Managing cash flow is critical for any business, and a Daily Cash Report makes it simple. This guide explores the purpose, creation, and use of a Daily Report Form to track inflows, outflows, and cash balances accurately. Learn how these reports serve as essential tools for maintaining transparency, detecting discrepancies, and ensuring financial accountability. Whether you’re managing a small business or large organization, understanding these reports can significantly enhance your operational efficiency. Dive in for examples, tips, and step-by-step guidance to create effective reports tailored to your needs.

Download Daily Cash Report Bundle

What is Daily Cash Report?

A Daily Cash Report records daily financial transactions, including income, expenses, and cash balances. It ensures accurate cash flow tracking and identifies discrepancies early. These reports are vital for businesses to maintain financial transparency and accountability. They include details like opening balances, daily transactions, and closing balances, offering a clear snapshot of financial health. By using a structured format, businesses can streamline reporting processes and focus on strategic decision-making.

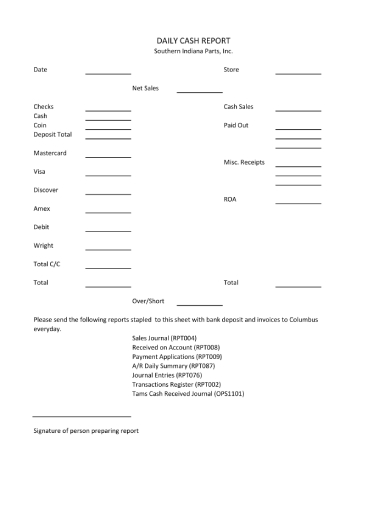

Daily Cash Report Format

Report Details

Report Date: ___________________

Prepared By: ___________________

Branch/Location: ___________________

Opening Cash Balance: ___________________

Cash Inflows

Source 1: ___________________ Amount: ___________________

Source 2: ___________________ Amount: ___________________

Source 3: ___________________ Amount: ___________________

Other Sources (specify):

Total Cash Inflows: ___________________

Cash Outflows

Expense 1: ___________________ Amount: ___________________

Expense 2: ___________________ Amount: ___________________

Expense 3: ___________________ Amount: ___________________

Additional Expenses (specify):

Total Cash Outflows: ___________________

Closing Cash Balance

Calculated Balance: ___________________

Cash on Hand: ___________________

Discrepancy (if any): ___________________

Approval and Verification

Verified By: ___________________ Signature: _______________

Approved By: ___________________ Signature: ______________

Additional Notes:

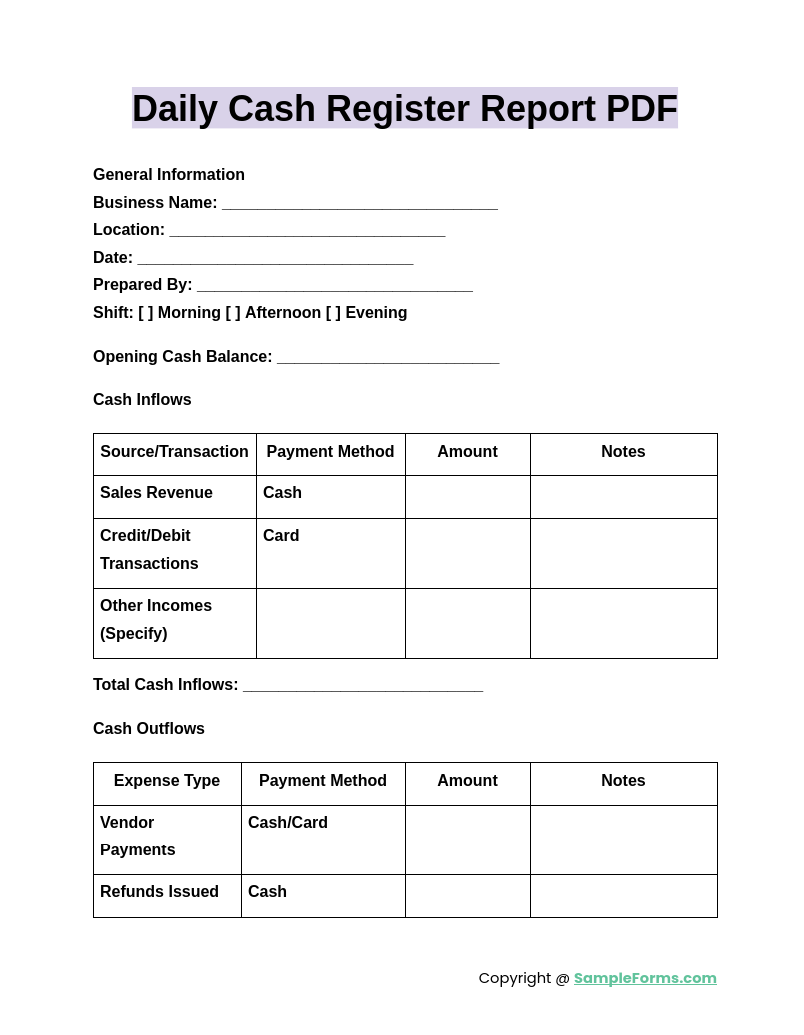

Daily Cash Register Report PDF

A Daily Cash Register Report PDF provides a structured way to document all cash transactions at the register. Similar to a Daily Cash Log, it records opening balances, sales, expenses, and closing balances for accurate reconciliation.

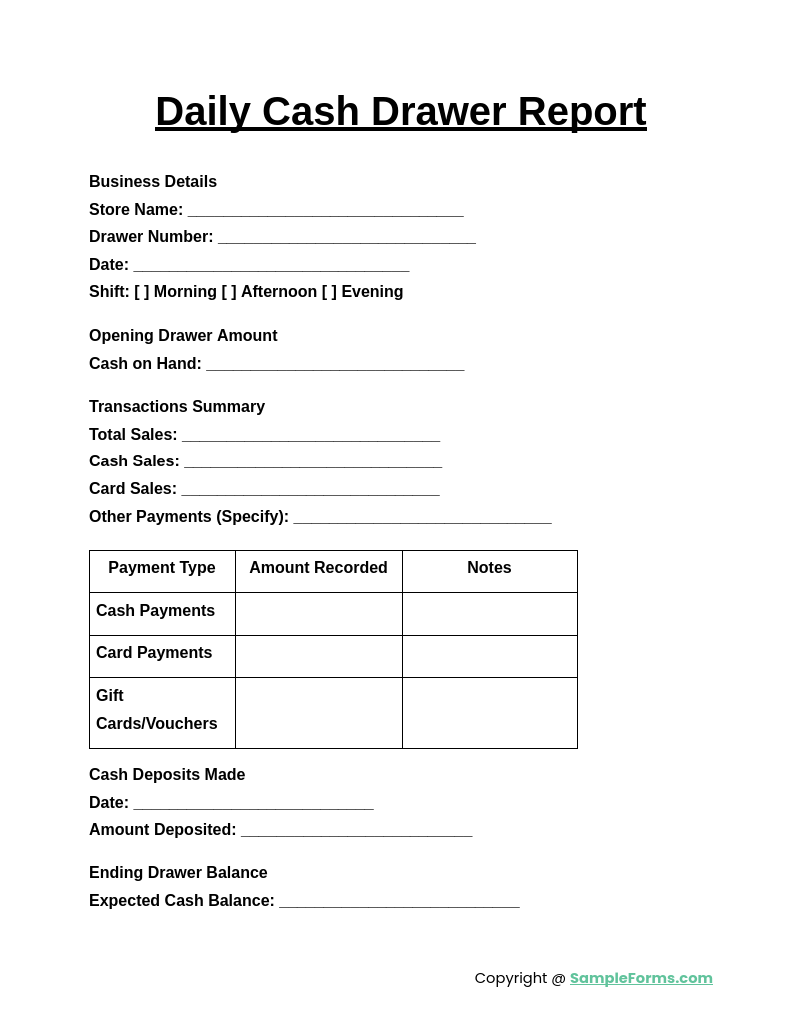

Daily Cash Drawer Report

A Daily Cash Drawer Report ensures accurate tracking of cash inflows and outflows for each drawer. Similar to a Joining Report Form, it ensures transparency by verifying balances before and after each shift or transaction cycle.

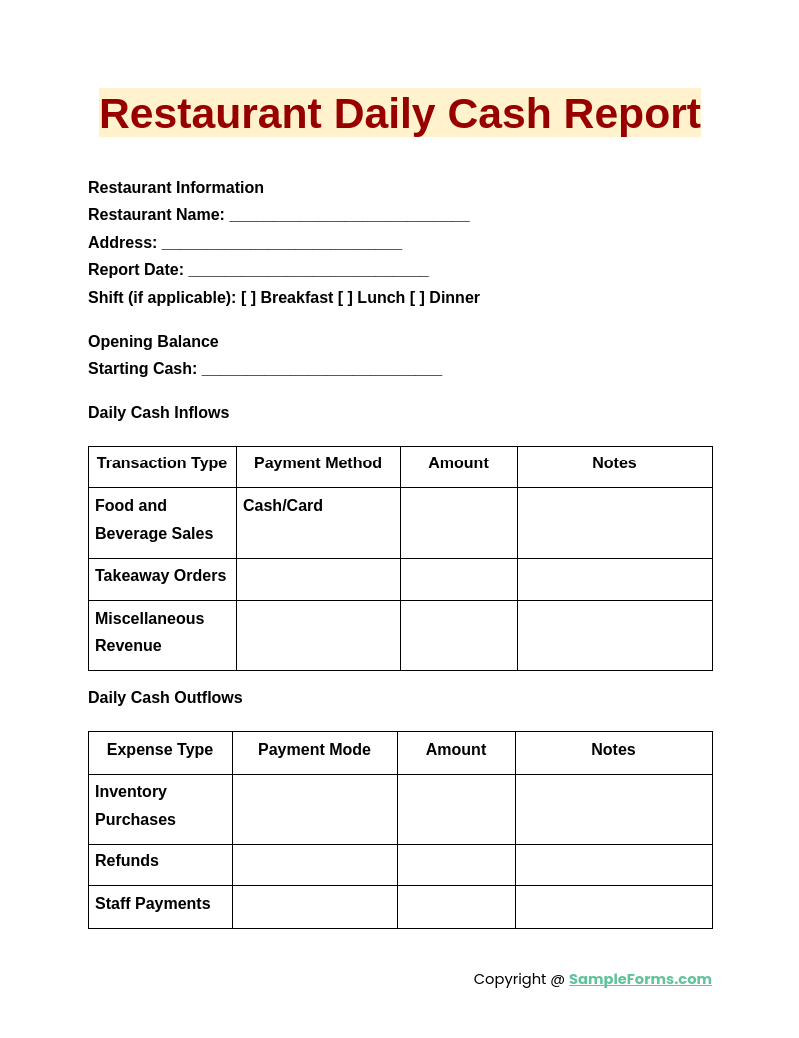

Restaurant Daily Cash Report

A Restaurant Daily Cash Report focuses on documenting cash sales, tips, and operational expenses. Similar to a Medical Report Form, it offers detailed insights into performance, helping owners and managers make informed decisions for financial health.

