A credit accounting form is a type of document that is used as a means of calculating the total credit the person has incurred. Credit is something the person has borrowed from someone else with the intent of paying it back with a certain interest, almost comparable to that of a loan. Credit is a topic most commonly found in financial accounting reviewing and studies.

There are actually several types of accounting variables available such as debit, credit, expense, assets, liabilities and etc. The reason for the diversity of naming each item in the ledger would be to prevent issues from occurring such as confusions as to what category each expense or items should go into so as to properly determine the financial statements of a person.

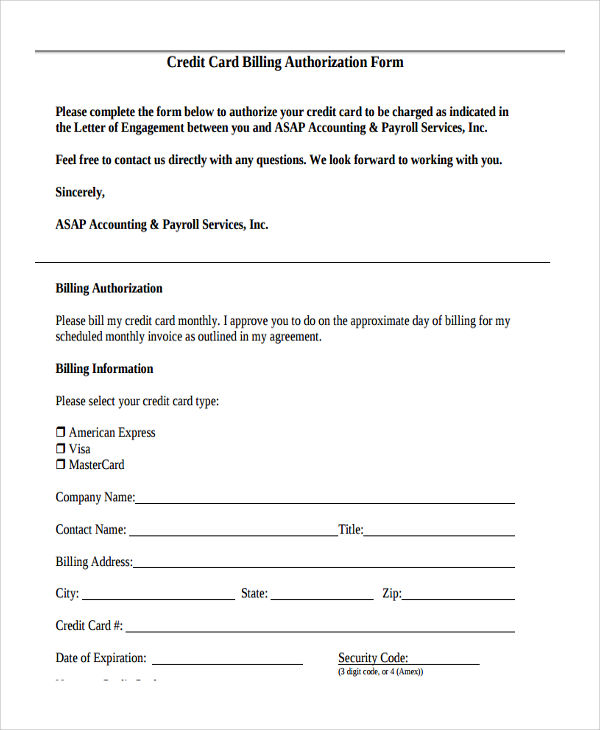

Credit Card Billing Authorization

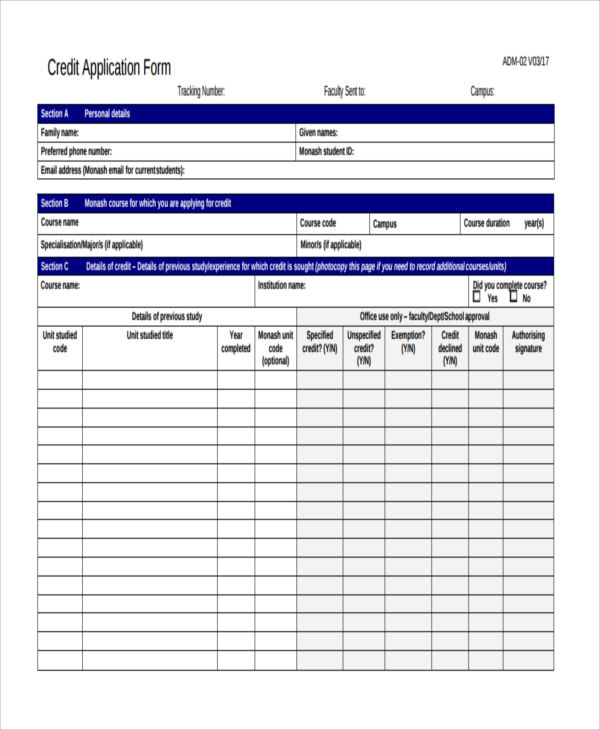

Credit Application Form

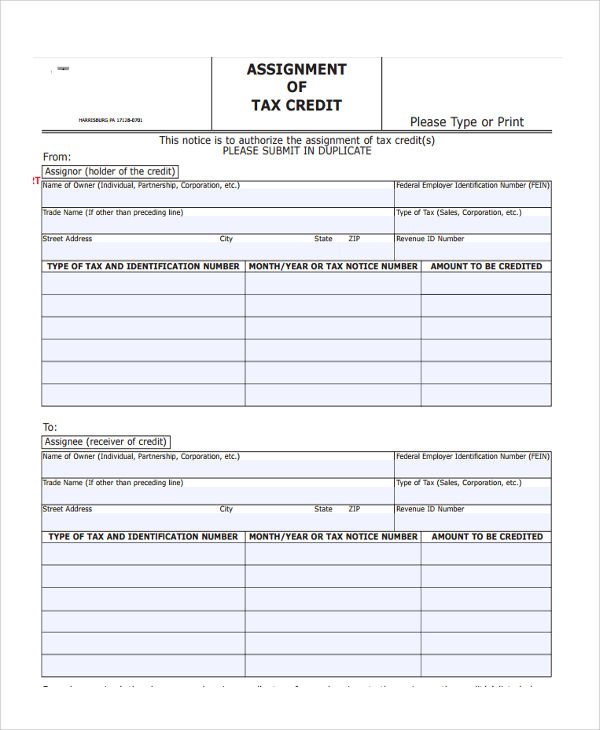

Assignment of Tax Credit

What is a Debit and Credit in Accounting?

As we know accounting has two major topics of interest, namely the debit and the credit. So the question is, what does debit and credit mean in accounting? Debit can be defined as a type of accounting entry that is used to classify an increase in expenses, but an increase in the asset as well.

Asset basically means something that of use to the accountant or the company. It still counts as a type of expense, but in a good way. Credit is defined as an increase in debt. This accounting entry is commonly termed as a debt or a loan that the person incurs for purchasing or acquiring materials for their company. Both debit and a credit entries are shown in a blank accounting form.

What is the Abbreviation for Debit and Credit?

In accounting, the abbreviation for debit and credit are DR and CR respectively, but why exactly is this abbreviation is more often used than actually spelling out the entire words? Well, aside from saving space and making the basic accounting form appear smaller and more manageable, there are other reasons why the debit and credit are named as DR and CR:

- DR is used as an abbreviation of the accounting term debit to identify something that is coming in. Mainly a type of expense.

- CR is used as an abbreviation of the accounting term credit s as to identify an expense that is going out of the company or organization.

