A Deed of Trust Form is a crucial legal document used in real estate transactions to secure property loans. It involves three parties: the borrower, lender, and trustee, ensuring that the lender’s interest in the property remains protected until the loan is fully repaid. Unlike a mortgage, a Deed Form allows the trustee to hold legal title until the borrower meets all obligations. This guide covers essential details, benefits, and step-by-step instructions to help you draft a legally sound deed of trust. Get expert tips and ready-to-use templates to simplify your process today.

Download Deed of Trust Form Bundle

What is Deed of Trust Form?

A Deed of Trust Form is a legal document used in real estate to transfer property rights while securing a loan. It ensures the lender’s financial interest by allowing a neutral third-party trustee to hold legal ownership of the property until the borrower fulfills loan obligations. Unlike a traditional mortgage, a deed of trust provides a faster foreclosure process if the borrower defaults. It is commonly used in states where mortgages are not the primary security instrument. This document legally binds all parties, ensuring a transparent and enforceable property agreement.

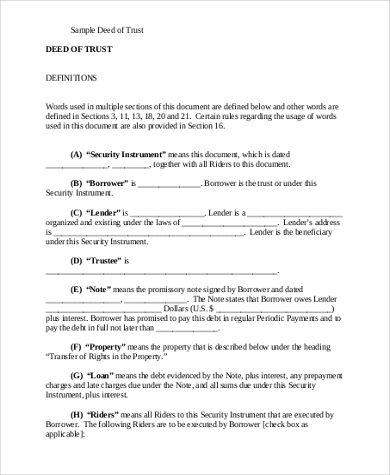

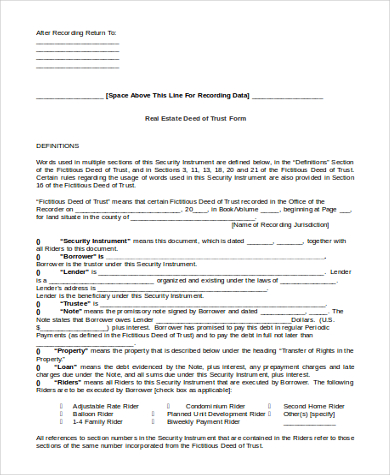

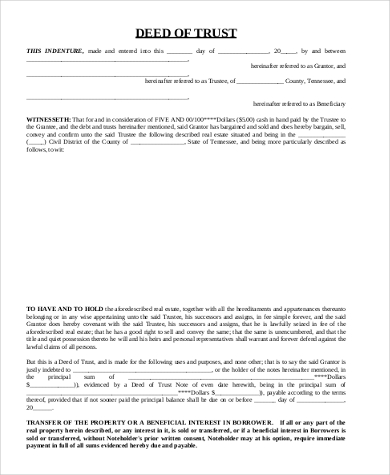

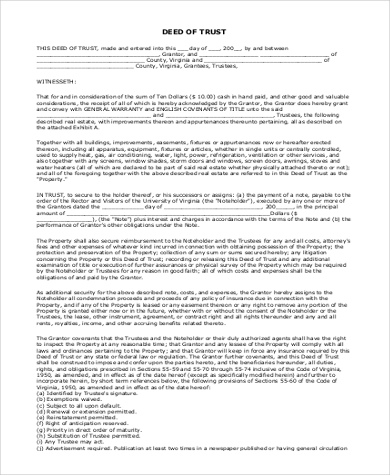

Deed of Trust Format

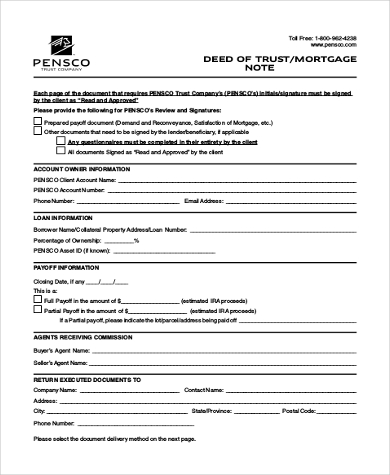

Parties Involved

- Borrower’s full name and address.

- Lender’s full name and financial institution details.

- Trustee’s name and legal authorization.

Property Details

- Full property address and parcel number.

- Legal description and zoning classification.

- Market value and purchase price of the property.

