A Debt Validation Letter is a crucial tool for verifying the legitimacy of a debt before making any payments. It ensures that the creditor provides proof of the debt, including details like the original creditor, outstanding balance, and payment history. A well-drafted Formal Letter and Debt Letter helps individuals dispute inaccuracies and prevent fraudulent collections. This guide provides step-by-step instructions, templates, and expert insights to help you craft a strong request. Whether dealing with credit agencies or debt collectors, knowing your rights can protect you from unfair financial claims.

Download Debt Validation Letter Bundle

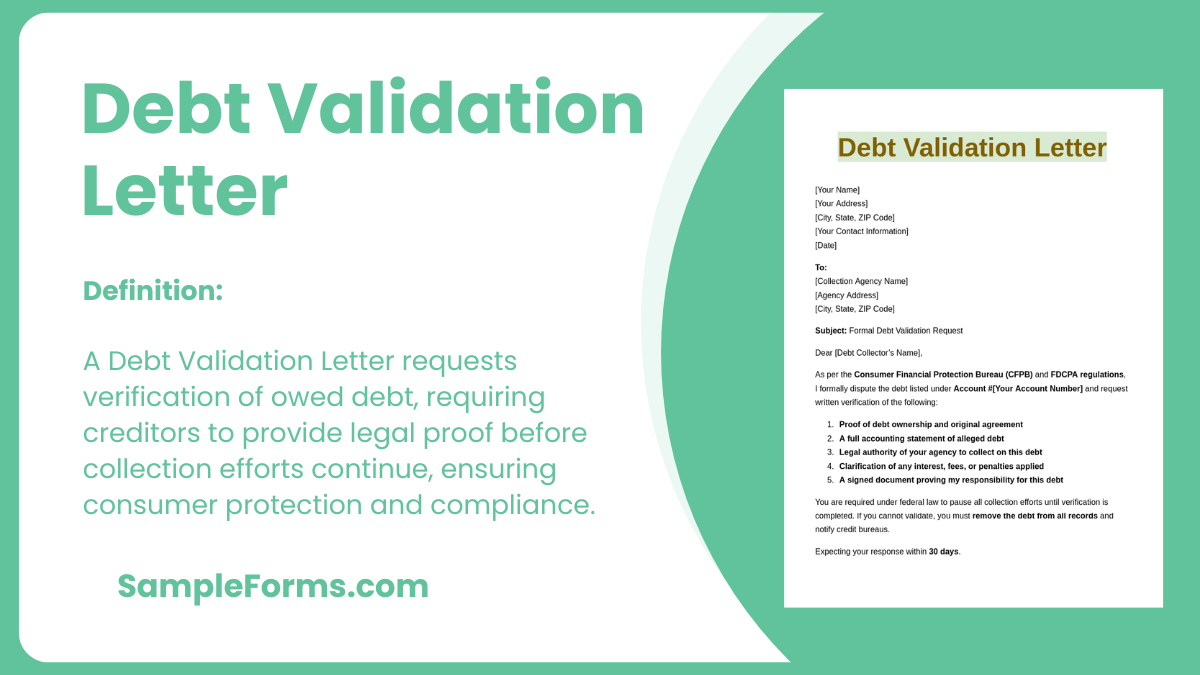

What is Debt Validation Letter?

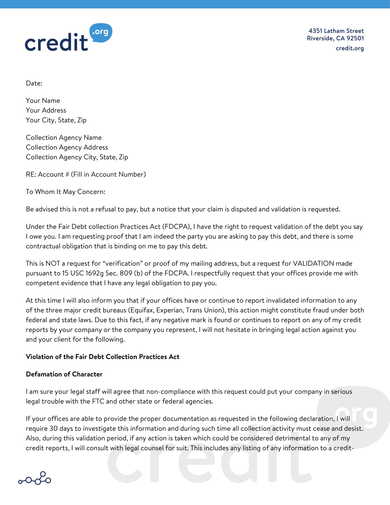

A Debt Validation Letter is a formal request sent to a debt collector asking for proof that the debt is legitimate and legally owed. It forces collectors to provide documentation confirming details like the original creditor, amount due, and payment history. This letter is a consumer’s right under the Fair Debt Collection Practices Act (FDCPA) and can prevent unjust or fraudulent debt collection attempts. By submitting a Debt Validation Letter, individuals can challenge inaccuracies, avoid unnecessary payments, and ensure fair treatment under debt collection laws.

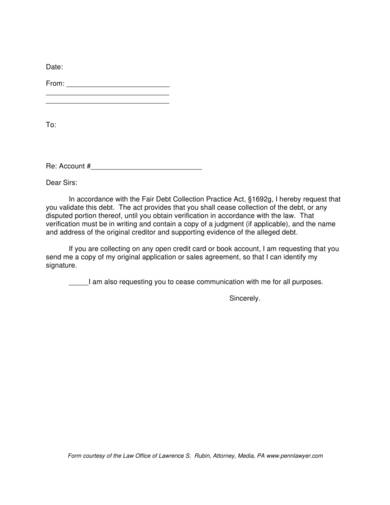

Debt Validation Letter Format

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Contact Information]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Subject: Debt Validation Request

Dear [Creditor’s Name],

I am writing to formally request validation of the alleged debt under the Fair Debt Collection Practices Act (FDCPA). Please provide detailed information, including:

- The original creditor’s name.

- The amount owed with a breakdown of interest and fees.

- Documentation proving you have the legal authority to collect this debt.

- Copies of any signed agreements related to this debt.

- Verification that the debt has not exceeded the statute of limitations.

As per the FDCPA, I request a written response verifying this debt within 30 days. Until proper validation is received, I dispute this debt and request no further collection efforts.

Sincerely,

[Your Full Name]

[Your Signature]

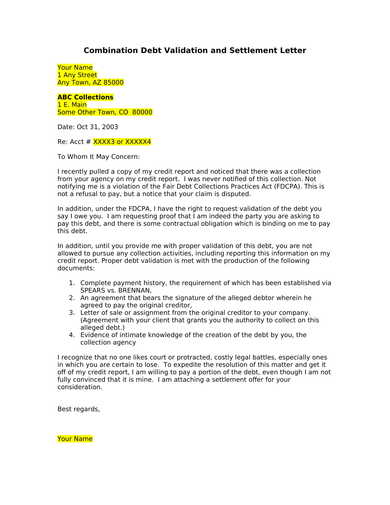

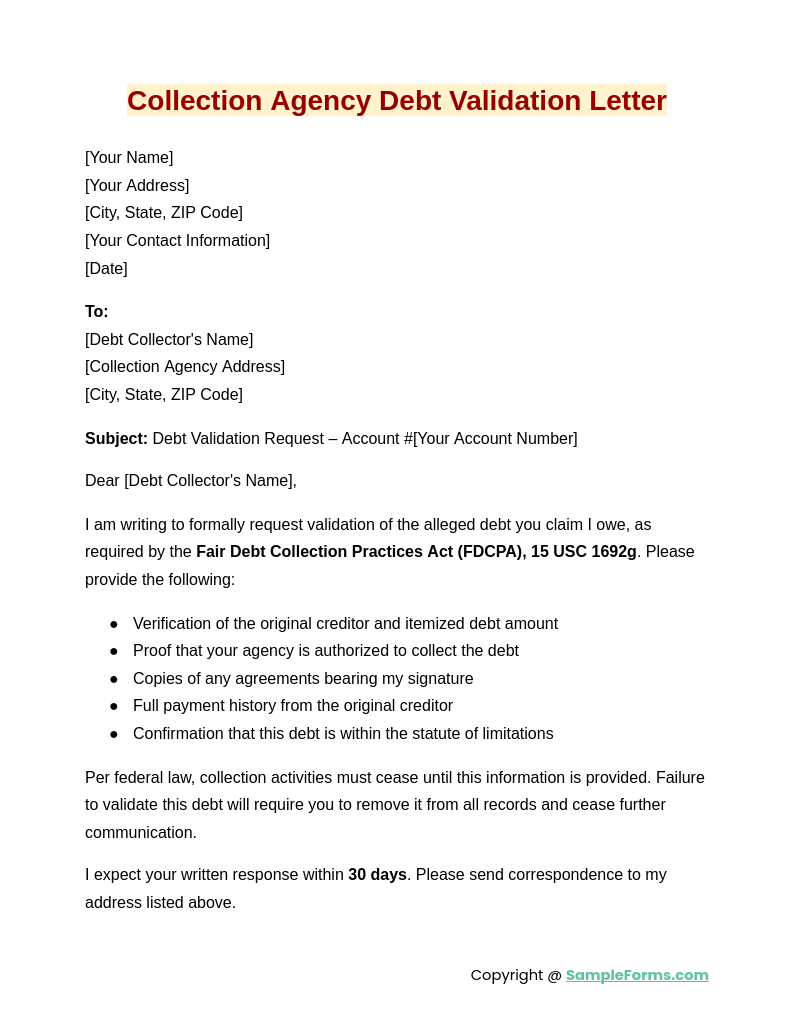

Collection Agency Debt Validation Letter

A Collection Agency Debt Validation Letter requests proof of a debt from collectors before making payments. Similar to a Letter of Application Form, it ensures transparency by requiring verification of the original debt details, creditor information, and payment records.

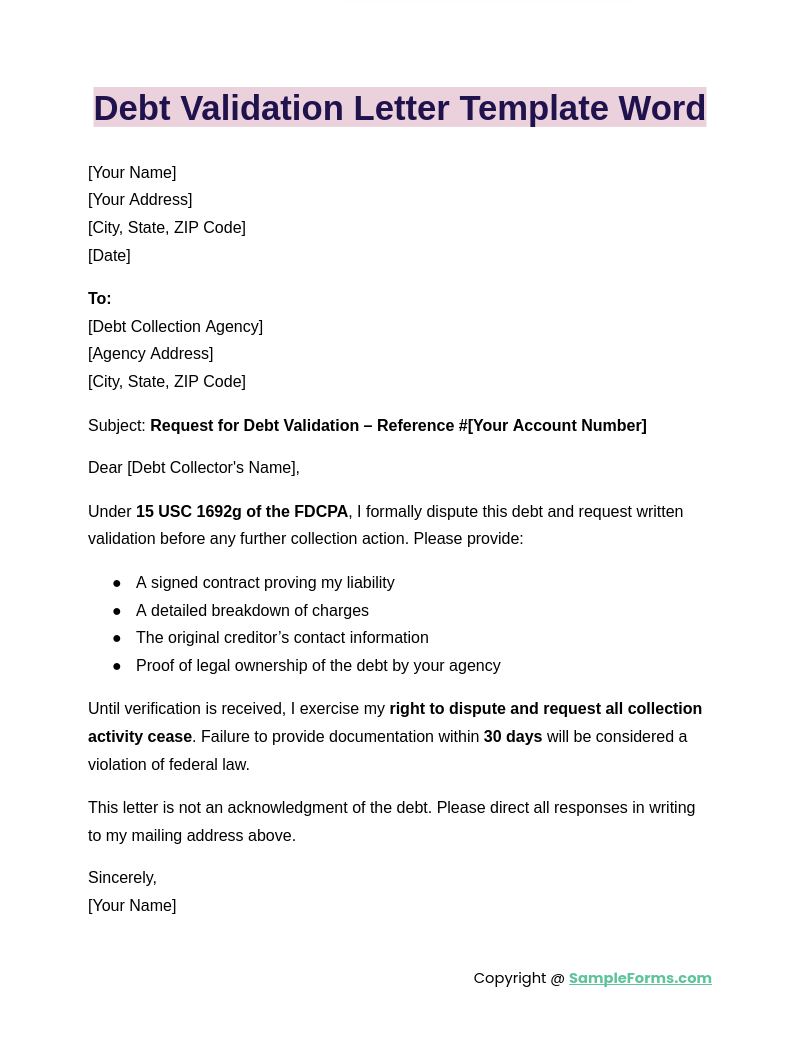

Debt Validation Letter Template Word

A Debt Validation Letter Template Word provides a pre-formatted document to dispute or verify debt claims. Like an Authorization Letter, it grants individuals the ability to formally request documentation proving the validity of a debt before proceeding with payments.

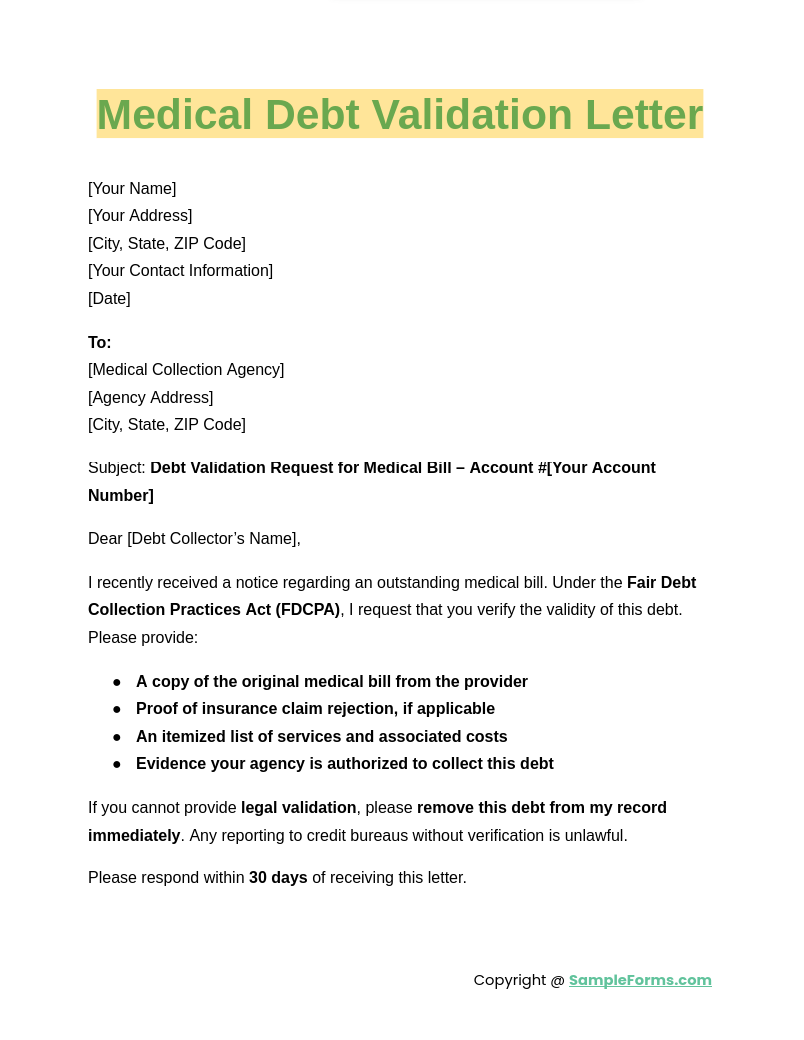

Medical Debt Validation Letter

A Medical Debt Validation Letter helps confirm medical bill accuracy and prevent wrongful charges. Similar to a Letter of Consent, it formally requests verification from healthcare providers or debt collectors to ensure all medical expenses are legitimate and correctly billed.

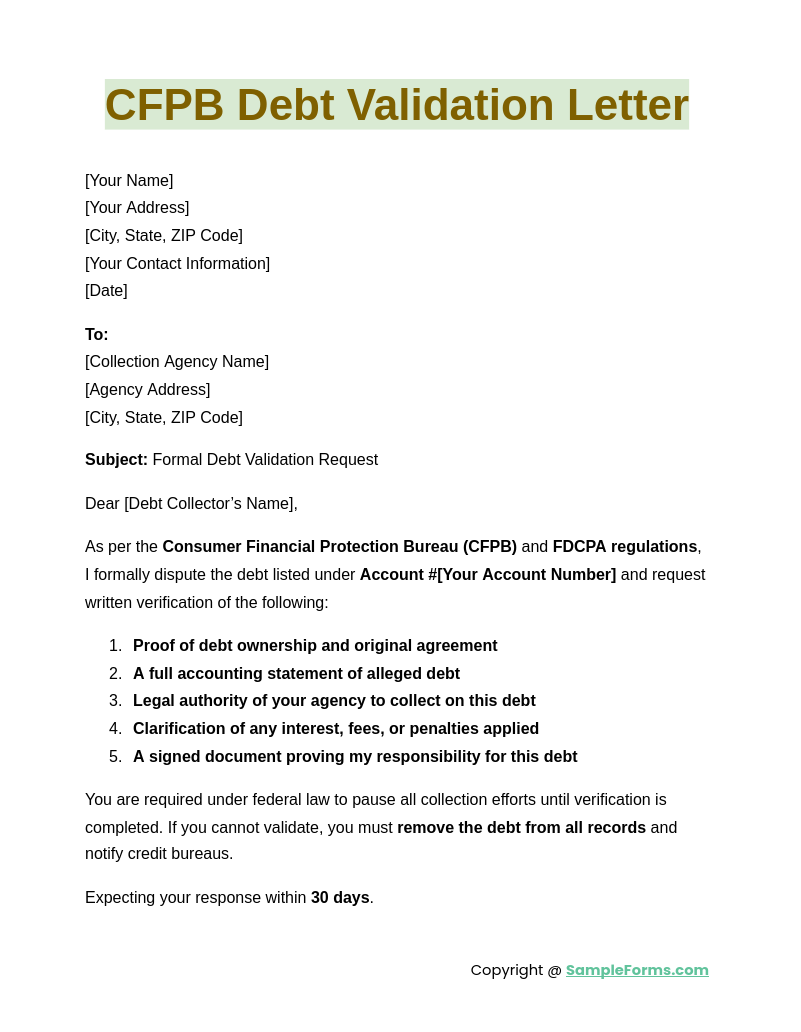

CFPB Debt Validation Letter

A CFPB Debt Validation Letter follows Consumer Financial Protection Bureau (CFPB) guidelines to challenge debt collection claims. Like a Reference Letter, it demands proof of the original debt, ensuring consumers are not paying fraudulent or inaccurate financial obligations.

List of Debt Validation Letters

Basic Debt Validation Letter

Credit Debt Validation Letter

Debt Validation and Settlement Letter

Debt Validation Letter in DOC

Debt Validation Letter Template Sample

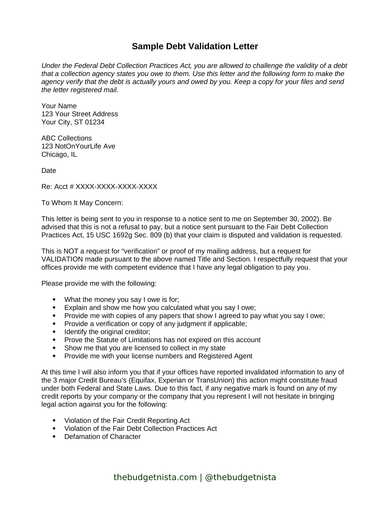

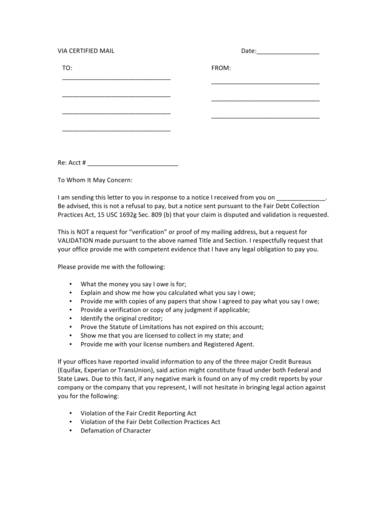

Sample Debt Validation Letter

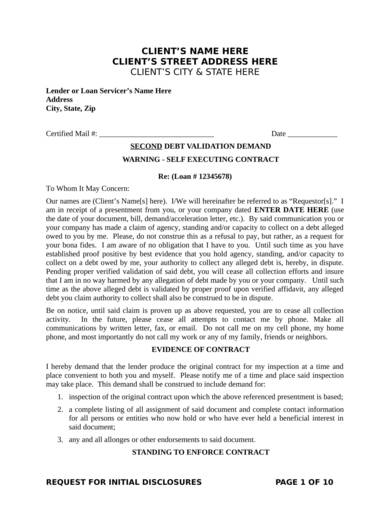

Second Debt Validation Demand Letter

How do I write a letter of debt validation?

A Debt Validation Letter formally requests proof of a debt’s legitimacy from collectors, ensuring compliance with legal requirements before making payments.

- Include Personal Information: Provide your full name, address, and account number, similar to a Letter of Intent for proper identification.

- Request Debt Details: Ask for proof of the original creditor, amount owed, and debt ownership.

- Cite Legal Rights: Mention the Fair Debt Collection Practices Act (FDCPA) to enforce compliance.

- Avoid Admissions: Do not acknowledge the debt or agree to payments until verified.

- Send via Certified Mail: Ensure a paper trail for legal protection and proof of submission.

What happens if you never received a debt validation letter?

If a debt collector fails to send a Debt Validation Letter, they cannot legally continue collection efforts under FDCPA regulations.

- Request Again in Writing: Submit a second request, similar to a Job Acceptance Letter, to confirm formal communication.

- Dispute the Debt: If no response, report the collector for violating consumer rights.

- Check Your Credit Report: Ensure the debt is not wrongly listed, affecting your score.

- File a Complaint: Contact the Consumer Financial Protection Bureau (CFPB) if the collector refuses compliance.

- Consider Legal Action: Seek attorney advice if harassment or violations continue.

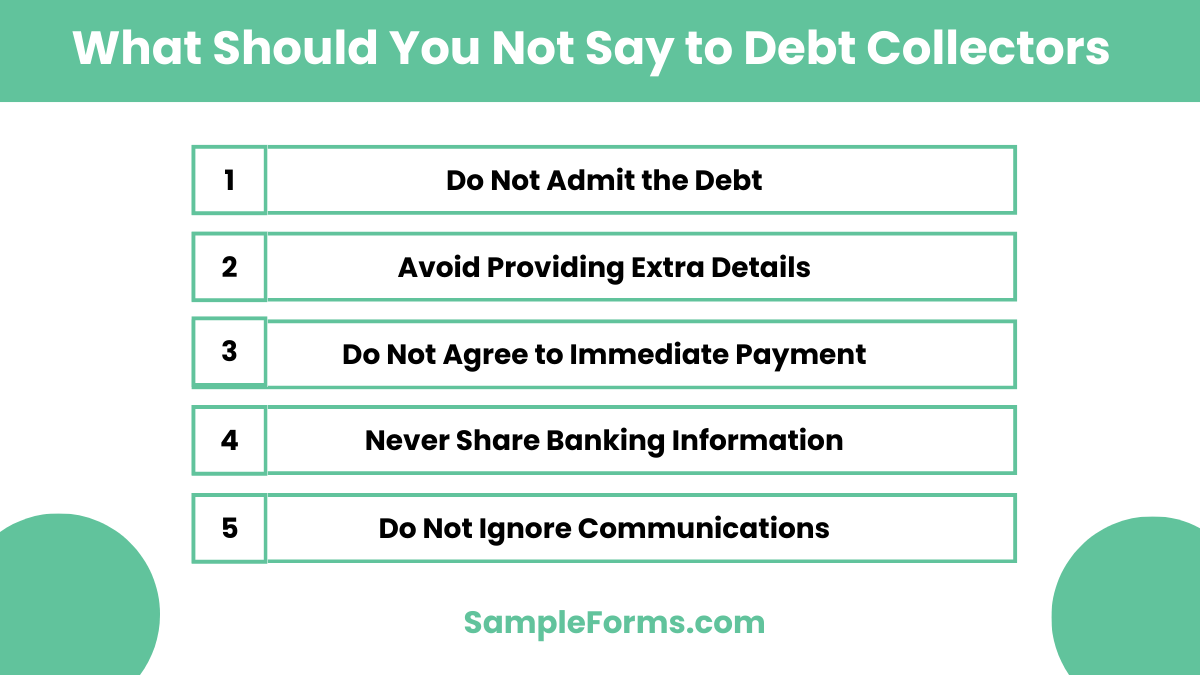

What should you not say to debt collectors?

Avoid giving unnecessary information or making commitments before verifying debt validity through a Debt Validation Letter.

- Do Not Admit the Debt: Never acknowledge or agree to pay before validation, similar to handling a Letter of Authorization.

- Avoid Providing Extra Details: Only discuss what is necessary and legally required.

