Embark on a journey through the corporate landscape with Company Forms, the backbone of business documentation. These forms are pivotal in capturing essential information, defining structures, and streamlining processes. From incorporation to daily operations, they come in various types, each serving a unique purpose. We’ll delve into their meanings, explore examples from application forms to feedback mechanisms, and provide a roadmap to creating your own. Plus, gain valuable tips to ensure your forms are not just compliant, but also clear and effective

What is a Company Form ? – Definition

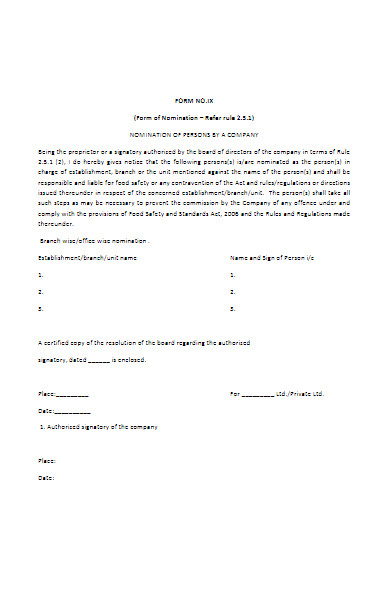

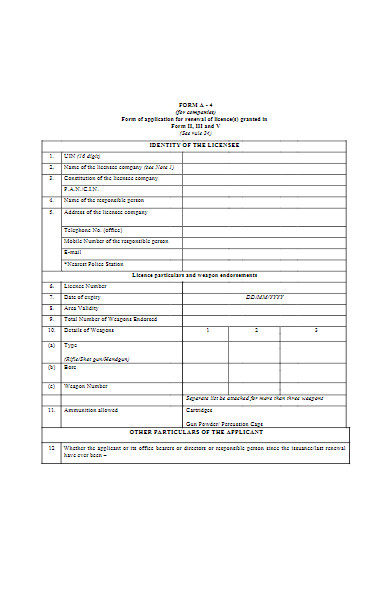

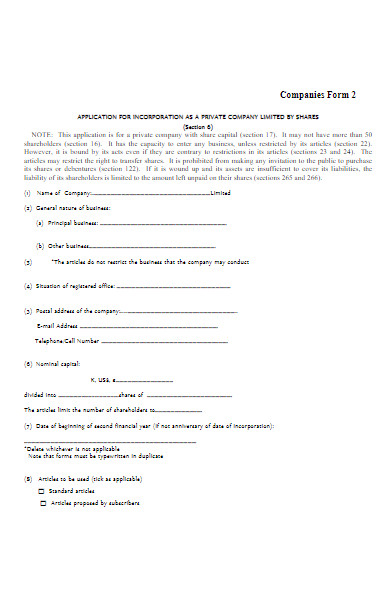

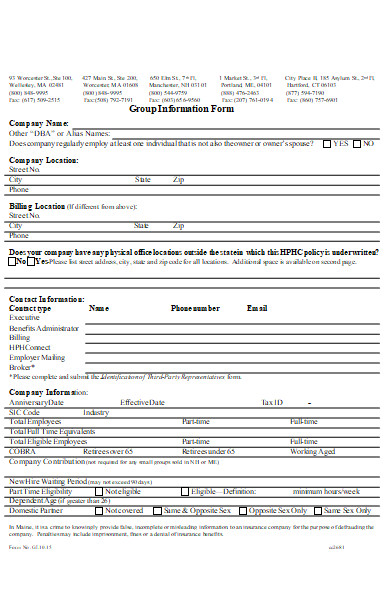

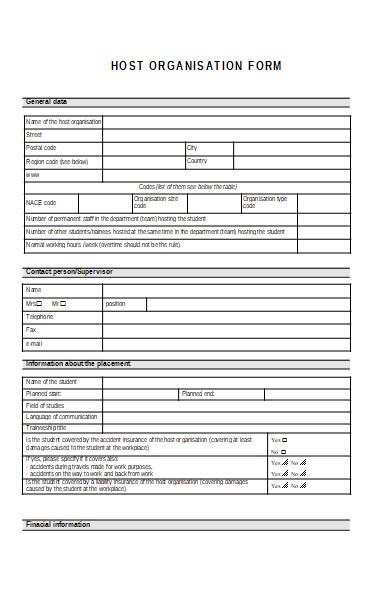

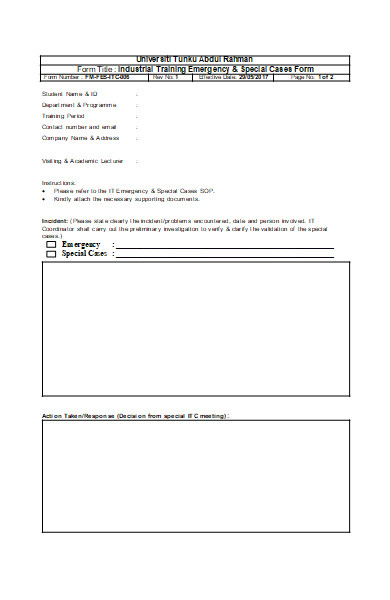

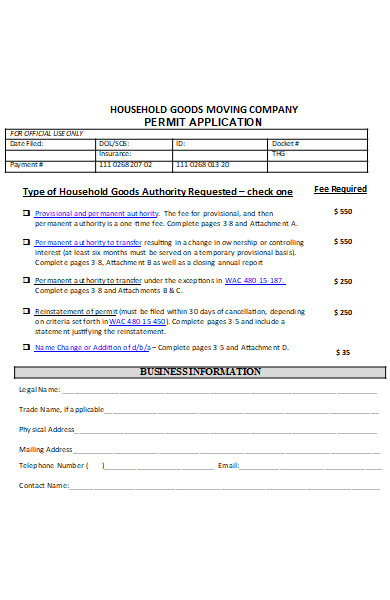

A Company Form is a standardized document used by businesses to collect and record information for a variety of purposes. It serves as an official template for internal and external communication, legal documentation, and administrative tasks. These printable forms are integral to corporate governance, facilitating clear and organized data collection, from employee details to financial transactions. They ensure consistency in the way information is captured and conveyed, making them essential tools for maintaining business operations and compliance with regulatory requirements

What is the Meaning of a Company Form?