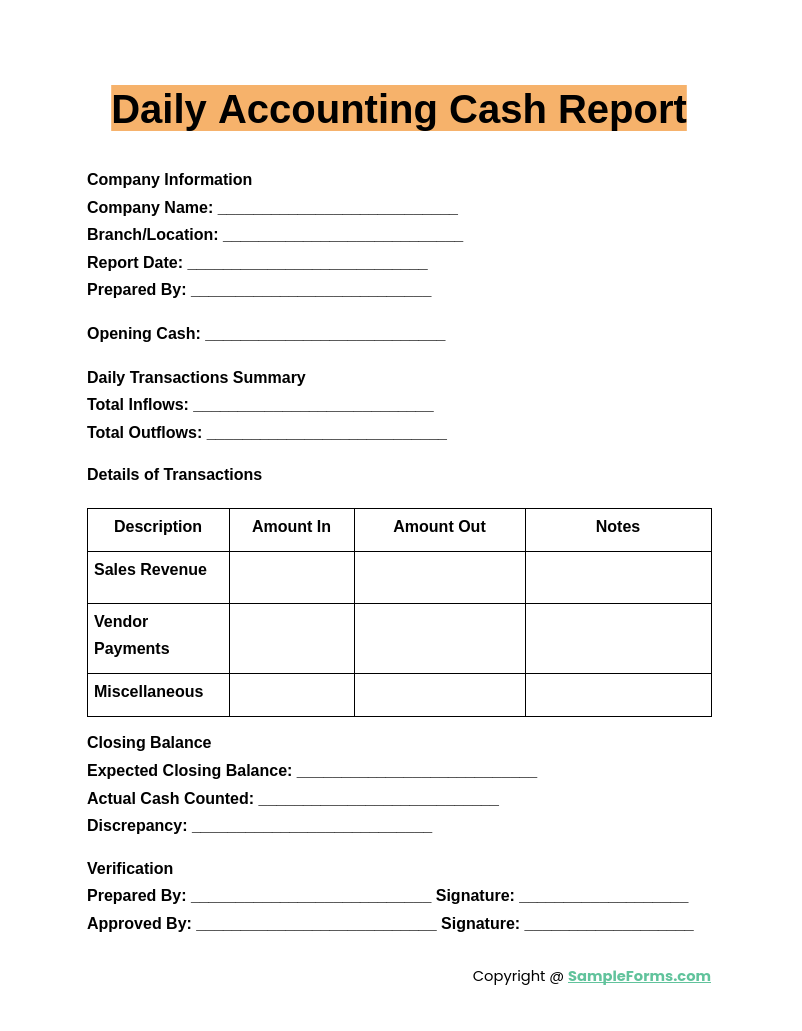

Daily Accounting Cash Report

A Daily Accounting Cash Report tracks all financial movements in a business’s cash accounts. Similar to a Student Progress Report Form, it provides a comprehensive overview, offering insights into daily revenue, expenses, and cash flow trends.

Browse More Daily Cash Reports

1. Daily Cash Report Sample

2. Simple Daily Cash Report

3. Cash Handling Report

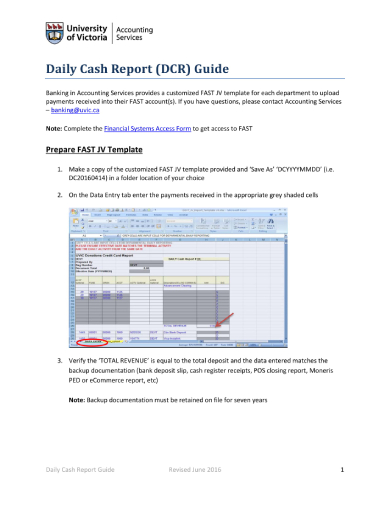

4. Daily Cash Report Guide

5. Sample Cash Report

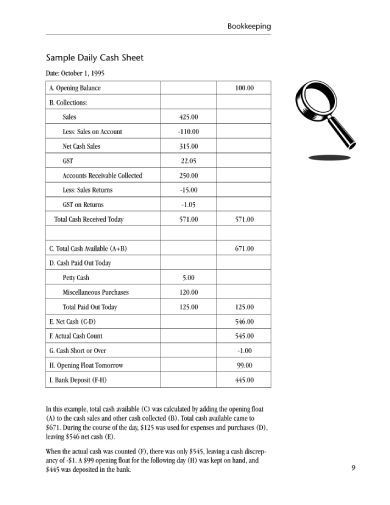

6. Sample Daily Cash Sheet

How to track daily cash flow?

Tracking daily cash flow ensures a clear understanding of inflows and outflows for effective financial management. Use structured methods to maintain accuracy.

- Record All Transactions: Use an Inspection Report Form to log every cash inflow and outflow daily.

- Monitor Opening and Closing Balances: Begin and end each day by reconciling cash balances.

- Categorize Income and Expenses: Separate revenues and expenditures into specific categories.

- Utilize Digital Tools: Implement cash management software for automated calculations and reporting.

- Review and Adjust: Analyze cash trends and make necessary adjustments for improved cash flow management.

Why is the daily cash position report important?

A daily cash position report offers a snapshot of an organization’s liquidity, aiding in financial planning and operational decision-making.

- Understand Liquidity: An Internship Report Form helps compare available cash against obligations.

- Prevent Cash Shortages: Identifying potential gaps ensures funds are allocated effectively.

- Enable Strategic Decisions: Insights from the report support better financial strategies.

- Build Stakeholder Confidence: Transparent reporting builds trust with stakeholders and investors.

- Ensure Compliance: Accurate reports meet regulatory requirements and organizational policies.

