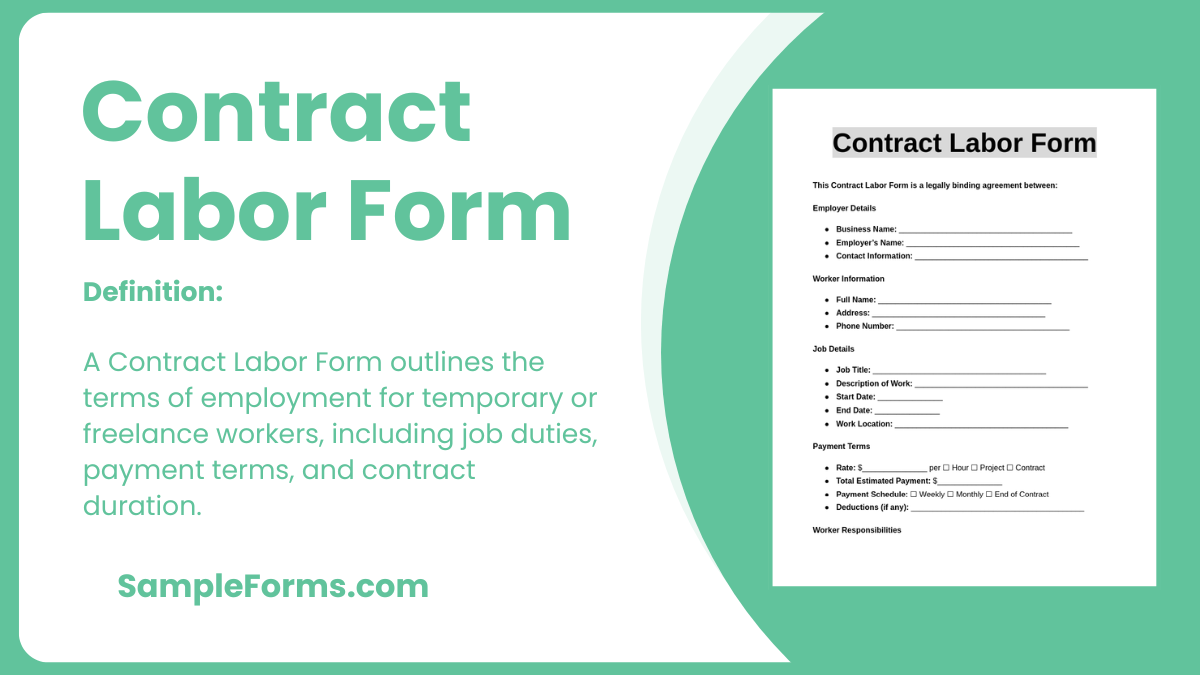

A Contract Labor Form is a legally binding document that outlines the terms between an employer and a contract worker. This Contract Form defines important details such as wages, job duration, work scope, payment terms, and rights of both parties. Whether hiring for short-term projects or independent work, this form protects both the employer and worker by ensuring transparency and compliance with labor laws. Proper documentation minimizes disputes and ensures that all conditions are met.

Download Contract Labor Form Bundle

What is Contract Labor Form?

A Contract Labor Form is an agreement between an employer and a labor worker specifying job details, compensation, and responsibilities. It ensures both parties understand their roles and obligations, reducing legal risks. This form typically includes worker’s duties, contract period, payment details, termination conditions, and employer obligations. By documenting these terms, the Contract Labor Form creates a legally enforceable contract that protects both parties from disputes and ensures compliance with labor laws.

Contract Labor Format

Employer and Worker Details

- Employer Name – Company or individual hiring the laborer.

- Worker Name – Full legal name of the contract employee.

- Contact Information – Address, phone number, and email of both parties.

- Work Location – Site where duties will be performed.

- Contract Duration – Start and end date of employment.

Job Description and Responsibilities

- Job Title – Specific role assigned to the worker.

- Scope of Work – Duties and tasks to be completed.

- Work Hours – Daily or weekly schedule requirements.

- Reporting Structure – Manager or supervisor oversight.

- Special Conditions – Additional requirements or work expectations.

Compensation and Benefits

- Payment Structure – Hourly, weekly, or monthly wage agreement.

- Payment Method – Bank transfer, check, or cash.

- Overtime Policy – Extra pay terms for extended work hours.

- Benefits Provided – Health insurance, travel allowance, or accommodation.

- Deductions – Tax and social security contributions.