Loan Terms

- Principal loan amount and interest rate.

- Loan repayment schedule and due dates.

- Prepayment penalties and refinancing conditions.

Rights and Responsibilities

- Borrower’s obligations for taxes, insurance, and maintenance.

- Lender’s rights in case of default.

- Process for handling foreclosure or property transfer.

Signatures

- Borrower, lender, and trustee signatures.

- Notary public certification and date of execution.

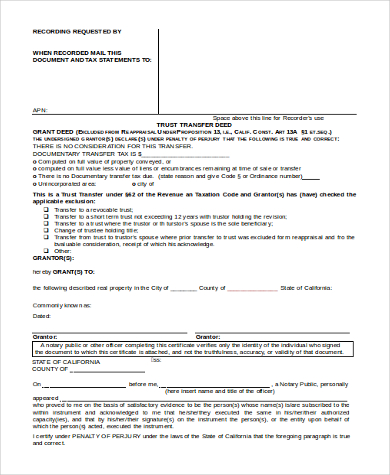

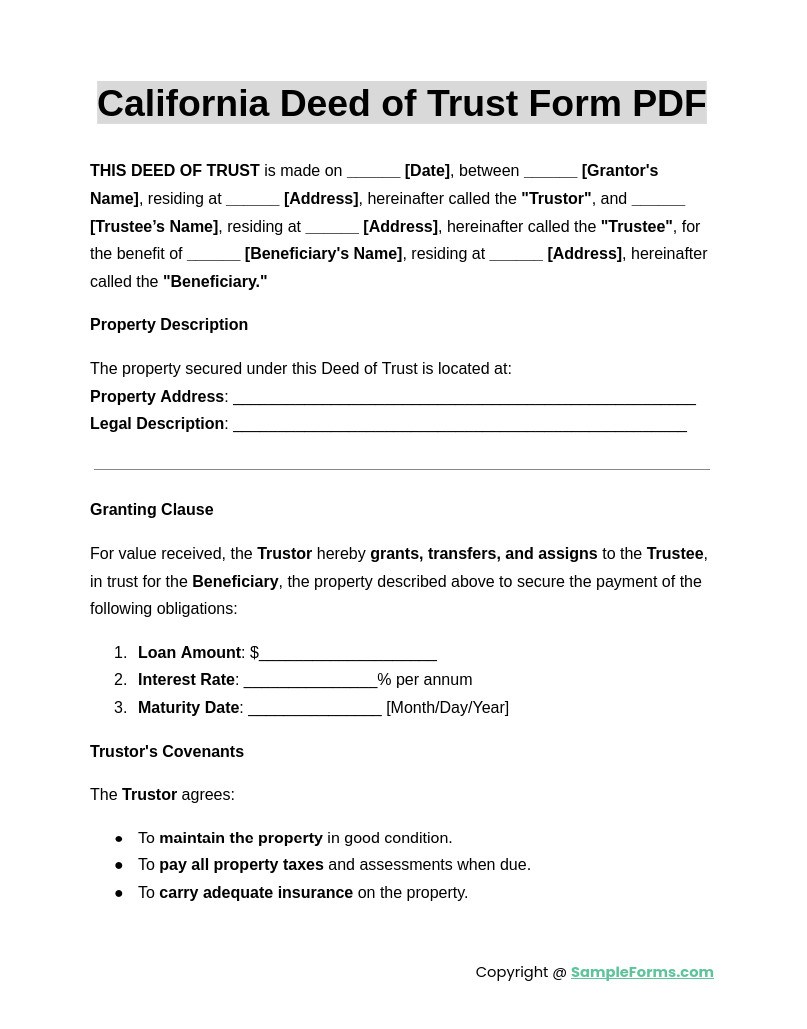

California Deed of Trust Form PDF

A California Deed of Trust Form PDF secures real estate transactions by involving a trustee. Similar to a Contract for Deed Form, it ensures the lender’s financial interest is protected until the loan is fully repaid.

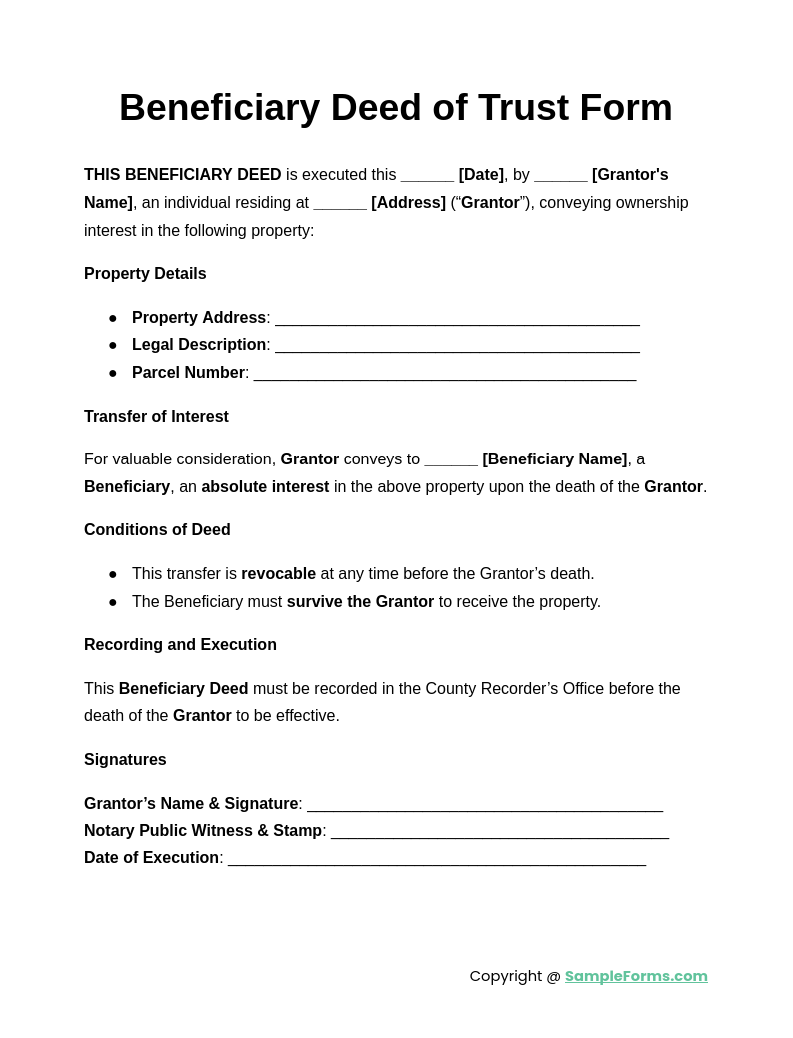

Beneficiary Deed of Trust Form

A Beneficiary Deed of Trust Form transfers property rights to a designated beneficiary after the owner’s death. Like a Deed Transfer Form, it simplifies property inheritance by avoiding probate and ensuring a seamless transition of ownership.

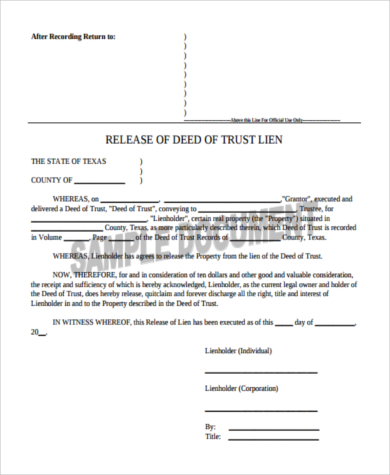

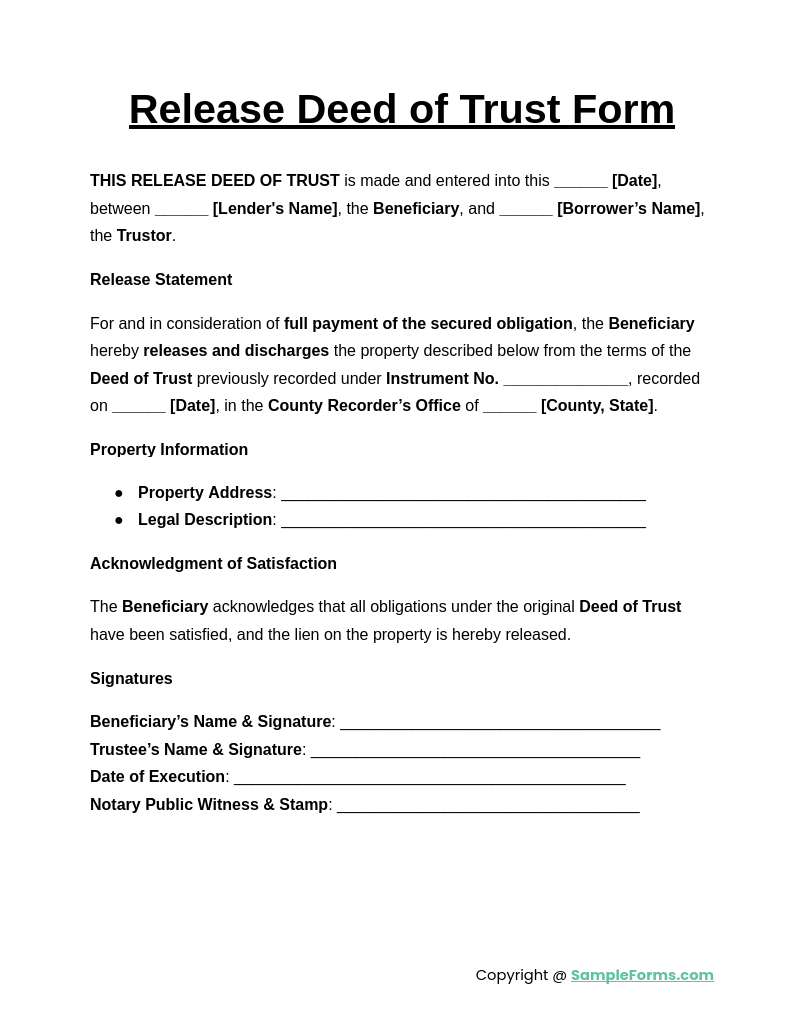

Release Deed of Trust Form

A Release Deed of Trust Form removes the lender’s claim on a property after the loan is paid. Similar to a Grant Deed Form, it provides proof that the borrower has fulfilled all financial obligations.

Deed of Trust Form for Property

A Deed of Trust Form for Property secures real estate financing with a trustee holding legal title. Like a Warranty Deed Form, it ensures the property is legally transferred with financial protections for lenders and borrowers.

Browse More Deed of Trust Forms

Trust Deed Note Form

Trust Deed Release Form

Trust Transfer Deed Form

Blank Deed of Trust Form

Real Estate Deed of Trust Form

Printable Deed of Trust Form

Simple Deed of Trust Form

Deed of Trust Form in PDF

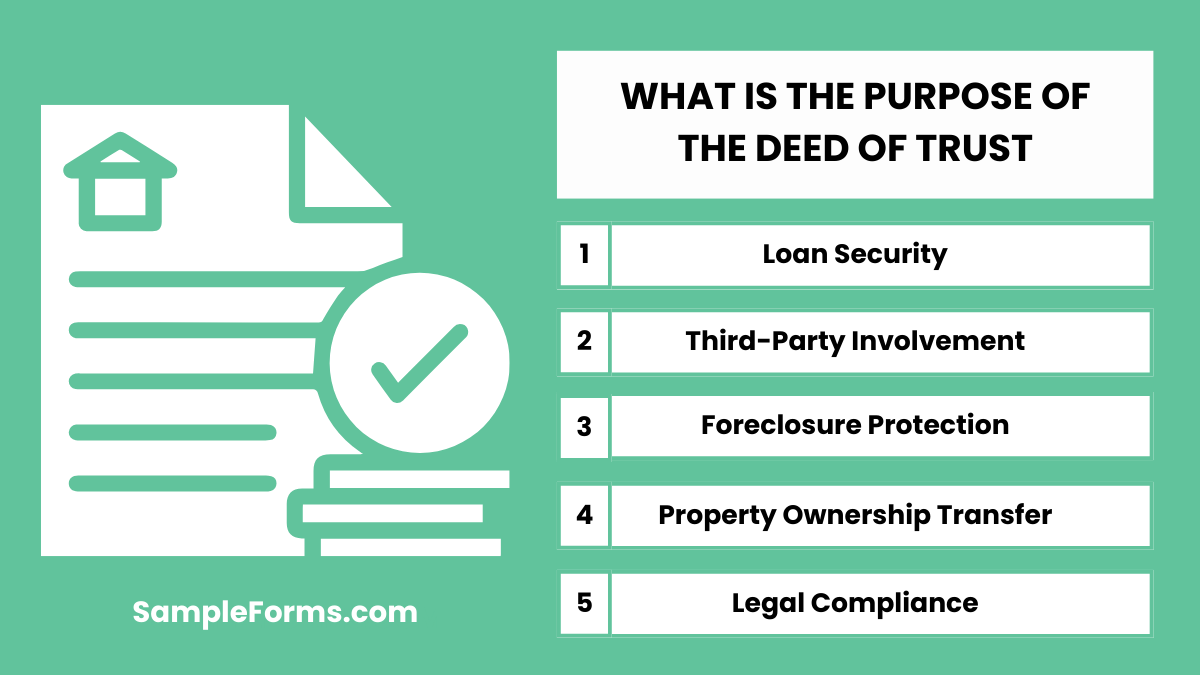

What is the purpose of the deed of trust?

A Deed of Trust Form secures a real estate loan, ensuring the lender’s interest is protected until full repayment. Key purposes include:

- Loan Security – Functions like a Quit Claim Deed Form, ensuring lenders have legal protection until the borrower clears the debt.

- Third-Party Involvement – Involves a neutral trustee who holds the property title until the loan is satisfied.

- Foreclosure Protection – Allows non-judicial foreclosure in case of default, streamlining the process.

- Property Ownership Transfer – Ensures ownership rights remain conditional on loan repayment.

- Legal Compliance – Aligns with real estate laws, protecting both lenders and borrowers.

How do I draft a trust deed?

Drafting a Deed of Trust Form requires legal precision to ensure validity and enforceability. Follow these steps:

- Identify the Parties – Include borrower, lender, and trustee details, similar to a Real Estate Deed Form.

- Define Loan Terms – Clearly state loan amount, interest rate, and repayment schedule.

- Include Property Details – Accurately describe the property being used as security for the loan.

- Outline Default Procedures – Specify actions in case of borrower default, including foreclosure terms.

- Notarize and Record – Have the document signed, notarized, and recorded with the local county office.

What is the disadvantage of a deed of trust?

While a Deed of Trust Form provides security, it has certain drawbacks for borrowers. Key disadvantages include:

- Risk of Foreclosure – Unlike a Deed Release Form, failure to repay results in property loss through foreclosure.

- No Borrower Protection – Unlike judicial foreclosures, non-judicial foreclosures give limited legal recourse to borrowers.

- Limited Negotiation Power – Loan terms are strict, offering little flexibility for borrowers.

- Trustee Control – The trustee holds legal ownership, restricting borrower rights until repayment.

- Higher Interest Rates – Lenders may charge higher rates due to the ease of foreclosure.

What is the use of a trust deed?

A Deed of Trust Form ensures loan security and protects all parties involved in a real estate transaction:

- Protects Lenders – Like a Quitclaim Deed Form, it ensures the lender has a legal claim until the loan is repaid.

- Legal Clarity – Defines the roles of the borrower, lender, and trustee clearly.

- Facilitates Loan Approvals – Helps borrowers secure financing by providing collateral assurance.

- Prevents Fraud – Ensures transactions are legally binding, reducing fraudulent transfers.

- Simplifies Property Transfers – Establishes a clear process for title transfer upon full loan repayment.

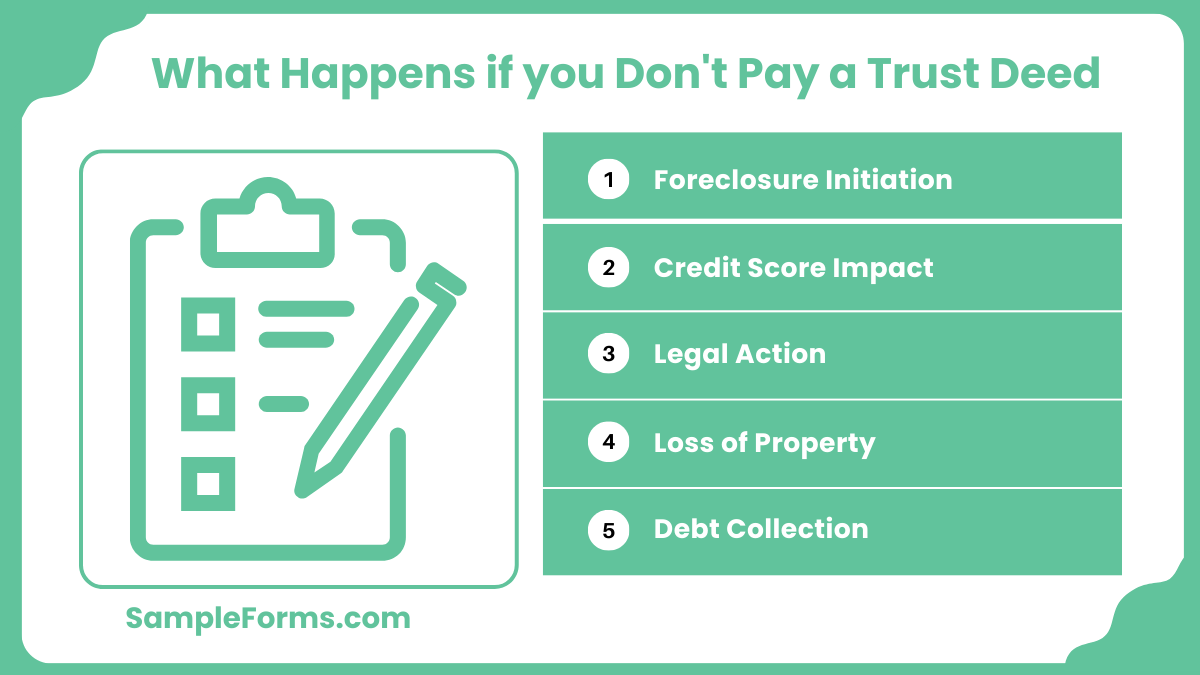

What happens if you don’t pay a trust deed?

Failure to repay a Deed of Trust Form results in legal and financial consequences. The key outcomes include:

- Foreclosure Initiation – Unlike a Quit Deed Form, non-payment leads to foreclosure, transferring ownership to the lender.

- Credit Score Impact – Defaulting severely damages the borrower’s credit rating.

- Legal Action – Lenders may pursue legal claims to recover unpaid amounts.

- Loss of Property – Borrowers lose property rights, as the trustee executes foreclosure.

- Debt Collection – Additional fees, penalties, and collection actions may be imposed.

Can you sell a house with a deed of trust?

Yes, but the loan must be settled first. Similar to a Living Trust Form, the lender’s claim must be cleared before transferring ownership.

Is a deed of trust the same as a title?

No, a Deed of Trust Form secures a loan, while a Trust Agreement Contract Form defines ownership rights. The title represents legal ownership.

Do you have to file a deed of trust?

Yes, it must be recorded with local authorities, just like a Revocable Living Trust Form, to establish legal recognition and enforceability.

Who creates a deed of trust?

The lender or their attorney drafts the document, similar to a Will and Trust Form, ensuring clear terms and loan security.

Are trust deeds safe?

Yes, they provide structured loan security. Like a Legal Petition Form, they offer legal protection but can lead to foreclosure if unpaid.

What document releases a deed of trust?

A Deed of Trust Form is released through a Legal Guardian Form, officially removing the lender’s claim once the debt is repaid.

Which is more important, title or deed?

Both are essential. A Legal Form confirms ownership, while a Deed of Trust Form secures a loan against the property.

Why do people use a deed of trust?

It provides financial security, similar to a Legal Declaration Form, ensuring lenders’ interests are protected until the loan is repaid.

Can a trustee be a beneficiary?

No, a trustee manages the trust, while a beneficiary receives benefits, similar to roles in a Legal Ownership Form.

Who is a deed of trust paid off to?

Payments go to the lender. Once fully paid, a Legal Guardianship Form or release document confirms the debt settlement.

A Deed of Trust Form is a vital tool in real estate, protecting lenders while ensuring borrowers meet their financial obligations. It streamlines loan security by involving a trustee who holds legal ownership until repayment is complete. Whether used for home purchases, refinancing, or securing large loans, this form ensures legal clarity and financial security. Additionally, a Agreement Form can be used alongside a deed of trust to define rental terms for property owners and tenants. Explore our expert templates and resources to create a legally sound deed of trust effortlessly.

Related Posts Here

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form

-

Fund Transfer Form