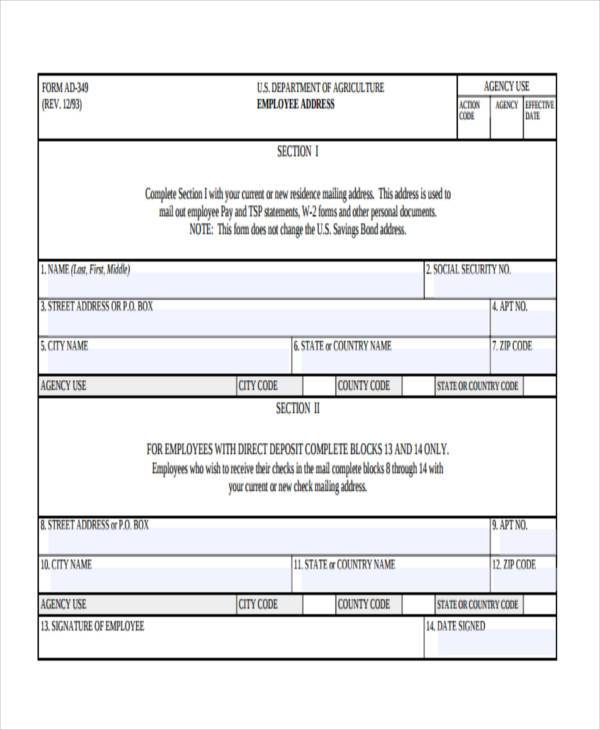

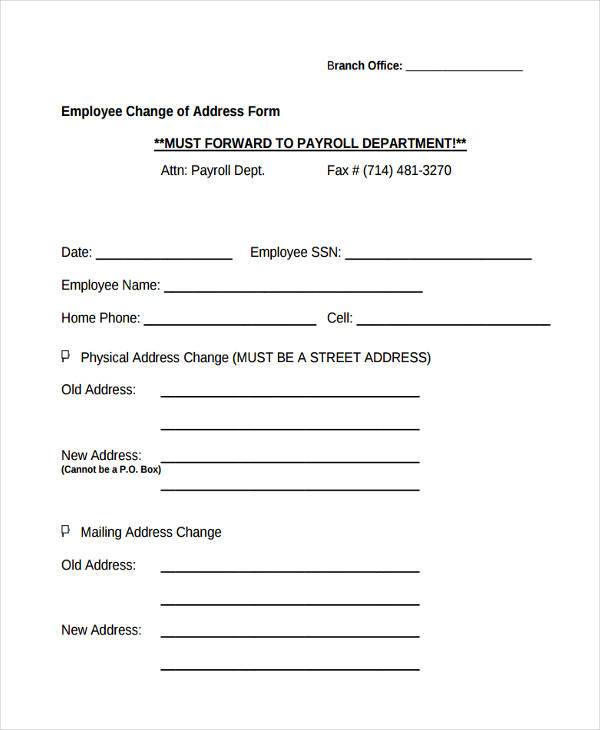

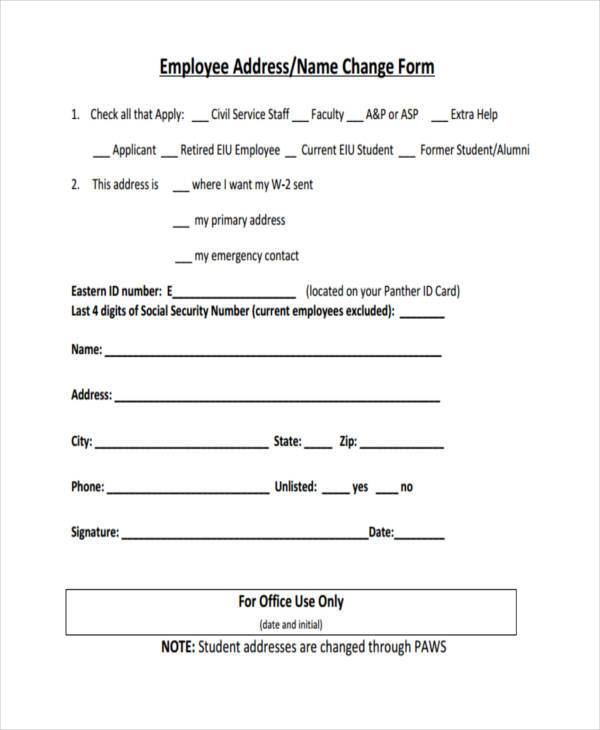

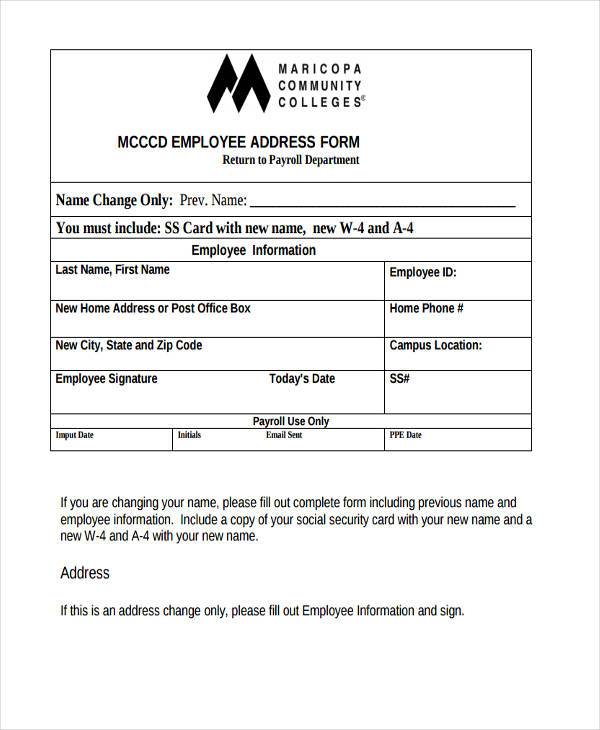

An Employee Address Form is a crucial document used to update and maintain accurate employee records. This Employee Form and Change of Address Form helps HR departments ensure seamless payroll processing, emergency contact updates, and tax compliance. Keeping address records updated minimizes miscommunication and ensures smooth correspondence between employers and employees. This form is essential when employees relocate, change phone numbers, or update mailing addresses.