Workplace Rules and Conduct

- Safety Regulations – Compliance with workplace safety standards.

- Dress Code – Required uniform or work attire.

- Breaks and Leave – Authorized time off and sick leave policies.

- Performance Expectations – Required standards for contract renewal.

- Termination Policy – Grounds for contract dismissal.

Signatures and Agreement

- Worker’s Signature – Acknowledgment of employment terms.

- Employer’s Signature – Approval of contract labor terms.

- Witness Signature – If required.

- Date of Agreement – Official signing date.

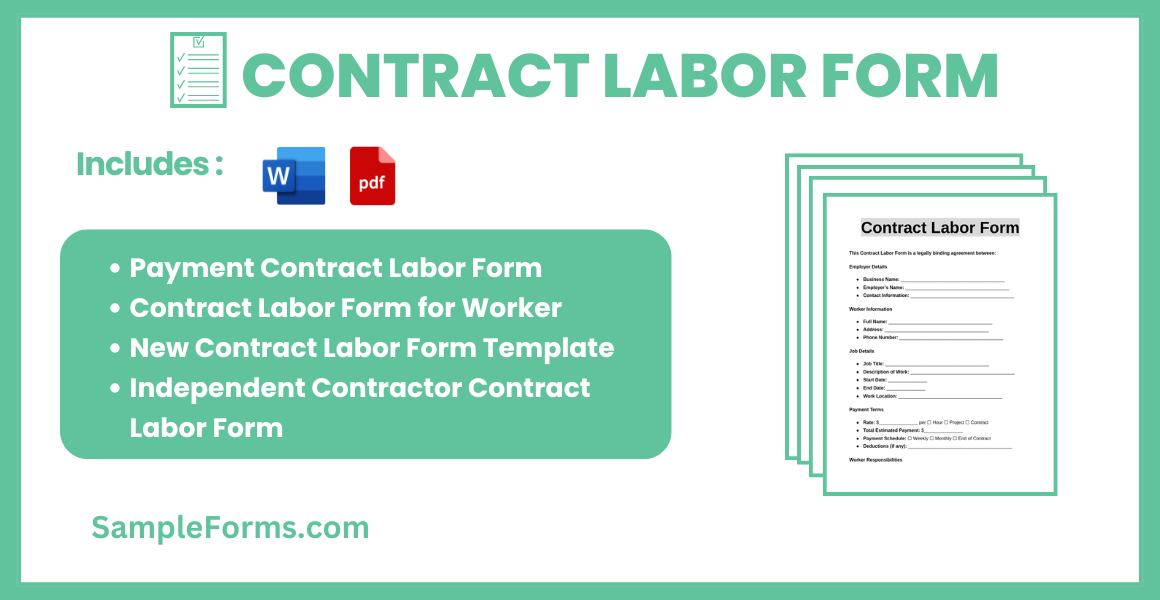

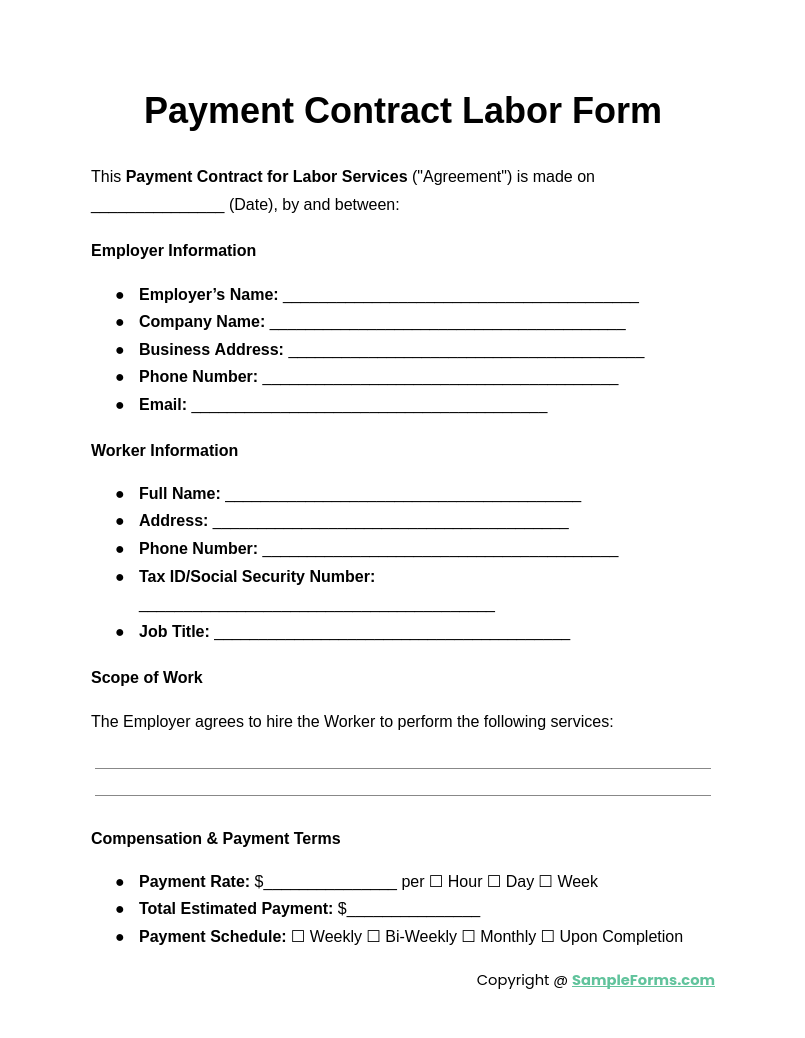

