In this comprehensive guide, we explore the essentials of creating an effective Donation Receipt Form. Whether you are managing a charity or a non-profit organization, this guide provides clear instructions, practical examples, and key tips. You’ll learn how to structure a Receipt Form that includes all necessary details for tax purposes and donor records. Additionally, we cover the specifics of a Donation Form, ensuring you have all the elements needed to document contributions accurately. From understanding the basics to mastering advanced techniques, this guide is your go-to resource for all things related to Donation Receipt Forms.

Download Donation Receipt Form Bundle

What is Donation Receipt Form?

A Donation Receipt Form is a document provided to donors as proof of their contribution to a charity or non-profit organization. It includes essential details such as the donor’s name, donation amount, date, and the organization’s information. This form is crucial for both the donor and the organization for tax reporting and record-keeping purposes. A well-structured Donation Receipt Form ensures transparency and compliance with legal requirements, much like a formal Cleaning Service Receipt Form ensures accurate service documentation.

Donation Receipt Format

Donor Information:

- Name:

- Address:

- Contact Information:

Donation Details:

- Date of Donation:

- Amount Donated:

- Method of Donation:

Organization Information:

- Name:

- Address:

- Contact Information:

Acknowledgment: “Thank you for your generous donation. This receipt serves as proof of your contribution.”

Signatures:

- Authorized Signature:

- Date:

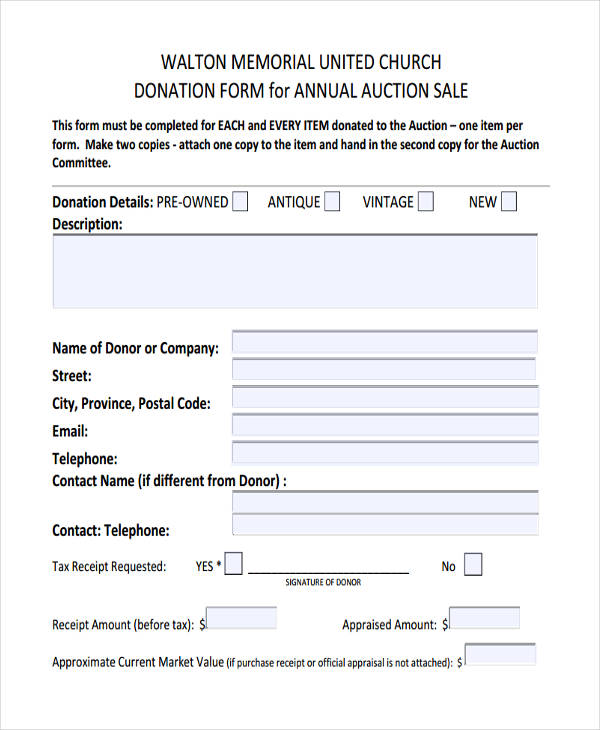

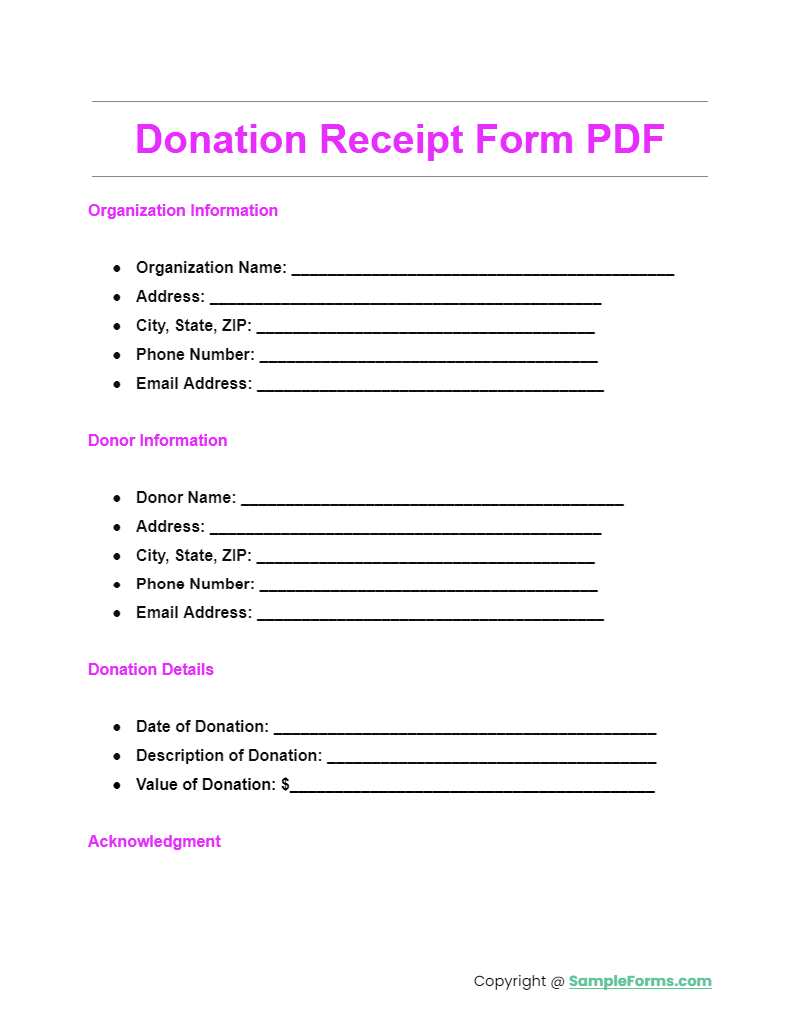

Donation Receipt Form PDF

A Donation Receipt Form PDF is a downloadable and printable document that organizations can use to provide donors with proof of their contributions. It includes donor details, donation amount, and date, similar to a Nonprofit Donation Form.

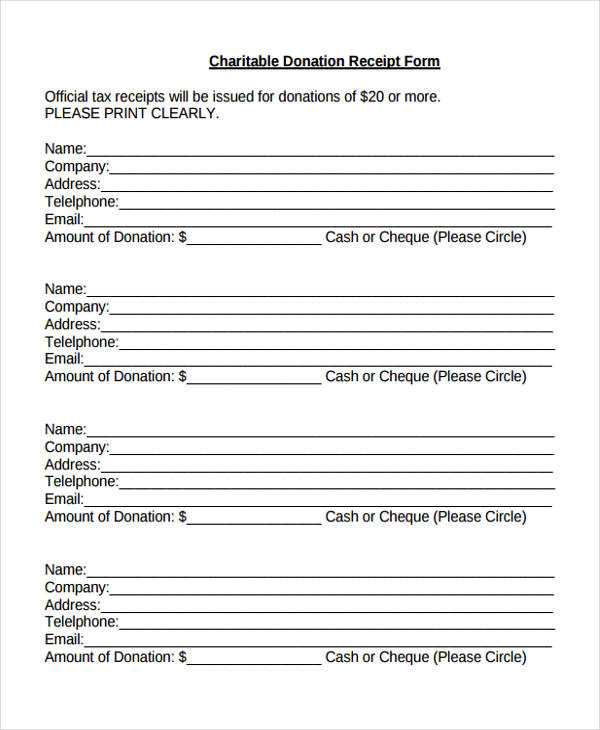

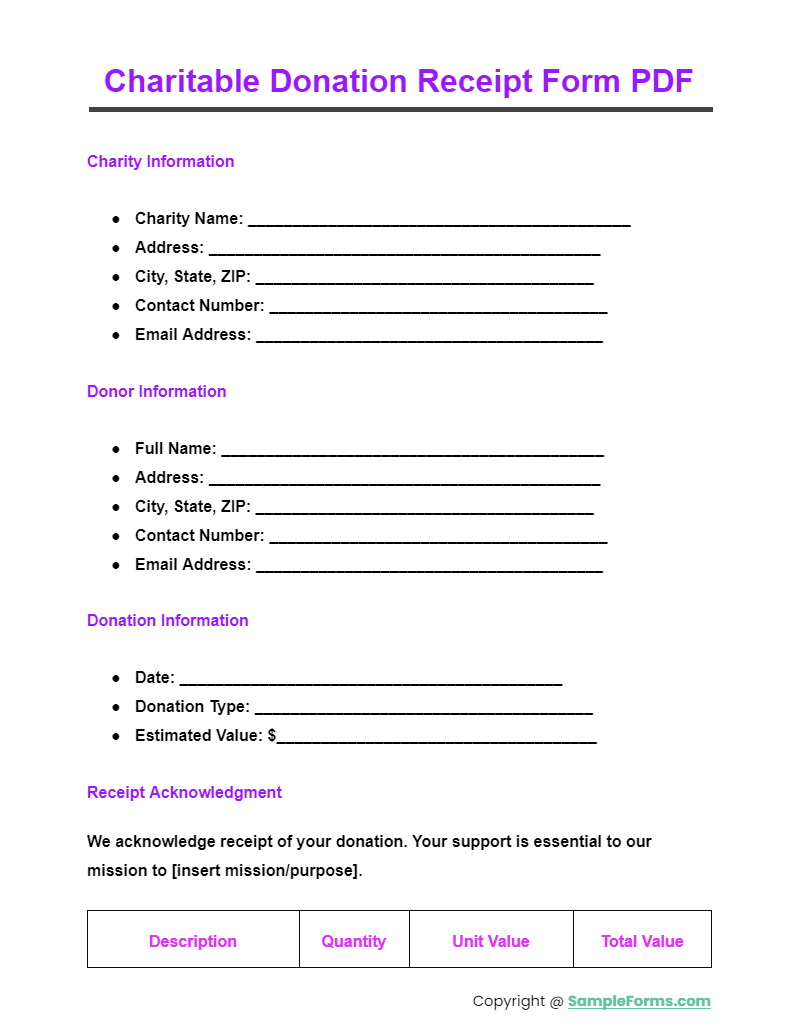

Charitable Donation Receipt Form PDF

A Charitable Donation Receipt Form PDF ensures compliance with tax regulations by providing a standardized format for documenting charitable donations. This form is essential for both the organization and donor, much like a Church Donation Form.

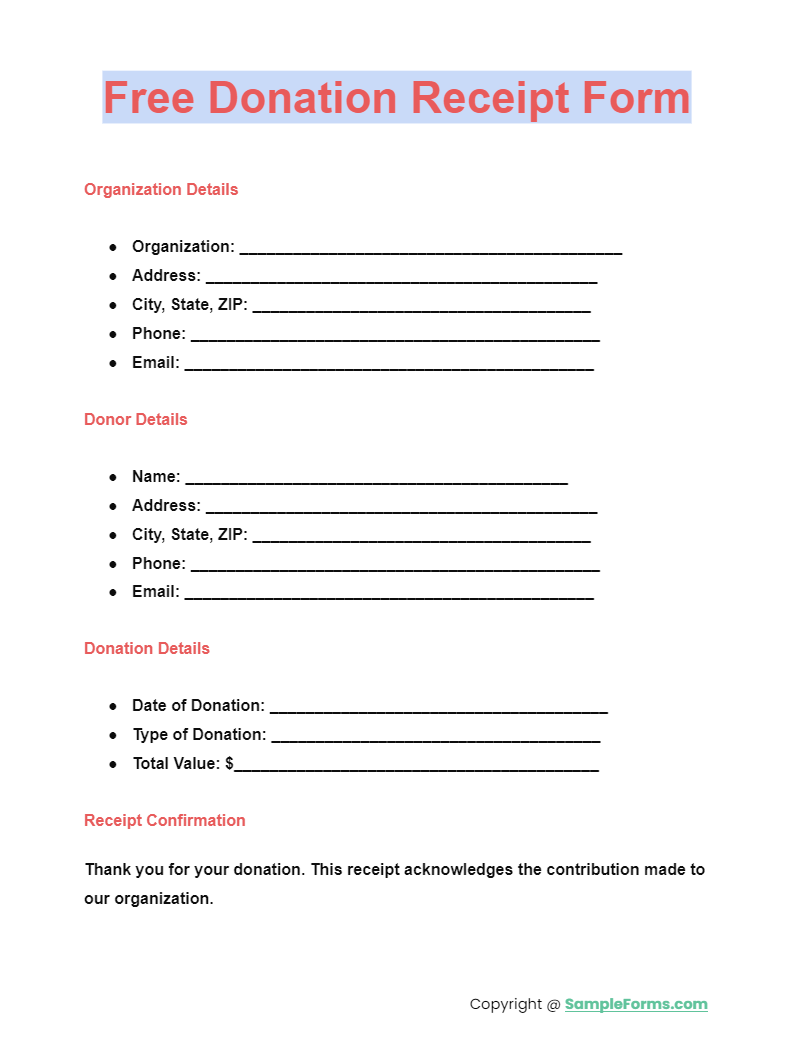

Free Donation Receipt Form

A Free Donation Receipt Form is an easily accessible template that organizations can use without cost. It helps document donations efficiently, similar to the straightforward format of a Blood Donation Form.

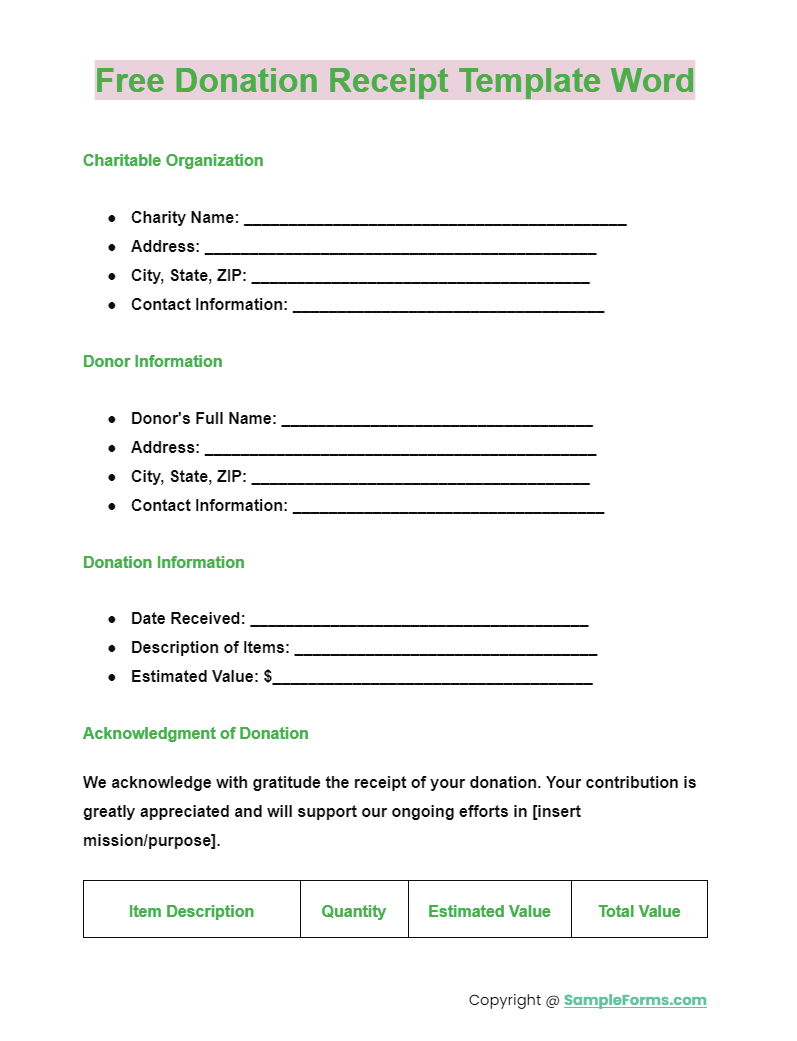

Free Donation Receipt Template Word

A Free Donation Receipt Template Word is a customizable document that organizations can edit in Microsoft Word. It offers flexibility in documenting donations, much like creating a personalized Organ Donation Form.

More Donation Receipt Form Samples

Contribution Donation Form

Email Donation Receipt Sample

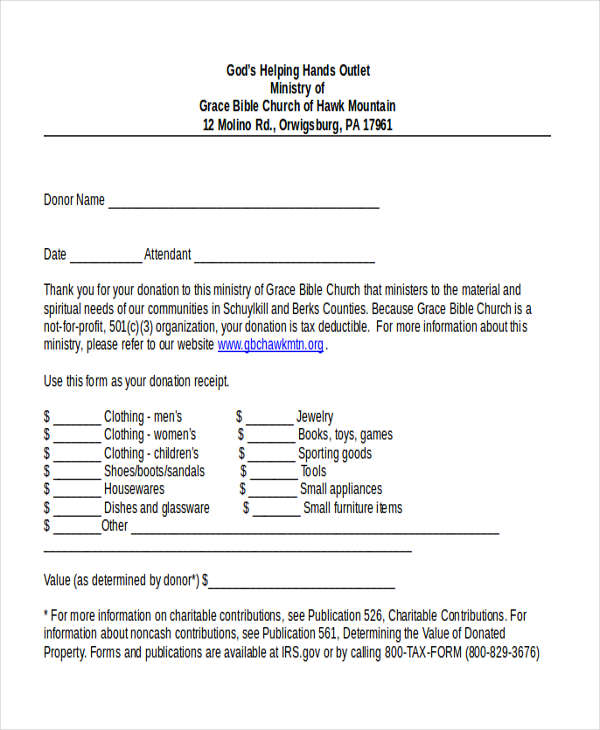

God’s Helping Hands Outlet Donation Receipt

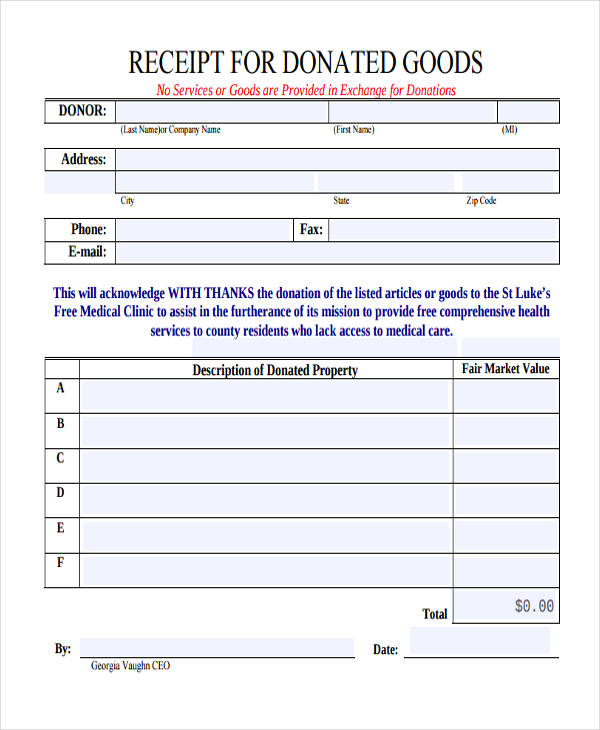

Donation Goods Receipt

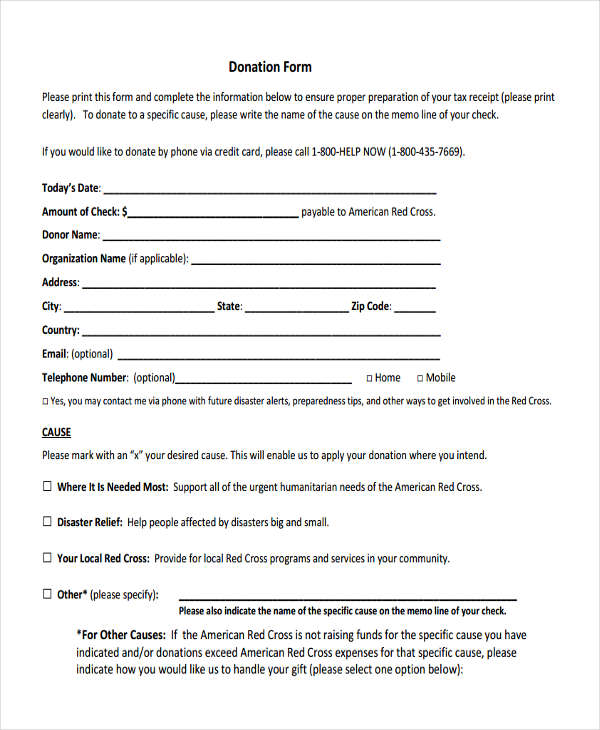

Free Donation Tax Form

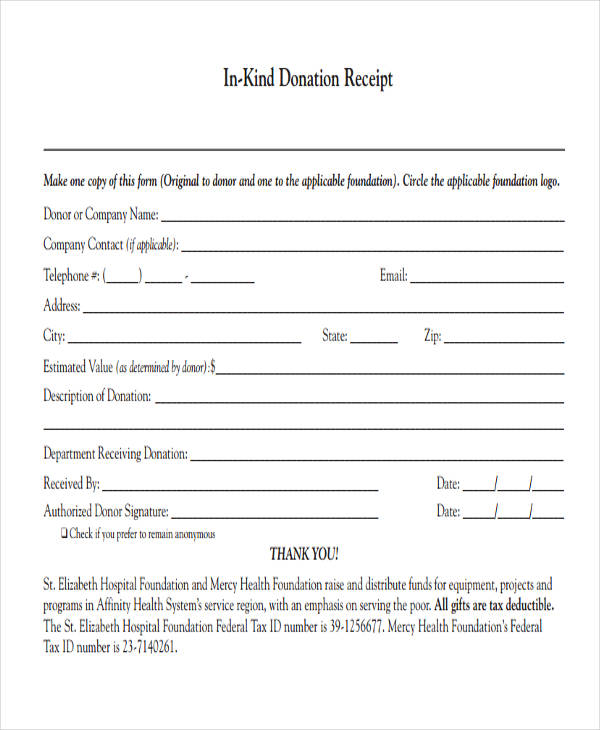

In-Kind Donation Receipt

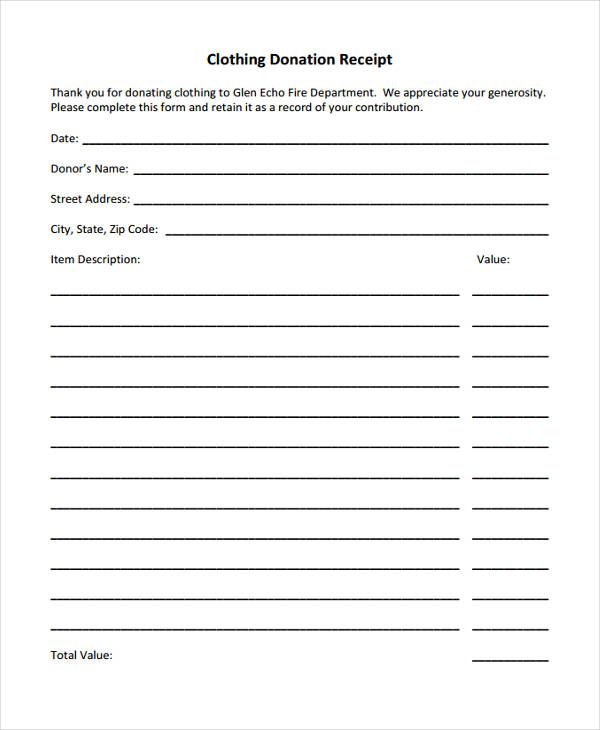

Clothing Donation Receipt Form

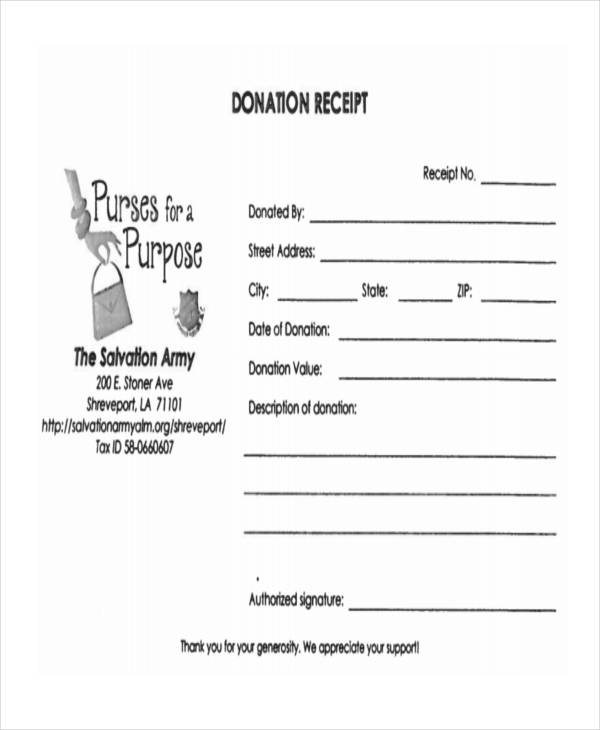

Salvation Army Donation

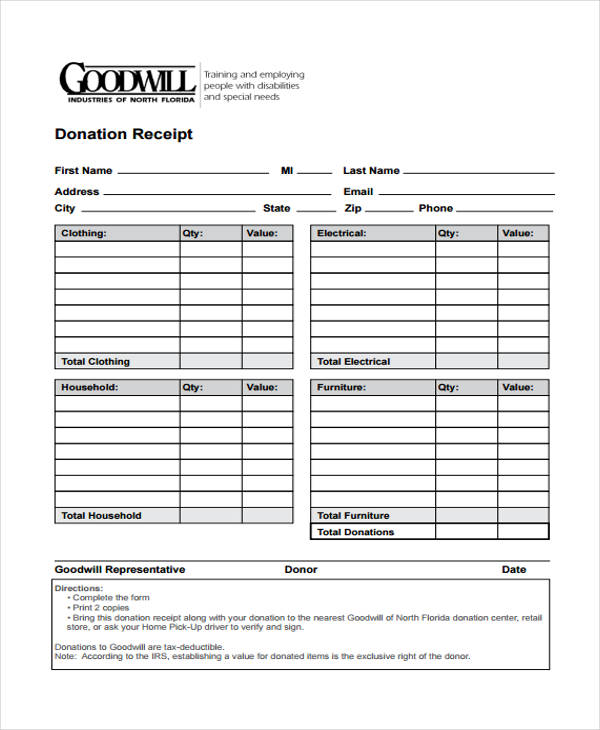

Free Goodwill Donation

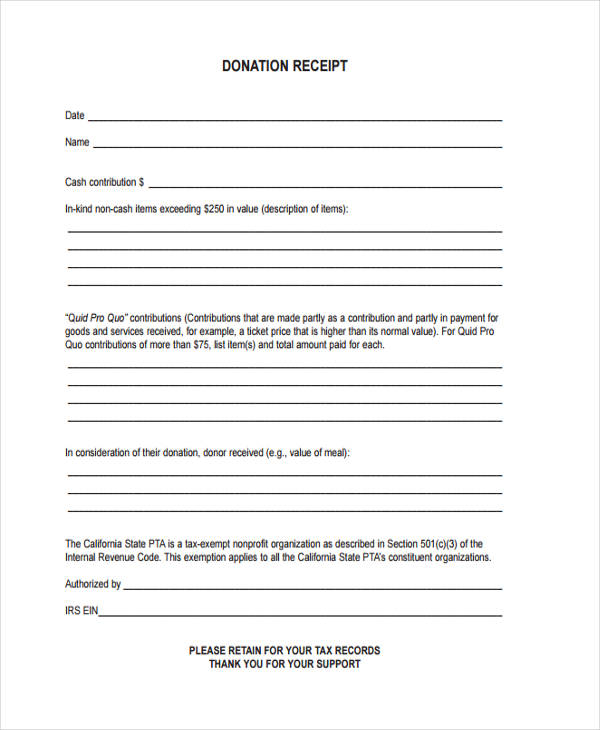

Non Profit Donation Receipt

Church Donation Receipt Form

Official Donation Receipt Example

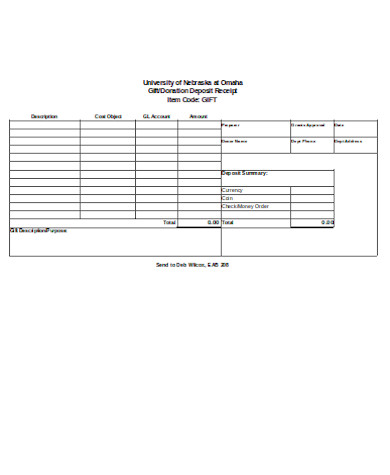

Printable Donation Deposit Receipt

How to Record Donation Receipts in Quickbook

Quickbook allows a person to keep track of all donations in the form of either cash, check, or credit card. So ere are some steps that can help you record all donation receipts via Quickbook:

- Click on the “non-profit” menu and select the “enter donations” option from the drop down menu

- Select the “customer.job” option from the drop-down arrow and choose an existing donor.If there are no donors, then you may choose the option “add new” to create a new donor.

- Click on the item from the item column which matches the type of donation.

- Select the “type” option and select “service”

- click on the “account” option and select the account that the donation should be deposited

- Select the project like a specific charity in which the donation should be made

- Enter the total amount of the donation and select the field you want to add to help you track the donation

- Click the “print” option to print your form

- Select the “deposit to” option and select the account to receive the deposit

- Save and close You may also see Missing Receipt Form

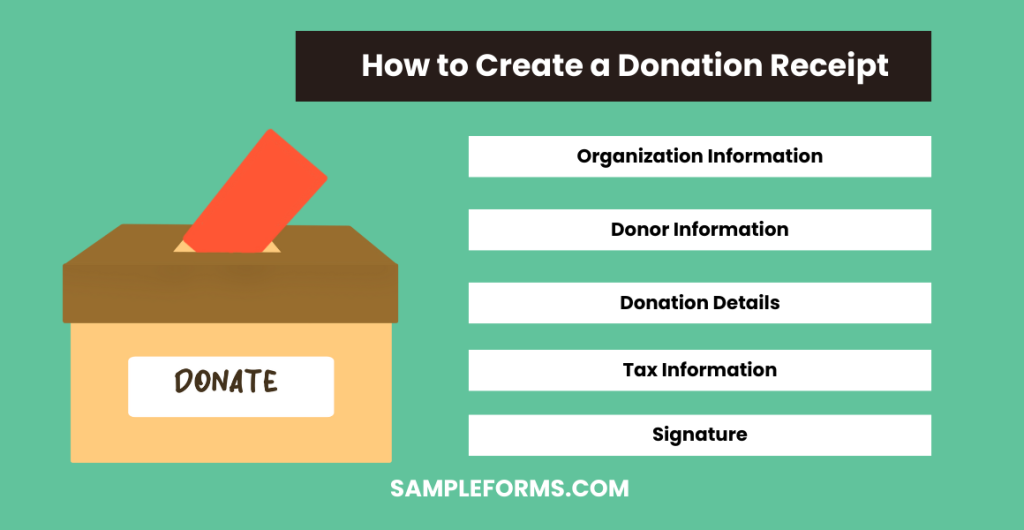

How to Create a Donation Receipt?

Creating a donation receipt involves providing a formal acknowledgment of a donor’s contribution. Key steps include:

- Organization Information: Include the name, address, and contact details of the organization.

- Donor Information: Add the donor’s name and contact details.

- Donation Details: Specify the donation amount, date, and type of donation.

- Tax Information: State the tax-exempt status and any relevant tax information.

- Signature: Provide a signature from an authorized person in the organization, similar to a Payment Receipt Form.

How Do I Write a Donation Form?

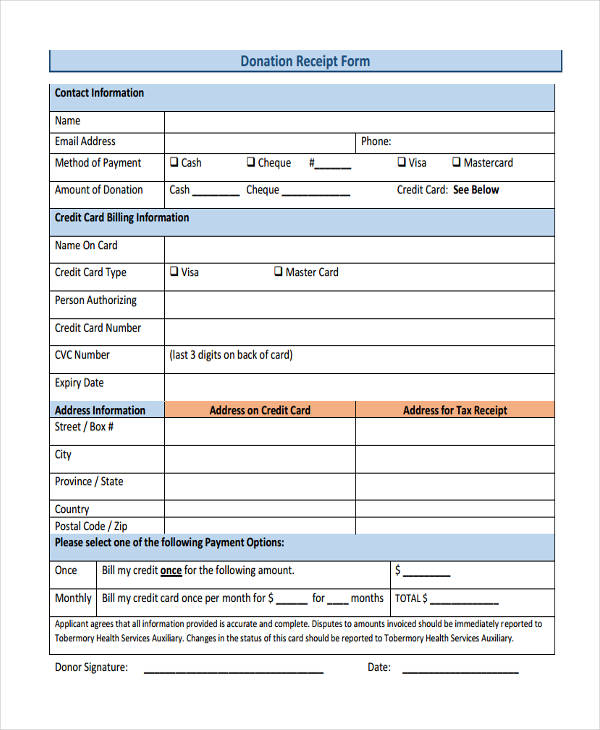

Writing a donation form involves creating a document to collect donor information and details about the contribution. Key steps include:

- Header: Include the organization’s name and logo at the top.

- Donor Information: Provide fields for the donor’s name, address, and contact information.

- Donation Details: Create sections for the donation amount, type, and date.

- Purpose of Donation: Include a field where donors can specify the purpose of their donation.

- Acknowledgment Statement: Add a statement acknowledging the donation for tax purposes, similar to a Car Donation Form.

How to Prove Donations for Taxes?

To prove donations for tax purposes, you need to provide documentation. Key steps include:

- Donation Receipts: Keep receipts from the charitable organization.

- Bank Statements: Save bank statements showing donation transactions.

- Credit Card Statements: Retain credit card statements with donation details.

- Acknowledgment Letters: Store acknowledgment letters from the charity.

- Donation Summary: Create a summary of all donations, similar to a Restaurant Receipt Form.

How Do You Record Donations for a Non-Profit?

Recording donations for a non-profit involves maintaining accurate financial records. Key steps include:

- Donation Log: Keep a detailed log of all donations received.

- Accounting Software: Use accounting software to record transactions.

- Receipt Issuance: Issue receipts for each donation received. You may also see Cleaning Receipt Form

- Bank Reconciliation: Regularly reconcile bank statements with donation records.

- Financial Reports: Generate regular financial reports, similar to creating a Rent Receipt Form.

How Do I Prove I Donated to Charity?

Proving you donated to charity involves maintaining thorough documentation. Key steps include:

- Donation Receipts: Ensure you have official receipts from the charity.

- Bank Statements: Keep statements that show the donations.

- Credit Card Statements: Retain statements with donation transactions. You may also see Asset Receipt Form

- Acknowledgment Letters: Store letters from the charity acknowledging your donation.

- Donation Records: Maintain a personal record of your donations, similar to keeping a Refuse Organ Donation Form.

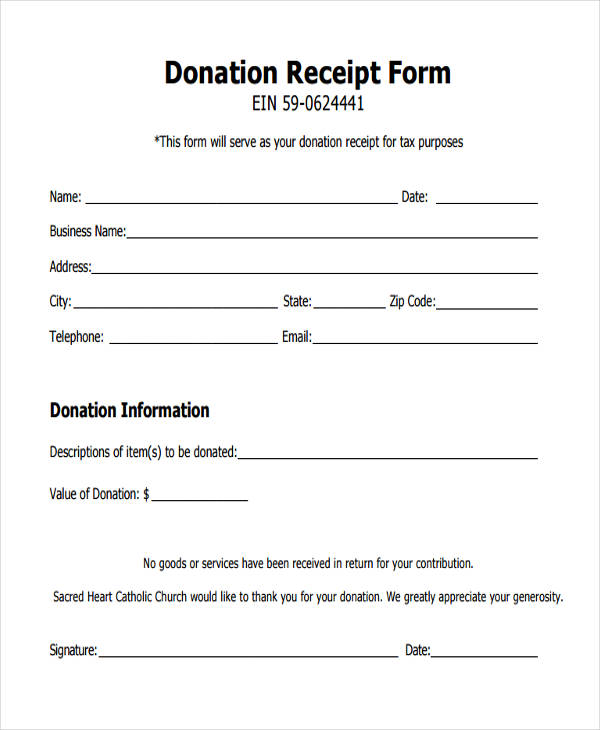

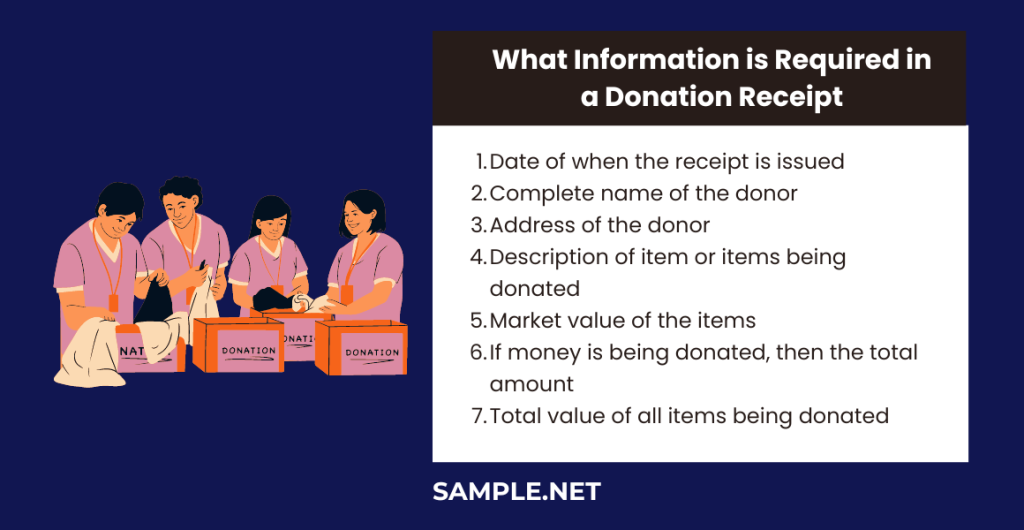

What Information is Required in a Donation Receipt?

If one is issued any type of donation receipt after providing whatever is needed, then the following information must be provided:

- Date of when the receipt is issued

- Complete name of the donor

- Address of the donor

- Description of item or items being donated

- Market value of the items

- If money is being donated, then the total amount

- Total value of all items being donated You may also see Deposit Receipt Form

Remember to provide all of the information above should you decide to make use of our printable receipt forms to create proof for any donation made. You may also see Petty Cash Receipt Form

How Much Can I Say I Donated to Charity Without Proof?

You can claim up to $250 in charitable donations without proof. For amounts above this, documentation is required, similar to keeping a Sales Receipt Form.

Does the IRS Need Proof of Donations?

Yes, the IRS requires proof of donations for deductions, especially for amounts over $250. Documentation is essential, akin to retaining a Purchase Receipt Form.

Are Donation Receipts Worth It?

Yes, donation receipts are crucial for tax deductions and financial records, making them as valuable as a Car Receipt Form for vehicle sales.

What Is a Donation Receipt Called?

A donation receipt is often referred to as an acknowledgment letter or charitable donation receipt, similar to a School Receipt Form for tuition payments.

Can You Email a Donation Receipt?

Yes, donation receipts can be emailed, ensuring timely and efficient delivery, much like sending a digital Daycare Receipt Form.

Are Donations Worth Claiming on Taxes?

Yes, claiming donations on taxes can reduce taxable income and provide financial benefits, similar to claiming deductions with a Contractor Receipt Form.

Can I Create an Invoice for a Donation?

Yes, you can create an invoice for a donation to document and acknowledge the contribution, similar to generating a Lost Receipt Form for reimbursement.

In conclusion, mastering the creation of a Donation Receipt Form is crucial for accurate record-keeping and compliance with tax regulations. With our guide, you have learned how to draft detailed samples, forms, and letters, ensuring your donation receipts are comprehensive and professional. Utilizing the provided templates and tips, you can streamline your documentation process and enhance donor trust. For more detailed examples and templates, visit Cleaning Service Receipt Form.

Related Posts

-

FREE 5+ Sample Cleaning Receipt Forms in PDF

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form