Download Employee Address Form Bundle

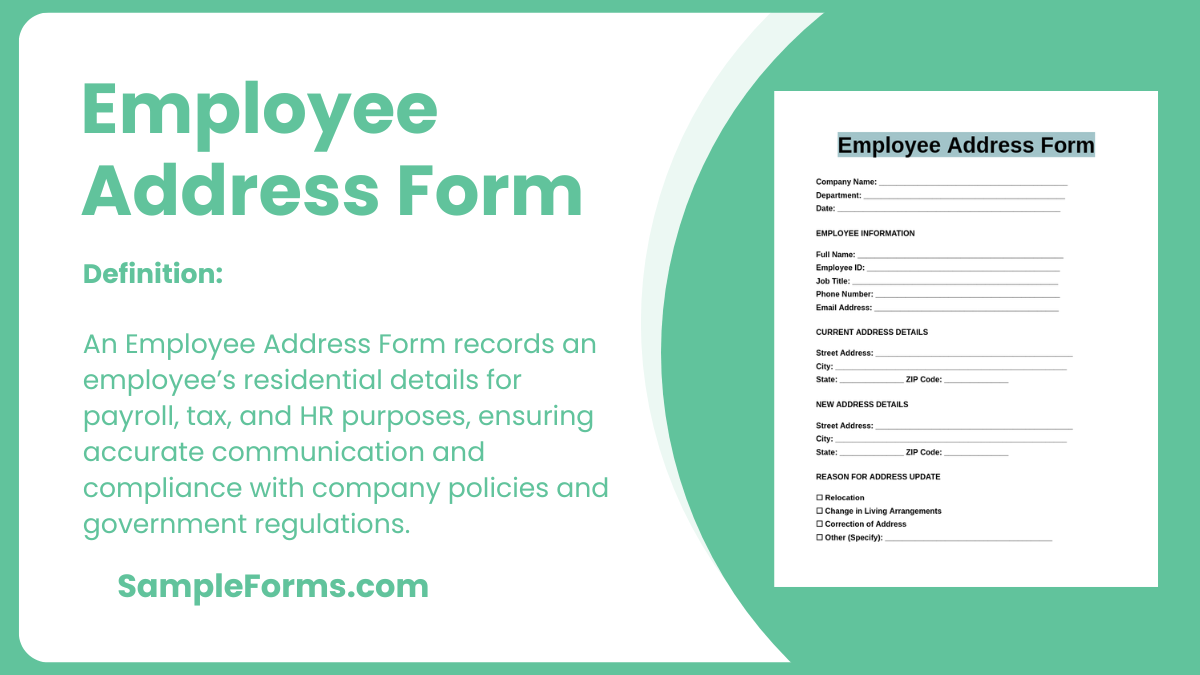

What is Employee Address Form?

An Employee Address Form is a document used by companies to collect and update an employee’s residential and mailing address. It ensures accurate record-keeping for payroll, benefits, tax documentation, and emergency contacts. Employers rely on this form to maintain proper communication and compliance with regulatory requirements. Employees are required to complete it when moving to a new location or updating personal information.