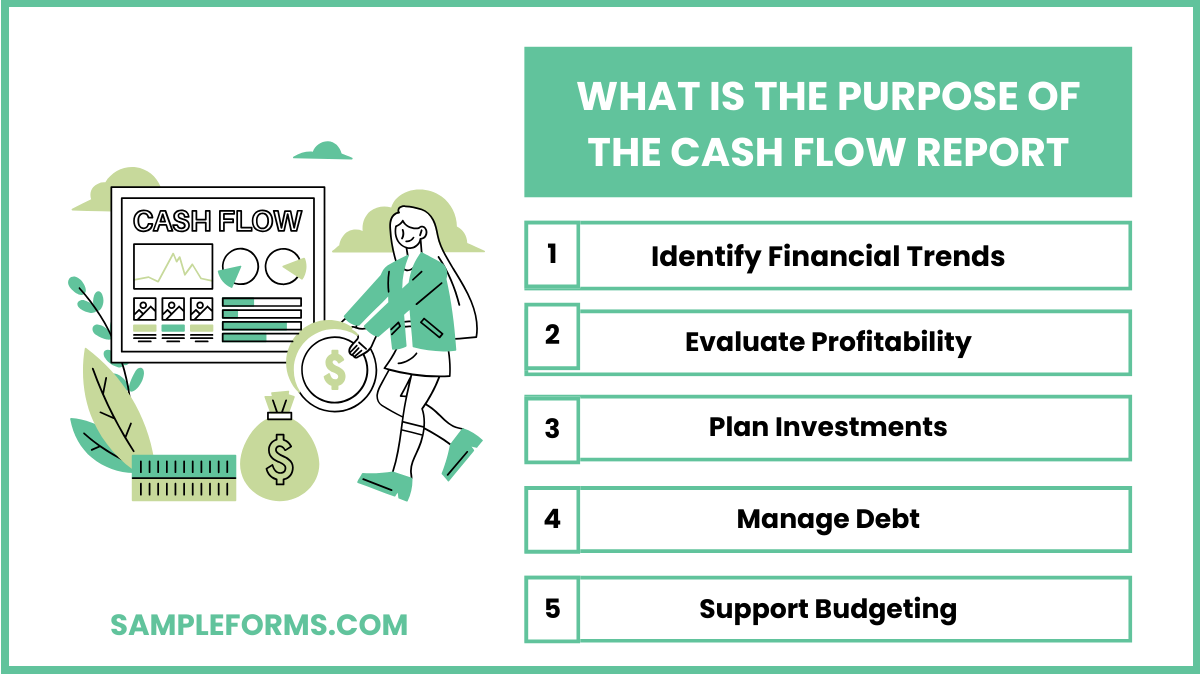

What is the purpose of the cash flow report?

A cash flow report outlines the movement of money within an organization, helping assess financial health and sustainability over time.

- Identify Financial Trends: Utilize a Visit Report Form to highlight income and expenditure patterns.

- Evaluate Profitability: Monitor whether cash inflows exceed outflows.

- Plan Investments: Understand available funds to make informed investment decisions.

- Manage Debt: Ensure cash availability for timely debt payments.

- Support Budgeting: Use cash flow insights to create realistic budgets.

How do you prepare a daily cash flow statement?

A daily cash flow statement summarizes cash transactions and balances for a specific day. Follow these steps to create an accurate report.

- List Opening Balances: Begin with the cash available at the start of the day using a Book Report.

- Record Cash Inflows: Include all sources of income, such as sales and receivables.

- Log Cash Outflows: Document expenses, such as payments and purchases.

- Calculate Net Cash Flow: Subtract total outflows from total inflows.

- Reconcile Closing Balances: Ensure the calculated balance matches the physical cash count.

