The District of Columbia Bill of Sale Form is a vital document for transferring ownership of various items, including vehicles, equipment, and personal property. This comprehensive guide provides examples and detailed explanations to help you understand and complete the form correctly. A Bill of Sale Form ensures that both the buyer and seller have legal proof of the transaction, protecting their interests. Whether you are selling a car, boat, or any other personal property, knowing how to fill out this form accurately is crucial. Let’s explore the nuances of the District of Columbia Bill of Sale to make your transactions seamless.

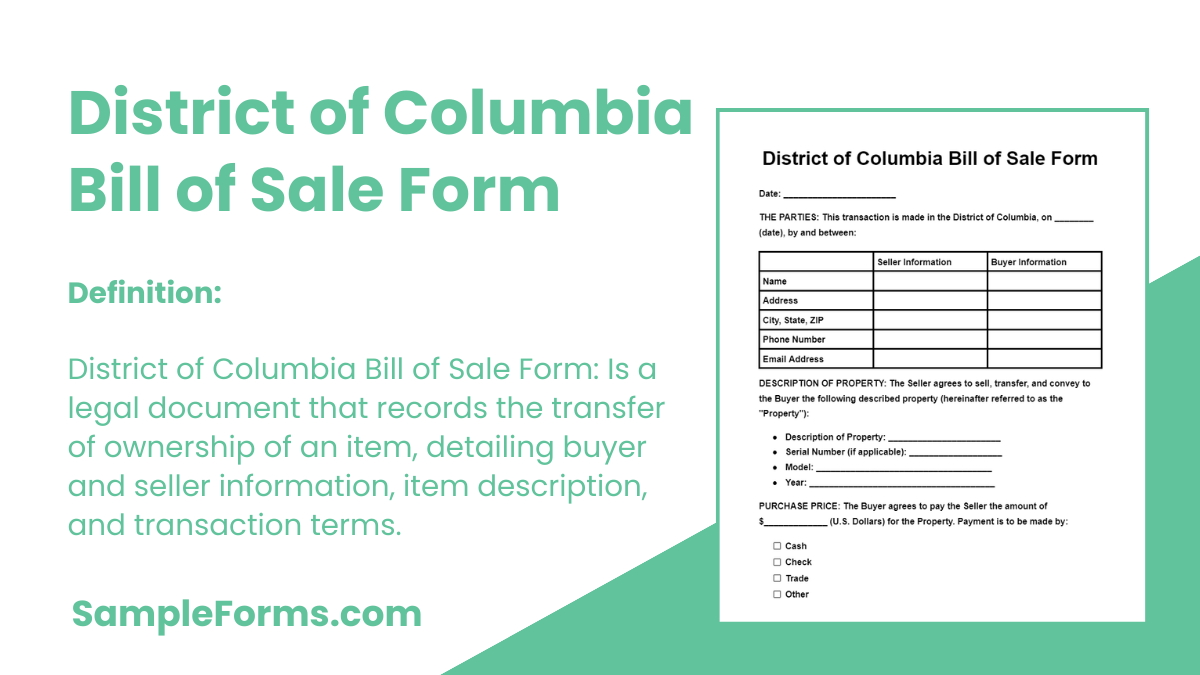

What is District of Columbia Bill of Sale Form?

A District of Columbia Bill of Sale Form is a legal document that records the sale of personal property between a buyer and seller. This form includes essential details such as the names and addresses of both parties, a description of the item sold, the sale price, and the date of the transaction. It acts as a receipt and proof of ownership transfer, ensuring both parties’ protection under the law. Understanding how to properly fill out this form can prevent future disputes and provide clear evidence of the sale.

District of Columbia Bill of Sale Format

1. Seller Information

- Name:

- Address:

- City, State, ZIP:

- Phone Number:

- Email Address:

2. Buyer Information

- Name:

- Address:

- City, State, ZIP:

- Phone Number:

- Email Address:

3. Item Description

- Item Type:

- Make:

- Model:

- Year:

- VIN/Serial Number:

- Color:

- Condition:

4. Sale Details

- Sale Date:

- Purchase Price:

- Payment Method:

5. Additional Terms and Conditions

- Warranty (if any):

- As-Is Clause:

6. Signatures

- Seller’s Signature:

- Date:

- Buyer’s Signature:

- Date:

7. Notarization (if required)

- Notary Public Signature:

- Date:

- Commission Expiry:

8. Witnesses (if required)

- Witness 1 Name:

- Witness 1 Signature:

- Date:

- Witness 2 Name:

- Witness 2 Signature:

- Date:

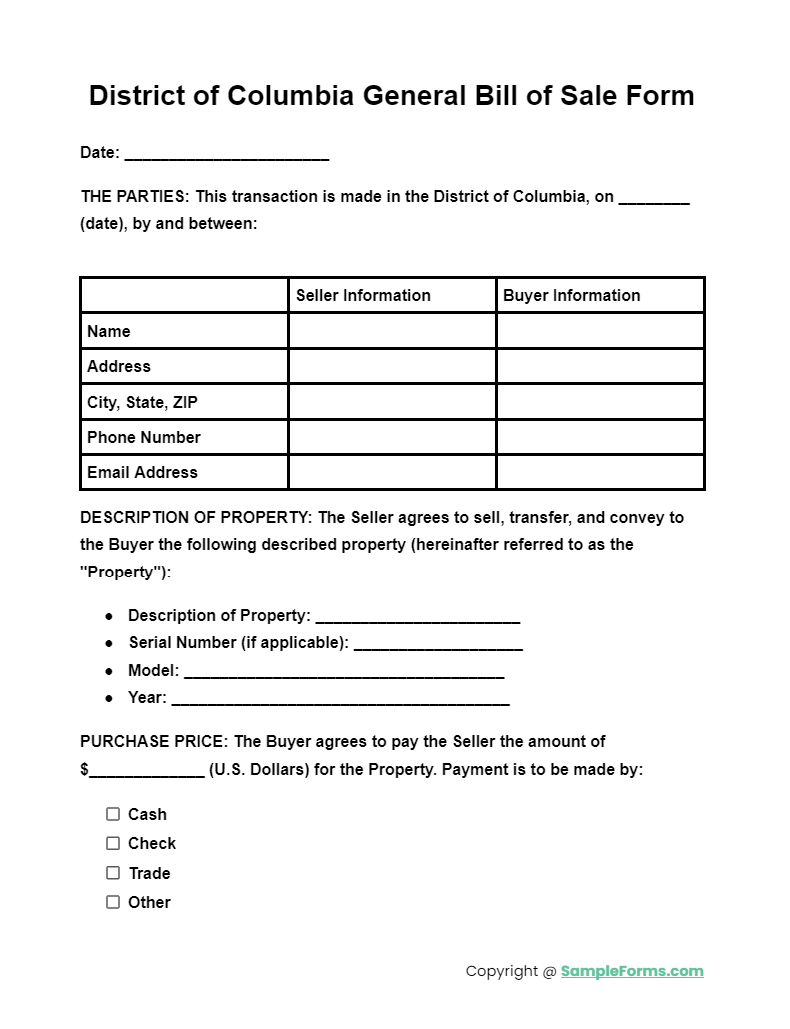

District of Columbia General Bill of Sale Form

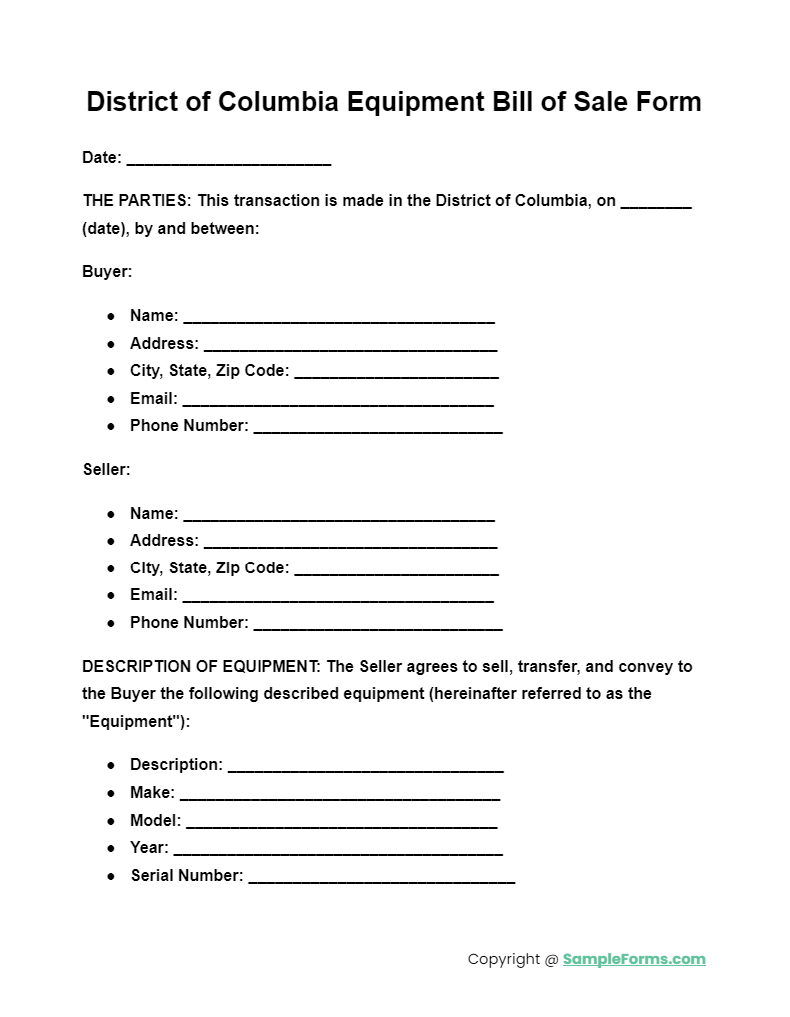

District of Columbia Equipment Bill of Sale Form

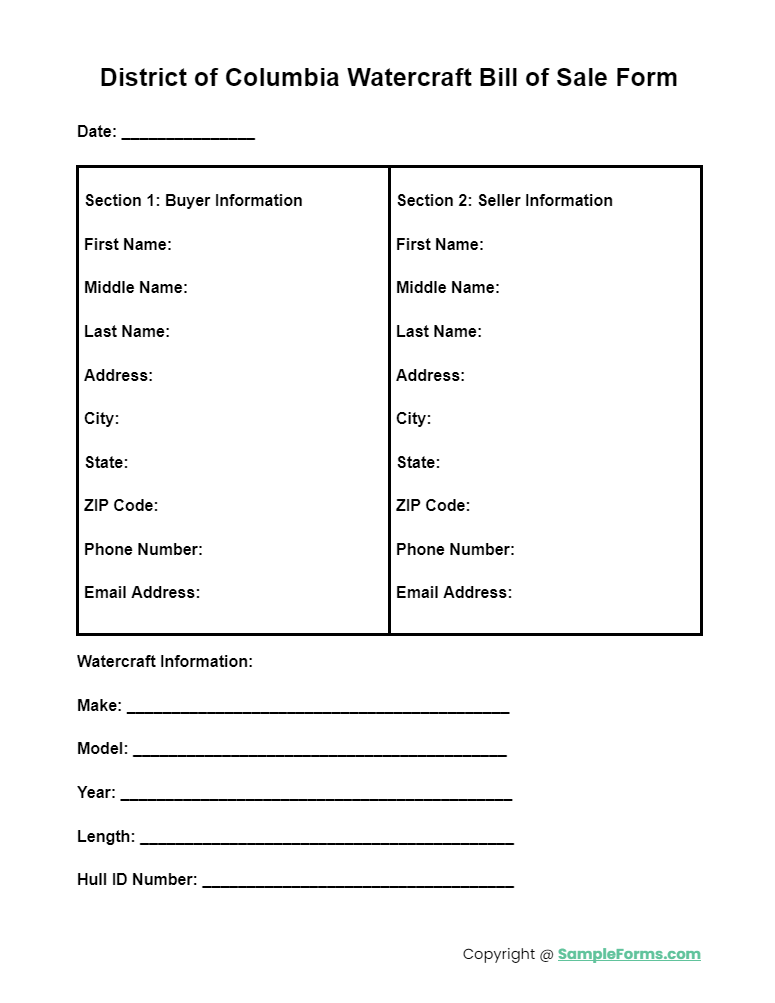

District of Columbia Watercraft Bill of Sale Form

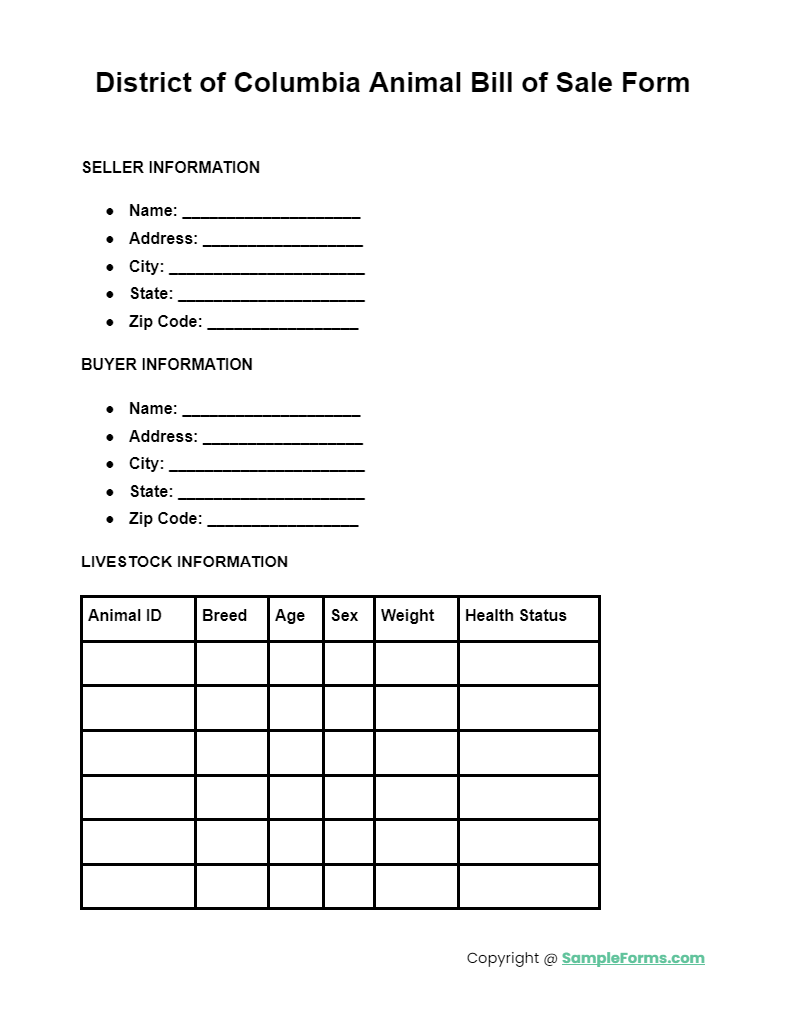

District of Columbia Animal Bill of Sale Form

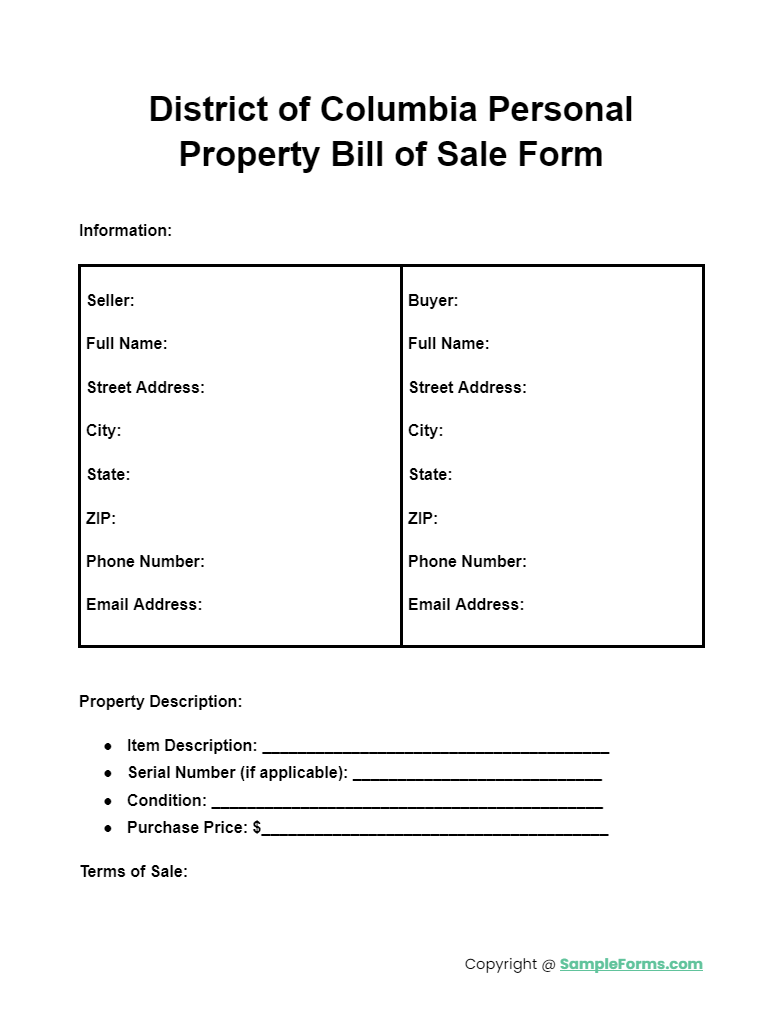

District of Columbia Personal Property Bill of Sale Form

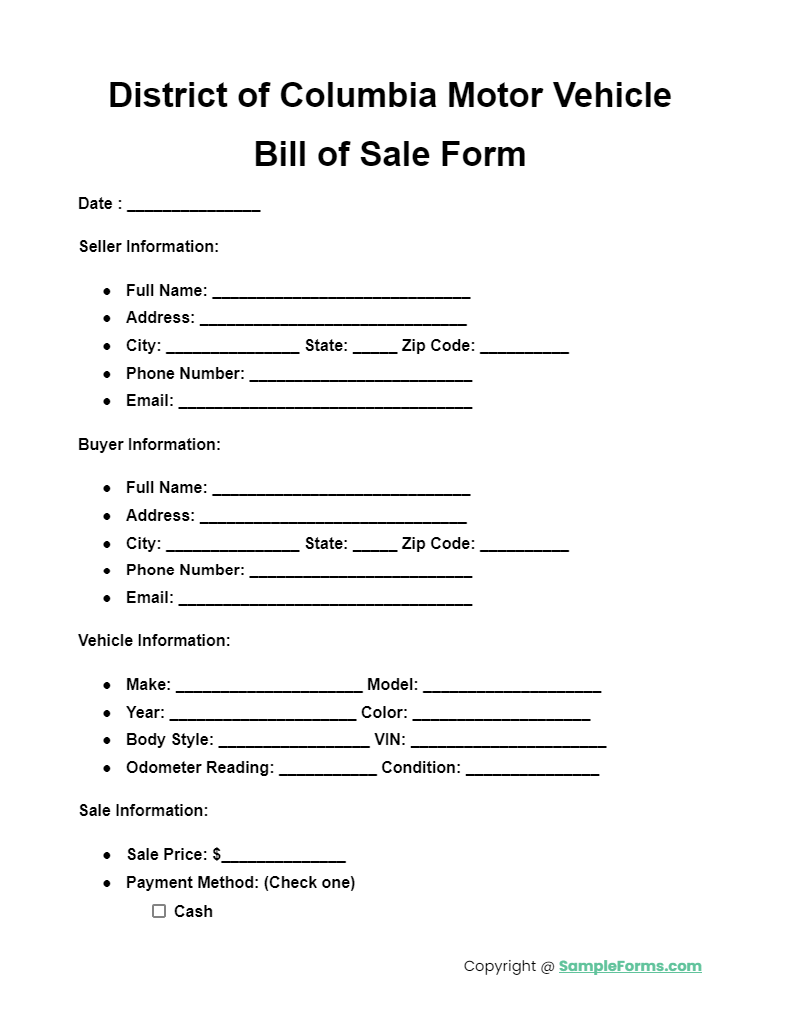

District of Columbia Motor Vehicle Bill of Sale Form

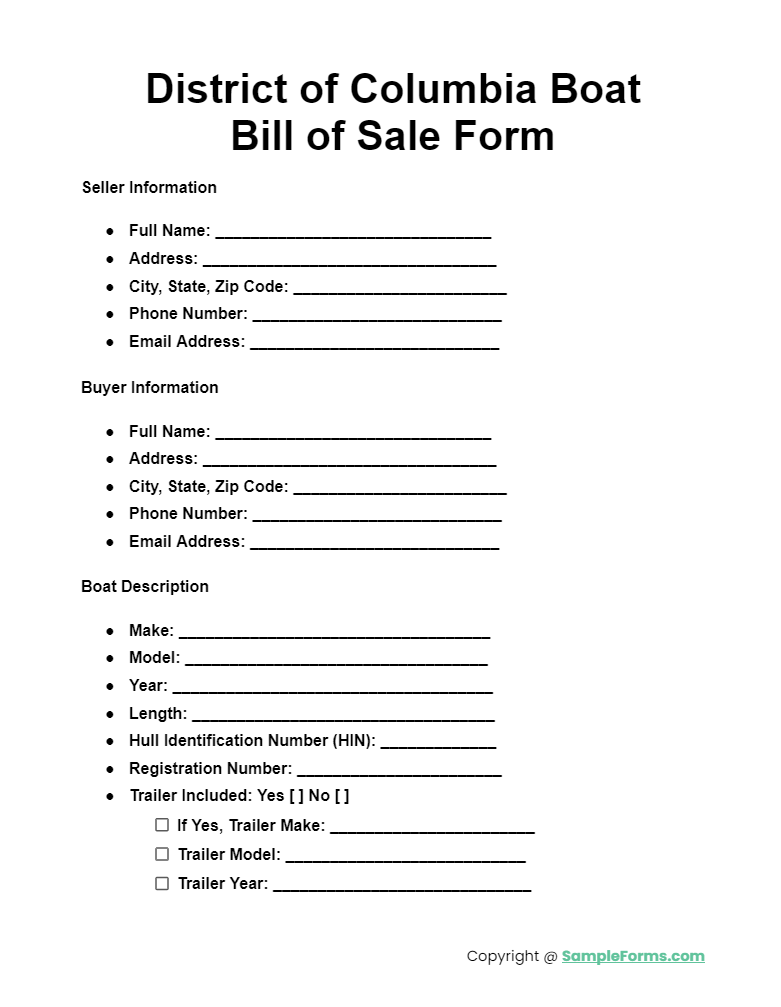

District of Columbia Boat Bill of Sale Form

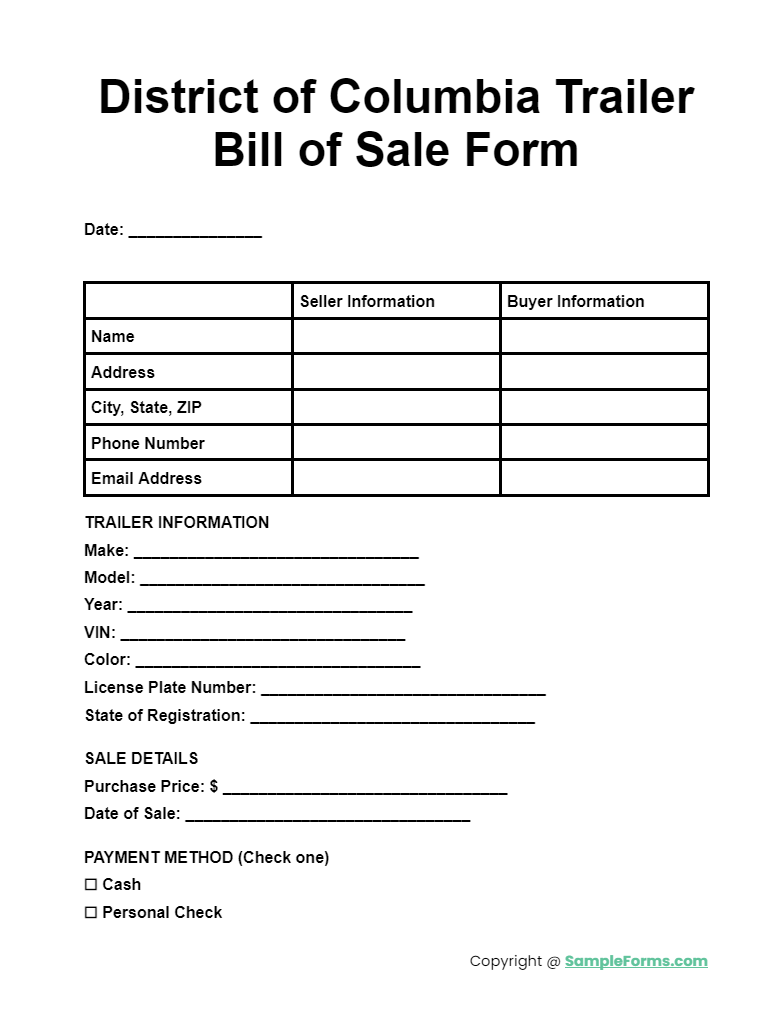

District of Columbia Trailer Bill of Sale Form

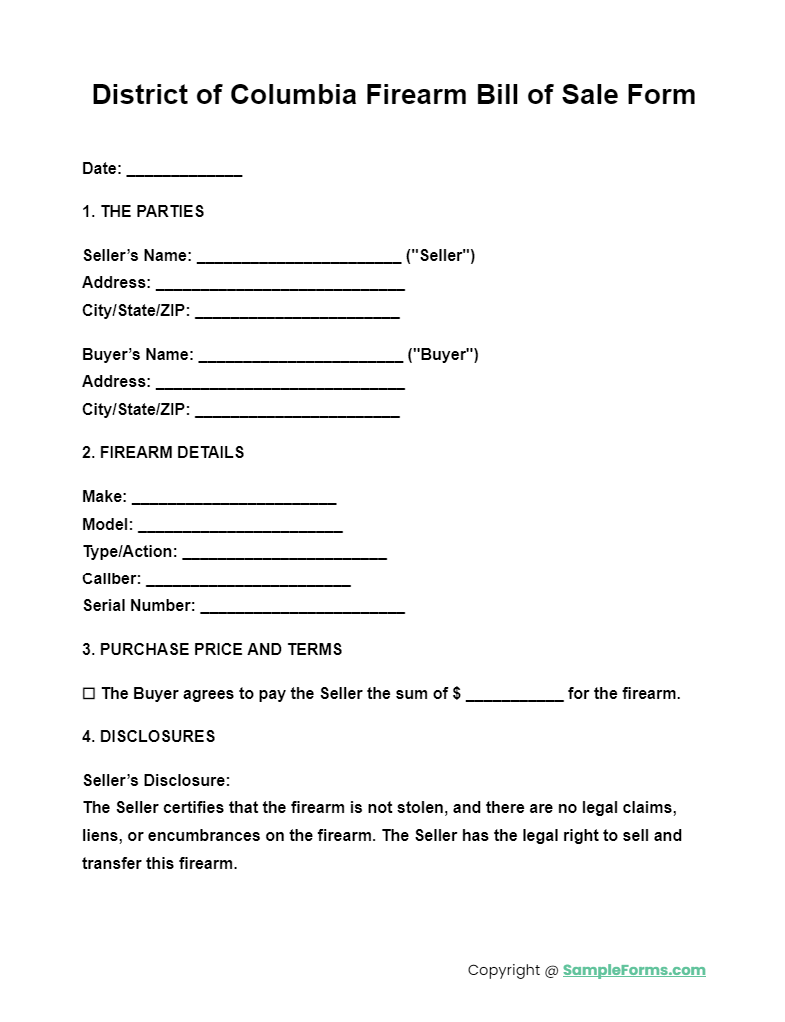

District of Columbia Firearm Bill of Sale Form

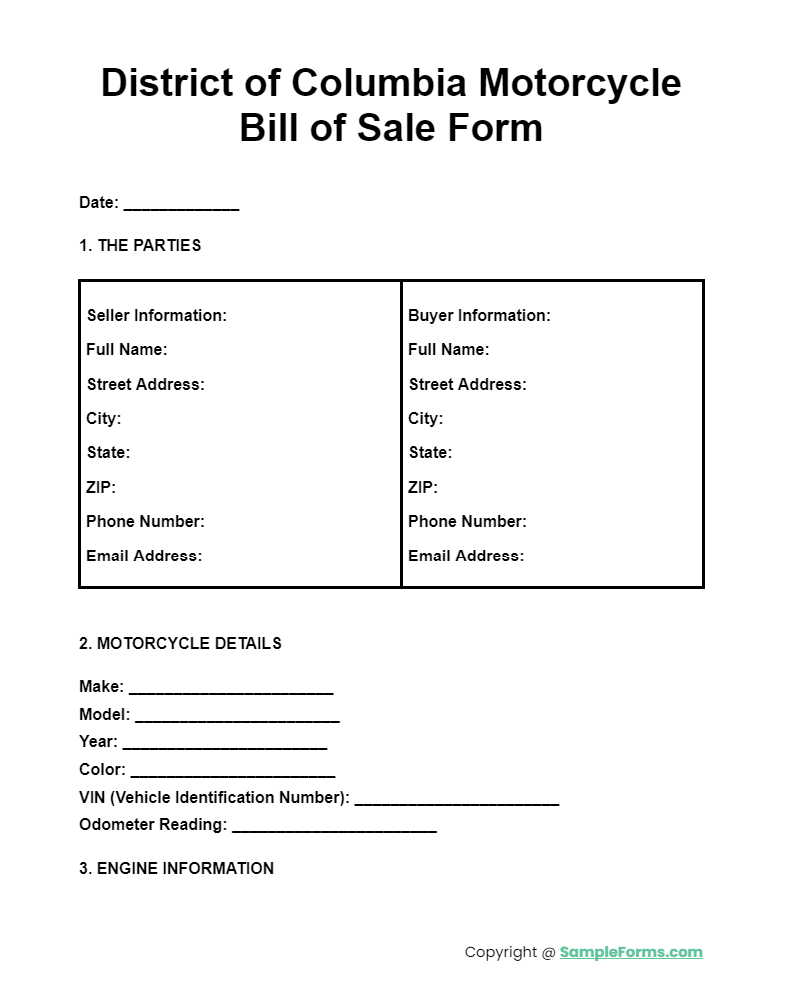

District of Columbia Motorcycle Bill of Sale Form

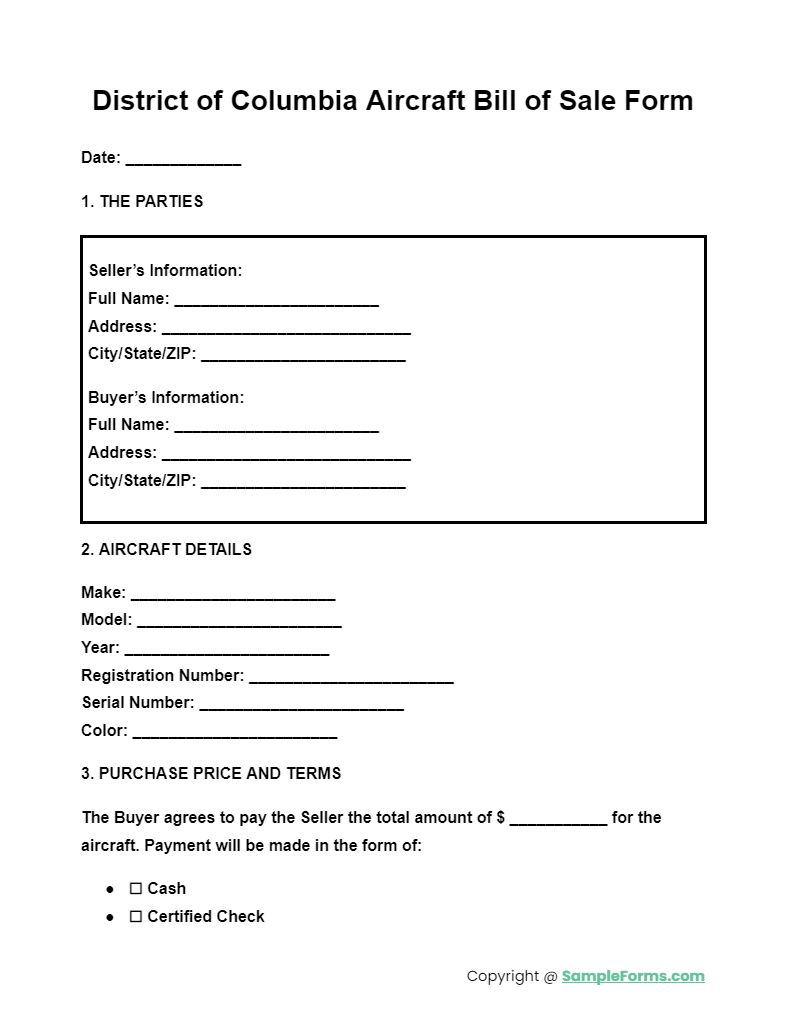

District of Columbia Aircraft Bill of Sale Form

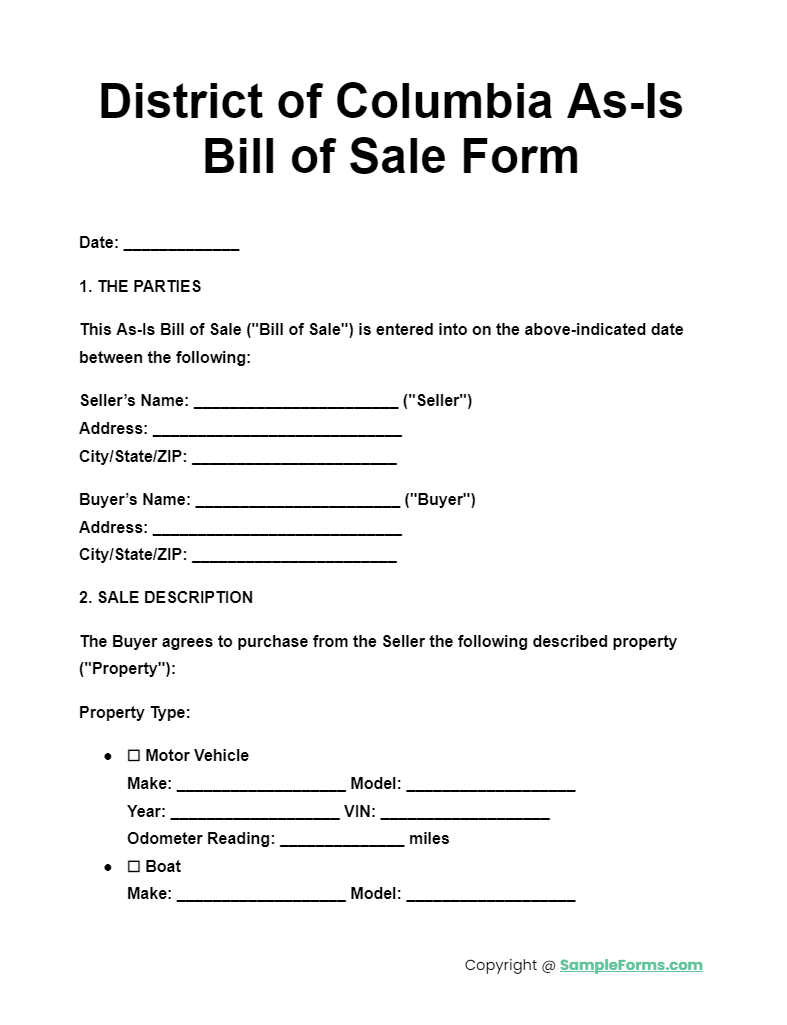

District of Columbia As-Is Bill of Sale Form

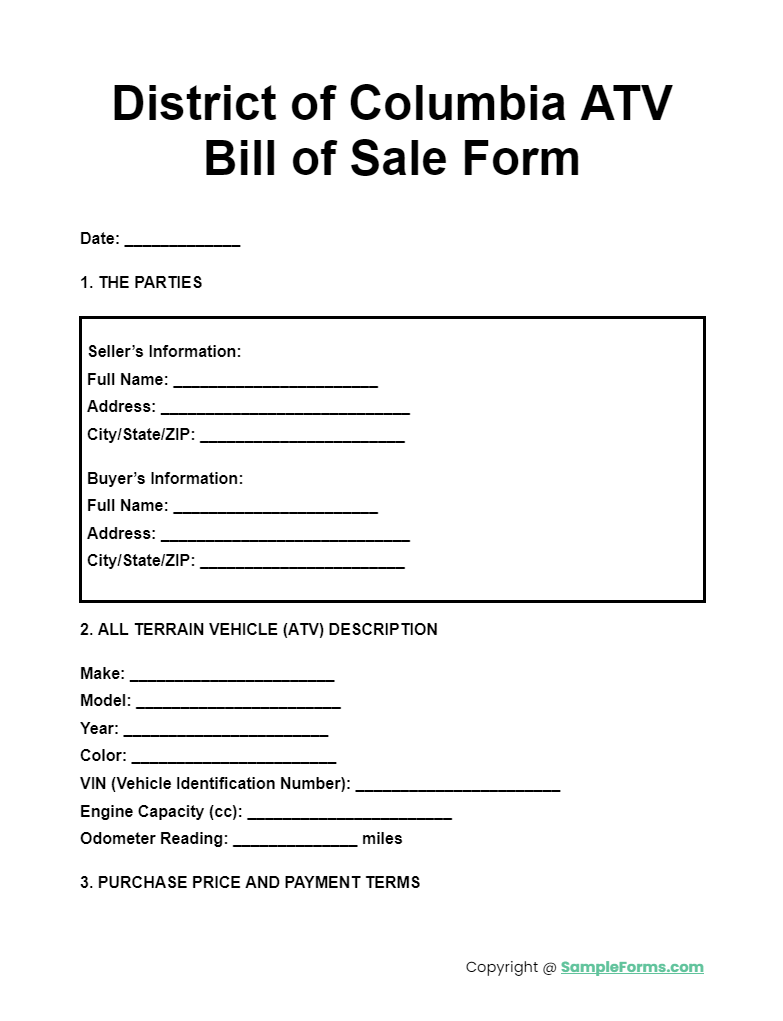

District of Columbia ATV Bill of Sale Form

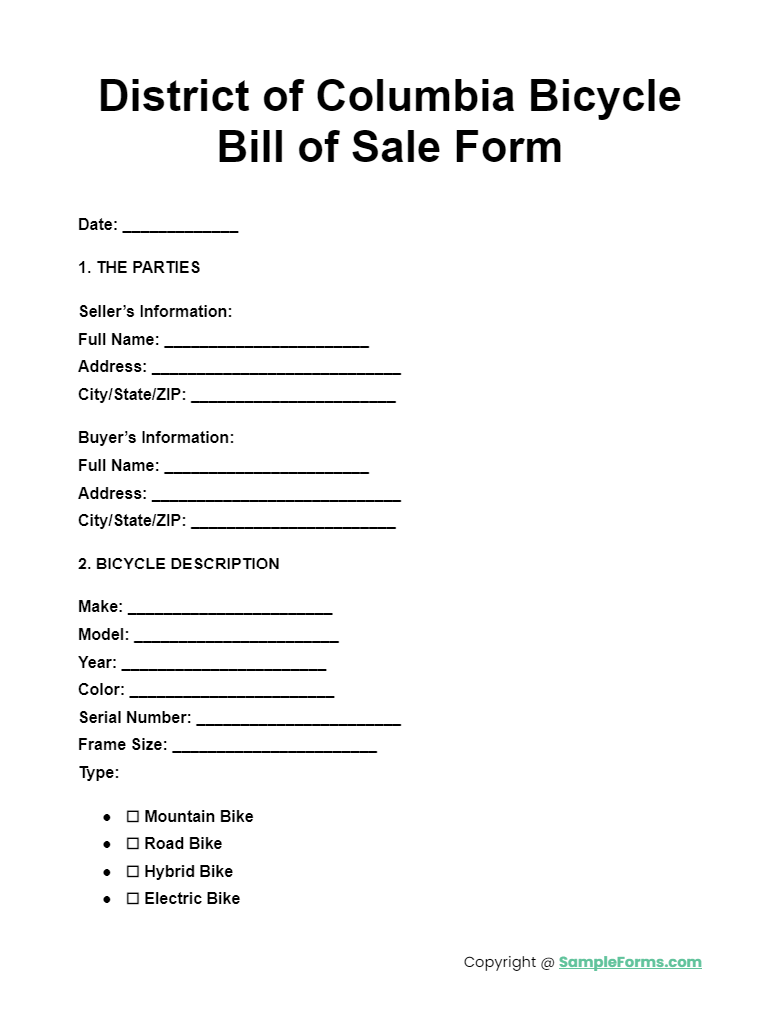

District of Columbia Bicycle Bill of Sale Form

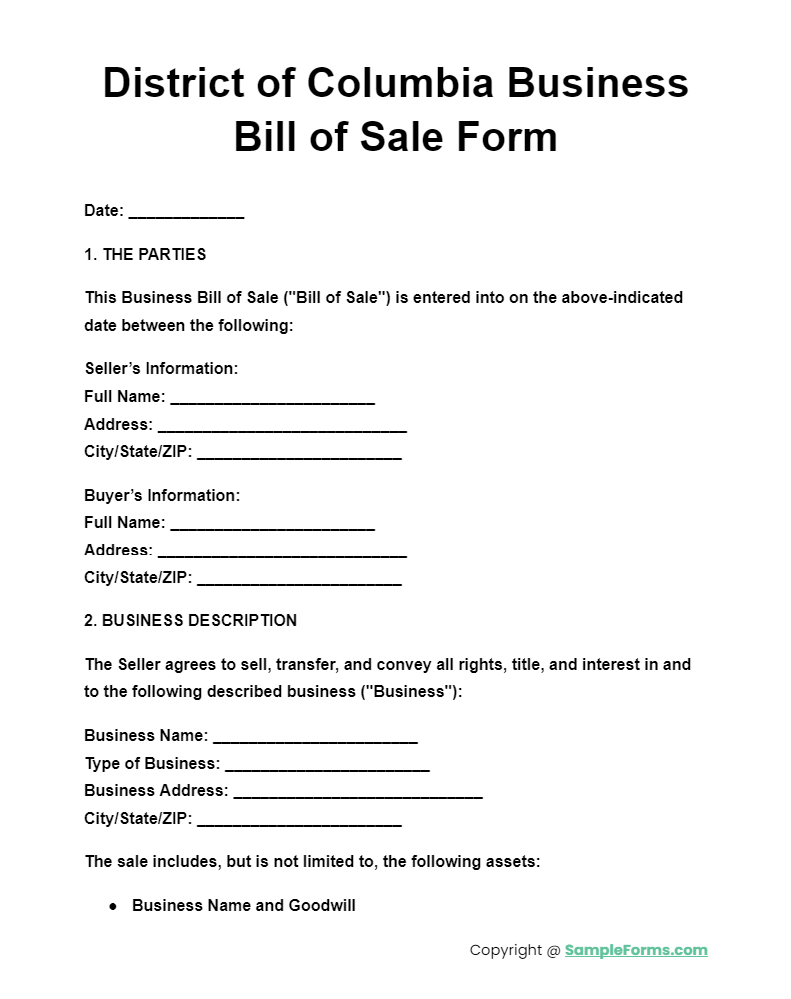

District of Columbia Business Bill of Sale Form

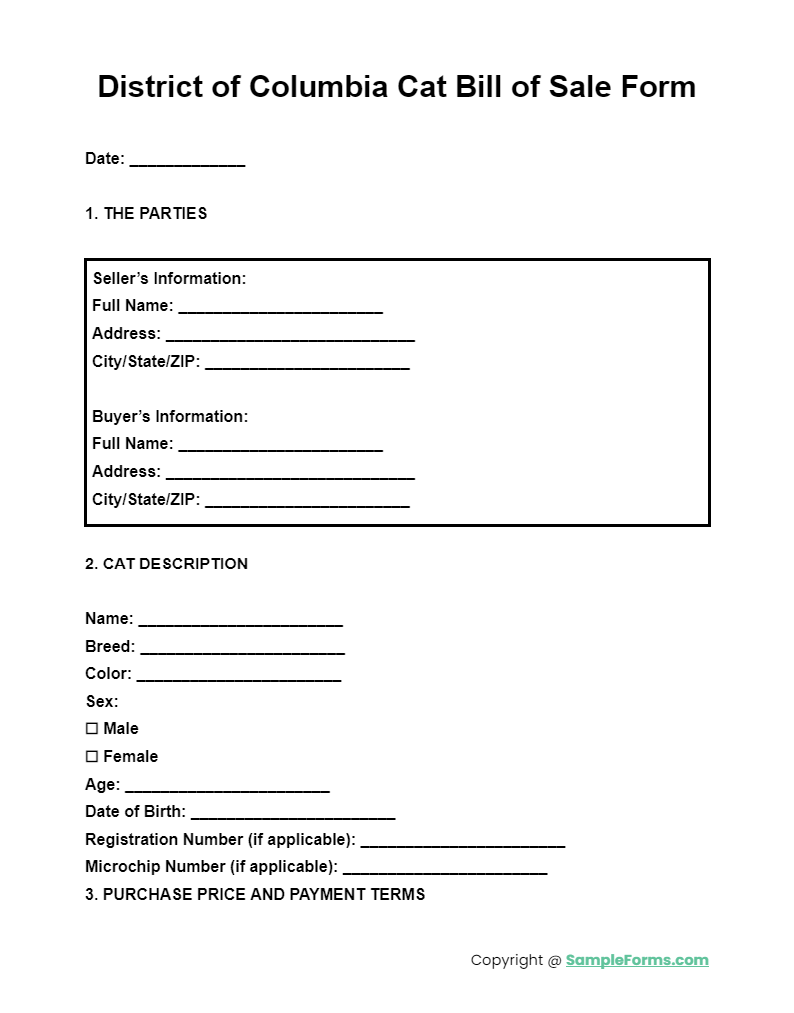

District of Columbia Cat Bill of Sale Form

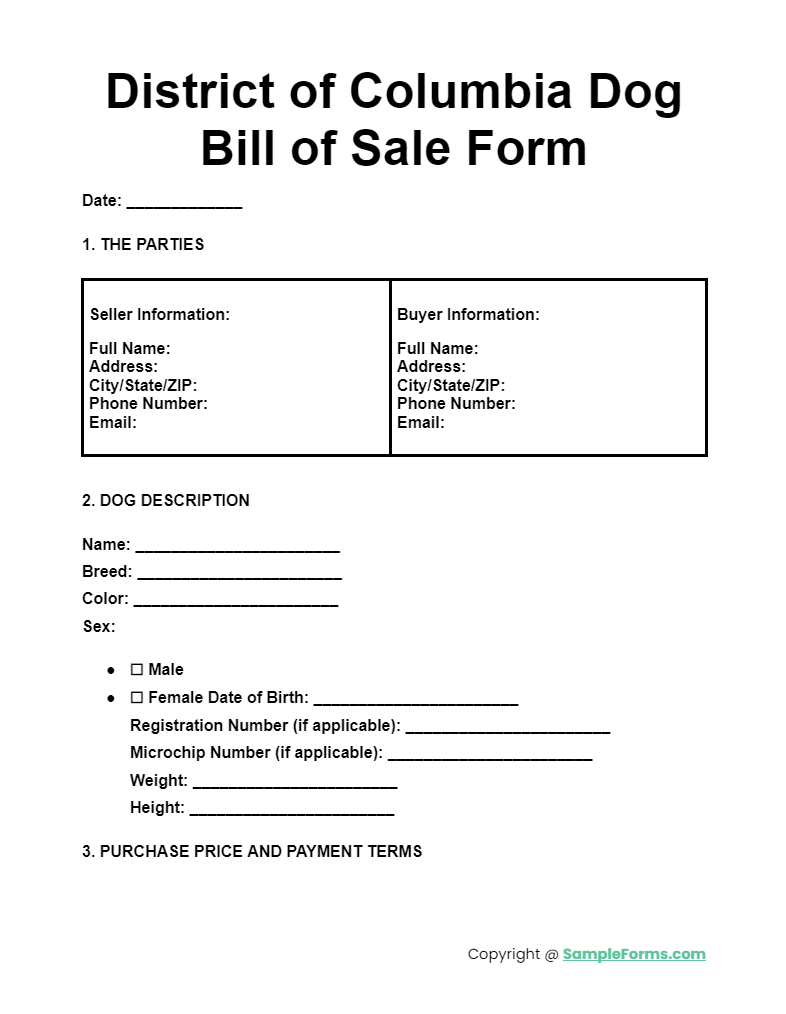

District of Columbia Dog Bill of Sale Form

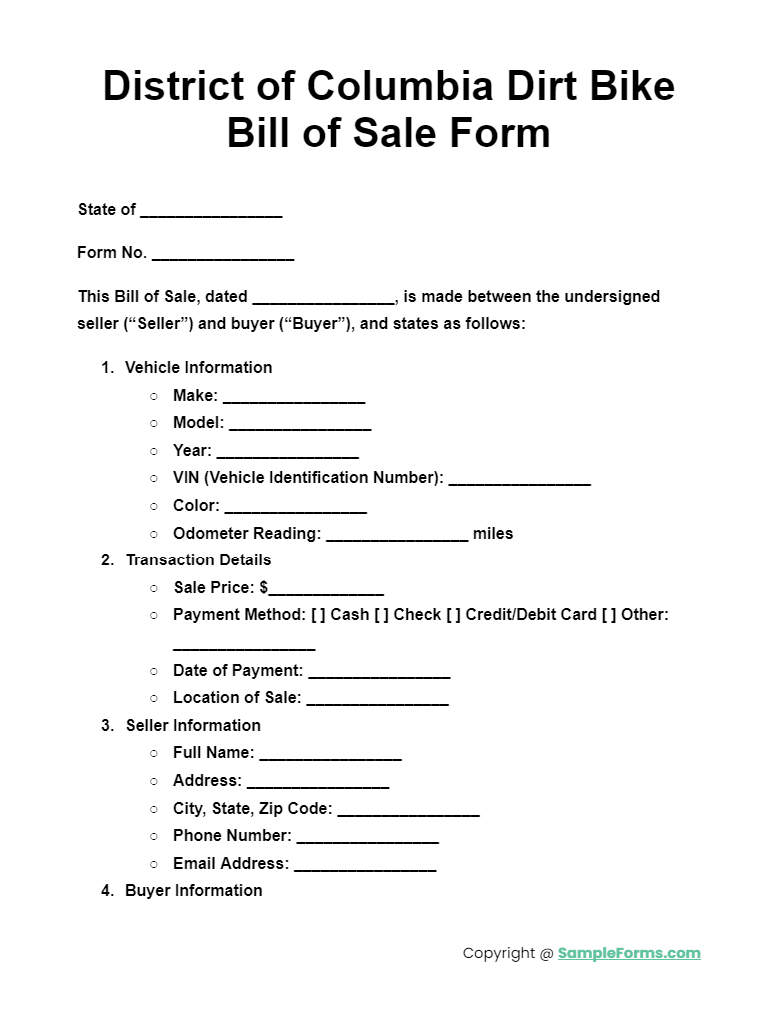

District of Columbia Dirt Bike Bill of Sale Form

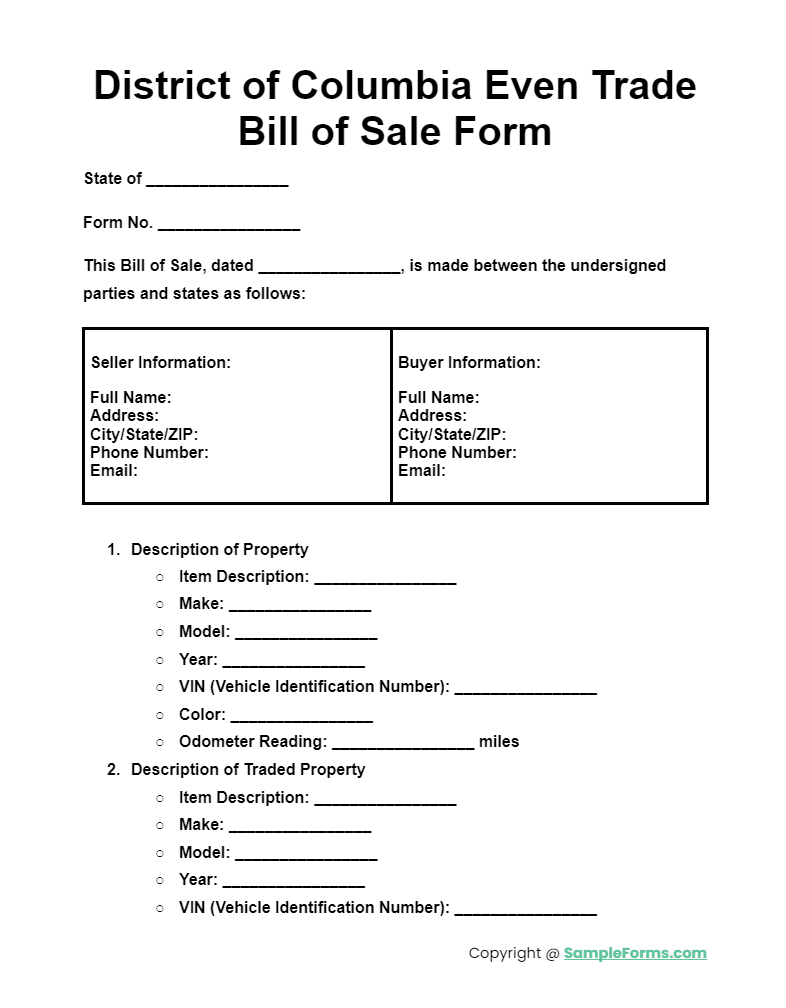

District of Columbia Even Trade Bill of Sale Form

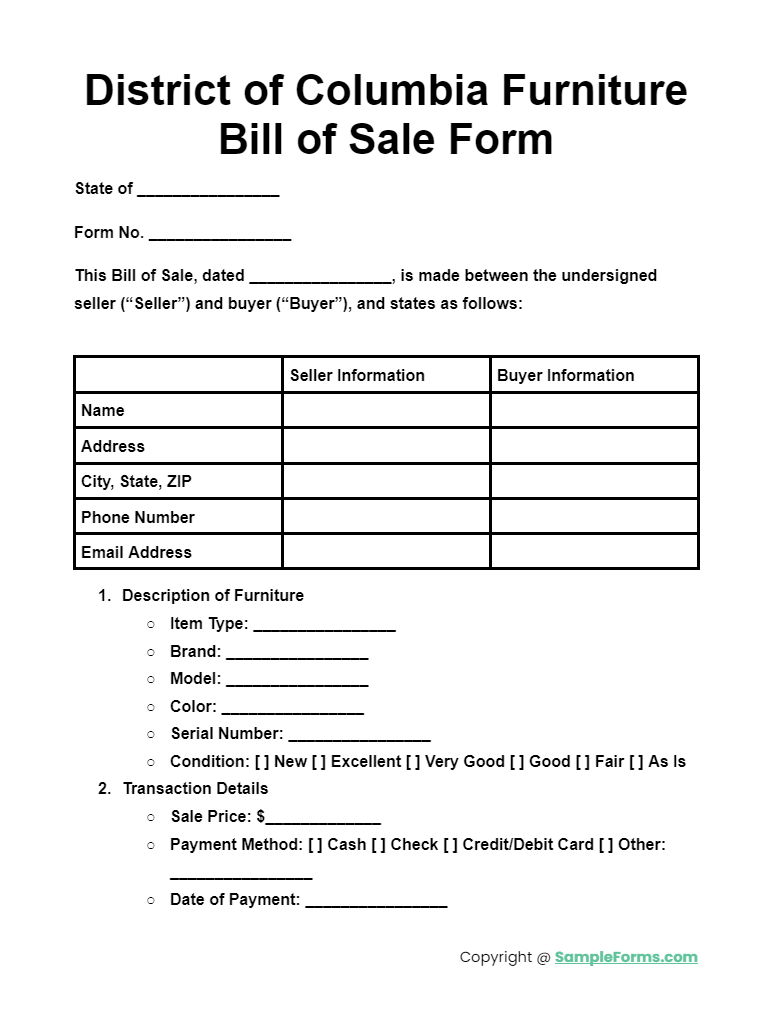

District of Columbia Furniture Bill of Sale Form

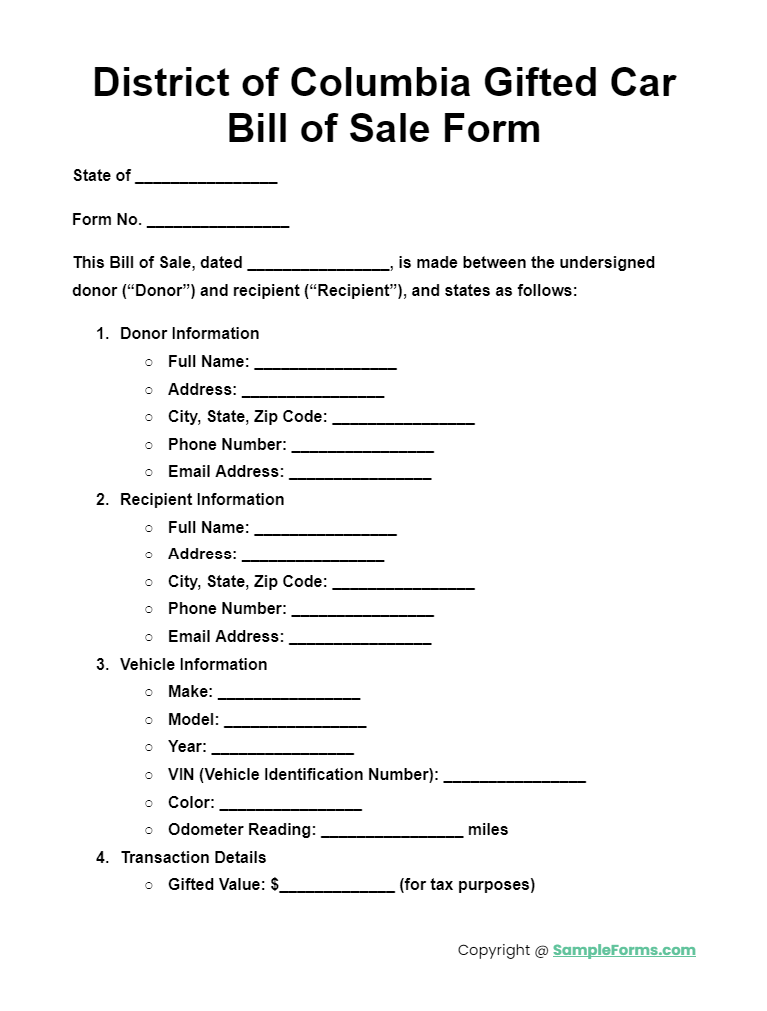

District of Columbia Gifted Car Bill of Sale Form

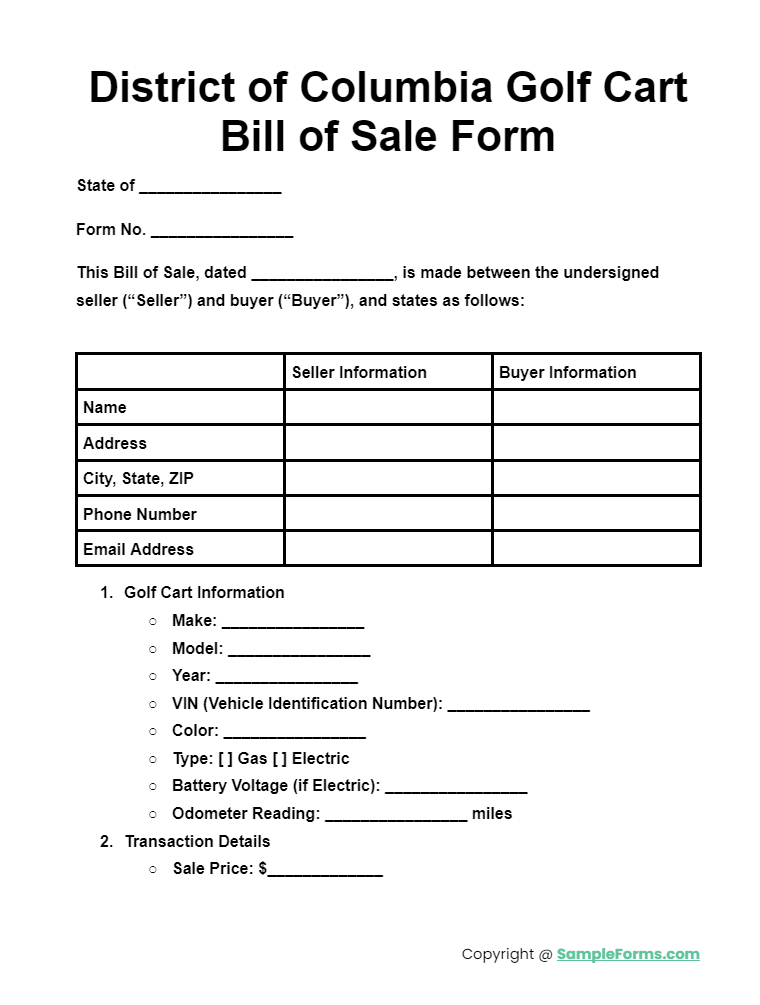

District of Columbia Golf Cart Bill of Sale Form

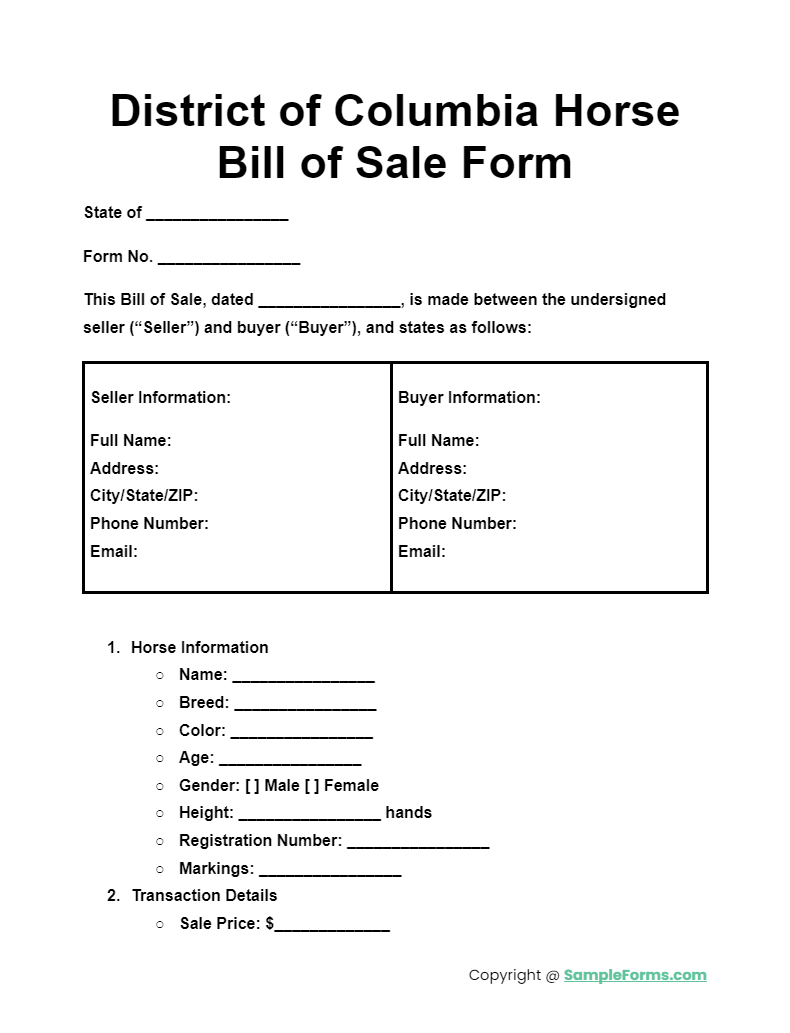

District of Columbia Horse Bill of Sale Form

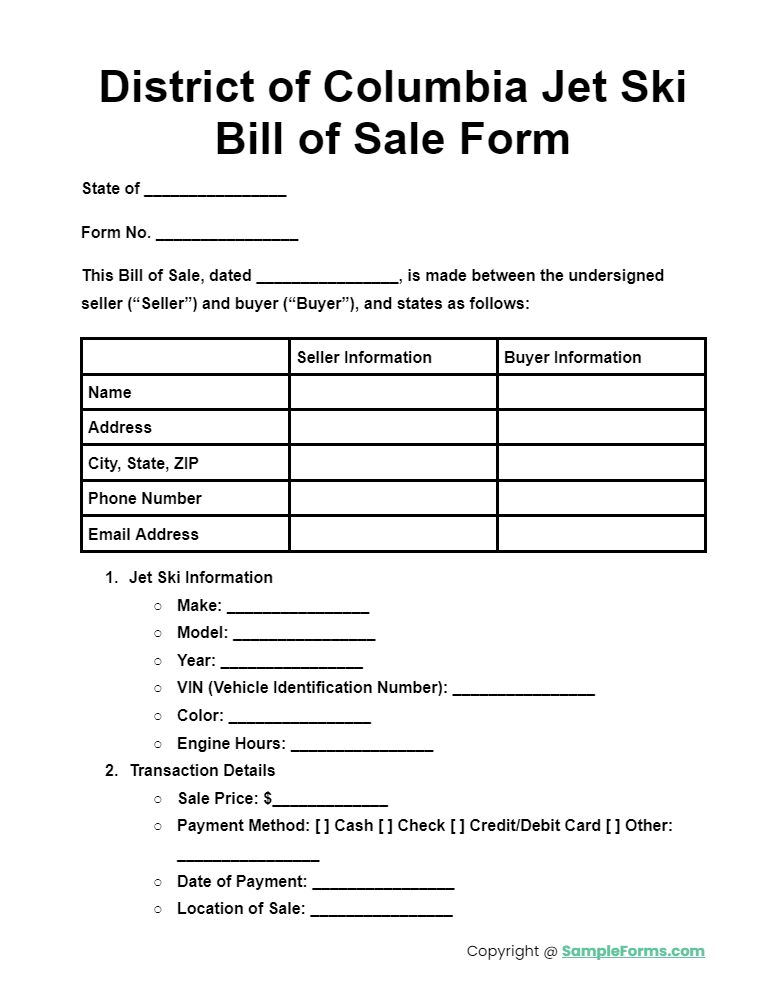

District of Columbia Jet Ski Bill of Sale Form

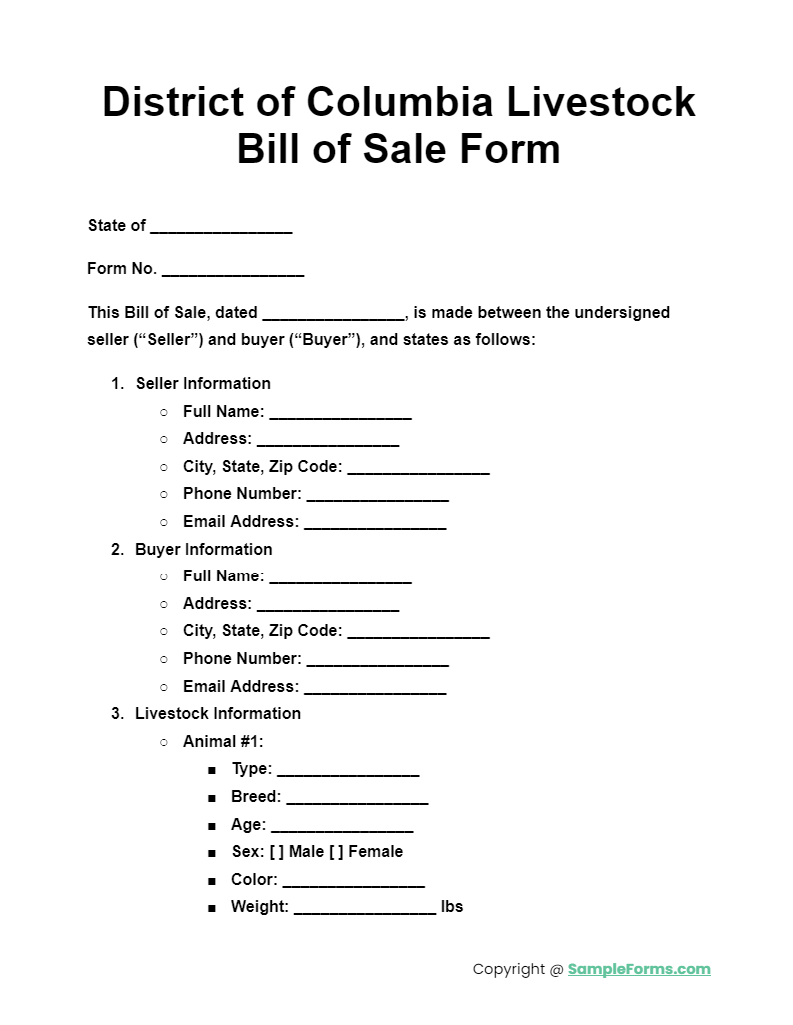

District of Columbia Livestock Bill of Sale Form

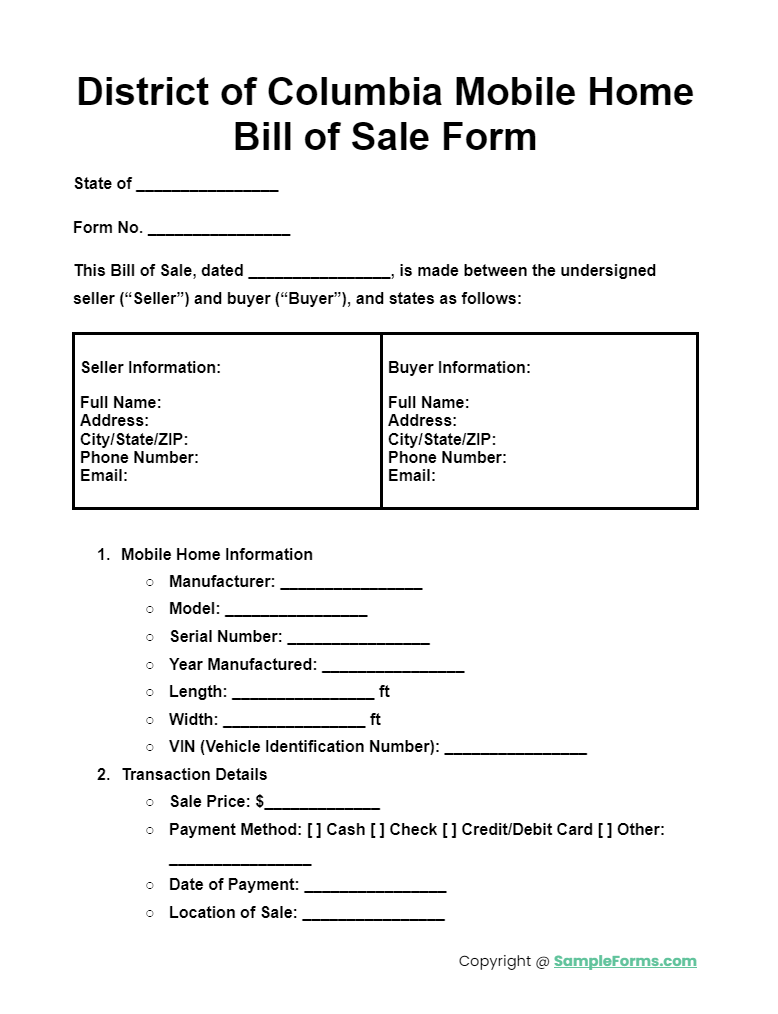

District of Columbia Mobile Home Bill of Sale Form

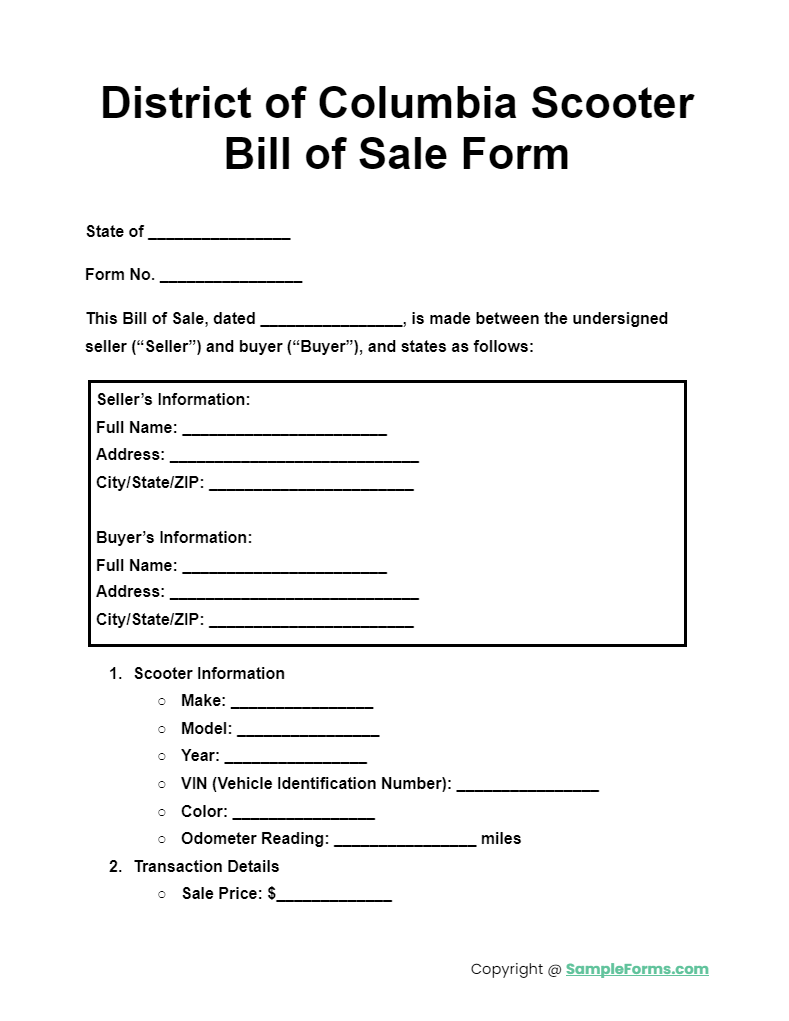

District of Columbia Scooter Bill of Sale Form

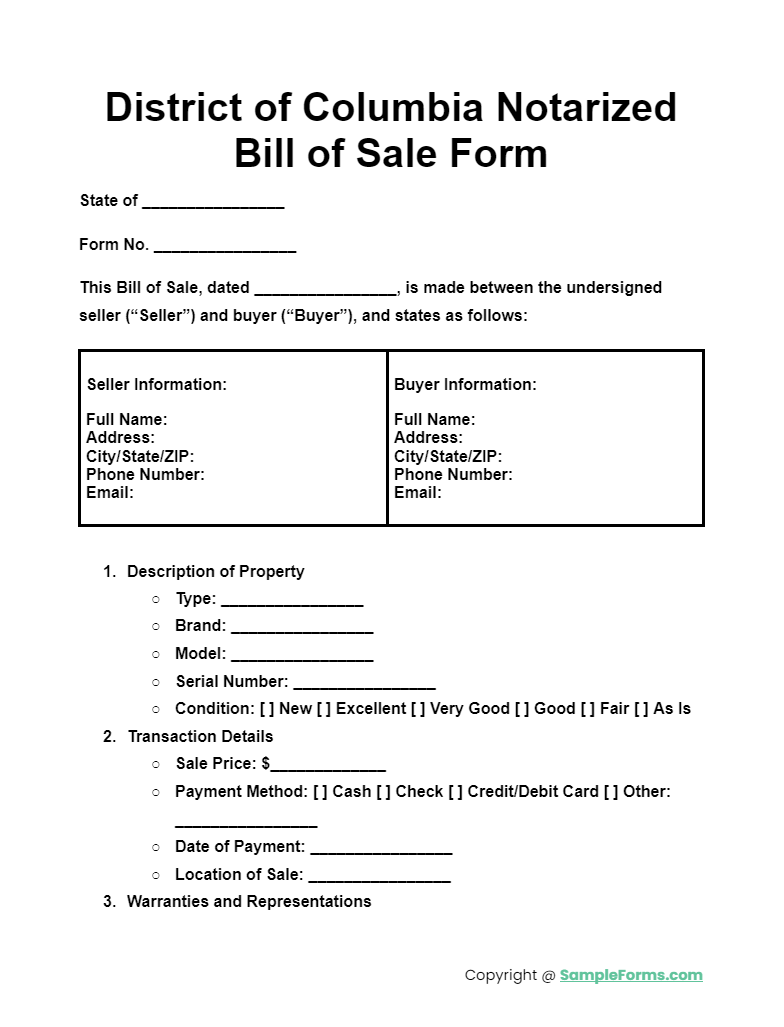

District of Columbia Notarized Bill of Sale Form

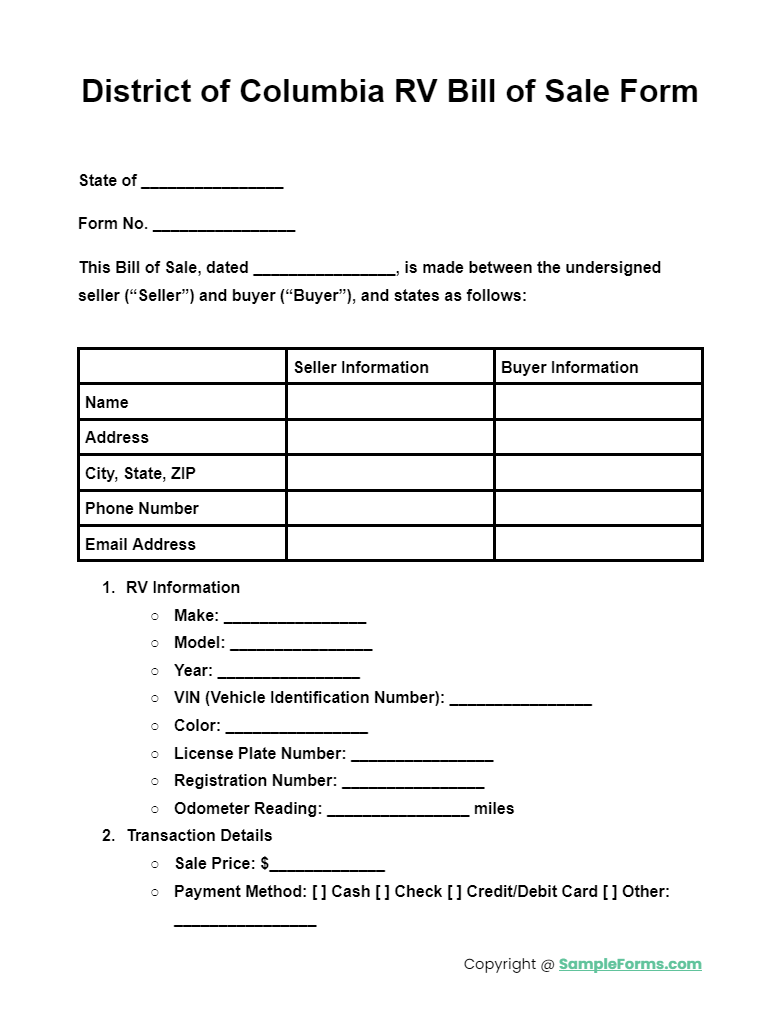

District of Columbia RV Bill of Sale Form

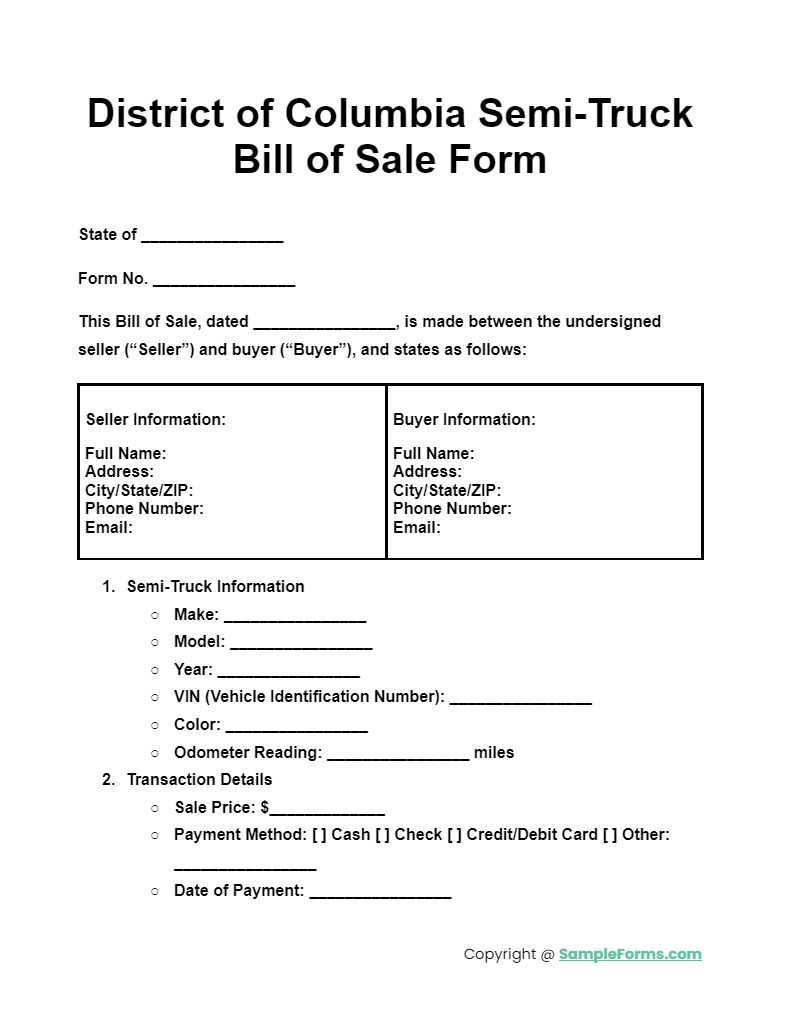

District of Columbia Semi-Truck Bill of Sale Form

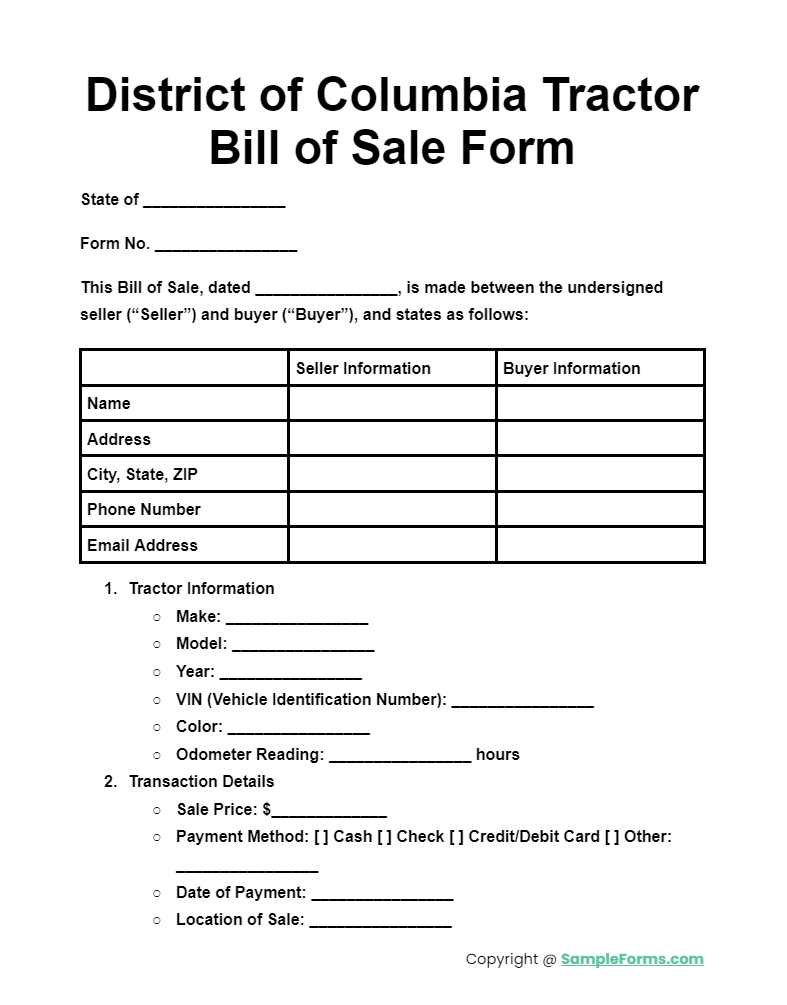

District of Columbia Tractor Bill of Sale Form

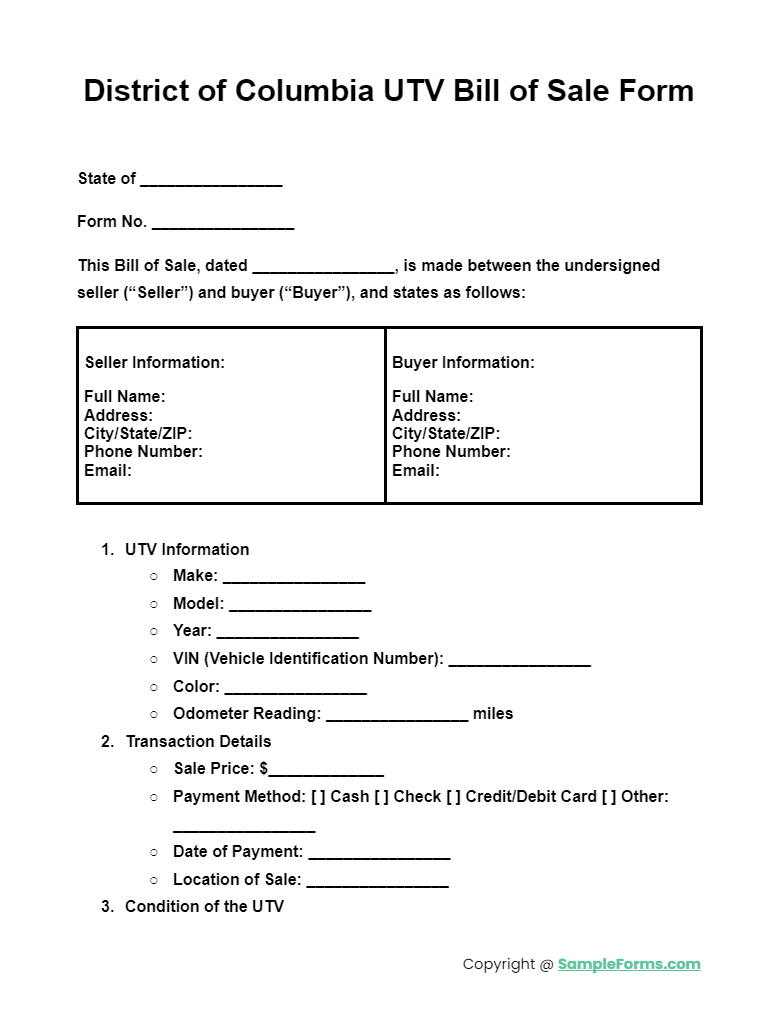

District of Columbia UTV Bill of Sale Form

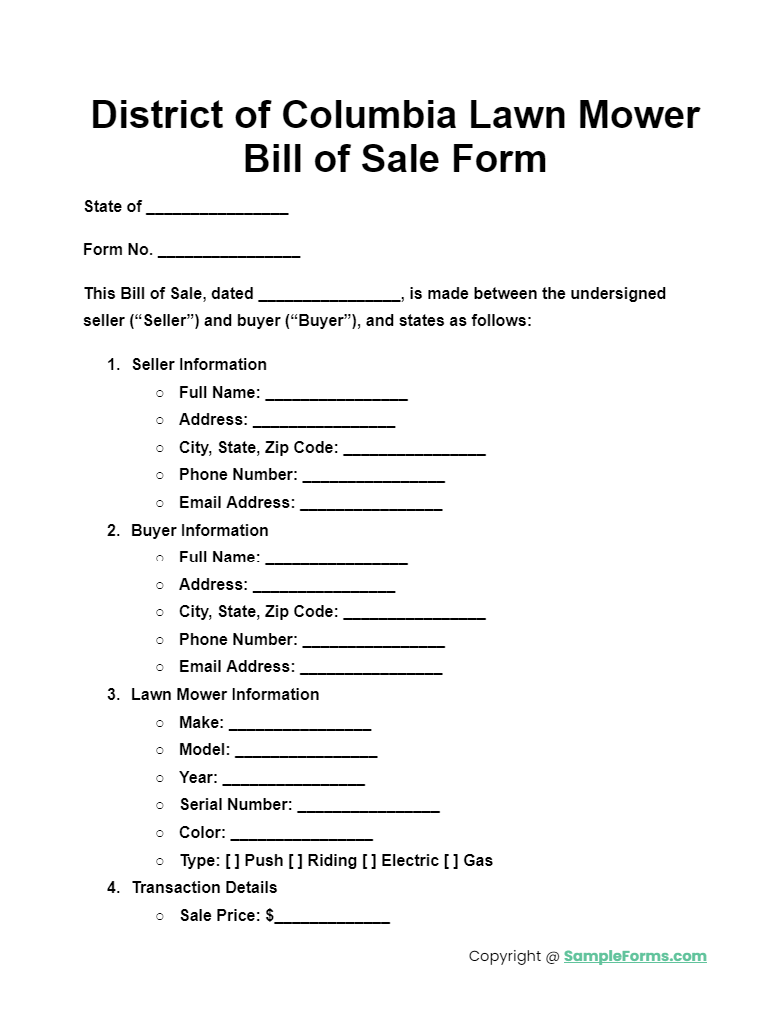

District of Columbia Lawn Mower Bill of Sale Form

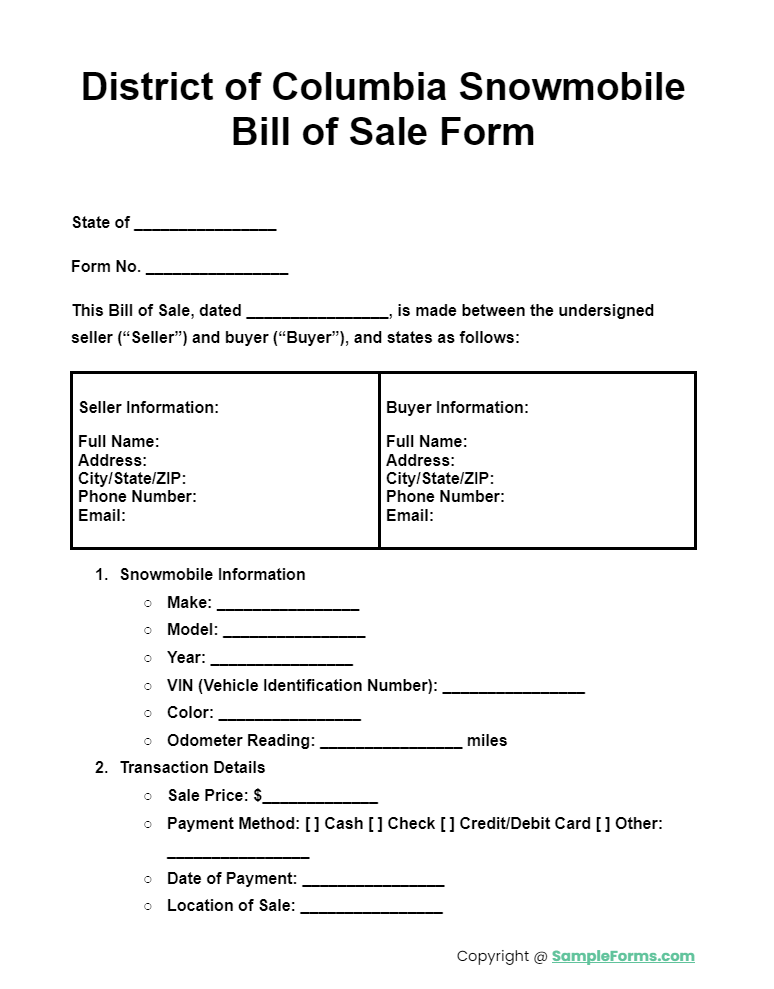

District of Columbia Snowmobile Bill of Sale Form

How to Register a Car in DC from Out of State?

Registering a car in the District of Columbia when moving from out of state involves several steps. Key steps include:

- Proof of Residency: Provide documents like a lease agreement or utility bill to prove DC residency.

- Vehicle Inspection: Schedule and pass a DC vehicle inspection at an authorized inspection station.

- Title Transfer: Complete the title transfer using the out-of-state title and a Vehicle Bill of Sale Form.

- Insurance: Obtain DC-compliant car insurance and provide proof of coverage.

- Registration Fee: Pay the necessary registration fees at the DC DMV. You also browse our Boat Bill of Sale Form

How do I register an out of state business in DC?

Adhering to specific rules and regulations ensures that registering an out-of-state business in DC is managed effectively. Key steps include:

- Eligibility Criteria: Ensure your business meets DC’s requirements for foreign entities, including compliance with state-specific regulations.