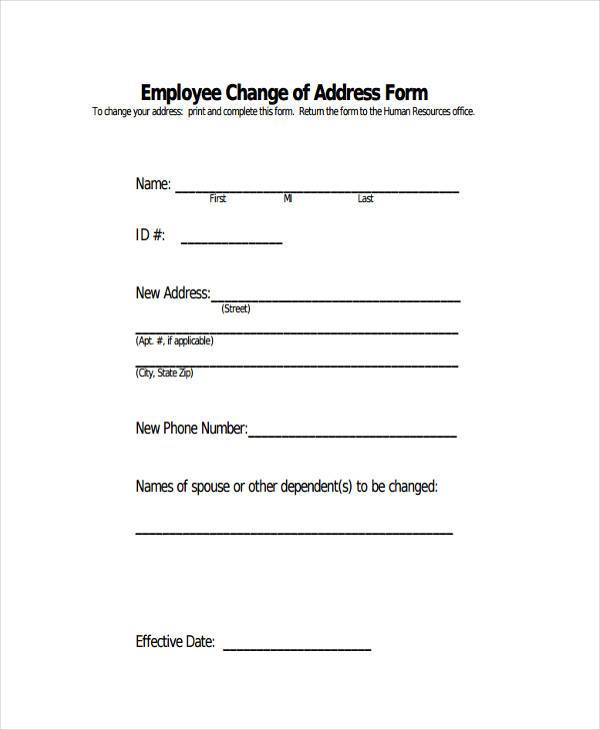

Employee Address Format

Employee Information

Name: [Full Name]

Employee ID: [Company ID]

Department: [Department Name]

Residential Address

Current Address: [Full Address]

City, State, ZIP: [City, State, ZIP Code]

Contact Details

Phone: [Primary Contact Number]

Email: [Company/Personal Email]

Emergency Contact

Name: [Full Name]

Relationship: [Parent, Spouse, Guardian]

Phone: [Emergency Number]

Update Clause

Employees must notify HR of any address changes within [Timeframe] to maintain accurate records.

