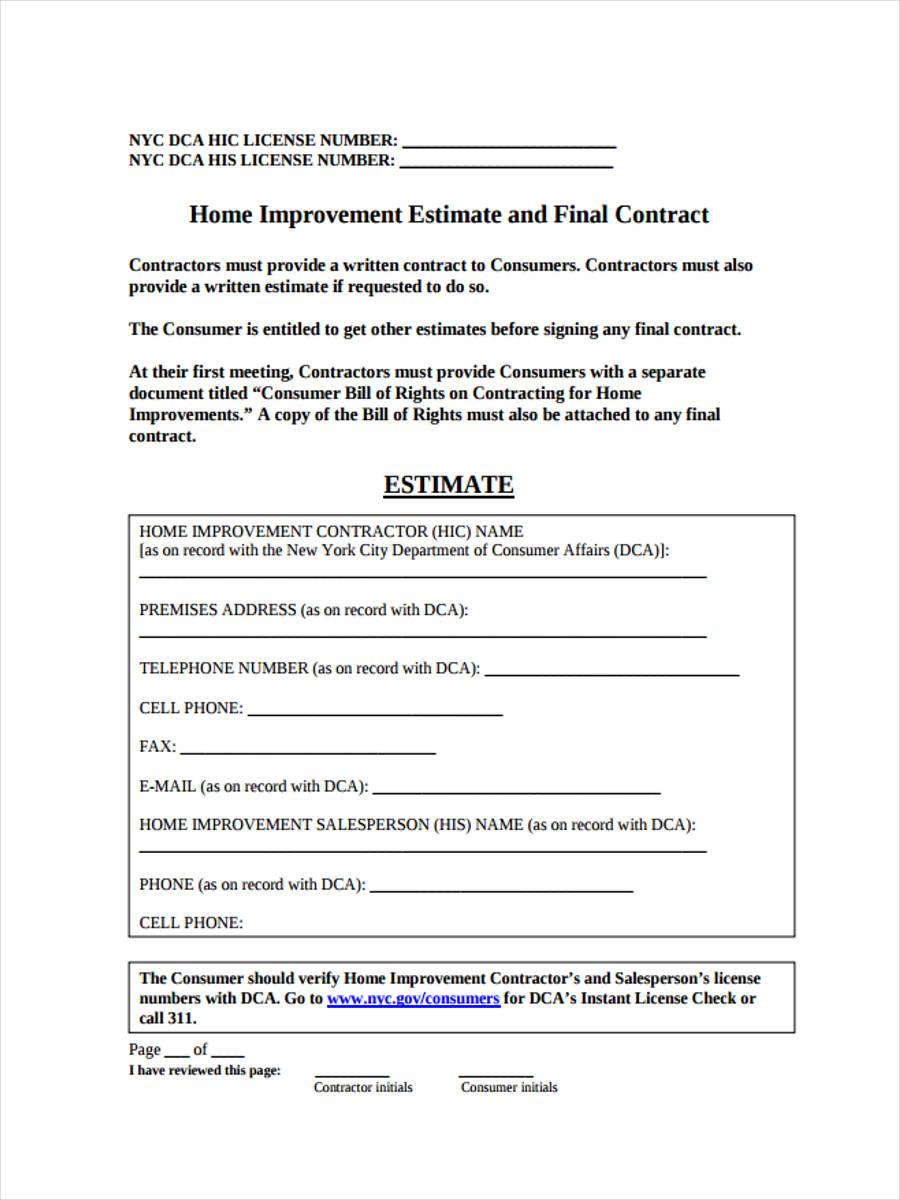

Home Model Estimate

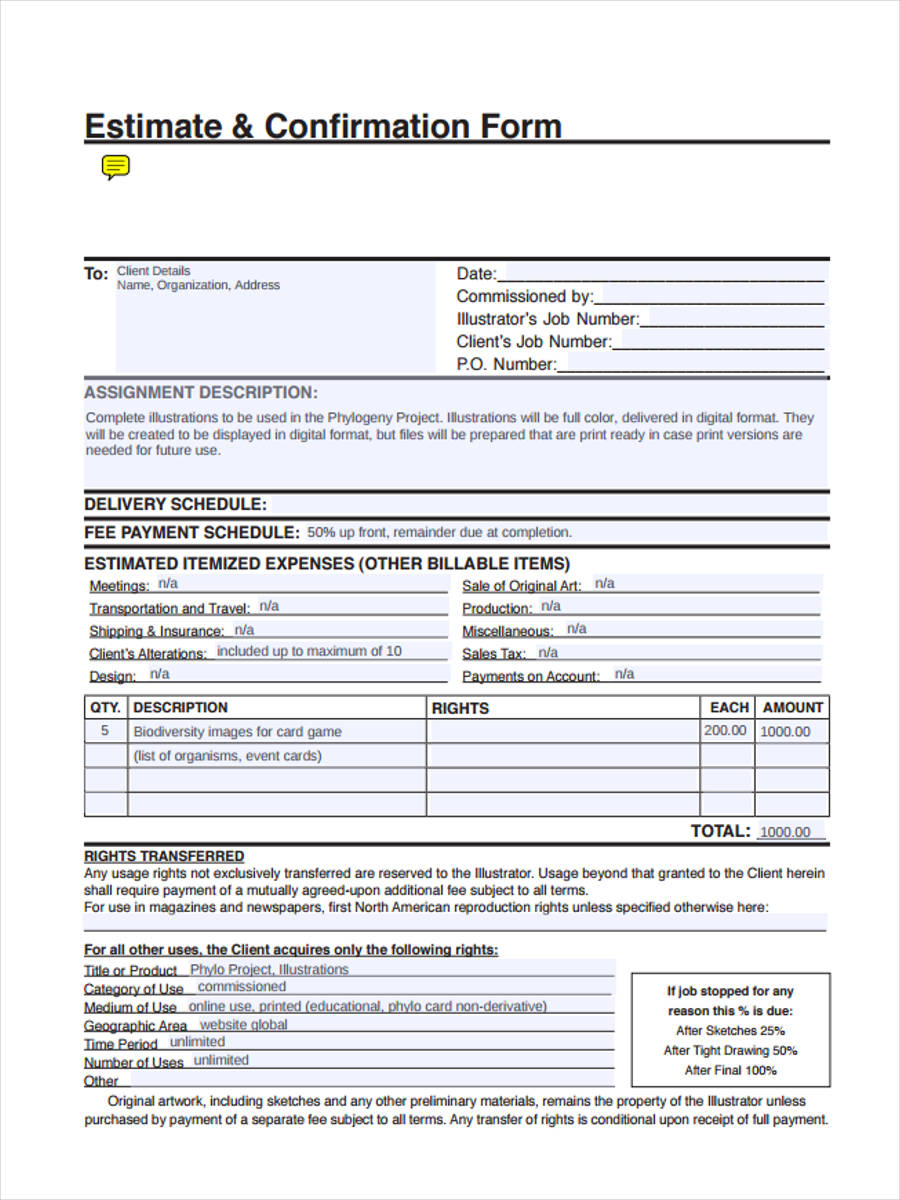

Estimate & Confirmation Form

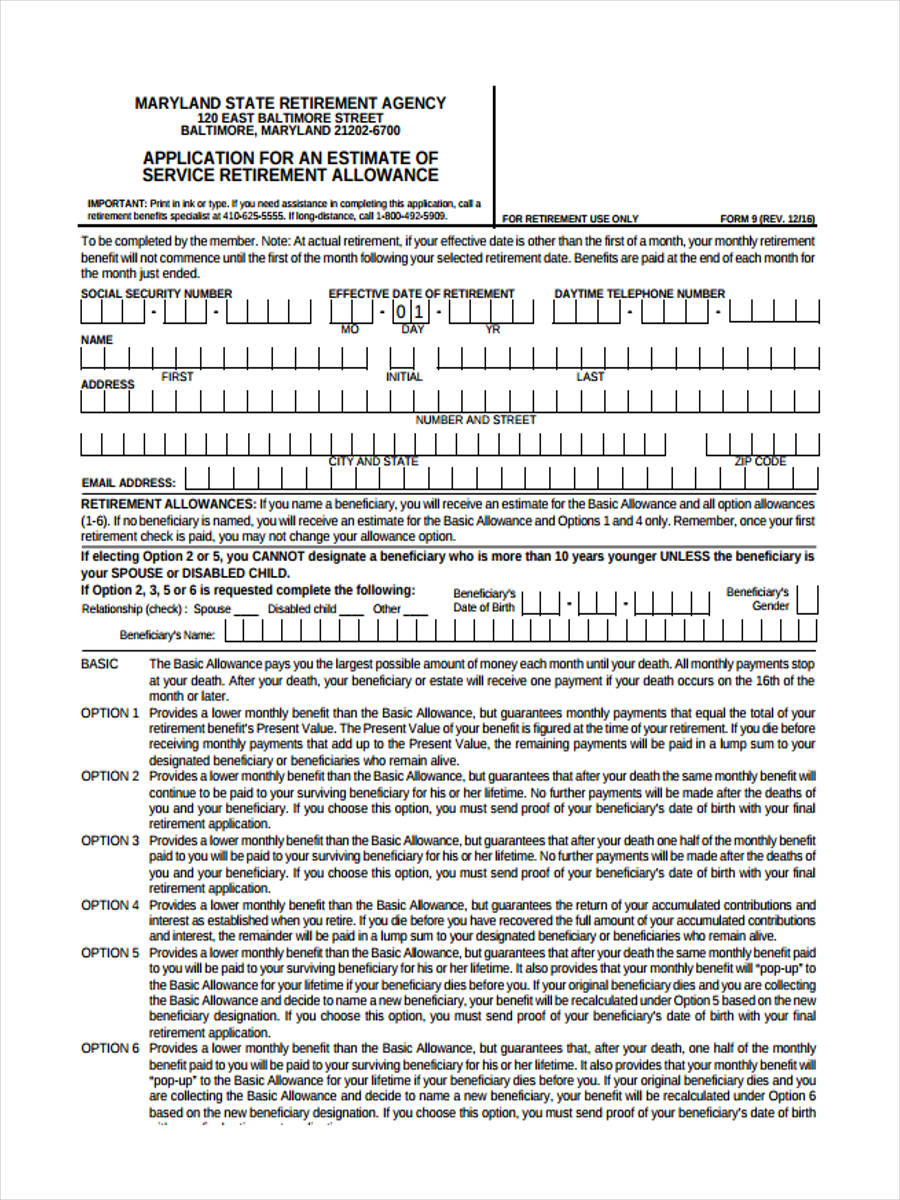

Application for Estimate of Service

How Do I Get Back My Old Estimate Form Style?

Losing a familiar form style can cause a headache to users, especially when this style is required for your business documents, such as an Estimate Form. There are two ways that you should consider when you lose the template:

- Make a new template and adopt it. Though this requires an ample amount of time to allow familiarity and edit the functions, this will aid you to set out new standards for your document.

- Scan and import. This will only be done if you have printed a copy of the document wherein you can scan it to your computer and import the file to a document maker.

Estimate Forms’ Advantages in Business

Managing a business is a tough job for any person since it requires a skill in dealing with the manpower, the clients, and the business processes. Using an Estimate Form will aid a businessman in knowing the relationship of the costs of his services. This will allow him to have a view of the probable projects that he will accept for his business. The form will also help in giving the client an approximate range for the payments required for him.

There is a particular document to be used by businessmen, and this is an Expedited Premium Estimate Form. It has the information for the type of insurance the company is enrolled, the number of staff and employers, the details of the owners, and the company’s annual gross income.