- Application Submission: Submit a Certificate of Registration (Foreign Entity) form, including details such as the business name, principal office address, and state of incorporation.

- Registered Agent: Appoint a registered agent located in DC who can receive legal documents on behalf of your business.

- Certificate of Good Standing: Obtain a Certificate of Good Standing from the home state, indicating that your business is in compliance with local regulations.

- Filing Fees: Pay the necessary registration fees to the DC Department of Consumer and Regulatory Affairs (DCRA), completing the process for your out-of-state business to operate legally in DC. You also browse our Motor Vehicle Bill of Sale

After selling your car in DC, follow these steps to ensure a smooth transition:

- Complete a Bill of Sale: Fill out and sign a Bill of Sale for Vehicle with the buyer.

- Remove License Plates: Remove the plates from the sold vehicle and return them to the DMV. You also browse our Horse Bill of Sale Form

- Notify DMV: Inform the DC DMV of the sale to update their records and avoid future liabilities.

- Transfer Title: Ensure the buyer completes the title transfer at the DMV.

- Cancel Insurance: Cancel your insurance policy for the sold vehicle to avoid unnecessary charges. You also browse our DMV Bill of Sale Form

How Do I Get Sales Tax Exemption in DC?

Obtaining a sales tax exemption in DC involves specific steps. Key points include:

- Eligibility: Determine if you qualify for sales tax exemption based on your situation. You also browse our Motorcycle Bill of Sale

- Complete Application: Fill out the sales tax exemption application form available at the DC DMV.

- Supporting Documents: Provide necessary documents, such as proof of eligibility and a Notarized Bill of Sale Form.

- Submit Application: Submit the completed application and documents to the DC DMV.

- Approval: Wait for approval from the DMV to receive your sales tax exemption certificate. You also browse our Vehicle Bill of Sale

What Happens If You Don’t Register Your Car in DC?

Failing to register your car in DC has several repercussions. Key steps to avoid them include:

- Compliance Check: Ensure your vehicle complies with DC registration requirements.

- Avoid Fines: Register your vehicle promptly to avoid fines and penalties. You also browse our Mobile Home Bill of Sale

- Legal Responsibility: Understand that unregistered vehicles can lead to legal issues.

- Insurance Validity: Keep your insurance valid by maintaining proper registration.

- Parking Regulations: Follow DC parking regulations, which require vehicle registration. You also browse our ATV Bill of Sale Form

