Understanding how to correct errors on your credit report is crucial for maintaining a healthy financial profile. Our comprehensive guide covers everything you need to know about drafting a Credit Report Dispute Letter effectively. From sample letters to step-by-step instructions, we’ve got you covered. A well-crafted dispute letter can significantly impact your credit standing, helping you secure better loan terms. Utilize our examples to draft your own letter, ensuring accuracy and efficiency. This guide is packed with SEO-friendly tips and Sample Letters to streamline the process, making it easy for anyone to follow.

Download Credit Report Dispute Letter Bundle

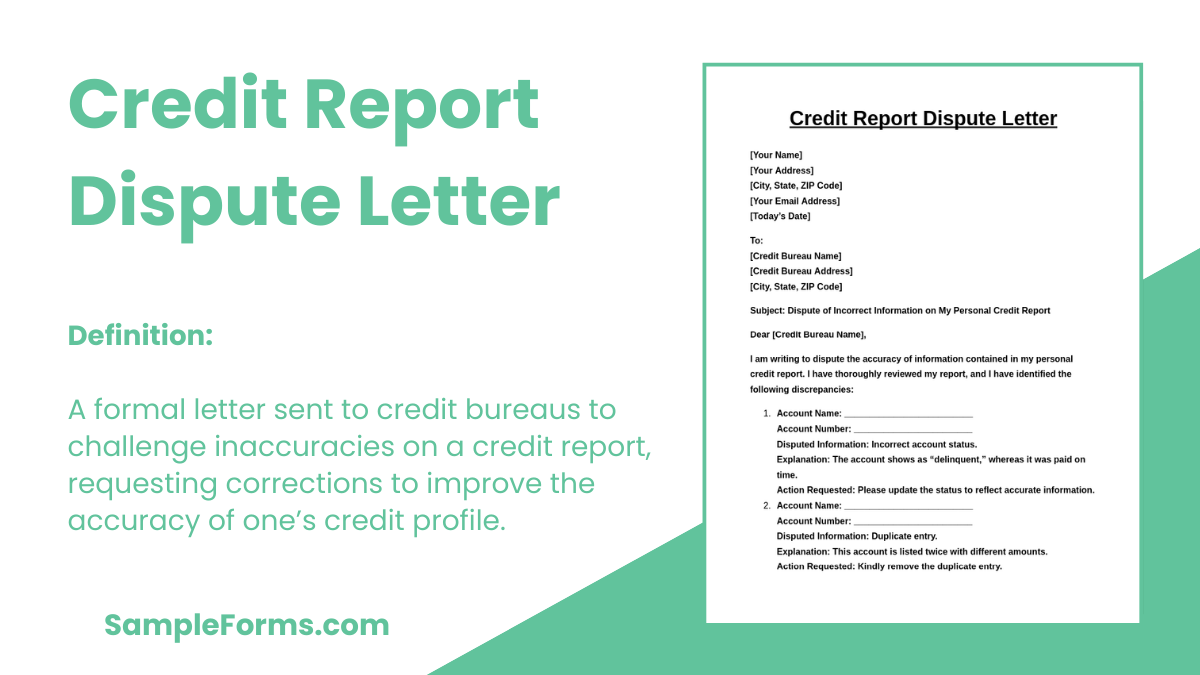

What is Credit Report Dispute Letter?

A Credit Report Dispute Letter is a formal document used to challenge inaccuracies on your credit report. It helps you communicate with credit bureaus, providing evidence and requesting corrections. A well-written letter includes clear details, supporting documents, and a concise explanation of the error, improving the chances of a swift resolution. Properly disputing errors can improve your credit score, making it easier to secure loans or lower interest rates.

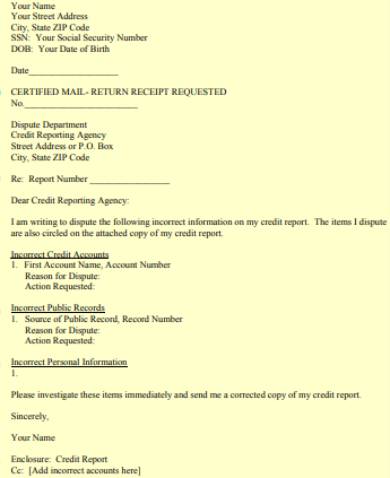

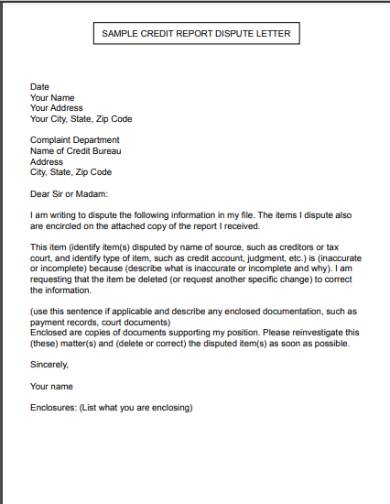

Credit Report Dispute Letter Format

Personal Information:

- Full Name:

(Enter your legal name) - Address:

(Include city, state, and zip code) - Phone Number:

(Provide a contact number) - Email Address:

(Official email address)

To:

Credit Bureau Name and Address:

Subject: Dispute of Errors on Credit Report

Dear [Credit Bureau],

I am writing to dispute incorrect entries in my credit report. Please correct the inaccuracies as per the details below:

Disputed Items:

- Entry #1:

(Describe the error and why it is incorrect) - Entry #2:

(Include any supporting details)

Supporting Documents:

- Copy of my ID

- Copy of the erroneous credit report

- Relevant supporting evidence

I request that these errors be corrected at the earliest and a new report issued.

Signatures:

- Your Signature:

- Full Name (Printed):

- Date:

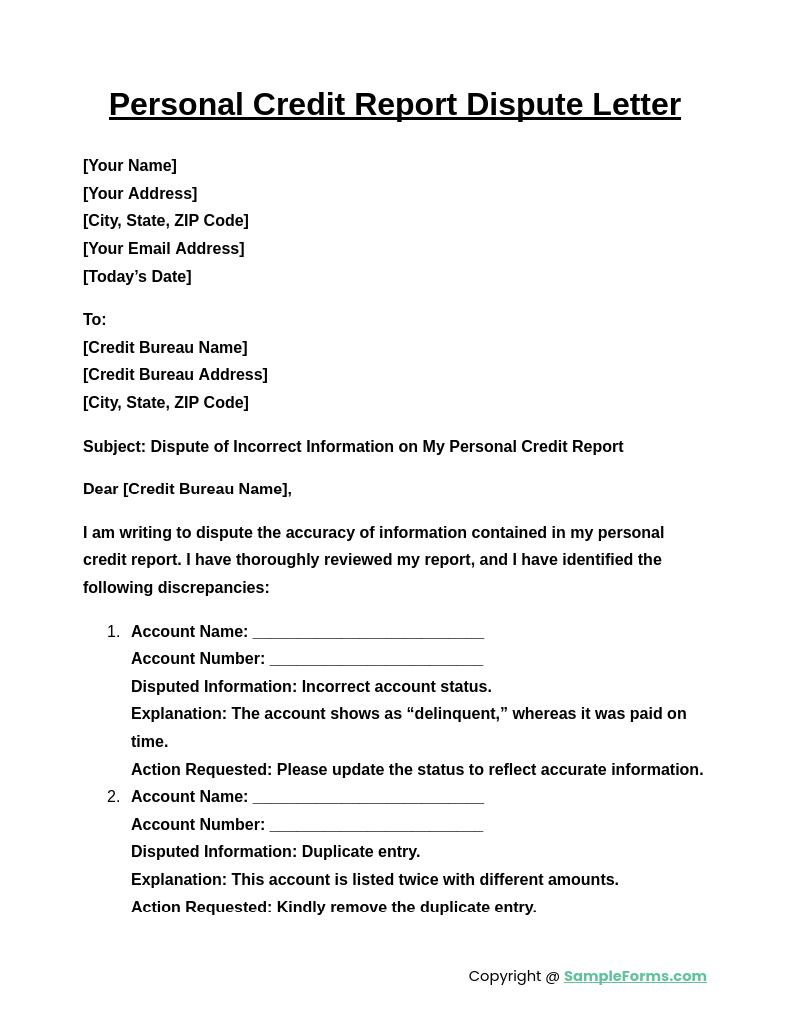

Personal Credit Report Dispute Letter

The Personal Credit Report Dispute Letter is essential for addressing inaccuracies in your credit report. It ensures corrections are made to maintain an accurate credit history, similar to a Letter of Application Form used to formally request adjustments or changes in official records.

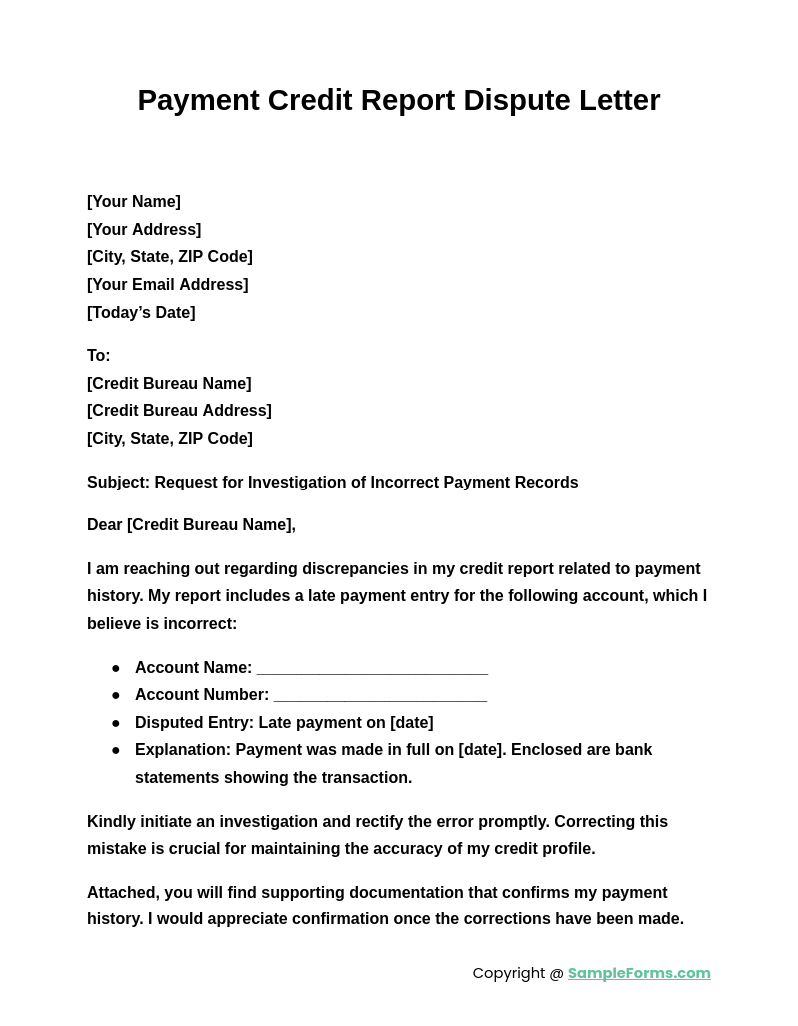

Payment Credit Report Dispute Letter

A Payment Credit Report Dispute Letter is used to dispute incorrect payment records, which can negatively impact your credit score. It works like an Authorization Letter where you authorize corrections to be made, ensuring accurate payment history is reflected in your credit report.

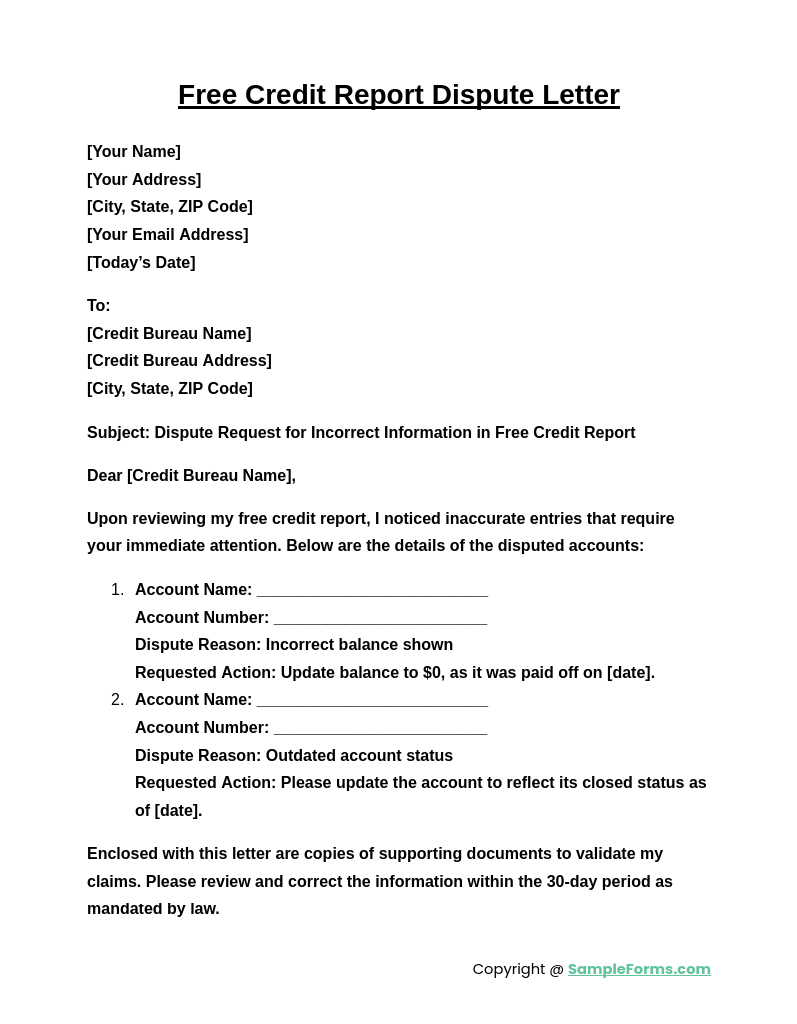

Free Credit Report Dispute Letter

The Free Credit Report Dispute Letter allows individuals to correct credit report errors without incurring additional costs. This letter functions similarly to a Letter of Resignation by clearly stating the changes or removals needed to correct inaccuracies in your financial records.

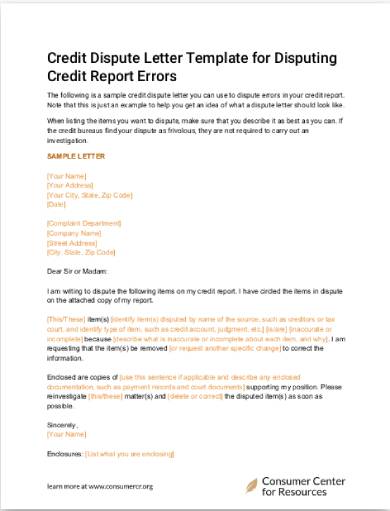

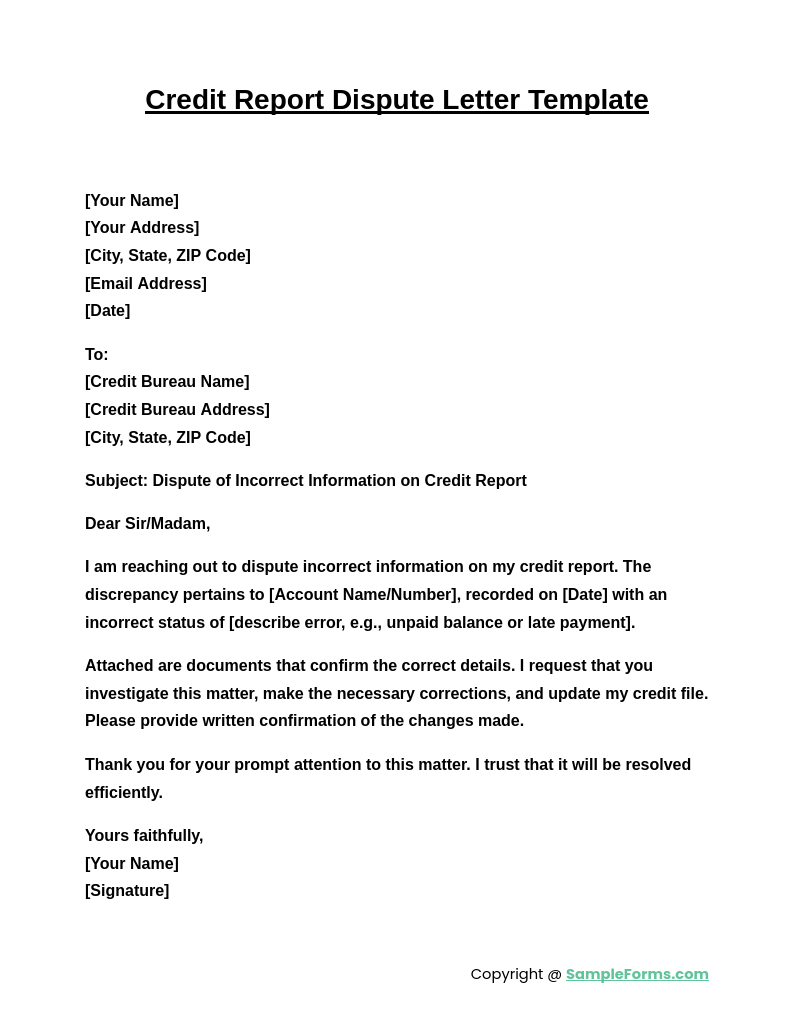

Credit Report Dispute Letter Template

The Credit Report Dispute Letter Template provides a structured format to help you dispute errors effectively. It serves a similar purpose as a Letter of Consent, allowing you to formally request corrections while providing consent for the necessary investigation to ensure your credit report’s accuracy.

Browse More Credit Report Dispute Letters

1. New York Law Help Sample Credit Dispute Letter

2. Consumer Credit Sample Credit Dispute Letter

3. First Hawaiian Bank Sample Credit Dispute Letter

4. Foley Law Sample Credit Dispute Letter

5. Debt.Org Sample Credit Dispute Letter

6. Consumer Credit.Org Sample Credit Dispute Letter

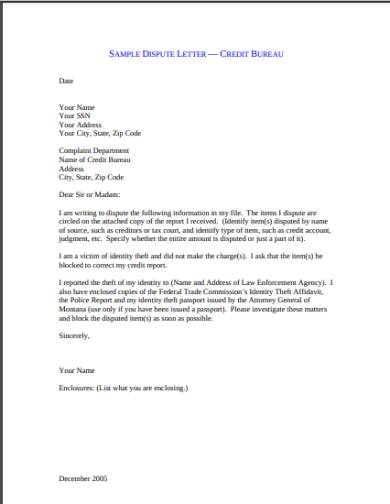

7. Montana Department of Justice Sample Credit Dispute Letter

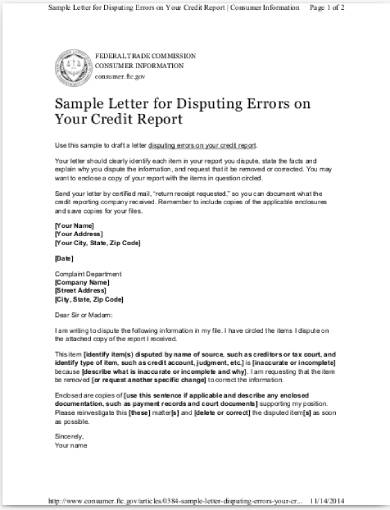

8. Federal Trade Commission Sample Credit Dispute Letter

How do I write credit report dispute Letter?

