A Deposit Form is essential for tracking financial commitments, while a Refund Request Form helps claim refunds efficiently. This guide provides expert insights into creating these forms for various scenarios like rentals, immigration, or security deposits. Whether you’re a tenant, parent, or event organizer, learning how to structure these forms ensures smooth transactions and timely refunds. Explore examples, tips, and best practices to avoid errors and streamline your requests. With clear templates and actionable advice, this guide will empower you to handle refunds with confidence and ease.

Download Deposit Refund Form Bundle

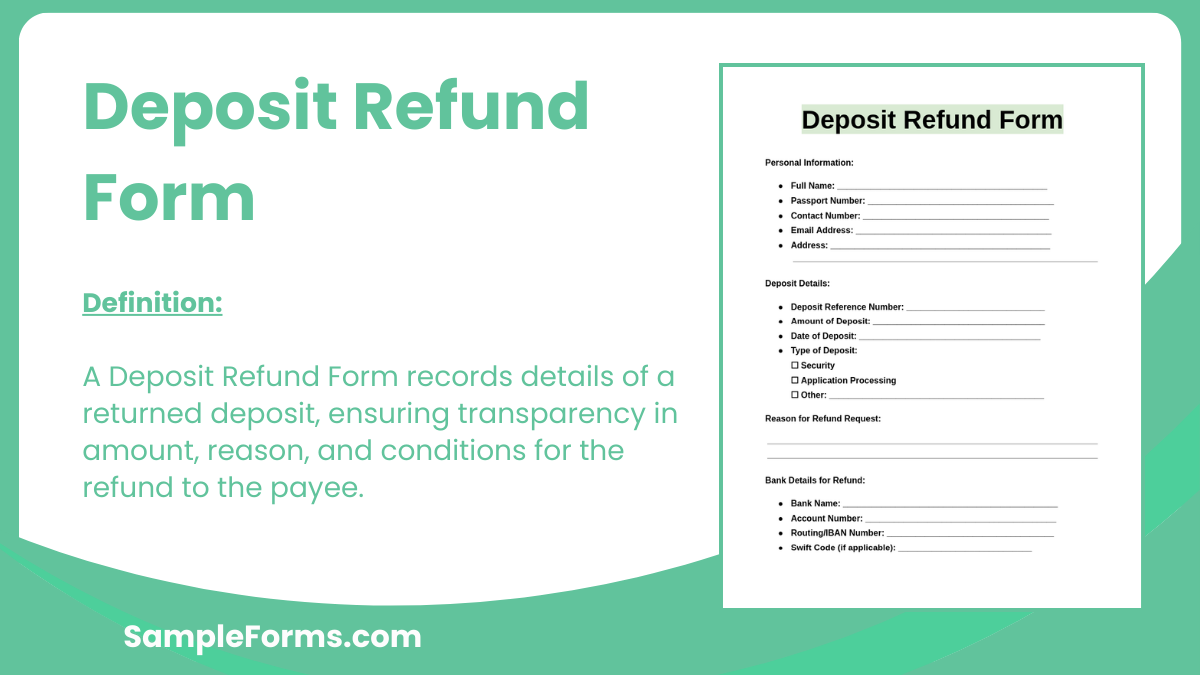

What is Deposit Refund Form?

A Deposit Refund Form is a document used to formally request the return of a deposited amount. It serves as proof that the depositor has fulfilled their obligations and is eligible for a refund. This form typically includes details like the depositor’s name, deposit amount, date, and reason for the refund. By providing necessary information, it ensures a smooth and transparent refund process for both parties. Proper use of the form prevents disputes and guarantees timely reimbursement.

Deposit Refund Format

Heading: Deposit Refund Form

Date: [Insert Date]

Refund Reference Number: [Insert Number]

Recipient’s Information:

- Full Name: [Insert Name]

- Address: [Insert Address]

- Contact Number: [Insert Contact Information]

Refund Details:

- Refund Amount: [Insert Amount]

- Reason for Refund: [Insert Reason]

- Original Deposit Date: [Insert Date]

- Payment Method for Refund: [Insert Method]

Acknowledgment Statement:

I confirm receipt of the refund amount and agree that this transaction fulfills all refund obligations.

Signature:

- Recipient’s Signature: [Insert Signature]

- Authorized Official’s Signature: [Insert Signature]

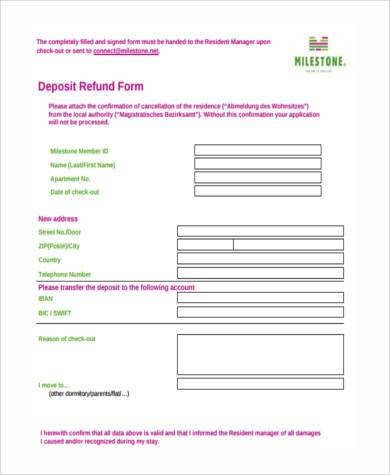

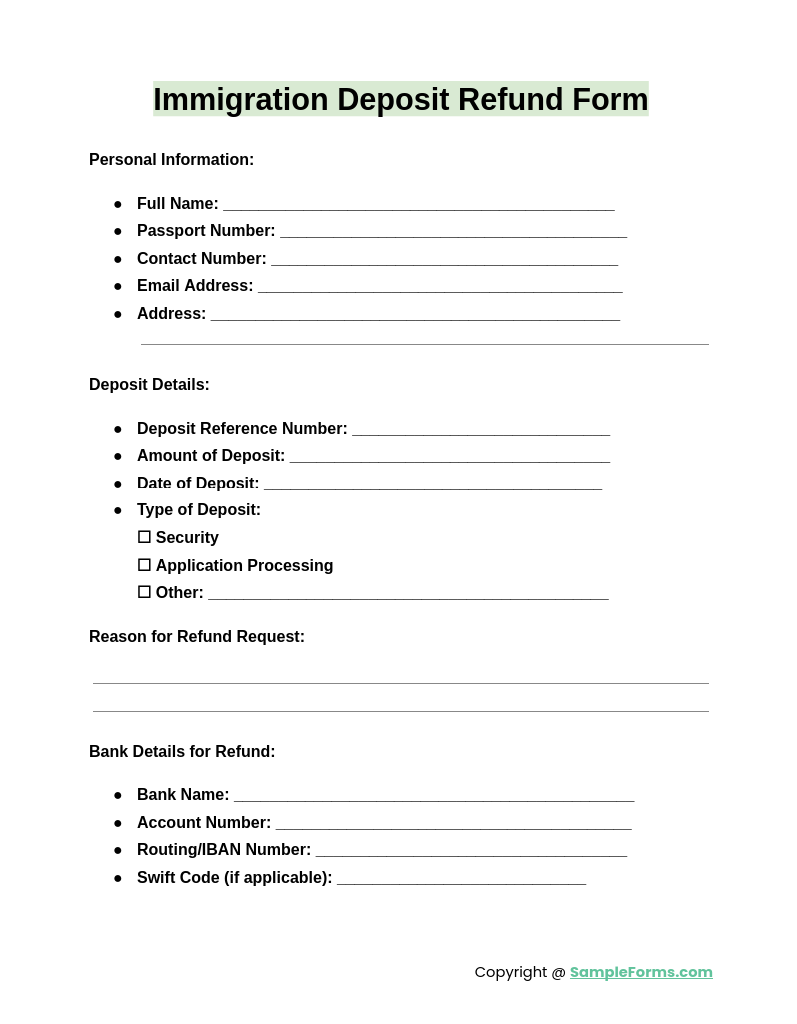

Immigration Deposit Refund Form

The Immigration Deposit Refund Form simplifies the refund process, ensuring timely returns of immigration-related deposits. Attach the Deposit Receipt Form and provide accurate details like payment date and purpose for faster approval and processing.

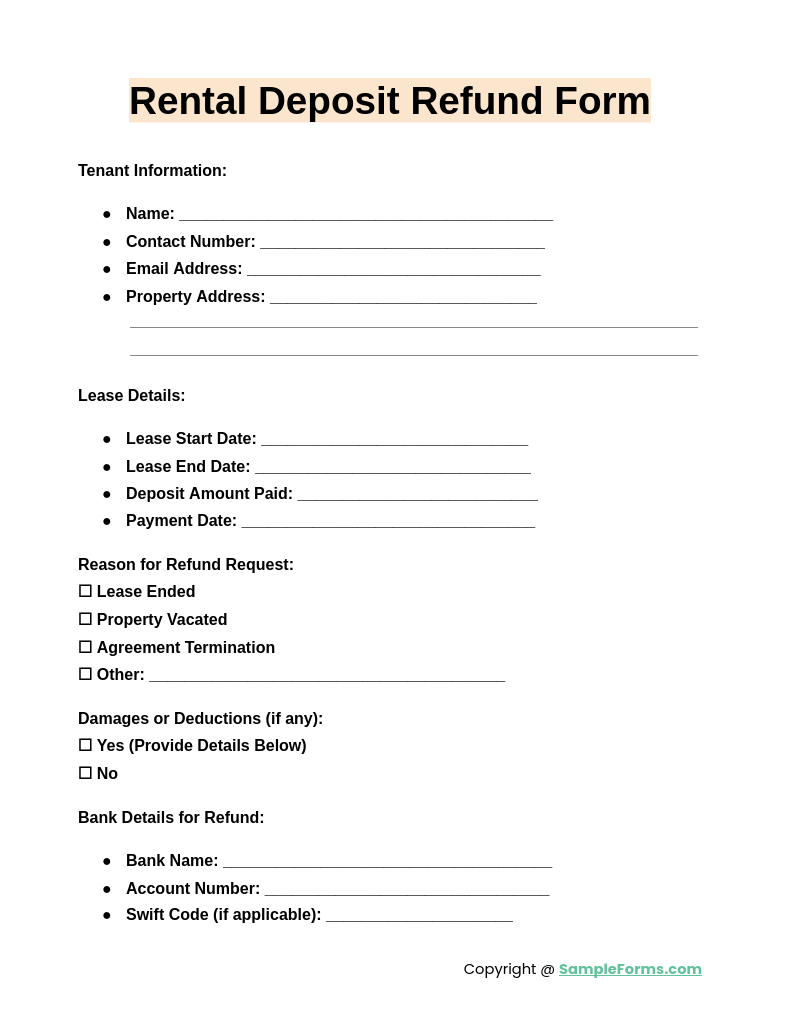

Rental Deposit Refund Form

The Rental Deposit Refund Form is essential for tenants reclaiming their deposits after fulfilling lease agreements. Including a signed Holding Deposit Agreement Form ensures transparency, preventing disputes and expediting refund requests for tenancy-related deposits.

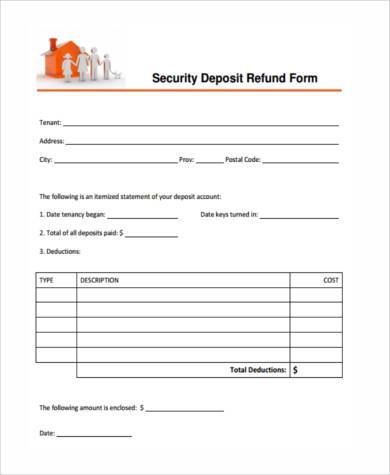

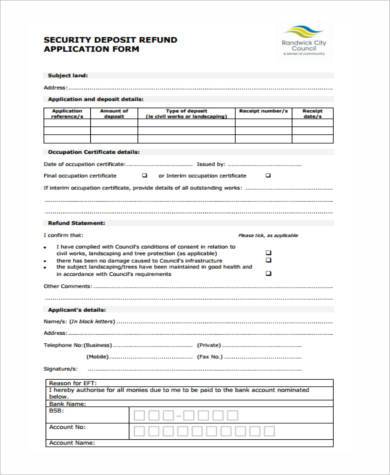

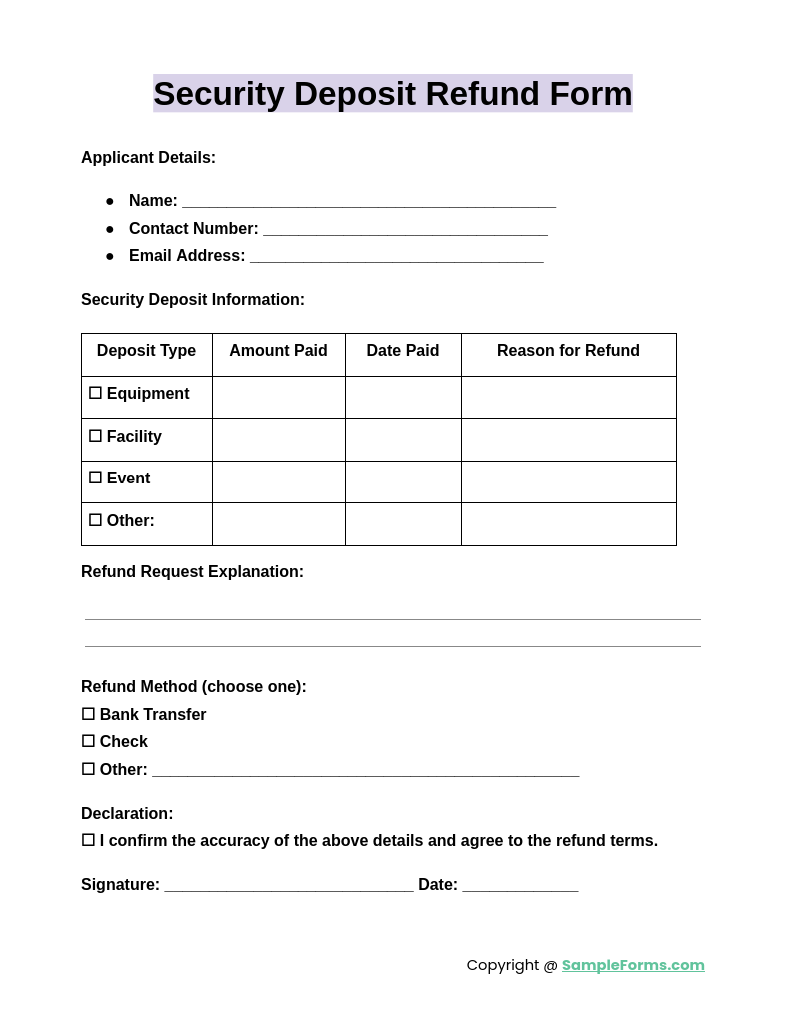

Security Deposit Refund Form

A Security Deposit Refund Form is used to claim back a security deposit upon meeting contract terms. Submitting this form alongside an Earnest Money Deposit Receipt ensures smooth reimbursement and avoids unnecessary delays.

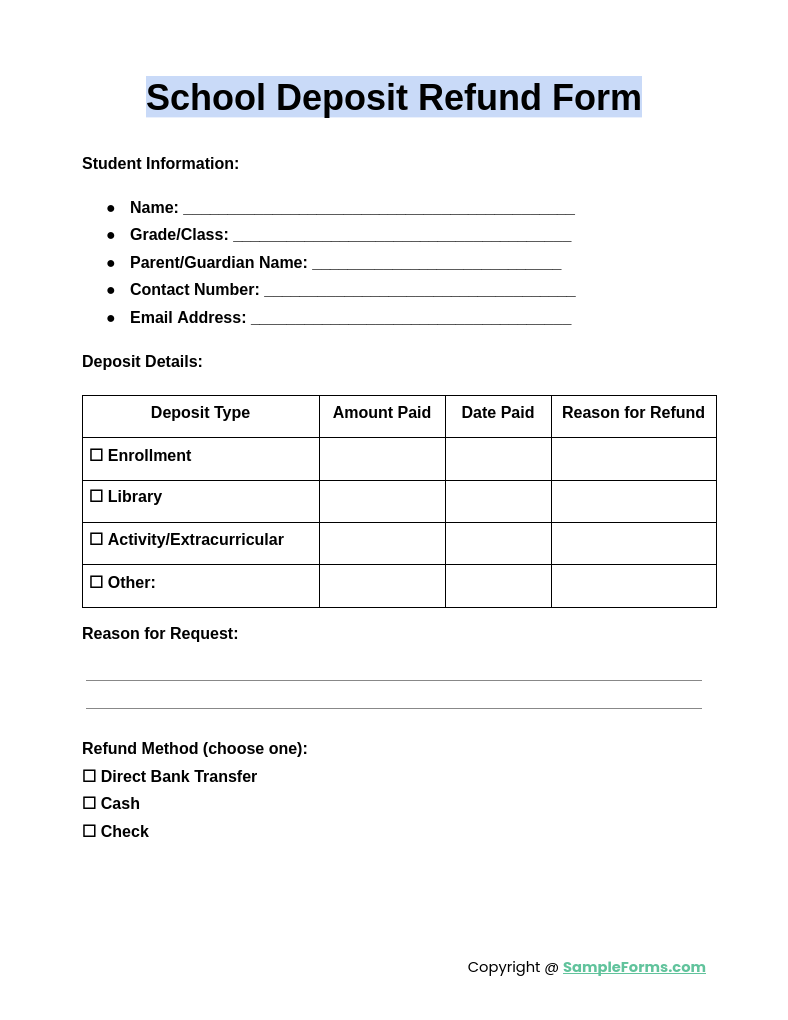

School Deposit Refund Form

The School Deposit Refund Form assists parents or students in reclaiming unused funds. Providing a complete Security Deposit Refund Form and supporting documents ensures a seamless refund process for school-related deposits.

Browse More Deposit Refund Forms

Security Deposit Refund Form

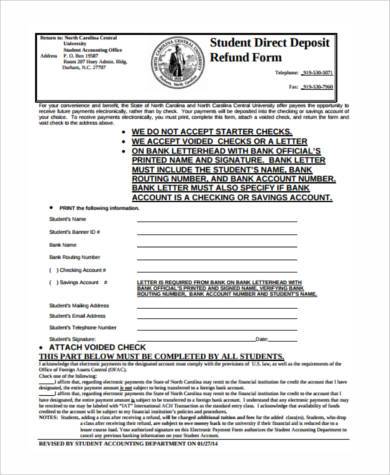

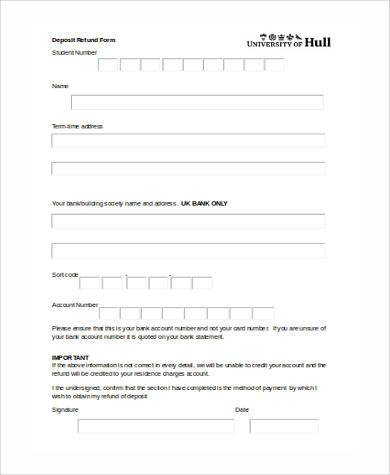

Student Direct Deposit Refund Form

Deposit Refund Form in PDF

Security Deposit Refund Application Form

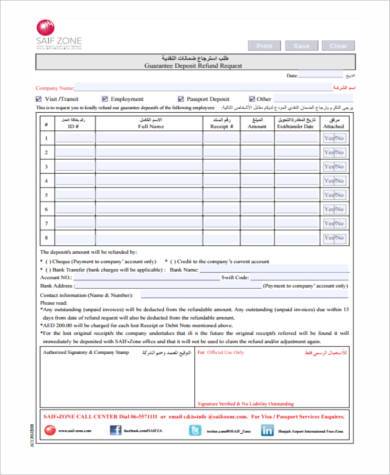

Guarantee Deposit Refund Request Form

Deposit Refund Form Example

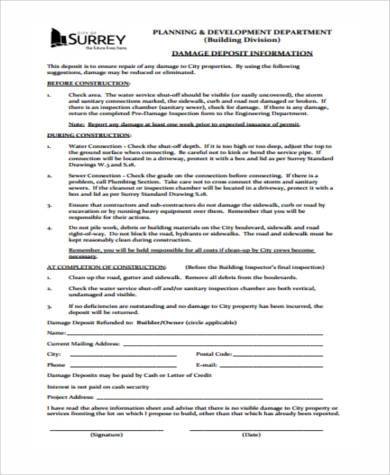

Damage Deposit Refund Form

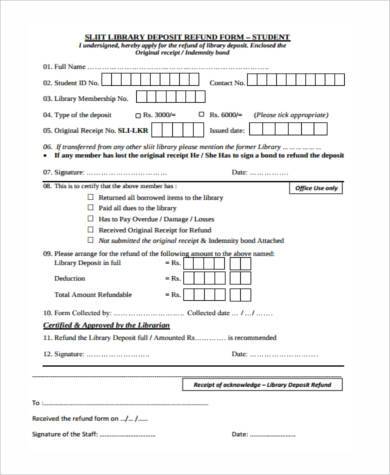

Library Deposit Refund Form

Deposit Refund Form in Word Format

How do you formally request a deposit back?

Formally requesting a deposit refund requires clear communication and proper documentation. Follow these steps for a smooth process:

- Review the Deposit Agreement:

Ensure you understand the terms outlined in the Deposit Agreement Form, including conditions for refunds. - Prepare Documentation:

Gather necessary documents like payment proof, lease agreements, or Vehicle Deposit Form, depending on the deposit type. - Write a Formal Request Letter:

Draft a polite letter or email addressing the recipient, detailing the refund request, amount, and reason. - Submit the Request:

Send the request along with required documentation to the concerned party via email, post, or in person. - Follow Up Politely:

If no response is received, follow up within a reasonable timeframe, reiterating the request in a polite tone.

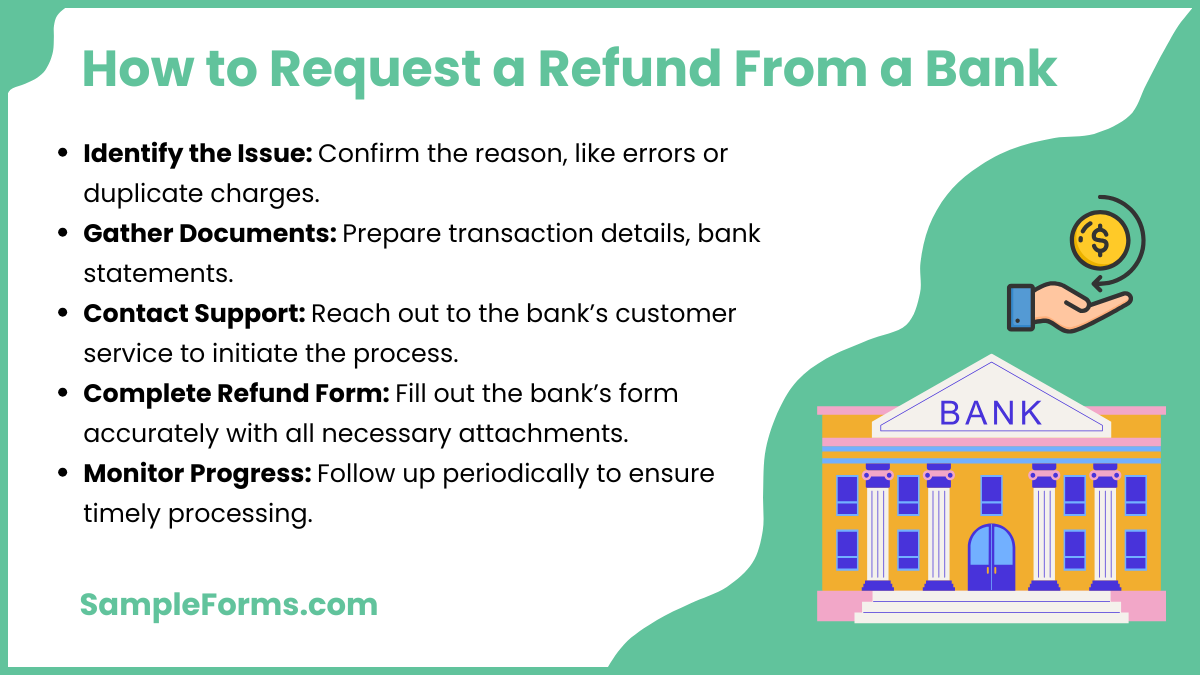

How to request a refund from a bank?

Requesting a bank refund requires following specific guidelines and providing accurate information. Here’s a step-by-step approach:

- Identify the Issue: Confirm the transaction or reason for requesting a refund, such as errors or duplicate charges.

- Prepare Required Documents: Collect transaction details, bank statements, and an ADP Direct Deposit Form if the refund relates to direct deposits.

- Contact Customer Service: Reach out to the bank’s customer service via phone, email, or an in-branch visit to initiate the refund process.

- Fill Out the Bank’s Refund Form: Complete the bank’s official refund form accurately, ensuring all fields are filled and supporting documents are attached.

- Monitor the Process: Follow up with the bank periodically to ensure the refund request is processed within the specified timeline.

How do I fill out form 3911 for refund?

Form 3911 is used to request a refund from the IRS for lost, stolen, or unclaimed checks. Steps include:

- Download the Form: Obtain Form 3911 from the official IRS website or a tax office near you.

- Complete Personal Information: Fill out the taxpayer’s name, address, and contact details in the form’s top section.

- Provide Refund Details: Include refund details, such as payment date, amount, and the reason for the claim, supported by a Security Deposit Form.

- Attach Supporting Documents: Add any necessary documents, like proof of payment or previous correspondence with the IRS.

- Mail the Form: Send the completed form to the IRS address provided for your state or region.

How do you politely ask for a deposit?

Politely asking for a deposit ensures a professional and respectful transaction. Use these steps for clarity and effectiveness:

- Be Clear About Terms: Clearly outline deposit requirements, referring to the relevant Notice of Deposition Form if applicable.

- Choose the Right Time: Approach the client or customer at an appropriate time, avoiding pressuring or rushing them.

- Provide Payment Options: Offer multiple deposit payment methods for convenience, such as online transfers, checks, or cash.

- Explain the Purpose: Politely explain why the deposit is required, ensuring transparency about how it will be used.

- Express Gratitude: Thank the individual for their cooperation, emphasizing the importance of the deposit for completing the transaction.

What to do if a company won’t refund your deposit?

When a company refuses to refund a deposit, you may need to take additional steps. Here’s a guide to handle it:

- Review the Agreement: Check the terms in the Deposit Agreement Form to confirm refund eligibility and company obligations.

- Communicate Clearly: Contact the company directly, providing all relevant details about the deposit and refund request.

- Send a Written Notice: Draft a formal letter requesting the refund and referencing legal obligations, if applicable.

- File a Complaint: Report the issue to consumer protection agencies or relevant authorities if the company remains uncooperative.

- Seek Legal Action: Consult a legal professional or consider small claims court to resolve the matter and recover the deposit.

How to ask for deposit back from landlord template?

Request your deposit using a formal letter or email. Attach a completed Rental Deposit Form with proof of payment and lease terms for clarity.

What is the deposit form for IRS refund?

The IRS requires a completed Direct Deposit Authorization to transfer refunds directly into your bank account, ensuring secure and quick transactions.

What is a direct deposit refund?

A direct deposit refund transfers funds electronically into your bank account using a Vendor Direct Deposit Form, ensuring faster refunds without delays.

Can a deposit be refunded?

Yes, deposits can be refunded if terms in the Security Deposit Receipt Form are met, such as fulfilling lease or agreement conditions.

What is a refundable deposit called?

A refundable deposit, often termed as a security deposit, is documented in a Security Deposit Return Form for tracking and reimbursement purposes.

How do I ask for a refund of a deposit?

Request a deposit refund by submitting a formal Deposit Contract Form to the concerned party, detailing payment, purpose, and refund reason.

How do you politely ask for a deposit back?

Politely request a refund by attaching proof of payment and a completed Payroll Direct Deposit Form in a concise, professional communication.

Does the IRS check your bank account?

The IRS doesn’t directly monitor bank accounts but requires a Direct Deposit Authorization Form for refunds or payments involving your account.

How do I get a deposit form?

Deposit forms, such as a Payment Form, can be obtained from banks, employers, or service providers for financial transactions or refunds.

How do I deposit a refund from the IRS?

To deposit an IRS refund, provide accurate details on a Payment Application Form or authorize direct deposit for seamless fund transfers.

The Deposit Refund Form use guide simplifies the process of handling refund requests across scenarios. Whether it’s a Tenancy Deposit Form or another refund request, these forms ensure a structured and professional approach. By using the correct format and providing necessary details, you can avoid delays and disputes while securing your refund. From understanding their purpose to leveraging practical examples, this guide ensures you’re equipped to reclaim deposits efficiently, with clarity and confidence.