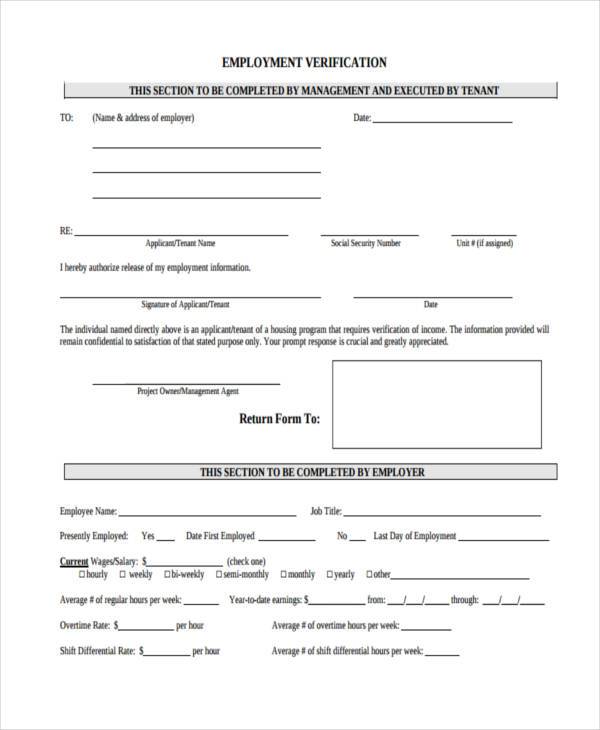

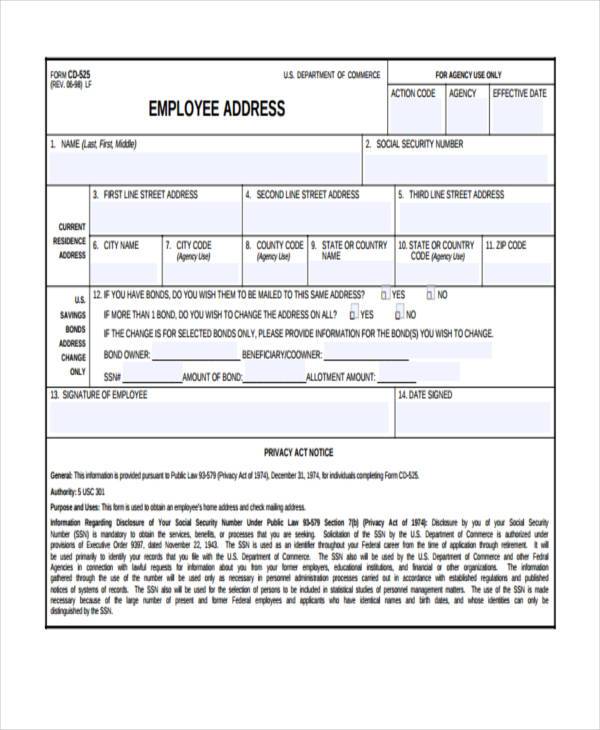

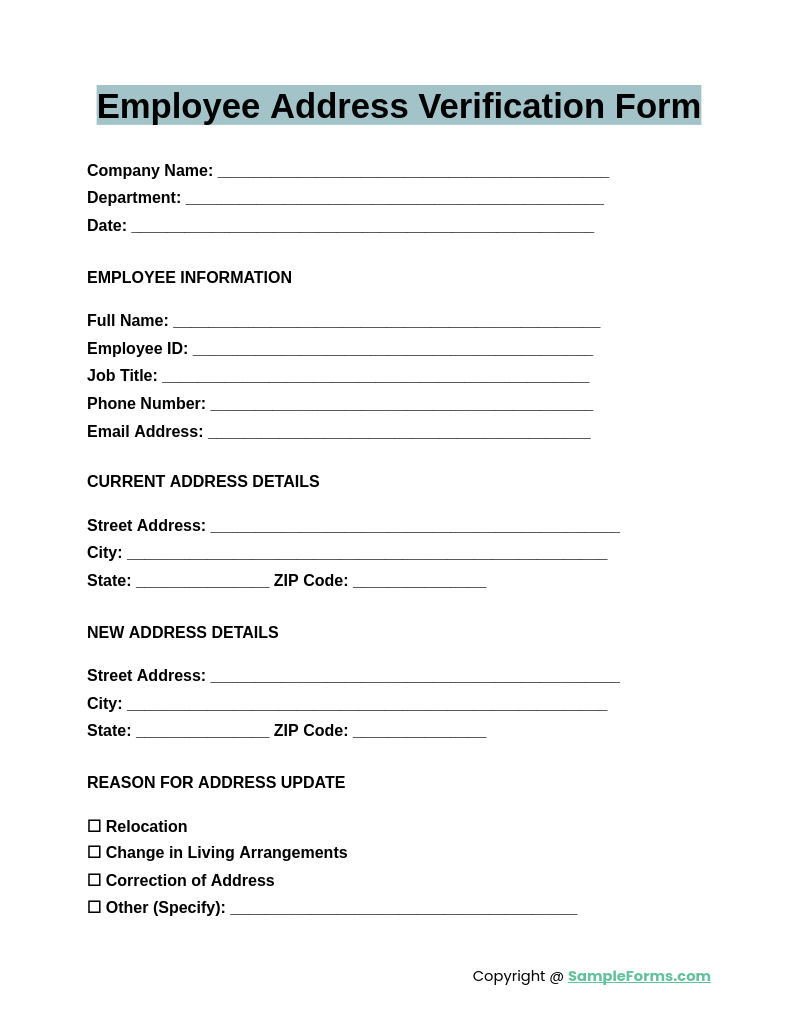

Employee Address Verification Form

An Employee Address Verification Form ensures accurate company records by confirming an employee’s current address. Similar to Address Verification, it prevents payroll errors, facilitates communication, and ensures compliance with tax and legal requirements.

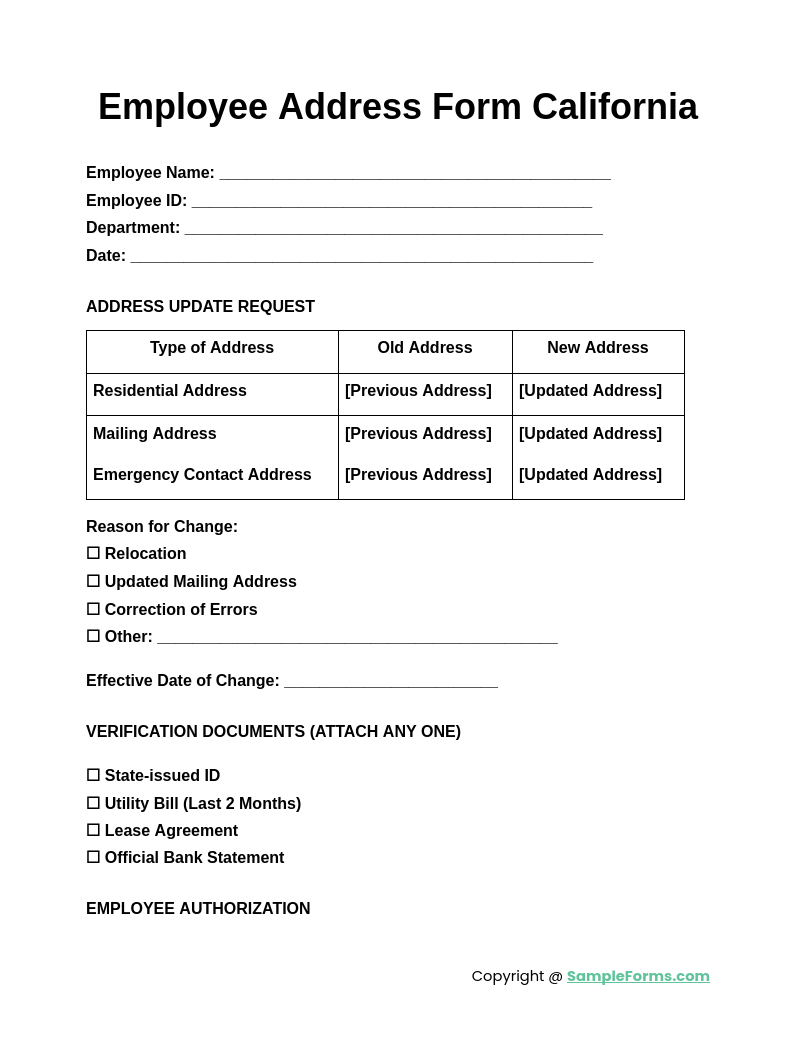

Employee Address Form California

An Employee Address Form California is required for updating address records per state regulations. Like a Name Address Change Form, it ensures proper documentation for payroll, benefits, and legal notices while maintaining compliance with California labor laws.

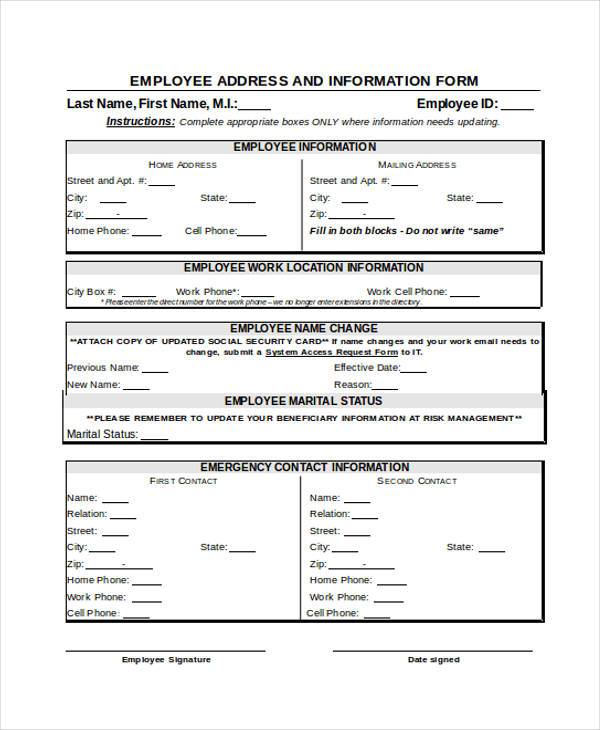

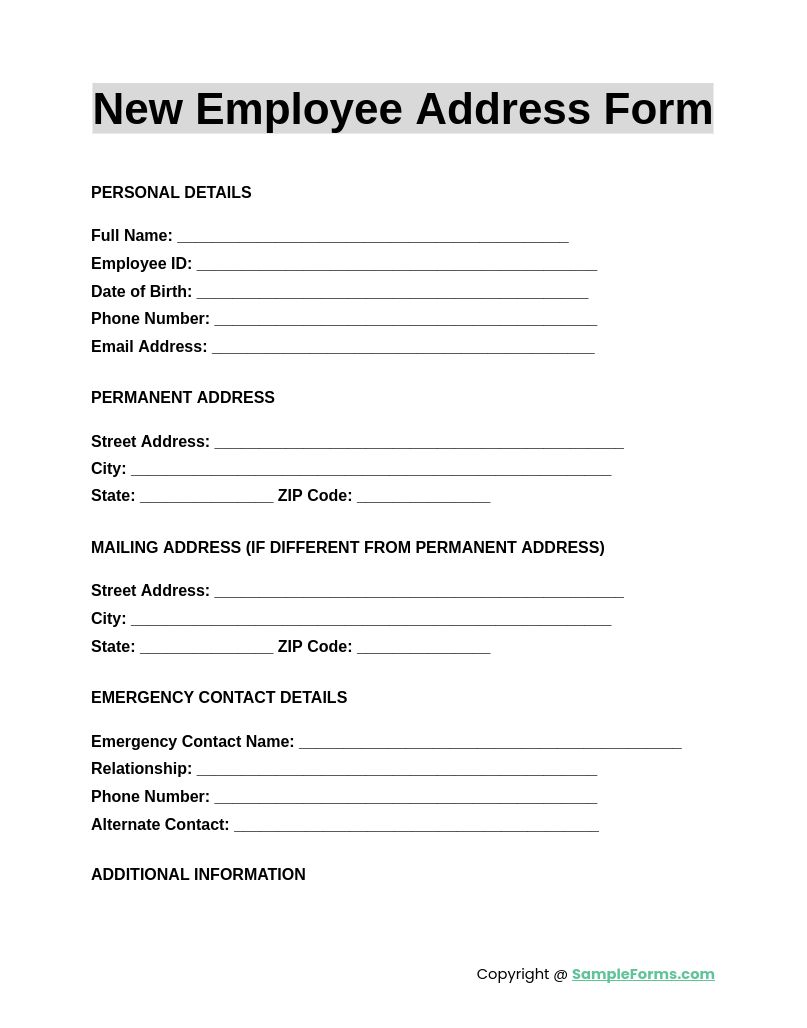

New Employee Address Form

A New Employee Address Form collects essential details for HR records when an employee joins a company. Similar to an Employee Information Form, it ensures accurate payroll, tax filings, and emergency contact updates from the beginning of employment.

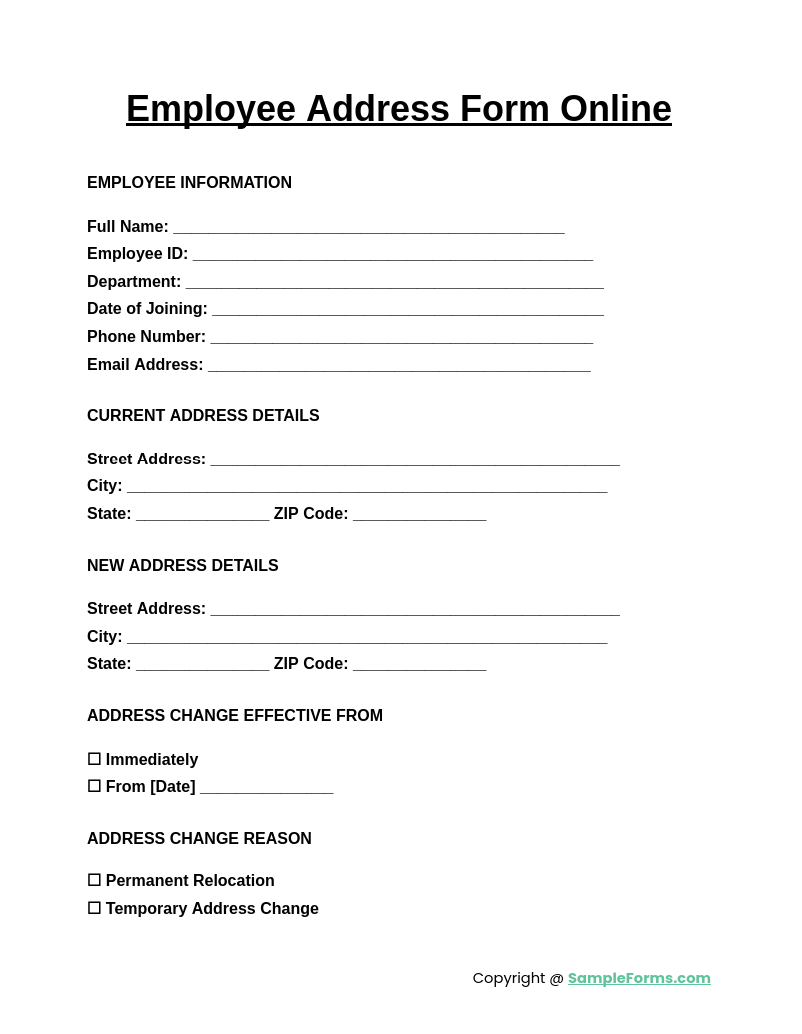

Employee Address Form Online

An Employee Address Form Online simplifies address updates through digital submissions. Like an Employee Evaluation Form, it streamlines HR processes, reduces paperwork, and ensures efficient record-keeping for remote and in-office employees.

Browse More Employee Address Forms

Employee Address Change Form

Employee Address Verification Form

Employee Address Form Example

Employee Address Form for Payroll

Employee Address/Name Change Form

Free Employee Address Form

Employee Address Form in PDF

Employee Address and Information Form in Doc

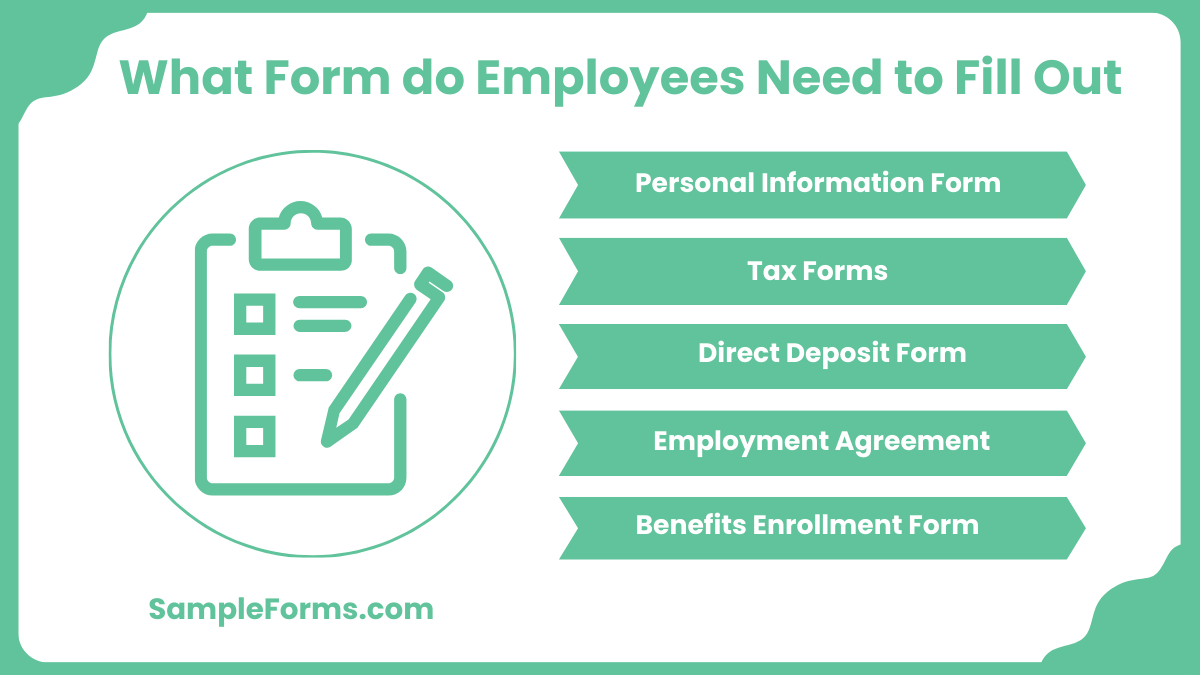

What form do employees need to fill out?

Employees must complete various forms to provide personal details, tax information, and job-related agreements. Similar to an Employee Write-Up Form, these forms ensure compliance with company policies and legal requirements.

- Personal Information Form: Collects employee name, address, and emergency contacts.

- Tax Forms: Includes W-4 for federal tax withholding.

- Direct Deposit Form: Allows payroll payments to a designated bank account.

- Employment Agreement: Defines job responsibilities and company policies.

- Benefits Enrollment Form: Registers employees for health insurance and retirement plans.

What paperwork is required for a new employee?

New hires must complete essential documents for identification, tax compliance, and job onboarding, similar to an Employee Clearance Form that ensures all necessary records are filed properly.

- I-9 Form: Verifies identity and employment eligibility.

- W-4 Form: Determines federal tax withholdings.

- State Tax Form: Required in applicable states for local tax deductions.

- Employee Handbook Acknowledgment: Confirms understanding of company policies.

- Emergency Contact Form: Provides contact details in case of workplace incidents.

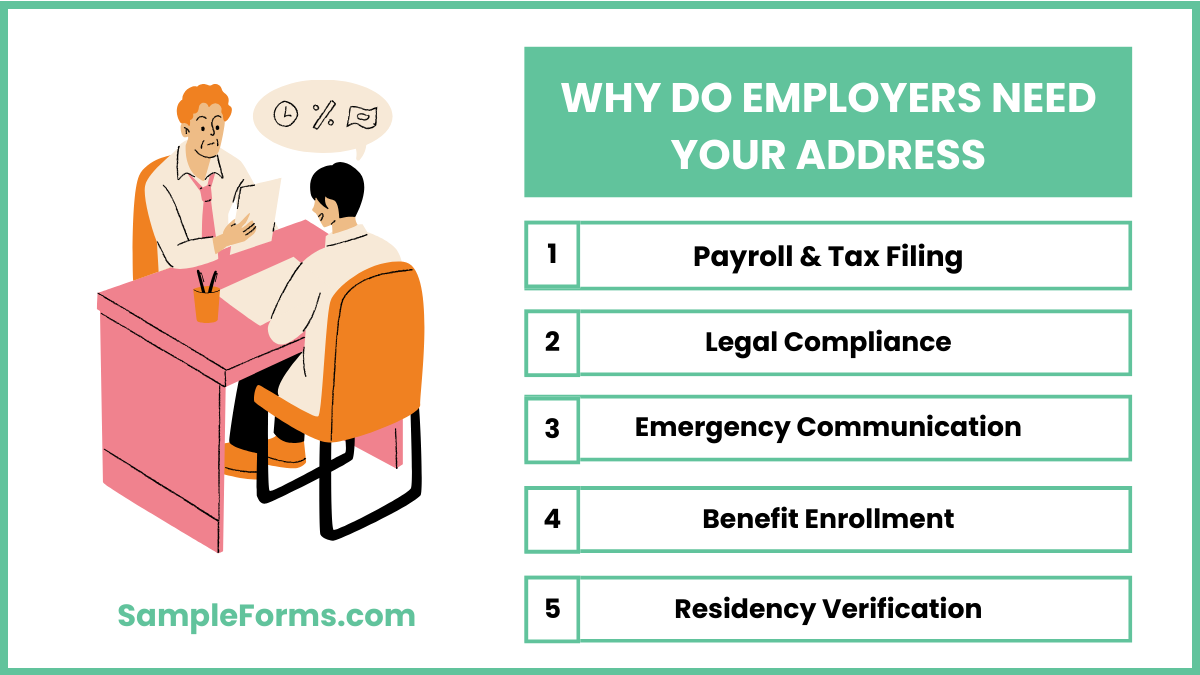

Why do employers need your address?

