In business, we love to maximize everything as much as we can, and that includes our business’s profit. We derive our happiness on that fact alone. By that, we’d go to great lengths to ensure that this year’s business would turn out to be, ultimately, profitable. Because of that, we want to have a useful tool to help us project the profitability of next year’s business. But being proud as most business people are, we’d rather go DIY than enlist the services of an accountant. With the help of a quick Google search, you can download free or premium Contribution Margin (Statement) Forms. These forms are useful tools that can help you calculate and project next year’s profitability.

What is a Contribution Margin (Statement) Form?

A Contribution Margin (Statement) Form is a type of income statement, wherein, a business’s profitability is calculated to make projections of profitability for the next period. Profitability is calculated by dividing the variable cost from the fixed cost of a product sold or the service offered. Contribution margins are derived from the calculations above and are expressed in percentages. Contribution Margin (Statement) Forms are essentially useful for businessmen who want to have a rough estimate of their business’s profitability for the next period by using a break-even analysis.

FREE 6+ Contribution Margin Forms in XLS

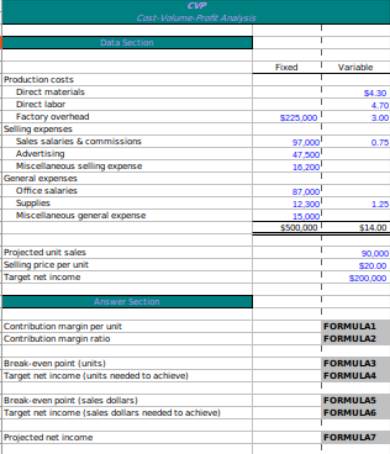

1. Contribution Margin Analysis Form

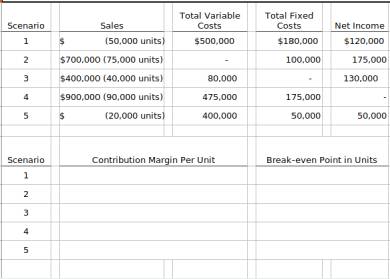

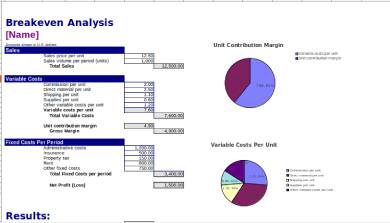

2. Contribution Margin Break-Even Analysis Form

3. Contribution Margin Table Form

4. Contribution Margin Worksheet Form

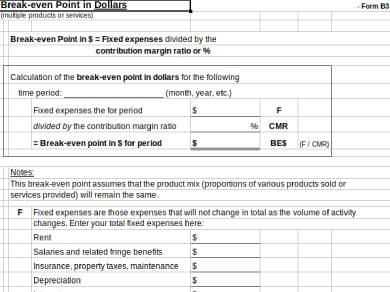

5. Contribution Margin Break-Even Point Form

6. Contribution Margin Practice Worksheet Form

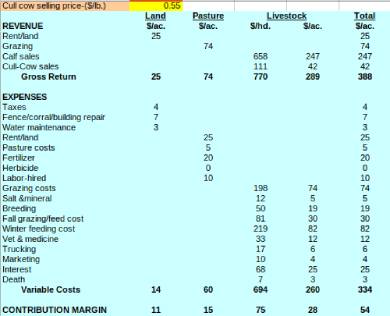

7. Livestock Contribution Margin Form

How to Compute the Contribution Margin

Contribution Margins are the percentage of the net amount of incremental profit earned from each unit of the product sold within a period. It is an essential and useful concept for businesses when deciding to make adjustments on prices especially for special pricing situations. It is also used by businesses and investors to make sales projections and analyze profitability for the next period. Contribution Margins are computed using the following formula:

Contribution Margin per Unit = Sales Price – Variable Cost per Unit

To calculate the Contribution Margin per Unit, subtract the product’s variable costs or expenses from the product’s sales price. The amount Contribution Margin generated represents the total amount of earnings to pay for fixed costs or expenses, which in turn, generates profit. Now, to determine the amount or volume of sales that your business needs to generate profit, the next thing to do is to do a break-even analysis. Break-even analysis is computed using the following formula:

Fixed costs ÷ (Revenue per unit-Variable costs per unit)

To do compute for your break-even analysis, all you have to do is to subtract the variable costs per unit from its individual sales revenue. Then divide the resulting amount with your business’s fixed costs. Break-even is the point where profit and loss are balanced. To make the equation more understandable, we must first define each of its components. Provided below are the list of its components, along with their respective definitions.

1. Fixed Cost or Expenses

Fixed Costs are costs or expenses that are not affected by any level of activity. These are expenses that are stable and do not change, from period to period. Other examples of fixed costs or expenses are advertising expenses, utility dues, equipment leases, insurance premiums, and rental expenses.

2. Variable Cost or Expenses

Variable Costs are costs or expenses that are affected depending on the level of any activity. Unlike fixed costs or expenses, variable costs change and vary from period to period. For example, the increase in the cost of direct materials is directly correlated to the rise in sales. Other examples of Variable Costs are commissions, billable labor, piece-rate labor, and credit card fees.

3. Revenue Per Unit

Revenue per unit is defined as the amount derived from the individual sales amount of each product sold. It is also known as the product’s selling price. To determine the Revenue per Unit, all you need to do is divide it with the total revenue of the products sold.

Now that we know what each component means and how to compute for break-even analysis, you would also need to understand how important it is for the business. Break-even analysis are done to enable companies to do the following:

- To increase the product’s selling price and increase sales.

- To reduce variable and fixed costs or expenses.

How to Make a Contribution Margin (Statement) Form

As a frugal businessman, you always see to it that you maximize everything, including expenses and profits. Thus, you also want to ensure that your business will be profitable in the next period. So, you take matters in your own hands and try to make a Contribution Margin (Statement) Form, all by yourself. Here are the steps on how to make a Contribution Margin (Statement) Form.

Step 1. Download a Contribution Margin (Statement) Form Template

First, download a Contribution Margin (Statement) Form template listed in this article. To start, choose among a list Contribution Margin (Statement) Form templates provided above. Make sure that the template that you selected is the one that you find comfortable working with.

Step 2. Edit the Contribution Margin (Statement) Form Template

Next, edit the Contribution Margin (Statement) Form template. To edit the template, type in the corresponding amount on the respective rows and columns where those amounts belong. The template is already preformatted with rows and columns specific to the task of preparing a Contribution Margin (Statement) Form, so editing it would be easy as a gentle breeze.

Step 3. Print the Contribution Margin (Statement) Form

Then, print the Contribution Margin (Statement) Form after you’re done completing it. You can use your home or office printer for that matter. Printing your Contribution Margin (Statement) Form allows you to show and discuss its results with your accountant.

Step 4. Discuss the Results with Your Accountant

After printing the Contribution Margin (Statement) Form, show it to your accountant so that you can discuss the results. Discussing the results in your Contribution Margin (Statement) Form enables you to have an in-depth analysis of your business’s profitability from this period. Plus, you can also discuss plans for the company based on the results contained in the Contribution Margin (Statement) Form.

Step 5. Have your Accountant Prepare a Sales Projection

After discussing the results, have your accountant prepare a sales projection so that you can prepare a business plan for the next period. Your accountant is in the perfect position to prepare a sales projection as they were trained and authorized to make such a financial document.

Related Posts

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 8+ Account Report Forms in PDF | MS Word | Excel