An Employee Loan Agreement is a crucial tool to formalize loan terms between employers and employees. It ensures clarity, trust, and mutual agreement on repayment schedules, interest rates, and loan conditions. This comprehensive guide simplifies creating an Agreement Form for workplace loans. Designed for transparency and legal compliance, our examples highlight best practices, including necessary clauses to avoid disputes. Whether you’re drafting a new Employee Form or updating an existing one, this guide offers valuable insights. Empower your HR processes with an agreement tailored for fairness and accuracy.

Download Employee Loan Agreement Bundle

What is Employee Loan Agreement?

An Employee Loan Agreement is a legal document that outlines the terms of a loan given by an employer to an employee. It ensures mutual understanding of repayment schedules, interest rates, and conditions. A clear and concise agreement protects both parties from misunderstandings, providing a structured framework for workplace financial assistance.

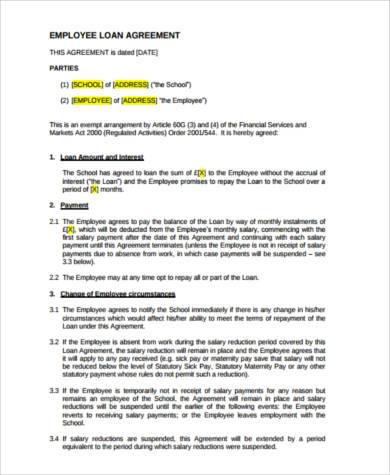

Employee Loan Agreement Format

This agreement outlines the terms under which the loan is granted by the employer to the employee.

Loan Details:

Loan Amount:

Purpose of Loan:

Repayment Term:

Repayment Terms and Conditions:

- I agree to repay the loan amount through payroll deductions as specified. The deductions will occur bi-weekly/monthly as per the outlined schedule.

Interest and Penalties:

Interest Rate:

Penalty for Delayed Payments:

Termination Clause:

- In the event of employment termination, the remaining loan balance becomes immediately payable.

Acknowledgment of Terms:

- I, the undersigned, agree to the terms and conditions of this loan.

Signature Section:

Employee Signature:

Date:

Employer Representative Signature:

Date:

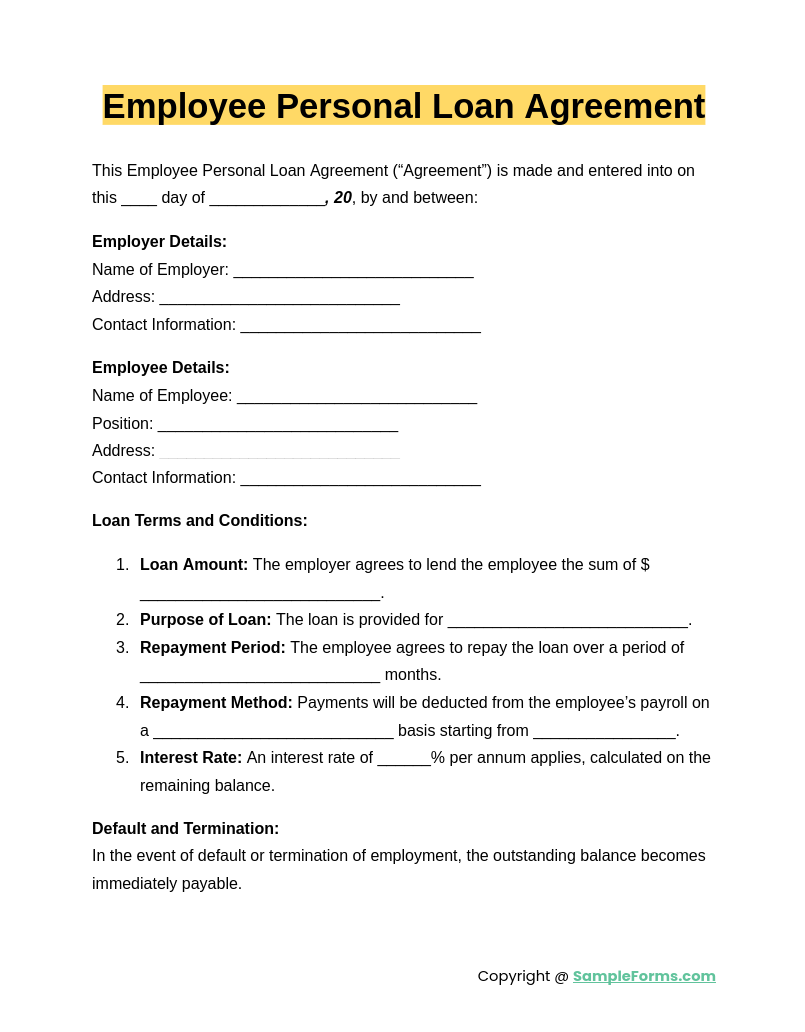

Employee Personal Loan Agreement

An Employee Personal Loan Agreement is designed to document terms for loans provided by employers to employees for personal use. It ensures mutual clarity on repayment terms, interest, and loan duration. Similar to a Commercial Rental Agreement Form, this document protects both parties, fostering trust and accountability.

