- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

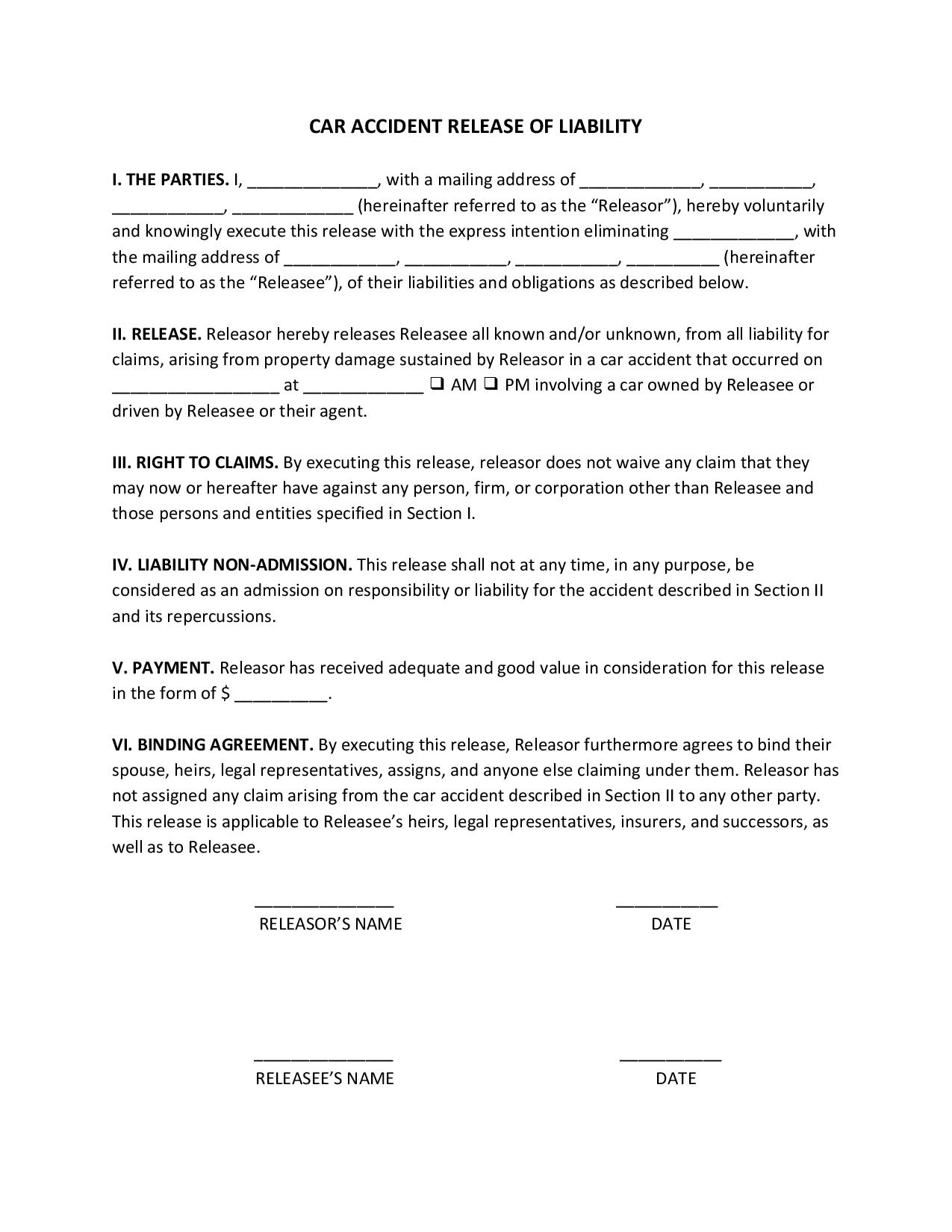

Car Accident Release of Liability

Car accidents are a part of the daily hustle. When two drivers decide to settle it, it usually ends in either way: by mutual agreement or by filing a case. The latter can be avoided by seeing eye to eye with the other party. A car accident release of liability form will help you settle a dispute peacefully. In this document, the other party will not be absolved of their responsibility. Instead, you waive your right to sue them in exchange for payment. Learn more about the contents of this release form by reading below. Read More

Car Accident Release of Liability

What Is a Car Accident Release of Liability Form?

