- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

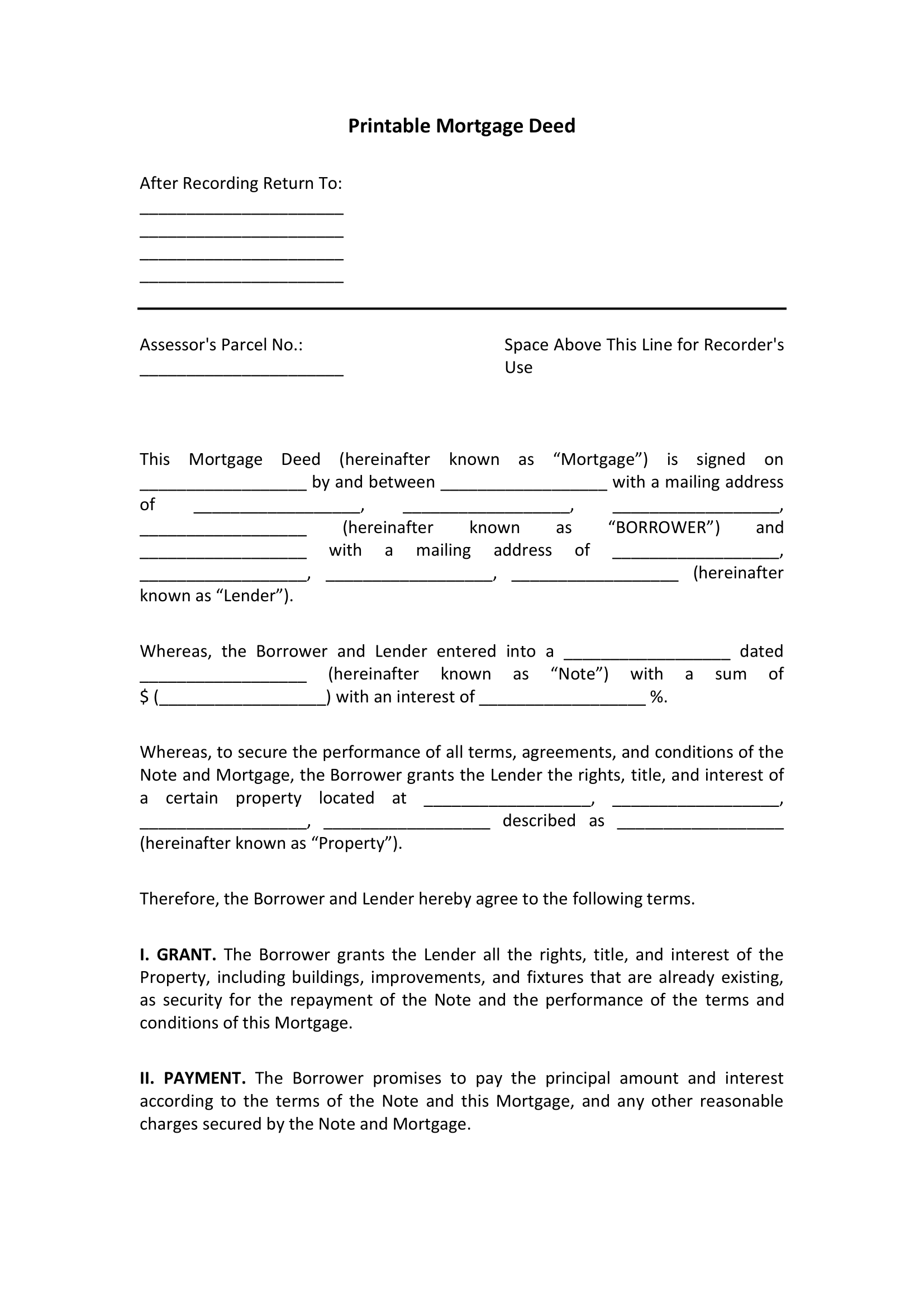

Printable Mortgage Deed Form

Since loaning a large sum of money is risky, most lenders require borrowers to pledge assets for financial security. For a home loan, signing a printable mortgage deed allows the lender to put a lien on the property or use it as collateral until the loan is satisfied. This serves as a guarantee for the repayment of the loan. Although other legal protections secure the property to the lender, a mortgage deed is most reliable. Find out more about the mortgage deed and how it eases up every loan process. Continue reading this article below. Read More

What Is a Printable Mortgage Deed?