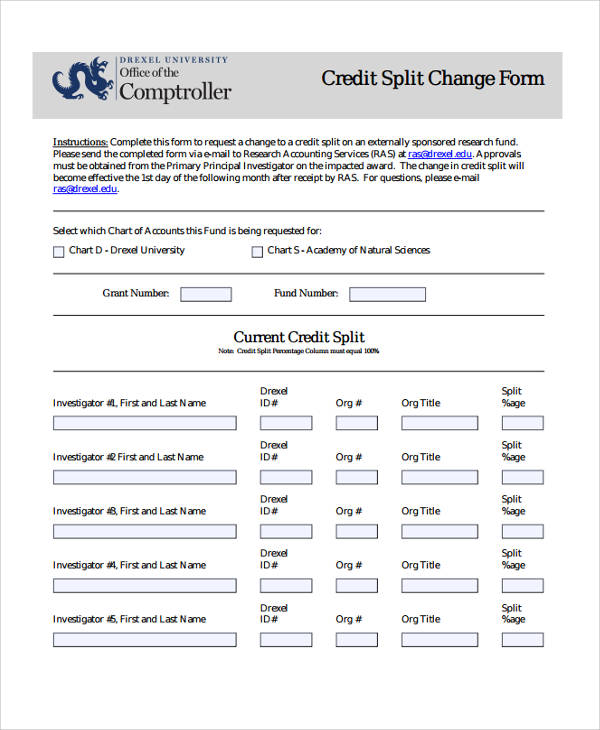

Credit Split Change

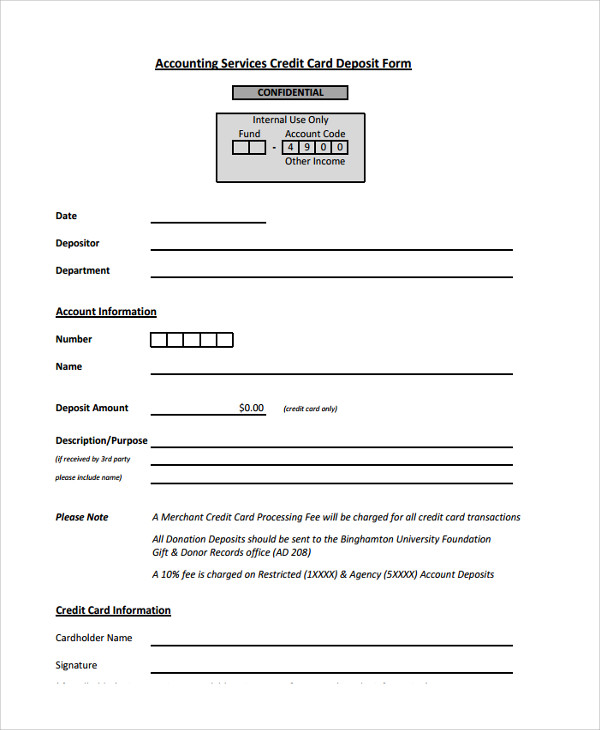

Accounting Services Credit Deposit

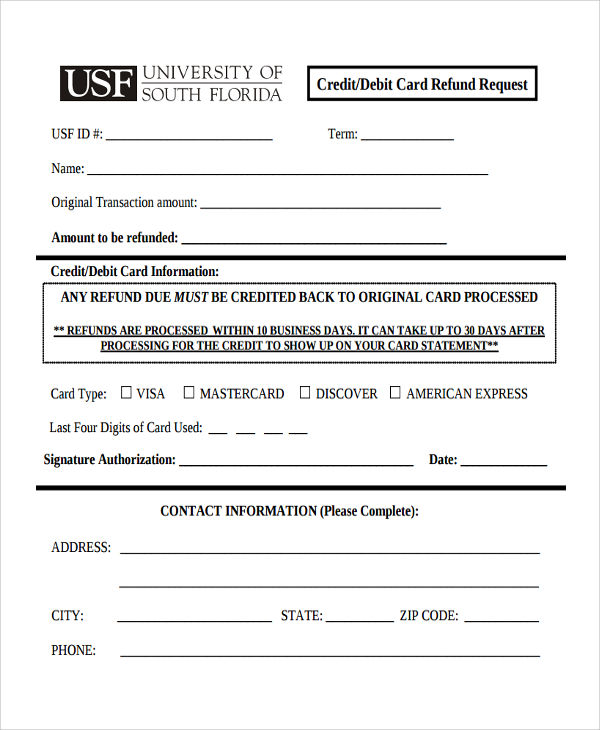

Credit Card Refund Request

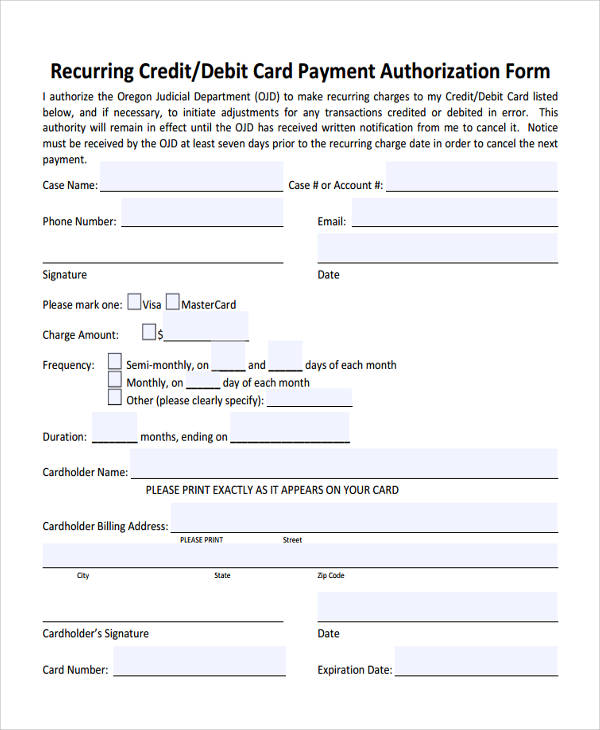

Recurring Credit Card Payment Authorization

How to Better Understand Debit and Credit in Accounting

The best way to better understand accounting would be to hire a professional accountant. However, in the event you do not want to hire someone to do your accounting for you, there is a way to understand the terms Debit and Credit in accounting.

This would be to understand that debit is something that goes into the company and would be beneficial for the company, while credit is something going out of the company, which would specify the payment of expenses and debts. Using accounting expense forms is another way to better understand accounting, as well as using a ledger account form in the sense these documents contain guidelines on how to deal with debit and credit.

Related Posts

-

Credit Debit Form

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 7+ Accounting Registration Forms in PDF

-

FREE 8+ Change Accounting Forms in PDF

-

What are Accounting Forms? [ Purpose, How to Create, Includes, Importance ]

-

What are Financial Accounting Forms? [ Objective, How to, Benefits, Guidelines ]

-

FREE 5+ Health Accounting Forms in PDF | MS Word

-

FREE 6+ Accounting Statement Forms in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel