An Electrical Subcontractor Agreement Form is essential for defining responsibilities, work scope, and payment terms between contractors and subcontractors. A well-structured Agreement Form and Subcontractor Agreement Form ensures legal compliance, reducing the risk of disputes and misunderstandings. This agreement outlines job expectations, deadlines, and safety requirements, helping both parties maintain a professional relationship. Whether hiring for residential, commercial, or industrial projects, a subcontractor agreement provides clarity, protects both parties, and establishes clear work conditions. This guide offers comprehensive details on how to draft an effective agreement, key clauses to include, and example templates.

Download Electrical Subcontractor Agreement Form Bundle

What is Electrical Subcontractor Agreement Form?

An Electrical Subcontractor Agreement Form is a legally binding document that outlines the terms of a business relationship between an electrical contractor and a subcontractor. It details responsibilities, compensation, project scope, deadlines, and liability protection. This agreement ensures that electrical work is completed according to industry standards and project specifications. It also protects both parties by defining payment schedules, dispute resolution methods, and compliance with local laws and safety regulations.

Electrical Subcontractor Agreement Format

Contracting Parties

Contractor Name: __________

Subcontractor Name: __________

Company Name (If Applicable): __________

Business Address: __________

Contact Information: __________

Project Details

Project Name: __________

Project Location: __________

Scope of Electrical Work: __________

Start Date: __________

Estimated Completion Date: __________

Payment Terms and Schedule

Total Agreed Payment: __________

Milestone-Based Payment Schedule: __________

Retainage Amount (If Applicable): __________

Responsibilities and Compliance

Subcontractor’s Duties and Expectations: __________

Compliance with Safety and Electrical Codes: __________

Use of Materials and Equipment: __________

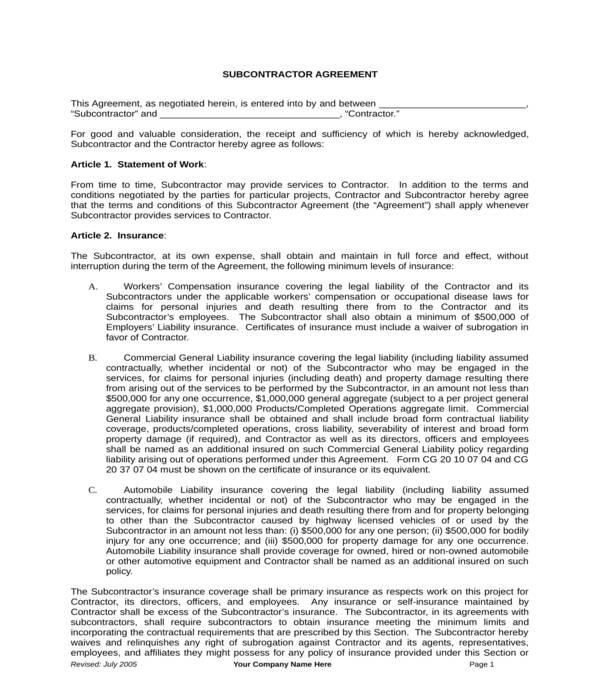

Liability and Insurance

General Liability Coverage: __________

Worker’s Compensation Insurance: __________

Damage or Defect Liability Period: __________

Termination and Dispute Resolution

Grounds for Contract Termination: __________

Dispute Resolution Method (Mediation, Arbitration): __________

Final Agreement and Signatures: __________

Contractor Signature: __________

Date: __________

Subcontractor Signature: __________

Date: __________

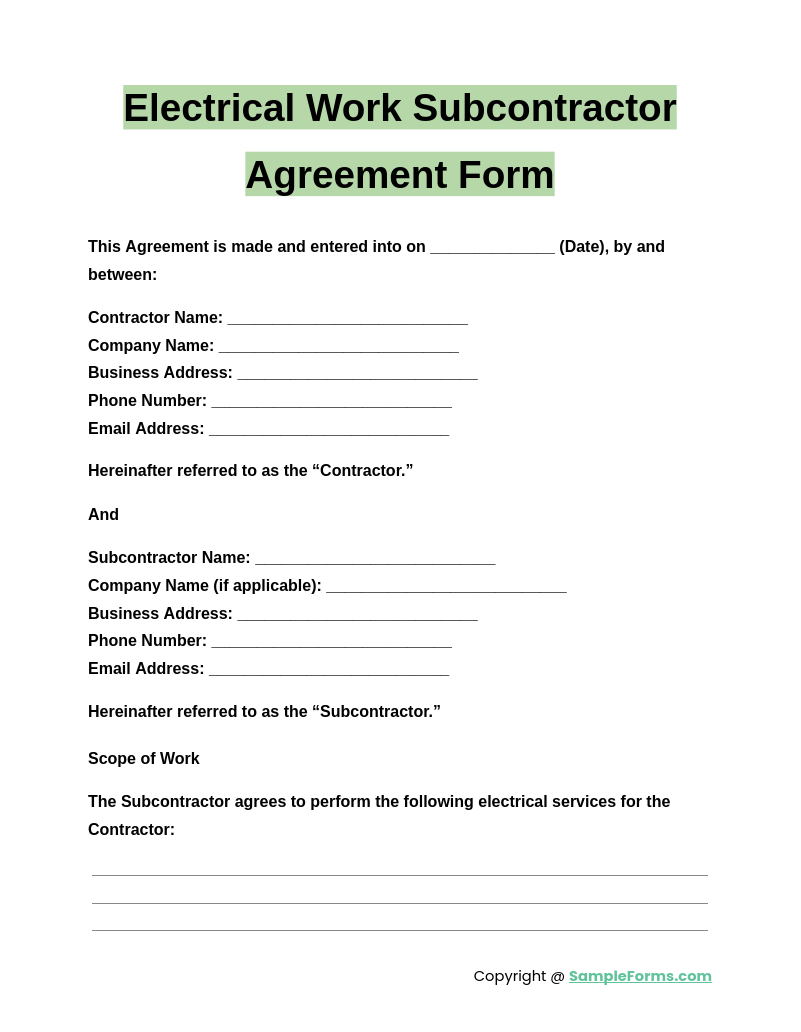

Electrical Work Subcontractor Agreement Form

An Electrical Work Subcontractor Agreement Form outlines terms between contractors and subcontractors for electrical projects. Similar to a Tenancy Agreement Form, it ensures compliance, defines scope, and protects both parties by establishing clear job roles, timelines, and payment terms.

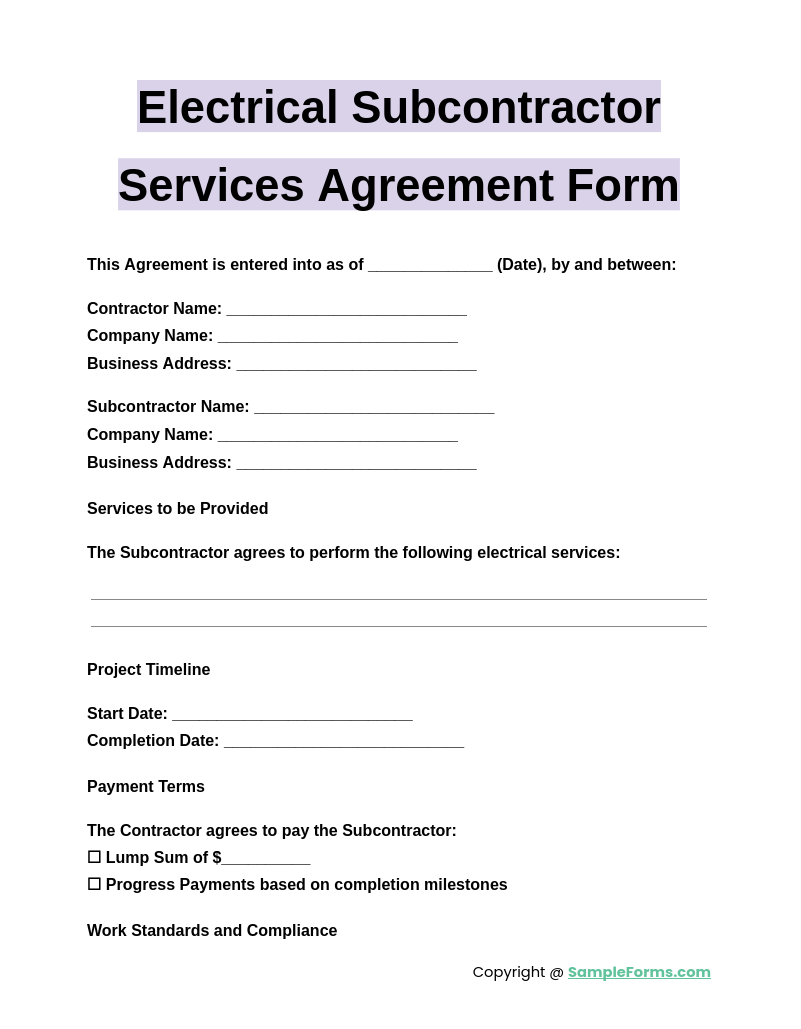

Electrical Subcontractor Services Agreement Form

An Electrical Subcontractor Services Agreement Form secures professional electrical service contracts. Like a Business Agreement Form, it verifies responsibilities, work quality, and safety compliance, ensuring subcontractors meet all project requirements while protecting contractors from potential legal and financial risks.

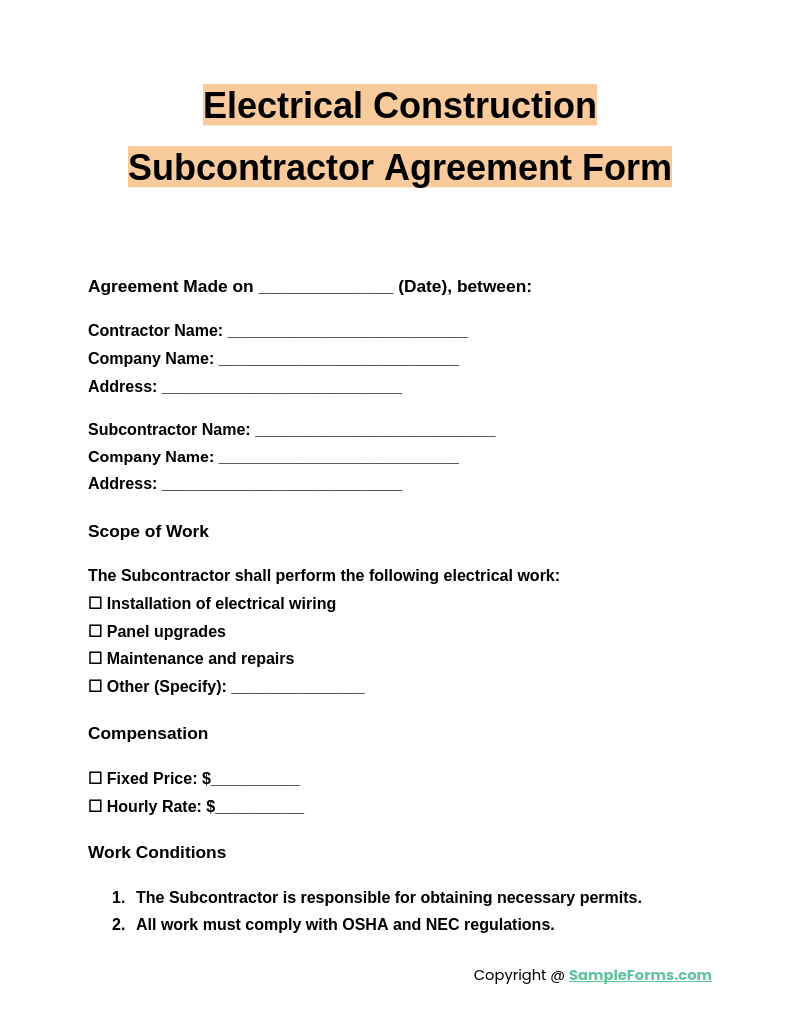

Electrical Construction Subcontractor Agreement Form

An Electrical Construction Subcontractor Agreement Form sets job expectations for large-scale electrical projects. Similar to a Promissory Note Agreement Form, it details labor terms, deadlines, and material provisions, ensuring smooth operations and accountability in construction subcontracting agreements.

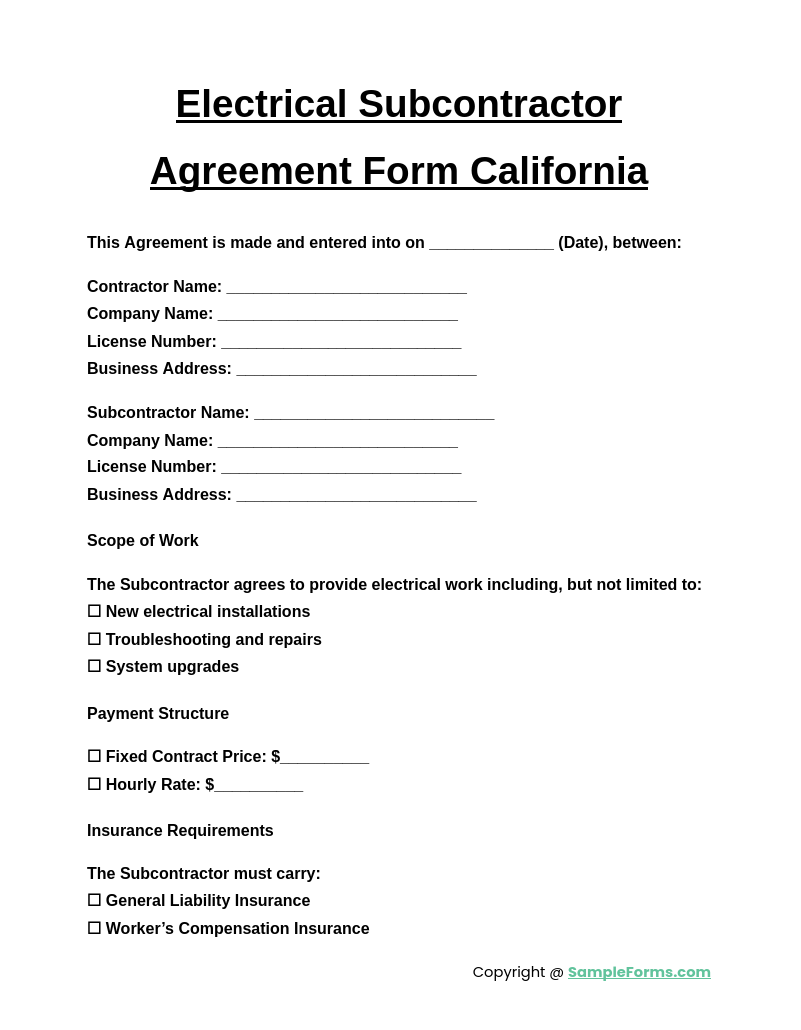

Electrical Subcontractor Agreement Form California

An Electrical Subcontractor Agreement Form California complies with state regulations, defining project responsibilities and legal obligations. Like a Personal Loan Agreement Form, it ensures all safety codes, licensing requirements, and labor laws are followed for legally binding contracts.

Types of Electrical Subcontractor Agreement Forms

Annual Electrical Subcontractor Agreement Form

Construction Electrical Subcontractor Agreement Form

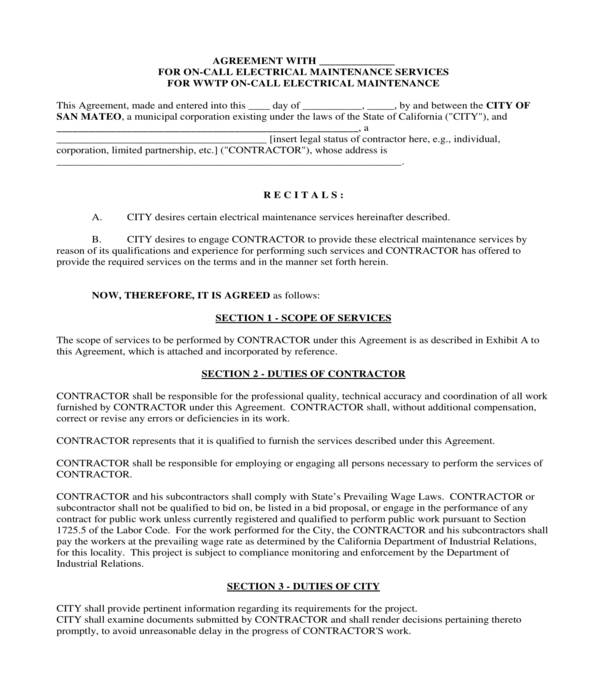

On-Call Electrical Subcontractor Agreement Form

Electrical Subcontractor Agreement Form Sample

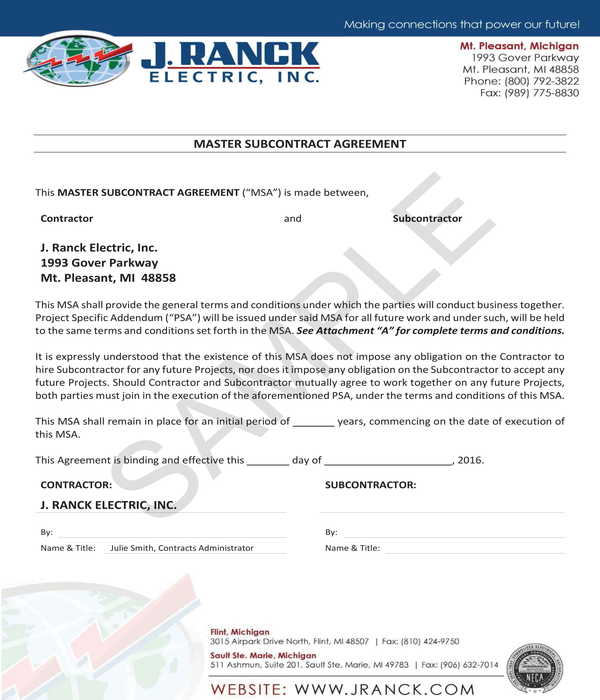

Master Electrical Subcontractor Agreement Form

Specialized Electrical Services Subcontractor Agreement Form

How to make a subcontractor agreement?

A subcontractor agreement outlines work scope, payment terms, and responsibilities. Similar to a Hold Harmless Agreement Form, it protects both parties by defining obligations and legal protections.

- Define Work Scope: Clearly outline tasks, deadlines, and performance expectations.

- Specify Payment Terms: Include rates, schedules, and invoice submission requirements.

- Address Legal Compliance: Ensure adherence to labor laws, insurance requirements, and licensing.

- Include Termination Clause: Define conditions under which the contract can be ended.

- Sign and Notarize: Both parties should sign and keep a copy for legal reference.

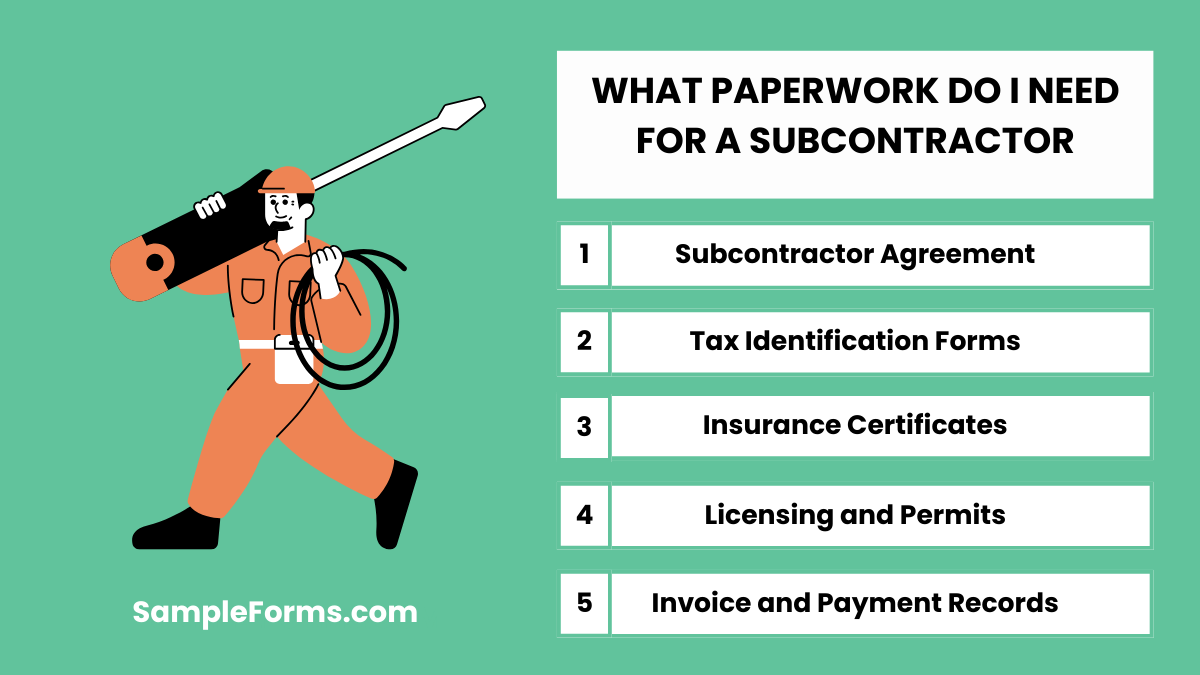

What paperwork do I need for a subcontractor?

Hiring a subcontractor requires specific documents for legal compliance. Like a Consignment Agreement Form, proper documentation ensures accountability and protects both contractor and subcontractor.

- Subcontractor Agreement: Defines responsibilities, compensation, and project scope.

- Tax Identification Forms: Includes W-9 for U.S. workers or equivalent forms for other regions.

- Insurance Certificates: Proof of liability or worker’s compensation insurance.

- Licensing and Permits: Ensures subcontractor meets legal requirements for work.

- Invoice and Payment Records: Maintains financial tracking and avoids disputes.

What is the downside to subcontracting?

Subcontracting has risks, including legal liabilities and inconsistent work quality. Similar to an Apprenticeship Agreement Form, clear expectations help mitigate risks and ensure project success.

- Lack of Direct Control: Contractors rely on subcontractors to maintain quality and meet deadlines.

- Legal Liabilities: Contractors may be responsible for subcontractor mistakes or non-compliance.

- Payment Disputes: Unclear payment terms can lead to financial conflicts.

- Inconsistent Work Availability: Dependence on subcontractors may affect workflow consistency.

- Confidentiality Risks: Sharing sensitive information requires strong non-disclosure agreements.

What makes someone a subcontractor?

A subcontractor is an independent worker hired for specialized tasks. Like an Investment Agreement Form, their role is contract-based, focusing on agreed deliverables rather than employment status.

- Independent Work Status: Not classified as a direct employee but as a separate business entity.

- Specialized Services: Hired for specific projects requiring unique skills.

- Contract-Based Payment: Paid per project, milestone, or task completion.

- No Employer Benefits: Not entitled to employee benefits such as health insurance or paid leave.

- Operates Independently: Manages work schedules, tools, and resources without employer control.

What are the liabilities of a subcontractor?

Subcontractors are responsible for their work quality, safety compliance, and financial obligations. Similar to a Purchase Agreement Form, clear terms help manage risks.

- Work Performance: Liable for completing tasks according to agreed specifications.

- Legal Compliance: Must follow labor laws, safety standards, and licensing requirements.

- Financial Responsibility: Covers business expenses, taxes, and insurance costs.

- Contractual Obligations: Must fulfill terms or face penalties for non-compliance.

- Liability for Damages: Responsible for any damages caused due to negligence or poor workmanship.

What tax form do I give my subcontractor?

Businesses must provide subcontractors with a 1099-NEC form if payments exceed $600 annually. Like a Custody Agreement Form, this form ensures proper tax reporting and compliance with IRS regulations for non-employee compensation.

Does a subcontractor need a contract?

Yes, a subcontractor contract is essential to define responsibilities and payment terms. Similar to a Sales Agreement Form, it protects both parties by outlining work scope, deadlines, and liability clauses in writing.

What form do I give a subcontractor?

A W-9 Form is required before issuing payments to subcontractors. Like a Child Support Agreement Form, it ensures proper documentation of financial transactions and tax compliance for independent contractors.

Do you have to have a subcontractor agreement?

Yes, a subcontractor agreement is crucial to avoid disputes and legal risks. Like a Construction Agreement Form, it establishes clear expectations, work scope, and payment terms for both parties.

Do subcontractors need a license?

Subcontractors may need a license depending on state regulations and project type. Like a Vendor Agreement Form, licensing requirements ensure compliance, professionalism, and adherence to local laws in construction and trade work.

How much can you pay a subcontractor without a 1099?

Payments under $600 in a tax year do not require a 1099-NEC. Similar to a Confidentiality Agreement Form, tracking all payments ensures compliance and proper financial record-keeping for tax purposes.

Does a subcontractor need to fill out a W9?

Yes, a subcontractor must submit a W-9 Form before receiving payments. Like a Contract Agreement Form, it verifies tax identification details and ensures accurate IRS reporting for non-employee compensation.

How do subcontractors get paid?

Subcontractors are usually paid per contract, milestone, or hourly rate. Like a Service Level Agreement Form, payment terms should be agreed upon, documented, and aligned with project deliverables.

Do subcontractors get a 1099 MISC or NEC?

Subcontractors receive 1099-NEC forms for non-employee compensation. Like a Training Agreement Form, this document ensures tax compliance and proper reporting for independent contractors who earn over $600 annually.

What if a contractor refuses to provide W-9?

If a contractor refuses to provide a W-9 Form, the hiring company must withhold 24% backup tax. Like an Operating Agreement Form, proper documentation is necessary to comply with IRS requirements and avoid penalties.

An Electrical Subcontractor Agreement Form is crucial for legally binding business relationships in electrical work. It ensures clear communication between contractors and subcontractors regarding job scope, responsibilities, and payment structures. Using a well-drafted agreement minimizes risks, protects financial interests, and ensures work is performed according to specifications. Whether for short-term projects or long-term collaborations, this form provides a structured approach to hiring subcontractors while maintaining compliance with labor laws and industry standards. A properly executed agreement helps businesses streamline operations, enhance professionalism, and prevent potential disputes in subcontractor relationships.

Related Posts

-

FREE 5+ College Roommate Agreement Samples in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word