Employers require an accurate address for payroll, tax reporting, and legal notifications, much like an Employee Witness Statement Form ensures proper documentation of workplace incidents.

- Payroll & Tax Filing: Helps report wages to tax authorities.

- Legal Compliance: Required for employment contracts and official correspondence.

- Emergency Communication: Ensures proper contact in urgent situations.

- Benefit Enrollment: Needed for health insurance and retirement plans.

- Residency Verification: Confirms jurisdiction for state and local tax purposes.

How to find an employer’s address?

Finding an employer’s address is essential for tax filings, official correspondence, and legal paperwork, just like an Employee Discipline Form ensures proper documentation in HR processes.

- Company Website: Check the official contact page.

- Payroll Documents: Employer details are listed on pay stubs.

- Business Directories: Search government or business registry databases.

- Tax Forms: W-2 and tax documents contain employer information.

- HR Department: Contact human resources for official address verification.

For which purpose do new employees fill out a W-4 form?

A W-4 form determines the amount of federal tax withheld from paychecks, similar to an Employee Satisfaction Survey Form, which helps employers manage employee benefits and tax deductions effectively.

- Tax Withholding: Ensures correct deductions based on income.

- Personal Exemptions: Allows employees to claim dependents.

- Additional Withholding: Employees can request extra tax deductions.

- Filing Status Declaration: Specifies whether filing as single, married, or head of household.

- IRS Compliance: Ensures proper tax reporting and employer compliance.

Can employers give out employees’ address?

No, employers cannot share an employee’s address without consent. Similar to an Employee Resignation Form, confidentiality policies protect personal data from unauthorized disclosure.

Is an employee’s address confidential?

Yes, an employee’s address is considered private information. Like an Employee Absence Form, it must be handled securely to prevent misuse and maintain confidentiality.

Can you sue a company for giving out your address?

Yes, if sharing your address causes harm or violates privacy laws, legal action can be taken, similar to an Employee Declaration Form ensuring workplace compliance.

Do employers need your address?

Yes, employers need addresses for payroll, tax reporting, and legal compliance, similar to an Employee Emergency Contact Form, which ensures accurate records for official use.

Do employers look up your address?

Employers verify addresses for tax purposes and background checks, similar to processing an Employee Pay Increase Form for salary adjustments and official documentation.

What happens if someone lies about their address?

Providing false address information can lead to penalties or termination, much like errors on an Employee Performance Evaluation Form affecting job credibility.

Is an employee’s address considered PII?

Yes, an address is personally identifiable information (PII), similar to data collected in an Employee Review Form, requiring secure handling to protect employee privacy.

Is it illegal to give out an address?

Yes, sharing an address without consent may violate privacy laws, similar to how an Employee Termination Form follows strict legal guidelines to protect employees.

Can you get a job without an address?

Yes, some employers allow alternative documentation, but verification can be challenging, similar to submitting an Employee Suggestion Form for workplace accommodations.

How should you address your employer?

Use professional titles like Mr., Ms., or Dr., or follow company culture, similar to completing an Employee Verification Form with correct personal details.

An Employee Address Form is vital for maintaining accurate employee records, ensuring efficient communication, payroll processing, and compliance. Like an Employee Engagement Survey Form, it plays a key role in HR management by streamlining data collection and keeping records current. Employers use this form to prevent address-related discrepancies in official documents, payroll, and tax filings. Ensuring timely updates and accuracy in these records is crucial for smooth workplace operations. This guide provides detailed steps, templates, and expert recommendations to help businesses manage employee address changes efficiently.

Related Posts

-

FREE 51+ Termination Forms in PDF | MS Word | XLS

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 4+ Payroll Reallocation Forms in PDF | Excel

-

FREE 4+ Employment Eligibility Verification Forms in PDF

-

FREE 4+ Skills Analysis Forms in PDF | MS Word

-

Employment Reference Form

-

FREE 4+ Incorporation Forms in PDF | MS Word

-

New Hire Form

-

FREE 6+ Employee Manual Acknowledgment Forms in MS Word | Pages | PDF

-

Employee Nomination Form

-

FREE 4+ Employee Time Sheet Forms in MS Word | Excel | PDF

-

Employee End of Day Report Form

-

Employment Rejection Letter

-

FREE 4+ Employee Termination Checklist Forms in MS Word | Excel | PDF

-

FREE 9+ Employment Eligibility Forms in PDF | MS Word