- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

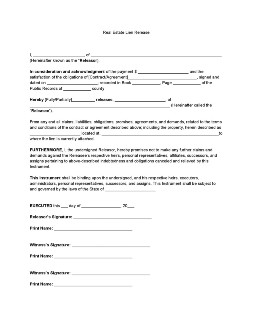

Real Estate Lien Release

Whether you’ve paid your house’s mortgage or its repairs in full, it is very important to certify the fulfillment of your obligations in writing. Do so by making a real estate lien release with the party you owe these obligations with. Learn more about relieving your property from the obligations that are tied against them by reading on in this article. Read More

What Is a Real Estate Lien Release?

A real estate lien release is a lien that certifies or proves the release of your property from obligations related to a real estate transaction. This is document is signed by the releasor, and conversely, created by the releasee upon satisfying their obligations to the former. Moreover, there are specific types of real estate lien releases that you can use for a specific type of real estate transaction—Partial release, contractor’s lien release, mortgage release, etc.

How to Create a Real Estate Lien Release?

A real estate lien or obligation is incurred whenever we buy a house in the most affordable way possible. Or, whenever hiring a contractor to do our house’s renovation without busting our wallets. And once we’ve fully paid for what we owe, the release of our property must be certified in writing. Now, here’s how you can create a real estate lien release, and some tips on how to use them.

1. Tailor your Real Estate Lien Release Accordingly

Just like liability releases, a real estate lien release can be used in so many ways depending on the type of real estate transaction that you have. So, likewise, it’s important to tailor your real estate lien release to match the specifics of the transaction on hand. You can do this by indicating the type of contract and agreement attached to the transaction, including its date and the amount paid.

2. Don’t Forget the Dates

Dates indicate when a transaction happened, and conversely when it will take place. They are crucial in real estate documents such as a lien release, so always see to it that they’re included in them as well. To do so, simply indicate when a particular real estate agreement was created, as well as when the lien release takes effect. This will help you prove when the property was released from a certain obligation in case further claims are wrongfully made against you.

3. Always Indicate the Parties of the Lien Release

Transactions happen when two parties agree on performing or selling a particular thing. The same can also be said when a party makes a particular promise to another party. Like so, always indicate the parties involved whenever creating a real estate lien release for a particular transaction. This identifies who releases your property from a certain obligation, which in turn, helps you clear your name with the County Registry of Deeds.

4. Good and Valuable Considerations Matter

Agreements, in general, are hardly enforceable without the good and valuable considerations attached to it. In this case, both the amount you owe and the lien attached to your property are your real estate lien release’s good and valuable considerations. So in writing your property’s lien release, it’s important to indicate the amount you paid and the property where the lien is tied to. This helps in removing the lien against your property with the County Registry, as well as, prevent any further claims against it.

5. Notarize the Lien Release if Necessary

Above all, notarizing your real estate lien release further ensures the validity of removing the lien against your property. What’s more, is that most states require real estate lien releases to be notarized, along with witnesses, before submitting it to your County’s Registry of Deeds. You can do this by letting the releasor sign the document, along with several witnesses, in front of the public notary.

Frequently Asked Questions

Who can write a real estate lien release?

A real estate lien release is written by individuals requesting to release their property from a claim tied against it. They can either be mortgagor to a housing loan or a homeowner who owes payment for the services of an independent contractor.

What are the different types of real estate lien release?

Real estate lien releases come in different types for different real estate transactions. They are namely the contractor’s lien release, mortgage release, and partial release of lien. These types of lien releases are used for releasing a certain property from a lien incurred from house repairs, mortgages, and among others.

What is a real estate lien?

A real estate lien is a claim attached to a particular property—house, land, or commercial property—to guarantee the payment or fulfillment of a certain obligation. These obligations may come from housing loans, personal loans, and even from owing a certain payment for a certain job.

How can we avoid real estate liens?

Real estate liens are commonly incurred by securing loans from financial institutions, buying a house through affordable housing, or owing payment from an independent contractor. These can be avoided by doing the following.

- Ensure that realtors and contractors sign a lien waiver.

- Timely payment of home contracts.

- Negotiate outstanding balance with the lien holder.

- Avoid lawsuits.

- Ensure that property has no claims tied against it before making a purchase.

- Pay taxes timely and in full, and avoid incurring a federal tax lien by owing less than $25,000 on taxes.

Do I need a copy of the real estate lien release?

Yes, since you can use these documents to prove that your property is clear from any claims against it, as well as prove that you are clear from any debts. Having a copy of a real estate lien release can help you in case you’re applying for a loan or when selling your property to a buyer.

Sometimes, we may find ourselves tied-up to certain obligations in pursuit of affordable ways of owning a property as well as caring for it. In turn, it’s also necessary for us to fulfill and satisfy those obligations and guarantee a real estate lien release for ourselves and our property. Besides, it took us a lot of hard work to have a property to call our own, and losing them is not an option.