- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

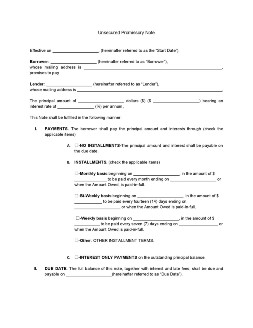

Unsecured Promissory Note

Unsecured loans are a huge leap of faith for lenders and could mean the difference between loss and profit. As risky as it may seem, there are still ways in which you can turn the odds to your favor. In this case, you’ll need to get an unsecured promissory note. An unsecured promissory note is a loan instrument that offers a degree of security to unsecured loans—despite the nature of its name. Read on in this article to learn more. Read More

Unsecured Promissory Note

What Is an Unsecured Promissory Note?

Unsecured promissory notes are loan instruments that don’t require any property or valuables attached as collateral. Instead, it is a simple instrument that only details the borrower’s promise to repay the loan. But despite this note’s simplicity and lack of security, it still contains staple features found in other loan instruments. These staple features are the loan’s principal amount and interest rate, payment schedules and maturity date, the co-signers detail, and other terms and conditions. And like other loan instruments, the parties and witnesses must sign the unsecured promissory note.

How to Make an Unsecured Promissory Note?

Whether it’s for personal loans, unsecured promissory notes are simple, straightforward, yet risky loan instruments. It may seem that enforcing these notes would be somewhat problematic; however, an enforceable unsecured note depends on how well it’s written. Now, here are some steps on how you can make a well-written and enforceable unsecured promissory note.

1. Define the Promissory Note’s Purpose

Like other loan instruments, writing an unsecured promissory note begins with the definition of its purpose right in its first paragraph. You can do this by indicating its effective date, introduce the lender and the borrower, and specify the loan’s principal amount and interest. Defining this note’s purpose also defines the boundaries of the enforcement of its terms and conditions. Furthermore, this will also help you with your claims against the borrower should you decide to bring it into court.

2. Outline the Loan’s Payment Details

Next, you must outline the details of how the borrower should pay for the loan. This begins by indicating whether the borrower chooses to pay for the loan through installment, interest payment, or by lump sum payment. Also, set the starting dates and payment amount if the borrower chooses to pay by instalments. Doing so helps you track and record the borrower’s payment schedule, as well as determine whether the borrower has paid the loan in time or has defaulted.

3. Set the Note’s Terms and Conditions

Then, set the note’s payment terms and conditions. This includes defining the note’s maturity date, late fee amount and period, the borrower’s default, the acceleration of the loan, the borrower’s right of prepayment, as well as their implementing rules and regulations. Setting and defining these terms lets the borrower know the mechanics of the note’s payment and default. But more importantly, it also enables you to secure further your interest in the loan and its timely payment as well.

4. Acknowledge the Promissory Note

Lastly, acknowledge the terms and conditions by signing it together with the borrower and some witnesses. Doing consolidates the note’s enforceability and validity by certifying the authenticity of the borrower’s promise to pay. Additionally, you can also choose to notarize the note to further secure your interest in the loan by putting it in public records.

5. Prepare Subsequent Documents

Demand letters, claim notices, and others, are subsequent documents that will help you secure the payment of an unsecured note. So it’s best to prepare them after executing an unsecured promissory note. Aside from those, you may also need to prepare payment plans, and debt releases should the borrower ask for an alternative way to pay for the loan or fulfill their obligations to the loan.

Frequently Asked Questions

How many witnesses should an unsecured promissory note have?

Witnesses allow you to prove your claims against the note should you decide to settle this on-court or with the help of collecting agencies. Promissory notes, especially unsecured ones, are usually witnessed by two or three persons. You can always have your unsecured promissory notes witnessed by some friends, or by persons of authority if you wish to do so.

When do we use unsecured promissory notes?

Unsecured promissory notes formalize personal or family loans that involve a small amount of money. You can also create unsecured promissory notes whenever lending some money to someone you deem worthy of your trust.

Is a debt release needed if the borrower fulfills an unsecured promissory note?

Yes, as a debt release certifies the borrower’s release from their obligations towards the loan. A debt release also prevents a borrower from having a bad credit history, as well. Debt release agreements are documents are some of the subsequent documents that you need to create alongside loan agreements.

Who can have copies of the unsecured promissory note?

Both the lender and the borrower can have a copy of the unsecured promissory note as they are the parties who executed it. Aside from that, the public notary or any person who acted as such will also need a copy of the unsecured promissory note for record-keeping purposes.

Is an unsecured promissory note similar to an I.O.U?

No. An unsecured promissory note is a loan instrument that outlines the borrower’s promise to pay, as well as some details and instructions of its repayment. An IOU, on the other hand, is a loan instrument that acknowledges the existence of a debt and the amount owed.

In a win or lose situation of unsecured lending, doing away with the usual security measures doesn’t always mean leaving its repayment entirely to luck. By documenting the entire transaction in an unsecured promissory note, you can always secure your interest and turn the odds to your favor.