Payment Contract Labor Form

A Payment Contract Labor Form ensures that laborers receive fair compensation under agreed terms. Similar to a House Contract Form, it details payment schedules, hourly rates, overtime policies, and terms for contract termination, ensuring financial security for workers.

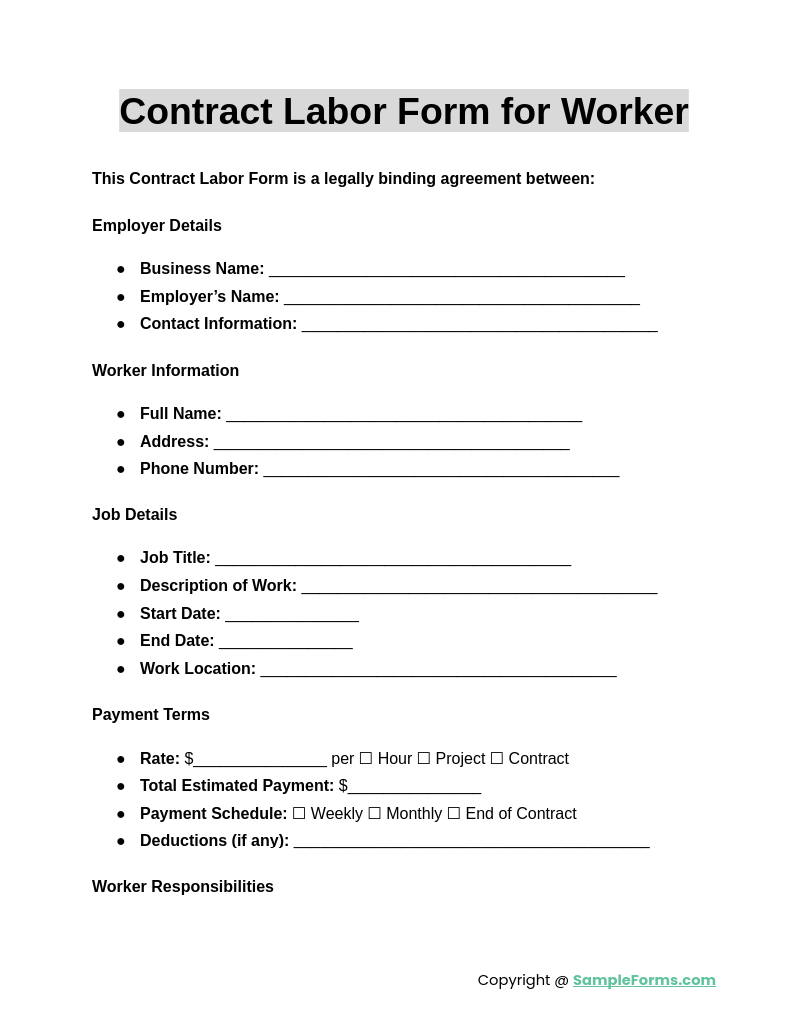

Contract Labor Form for Worker

A Contract Labor Form for Worker defines employment terms for contract-based workers. Like a Business Contract Form, it outlines job responsibilities, project duration, work conditions, and employer obligations, ensuring legal compliance and clear expectations between both parties.

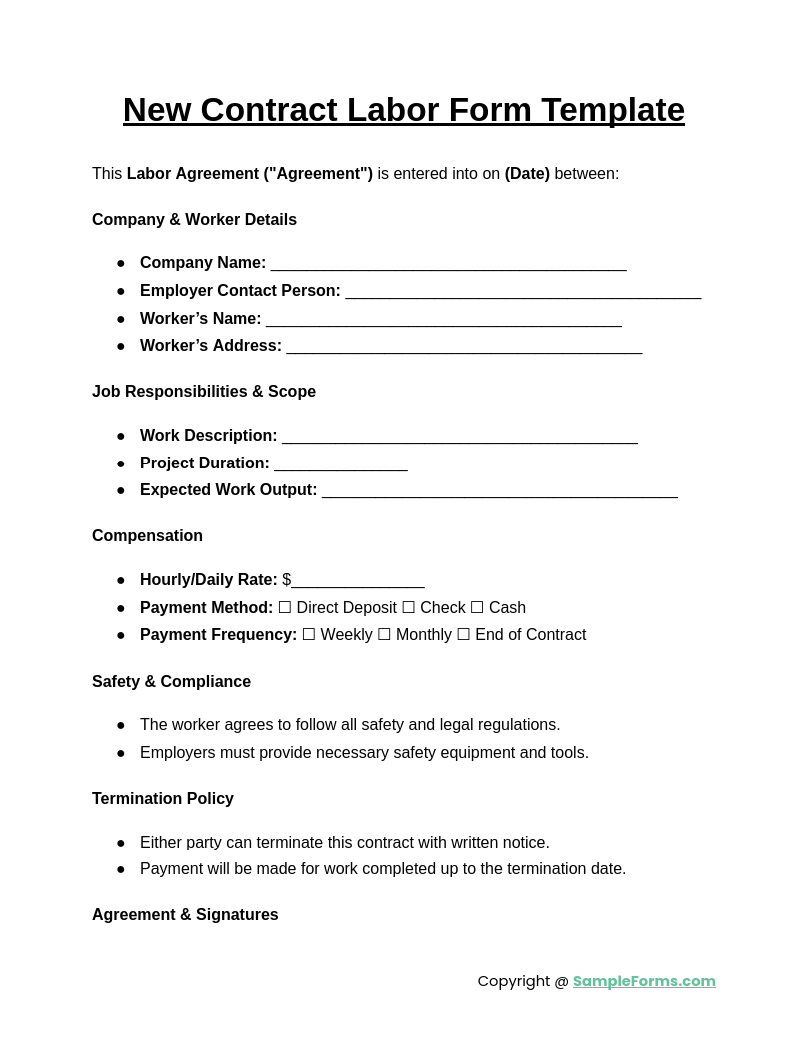

New Contract Labor Form Template

A New Contract Labor Form Template provides a standardized agreement for hiring contract workers. Similar to a Rental Contract Form, it includes essential details such as scope of work, deadlines, pay structure, and dispute resolution clauses for a structured agreement.