The meaning of a Company Form extends beyond mere paperwork; it embodies the structured approach a business takes to organize, validate, and record important information. These forms are the vessels through which data flows within the corporate body, ensuring accuracy, legal compliance, and efficiency in operations. They act as official records for transactions, employee onboarding, policy acknowledgments, and more, reflecting the company’s commitment to orderliness and regulatory adherence. In essence, a Company Form is a critical instrument in the symphony of business administration.

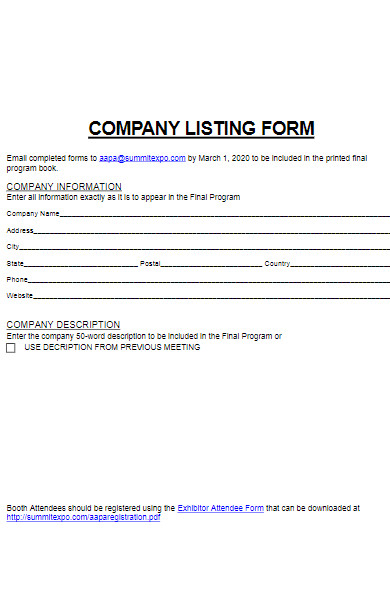

What is the Best Sample Company Form?

Business Details:

- Business Name:

- Business Type:

- Industry:

- Federal EIN:

Owner/Proprietor Information:

- Full Name:

- Contact Number:

- Email Address:

- Social Security Number:

Business Address:

- Street Address:

- City:

- State:

- ZIP Code:

Operational Information:

- Number of Employees:

- Date of Establishment:

- Annual Revenue Estimate:

Legal Compliance:

- Business License Number:

- Compliance Certifications:

Banking Information:

- Bank Name:

- Account Number:

- Routing Number:

Signature and Date:

- Authorized Signature:

- Date:

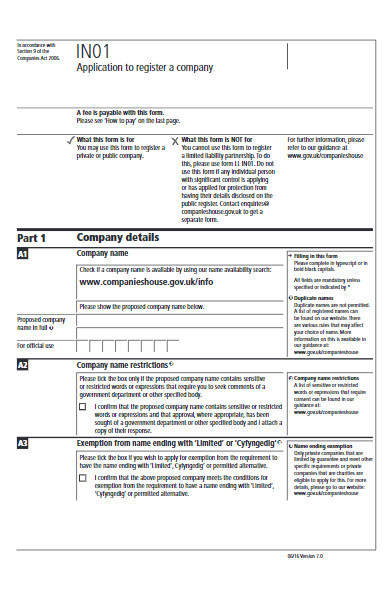

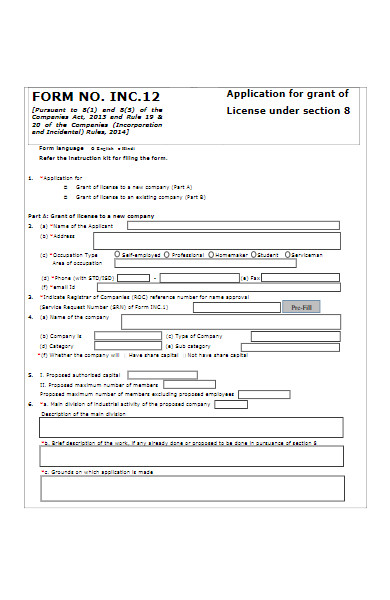

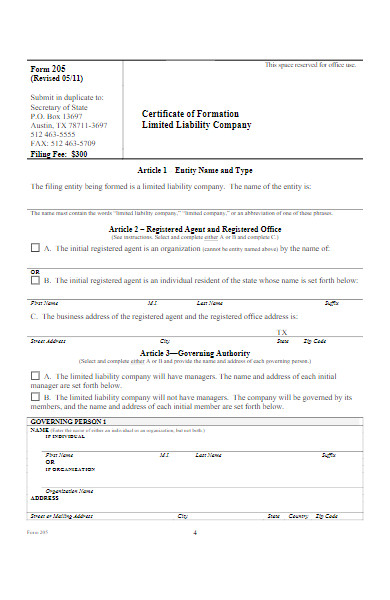

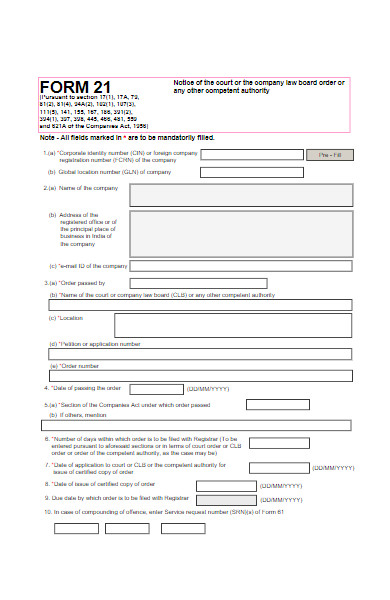

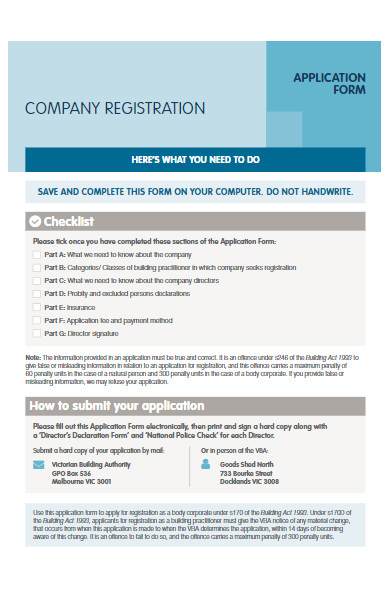

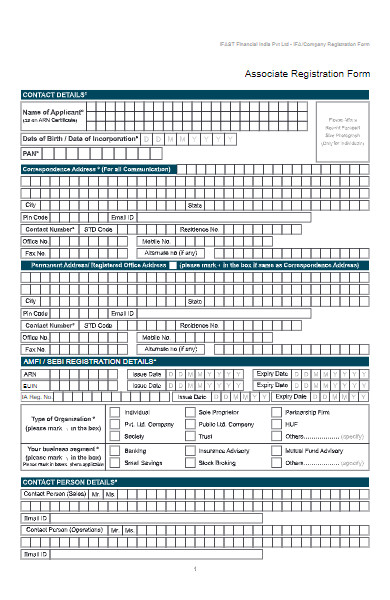

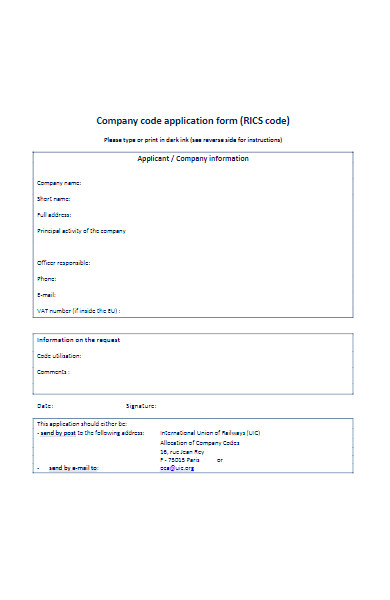

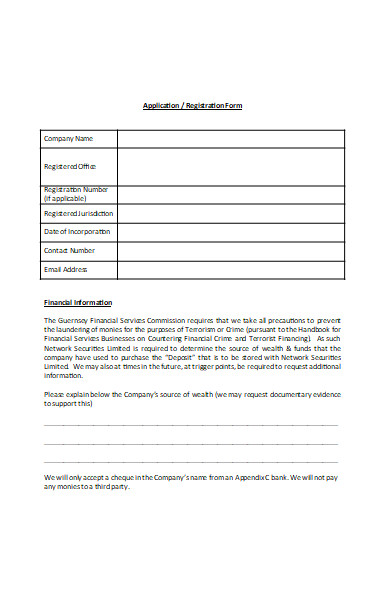

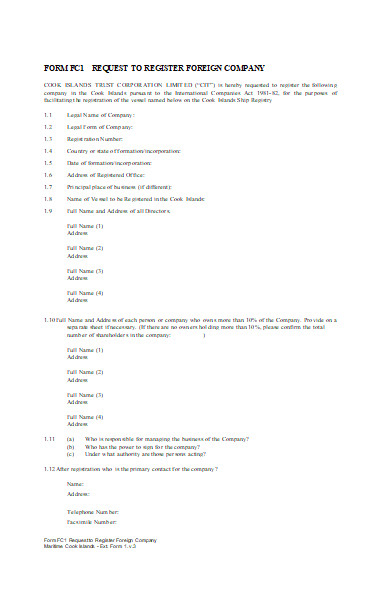

This Company Registration Form is a prime example of a foundational document, capturing all the essential details required for a business to establish its legal and operational presence.

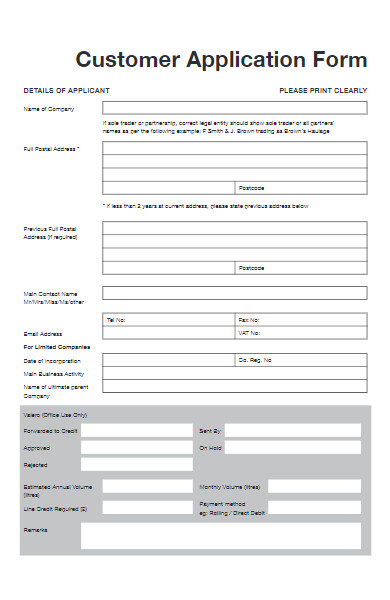

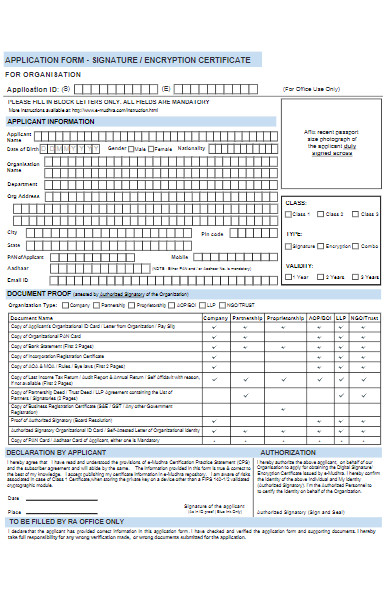

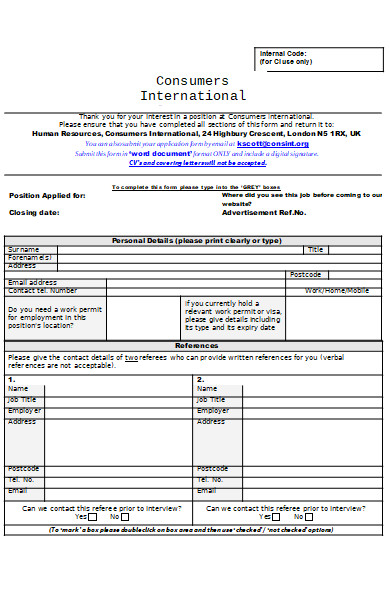

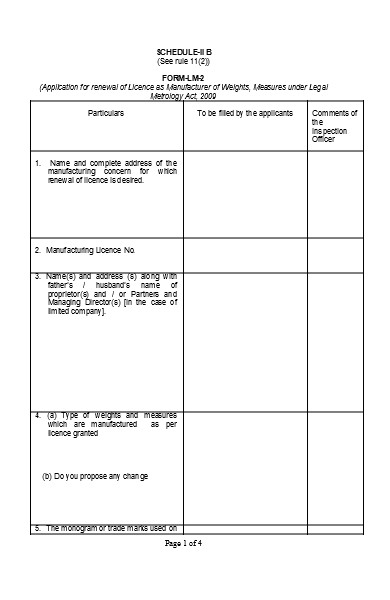

FREE 50+ Company Forms

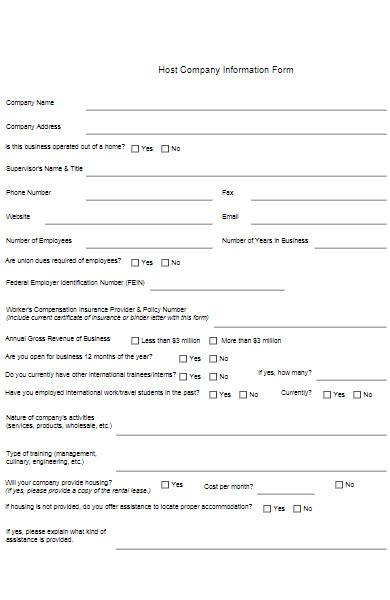

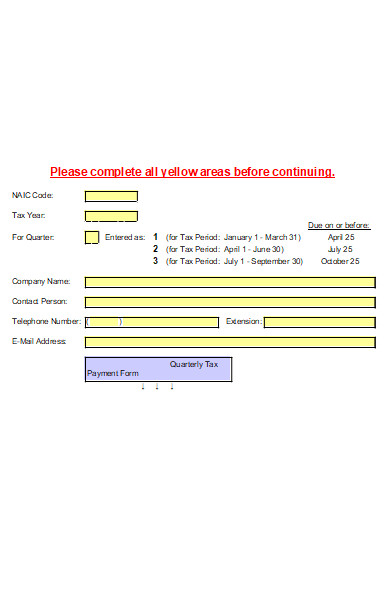

51. Company Information Request Form

- Excel

What information do I need to provide on a Company Form for business registration?

Business Identification

- Legal Business Name: The official name registered with the government.

- DBA (Doing Business As): Any alternate names under which the business operates.

- Business Structure: Whether it’s an LLC, corporation, partnership, or sole proprietorship.

- Industry Type: The primary sector or nature of the business.

Owner/Proprietor Details

- Owner’s Full Name: The legal name of the business owner or primary contact.

- Ownership Percentage: The share of ownership each member holds if applicable.

- Social Security Number or EIN: For tax identification purposes.

Contact Information

- Business Address: The primary place of business, including street, city, state, and ZIP code.

- Phone Number: A direct line to the business.

- Email Address: For official correspondence.

Operational Data

- Date of Inception: When the business officially started.

- Number of Employees: Current employee count.

- Annual Revenue: An estimate of yearly earnings.

Legal Compliance

- Licenses and Permits: Any regulatory documents that authorize business operations.

- Compliance Certifications: Necessary industry-specific compliance acknowledgments.

Financial Information

- Bank Details: For transactions, loans, and financial history.

- Capital: Information on the initial amount invested in the business.

Signature and Verification

- Authorized Signature: Legally binding sign-off by the owner or authorized representative.

- Date: The date on which the form is completed and submitted.

Additional Business Information

- Business Plan: A brief overview or attachment of the business plan, outlining the objectives and strategies.

- Products/Services Offered: A description of what the business provides to customers.

Regulatory Information

- Zoning Compliance: Confirmation that the business location complies with local zoning laws.

- Environmental Regulations: Any relevant environmental permits or compliance information.

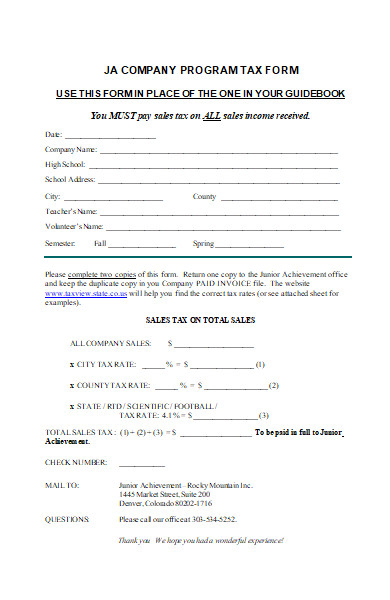

Tax Information

- State Tax ID: If different from the federal EIN, for state tax purposes.

- Sales Tax Permit: Required information if the business sells goods or services subject to sales tax.

Declaration and Consent

- Acknowledgment of Terms: A statement confirming understanding and agreement to legal and regulatory terms.

- Privacy Agreement: Consent to how the business will handle and protect personal and sensitive data.

Submission Details

- Filing Instructions: How and where to submit the completed Company Form.

- Processing Time: Expected duration for the registration process to be completed.

- Contact for Queries: Information on who to contact for help or questions regarding the form.

By providing comprehensive and accurate information in these sections, businesses can ensure a smooth registration process, laying a strong foundation for their operations and compliance. You also browse our company feedback forms.

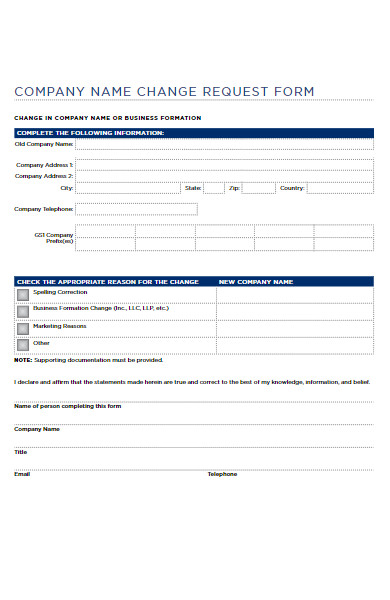

How do I update my contact details using a Company Form?

Updating your contact details using a Company Form typically involves the following steps:

Locate the Update Section

- Find the section of the form specifically designated for contact information updates.

Current Information

- Enter your current details as they are listed in the company’s records.

New Contact Details

- Provide the new contact information, including:

- New Business Address: If the location has changed.

- Phone Number: Update with any new business or direct contact numbers.

- Email Address: Provide a new email if the primary correspondence email has changed.

Reason for Update

- Briefly explain the reason for the change in contact details, if required.

Verification

- Verify that the new information is accurate and complete.

Authorization

- Sign and date the form to authorize the update, if necessary.

Submission

- Follow the company’s procedure for submitting the updated form, which may include emailing a scanned copy, submitting it through an online portal, or mailing it to the designated department.

Confirmation

- Await confirmation from the company that your details have been updated in their system.

It’s important to ensure that all sections are filled out correctly to prevent any delays or issues with the update process. You should also take a look at our company clearance forms.

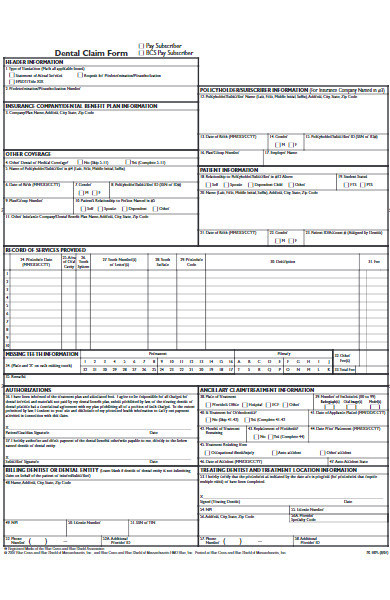

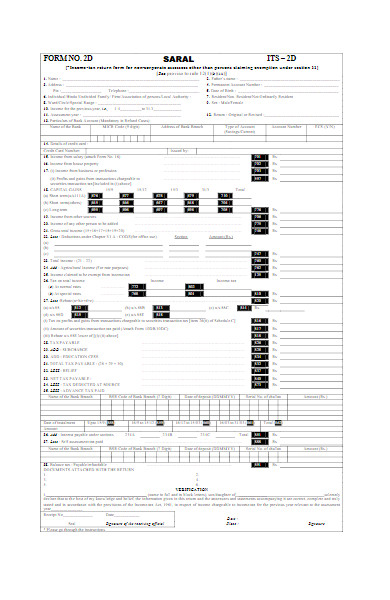

Can I file taxes with a Company Form, and which sections are mandatory for tax purposes?

When filing taxes for a company in the United States, the specific form used typically depends on the type of Business Registration Forms. Here are the common forms and the mandatory sections for each:

1. Form 1120: U.S. Corporation Income Tax Return

- Income Section: Report the gross receipts or sales and subtract the cost of goods sold to calculate the gross income.

- Deductions: Company Appraisal Form providing users with a resource to understand how appraisals can impact their tax filings..

- Tax and Credits: Calculate the tax liability and list any payments or credits.

2. Form 1120-S: U.S. Income Tax Return for an S Corporation

- Income: Report income and losses on the applicable lines.

- Deductions: Business expense deductions similar to Form 1120.

- Schedule K: Shareholders’ pro-rata share of income, credits, and deductions.

3. Form 1065: U.S. Return of Partnership Income

- Income: Report the ordinary business income (loss).

- Deductions: Similar to corporate deductions.

- Schedule K-1: Allocation of income, deductions, and credits to partners.

4. Form 1040 Schedule C: Profit or Loss from Business (Sole Proprietorship)

- Part I – Income: Summarize the income of the business.

- Part II – Expenses: Report all expenses, such as advertising, car expenses, wages, and rent.

- Part IV – Information on Your Vehicle: If claiming vehicle expenses, provide information on business use.

5. Form 990: Return of Organization Exempt from Income Tax (Nonprofits)

- Revenue: Details of the organization’s revenue.

- Expenses: Breakdown of expenses into categories.

- Supplemental Information: Disclosures about the organization’s activities and governance.

Mandatory Attachments:

- Schedules: Depending on the form, various schedules are required to provide additional details about income, deductions, and credits.

- Supporting Documentation: Attach any forms that support an entry on a line, such as Form 4562 for depreciation or Form 4797 for sales of business property.

Note: While this guide covers the basic mandatory sections, tax law is complex, and additional forms or schedules may be required depending on specific circumstances. Always consult the IRS instructions for each form or a tax professional to ensure compliance with tax filing requirements.

Remember to include accurate and complete information in each section to avoid penalties or audits from the IRS. Using the correct form and thoroughly filling out all mandatory sections are key steps in the compliance process.

What is the process for submitting a Company Form for new employee onboarding?

Onboarding a new employee into a company in the United States typically involves a series of steps to ensure that the individual is properly registered with the company’s systems, is legally authorized to work, and has been introduced to the company’s policies and culture. Here’s a simplified process that many companies follow:

Step 1: Completion of Form I-9

- Section 1: The employee must complete this section no later than the first day of work. It collects identification information and attests their authorization to work in the U.S.

- Section 2: The employer reviews the employee’s documentation and completes this section within three business days of the employee’s start date.

Step 2: Filling Out Form W-4

- Employee Information: The employee provides their personal information and Social Security Number.

- Filing Status: The employee selects their tax filing status which determines the withholding amount.

- Adjustments: The employee may adjust their withholding based on income, deductions, and any additional job or tax credit situations.

Step 3: State Tax Withholding Forms

- Similar to the W-4 but for state tax purposes, if applicable.

Step 4: Benefits Enrollment

- Health Insurance: Employees select from the available health insurance options.

- Retirement Plans: Employees may enroll in a 401(k) and select their contribution levels.

- Other Benefits: Enrollment in other benefits like life insurance or disability coverage.

Step 5: Company Policies and Procedures

- Employee Handbook: Review and acknowledgment of the company’s policies and procedures.

- Safety and Compliance Training: Completion of any mandatory industry-specific training.

Step 6: Setting Up Payroll

- Direct Deposit Forms: Employees provide bank information for salary deposits.

- Payroll Schedule: Employees are informed about the pay cycle.

Step 7: Work Eligibility Verification

- E-Verify: If the employer participates in E-Verify, they must confirm the employee’s eligibility to work in the U.S. electronically.

Step 8: Company-Specific Forms and Procedures

- Non-Disclosure Agreements: Signing confidentiality agreements, if required.

- Emergency Contact Information: Collecting contact details for use in emergencies.

Step 9: Introduction to Team and Culture

- Orientation Sessions: Introduction to the company culture, vision, and team members.

- Mentor/Peer Assignments: Assigning a mentor or buddy for guidance and support.

Step 10: Equipment and Access

- Company Assets: Issuing laptops, phones, or other necessary equipment.

- System Access: Providing access to company email, intranet, and work systems.

Step 11: Ongoing Support and Training

- Training Programs: Enrollment in job-specific training programs.

- Performance Management: Explanation of performance review processes and goals setting.

Final Note: Each company may have specific additional blank forms or procedures based on their size, industry, or internal HR policies. It’s important to have a checklist and guide for new employees to ensure a smooth onboarding process. Employers should always stay updated on federal and state regulations to maintain compliance during employee onboarding.

Where can I find a Company Form for reporting annual financial statements?

To find a Company Form for reporting annual financial statements in the United States, you would typically look for specific forms based on your business structure. Here are some resources and forms that are generally used for the purpose of reporting annual financial statements:

1. Form 10-K for Publicly Traded Companies

Publicly traded companies must file a Form 10-K annually with the Securities and Exchange Commission (SEC). This comprehensive report includes the company’s financial statements and is available on the SEC’s EDGAR database online.

Where to Find:

- EDGAR Database: Visit the SEC EDGAR database where you can search for and access filed 10-K forms.

- Company Website: Public companies often provide their 10-K filings in the investor relations section of their website.

2. Form 1120 for Corporations

Corporations file an annual Form 1120, U.S. Corporation Income Tax Return, which includes financial statements and other pertinent financial information.

Where to Find:

- IRS Website: Form 1120 can be downloaded from the IRS website.

- Tax Software: Many corporate tax software programs have the capability to generate Form 1120.

- Accountant or CPA: A certified public accountant can provide you with the form and assist with its preparation.

3. Form 1065 for Partnerships

Partnerships use Form 1065, U.S. Return of Partnership Income, to report their financials annually. This form includes various schedules that detail the financial state of the partnership.

Where to Find:

- IRS Website: Form 1065 is available on the IRS website.

- Professional Tax Services: Tax professionals or business accountants typically provide these forms and filing services.

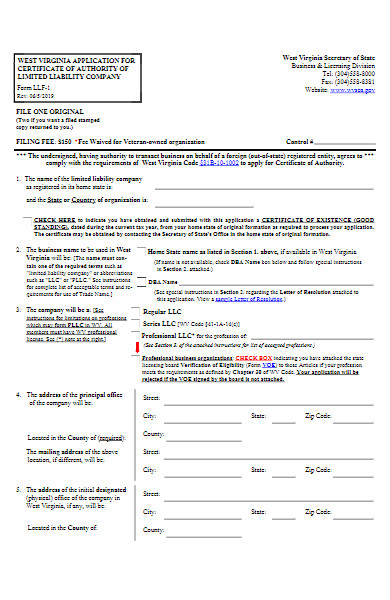

4. Annual Reports for LLCs

The requirements for LLCs can vary by state. Most LLCs are required to file an annual report with their state’s Secretary of State office.

Where to Find:

- State Secretary of State Website: Each state has its own requirements and forms, which can typically be found on the state’s Secretary of State website.

- Legal Document Services: Online legal document services may also provide state-specific annual report forms for LLCs.

5. Nonprofit Form 990

Nonprofit organizations are required to file Form 990, Return of Organization Exempt From Income Tax, annually.

Where to Find:

- IRS Website: Form 990 is available for download from the IRS website.

- Nonprofit Specialist Accountants: Accountants who specialize in nonprofit organizations can assist with the preparation and filing of Form 990.

Key Considerations

- Ensure you are accessing the most current form for the reporting year.

- Review the instructions for each form carefully to understand the reporting requirements.

- Consider consulting with a tax professional or accountant for assistance in preparing and filing your annual financial statements to ensure accuracy and compliance with federal and state laws.

Always verify that you are using the correct fillable form and version for the specific tax year you are reporting, as tax laws and form requirements can change annually.

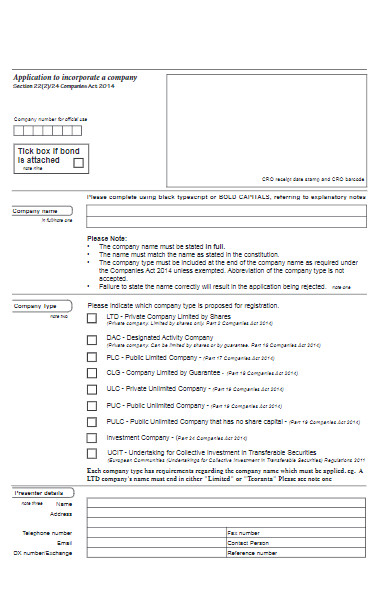

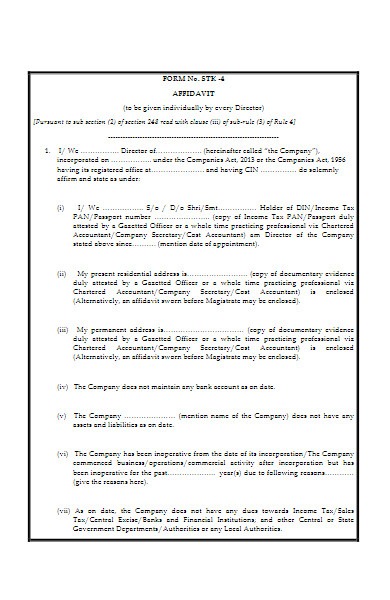

What are the requirements for completing a Company Form for a merger or acquisition?

Completing a Company Form for a merger or acquisition in the United States involves several legal, financial, and regulatory requirements. The process is intricate, and the specific forms needed can vary depending on the size of the companies involved, the nature of the merger or acquisition, and the jurisdictions in which the companies operate. Below are the general steps and requirements:

Pre-Merger/Acquisition Requirements:

- Due Diligence: Conducting thorough due diligence to evaluate the target company’s assets, liabilities, contracts, and potential legal issues.

- Valuation: Assessing the value of the target company through various valuation methods to inform the purchase price.

- Letter of Intent (LOI): Drafting a non-binding agreement outlining the terms of the potential merger or acquisition.

Legal Documentation:

- Merger or Acquisition Agreement: This is the primary document that outlines all terms of the transaction including price, structure, representations and warranties, and conditions to closing.

- Board Resolutions: Approval by the board of directors of each company involved is required, typically documented in written resolutions.

- Shareholder Approval: Depending on the company structure and the size of the transaction, shareholder approval may be needed.

Regulatory Filings:

- Form 8-K: Public companies must file a current report with the SEC when entering into a material definitive agreement regarding a merger or acquisition.

- Hart-Scott-Rodino (HSR) Act Filing: For certain large transactions, parties must file a notification with the Federal Trade Commission (FTC) and the Department of Justice (DOJ) and wait for the transaction to clear antitrust review.

- State Filings: Depending on the state, companies may need to file a certificate of merger or other documents with the Secretary of State where the companies are incorporated.

Financial Statements:

- Audited Financial Statements: The SEC requires that public companies provide audited financial statements of the companies involved in the merger or acquisition.

- Pro Forma Financial Statements: These are often required to show the effects of the merger or acquisition on the financial position of the acquiring company.

Post-Merger/Acquisition Requirements:

- Integration Plans: Developing a plan for integrating the operations, personnel, cultures, and systems of the two companies.

- Public Announcements: Coordinating the release of information to the public, if the companies are publicly traded.

- Employee Notices: Communicating to employees of both companies about the impact of the merger or acquisition.

Additional Considerations:

- Confidentiality Agreements: Often used to protect sensitive information shared during the merger or acquisition process.

- Non-Compete and Non-Solicit Agreements: These may be required from the sellers to protect the value of the acquired business.

Final Note: The specifics can vary greatly, and it’s important to consult with legal and financial professionals who specialize in mergers and acquisitions. This ensures all necessary documents are completed accurately and that all legal and regulatory requirements are met. The complexity of mergers and acquisitions mandates a careful and thorough approach to avoid future liabilities and to ensure a smooth transition. Our Business forms is also worth a look at

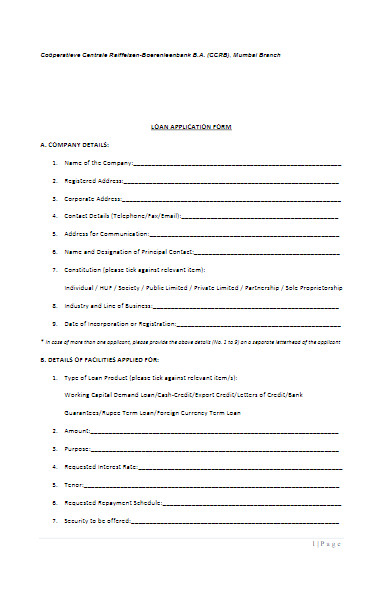

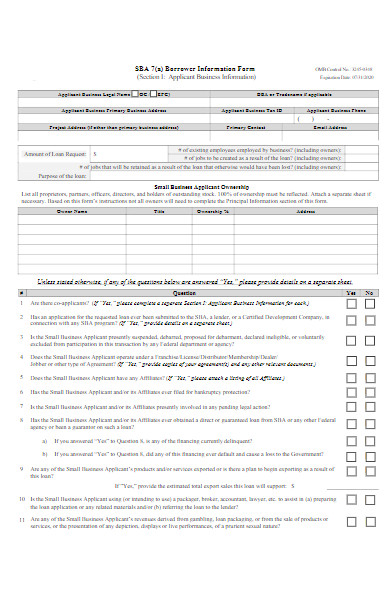

Can I use a Company Form to apply for a business loan or credit line?

Yes, you can use a Company Form to apply for a business loan or a credit line. The specific forms and documentation required will depend on the lender’s requirements and the type of loan or credit you are seeking. Here’s a general outline of the process and the types of forms and information you’ll need to prepare:

Business Loan Application Process:

- Loan Application Form: This is the primary document that a lender will require to start the application process. It includes business and personal information, the amount of loan requested, and the purpose of the loan.

- Business Plan: Many lenders require a detailed business plan that outlines your business model, market analysis, management structure, and financial projections.

- Personal and Business Financial Statements: You will need to provide your lender with financial statements, including balance sheets, income statements, and cash flow statements, often for the past two to three years.

- Credit History: Lenders will check the credit history of the business and possibly the personal credit history of the owners. You may need to provide your business credit report and personal credit reports.

- Collateral Documentation: If the loan will be secured, you will need to provide documentation about the collateral you are offering, such as real estate deeds, vehicle titles, or inventory lists.

- Legal Documents: Depending on the structure of your business, you may need to provide legal documents such as articles of incorporation, commercial leases, or franchise agreements.

- Tax Returns: Typically, lenders require several years of business and personal tax returns to verify income and tax compliance.

- Bank Statements: Recent bank statements for your business will likely be required to assess your business’s current financial health and cash flow.

- Debt Schedule: A list of current debts, if any, to show your existing financial obligations.

Additional Forms and Information:

- Proof of Ownership: Documents that show the ownership structure of your business.

- Business Licenses and Permits: Copies of any professional licenses or permits required to legally operate your business.

- Insurance Information: Details about your business’s insurance policies.

After Submission: Once you’ve submitted all required forms and documentation, the lender will review your application to determine your creditworthiness. This process can take anywhere from a few days to several weeks.

Note: Each lender has its own set of requirements and may request additional documentation. It’s important to review the sample application forms requirements carefully and prepare all documents in advance. It’s also beneficial to maintain a good credit score, a solid business plan, and a clear understanding of how you intend to use and repay the loan to increase your chances of approval. Consulting with a financial advisor or loan officer can provide guidance tailored to your specific situation.

How to Create a Company Form?

Creating a Company Form is an essential task for many business operations, whether for internal use, customer transactions, or compliance with regulations. Here’s a step-by-step guide to help you create a professional and effective form for your company:

Step 1: Define the Purpose

- Identify the Need: Determine what the form will be used for—employee onboarding, customer orders, data collection, etc.

- Establish Objectives: Outline what you aim to achieve with the form (e.g., gather specific information, streamline a process).

Step 2: Gather Information

- List Required Information: Compile a list of the data you need to collect.

- Consult Stakeholders: Speak with everyone who will use or process the form to ensure you include all necessary fields.

Step 3: Choose a Format

- Select a Medium: Decide whether the form will be digital (fillable PDF, web form, etc.) or printed.

- Software Tools: Choose a software tool appropriate for creating your form (Microsoft Word, Google Forms, Adobe Acrobat, specialized form builders).

Step 4: Design the Form

- Create a Layout: Sketch a draft layout that organizes information logically and clearly.

- Incorporate Branding: Use your company’s color scheme, logo, and fonts to maintain brand consistency.

Step 5: Input Form Fields

- Add Text Fields: Include spaces for text entries such as names, addresses, or descriptions.

- Include Checkboxes/Radio Buttons: For selections with multiple choices, use checkboxes (multiple options) or radio buttons (single option).

- Insert Drop-down Lists: To save space and streamline choices, use drop-down lists.

- Date and Signature Fields: Make sure there is space for dates and signatures where necessary.

Step 6: Ensure Clarity

- Instructions: Provide clear instructions for each section to guide the user through the form.

- Labels: Ensure that each field is clearly labeled with what information is required.

Step 7: Test the Form

- Internal Review: Have team members fill out the form to catch any issues or confusing sections.

- Collect Feedback: Ask for feedback on the form’s usability and clarity, and make adjustments as needed.

Step 8: Legal Compliance Check

- Legal Review: If the form is used for legal or official purposes, have it reviewed by a legal professional.

- Privacy Considerations: Ensure the form complies with data protection laws and include any necessary disclaimers or consent clauses.

Step 9: Finalize the Form

- Edit and Refine: Make final changes to the form based on feedback and legal advice.

- Create a Version Log: Include a section for version control to track updates to the form over time.

Step 10: Distribute and Implement

- Distribution: Share the form with users via email, company intranet, or physical distribution.

- Integration: Integrate the form into your business processes, ensuring all relevant staff are trained on its use.

Step 11: Monitor and Update

- Track Usage: Monitor how the form is being used and whether it is fulfilling its purpose.

- Periodic Reviews: Schedule regular reviews of the form to make necessary updates or improvements.

By following this guide, you’ll be able to create a Company Form that is both functional and professional, catering to the specific needs of your business and ensuring a smooth and efficient information-gathering process.

Tips for creating an Effective Company Form

Creating an effective company form requires careful planning and design to ensure that it serves its intended purpose efficiently. Here are some tips to help you create a form that is user-friendly and effective:

Keep It Simple and Clear

- Minimize Fields: Only ask for information that is absolutely necessary. Too many fields can be overwhelming and may deter completion.

- Logical Flow: Arrange questions in a logical sequence, making the form intuitive to complete.

- Clear Instructions: Provide concise instructions where needed to guide the user on how to fill out the form.

Design for the User

- User-Friendly Layout: Use a clean layout with plenty of white space to avoid clutter.

- Legible Fonts: Choose fonts that are easy to read. Avoid using multiple font styles.

- Mobile Optimization: If the form is online, make sure it’s mobile-friendly as many users may access it from their mobile devices.

Ensure Accessibility

- Accessible Design: Use high contrast text and backgrounds to accommodate users with visual impairments.

- Tab Indexing: For digital forms, ensure that the tab order is logical and follows the visual flow of the form.

Use Clear Labels

- Descriptive Labels: Make sure each field is clearly labeled with the information that is required.

- Aligned Labels: Align labels consistently to help users quickly scan and understand the form.

Include Help Text

- Contextual Help: Provide examples or help text for fields that might require extra explanation.

- Error Messages: Use clear, helpful error messages to assist users in correcting mistakes.

Optimize for Efficiency

- Autofill: Enable autofill where appropriate to save users time.

- Default Values: Set default values for fields when possible to streamline the completion process.

Maintain Brand Consistency

- Brand Elements: Incorporate your company’s logo, color scheme, and typography to make the form feel like a part of your brand.

- Professional Appearance: A form that reflects your brand’s professionalism can increase trust and completion rates.

Protect User Data

- Data Security: If the form collects sensitive information, ensure that data is transmitted and stored securely.

- Privacy Policy: Link to your privacy policy so users understand how their data will be used.

Test and Revise

- Pretest: Run a pilot test of your form with a small group before full deployment.

- Feedback Mechanism: Allow users to provide feedback about the form to identify areas for improvement.

Use Conditional Logic (for Digital Forms)

- Smart Fields: Use conditional logic to show or hide fields based on previous answers, reducing irrelevant questions for the user.

Ensure Legal Compliance

- Compliance Checks: Make sure your form complies with all relevant laws, including data protection regulations.

Review and Update Regularly

- Periodic Reviews: Forms should be reviewed periodically to ensure they remain up to date with current practices and laws.

By incorporating these tips, you can create a company form that not only looks professional but also enhances user experience, leading to higher completion rates and more accurate data collection.

A Company Form is a standardized document used by businesses to collect and record information systematically. These information forms vary by purpose, such as onboarding, financial reporting, or customer transactions. Examples include employment applications, tax forms, and order forms. Creating an effective form involves defining its purpose, designing a user-friendly layout, and ensuring legal compliance. Regular updates and testing are crucial for maintaining relevance and accuracy.

Related Posts

FREE 8+ Public Liability Forms in PDF Ms Word

FREE 8+ Sample Partnership Application Forms in PDF MS Word

FREE 9+ Business Insurance Forms in PDF MS Word

FREE 7+ Sample Business Report Forms in PDF MS Word

FREE 13+ Operating Statement Forms in PDF MS Word

FREE 7+ Sample Employee Suggestion Forms in PDF MS Word

FREE 5+ Corporate Resolution Forms in PDF MS Word

FREE 7+ Sample Expense Authorization Forms in PDF MS Word

FREE 20+ Sample Business Forms in PDF MS Word

FREE 3+ Construction Employee Evaluation Forms in PDF MS Word

FREE 7+ Sample Company Registration Forms in PDF MS Word

FREE 8+ Company Appraisal Forms in PDF

FREE 12+ Company Exit Clearance Forms in PDF

FREE 12+ Sample Business Request Forms in PDF MS Word | Excel

FREE 7+ Sample Staff Purchase Forms in MS Word PDF