More than half of the employees in the United States receive their paychecks through direct deposit, instead of receiving their paychecks in the mail or personally being handed them. Direct Deposit is an electronic way of payment wherein the amount is being deposited directly into the recipient’s bank account.

For employees to be able to receive their paychecks through direct deposit, they would only need to have a bank or credit union account where the amount will be directly deposited in. You may use our samples below as basis for your own forms. You may also check out our Deposit Forms for more downloadable samples and information.

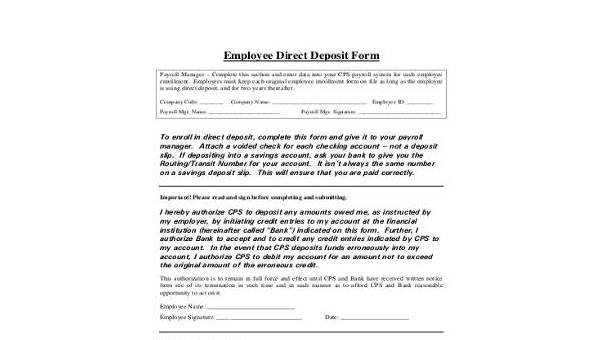

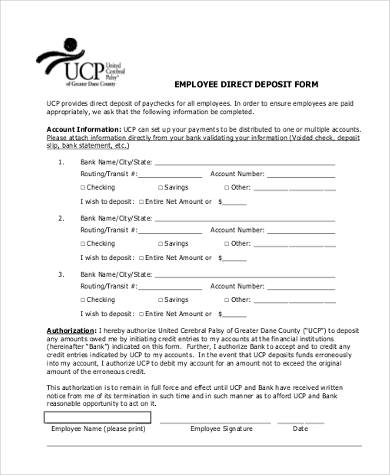

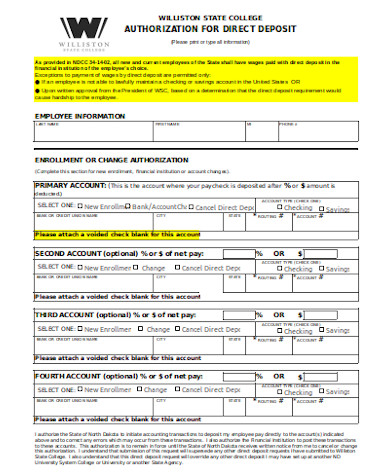

Employee Direct Deposit Enrollment Form

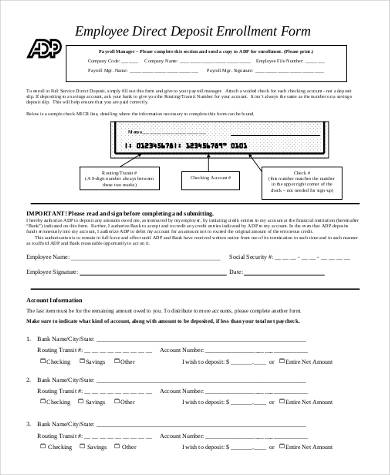

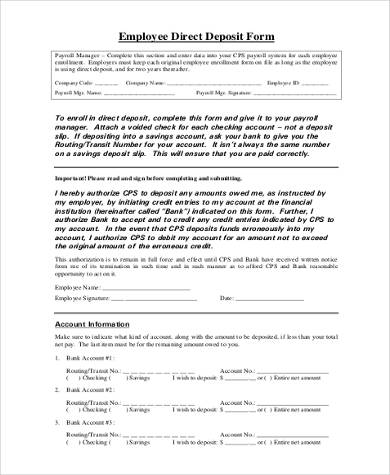

Employee Direct Deposit Authorization Form

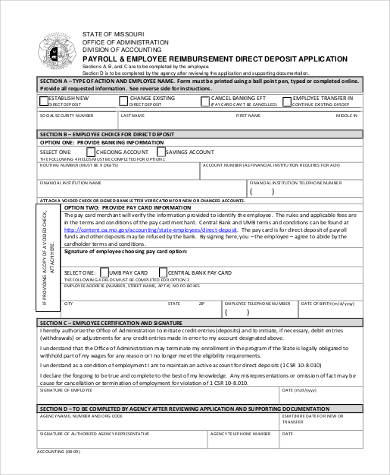

Employee Reimbursement Direct Deposit Form

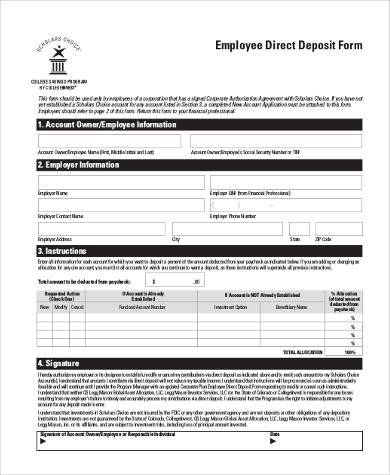

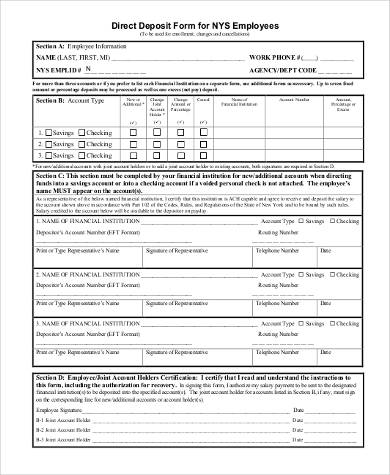

Employee Direct Deposit Form in PDF

Payroll Checks versus Direct Deposits

- When you pay your employee using payroll checks, you will have to expend funds to print and process those checks. You will need to order a lot of checks, especially if you own a huge company. This will cost you more money and it will take a lot more time in processing the checks, especially if you have to write them by hand. Direct deposits are faster because all payments are done online. You would only need to have your employees fill out Payroll Direct Deposit Forms if they want to sign up.

- One drawback of direct deposits is that not everyone can be paid through it. This is because an employee would need to have a bank or credit union account for them to be able to sign up for direct deposit, and most banks would refuse to open accounts for people with bad credit. However, for payroll checks, an employee would only need a valid ID to cash a check, even if it involves a certain fee. So it is not always possible for all employees to be paid through direct deposits. You would also need Direct Deposit Authorization Forms to be filled out by employees who want to sign up for direct deposit.

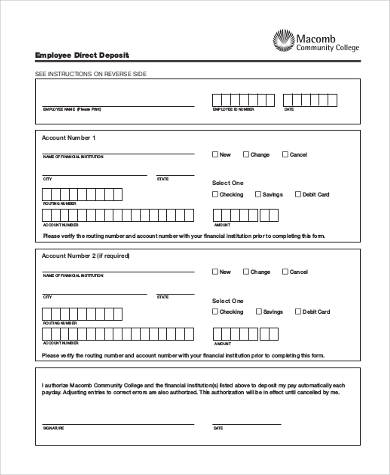

Blank Employee Direct Deposit Form

Free Employee Direct Deposit Form

Generic Employee Direct Deposit Form

Employee Direct Deposit Form Example

General Employee Direct Deposit Form

Printable Employee Direct Deposit Form

- There are states that have laws wherein the employee has the right to receive their pay without having to pay a fee to a bank, and with payroll checks, there are certain bank fees applied to cashing checks. In certain states, you have to write checks against a bank that have branches in the state or county where you operate your business in. But since it is a standard operating procedure for banks to charge a fee for individuals who are not account holders, you may have to move your account to a new bank to comply with state laws. But if you use direct deposit, the employees will not pay a cent when they receive their pay, so you can pay your employees so long as they have an account at any bank.

- Paying your employees with payroll checks also exposes you to fraud, because a check contains information on your account number, the bank’s routing number, and the name and address of your business. These bits of information can be used by a fraudster to gain unauthorized access to your accounts, whereas using direct deposit protects you from fraud, because your bank account information will not show on your employee’s bank statement.

So you see, there are various pros and cons to setting up direct deposit for your employees. It is important that you weigh the pros and cons, and consider the opinions of your employees as well. In the meantime, you may see our Direct Deposit Forms for more samples and information.