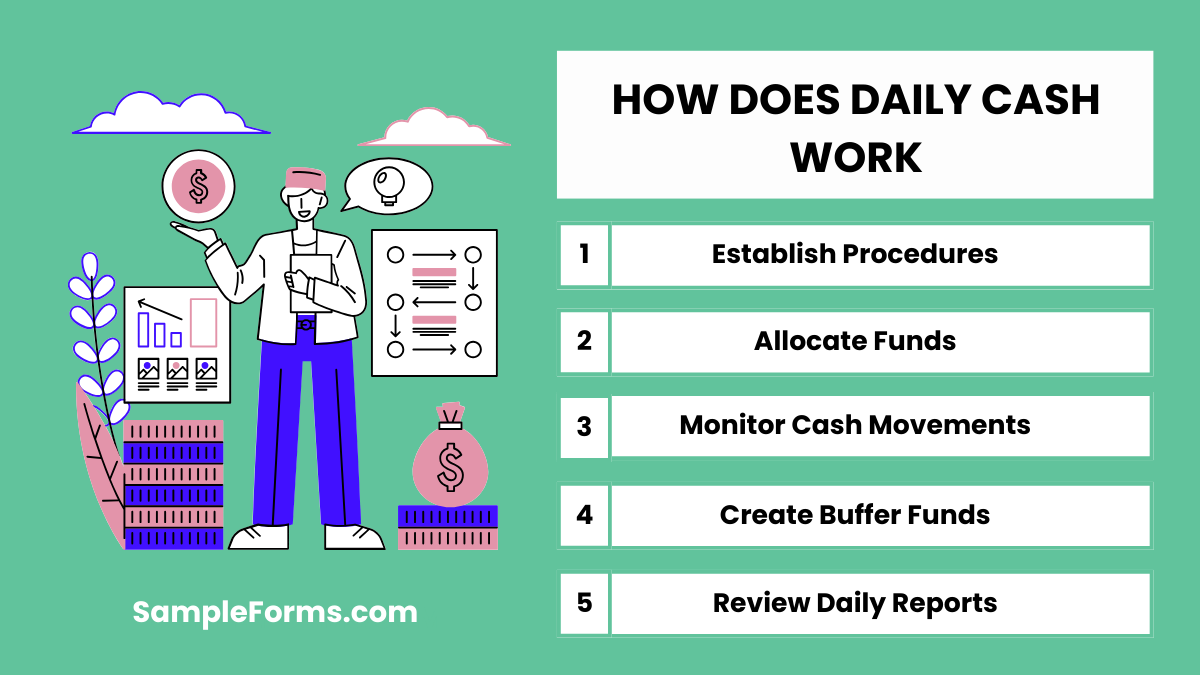

How does daily cash work?

Daily cash management ensures an organization’s operational needs are met while maintaining liquidity and financial stability.

- Establish Procedures: Implement protocols using an Audit Report Form to manage cash receipts and disbursements.

- Allocate Funds: Prioritize essential expenditures for effective cash usage.

- Monitor Cash Movements: Track inflows and outflows continuously to identify discrepancies.

- Create Buffer Funds: Maintain reserves for unforeseen expenses.

- Review Daily Reports: Analyze daily cash reports to refine processes and identify improvement areas.

What is a daily cash sheet?

A daily cash sheet tracks all financial transactions for the day. It ensures accurate records, similar to an Evaluation Report Form.

What is a daily position report?

A daily position report provides a snapshot of available cash and outstanding obligations. It’s as detailed as a Construction Report Form.

How to do a cash report?

To create a cash report, document daily inflows, outflows, and balances. Using a Marketing Report Form template simplifies this process.

What is cashier daily report?

A cashier daily report summarizes the day’s transactions, including sales and cash counts, resembling a Referee Report Form in structure.

What is a daily financial report?

A daily financial report highlights an organization’s cash flow, income, and expenses, much like a Cash Payment Receipt Form.

How do I cash out my daily cash?

Daily cash-out involves reconciling receipts and expenses while maintaining records, typically using tools like a Behavior Report Form.

Does daily cash expire?

Daily cash doesn’t expire but requires proper documentation and tracking through forms like a Case Report Form for accountability.

What is daily cash adjustment?

Daily cash adjustment corrects discrepancies in reported balances, often recorded in a Cash Receipt Form for accuracy.

What is the daily cash report summary?

A daily cash report summary provides an overview of total inflows, outflows, and ending balances, similar to a Petty Cash Log.

What is the 3000 cash rule?

The $3000 cash rule mandates reporting cash transactions over $3000 for transparency, typically documented in a Cash Receipt Journal Form.

A Daily Cash Report ensures accurate financial tracking and streamlines cash management processes. From small businesses to large enterprises, these reports are indispensable. By combining a well-structured Business Report Form with proper documentation practices, organizations can foster transparency and accountability. This guide highlights their importance, offers examples, and provides actionable steps to create them effectively. Implementing daily cash reports ensures better decision-making, improved cash flow management, and long-term financial success.

Related Posts

-

Report Form

-

FREE 15+ Case Report Forms in PDF | MS Word

-

FREE 4+ Campaign Finance Forms in PDF

-

Internal Audit Form

-

Referee Report Form

-

Joining Report Form

-

Laboratory Report Form

-

FREE 5+ Sponsorship Report Forms in PDF | MS Word

-

FREE 9+ Final Report Forms in PDF | MS Word | Excel

-

11+ Confidential Report Form

-

FREE 6+ Rent Report Forms in PDF

-

FREE 5+ Mileage Report Forms in MS Word | PDF | Excel

-

FREE 4+ Management Report Forms in PDF | MS Word

-

FREE 17 + Disciplinary Report Forms in MS Word | PDF | Google Docs | Apple Pages