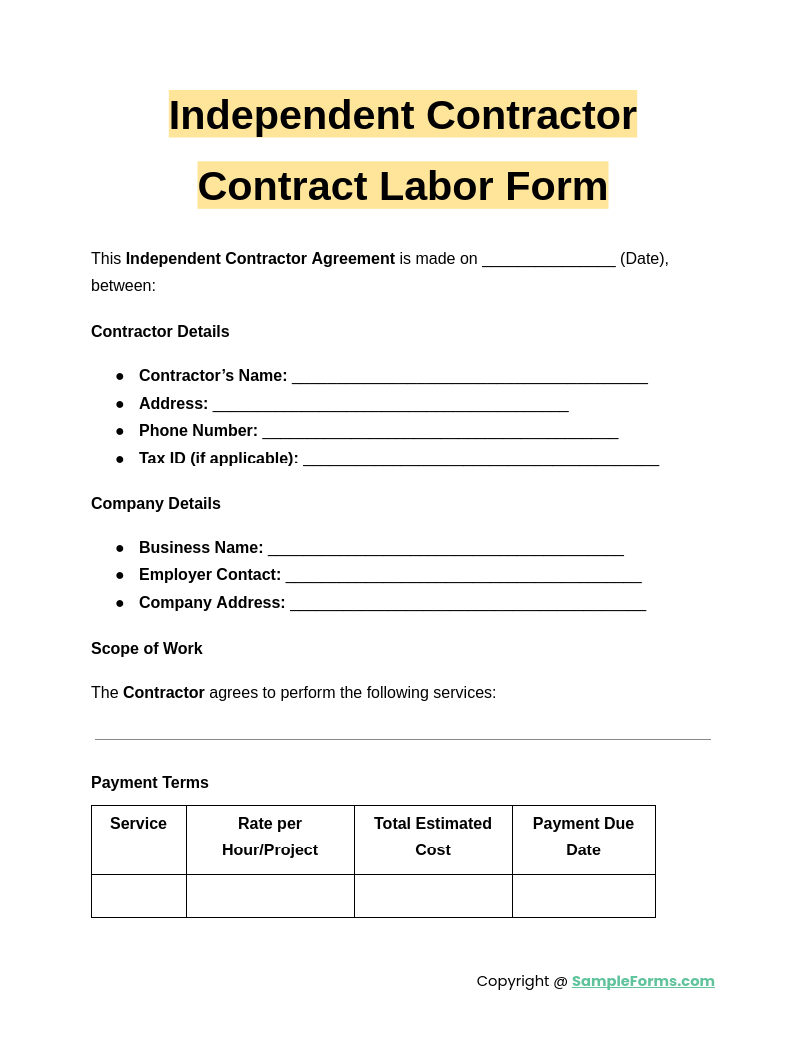

Independent Contractor Contract Labor Form

An Independent Contractor Contract Labor Form protects both the contractor and employer by defining non-employee work terms. Like a Sale Contract Form, it ensures clarity on work scope, tax responsibilities, confidentiality clauses, and termination policies, ensuring smooth contractual engagements.

Browse More Contract Labor Forms

Remodeling Labor Contract Form

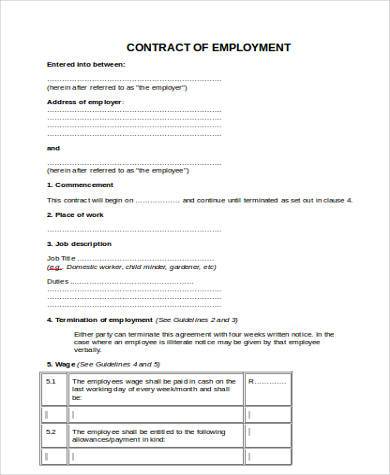

Contract Labor Agreement Form

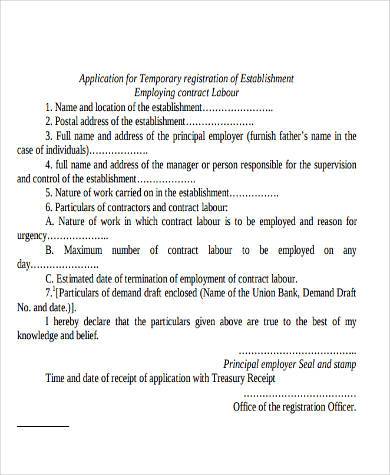

Registration Of Labor Contract Form

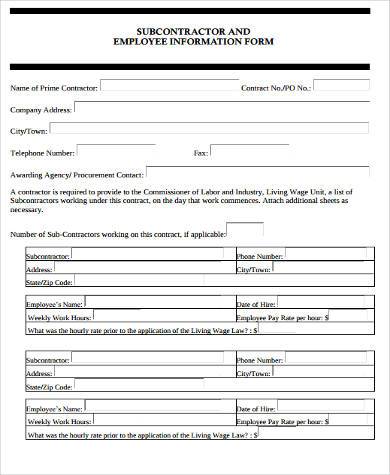

Contract Labor Information Form

Contract Labor Form Free

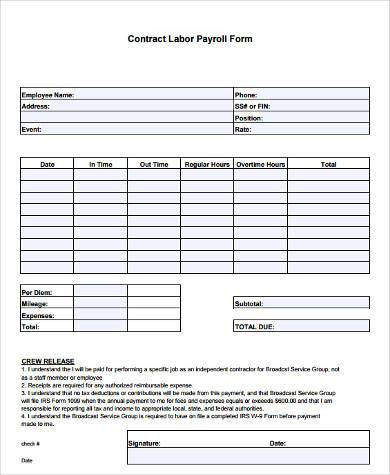

Contract Labor Payroll Form

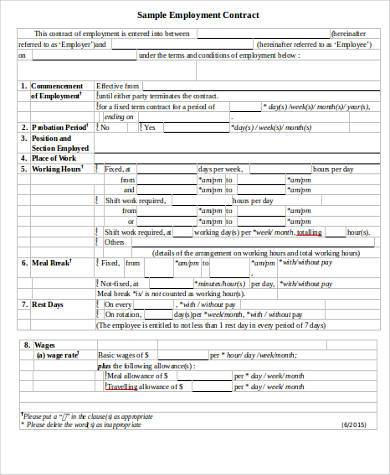

Sample Employment Contract Form

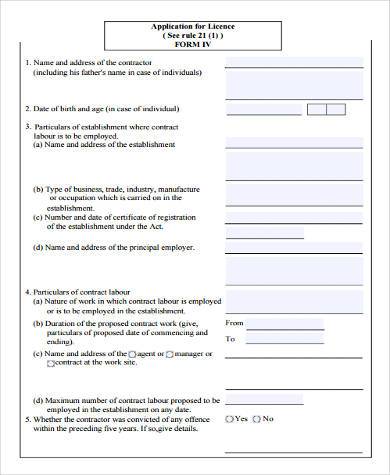

Application for Labor Licence Form in PDF

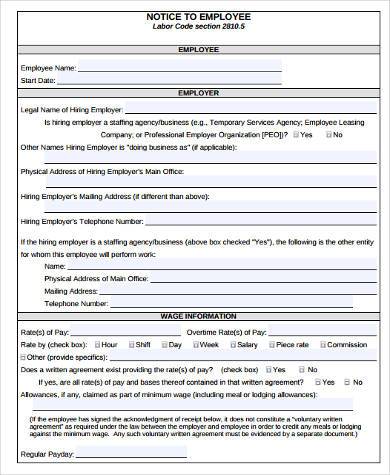

Notice For Labor Contract Form

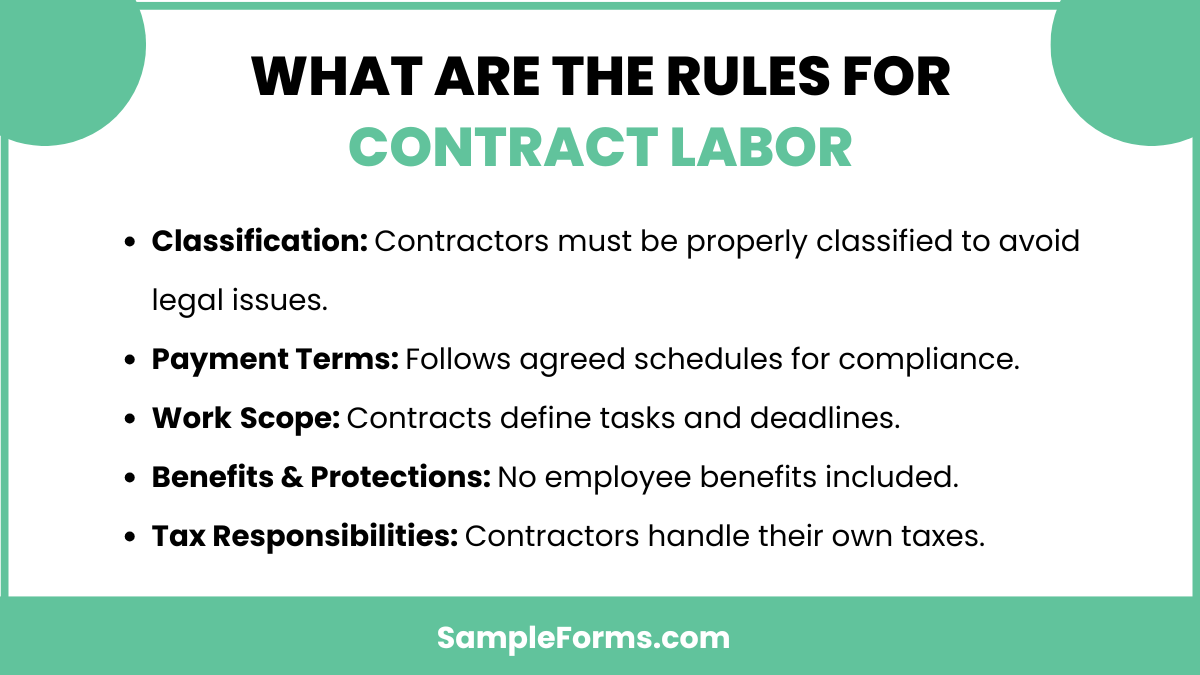

What are the rules for contract labor?