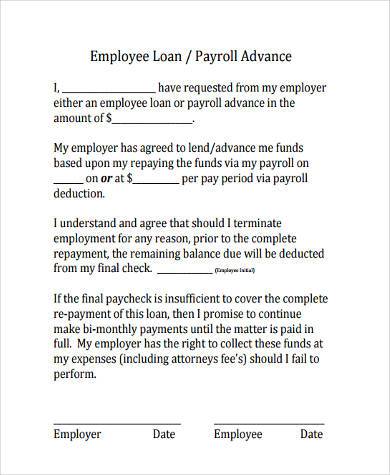

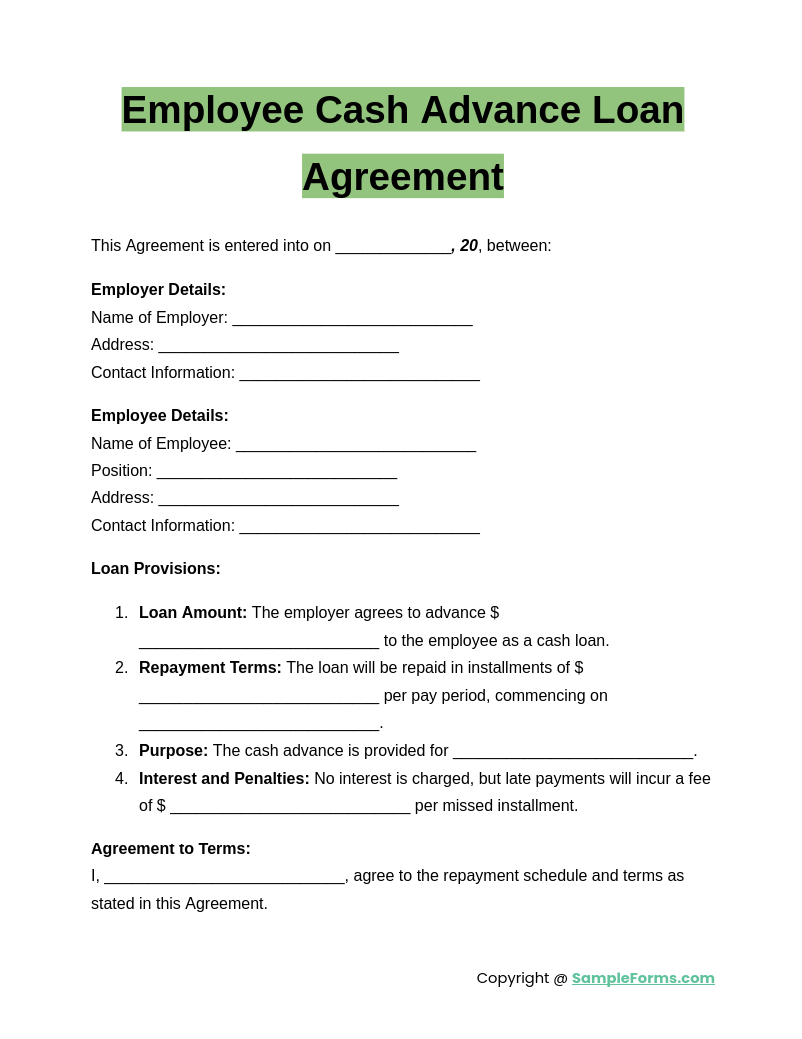

Employee Cash Advance Loan Agreement

The Employee Cash Advance Loan Agreement formalizes cash advances offered to employees, specifying repayment schedules and conditions. It provides clear financial accountability. Comparable to a Settlement Agreement Form, this document safeguards against misunderstandings while offering a fair financial solution.

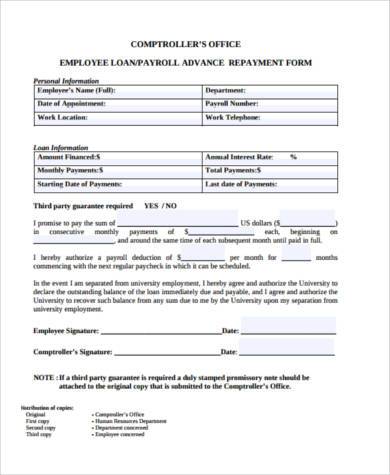

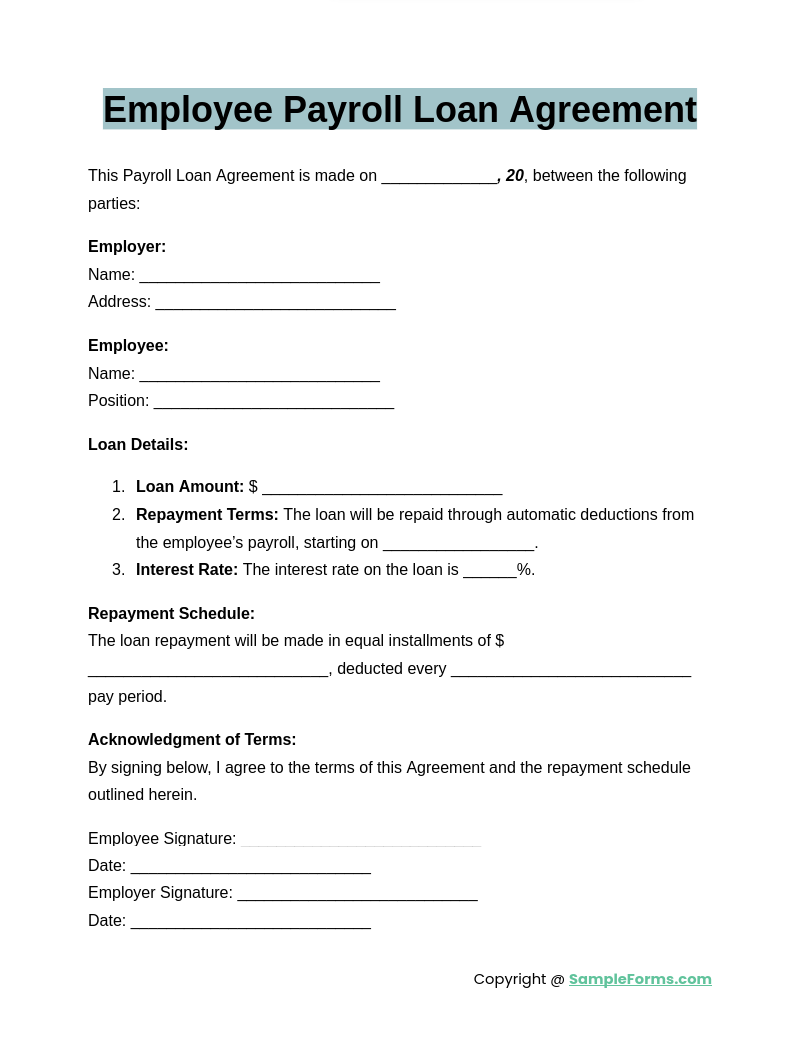

Employee Payroll Loan Agreement

An Employee Payroll Loan Agreement streamlines loan repayments directly through payroll deductions. It outlines the loan amount, interest, and deductions. Like a Rental Lease Agreement Form, it ensures clarity, preventing financial disputes and ensuring compliance with legal and organizational policies.

