- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

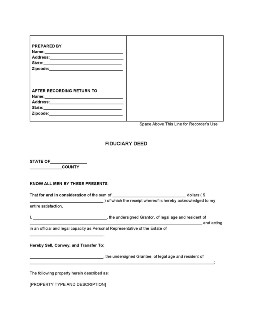

Fiduciary Deed

Entering into transactions are some of our responsibilities as appointed agents to our principal’s estate. And, included in such a responsibility is the execution and delivery of its corresponding paperwork. One of these is a fiduciary deed for our principal’s property. Learn how you can fulfill your fiduciary responsibilities with these documents by reading further. Read More

What Is a Fiduciary Deed?

A fiduciary deed is a deed of sale written and executes when closing a property’s sale. And the same with other deeds, this includes the description and location of the property for sale, as well as the warranties to the property’s title and history. But unlike other deeds, a fiduciary stands as its grantor instead of the owner of the property himself. Moreover, this document is still signed and executed in front of a notary and several witnesses regardless of its uniqueness.

How To Write a Prepare a Fiduciary Deed

There are many circumstances why fiduciaries—appointed agents or personal representatives—enter into a real estate transaction instead of their principals. It’s either that the principal is physically unable to do so or is legally incapable. As their legally and duly appointed fiduciaries, preparing the necessary real estate documents is part of our responsibilities. So here are some tips on how to prepare a fiduciary deed on behalf of your principal and his property.

1. Consult Your Attorney Beforehand

Deeds use a specific language that most legal documents have, so its best to consult your attorney beforehand when preparing a fiduciary deed. Aside from the language, an attorney can also give you some advice on goes into the deed as well. For this, all you have to do is visit your attorney and take some notes on how a fiduciary deed should look like. This not only gives you a proper document that will help the buyer get a title for the property but also ensures that its provisions stay true to its promises.

2. Mention The Principal or Estate Owner

Since a fiduciary deed is prepared by a personal representative on behalf of their principal, it’s very necessary to mention your principal or the estate owner in the deed. They are mentioned repeatedly in the contents of this document, and the spaces for these are already provided so you don’t have to worry about misplacing them. What this step does is it prevents you from guaranteeing the property’s title using the wrong persona.

3. Provide a Full Disclosure of the Property

Describing the property fully is necessary for real estate transaction documents. And in a fiduciary deed, descriptions not only include the type, address, and the inclusions of the property. It also includes the covenants that will affect the buyer’s use of the property in the long run, as well. Providing full disclosure of what the property has to offer helps the buyer secure a title over it, aside from furthering the trust they have on you.

4. Include All of Its Supporting Documents

Since this type of deed guarantees the title of the property on behalf of its owner, including and attaching the documents to support those guarantees is also necessary. These documents may include lien releases if the property has one attached in the past, as well as any documents that will support its guarantees.

5. Sign and Acknowledge the Deed

Lastly, sign and acknowledge the deed after preparing its necessary elements. This validates the warranties provided by the deed towards the property, as well as your authority to grant such warranties on behalf of your principal. To sign and acknowledge the deed, simply sign the fiduciary deed in the presence of a public notary and several witnesses. Furthermore, you must also furnish a copy of the deed to the buyer and the public notary after its execution.

Frequently Asked Questions

What type of attorney do I need to consult in preparing a fiduciary deed?

The best type of attorney to consult in preparing a fiduciary deed will be a real estate attorney. This is because fiduciary deeds are used primarily for selling real estate. But in case your attorney may have some knowledge regarding real estate transactions, you can consult them instead of hiring another attorney.

Aside from me, who else can stand as my principal’s fiduciary?

Aside from the principal’s representative, other persons can act as the principal’s fiduciary as well. They can either be the principal’s attorney-in-fact, guardian, conservator, or executor acting in his official capacity.

What makes a fiduciary deed different from other deeds?

Fiduciary deeds are unique because unlike other deeds, they are prepared exclusively by the property owner’s representatives instead of themselves. Furthermore, a fiduciary deed is not the owner’s guarantee of title to the property as opposed to general warranties and quitclaim deeds.

Is there a deed of trust similar to a fiduciary deed?

No. A deed of trust is a type of deed which places the property’s title under the possession of a trustee—which could either be a bank, escrow, and title company. This type of deed is often used in transactions that require a property to be placed as security such as loans and mortgages. A fiduciary deed comes into use in these kinds of transactions when the property owner defaults and needs to sell the property to compensate for the money owed.

Acting and standing on behalf of someone we care about the most are the greatest forms of help that we can give them. And in transactions where properties are involved, it is our primary responsibility as their trusted representatives to act with the diligence of a loving parent. Hence, as part of our responsibility, preparing real estate documents—such as a fiduciary deed—ensures that every effort we exert on our principle’s behalf will not go in vain.