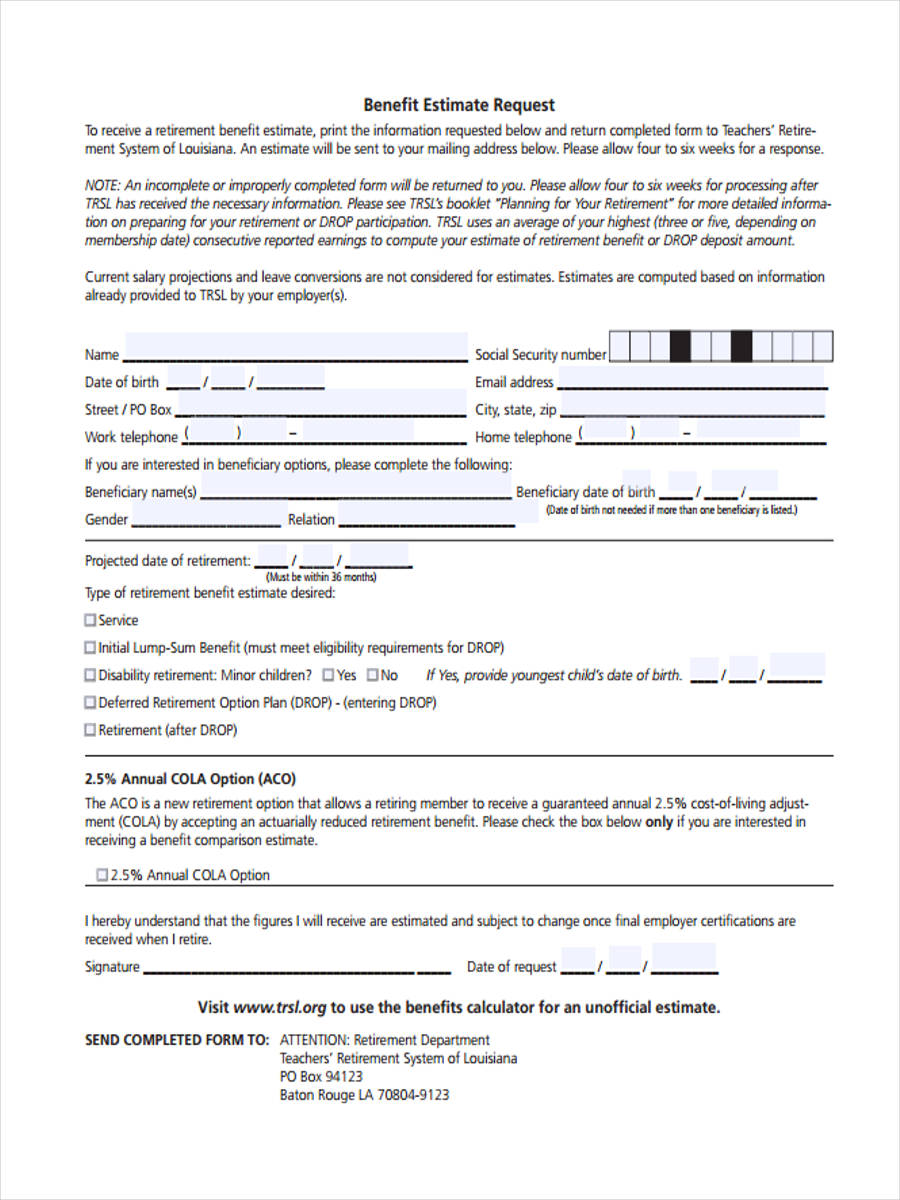

Benefit Estimate Request

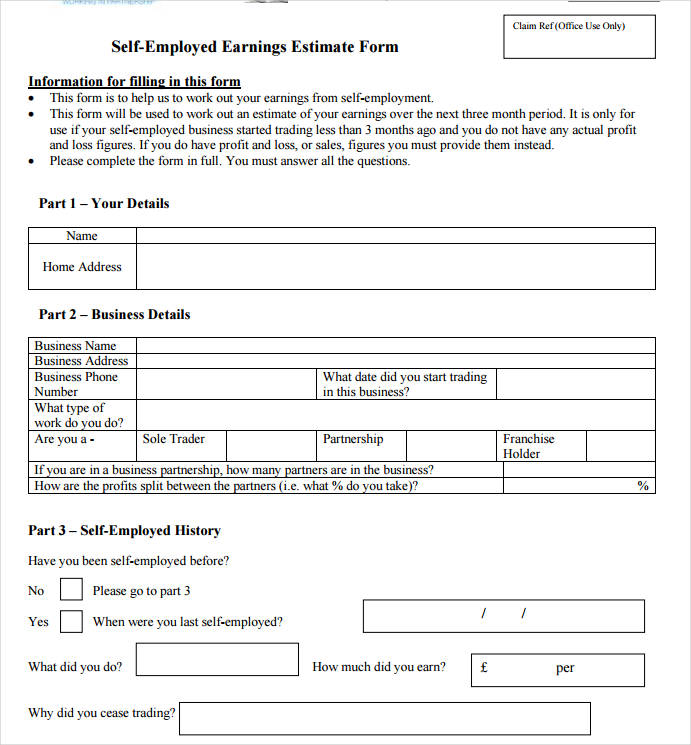

Estimate Form for Self-Employed Earnings

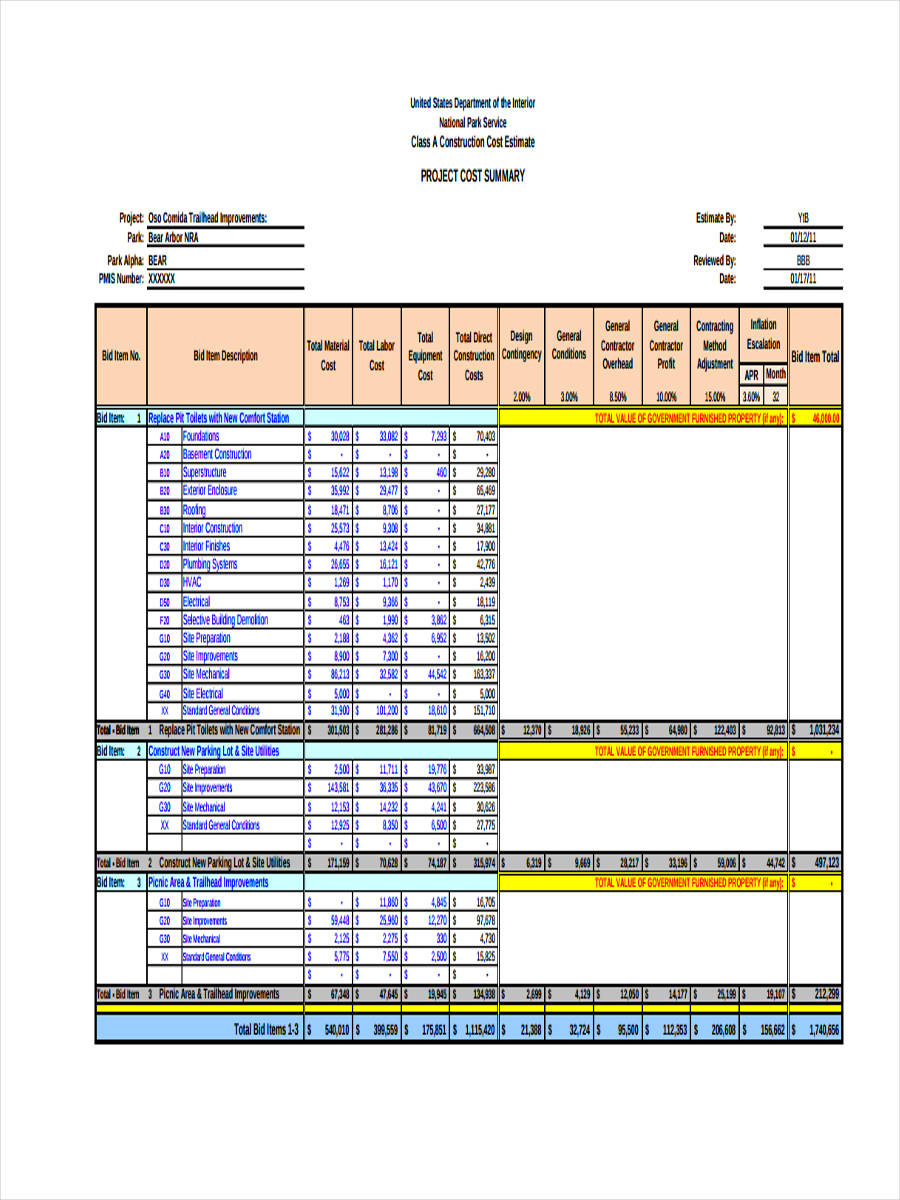

Construction Estimate

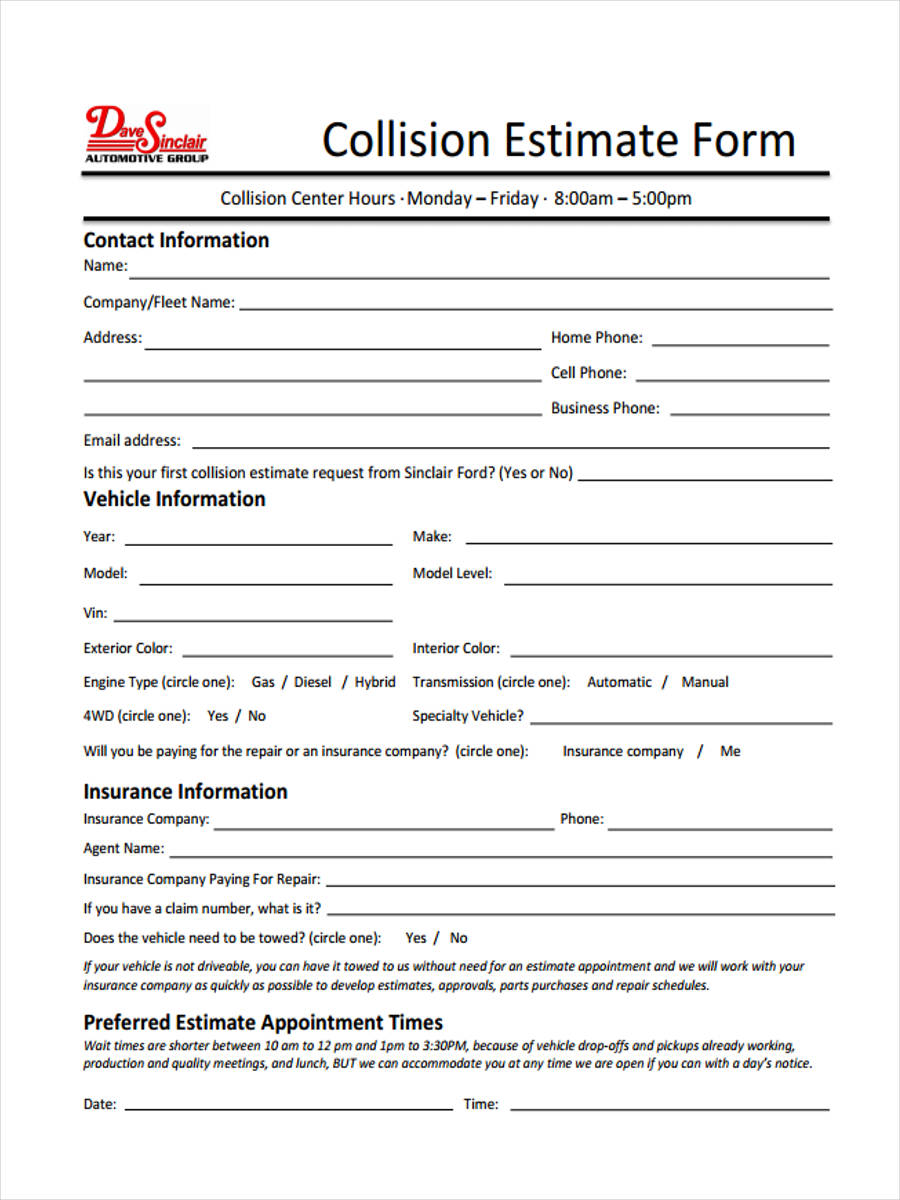

Collision Estimate Form

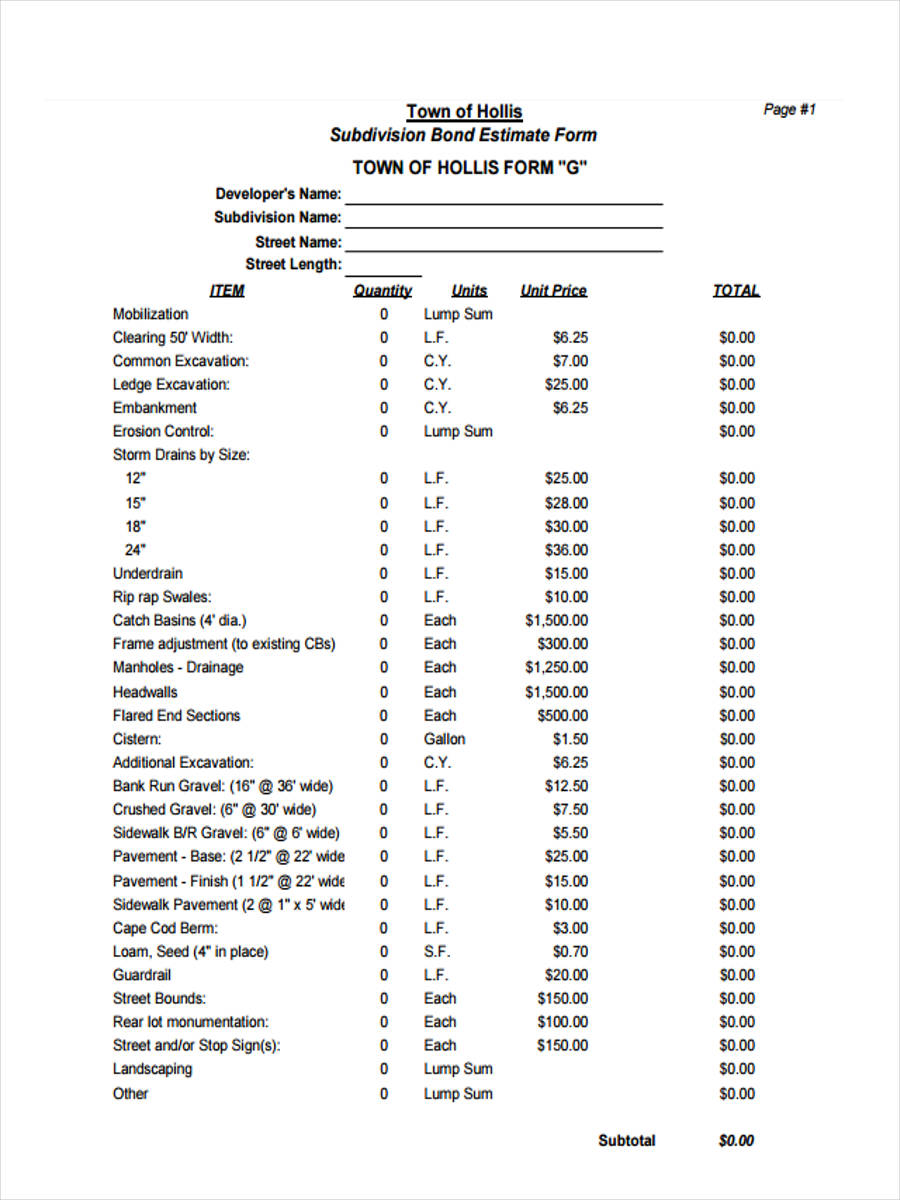

Bond Estimate

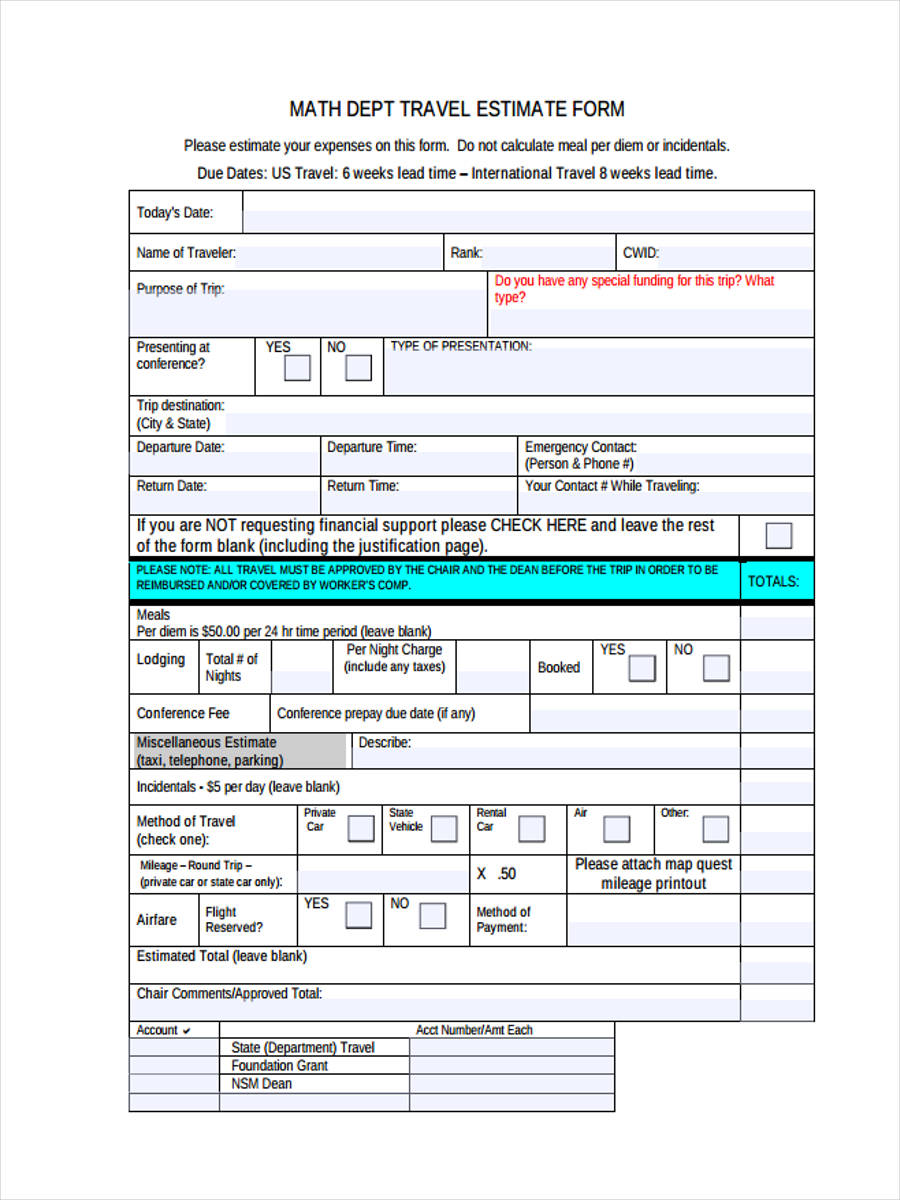

Travel Estimate Form

Good Faith Estimate

Self-Employed Earnings Estimate

Credit Estimate Form

Customer Fence Estimate

Property Repair Estimate

Independent Estimate Determination

Sample Construction Estimate Form

Tips for Understanding and Calculating Your Estimated Tax

One can acquire his tax estimation with the aid of his income. Here are tips that you should remember when computing your own estimated tax payment:

- Record your income rates to allow you in tracking your possible taxes. This is because your required tax payments will vary on the amount of your income with the number of your beneficiaries.

- Know if you have penalties due to the reason of not paying your taxes on time. And if there are, prepare these supporting documents which includes a Notice of Due or a Notice of Penalty for taxes that you failed in complying.

- Inquire at your tax agency on how the taxes are computed with regards to your ability in receiving a regular income.

- Fill out and use only the required form document provided by your State or government to aid you in the computation.

Some agencies who have statisticians and experts, who deal with estimation, offers services to individuals who are facing problems and difficulties with their estimating strategies in their businesses. These agencies require Estimate Request Forms to be completed by their client in order for them to have adequate number of information to create the estimated calculation.

Related Posts

-

FREE 7+ Sample Loan Estimate Forms in PDF | MS Word

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel