A well-maintained Daily Cash Log is crucial for tracking cash transactions and preventing discrepancies. Whether managing business expenses or handling a Petty Cash Log, keeping detailed records helps maintain transparency and accountability. This guide covers everything you need to know about organizing, maintaining, and analyzing a Daily Cash Log for financial accuracy. Learn best practices, common mistakes to avoid, and how to structure a log for efficiency. With proper documentation, businesses and individuals can ensure smooth cash flow, prevent losses, and simplify financial audits. Explore detailed examples and templates to optimize your cash tracking process.

Download Daily Cash Log Bundle

What is Daily Cash Log?

A Daily Cash Log is a structured record used to track all cash transactions within a specific period. It documents every cash inflow and outflow, ensuring financial accuracy and preventing mismanagement. Businesses and individuals use it to monitor expenses, record payments, and reconcile accounts. A well-organized Daily Cash Log reduces errors, supports transparency, and simplifies audits. Whether for business operations or maintaining a Petty Cash Log, proper documentation ensures accountability. It is an essential financial tool for cash-based businesses, ensuring all monetary activities are accurately recorded and reviewed when needed.

Daily Cash Log Format

Log Details

- Date: [Log Date]

- Log Number: [Unique Entry ID]

- Cashier Name: [Person Managing Cash]

Beginning Cash Balance

- Starting Amount: [Cash at Start of Day]

Cash Inflows

- Sales Transactions: [Total Sales Revenue]

- Refunds Received: [Any Money Returned]

- Other Income Sources: [Additional Revenue]

Cash Outflows

- Expenses Paid: [Any Business Expenses]

- Refunds Issued: [Money Returned to Customers]

- Other Deductions: [Additional Withdrawals]

End-of-Day Balance

Total Cash on Hand: [Final Amount]

Reconciliation Notes: [Any Discrepancies or Issues]

Cashier Signature: [Signature]

Supervisor Signature: [Signature]

Verification Date: [Date Reviewed]

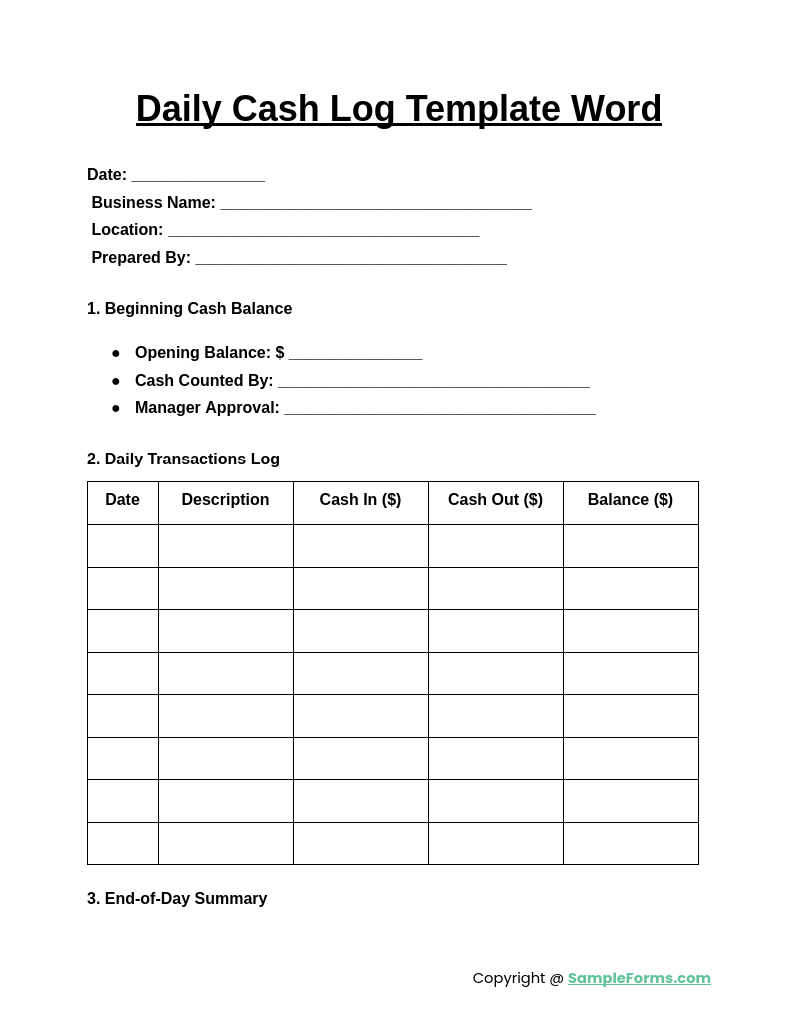

Daily Cash Log Template Word

A Daily Cash Log Template Word helps businesses track daily cash flow systematically. Similar to a Cash Receipt Journal Form, it records cash inflows and outflows, ensuring accuracy, transparency, and easy financial reconciliation for small and large businesses.

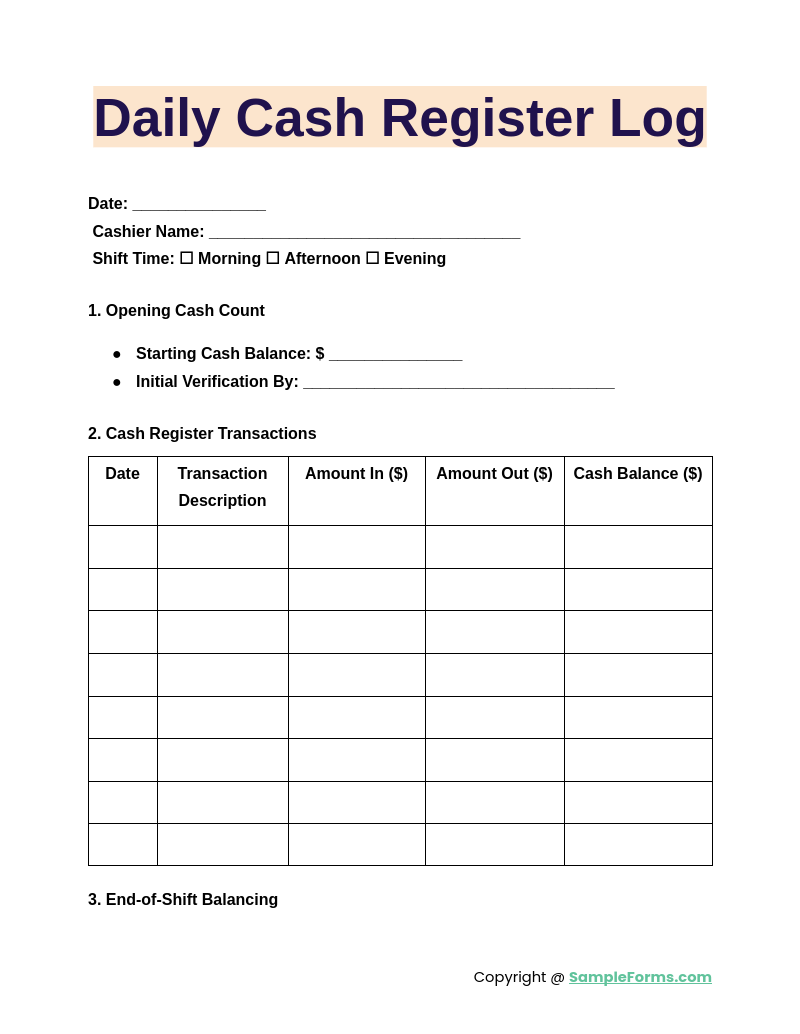

Daily Cash Register Log

A Daily Cash Register Log maintains a structured record of cash transactions throughout the day. Similar to a Daily Cash Report, it ensures accountability by documenting every sale, refund, and expense, helping businesses prevent discrepancies and improve financial management.

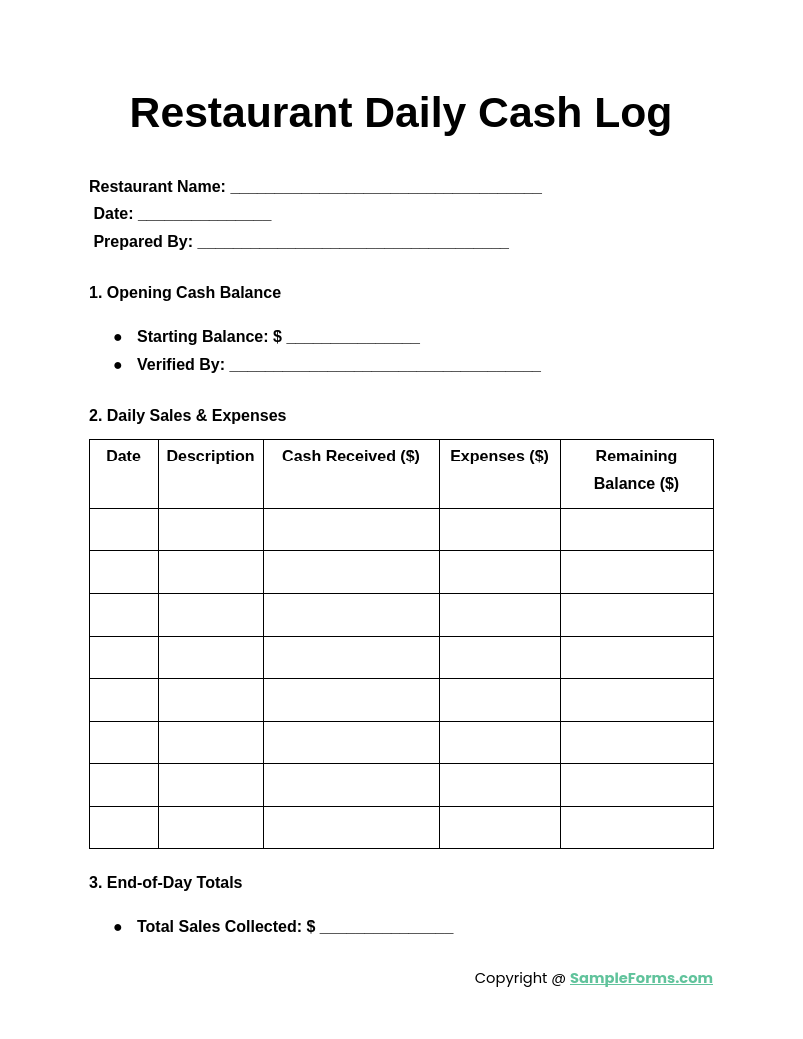

Restaurant Daily Cash Log

A Restaurant Daily Cash Log helps food establishments track daily revenue and expenses. Similar to a Petty Cash Receipt Form, it ensures proper handling of transactions, reducing errors while maintaining financial transparency in food service operations.

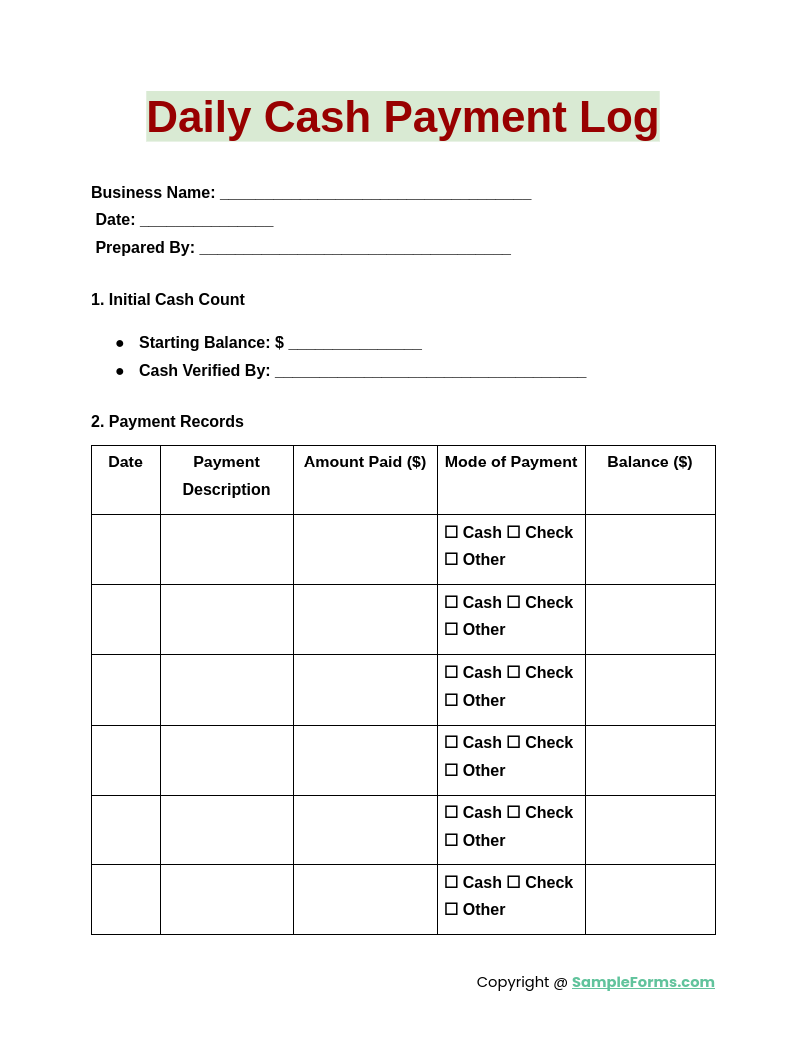

Daily Cash Payment Log

A Daily Cash Payment Log documents all cash payments made within a business. Similar to a Petty Cash Register, it tracks expenses, helping businesses manage spending, prevent unauthorized transactions, and maintain a clear financial audit trail.

Browse More Daily Cash Logs

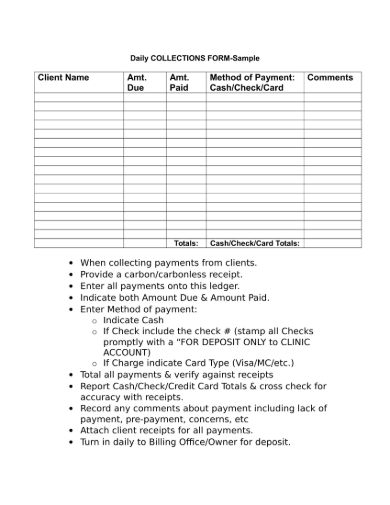

1. Sample Daily Collections Form

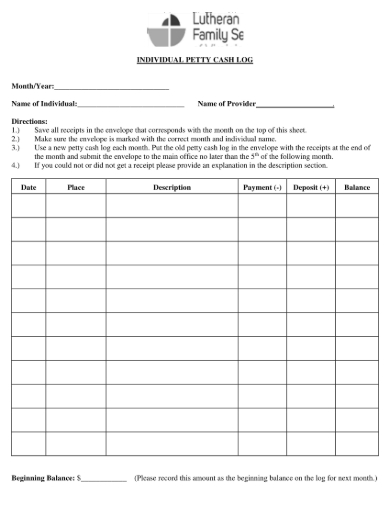

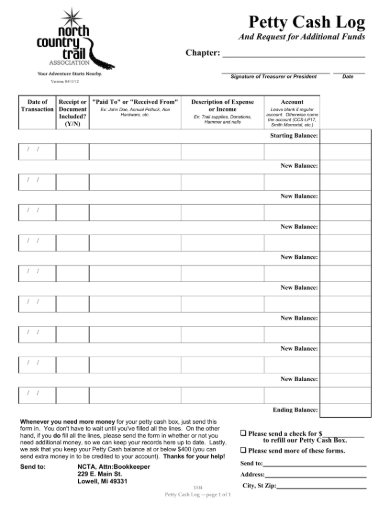

2. Sample Individual Petty Cash Log

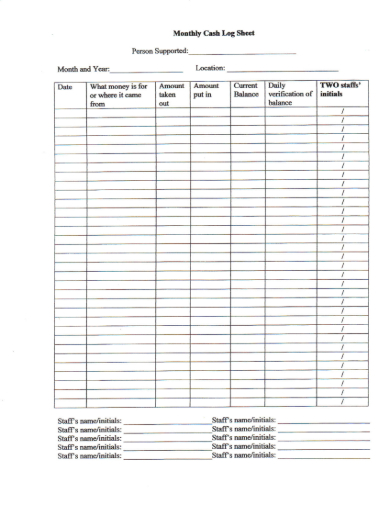

3. Sample Monthly Cash Log Sheet

4. Sample Specific Petty Cash Log

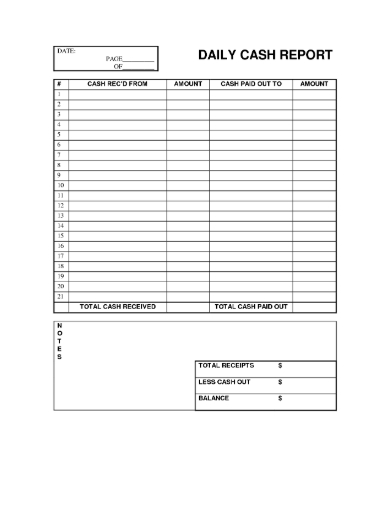

5. Sample Daily Cash Report

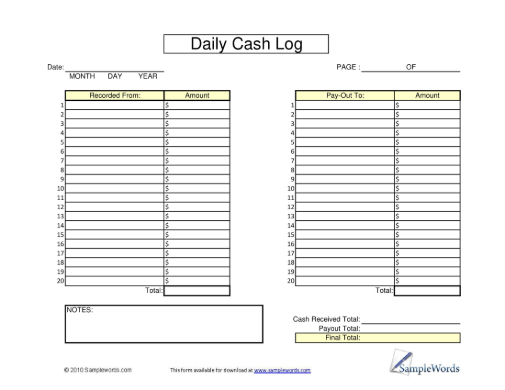

6. Sample Daily Cash Log Form

7. Sample Daily Cash Receipt Log

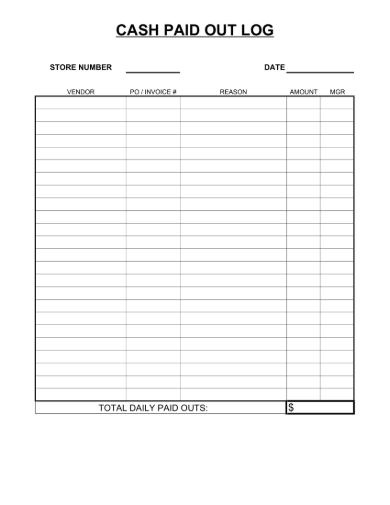

8. Sample Cash Paid Out Log

How do I make a daily cash report?

A Daily Cash Log ensures accurate cash tracking and financial transparency. It provides a structured approach to documenting cash transactions and reconciling balances.

- Record Opening Balance: Document the starting cash amount to establish a baseline for tracking inflows and outflows.

- Log Cash Receipts: Enter all incoming cash transactions, such as sales, refunds, and customer payments.

- Track Cash Payments: Record all outgoing cash transactions, similar to a Petty Cash Requisition, ensuring each expenditure is properly documented.

- Reconcile Transactions: Compare recorded cash transactions with actual cash in hand to identify discrepancies.

- Prepare a Summary: Generate a final cash report, ensuring all details are accurate before submission for review.

