A Debt Validation Letter is a powerful tool for verifying and managing outstanding financial obligations. This guide provides a detailed roadmap for creating professional and effective debt letters for various purposes, such as validation, settlement, or acknowledgment. Learn how to structure your letter, include essential details, and ensure legal compliance to protect your rights and simplify debt resolution. With clear examples and actionable advice, this guide empowers you to communicate effectively with creditors and take control of your financial situation. Whether you’re disputing a debt or confirming terms, our comprehensive guide has you covered.

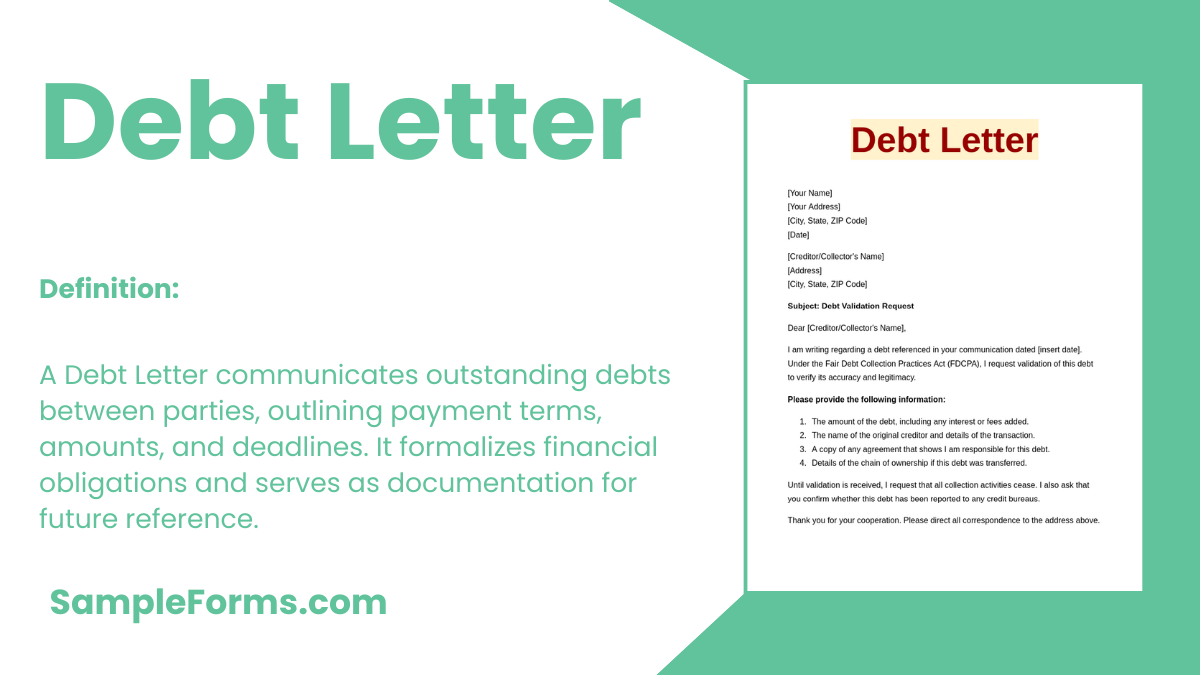

What is Debt Letter?

A Debt Letter is a formal communication between a debtor and a creditor that addresses financial obligations, such as outstanding payments or payment plans. It serves as an official record, providing details like the amount owed, due dates, and any agreed terms. Debt letters can be used for validation, settlement requests, or reminders to ensure clarity and accountability in financial dealings. Written professionally, they help resolve disputes, negotiate terms, and maintain transparency in debt-related matters.

Debt Letter Format

[Your Name]

[Your Address]

[Date]

[Recipient’s Name]

[Recipient’s Address]

Subject: Notification of Outstanding Debt

Dear [Recipient’s Name],

This letter serves as formal notice of an outstanding debt of [amount].

- Loan/Invoice Number: _______________________________

- Transaction Date: _______________________________

- Amount Due: _______________________________

- Due Date: _______________________________

Please arrange payment by [date]. Contact me at [your contact] for questions.

Sincerely,

[Your Name]

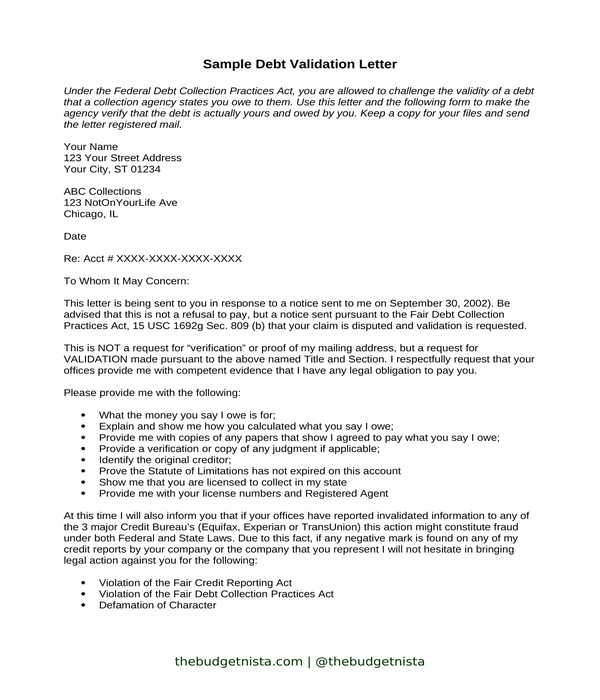

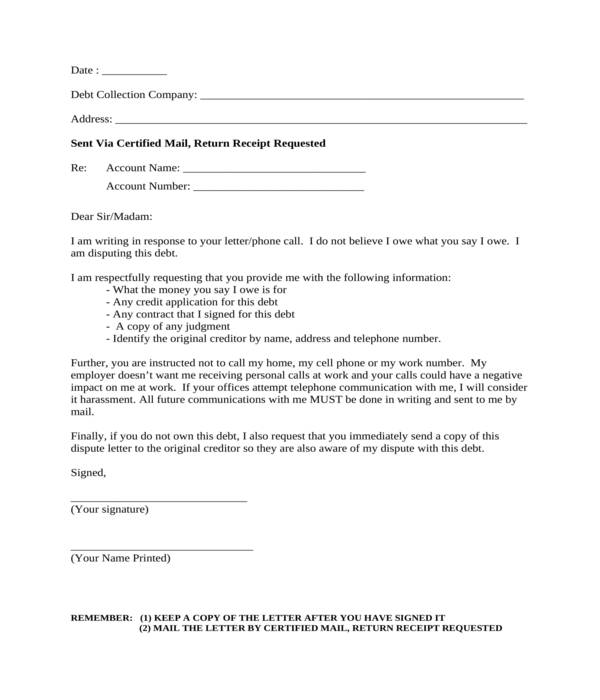

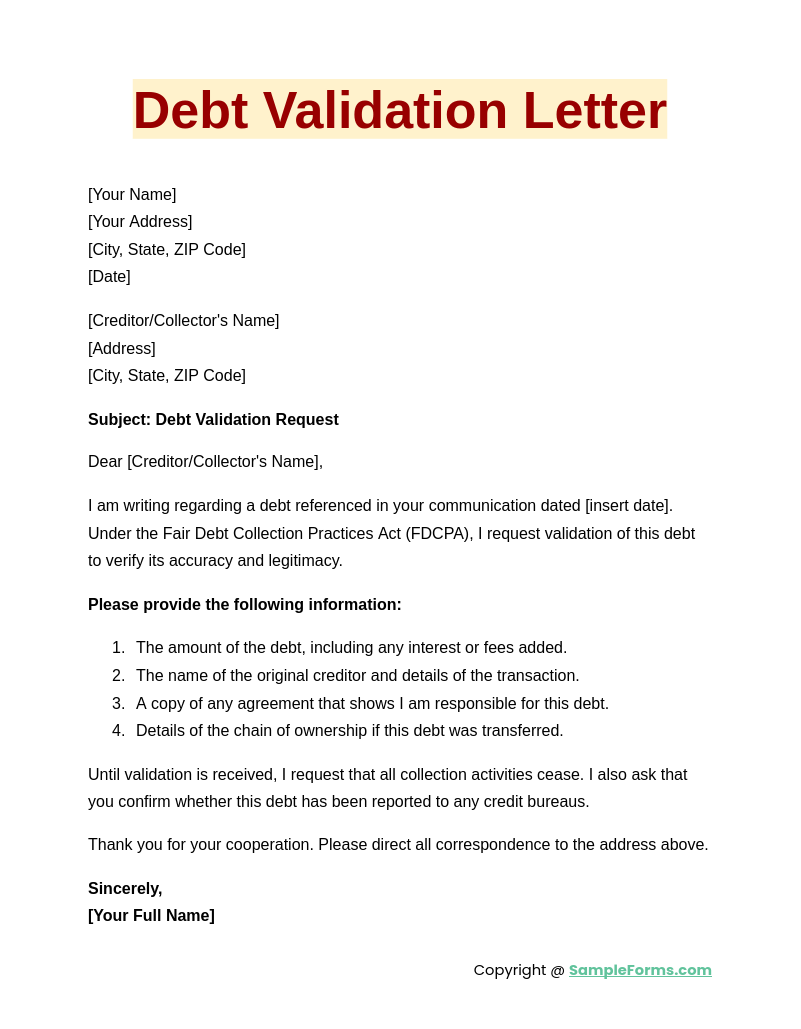

Debt Validation Letter

A Debt Validation Letter ensures that a debt is verified by the creditor. Similar to a Debt Collection Letter, it protects consumers by requesting proof of the debt’s validity.

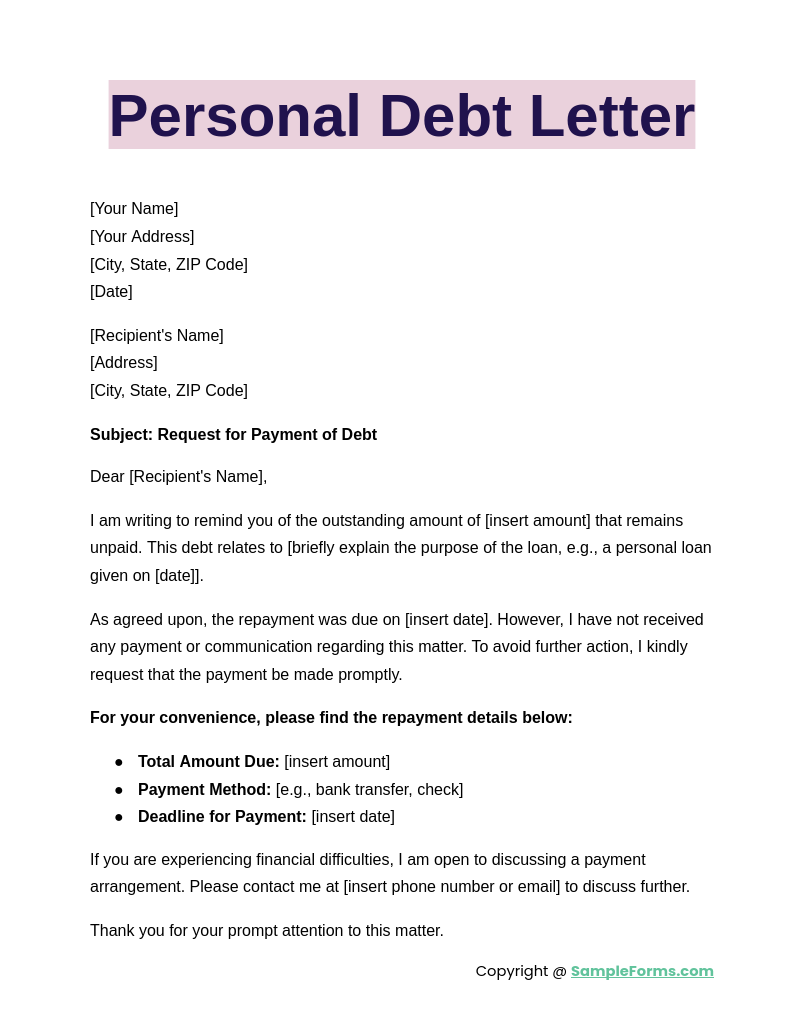

Personal Debt Letter

A Personal Debt Letter communicates the details of a private loan or financial obligation. Like a Letter of Application Form, it outlines the amount, terms, and repayment schedule in clear, professional language.

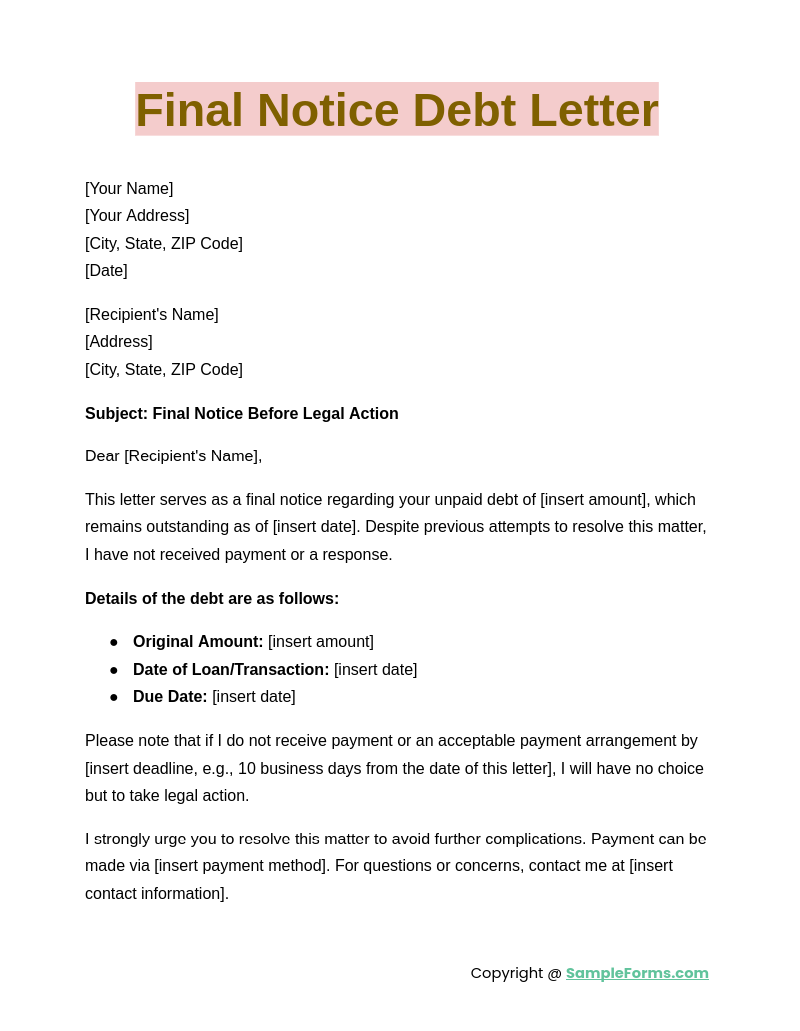

Final Notice Debt Letter

A Final Notice Debt Letter serves as the last communication before pursuing legal or collection action. Comparable to an Authorization Letter, it confirms the debt’s legitimacy and urges immediate payment to avoid further consequences.

