- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

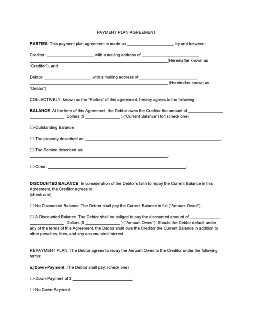

Payment Plan Agreement

Ensuring the repayment of debts is a top priority for lenders like you. But sometimes, traditional loan terms might be too much for a borrower to fulfill. To solve this dilemma, offering loan extensions and payment plan agreements tailored according to the borrower’s capacity ensures the timely payment of debts. Learn more about these loan payment solutions by reading on in this article. Read More

Payment Plan Agreement

- Is a payment plan agreement separate from the loan agreement?

- Can payment plan agreements be used with instruments such as an I owe you?

- What type of loans can a payment plan agreement be used for?

- When do we need to notarize a payment plan agreement?

- Do we need to sign a payment plan agreement in front of a witness?

What Is a Payment Plan Agreement?

Debts can be a burden for the borrowers, especially when interest rates are piling up on top of the principal amount. This can be a problem for lenders, as well. A payment plan agreement provides a win-win solution by laying-out favorable payment schemes and terms convenient to the borrower’s financial situation. In this way, borrowers can no longer worry about paying for the money they owe, and lets lenders get their money back on time.

How To Create a Payment Plan Agreement

Payment plan agreements are one way of showing your generosity towards borrowers, aside from loan extensions. It enables your borrowers to pay for their debts quickly, in ways that are more convenient on their part. But more importantly, it guarantees the timely payment of their debts as well. And regardless if it’s a family loan or something more elaborate, here’s how you can create payment plan agreements using the following steps.

1. Agree on the Payment Terms with the Borrower

Payment plan agreements are also given as a “last chance” offer to borrowers. And in creating a payment plan agreement, it’s imperative to discuss and agree on payment terms with the borrower. You may either agree for the loan to be paid through goods or services or agree on deferred payments. Aside from that, you may also agree on other payment terms as well.

2. Outline the Payment Agreement

Next, outline the loan’s payment agreement after agreeing to the payment terms with the borrower. It is also in this step that you’ll begin writing the payment plan agreement. You must first establish the parties of the agreement by writing your name and address as well as that of the borrower. Then, state the loan’s principal amount, its discount, and interest rate, if any. Aside from that, you must also specify if the borrower is allowed to have a co-signer, or if he’s allowed to pay the loan in advance.

3. Set the Payment Schedule

Then, set the payment plan’s schedule after outlining the payment agreement. For you to do this step, indicate whether the loan will be paid on a weekly, bi-weekly, or monthly basis. You should also include the amount that they shall pay on those periods. Additionally, you should also lay out the dates and corresponding fees for late-payments and defaults, or pre-payment if he’s not allowed to do so.

4. Provide Additional Terms if Needed

Since payment plan agreements are tailored according to the borrower’s payment capacity, providing additional terms and conditions might be necessary. To do this, write down all the other terms and conditions that you and the borrower agreed on. Doing this formalizes the borrowers promise to pay for the loan in his terms on record and writing.

5. Sign and Attach a Notarial Acknowledgment

After completing all the previous steps, the last thing that’s left for you to do is to sign the agreement with the borrower. This signifies your acceptance of its terms and conditions and serves as a promise to comply with them as well. You may also attach a notarial acknowledgment for an added security to your interest on the loan if needed.

Frequently Asked Questions

Is a payment plan agreement separate from the loan agreement?

No. Payment plan agreements are subsequent agreements made after a borrower fails to pay for their loans in time. And, these are given as a “last chance” option for borrowers to settle their outstanding debts once and for all.

Can payment plan agreements be used with instruments such as an I owe you?

Yes. Any loan instrument that bears the promise of a borrower to pay for the amount owed can be given a chance to settle their debts with payment plan agreements. Instruments such as an I.O.U and promissory note can have payment plan agreements subsequently made if the borrower has difficulty in paying under these instrument’s terms.

What type of loans can a payment plan agreement be used for?

Any loan, such as family loans, can have a payment plan agreement made after them. Payment plan agreements are agreements made subsequently after a borrower has difficulty paying for the loan under its original terms.

When do we need to notarize a payment plan agreement?

Payment plan agreements are only notarized if the loan agreement involves sums amounting to more than $ 10,000. This so to put the agreement in public records and compel the borrower to abide by its provision. Loans involving sums lesser than that will not need to be notarized. Payment plan agreements usually don’t include notarial acknowledgments on them. So you’ll need to attach a separate notarial acknowledgment if the agreement needs notarization.

Do we need to sign a payment plan agreement in front of a witness?

Witnesses are only needed if the payment plan agreement needs to be signed in front of a public notary. If the amount of the loan is below the than what is required, then there will be no need for the payment plan agreement to be signed in front of witnesses.

Debts can be an absolute burden for lenders if borrowers find it difficult to pay for them under the loan’s current terms. To guarantee the payment for these debts, you need to offer terms and conditions that are more favorable to the borrower’s capacity, and you as well. And should you find yourself in this similar situation, you know you can always get your money back with the help of a payment plan agreement