A credit is the ability of a person or organization to acquire products or services before payment. It is mostly based on trust that payment will be made in the future. A contractual agreement is drafted so that the borrower gets the item in the present while promising to pay the lender at a later date.

A credit report details an individual’s credit history for the purpose of determining a loan applicant’s worthiness. Unlike Expense Report Forms, which are done by the person concerned, credit reports are done by credit bureaus who collect information such as the number of past due or good standing accounts, high balances account information, and credit limits.

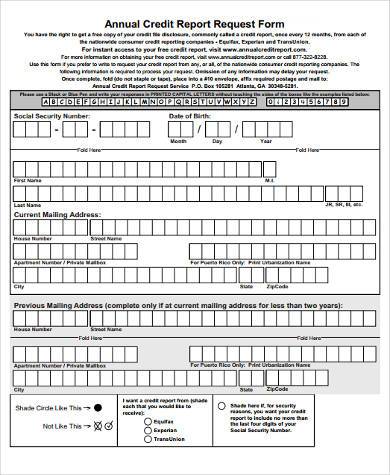

Annual Credit Report Request Form

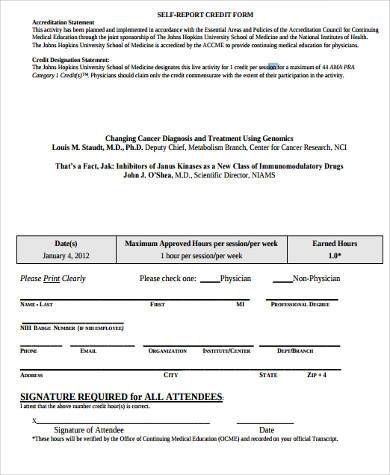

Free Self Credit Report Form

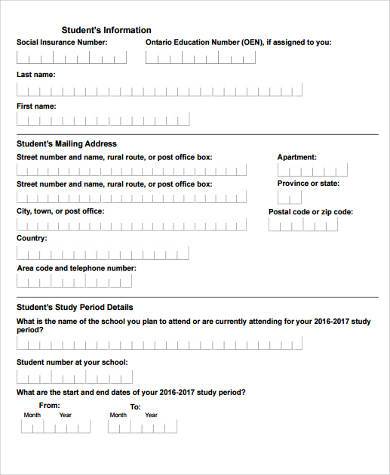

Credit Information Report Form

Credit Check ReviewForm

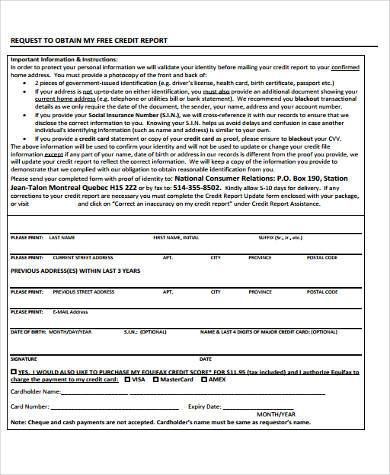

Request for Free Credit Report Form

What Is in a Credit Report

- Identifying Information

Like Incident Report Forms and any other forms, personal details such as name, address, Social Security number, date of birth, employment information, and others are clearly indicated in the report in order to identify the borrower.

- Trade Lines

Credit accounts are also called trade lines, which refer to the relationship borrowers establish with lenders. The type of account, the date the account was opened, the amount of loan or credit limit, the account balance, and payment history are stated.

- Credit Inquiries

Inquiries appear on a credit report when lenders ask for a copy of a borrower’s credit report. It contains a list of everyone who has accessed the credit report to inquire about one’s credit history and standing.

- Public Record and Collections

Overdue debt from collection agencies and public record information such as bankruptcies, foreclosures, suits, wage attachments, liens, and judgments are collected by credit bureaus from state courts.