- Do Not Agree to Immediate Payment: Ensure proper verification before making financial commitments.

- Never Share Banking Information: Protect personal financial details from potential scams.

- Do Not Ignore Communications: Respond professionally but assertively to protect your rights.

What if the creditor cannot validate the debt?

If the creditor fails to validate a debt, they must cease collection efforts immediately under federal law.

- Send a Written Dispute: Request confirmation that collection attempts will stop, similar to a Job Recommendation Letter for formal documentation.

- Check Credit Reports: Ensure the debt is not reported if it remains unvalidated.

- Request Debt Removal: Ask for deletion from all financial records due to lack of proof.

- Monitor Future Collection Attempts: If they persist, consider legal action.

- Know Your Rights: Debt collectors cannot harass or threaten if they fail to validate the claim.

How effective is a debt validation letter?

A Debt Validation Letter is a powerful tool for disputing and verifying debt claims, protecting consumers from unfair collection practices.

- Stops Unverified Collections: Forces collectors to prove debt legitimacy, similar to a Proof of Employment Letter confirming job status.

- Prevents Credit Score Damage: Ensures only valid debts appear on credit reports.

- Eliminates Fraudulent Claims: Helps identify and dispute fake or mistaken debts.

- Protects Against Legal Action: Prevents wrongful lawsuits for unverified debt.

- Empowers Consumers: Strengthens financial control and legal standing in debt disputes.

Do debt validation letters really work?

Yes, a Debt Validation Letter forces collectors to prove a debt’s legitimacy. Like a Two Week Notice Letter, it legally protects consumers by ensuring accurate debt claims before payment.

How long does the validation period last?

Debt collectors must provide validation within 30 days of receiving a request. Similar to a Letter of Recommendation for Employment, it confirms legitimacy before further action.

How long before a debt becomes uncollectible?

The statute of limitations varies by state, typically 3-10 years. Like a Letter of Interest, timing determines whether legal action can still be pursued.

Do debt collectors have to prove you owe?

Yes, they must provide written proof. Similar to a Complaint Letter, a Debt Validation Letter challenges inaccuracies and protects consumer rights.

Can you dispute a debt if it was sold to a collection agency?

Yes, debts sold to agencies can still be disputed. Like a College Letter of Recommendation, documentation is essential for verifying legitimacy.

What is the next step after debt validation letter?

If collectors validate the debt, review their proof. If not, dispute further. Similar to a Donation Letter, it ensures clarity in financial transactions.

How long does a debt collector have to send a validation letter?

Collectors must send a Debt Validation Letter within five days of initial contact, much like an Appeal Letter ensures timely responses.

How do you respond to debt validation?

Review their proof carefully. If incorrect, dispute with evidence, similar to a Job Offer Acceptance Letter, ensuring formal communication and clarity.

What is a letter to a collection agency to validate debt?

A Debt Validation Letter requests proof of a debt’s legitimacy, like a Business Letter, ensuring proper documentation and compliance with laws.

How long before a debt becomes uncollectible?

A debt becomes uncollectible once the statute of limitations expires, similar to a Teacher Resignation Letter marking the end of obligations.

collection. It helps verify the accuracy of claims and ensures compliance with legal standards. This guide offers detailed examples to help you navigate the process confidently. Whether disputing a mistake or requesting proof, understanding how to use this letter effectively is essential. Similar to a Debt Collection Letter, it plays a vital role in managing financial obligations responsibly. Taking the right steps can safeguard your rights and prevent fraudulent debt claims.

Related Posts

-

Nursing RN Resignation Letter

-

MBA Recommendation Letter

-

Security Deposit Return Letter

-

FREE 5+ Fraternity Recommendation Letters in PDF

-

Audit Response Letter

-

Medical School Recommendation Letter

-

Law School Recommendation Letter

-

FREE 9+ Paralegal Recommendation Letters in PDF | MS Word

-

FREE 9+ Professional Recommendation Letters in PDF | MS Word

-

FREE 5+ Employment Resignation Letters in PDF

-

Official Resignation Letter

-

Character Reference Letter for Immigration

-

Job Recommendation Letter

-

Tenant Recommendation Letter