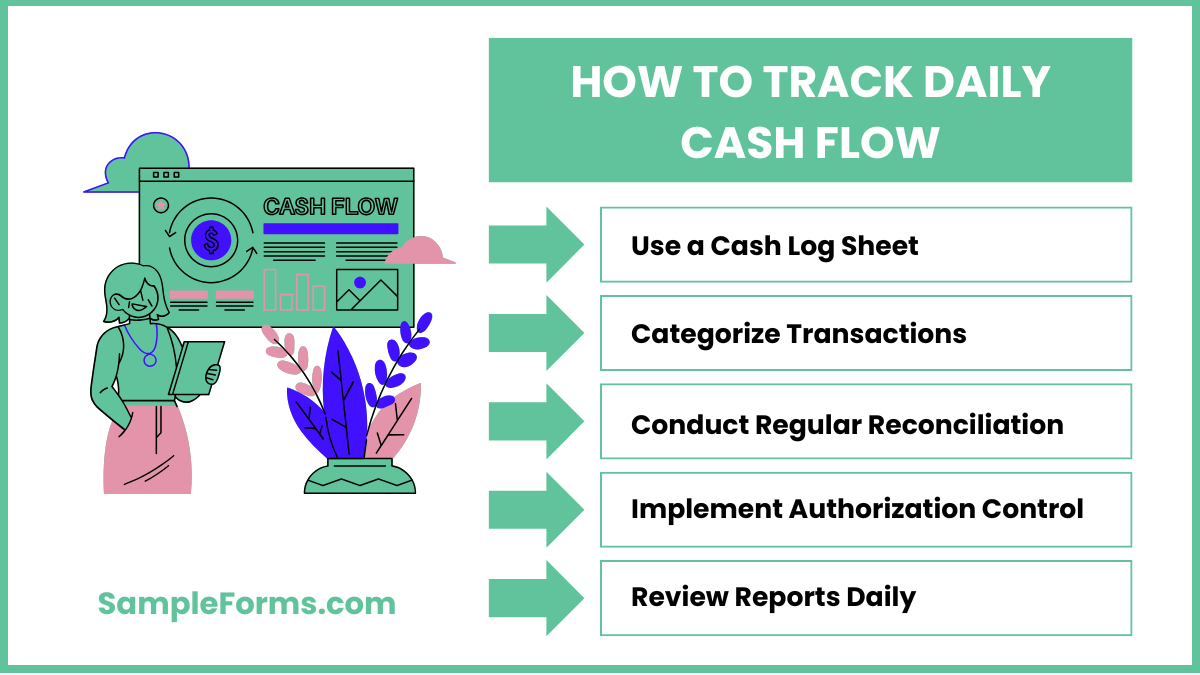

How to track daily cash flow?

Tracking daily cash flow is essential for financial stability and accuracy. Similar to a Cash Payment Receipt Form, every transaction must be documented properly.

- Use a Cash Log Sheet: Maintain a structured Daily Cash Log to record all cash transactions in real time.

- Categorize Transactions: Separate cash inflows and outflows to monitor spending and revenue sources.

- Conduct Regular Reconciliation: Compare cash balances against recorded transactions to detect errors or discrepancies.

- Implement Authorization Controls: Restrict unauthorized access to cash handling, ensuring accountability and security.

- Review Reports Daily: Summarize and analyze cash flow trends to improve financial decision-making.

How do you maintain daily cash flow?

Maintaining a stable Daily Cash Log helps businesses avoid financial shortfalls. Similar to a Daily Report Form, structured record-keeping ensures smooth cash management.

- Monitor Cash Receipts and Expenses: Keep a daily record of incoming and outgoing cash transactions.

- Set Cash Handling Policies: Establish strict guidelines to prevent errors, fraud, and mismanagement.

- Replenish Petty Cash Regularly: Maintain small cash reserves for daily operational expenses.

- Analyze Cash Flow Trends: Identify patterns and make informed financial adjustments.

- Ensure Secure Storage: Store cash in a safe location and limit access to authorized personnel only.

What should be included in a daily activity report?

A Daily Cash Log should document all key financial activities. Similar to a Sign In Sign Up Sheet, it ensures accountability and structured reporting.

- Date and Opening Balance: Record the beginning balance of cash on hand for accurate tracking.

- Cash Transactions: Log all payments received and expenses made throughout the day.

- Reconciliation Summary: Compare recorded transactions with actual cash to detect discrepancies.

- Notes and Adjustments: Include explanations for discrepancies or unusual transactions.

- Signatures and Approval: Obtain verification from authorized personnel to confirm the report’s accuracy.