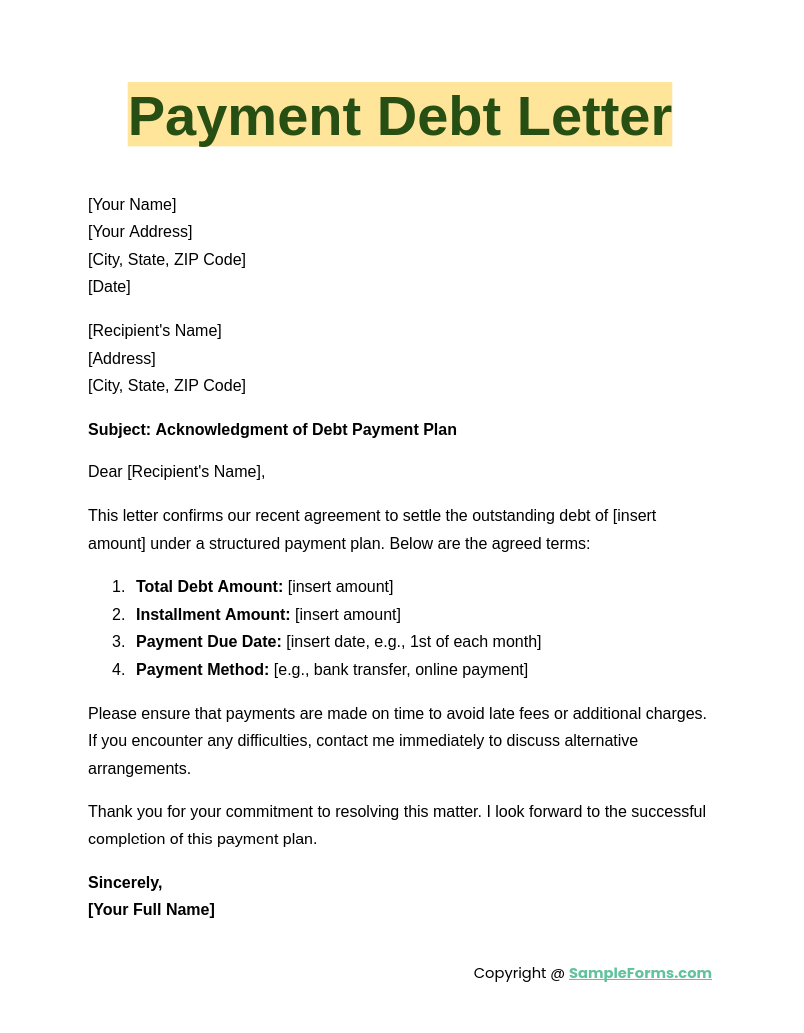

Payment Debt Letter

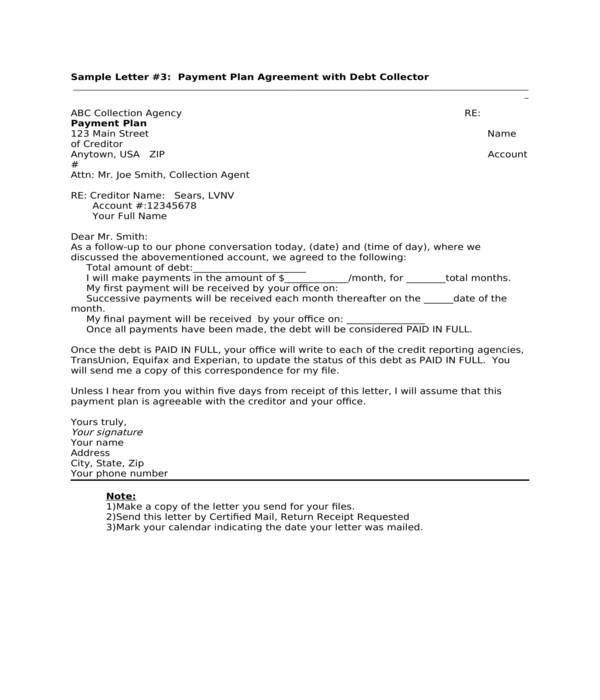

A Payment Debt Letter acknowledges or confirms a payment plan for settling an outstanding debt. Similar to a Letter of Resignation, it must be precise and formal, clearly detailing payment terms and responsibilities for both parties.

Browse More Debt Letters

Debt Validation Letter

Types of Debt Letter Templates

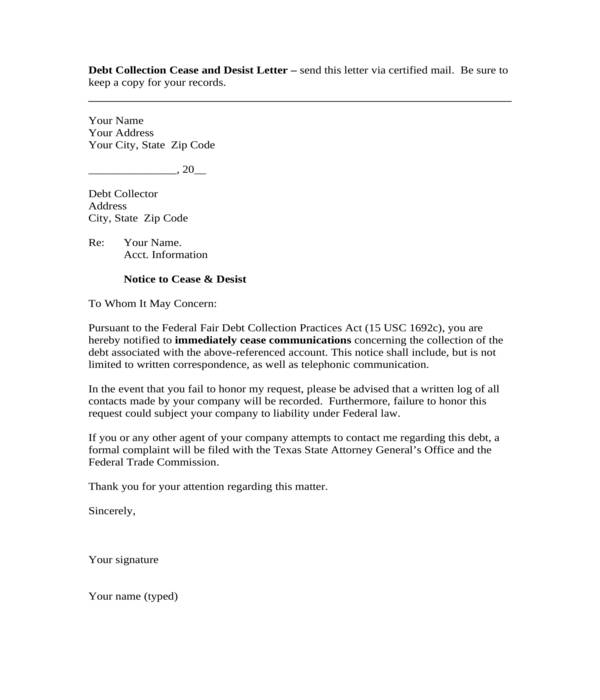

Debt Collection Cease and Desist Letter

Debt Collection Letter

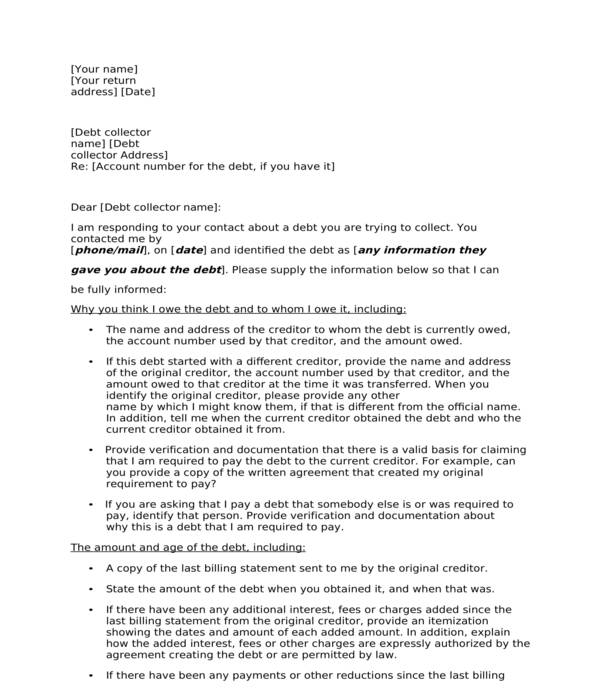

Debt Dispute and Validation Letter

Debt Information Letter

Debt Payment Plan Agreement Letter

Debt Collector Letter

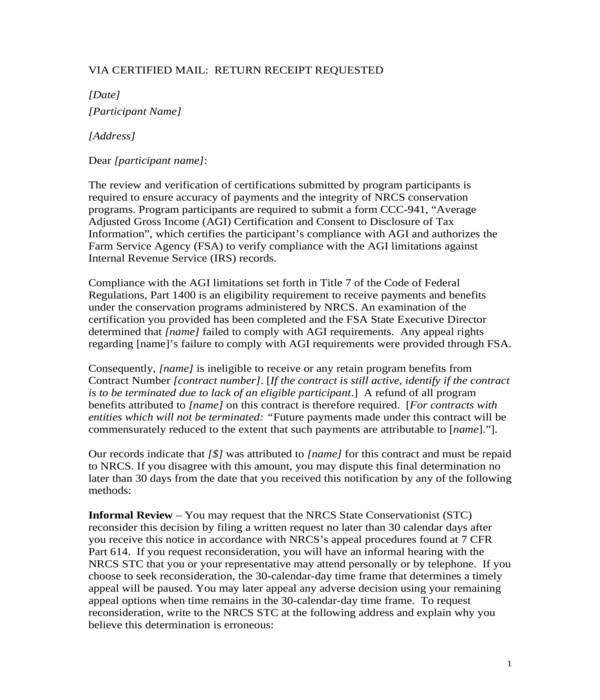

How do I write a proof of debt letter?

A proof of debt letter confirms the validity of a debt. Like a Letter of Authorization, it requires precise details for accuracy.

- State Your Intentions: Begin with a clear purpose of the letter, such as debt validation or confirmation.

- Provide Personal Information: Include your full name, address, and any reference numbers associated with the debt.

- Request Specific Details: Ask for the creditor’s name, original debt amount, payment history, and proof of ownership.

- Attach Supporting Documents: Include any receipts, agreements, or correspondences related to the debt.

- Conclude Professionally: End with a formal statement requesting timely feedback and your contact details.

How do you deal with debt letters?

Managing debt letters requires strategic communication and prompt action. Similar to a Letter of Consent, it necessitates clarity and professionalism.

- Review the Letter: Carefully read the letter to understand its purpose, amount due, and deadlines.

- Validate the Debt: Verify the debt’s legitimacy by requesting a validation letter from the creditor.

- Negotiate Payment: If valid, negotiate a manageable payment plan with the creditor.

- Seek Professional Advice: Consult a financial advisor or lawyer for complex cases.

- Document Everything: Keep records of all communications for future reference.

What happens if you never received a debt validation letter?

Not receiving a debt validation letter complicates matters but doesn’t nullify the debt. Like a Reference Letter, it’s crucial for clarity.

- Contact the Creditor: Request a validation letter immediately upon realizing its absence.

- Document Communications: Keep records of every interaction for your protection.

- Verify Legality: Ensure the creditor followed legal processes under debt collection laws.

- Dispute the Debt: If the debt seems incorrect, submit a formal dispute letter.

- Seek Legal Assistance: Engage a legal expert to review your rights and take necessary actions.

How to get rid of debt collectors without paying?

Eliminating debt collectors without payment is rare but possible through legitimate means. Similar to a Letter of Intent, the process must be intentional and structured.

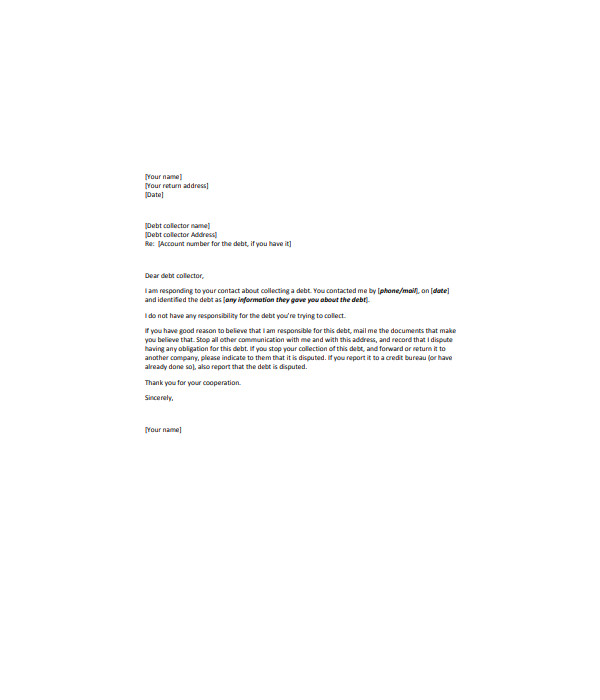

- Dispute the Debt: If the debt is inaccurate, formally dispute it with the collection agency.