A printable mortgage deed or “deed of trust” is a legal document that gives a lender an interest in a property that serves as collateral. Since a loan process involves an agreement between the lender and borrower, they are expected to perform the obligations that come with it. If the borrower fails to repay the loan, the lender can foreclose the deal and take the property in accordance with the agreement. More so, the traditional mortgage deed does not need a third party, unlike the deed of trust. Sometimes, the mortgage deed and deed of trust are interchanged, but some legal boundaries set them apart.

How Do You Create a Printable Mortgage Deed Form in Four Easy Steps?

The recession is a downturn for the American economy. It greatly affected the housing market and put it into a halt. But, after the demand for new mortgages dropped as well as every home equity slipped away, the US economy is finally making a welcome recovery when the mortgage market rose in 2013. Even the Federal Reserve raised the market’s interest rates in 2017 and 2018. That is why a mortgage deed is essential when you loan a property today. Here is a step-by-step guide to help you make a printable mortgage form in MS Word and PDF file formats. More on this below:

1. Provide the Basic Details, Mailing Address, and Effective Date

Since a mortgage deed is a document used to transfer property, it should begin with the mailing address. This refers to where the deed form should be returned after the County has recorded it. Often, a trustee keeps this document. Then, introduce the parties by stating their complete names and identifying their status as the lender or borrower. In the next few lines, indicate the execution date. Providing these details make legal document accurate and professional. Also, report the property’s parcel number for the tax documentation.

2. Identify the Type of Financial Note and the Property’s Location

Purchasing a home is a major investment. And it involves a substantial amount of money. Because of that, the printable mortgage deed form must identify the type of financial note—indicate this as a home loan automatically. Aside from clarifying the loan agreement’s payment provisions, this part also shows the principal amount. Then, provide the property’s location and legal description. To prevent misunderstanding, further define the property by consulting an attorney. It is also an opportunity to ask about the legitimacy of the document and settle concerns related to the home loan.

3. Set the Terms and Conditions Clearly

Having a loan agreement can prevent misunderstanding between the participating parties. It can also avoid having a dispute with the Internal Revenue Service (IRS) since taxes fall in with every property purchase. So, set the terms and conditions in the printable mortgage deed clearly. Aside from outlining each party’s obligations, it will also guide them on what to do once the deal is not working out as what they had hoped. You can discuss the following in this part of the form: the power of sale, security interest, property and mortgage insurance, covenant, ownership transfer, release, notices, and other assignments.

4. Seal the Deal and Notarize If Necessary

Lastly, the printable mortgage deed form must state that the agreement will be terminated after the loan has been paid. In other words, the property will be longer under the lender’s ownership, and it will be under the borrower’s name. The parties must sign the form after agreeing on these terms. Make sure to review your state laws because legal requirements vary on location. If your state requires to notarize the document, consult with a notary public. Additionally, we recommend signing the form with the other party’s presence even though the law does not require it. This builds trust and shows the commitment from each party.

Frequently Asked Questions

When is a mortgage agreement needed?

It will help if you have a mortgage agreement whenever purchasing a property or a home. A mortgage deed will allow a lender to take possession of the property until you have paid it. Also, it entitles you to borrow large sums of money and repay the property loan.

What are the private mortgage’s tax benefits?

One of the benefits of a private mortgage is the elimination of gift taxes. The IRS limits how much money family members can gift each other. You can give your sibling up to 14,000 US dollars without any gift tax.

What happens if I don’t use a mortgage deed?

A mortgage deed secures a loan. Without this, a lender is left with a few options if the borrower cannot repay the loan. And, the lender will have to wait with other creditors while going through a lengthy court process.

There’s a big shoe to fill in when signing up for a property loan. Because a large amount of money is at stake, all creditors and debtors must agree to sign a mortgage deed form. It sets both parties’ obligations. And, protect their interest while the loan is not yet paid. Download our ready-made printable mortgage form templates now and feel secured whenever you apply for a loan!