- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

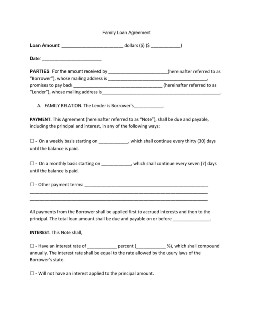

Family Loan Agreement

About “88 million Americans borrow money from their family and friends,” according to a Federal Reserve report cited by finder.com. These loans may often amount to as little as a hundred bucks up to a thousand dollars. But regardless of the amount borrowed, it is always crucial for us to secure its repayment in writing with a family loan agreement. Find out more about the importance of creating a Family Loan Agreement by reading this article. Read More

What Is a Family Loan Agreement?

A family loan agreement is a set of terms and conditions that you and a family member enter concerning the payment of the money borrowed. This agreement outlines the loan’s principal amount, its maturity date, as well as other terms and conditions such as pre-payment and extension options. Although very uncommon, a family loan agreement may also impose interest rates and include a notarial seal to guarantee its repayment further.

How To Create a Family Loan Agreement

According to the same source mentioned above, almost half of family loans are left unpaid and outstanding. And with those numbers at play, you need to outline a clear set of terms and conditions to secure its repayment. For you to do that, detailed in the steps below is how you can create a family loan agreement.

1. Review Laws that Govern Loans

Like personal loans, family loans are governed and subject to federal and state laws. These laws set the limits of the lender and the borrower. It also ensures that investments are legally made by both parties as well. So, better start by checking these laws first before creating a family loan agreement with a family member.

2. Introduce the Parties of the Agreement

Much like a lease agreement, a family loan agreement starts by introducing the parties that created this agreement—The lender, the one lending the money, and the borrower, the one borrowing the money. Introducing the agreeing parties outlines their roles and responsibilities in the agreement. In turn, it solidifies the agreement’s terms and conditions as well. Since these loans are matters of the family, it’s also important to mention the parties’ relationship with one another as well.

3. State the Loan’s Principal Amount.

The loan’s principal amount is the actual amount of money borrowed and received by the borrower. It is also the object of which a loan agreement revolves around, as well. After introducing the lender and borrower, the next thing you should do is state the loan’s principal amount—in words and figures. Doing so prevents both parties from defrauding one another by knowing the exact amount of money involved in the agreement.

4. Set the Loan’s Maturity Date

The repayment of the money owed is the primary objective of a loan agreement. So aside from stating the loan’s principal amount, it is also essential to set the date of when the loan will mature or due for payment. Doing so allows the borrower to have a reasonable time to prepare the amount, as well as a routine schedule of payment. You may also set the terms and conditions of late payment here if needed, as well.

5. Sign and Seal the Agreement

Lastly, sign the family loan agreement with the borrower after agreeing with the terms and conditions for the repayment of the loan. Signing the loan agreement signifies that you and the borrower promise to pay the loan, as well as to respect each other’s rights to the contract.

Frequently Asked Questions

Why do borrowers turn to family loans?

Borrowers turn to family loans for many reasons. But, the most common and probable reason is when traditional lending institutions refuse to lend them any money. This means that they either had a bad credit reputation or creditors don’t find them trustworthy enough. For cases like these, there’s nothing wrong with creating a family loan agreement with them to protect your interests.

Who can be the parties in a family loan agreement?

Family loans are loans extended to family members and relatives who need cash. The parties in this agreement can be the lender’s direct family, such as their children, siblings, as well as relatives. Aside from those, family loans can also be extended to indirect family members such as the lender’s in-laws, as well.

Do I need to notarize a family loan agreement?

In general, loans are founded on trust that the lender has on the borrower, regardless of their relationship. The same also applies to family loans. Notarizing a family loan agreement isn’t always necessary. However, you can always opt to do so if you find the need to add an extra layer of protection.

Should I impose an interest rate on a family loan?

Although family loans often don’t bear interest, you can, however, do so if you need to. And if you do choose to put an interest on top of the principal amount, make sure to check your laws governing loans and interest rates first.

How much money can I lend in a family loan agreement?

There is no limit on the amount that you can lend to your family members. However, according to the IRS annual gift threshold, an interest-free loan should be no more than $14,000, and anything beyond that will incur tax liabilities.

Family is some of the few places where one could instantly find help. And likewise, it is also one of many people whose kindness is too susceptible to abuse. Loaning money can be of great help to family members who are in the shoes of neediness. Yet despite them being connected to us by blood or by affinity, there’s nothing wrong in having an extra measure of protection by creating a family loan agreement between them.