- Request Validation: Ask the collector to provide proof of the debt’s authenticity.

- Check the Statute of Limitations: Confirm whether the debt is legally enforceable based on its age.

- Seek Legal Protection: Use consumer protection laws to avoid harassment or unfair practices.

- Negotiate for Settlement: Consider settling for a lesser amount to close the case amicably.

What happens if I ignore debt collection letters?

Ignoring debt collection letters can escalate the situation. Similar to a Formal Letter, addressing the issue early demonstrates responsibility.

- Increased Collection Efforts: Ignoring letters leads to persistent collection attempts.

- Negative Credit Impact: Unpaid debts can significantly harm your credit score.

- Legal Consequences: Creditors may file lawsuits to recover the debt.

- Wage Garnishment: Court orders may lead to deductions from your wages.

- Loss of Negotiation Opportunities: Ignoring letters removes the chance to settle the debt favorably.

What is a proof of debt?

A proof of debt is a document confirming an obligation to repay a debt. Similar to a Proof of Employment Letter, it establishes credibility and details repayment terms.

What’s the worst a debt collector can do?

Debt collectors can sue, garnish wages, or report delinquent accounts to credit bureaus. However, they must follow legal protocols like sending a Two Week Notice Letter.

Will a debt collector sue me for $500?

Yes, debt collectors may sue for small amounts like $500, especially if it’s profitable, similar to handling a Letter of Recommendation for Employment formally.

How long before a debt becomes uncollectible?

Debt typically becomes uncollectible after the statute of limitations expires. Like a Letter of Interest, the timeframe depends on state laws and varies widely.

Can you dispute a debt if it was sold to a collection agency?

Yes, you can dispute sold debts. Provide written notice, akin to a Complaint Letter, to demand proof and clarify inaccuracies.

Can I write a letter to get out of debt?

Yes, drafting a settlement or hardship letter helps reduce or manage debts. A College Letter of Recommendation style approach ensures professionalism and clarity.

Do debt collectors have to prove you owe?

Yes, collectors must validate debts upon request. Similar to a Donation Letter, their proof must include clear details of the amount and source.

What not to tell a debt collector?

Avoid admitting responsibility or providing personal financial details, similar to how a Appeal Letter maintains precision and professionalism.

What happens if I don’t respond to a debt collector letter?

Ignoring a debt letter leads to potential legal action or credit damage. Like a Job Offer Acceptance Letter, timely responses prevent negative consequences.

Do debt collectors give up?

Debt collectors rarely give up, but persistence varies by agency. Comparable to writing a Business Letter, responses should be strategic and factual.

A Debt Letter is an essential tool for managing financial obligations efficiently. From drafting letters, use to ensuring proper communication, it simplifies the debt resolution process. Similar to a Thank You Letter for Donation, it emphasizes clarity, professionalism, and accountability. Whether you’re validating, settling, or addressing overdue payments, a well-structured debt letter ensures effective communication and fosters trust between parties. This guide equips you with practical tips and detailed examples to handle debt-related correspondence confidently and successfully.

Related Posts

-

Nursing RN Resignation Letter

-

MBA Recommendation Letter

-

Security Deposit Return Letter

-

FREE 5+ Fraternity Recommendation Letters in PDF

-

Audit Response Letter

-

Medical School Recommendation Letter

-

Law School Recommendation Letter

-

FREE 9+ Paralegal Recommendation Letters in PDF | MS Word

-

FREE 9+ Professional Recommendation Letters in PDF | MS Word

-

FREE 5+ Employment Resignation Letters in PDF

-

Official Resignation Letter

-

Character Reference Letter for Immigration

-

Job Recommendation Letter

-

Tenant Recommendation Letter