A car accident release of liability form is a legally binding document that settles a dispute between two parties outside of court. This is a mutual agreement between two parties wherein the party at fault agrees to provide payment to the other party. This is done to prevent the other party from filing a case against the party at fault. The payment shall cover the property damage, personal hardship, compensation for loss of employment, and hospitalization dues. This is also known as a settlement agreement.

How to Create a Car Accident Release of Liability Form?

According to Driver Knowledge, an average of 6 million car accidents happen in a year. And about 72% of these result in property damage. No matter how careful you are on the road, you’ll eventually end up being involved in a car accident because of some reckless driver. A car accident release of liability form will help settle the dispute peacefully. Below are tips on how to make one:

1. Introduce Both Parties

Start by introducing the releasor and the releasee. The releasor is the victim of the car accident. Whereas the releasee is the one at fault. Include only the full names of both parties in this section. Both parties should be identified as to who the releasor and the releasee are. If there are more than two persons at fault, include them in the agreement.

2. Cover a Liability Waiver

In most cases, the releasee’s auto insurance company will cover all the expenses needed. These are the hospitalization dues, property damage, compensation for loss of employment, and personal hardship. The details of the injury and property damage should be specified in order for the insurance company to cover the expenses justly. Once the release form has been signed, the releasor can no longer claim future obligations and/or damages from the releasee and the insurance company.

3. Specify the Amount that the Releasee Has to Pay

Like what has been previously mentioned, the amount offered by the insurance company has to cover all fees pertaining to the accident. That’s why it’s very important to specify all injuries and damages for the insurance company to justly cover them. If you cannot provide the exact amount, you can estimate all future costs.

4. Observe Governing Laws

The release form must be in compliance with its governing laws. Otherwise, the whole document will be considered as invalid and unenforceable. In case of future disputes, the governing law will be used to uphold any decision made by the court. Be on the safe side and get educated by your state’s laws.

5. Consult with a Personal Injury Attorney

When in doubt, don’t hesitate to consult a personal injury lawyer. Normally, some insurance companies will try to save time and money by settling the claim quickly. If you are not satisfied with the amount, consult your personal injury attorney to ensure the amount is justly set. Take your time and don’t sign the document immediately.

Frequently Asked Questions

Should I notarize my car accident release of liability form?

It entirely depends on you. However, some states require you to notarize your release of liability. If you belong to the states that don’t require notarization, still, it is highly recommended that you do for extra protection. A notarized document also guarantees the agreement’s validity.

What are the steps before obtaining a car accident release of liability form?

The first step is to gather information about the accident. The police should be involved during this process to capture images, make an accident report, and to determine who is at fault. An agreement will now be made between the two parties. Second, the releasee is made aware of the injuries and damages that they have sustained. The release form must be established immediately to prevent a long list of claims and damages by the releasor. Third, the dispute must be settled. A background check must be done to ensure the releasor has not been previously involved with insurance fraud. Lastly, once everything has been finalized, the release should be signed by both parties.

What are the names of the parties involved?

The release of liability form or the hold harmless agreement consists of the releasor and the releasee. The releasor is the victim of the accident while the releasee is the person being released from the liability.

Do I need to inform my insurance agent about the accident?

Yes, According to Which. However, you have to inform them within the required window. If you fail to do this, they have the right to refuse to cover you.

Is it acceptable if I pay out of pocket for a car accident?

Yes. It is acceptable to pay out of pocket for a car accident.

Responsible drivers try to avoid accidents as much as possible. Aside from the trauma, financial loss, property damage, and possible death are the things that should be rightfully avoided. But no matter how careful you are on the road, road mishaps happen because of irresponsible drivers. These drivers have no regard for human life. One way of holding them accountable is through the use of a car accident release of liability. Practically, nobody wants to go through the long and arduous process of legal methods. That’s why it’s wise to settle everything by paying a hefty sum of money to the releasor. As the releasor, you should be wise enough to ensure that the amount covers all claims and damage. But all these will be unnecessary as long as everyone practices safe driving.