- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Career Assessment - 16+ Examples, Format, Tips, Pdf Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

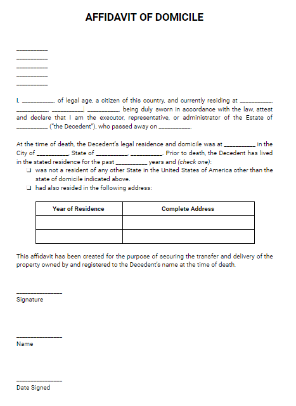

Affidavit of Domicile Template

An affidavit of domicile is essentially needed at times when there is a need for legal proof of the last residence of a person who died. Most of the cases are related to an executor who needs to transfer certain assets that the person left behind, most especially stocks, securities, properties, and many more. Whether you are to create an affidavit of domicile for personal use or a client, you have come to the right place. Our website offers a variety of legal templates that you can easily download. There is more! When you sign to any of our subscription plans, you can enjoy exclusive perks from us. More on this below. Read More

Affidavit of Domicile Template

What Is an Affidavit of Domicile?

An affidavit of domicile is a sworn statement and a legal document used when someone died to help legal authorities establish the deceased person’s permanent place of residence. Usually, it is the last place they reside in. The affidavit is often made by the executor of the deceased’s estate. It is also required by financial brokers to transfer securities ownership to the beneficiaries. Moreover, an affidavit of domicile must be signed before a notary public. The executor must swear to the best of their knowledge, that the information contained in it is based on facts. Telling false statements in the affidavit is equivalent to lying to the court of law.

How Do You Create an Affidavit of Domicile Using a Template?

Whether it is your first time making a sworn statement or not, it will be a lot easier if you use a template. For sure, there is no one way to make an affidavit. You can consult an attorney to make one for you. However, you can also write an affidavit on your own. It is very important to know the most common terms used in an affidavit of domicile like deceased, estate, executor of estate, beneficiaries, probate court, jurisdiction, domicile, estate account, financial broker, stocks, and securities. Continue reading the list below for more tips and tricks.

Select an Affidavit Template

Using a template is helpful to structure an affidavit. The best thing about using it is that you are no longer required to start from the bottom and most especially it is cost-efficient compared to hiring an attorney to write an affidavit for you. Have you checked out our collection of templates? If not, then it is your chance to download a stencil fitting for your affidavit-writing task. Since a template comes in with suggested content, you can modify it as needed or leave it as it is.

Edit Your Template Using an Editing Tool

To customize and align the affidavit template to legal requirements, use an editing tool. Select an editing tool that is compatible with your template file format. You will know if you can work on an editing tool if it is featured on the website where you get your template from. Otherwise, it would be difficult to modify your template or mess up the format. But before you get started, ensure that you know what an affidavit looks like and what it should include. It will help you put everything in order. Thus, let us get started with the title.

Provide a Title and the Content

The affidavit’s title should capture the attention of the readers. What better way to do that than placing the title on the topmost part of the document, written in bolder font size than the rest of the words in the affidavit. More so, the title must tell right away what the affidavit is all about. After that, compose the body of the affidavit and include the details regarding how the assets will be transferred, who is the beneficiary, and more.

Let the Executor Sign the Affidavit

Lastly, the affidavit must be signed by the executor in order to be valid. Upon signing, there should be witnesses who have no interest in the matter. Then, get the affidavit notarized so that it can stand in front of the court of law.

FAQs

When do you need an affidavit of domicile?

You need an affidavit of domicile when you are appointed as the executor of an estate and need to transfer the deceased’s properties and securities to their beneficiaries. As it is required by a financial broker to confirm the deceased person’s residence, the affidavit should determine which state’s estate and inheritance taxes will be assessed against these assets. Additionally, a separate affidavit of domicile is required for each security account. Say for example, if you a deceased person owned shares of stock in a company, only one affidavit is required. On the other hand, if they owned stock in five different companies, five affidavits of domicile will be required to be able to transfer these assets.

What are the consequences of not having an affidavit of domicile?

If an executor has no affidavit of domicile, he or she cannot settle an estate that includes stocks, bonds, and other securities. Under these circumstances, ownership of these assets cannot be transferred to the rightful beneficiaries and they cannot be cashed in order for the proceeds deposited into the estate account. Also, this asset is considered a debt against the estate due to the taxes that must be paid upon transfer or sale. In return, the beneficiaries could sue the executor for incompetence and failure to fulfill his or her duties to distribute the assets as per the terms of the will.

What is the most common use of an affidavit of domicile?

The most common use of an affidavit of domicile occurs when the executor of an estate is responsible for settling an estate that includes securities. Some financial institutions may also require this document, unless an estate account has been opened. However, you can avoid using an affidavit of domicile by opening a joint securities account with your intended beneficiary. In this situation, the assets are not included in the estate as they are already owned by the person you have selected.

What should you include in your affidavit of domicile?

A basic affidavit of domicile includes the following details: name of the deceased, deceased’s address, length of time they lived at the address, date the deceased died, probate court which has the jurisdiction over the assets, and instructions for the transfer or cashing of securities. In instances where the decedent was a minor, mentally incompetent, residing in a nurising home, or otherwise lacking legal capacity, completing an affidavit of domicile can be more complicated and expert advice may be required.

Making an affidavit of domicile is not as difficult as you think. Use our template for a more convenient affidavit-making task. Whether you are to create one for yourself or for a client, our affidavit template is a great help to you. What are you waiting for? Get a copy now!