- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

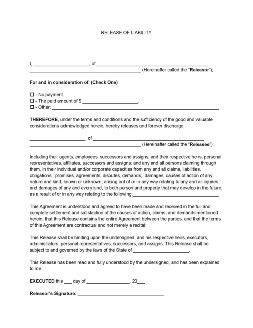

Release of Liability Agreement

In business, one random mishap can derail and throw everything that we’ve worked for. What’s worse, is that we might have to endure expensive and unnecessary legal battles when a settlement would have sufficed. But by signing a release of liability with your client, you can spare yourself from unwanted liabilities, and unnecessary expenses, by defining its boundaries clearly. Learn more about protecting yourself and your business with these documents by reading on in this article. Read More

By Type

- Model Release Form

- Car Accident Release of Liability

- Media Release Form (Video + Form)

- Equipment Release Form

- Mutual Rescission and Release Agreement Form

- Medical Information Release Form

- Activity Release of Liability (Waiver)

- Music Release Form

- Real Estate Lien Release

- Photo Release Form

- Release of Personal Guarantee Form

- Release of Non-compete Agreement

- Release of Debt Agreement

Release of Liability Agreement

In business, one random mishap can derail and throw everything that we’ve worked for. What’s worse, is that we might have to endure expensive and unnecessary legal battles when a settlement would have sufficed. But by signing a release of liability with your client, you can spare yourself from unwanted liabilities, and unnecessary expenses, by defining its boundaries clearly. Learn more about protecting yourself and your business with these documents by reading on in this article.

What Is a Release of Liability Agreement?

Whether you’re selling cars or other properties, a release of liability is an essential document that releases you from any liabilities resulting from negligence, misuse, and other untoward events. This document defines and outlines the extent of your responsibility towards your merchandise and the releasor, as well as the other parties that are to be indemnified and hold harmless.

Alternatively, you can also use a release of liability to free you from any claims and liabilities against past and future damages and injuries. You can sign this agreement with the releasor to settle their claims extrajudicially, without the need for expensive lawsuits and legal actions.

How To Make a Release of Liability Agreement

Businesses use a release of liability agreement to hold them harmless against any liability coming from mishaps and other untoward events. Likewise, it can also spare you from the expenses of legal proceedings by way of settlement out of court. These are some of the ways that a release of liability can protect you and your business. Now, here’s how you can make a release of liability agreement and add an extra layer of protection to you and your business.

1. Check What Is Legally Needed

Laws that determine the extent of liability varies from state to state. So it’s best to check and review the state and federal laws that govern these matters before making a release of liability agreement. Checking what is legally needed helps you determine the extent of your liability towards your merchandise, as well as the releasor. And it also gives a stronger legal footing should matters land in court.

2. Name the Releasor

After checking and reviewing the release’s legal requirements, you can now begin making the agreement starting with releasor’s information. You can do this by writing the releasor’s name and address in the agreement’s first paragraph. Naming the releasor identifies and records the indemnifying party. This, in turn, protects you from wrongful claims in the future by having a proof signed and named on the releasor.

3. Specify the Waiver’s Consideration

Considerations are objects that put agreements into effect. They can either be in the form of goods, services, promises, or a certain amount of cash. In the case of liability releases, consideration can either be any of them or all. Specify these considerations when making a release of liability for a specific purpose.

4. Draft the Indemnity and Release Clauses

A release of liability defines the scope and limits of your liability to the releasor, as well as other parties that are to be indemnified. To do this, draft the terms and conditions of the liability release, including the definition of the parties included in the release. Additionally, you must also indicate the satisfaction and fulfillment of your liability to the releasor as well. This further consolidates and proves your release from your liabilities.

5. Let the Releasor Sign the Release of Liability

Lastly, conclude and certify the provisions of the agreement by letting the releasor sign the release of liability. This signifies the releasor’s confirmation of your release from any liability towards them. Moreover, the releasor’s signature also certifies the enforceability of the document and its provision against claims related to the release.

Frequently Asked Questions

Is a release of liability similar to an indemnification?

While both are used to free oneself from any liabilities, there are some differences between both of them. A release for liability offers the flexibility of releasing from present and future liabilities, while an indemnification holds you harmless against any liability that is yet to happen.

When do we use a release of liability?

A release of liability can be used in two different ways: You can use this document to release you from future liabilities—such as specifying the party that bears the responsibility for damages and injuries in a commercial lease, for example. You can also use a release of liability to free you from your present obligations to a certain releasor.

Are there different kinds of liability release agreements?

A release of liability is used by many businesses in their respective fields. This is to release them from liabilities that are common in their industries. The types of liability releases are listed below, as follows.

- Photo Release Form

- Car Accident Release of Liability

- Video Release Form

- Medical Record Information Release (HIPAA)

- Location (Event) Release of Liability

- Media Release Form

In what transactions can we use a release of liability?

A release of liability is used by businesses to add a layer of protection in their transactions. These can be used in real estate sales and purchase, equipment rentals, lending, and in B2B transactions. Aside from transactions, A release of liability may also be used by employers to release them from any liability should accidents happen to their employees.

What does a release of liability consist of?

A release of liability, as well as other releases in general, consists of elements that consolidate its purpose and enforceability. These elements are namely:

- The Releasor or the releasing party;

- The Releasee or the party being released;

- Its Effective Date;

- The event, activity, or circumstances being held;

- Consideration for signing the liability release; and

- The state laws governing the interpretation of its provisions.

Claims and obligations are commonplace in a business transaction. And while they are a healthy part of a business’s daily activities, some of them also be harmful and damaging as well. Claims and obligations from disputes, negligence, and other untoward events can be solved in several ways without resorting to lengthy and expensive legal battles. All it takes is an ear to listen, a mind to reason, and a release of liability agreement to patch our wounded pride and injured egos.