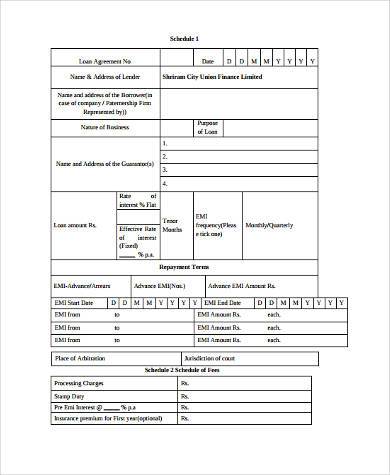

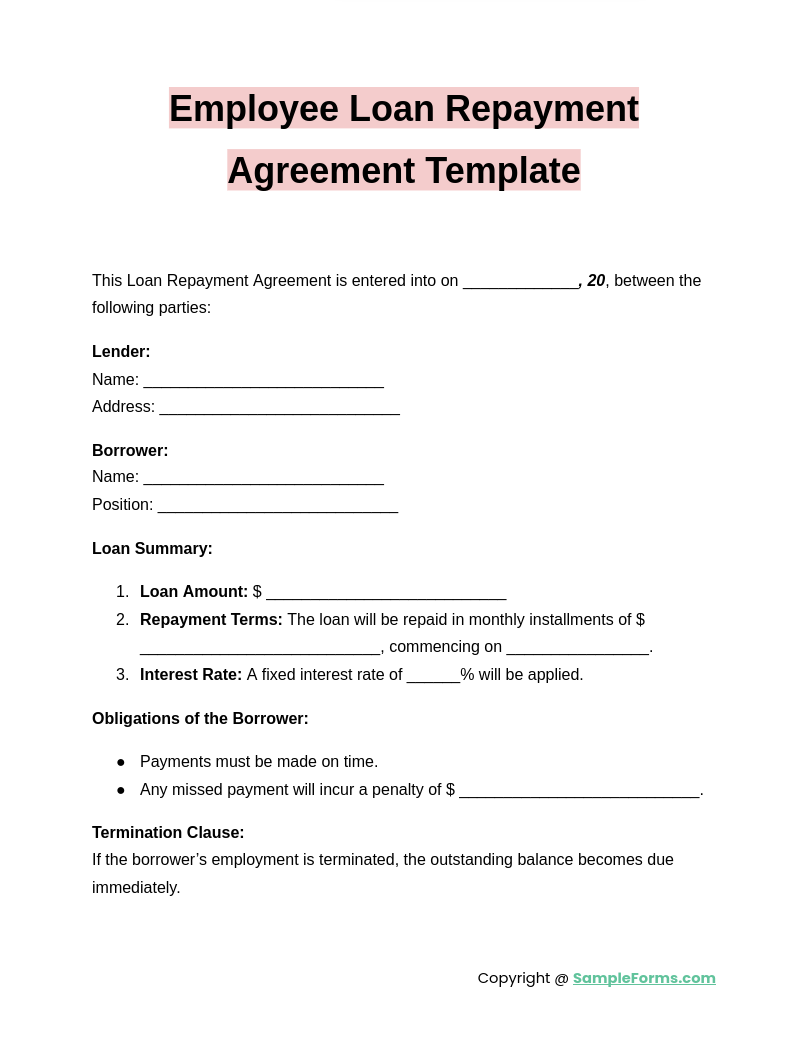

Employee Loan Repayment Agreement Template

The Employee Loan Repayment Agreement Template provides a comprehensive format for defining repayment terms of loans extended by employers. It includes essential clauses for mutual understanding. Similar to a Trailer Rental Agreement Form, it emphasizes precision and clarity, ensuring seamless loan recoveries.

Browse More Employee Loan Agreements

Employee Loan Repayment Agreement Form

Employee Loan Advance Agreement

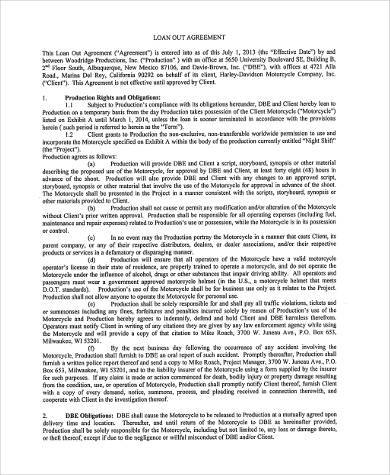

Employee Loan Out Agreement

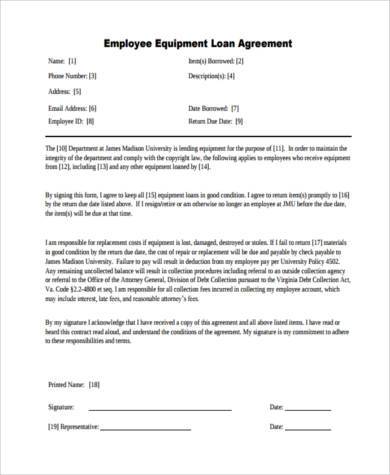

Employee Equipment Loan Agreement

Employee Personal Loan Agreement

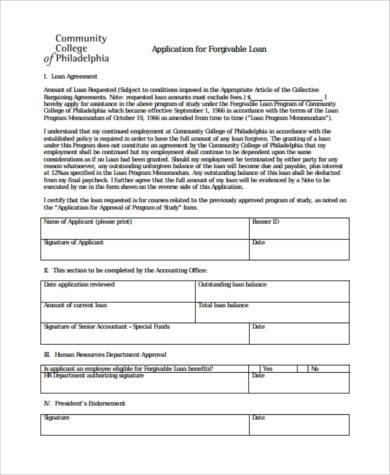

Employee Forgivable Loan Agreement

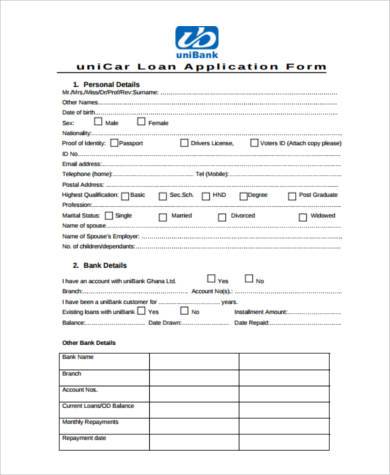

Employee Car Loan Agreement

Employee Loan Agreement Form

Employee Loan Agreement Format

How do I set up a loan for an employee?

Setting up a loan for an employee involves documenting terms and ensuring legal compliance. This ensures mutual understanding and protects both parties. Key steps include:

- Determine Loan Terms: Decide on the loan amount, interest rate, and repayment schedule. Similar to a Business Purchase Agreement Form, ensure terms are clear and fair.

- Draft a Loan Agreement: Include all relevant details like repayment terms, late fees, and consequences for default.