Writing a Credit Report Dispute Letter involves clearly stating the error, providing evidence, and requesting corrections. It’s similar to an Offer Letter where you formally present your request to resolve discrepancies.

Adhering to specific guidelines ensures an effective dispute process:

- Identify the Inaccuracies: Review your credit report to pinpoint incorrect entries.

- Gather Supporting Evidence: Attach proof such as statements or receipts.

- Compose the Letter: Address it to the credit bureau with your contact details.

- State the Issue Clearly: Specify the error and request a correction.

- Follow Up: Ensure the bureau acknowledges and resolves the dispute.

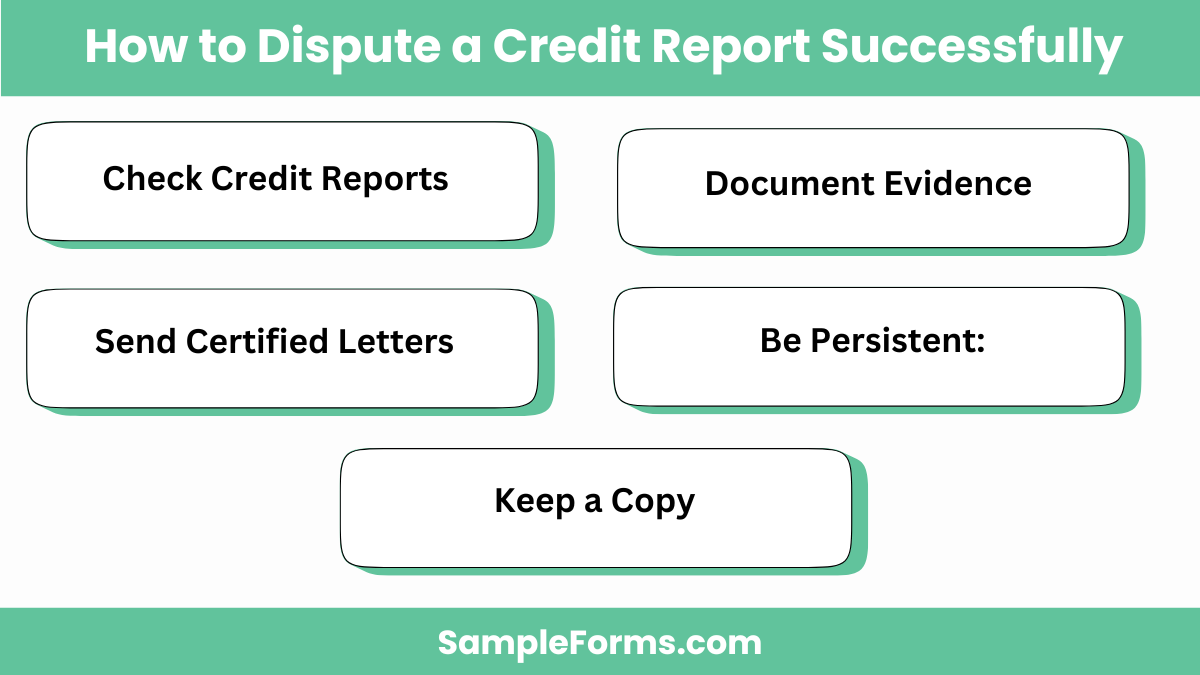

How do I dispute a credit report successfully?

