A Deed Transfer Form is essential for transferring property ownership seamlessly. This guide covers every detail, from creating a professional Transfer Form to ensuring accurate legal documentation. Designed for individuals and professionals alike, it simplifies property transactions while meeting legal requirements. With a focus on creating an efficient and user-friendly Ownership Transfer Form, this guide provides practical tips, templates, and examples to make property dealings easier. Whether you’re selling, gifting, or exchanging property, learn how to manage the process effectively and ensure compliance with all necessary regulations.

Download Deed Transfer Form Bundle

What is Deed Transfer Form?

A Deed Transfer Form is a legal document used to transfer property ownership from one party to another. It ensures accurate details, legal compliance, and mutual agreement for secure transactions.

Deed Transfer Format

Property Information

Property Address: ________________________________________

City: ____________________________

State: ____________________________

Postal Code: ______________________________

Property Identification Number (if applicable): ______________

Current Owner Information

Full Name(s): __________________________________________

Address: _____________________________________________

City: ____________________________

State: ____________________________

Postal Code: ______________________________

Phone Number: ________________________________________

Email Address: ________________________________________

New Owner Information

Full Name(s): __________________________________________

Address: _____________________________________________

City: ____________________________

State: ____________________________

Postal Code: ______________________________

Phone Number: ________________________________________

Email Address: ________________________________________

Transfer Details

Reason for Transfer:

[ ] Sale

[ ] Gift

[ ] Exchange

[ ] Other: _______________________________________________

Effective Date of Transfer: _____________________________

Agreed Transfer Value: ________________________________

Declaration of Transfer

I, ________________________________________, as the current owner, transfer ownership of the property described above to _____________________________ under the terms agreed.

Signature of Current Owner: ____________________________

Date: ___________________________________

Signature of New Owner: ____________________________

Date: ______________________________

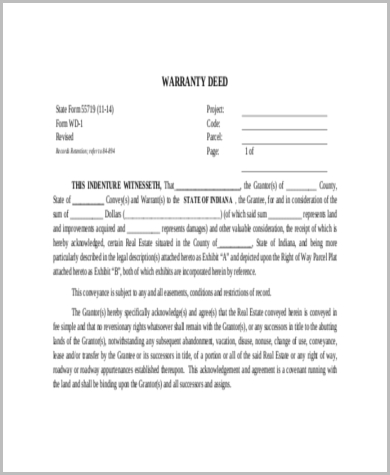

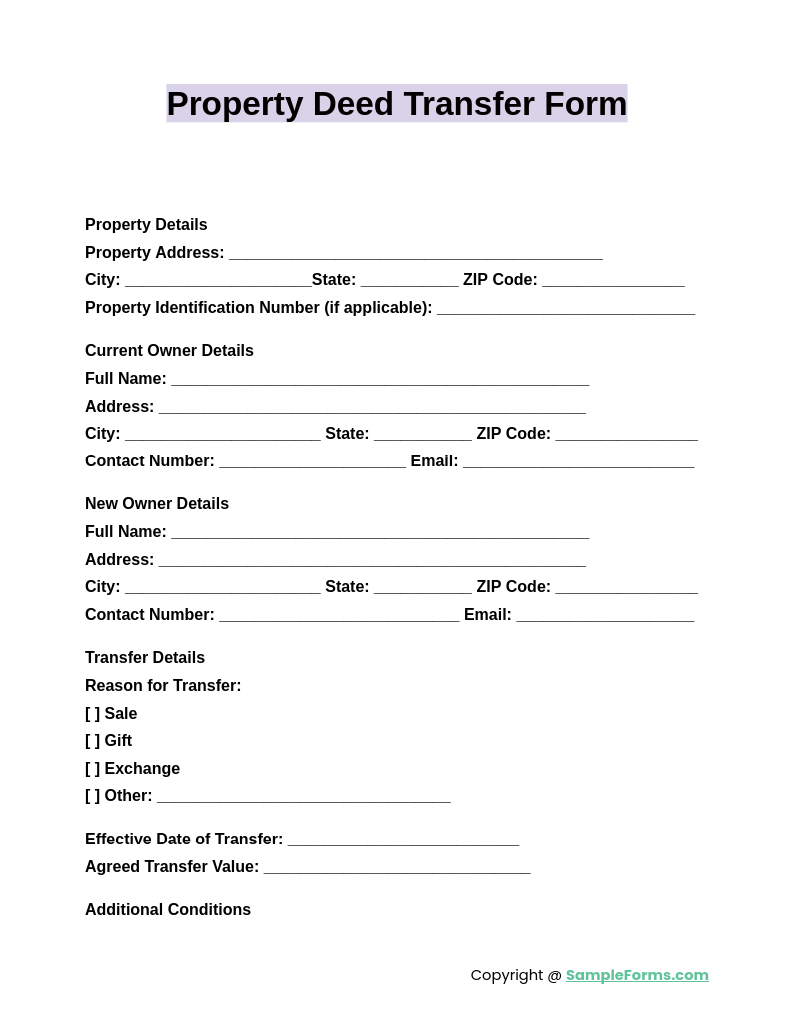

Property Deed Transfer Form

A Property Deed Transfer Form legally transfers property ownership between parties, ensuring clear rights and responsibilities. Similar to a School Transfer Form, it streamlines the process with accurate documentation for smooth transactions.

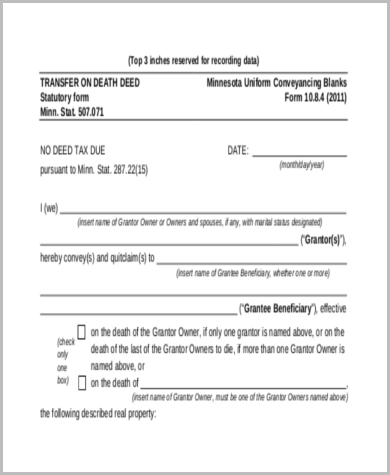

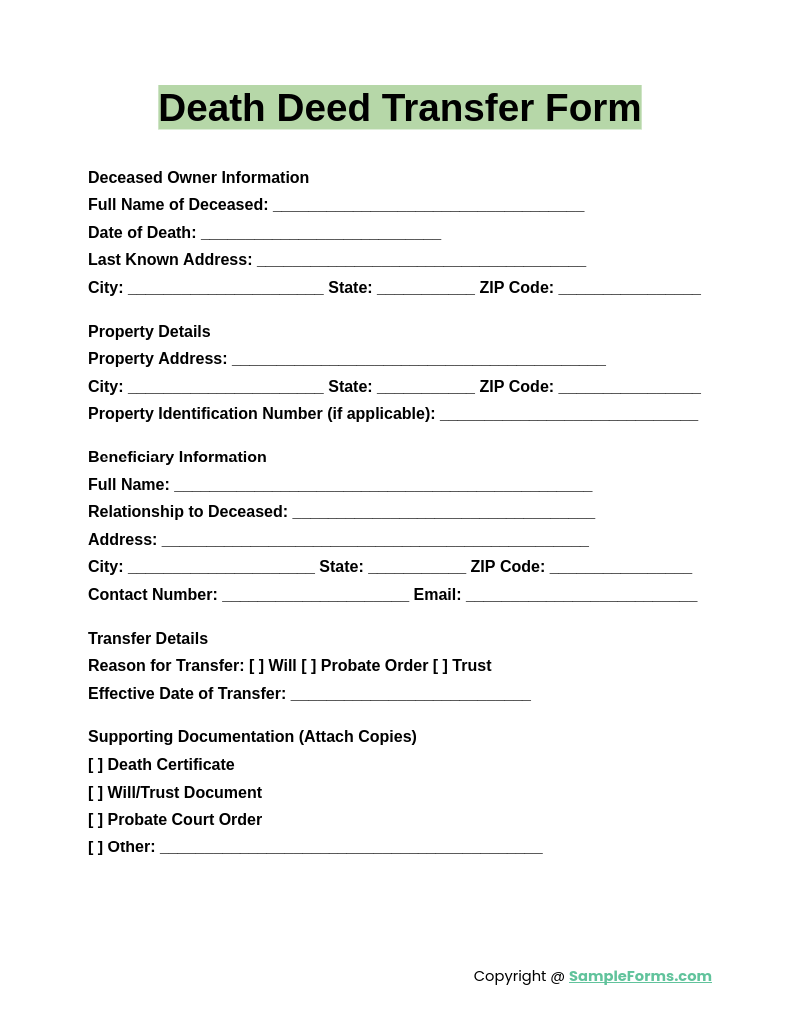

Death Deed Transfer Form

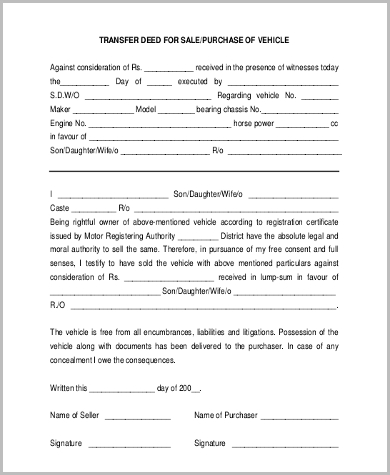

A Death Deed Transfer Form allows property ownership transfer after the owner’s death, ensuring compliance with legal procedures. It simplifies inheritance processes, much like a Vehicle Transfer Form facilitates ownership changes for vehicles.

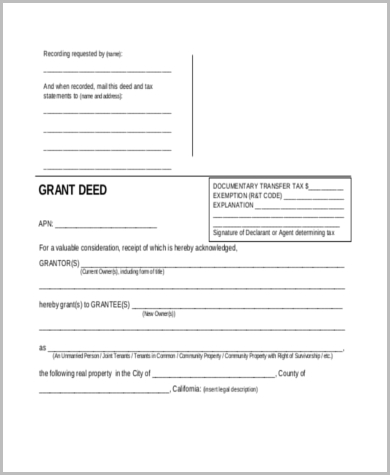

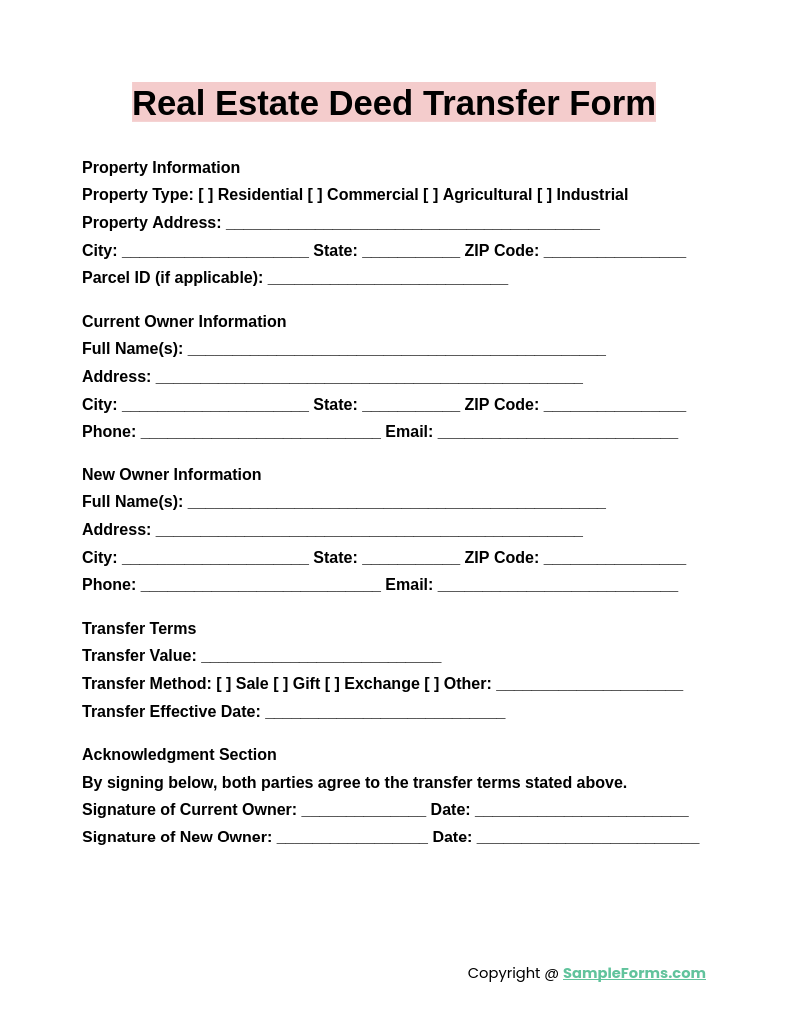

Real Estate Deed Transfer Form

A Real Estate Deed Transfer Form formalizes property exchanges between buyers and sellers. It ensures legal clarity and financial transparency, similar to how a Wire Transfer Form secures monetary transactions.