- Legal Review: Consult a lawyer to validate the agreement’s compliance with local laws.

- Employee Consent: Obtain written approval from the employee, ensuring they understand all terms.

- Monitor Repayment: Implement a tracking system for repayments, ideally linked to payroll deductions.

How does a loan agreement work?

A loan agreement legally binds the lender and borrower, detailing loan terms, repayment, and consequences for default. It protects both parties’ interests. Key steps include:

- Define Obligations: Specify the lender’s obligations and borrower’s repayment responsibilities. Align it with a Non Compete Agreement Form for clarity.

- Interest Rates and Fees: Clearly state any interest rates or administrative fees applicable.

- Repayment Schedule: Detail repayment timelines, methods, and conditions for early payments.

- Default Clauses: Include provisions for non-payment or default scenarios.

- Final Agreement: Ensure both parties sign the agreement with a witness if necessary.

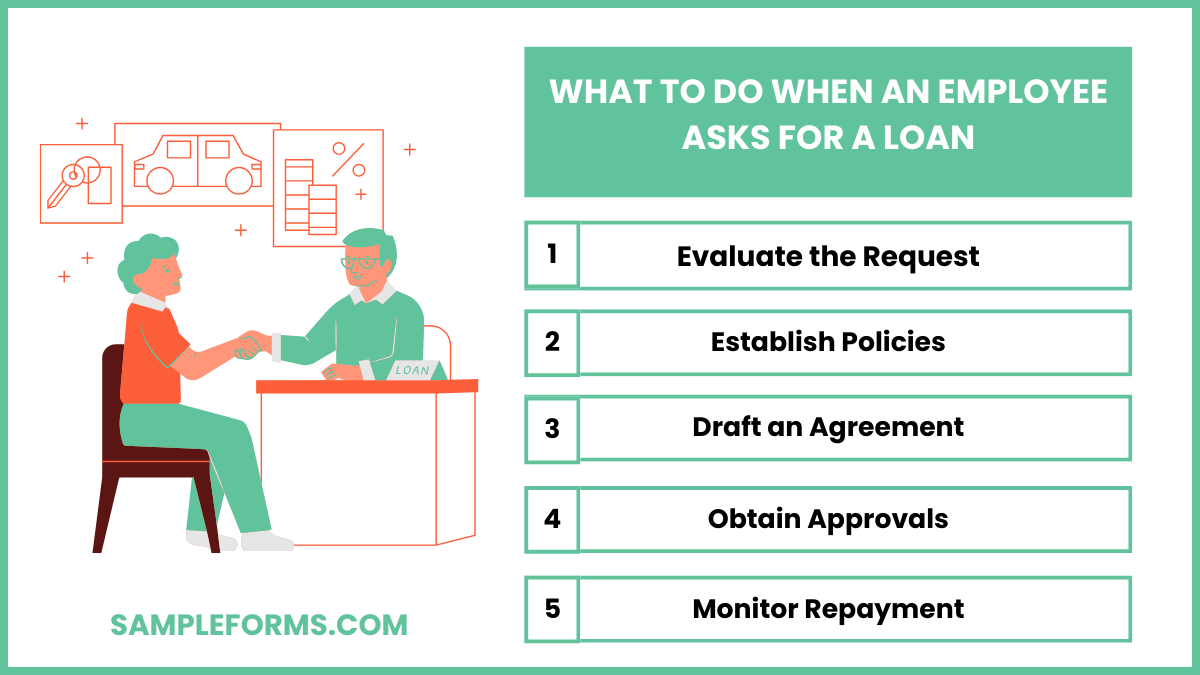

What to do when an employee asks for a loan?

When an employee requests a loan, assess the situation carefully to ensure fairness and legal compliance. Key steps include:

- Evaluate the Request: Determine the necessity and amount requested. Similar to a Room Agreement Form, consider the employee’s history and circumstances.

- Establish Policies: Have a standardized policy for granting loans to maintain fairness.

- Draft an Agreement: Document all loan terms, repayment schedules, and legal protections.

- Obtain Approvals: Secure necessary managerial or HR approvals before proceeding.

- Monitor Repayment: Track repayments and maintain transparency with the employee.

What makes a loan agreement invalid?

A loan agreement becomes invalid if it lacks legal compliance, clear terms, or mutual consent. Ensure the agreement is comprehensive and legally sound. Key considerations include:

- Ambiguity in Terms: Unclear or missing terms can nullify the agreement.

- Lack of Consent: Both parties must willingly sign. Align it with a Parking Agreement Form for added clarity.

- Violation of Laws: Ensure compliance with local and federal loan regulations.

- Improper Documentation: Missing critical details like loan amount or repayment terms makes it invalid.

- Unfair Terms: Ensure the agreement is fair and reasonable for both parties.

What if you can’t afford to pay your employees?

If financial constraints hinder employee payments, address the issue transparently to maintain trust. Key steps include:

- Assess Financial Health: Evaluate the business’s financial status and explore cost-cutting measures. Similar to an Electrical Subcontractor Agreement Form, prioritize obligations.

- Communicate Transparently: Inform employees about the situation and proposed solutions.

- Seek External Assistance: Explore loans or grants to cover temporary cash flow issues.

- Offer Alternatives: Provide partial payments or deferred salary arrangements with employee consent.

- Revise Budgets: Implement long-term financial planning to avoid future constraints.

Can you charge interest on employee loans?

Employers can charge interest on employee loans if agreed upon in a Financial Agreement Form, ensuring compliance with local laws and fair lending practices.

How do 1099 employees get loans?

1099 employees can secure loans by providing proof of consistent income and agreements like a Joint Venture Agreement Form to support their financial stability.

Can my employer pay for my down payment?

Employers may offer down payment assistance through structured programs documented in a Deposit Agreement Form, often as part of employee benefits or loans.

Is a handwritten loan agreement legally binding?

A handwritten loan agreement is legally binding if it meets the criteria of a Land Purchase Agreement Form, including clear terms, signatures, and mutual consent.

Can employers offer loans to employees?

Employers can provide loans outlined in a Lease Agreement Form, detailing repayment terms and compliance with legal and tax regulations for workplace benefits.

Can you take out a loan to pay employees?

Companies can secure loans to meet payroll obligations, adhering to terms in an Employee Grievance Form for transparency and employee satisfaction.

Can a company write off a loan to an employee?

Employee loans may be written off under certain circumstances, documented via an Employee Complaint Form, ensuring proper tax and legal compliance.

Are employee wages 100% tax deductible?

Employee wages, including overtime and bonuses, are generally 100% tax deductible when recorded appropriately in an Employee Shift Change Form.

What to do when an employee asks for a loan?

Evaluate requests thoroughly and establish terms in an Employee Resignation Form, ensuring mutual understanding and adherence to workplace policies.

Are employment agreements legally binding?

Employment agreements are legally binding when they include all necessary terms, signatures, and compliance checks, similar to an Employee Absence Form.

A structured Employee Loan Agreement is indispensable for workplace financial arrangements. By defining terms and repayment schedules, it safeguards trust and transparency. Drafting an effective Employment Agreement Form ensures mutual accountability, legal compliance, and streamlined HR operations. Use our detailed samples and templates for guidance.

Related Posts

-

FREE 3+ Triple-Net (NNN) Lease Agreement Samples in PDF | MS Word

-

FREE 3+ Month-to-Month Residential Lease Agreement Samples in PDF | MS Word

-

FREE 9+ Apartment Lease Agreements in PDF | MS Word

-

FREE 6+ Joint Lease Agreements in PDF | MS Word

-

FREE 4+ Massage Rental Agreement Forms in PDF | MS Word

-

FREE 5+ College Roommate Agreement Samples in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form