Contract labor regulations ensure fair treatment, proper classification, and compliance with labor laws. Similar to a Loan Contract Form, these rules establish legal guidelines for employer-worker relationships and payment terms.

- Legal Classification: Contract workers must not be misclassified as employees to avoid tax and legal issues.

- Payment Terms: Compensation must follow agreed schedules, ensuring fair pay and legal compliance.

- Work Scope Definition: Contracts should clearly outline tasks, deadlines, and expectations.

- Benefits & Protections: Contractors do not receive employee benefits like health insurance or paid leave.

- Tax Responsibilities: Contractors handle their own tax payments, unlike traditional employees.

What is the downside of being a 1099 employee?

Being a 1099 worker provides flexibility but comes with challenges. Similar to an Equipment Contract Form, it involves independent responsibilities without employer-provided benefits.

- No Employee Benefits: Contractors lack health insurance, retirement plans, and paid leave.

- Self-Employment Taxes: Independent workers must pay their own Social Security and Medicare taxes.

- Inconsistent Income: Work availability and payment schedules vary, leading to financial instability.

- Contract Termination Risks: Without job security, contractors face sudden contract cancellations.

- Administrative Responsibilities: Contractors must handle invoices, tax filings, and compliance.

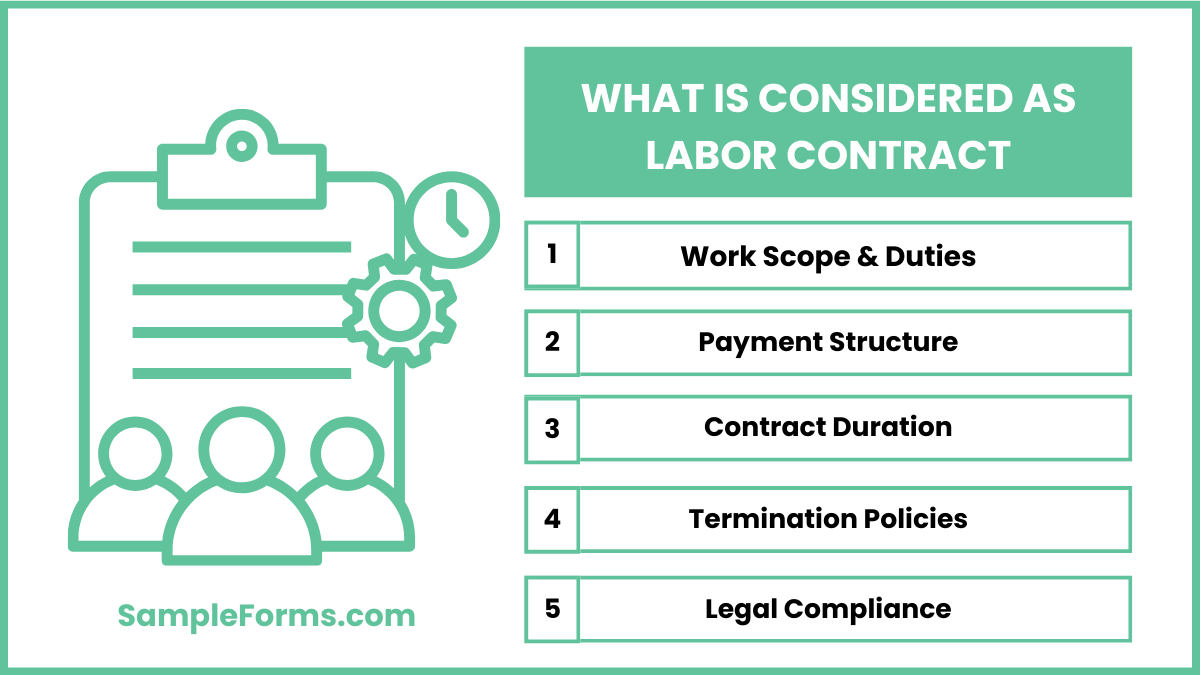

What is considered as labor contract?

A labor contract is a formal agreement outlining work terms between an employer and worker. Like a Subscription Contract Form, it legally defines roles and obligations.

- Work Scope & Duties: Specifies tasks, responsibilities, and project details.

- Payment Structure: Defines wages, payment terms, and overtime policies.

- Contract Duration: States the start and end dates of employment.

- Termination Policies: Outlines contract cancellation conditions and notice periods.

- Legal Compliance: Ensures adherence to labor laws and worker protections.

What happens if a contractor doesn’t fill out a W9?

Failure to submit a W9 form delays payments and causes tax reporting issues. Similar to a Deposit Contract Form, the form ensures accurate financial documentation.

- Payment Delays: Employers may withhold contractor payments until the form is submitted.

- Backup Withholding: The IRS requires withholding 24% of earnings for tax compliance.

- Tax Reporting Issues: Employers cannot issue a proper 1099 form without the contractor’s tax details.

- Legal Penalties: Non-compliance may result in IRS fines or audits.

- Employer Liability: Businesses may face tax penalties for hiring unverified contractors.

Which 1099 do I use for contract labor?

The 1099-NEC form is used to report contract labor payments. Like a Purchase Contract Form, it serves as financial documentation for business expenses and tax reporting.

- 1099-NEC: Used for reporting non-employee compensation exceeding $600 annually.

- 1099-MISC: Previously used for contract labor but now for rent, royalties, and legal fees.

- Filing Deadline: Employers must issue 1099-NEC forms by January 31 each year.

- IRS Submission: Businesses must file copies with the IRS to document payments.

- Taxpayer Responsibility: Contractors report 1099-NEC income on their tax returns.

Are contract jobs 1099 or W-2?

Contract jobs are typically 1099, meaning workers are independent contractors, not employees. Similar to an Agency Contract Form, terms outline payment, responsibilities, and tax obligations without employer benefits.

Is contract labor the same as self-employed?

Yes, contract labor is considered self-employment since workers manage their taxes and business expenses. Like an Entertainment Contract Form, agreements define work terms without direct employer control.

How much contract labor before 1099?

If a contractor earns $600 or more annually from a business, a 1099-NEC must be issued. Similar to a Financial Contract Form, documentation ensures compliance with tax reporting laws.

How much can you pay a contractor without a 1099?

Payments under $600 annually do not require a 1099-NEC form. Like an Event Contract Form, this threshold helps businesses manage financial obligations while remaining compliant with tax regulations.

Do you have to report contract labor?

Yes, businesses must report contract labor payments exceeding $600 per year. Like a Installment Contract Form, documentation ensures legal compliance and accurate financial records for tax purposes.

What falls under contract labor?

Contract labor includes freelancers, consultants, and independent workers performing temporary tasks. Similar to an Advertising Contract Form, agreements specify work scope, deadlines, and payment terms for non-employee services.

Can you write off contract labor?

Yes, businesses can deduct contract labor expenses as a business expense. Like a Joint Venture Contract Form, proper documentation ensures tax compliance and financial accountability.

Do you have to report contract labor?

Yes, payments of $600 or more require tax reporting via 1099-NEC. Similar to a Legal Services Contract Form, formal agreements ensure transparency and prevent tax-related issues.

Do I need an LLC to do contract work?

No, an LLC is not required, but it provides legal protection and tax benefits. Like a Photography Contract Form, structuring work properly ensures professionalism and liability protection.

What is an example of contract labor?

Contract labor includes freelance designers, consultants, and independent tradespeople. Similar to a Behavior Contract Form, agreements outline responsibilities, payment terms, and duration without an employer-employee relationship.

A Contract Labor Form is essential for businesses hiring temporary or project-based workers. Similar to a Real Estate Contract Form, it establishes clear employment terms, ensuring both employers and workers adhere to agreed conditions. This form is widely used in construction, freelancing, manufacturing, and other contract-based industries to formalize agreements and protect legal rights. By clearly defining payment structure, work scope, deadlines, and termination policies, this contract ensures smooth professional relationships and prevents misunderstandings.

Related Posts

-

FREE 5+ Mutual Release Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Merger Agreement Contract Forms in PDF | MS Word

-

FREE 3+ Limited Partnership Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Medical Release Agreement Contract Forms in PDF

-

FREE 5+ Office Lease Agreement Contract Forms in PDF

-

FREE 6+ Pledge Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Medicaid Agreement Contract Forms in PDF

-

FREE 8+ Non-Competition Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Limited Liability Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Joint Venture Contract Forms in PDF | MS Word

-

Indemnity Agreement Form

-

FREE 3+ Sale of Goods Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Home Sales Agreement Contract Forms in PDF | MS Word

-

FREE 10+ Easement Agreement Contract Forms in PDF

-

FREE 8+ Consulting Contract Forms in PDF | MS Word