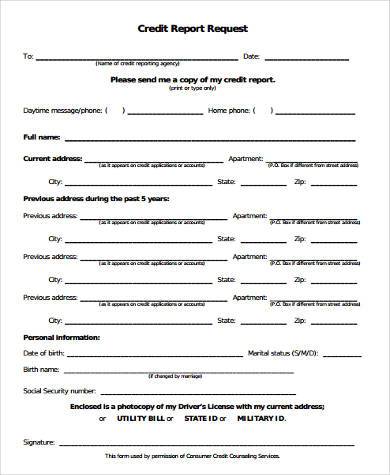

Credit Report Request Form

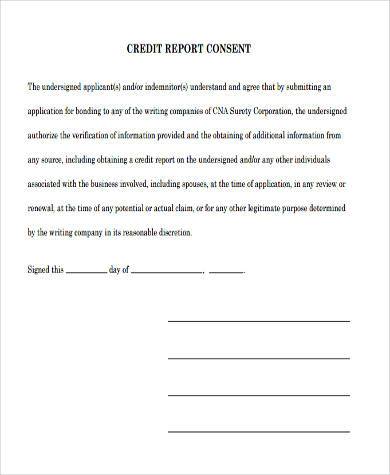

Credit Report Consent Form

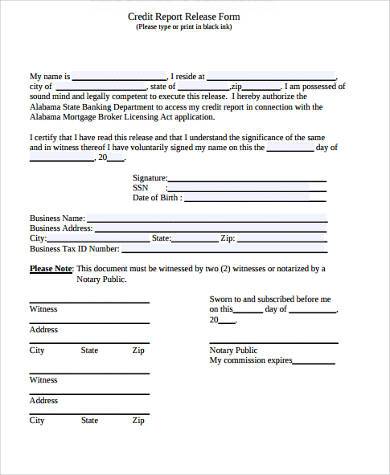

Credit Report Release Form

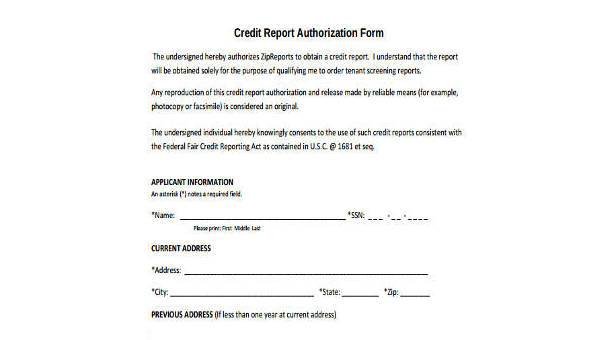

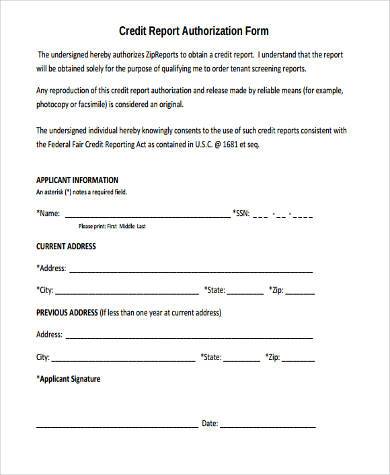

Credit Report Authorization Form

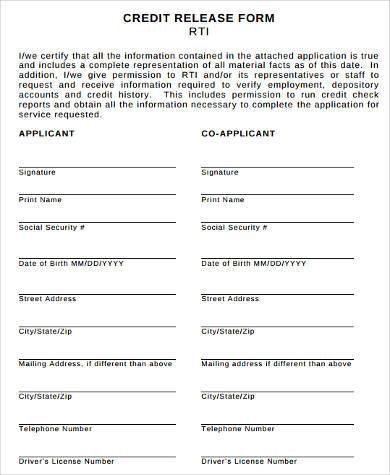

Credit Release Form in PDF

What Is a Credit Score

Just like how Book Report Forms ensure good grades from teachers, a credit report also determines a loan application’s chances of getting approved. As a credit report reveals many aspects of a person’s borrowing activities, lenders are able to identify the borrower’s credit score, which should help them discern his or her ability to pay. This credit score is calculated from different related credit data in the credit report.

How to Maintain a Credit Report

Credit bureaus maintain credit reports, which are then issued to creditors, insurers, lenders, and other businesses authorized by law upon request. Credit grantors such as retailers, credit card issuers, banks, finance companies, credit unions, and others send regular updates of people’s credit accounts to the bureaus. Therefore, it is important to pay bills on time in order to maintain a good credit standing and high credit score.

How to Access a Credit Report

Since it contains information from both borrowers and lenders, either can access a credit report even without the knowledge of the other party. Lenders and grantors request it when they want to investigate a borrower’s credit eligibility. Personal access is granted for checking on accuracy and timeliness of information, provided one is able to answer a series of security questions.

Related Posts

-

FREE 9+ Sample Status Report Forms in PDF | MS Word

-

FREE 8+ Sample Performance Report Forms in PDF | MS Word

-

FREE 9+ Sample Student Report Forms in PDF | MS Word

-

FREE 9+ Sample Inspection Report Forms in PDF | MS Word

-

FREE 8+ Sample Action Report Forms in PDF | MS Word

-

FREE 7+ Sample Business Report Forms in PDF | MS Word

-

FREE 7+ Sample Annual Credit Report Forms in MS Word | PDF | Pages

-

FREE 9+ Sample DMV Accident Report Forms in PDF | MS Word | Pages | Google Docs

-

FREE 10+ Sample Book Report Formats in PDF | MS Word

-

Student Progress Report Form

-

Testimonial Report

-

Daily Cash Report

-

Inspection Report Form

-

Medical Report Form

-

Car Accident Report Form