Disputing a credit report successfully requires clear communication and documentation. It’s similar to sending a Debt Collection Letter to settle discrepancies while ensuring compliance.

To maximize success:

- Check Credit Reports: Review reports from all three major bureaus.

- Document Evidence: Keep records of all communications.

- Send Certified Letters: Ensure your dispute is formally acknowledged.

- Be Persistent: Follow up if there’s no response within 30 days.

- Keep a Copy: Retain all correspondence for future reference.

How can I get a collection removed without paying?

Removing a collection without paying is possible by challenging its validity. This method is akin to writing an Application Letter to request specific changes by demonstrating errors in the report.

Key strategies include:

- Request Validation: Ask the collector to verify the debt.

- Challenge Inaccuracies: Dispute incorrect entries with the bureau.

- Negotiate a Pay-for-Delete: Offer partial payment for removal.

- Leverage Statute of Limitations: Verify if the debt is beyond its legal limit.

- File a Complaint: Approach regulatory bodies if the dispute remains unresolved.

How to get late payments removed from credit report?

Removing late payments requires persistence and negotiation, much like drafting an Audit Response Letter Form to rectify discrepancies with documented evidence.

Steps to remove late payments:

- Send a Goodwill Letter: Request creditors to remove the entry.

- Dispute Errors: Challenge any inaccuracies in reporting.

- Negotiate for Removal: Offer partial payment in exchange for deletion.

- Use Automated Disputes: Some platforms expedite this process.

- Monitor Progress: Keep track of updates from credit bureaus.

How to dispute a closed account on a credit report?

Disputing a closed account entry is similar to composing a Financial Hardship Letter, where clear evidence and a formal request can lead to adjustments.

Follow these guidelines:

- Review Account Details: Ensure the closure was accurate.

- Gather Supporting Documents: Include evidence proving the account status.

- Contact Credit Bureaus: Address your dispute with each relevant bureau.

- Request a Formal Review: Insist on a thorough investigation.

- Track Resolutions: Document all responses for reference

Do pay for delete letters really work?

Yes, they can work, but success varies. Sending a Debt Validation Letter may be a more reliable way to remove errors from your report.

Is it better to dispute online or by mail?

Disputing by mail with a Letter of Application provides a paper trail, ensuring evidence of your claim, unlike online disputes that may lack formal documentation.

Is it true that after 7 years your credit is clear?

Yes, negative marks typically drop off after seven years, but some debts, like those involving a Debt Letter, can remain under certain conditions.

Is there a downside to disputing credit report?

Frequent disputes may flag your file for review. A Personal Reference Letter can support your claim if the dispute involves mistaken identity.

What is the best reason to put when disputing a collection?

Claiming “incorrect information” is effective, especially if supported by a Letter of Reference detailing the discrepancies in your credit report.

Is it better to pay off collections or wait?

Paying off collections helps your credit faster than waiting. A Military Recommendation Letter Form may assist if disputes are tied to military service.

What is the fastest way to remove credit inquiries?

A Fraternity Recommendation Letter can be effective in removing unauthorized hard inquiries if you demonstrate no consent was given for the inquiry.

Can you pay to clear your credit history?

While some agencies claim this, it’s often a scam. Use a Fundraising Letter to challenge inaccuracies rather than paying off sketchy services.

How to get collections removed from credit report?

Submit a Job Resignation Letter-style request to creditors for removal after payment or negotiate a “pay for delete” agreement for faster results.

How to dispute a credit report and win?

Send a well-documented Letter of Recommendation to credit bureaus, ensuring all supporting evidence is included to boost your chances of a successful dispute.

Correcting errors on your credit report can significantly impact your financial future. A well-prepared Credit Report Dispute Letter serves as a powerful tool in communicating with credit bureaus. By using the examples provided in our guide, you can streamline the process, ensuring that your dispute is handled efficiently and effectively. Take charge of your credit health today with our expert tips and templates designed to simplify the dispute process.