- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

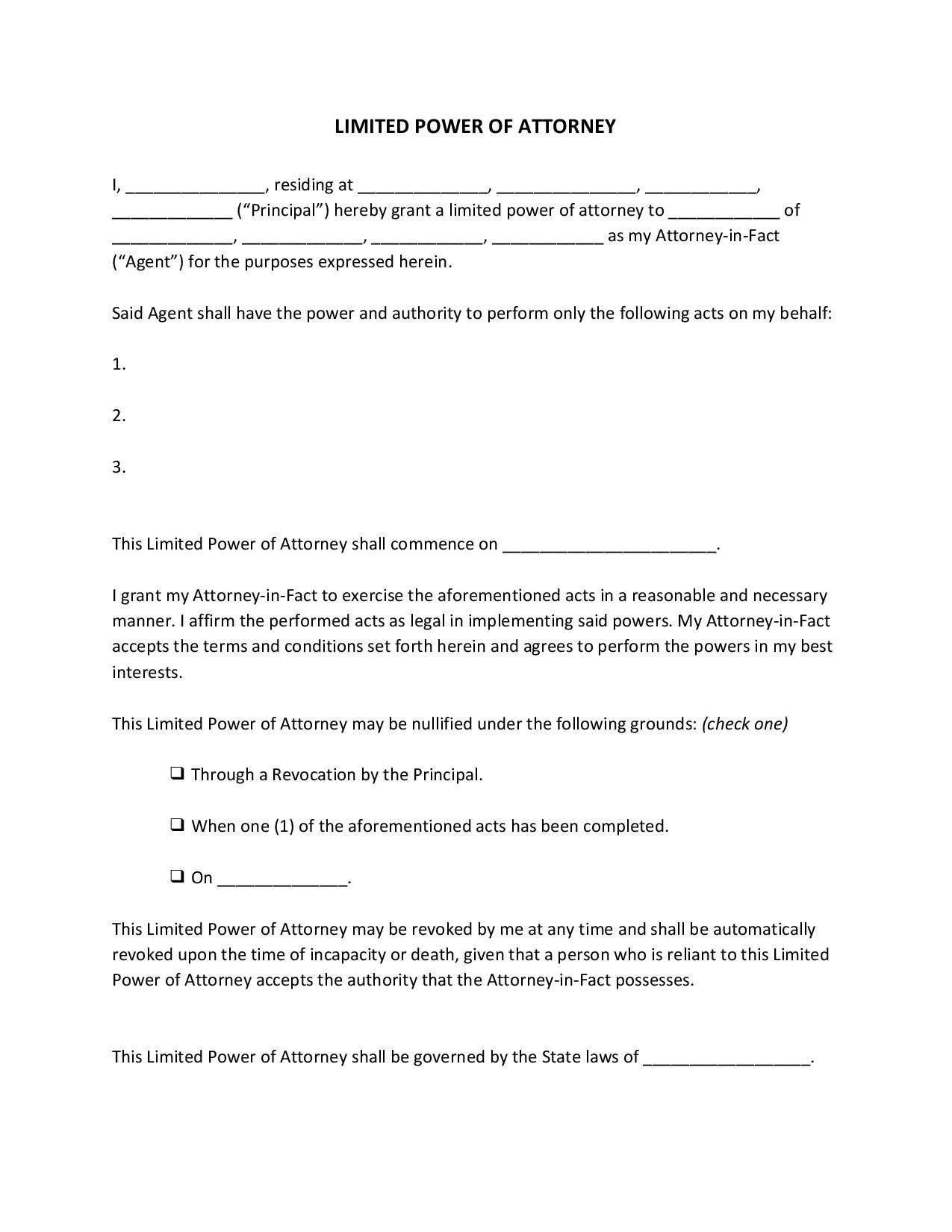

Limited Power of Attorney

Adults face the day with bearing the daily weight of obligations and responsibilities—they are always expected to be at their best. But what happens when something were to disrupt their daily routine? When faced with the inability to perform both personal and professional duties, we appoint someone legally to complete the tasks for us. The perfect document to assist us is called a Limited Power of Attorney (POA). This POA explicitly lists the specific tasks that the agent or attorney-in-fact may perform on our behalf. Read More

Limited Power of Attorney

- What Is a Limited Power of Attorney?

- Who Should You Choose As Your Agent?

- How to Create a Limited Power of Attorney?

- Frequently Asked Questions

- Do I need to notarize my limited power of attorney?

- How long should a limited power of attorney be valid?

- Can a power of attorney supersede a will?

- Can I appoint a family member as my agent?

- Are there any benefits to having a power of attorney?

What Is a Limited Power of Attorney?

A limited power of attorney or a limited POA is a document that provides a limited power of attorney to the agent or the attorney-in-fact. The limited power is given by the principal to perform particular actions on behalf of the principal. This power of attorney does not deprive you of your right to perform a specific action, but it legally authorizes another individual to act on your behalf. This limited power of attorney is also known as a special power of attorney.

Who Should You Choose As Your Agent?

You’ll be appointing someone who will fulfill your personal and professional duties—so, this person must be someone you fully trust. This person must be 18 years of age or older and may be a family member or any able adult. However, having a family member as your agent may save you some professional fees and can keep family matters within the family. The most common reason for acquiring a POA is when you have to be physically away either for serving in the military, working abroad, and completing a prison sentence.

How to Create a Limited Power of Attorney?

Your limited power of attorney can be created in the comforts of your own home. Read our helpful tips below to get you started.

1. Use a Template

Creating the form from scratch cannot guarantee your accuracy. We want to make sure that you’re on the safe side when making your POA. So, download the form from reliable websites that allow you to create the form that’s suitable to the State that you belong to. You just need to fill out the fields to create the form.

2. Identify the Agent or Attorney-in-Fact

In the POA, you are known as the Principal. The other party is known as the Agent or the Attorney-in-Fact. Indicate your full names and your mailing addresses in this section. Use government-issued documents or identification cards to ensure accuracy.

3. Specify the Powers

Under this section, specify the powers that you authorize the agent to perform legally. You must outline the powers one by one and non-generic because they might be playing something that you did not intend to allow or perform. You should also include that the principal may revoke a power of attorney anytime.

4. Set the Validity of the POA

Limited POAs are either springing, durable, and non-durable. A springing POA only becomes effective after the death or incapacity of the principal. A durable POA gives the agent unlimited time to perform the power bestowed upon them. On the other hand, a non-durable POA becomes ineffective upon your death or incapacity. Nevertheless, always include the starting and ending date in your POA. You not indicating the termination date in the POA form would mean that the form will be non-effective upon your death or incapacity.

5. Notarize the Form

You should notarize your POA, even if not all states require you to do so. It’s just that institutions more prefer notarized POAs compared to those that are not. Sign the POA in front of the notary public with the other party. But, some POAs only require the signature of the principal in it—so you may need to sign the POA alone in front of the notary public.

Frequently Asked Questions

Do I need to notarize my limited power of attorney?

Most states do not require a notarized POA. Whereas in some states, you may choose to have your POA witnessed or notarized.

How long should a limited power of attorney be valid?

The validity of the POA depends entirely on you. You will be responsible for the starting and ending date of the POA. However, if no termination date has been specified in the POA, then the POA will remain effective until your incapacity or death.

Can a power of attorney supersede a will?

No. According to Legal Zoom, a power of attorney loses its effect once the principal dies. Whereas a will only becomes effective once the testator dies.

Can I appoint a family member as my agent?

Yes. Most individuals appoint their family members as agents when it comes to handling financial or health matters. This is because family members are less likely to divulge financial and health matters outside the family.

Are there any benefits to having a power of attorney?

Yes. You’ll have someone to make decisions for you, look after your assets, and handle your affairs for you in case you get mentally or physically incapacitated. As long as you choose a reliable person, then your assets and dependents are in good hands.

There is no guarantee that the capacity and resources we have now are all-enduring. Who knows? The next day we might be incapacitated in some way—leaving our obligations and dependents hanging. We can never be too sure about the future, and what we have now may be taken away from us tomorrow without even knowing it. And it pays to be secure. That’s why, if anticipation motivates us to, we have to prepare the necessary paperwork, such as a Limited POA, in case something happens. Your chosen agent will take care of your obligations and dependents while are you are physically or mentally incapacitated. So, secure as early as now by using a limited power of attorney form.