- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

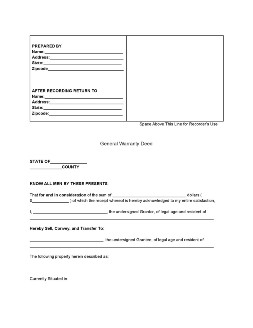

General Warranty Deed

Liens and encumbrances attached to a property may throw off your chances of closing its sale. Thus, the property’s clean history must be certified in paper before and after selling it. This can be done by writing a general warranty deed for the property. And whether you’re selling a house and other types of real estate, read further to take a closer look at these instruments. Read More

General Warranty Deed

- Who prepares a general warranty deed?

- Is there another way of guaranteeing a property’s title aside from a general warranty deed?

- Aside from the property’s title, what else does a general warranty deed warrant?

- Can I have a representative prepare a general warranty deed?

- What are the most important elements of a general warranty deed?

What Is a General Warranty Deed?

A general warranty deed is an instrument that guarantees the title to a property being sold or transferred. This instrument certifies that its present owner—as well as its past owners— has the right to sell, convey, and transfer its ownership. Additionally, a general warranty also certifies that the property is free and clear of any liens and encumbrances, therefore offering the buyer a secure and safe transaction.

Furthermore, a general warranty deed must be signed and acknowledged by the grantor in front of a notary public and several witnesses. And just like most deeds of sale, this instrument is also a primary requirement for granting a title over the property to its new owner.

How To Write a General Warranty Deed

General warranties are commonly used in real estate transactions where both parties are strangers to each other. And these documents remove any doubts and skepticism that the buyer has towards you and the property you sell. Now here’s how you can write a reassuring general warranty deed with the steps listed below.

1. Determine the Property’s History

As mentioned above, a clean history determines the success of selling a property. And you must determine whether the property is free from any liens or encumbrances before making the sale. You can do this by visiting your local registry where your property is located and find out if there are claims against. Furthermore, it’s also best to bring a copy of the lien release if the property has liens attached against it in the past. Doing this ensures the smooth flow of selling and transferring the property to its new owners.

2. Name the Property’s New Owner

General warranties transfer a property’s ownership to the seller, and it’s necessary to name them when writing one. This indicates who the property’s title will be named after when recording the sale and transfer of ownership in the public registry. To do so, simply put the name and address of the seller—or the grantee, in this case—on the space provided in the document. Aside from that, you should also indicate that you’re the property’s rightful owner, the grantor the transfer of ownership, and the guarantor of the property’s title, as well.

3. Bare All Information about the Property

Since a general warranty deed will be recorded in the public registry following its execution, it’s also necessary to bare all information about the property. This includes describing the property being transferred, as well as indicating whether it is a residential or commercial property, where it is located, and other details. Aside from that, you should also include information about the property’s history as well. For this, you should attach the list of the property’s previous and present owners, lien releases, and other supporting documents.

4. Disclose All and Any Existing Covenants

Properties are subject to laws and different rules, and, there are limitations of what owners can do with their properties. When writing a general warranty for your property, disclosing all and any existing covenants tied with the property is also required. This means providing the limitations and restrictions set by the locality where the property is located, or the rules set by the neighborhood association. This will help you build trust between the buyer, and provide them secure ownership of the property.

5. Conclude the Property’s Transfer

After completing all the particulars of the general warranty deed, you can now conclude the property’s transfer to its new owner. All you have to do is sign the deed in front of a public notary and some witnesses. After doing so, you can now provide a copy of the deed to the buyer, as well as record the deed in the local registry where the property is located.

Frequently Asked Questions

Who prepares a general warranty deed?

The person who stands as the grantor in a general warranty deed is the only person who can prepare such a document. This is because the general warranty deed constitutes as the grantor’s guarantee of the property’s title.

Is there another way of guaranteeing a property’s title aside from a general warranty deed?

Yes, there is. Aside from the general warranty, you can guarantee that the property’s title with a special warranty deed. However, this particular type of deed only guarantees the property’s title only during the time it had with the grantor and not with its past owners.

Aside from the property’s title, what else does a general warranty deed warrant?

There are 5 other warranties that a general warranty has in addition to the property’s title. These are namely the (1) covenant for seisin; (2) covenant of the right to convey; (3) covenant against encumbrances; (4) covenant for quiet enjoyment; and (5) covenant for further assurances.

Can I have a representative prepare a general warranty deed?

No. As mentioned in the first question, only the grantor can prepare a general warranty deed. However, a fiduciary deed may be prepared by the grantor’s representative if the grantor is unable to do so.

What are the most important elements of a general warranty deed?

- The most important elements to take note when writing a general warranty deed are:

- The names and addresses of both the grantor and the grantee;

- The legal description of the property; and

- The 6 warranties.

Trust is the most important element in selling property, especially if this involves selling real estate. You can do this by guaranteeing the clean history of the property with a general warranty. But aside from that, having a general warranty on the property also says that you guarantee the buyer’s quiet and worry-free enjoyment of the property, as well.