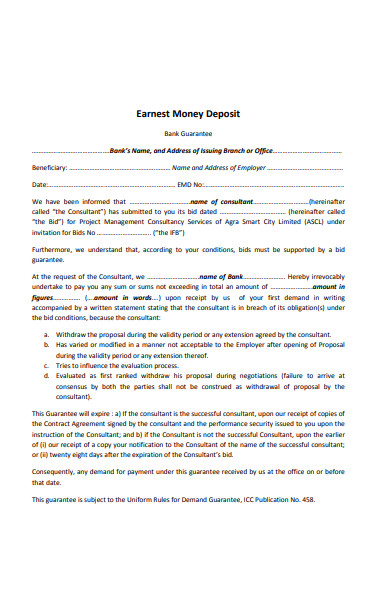

An Earnest Money Deposit Receipt is a crucial document in property transactions, confirming the buyer’s deposit and intent to purchase. This guide explores the importance of using a structured Receipt Form and Deposit Form for legal and financial clarity. It ensures that both parties have documented proof of the agreement and outlines key details such as the deposit amount, property address, and payment terms. From residential deals to commercial transactions, an earnest money receipt builds trust and prevents disputes. Learn to create and use these receipts effectively with our comprehensive examples and tips.

Download Earnest Money Deposit Receipt Bundle

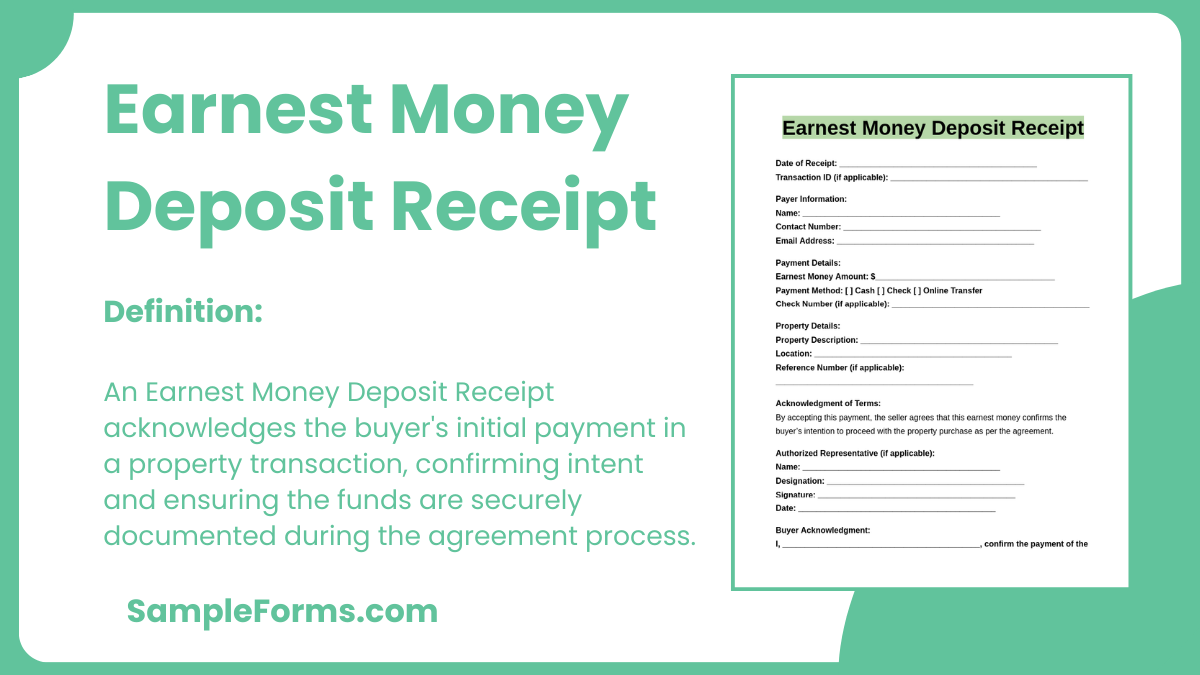

What is an Earnest Money Deposit Receipt?