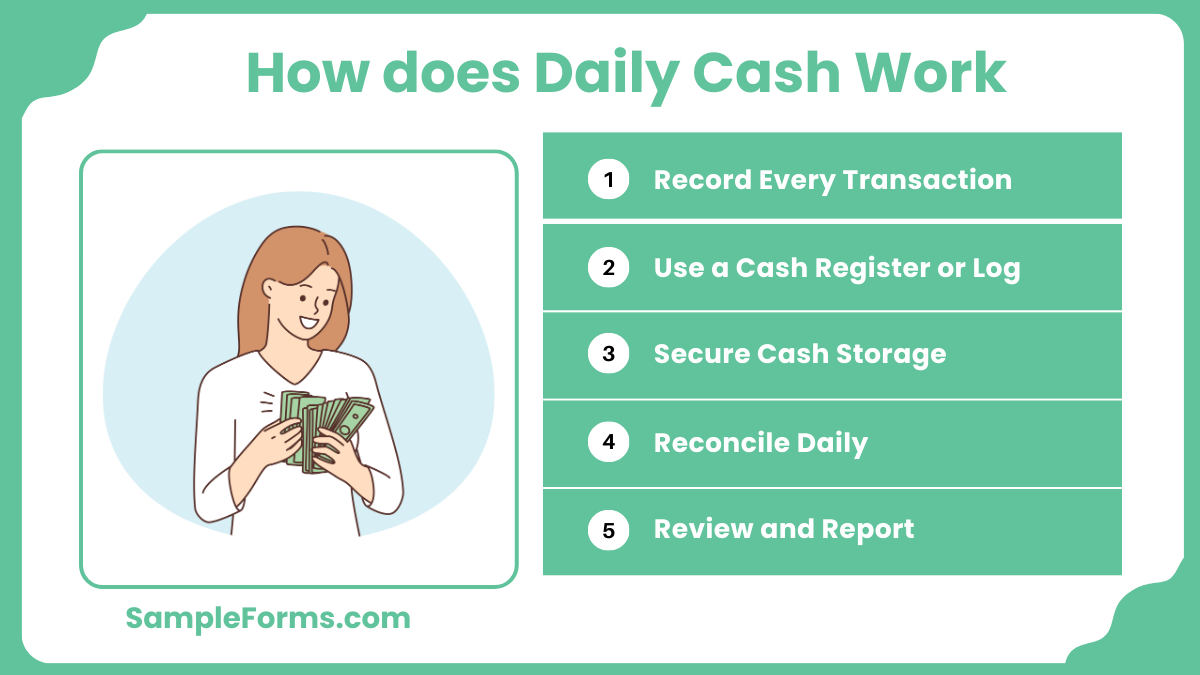

How does daily cash work?

Daily cash management ensures proper handling of financial transactions. Similar to a Petty Cash Reimbursement Form, , it tracks all cash inflows and outflows to maintain accuracy.

- Record Every Transaction: Log all cash received and spent to prevent financial inconsistencies.

- Use a Cash Register or Log: Maintain organized records for real-time cash tracking.

- Secure Cash Storage: Keep cash in a secure location to prevent unauthorized access or theft.

- Reconcile Daily: Compare recorded cash transactions with physical cash on hand.

- Review and Report: Summarize cash activity and report findings for transparency and financial planning.

How to do a petty cash log?

A Daily Cash Log for petty cash records small expenses. Similar to a Daycare Sign In Sheet, it tracks transactions, ensuring accountability and preventing mismanagement in business cash handling.

What is daily cash position?

A Daily Cash Log shows available cash for daily operations. Similar to a Safety Meeting Sign In Sheet, it helps businesses monitor liquidity, ensuring financial stability and proper fund allocation.

What is daily cash adjustment?

Daily cash adjustments correct discrepancies in cash records. Similar to a Parent Sign In Sheet, it ensures accurate financial tracking by reconciling transactions against actual cash holdings.

Does Apple Cash have a monthly fee?

No, Apple Cash does not charge monthly fees. Similar to a Visitor Sign In Out Sheet, it provides a convenient and accessible digital transaction system for users.

What is cash flow for dummies?

Cash flow refers to money movement in and out of a business. Similar to a Student Sign In Sheet, it tracks financial transactions, ensuring stability and proper expense management.

Is cash a debit or credit?

Cash is recorded as a debit when received and a credit when spent. Similar to a Volunteer Sign In Sheet Form, it maintains accurate financial balance tracking.

How to use daily cash?

Daily cash should be used responsibly for business operations. Similar to a Patient Sign In Sheet, it requires proper documentation to ensure financial accountability and security.

What is the daily cash policy?

A daily cash policy sets rules for handling money transactions. Similar to an Employee Time Sheet, it ensures transparency, security, and accuracy in financial operations.

How do you maintain a daily cash book?

A Daily Cash Log records transactions systematically. Similar to a Guest Attendance Sign In Sheet, it organizes financial data, preventing discrepancies and improving cash management.

How much cash flow should I keep?

Businesses should maintain enough cash flow to cover short-term expenses. Similar to a Health Record Form, it provides financial stability by ensuring sufficient reserves for operations.

A Daily Cash Log is a fundamental tool for tracking financial transactions, preventing cash mismanagement, and ensuring transparency. Whether for business or personal use, maintaining a structured log improves financial oversight. Using accurate templates and detailed records reduces errors and enhances accountability. For efficient money management. For broader financial documentation and reviews, businesses may also require a Record Review Form to ensure accuracy and compliance.