Does a MD bill of sale need to be notarized?

In Maryland, a Livestock Bill of Sale Form or any other bill of sale does not need to be notarized, but notarization is recommended for added security.

Does DC require a bill of sale?

Yes, the District of Columbia requires a Bill of Sale for Firearm or other property to document the transfer of ownership, ensuring legal protection for both parties.

Will your business be required to collect sales and use tax in DC?

Businesses in DC must collect sales and use tax if they sell tangible personal property or certain services, as indicated by the Business Bill of Sale Form guidelines.

Is a front license plate required in DC?

Yes, Washington DC mandates that vehicles display a front license plate. A Truck Bill of Sale Form must be completed upon sale to ensure proper registration.

What requires a permit in DC?

Various activities, including construction, renovations, and certain business operations, require permits in DC. A Dog Bill of Sale Form for pet sales may also need documentation. You also browse our Motorcycle Bill of Sale Form

What is the sales tax in the District of Columbia?

The sales tax rate in the District of Columbia is 6%. The Bill of Sale Vehicle Form should reflect this when calculating the total purchase amount.

Can you gift a car to a family member in Washington state?

Yes, you can gift a car to a family member in Washington state. Completing an Aircraft Bill of Sale Form can help document the transfer for legal purposes. You also browse our Equipment Bill of Sale Form

Do you need a seller’s permit in DC?

Yes, a seller’s permit is required for businesses operating in DC. This ensures compliance with local tax laws, similar to a Gun Bill of Sale Form for firearm sales. You also browse our Auto Bill of Sale Form

What is form FR 500 in DC?

Form FR 500 is used to register for various DC business taxes, including sales and use tax. It’s crucial for transactions documented by a Used Car Bill of Sale.

Related Posts

-

Florida Bill of Sale Form

-

Delaware Bill of Sale Form

-

Connecticut Bill of Sale Form

-

Colorado Bill of Sale Form

-

California Bill of Sale Form

-

Arizona Bill of Sale Form

-

Arkansas Bill of Sale Form

-

Alaska Bill of Sale Form

-

Alabama Bill of Sale Form

-

FREE 6+ Recreational Vehicle Bill of Sale Forms in PDF | MS Word

-

FREE 5+ Kitten / Cat Bill of Sale Forms in PDF

-

FREE 6+ Notarized bill of sale Forms in PDF

-

FREE 6+ Boat (Vessel) Bill of Sale Forms in PDF | MS Word

-

FREE 6+ Motorcycle Bill of Sale Forms in PDF | MS Word

-

FREE 5+ Mobile Manufactured Homes Bill of Sale Forms in PDF