An Earnest Money Deposit Receipt is a document that acknowledges the payment made by a buyer as a sign of intent to purchase property. It details the deposit amount, payment date, and terms agreed upon by both parties. This receipt ensures transparency and serves as proof of the buyer’s commitment. By using a receipt, sellers can secure the deal, while buyers gain assurance of their financial investment in the transaction.

Earnest Money Deposit Receipt Format

Received From: ____________________________________________

Address: ____________________________________________

Contact Number: ____________________________________________

Property Address: ____________________________________________

Transaction Date: ____________________________________________

Amount Received: $________________________________________

Payment Method: [ ] Cash [ ] Check [ ] Bank Transfer

Check Number/Transaction ID (if applicable): ____________________________________________

Signature of Buyer: ____________________________________________

Date: ____________________________________________

Signature of Seller: ____________________________________________

Date: ____________________________________________

Signature of Witness: ____________________________________________

Date: ____________________________________________

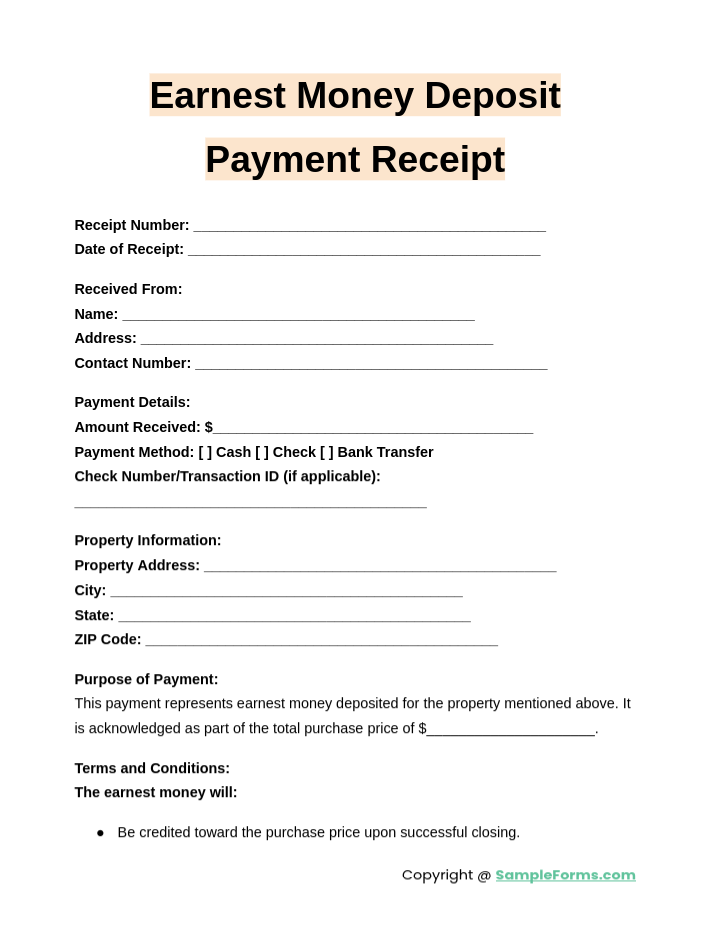

Earnest Money Deposit Payment Receipt

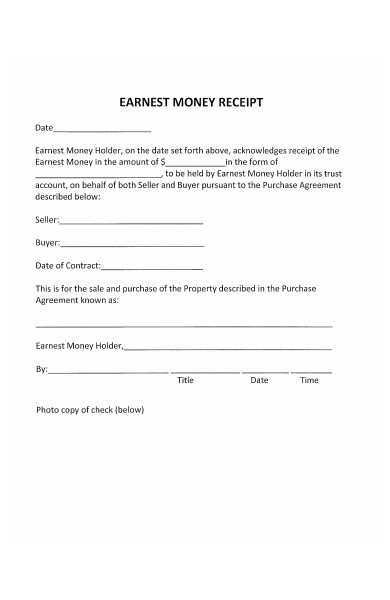

An Earnest Money Deposit Payment Receipt records the initial payment made during a transaction, ensuring financial accountability. Similar to a Restaurant Receipt Form, it provides transparency by documenting the payer, amount, and purpose.

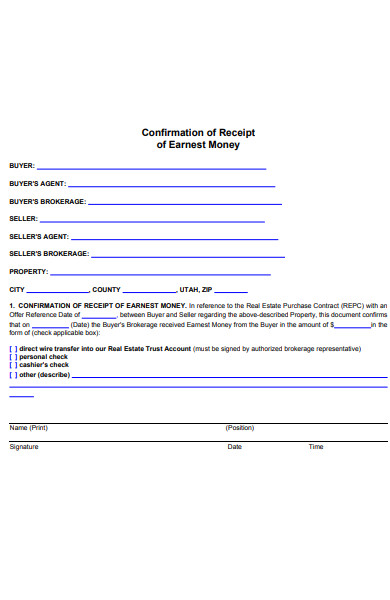

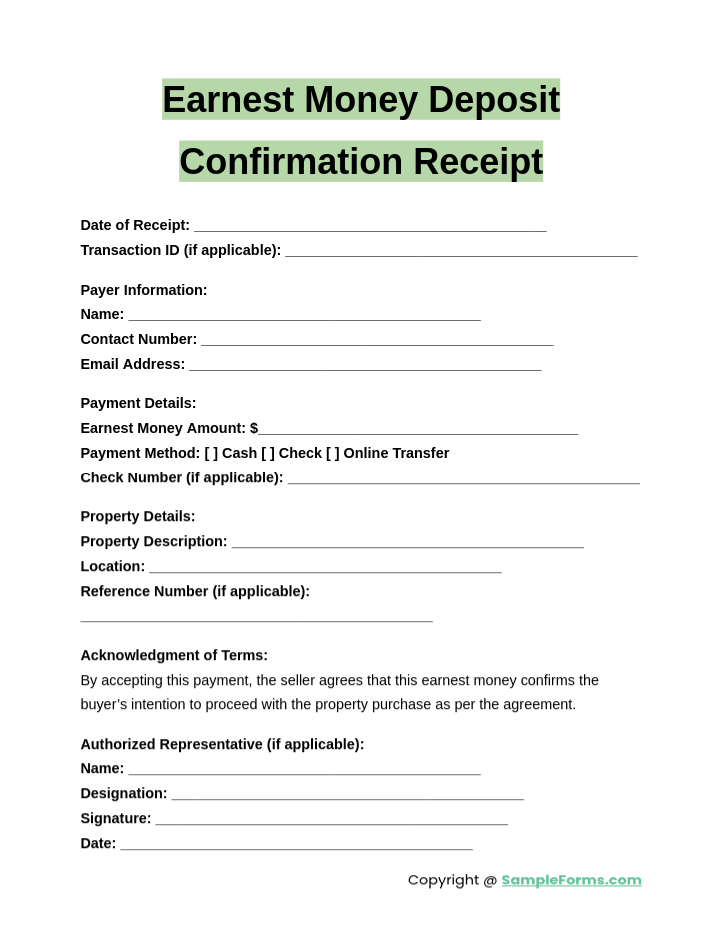

Earnest Money Deposit Confirmation Receipt

An Earnest Money Deposit Confirmation Receipt verifies the successful payment of a deposit for a purchase agreement. Comparable to a Rent Receipt Form, it ensures clarity by including the transaction details and agreement references.

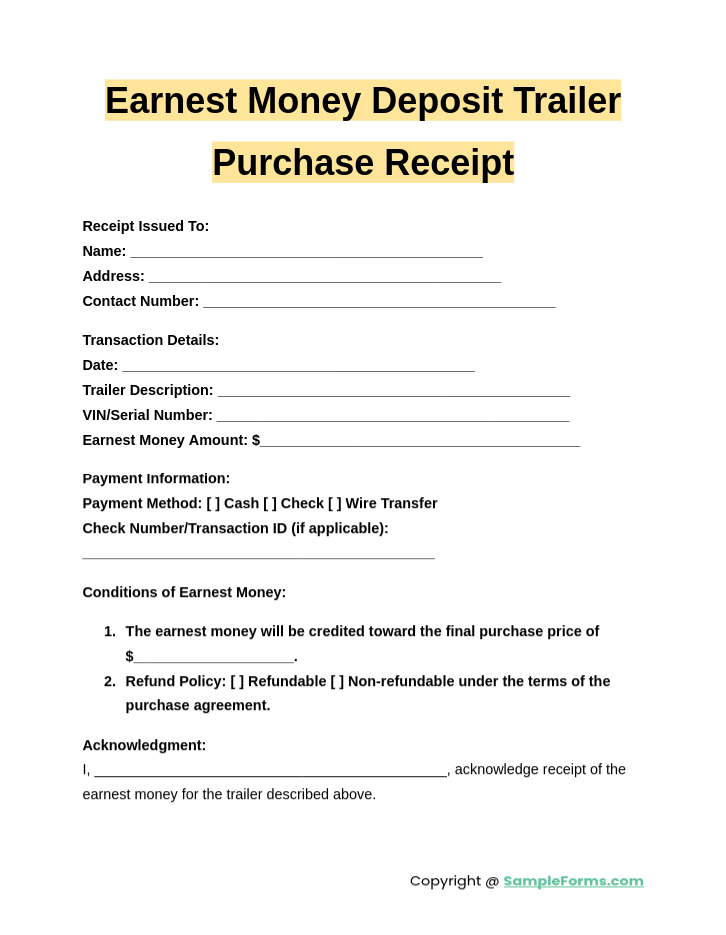

Earnest Money Deposit Trailer Purchase Receipt

An Earnest Money Deposit Trailer Purchase Receipt secures payment proof for trailer transactions. Like a Hotel Receipt Form, it documents buyer details, trailer specifications, and deposit terms, fostering trust and accountability.

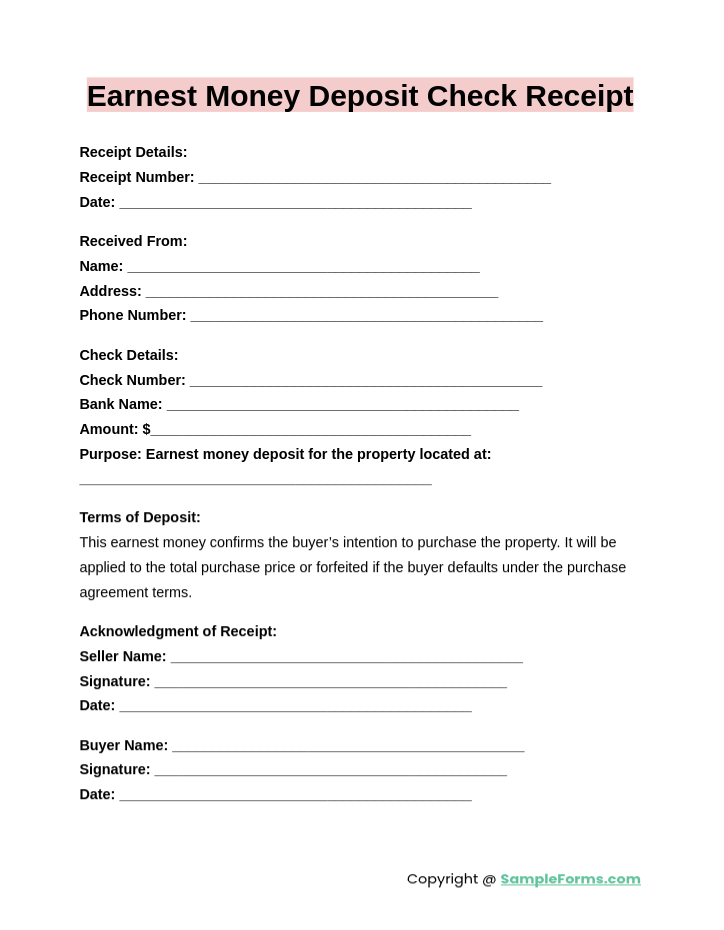

Earnest Money Deposit Check Receipt

An Earnest Money Deposit Check Receipt confirms receipt of a deposit via check, ensuring traceability. Similar to a Cash Receipt Form, it includes the check number, payment date, and payer information for clear financial records.

Browse More Money Deposit Receipts

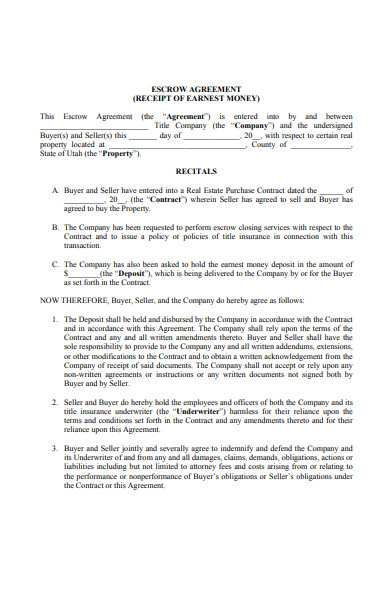

1. Earnest Money Deposit Receipt

2. Sample Earnest Money Deposit Receipt

3. Real Estate Earnest Money Deposit Receipt

4. Simple Earnest Money Receipt

How do you record earnest money received?

Recording earnest money ensures accurate financial tracking and compliance. Use tools like a Security Deposit Form to document all payment details systematically.

- Identify the Payer and Property: Record the buyer’s name and property address.

- Specify the Payment Date: Note the exact date of receipt.

- Include Payment Details: Document the amount and payment method (cash, check, or transfer).

- Issue a Receipt: Provide a formal acknowledgment using a Deposit Receipt Form.

- Maintain Records: File the details for transparency and future reference.

How do you document earnest money?

Documenting earnest money ensures clarity and prevents disputes. Like a Rental Deposit Form, this process involves creating a detailed record of payment terms.

- Prepare a Receipt: Include the deposit amount, payer, and recipient details.

- Outline Conditions: State the purpose and conditions of the earnest money.

- Secure Signatures: Obtain signatures from both parties for validation.

- Attach Supporting Documents: Include agreements or property details.

- Store Securely: Maintain digital and physical copies for legal compliance.

Why is the earnest money deposit important?

The earnest money deposit signifies the buyer’s commitment and secures the property agreement. It serves as a financial guarantee for both parties.

- Demonstrates Serious Intent: Buyers show their commitment to purchasing.

- Protects Sellers: Offers assurance against buyer withdrawal.

- Fosters Trust: Strengthens relationships between buyer and seller.

- Facilitates Negotiations: Encourages smoother transactions.

- Mitigates Risks: Provides a basis for legal action if terms are breached. You may also see Delivery Receipt Form

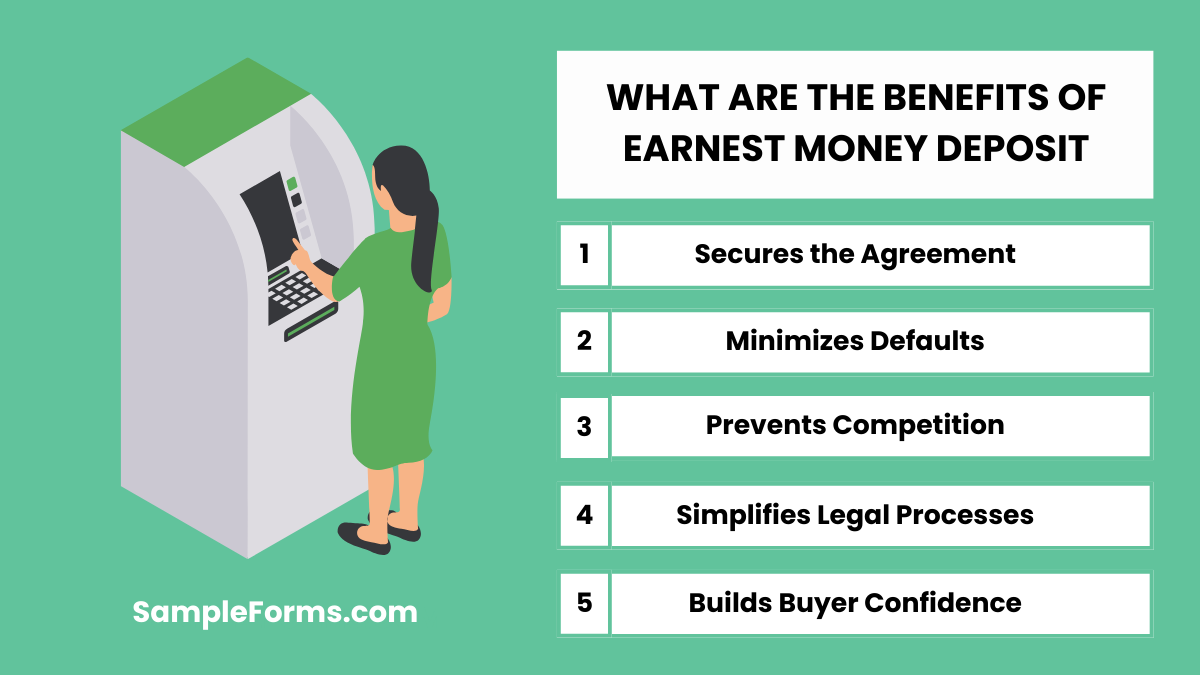

What are the benefits of earnest money deposit?

Earnest money deposits ensure financial accountability and mutual trust in property transactions. Like a Direct Deposit Form, it simplifies and formalizes agreements.

- Secures the Agreement: Protects both parties’ interests.

- Minimizes Defaults: Encourages buyers to fulfill commitments.

- Prevents Competition: Sellers remove the property from the market.

- Simplifies Legal Processes: Ensures documentation for future reference.

- Builds Buyer Confidence: Demonstrates financial capability.

What happens to earnest money deposit?

The earnest money deposit is credited, refunded, or forfeited based on the transaction outcome. Processes similar to a Deposit Refund Form may apply.

- Credited at Closing: Applied toward the buyer’s purchase costs.

- Refunded Upon Withdrawal: Returned if the buyer exits under valid conditions.

- Forfeited for Default: Retained by the seller if terms are breached.

- Held in Escrow: Safeguarded until transaction completion.

- Used as Security: Protects sellers against non-serious buyers.

What is copy of the earnest money deposit check?

A copy of the earnest money deposit check is a duplicate proof of payment, similar to a Vehicle Deposit Form, used for documentation.

Who releases earnest money?

Earnest money is released by the escrow holder or agreed intermediary upon meeting conditions in a Deposit Agreement Form.

Is my earnest money refundable?

Earnest money is refundable under valid terms, like contract breaches or contingencies, much like addressing a Missing Receipt Form issue.

What is the validity period of EMD?

The validity of EMD depends on contractual agreements, often outlined explicitly, akin to a Receipt Book Form for payment records.

Who pays earnest money?

The buyer pays earnest money to demonstrate intent, similar to issuing a Car Receipt Form during a vehicle purchase.

Is earnest money deposited?

Yes, earnest money is deposited into an escrow account, ensuring safekeeping, similar to an ADP Direct Deposit Form.

Who keeps earnest money?

The escrow holder or intermediary keeps the earnest money until the transaction is completed or terminated, like handling a Contractor Receipt Form.

What is the EMD amount?

The EMD amount varies but is typically 1-3% of the purchase price, as recorded in structured forms like a Daycare Receipt Form.

What is the percentage of earnest money?

Earnest money often constitutes 1-3% of the transaction value, similar to deposits documented in a School Receipt Form.

How do you source earnest money?

Earnest money is sourced from personal savings, loans, or other financial means, recorded in forms like a Cleaning Receipt Form for transparency.

The Earnest Money Deposit Receipt is essential for clear and secure property transactions. It formalizes the buyer’s intent and protects both parties’ interests by detailing payment amounts, dates, and conditions. Using a well-drafted Payment Receipt Form, buyers and sellers can ensure accountability, reduce misunderstandings, and maintain professionalism throughout the process. Whether for real estate or other contractual agreements, this receipt simplifies documentation and supports effective communication.