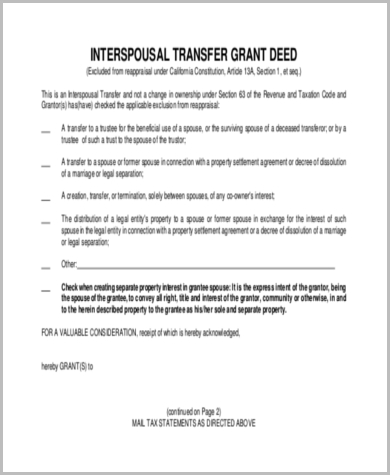

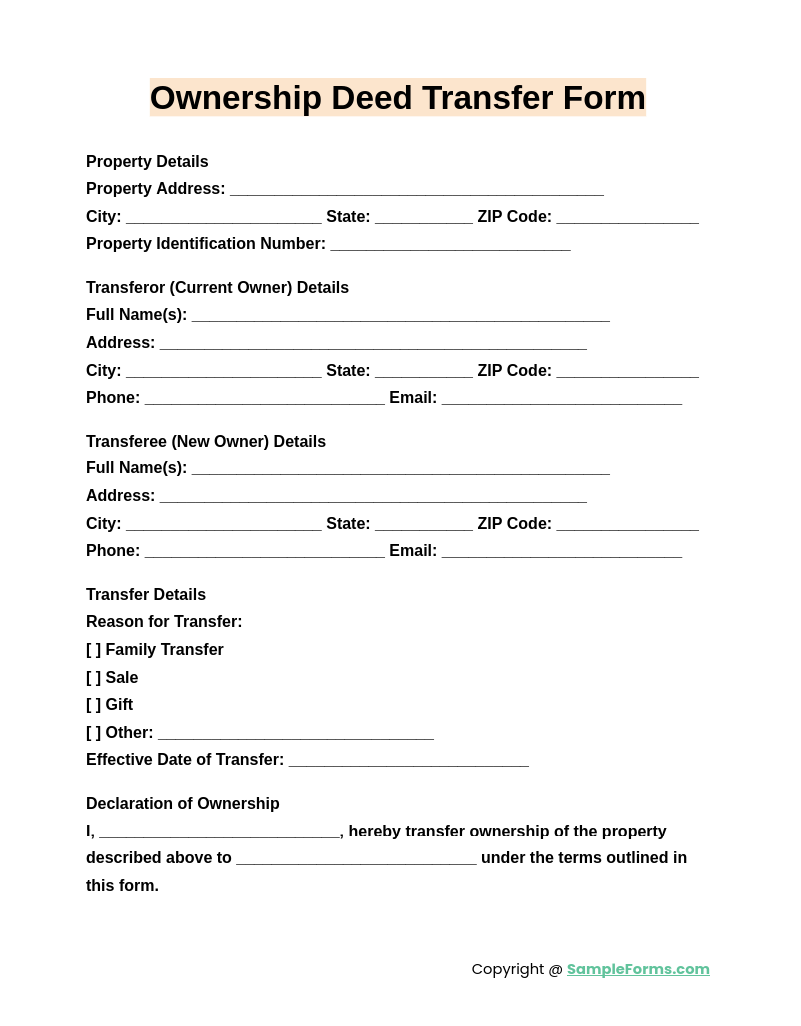

Ownership Deed Transfer Form

An Ownership Deed Transfer Form records the transfer of property rights, protecting both parties involved. Comparable to a Transfer of Ownership Form, it ensures proper documentation for accountability and security in the transaction

Browse More Deed Transfer Form

Property Deed Transfer Form

Real Estate Deed Transfer Form

Title Deed Transfer Form

Warranty Deed Transfer Form

Cemetery Deed Transfer Form

Deed Transfer on Death Form

Transfer Deed Form for Vehicle

Blank Transfer of Shares Form Format

Interspousal Transfer Grant Deed

Basic Contract Deed Transfer Form

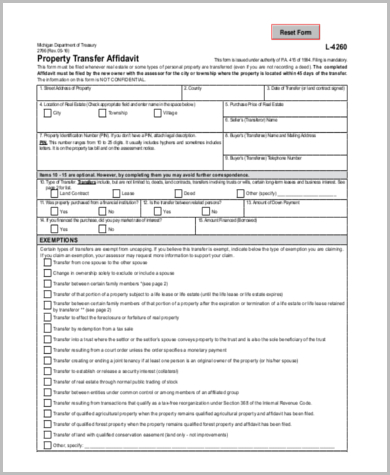

How do I transfer a property deed in Kansas?

Transferring a property deed in Kansas involves preparing the necessary forms, filing them, and paying required fees. Key steps include:

- Prepare a Deed Form: Complete a Registration Transfer Form with accurate property details.

- Notarize the Deed: Ensure signatures are notarized to validate the transaction.

- File with the Register of Deeds: Submit the deed to the county office where the property is located.

- Pay Filing Fees: Cover associated recording fees based on county regulations.

- Receive Recorded Deed: Obtain the updated deed with official filing confirmation.

What form do I need to transfer property in Texas?

To transfer property in Texas, a deed form like a warranty or quitclaim deed is required, ensuring ownership clarity. Key steps include:

- Select the Right Form: Choose a deed type suitable for the transfer, such as a Land Transfer Form.

- Complete the Deed Form: Include names, property description, and transfer details.

- Sign and Notarize: All parties must sign in the presence of a notary public.

- File with the County Clerk: Submit the deed in the county where the property resides.

- Pay Applicable Fees: Cover recording fees for processing the document.

What are the disadvantages of a transfer on death deed?

While a transfer on death deed simplifies inheritance, it has potential drawbacks, including unintended tax implications or conflicts. Key considerations include:

- Limited Flexibility: Once filed, changes require a new Student Transfer Form for adjustments.

- Creditor Claims: Beneficiaries may still be liable for the decedent’s debts.

- Legal Challenges: Risk of disputes among heirs or potential fraud.

- Tax Implications: May not provide the same tax benefits as trusts.

- Complex Estate Planning: Not suitable for complex property holdings or multiple beneficiaries.

How do I add someone to my property deed in SC?

Adding someone to a property deed in South Carolina involves preparing a new deed, notarization, and filing with the local office. Steps include:

- Draft a New Deed: Use a Material Transfer Form to include the new co-owner’s name.

- Verify Ownership Details: Ensure accurate property description and ownership percentages.

- Notarize the Document: All parties must sign in front of a notary public.

- File with the Register of Deeds: Submit the updated deed for official recording.

- Pay Recording Fees: Cover the associated costs to complete the process.

How do I transfer property to a family member tax-free in the USA?

Transferring property tax-free requires strategic use of exemptions and legal compliance. Key steps include:

- Use a Gift Deed: Draft a gift deed using an Employee Transfer Form for clear documentation.

- Check IRS Exemptions: Utilize the annual gift tax exclusion limit to avoid taxation.

- Notarize the Deed: Ensure all required signatures are notarized.

- File with Local Authorities: Submit the deed to the appropriate local office.

- Consult a Tax Advisor: Verify compliance with state and federal laws for tax-free transfers.

How much does it cost to transfer a deed in Kansas?

Deed transfers in Kansas cost approximately $10-$20 per page in filing fees, similar to a Gun Transfer Form process.

Who signs a quit claim deed in Kansas?

In Kansas, the grantor signs the quit claim deed, transferring rights, comparable to the process in a Fund Transfer Form.

How do I record a deed in Kansas?

To record a deed, submit it to the county’s Register of Deeds with required fees, akin to an Inventory Transfer Form.

Who owns the rights to this land is your land?

The rights to “This Land Is Your Land” rest with its copyright owner, reflecting the precision needed in an Asset Transfer Form.

How much does it cost to transfer property deeds in Texas?

Property deed transfers in Texas cost approximately $30-$50, ensuring legal compliance, like filing a Stock Transfer Form.

How much is a deed transfer in California?

In California, deed transfers cost $15-$75, including additional local fees, much like completing a Title Transfer Form.

Do I need a lawyer to transfer a deed in Florida?

Hiring a lawyer for deed transfers in Florida is advisable for accuracy, similar to the process in a Motor Vehicle Transfer Form.

How do I transfer a car on death in Kansas?

Use a Transfer-on-Death form to legally transfer vehicle ownership, comparable to filing a Gun Owners Transfer Form.

Who pays transfer fees in SC?

In South Carolina, buyers typically pay deed transfer fees, reflecting principles similar to an Property Transfer Form.

What is local transfer tax in real estate?

Local transfer tax is a fee on property sales, calculated as a percentage, akin to charges in a Medical Records Transfer Form.

The Deed Transfer Form is an essential tool in property transactions. Whether for sales, gifts, or exchanges, a professional Budget Transfer Form ensures smooth and legally sound ownership transitions.

Related Posts

-

Fund Transfer Form

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 6+ Sample Residence Questionnaire Forms in PDF

-

FREE 8+ Stock Transfer Forms in PDF | Ms Word

-

FREE 7+ Inventory Transfer Forms in MS Word | PDF | Excel

-

FREE 7+ Ownership Transfer Forms in PDF

-

FREE 9+ Asset Transfer Forms in PDF | Ms Word | Excel

-

FREE 10+ Transfer Form Samples in PDF | MS Word | Excel

-

FREE 8+ Sample Transfer Verification Forms in PDF | MS Word

-

FREE 7+ Sample Assets Transfer Forms in MS Excel | PDF

-

Transfer of Ownership Form

-

FREE 9+ Sample Firearm Transfer Forms in PDF | MS Word

-

Gun Ownership Transfer Form

-

FREE 9+ Sample Title Transfer Forms in PDF | Word

-

School Transfer Form